3D Printing Materials and Equipment Market Size and Forecast 2025 to 2034

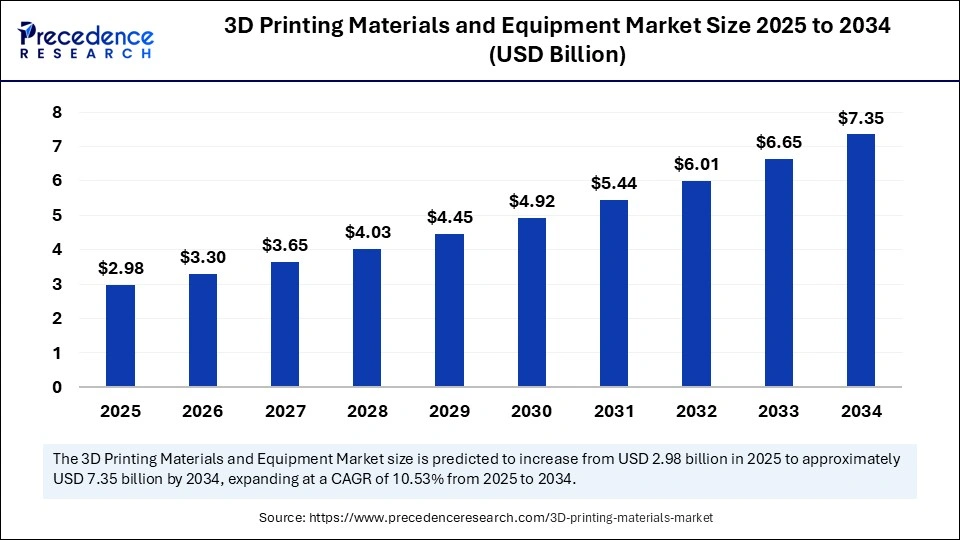

The global 3D printing materials and equipment market size accounted for USD 2.70 billion in 2024 and is predicted to increase from USD 2.98 billion in 2025 to approximately USD 7.35 billion by 2034, expanding at a CAGR of 10.53% from 2025 to 2034.The market is experiencing rapid growth due to the rising demand for rapid prototyping, custom production, and localized manufacturing across various industries, resulting in enhanced efficiency, innovation, and cost savings. Additionally, this market is transforming industries by facilitating complex designs, shorter production times, and on-demand manufacturing, benefiting various sectors like aerospace, automotive, healthcare, and consumer goods.

3D Printing Materials and Equipment MarketKey Takeaways

- In terms of revenue, the 3D printing materials and equipment market is valued at $2.98 billion in 2025.

- It is projected to reach $7.35 billion by 2034.

- The market is expected to grow at a CAGR of 10.53% from 2025 to 2034.

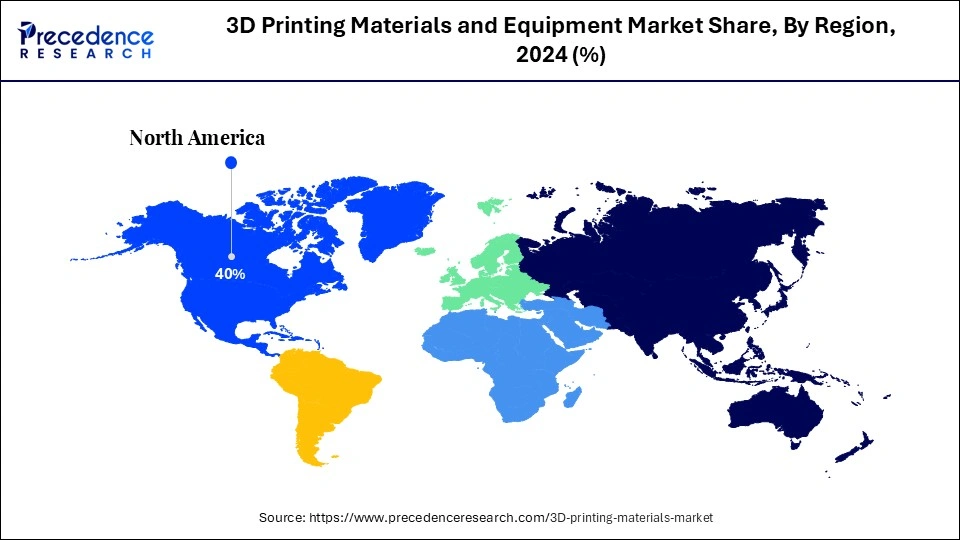

- North America accounted for the major revenue share of 40% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By material type, the metals segment held the major market revenue share in 2024.

- By material type, the plastics segment is expected to expand at the highest CAGR over the upcoming period.

- By product, the fused deposition modeling (FDM) segment held the biggest market share in 2024.

- By product, the selective laser sintering (SLS) segment is expected to grow at the highest CAGR in the coming years.

- By end-user, the industrial segment contributed the biggest revenue share in 2024.

- By end-user, the automotive segment is expected to register the fastest CAGR during the forecast period.

What is the Role of AI in the 3D printing materials and equipment market?

Artificial intelligenceis revolutionizing the market for 3D printing materials & equipment by improving various stages of the printing process, from material selection and design to process optimization and quality control. AI algorithms are employed to automate design, optimize material usage, and elevate quality, as well as facilitate predictive maintenance for 3D printers. Furthermore, AI-powered robots and automation systems not only manage tasks such as material loading, printing, and post-processing but also enhance efficiency and productivity. AI also helps in scaling 3D printing for mass production by optimizing workflows and ensuring consistency across multiple machines.

U.S. 3D Printing Materials and Equipment Market Size and Growth 2025 to 2034

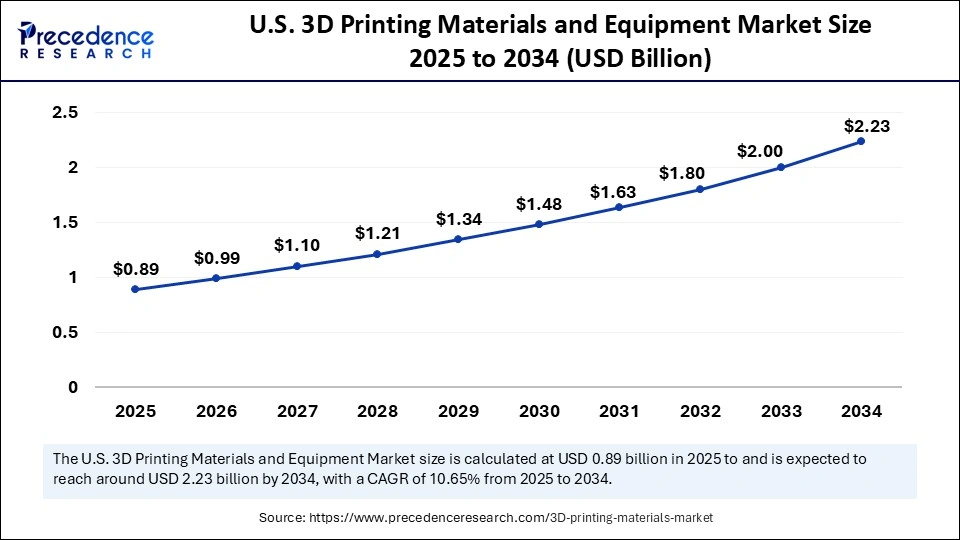

The U.S. 3D printing materials and equipment market size was exhibited at USD 0.81 billion in 2024 and is projected to be worth around USD 2.23 billion by 2034, growing at a CAGR of 10.65% from 2025 to 2034.

What Made North America the Dominant Region in the 3D printing materials and equipment market in 2024?

North America dominated the market by capturing the largest revenue share of 40% in 2024, owing to its well-established and advanced technological infrastructure, robust research and development ecosystems, strong government support, and a superior manufacturing base. These factors drive innovation, attract investment, and encourage the early adoption of 3D printing across various industries. Furthermore, major players in the 3D printing industry, such as 3D Systems, Stratasys, HP, General Electric, and Desktop Metal, are headquartered in North America, contributing to the region's dominance. The region has a well-established aerospace sector, along with the increasing development of aircraft, which creates the need for 3D-printed functional parts.

The U.S 3D printing materials and equipment market Trends

The U.S. plays a major role in the North American 3D printing materials and equipment market. This is mainly due to its advanced technological infrastructure, which includes major tech hubs like Silicon Valley and Boston, centers of innovation and research and development. Major industry players, including Stratasys, Ltd., and 3D Systems, Inc., along with large companies like General Electric, with a specialized 3D printing division, further strengthen the region's position. The country is swiftly moving toward 4D printing, opening up new avenues for market growth.

What Factors Contribute to the 3D printing materials and equipment market Within Asia Pacific?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This growth is largely attributed to government initiatives encouraging the adoption of advanced technologies, rapid industrial growth, and increasing adoption of additive manufacturing across sectors like automotive, aerospace, and healthcare. There is high adoption of 3D printing for prototyping, customized parts, and production. Governments of various Asian countries are actively promoting advanced manufacturing technologies, including 3D printing, through various programs and policies to increase domestic production and reduce reliance on imports. Additionally, advancements in manufacturing technologies and rising demand for personalized products lead to increased adoption of additive manufacturing.

China: A Major Hub for the Development of 3D Printing Materials and Equipment

China plays a significant role in the 3D printing materials and equipment market, primarily due to having the largest 3D printing manufacturing hub that produces a wide range of 3D printers and materials. The Chinese 3D printing market is experiencing rapid growth, driven by government initiatives, technological advancements, and increased adoption by various industries. Notable companies like Creality and TDLmould are prominent Chinese manufacturers recognized for their entry-level FDM 3D printers and for specializing in Photon LED stereolithography resin 3D printers, respectively. China's Made in China 2025 strategy, which aims to enhance manufacturing capabilities and competitiveness by incorporating 3D printing into its agenda, is influencing the market.

Indian 3D printing materials and equipment market Trends

India also plays a vital role in the 3D printing materials and equipment market, focusing on developing a robust 3D printing ecosystem and promoting its adoption in key sectors like aerospace, automotive, and healthcare. Furthermore, the Indian government has launched initiatives to stimulate advanced manufacturing and digital transformation, including the National Strategy for Additive Manufacturing. For instance, Titan, a leading Indian watch manufacturer, leverages 3D printing for prototyping and producing intricate watch components. The Indian government has introduced several policies to promote 3D printing in the country. Additionally, Imaginarium, India's largest 3D printing company, provides services across various sectors.

What Opportunities Exist in the 3D printing materials and equipment market Within Europe?

Europe is considered to be a significantly growing area. This is mainly due to its strong industrial base, particularly the wide presence of manufacturing, aerospace, and automotive sectors, as well as its aging population driving demand for personalized medical devices. The increasing number of 3D printing construction projects in countries like Germany, France, Italy, and Denmark highlights the expanding applications of 3D printing. Ongoing innovations, advancements, and collaborations within Europe, including initiatives like the EU AI Act and partnerships between companies and research institutions, further solidify its position as a significant player in this field.

Market Overview

The 3D printing materials and equipment market is rapidly expanding due to the growing adoption of additive manufacturing in different industries. It is beneficial in several ways, like enhancing the ability of businesses to create intricate parts with minimal waste, reducing manufacturing costs and time to market, and enabling the development of specialized materials for specific applications. The rising demand for customized products is expected to boost the growth of the market. Moreover, businesses are looking to scale up production capacity, creating the need for 3D printing.

What are the Key Trends in the 3D printing materials and equipment market?

- Development of Specialized Materials: The availability of a wider range of 3D printing materials, like high-performance polymers, metals, and ceramics, is expanding applications in various sectors, further contributing to market Growth.

- Need for Fast Prototyping: 3D printing allows for faster prototyping, enabling on-demand production and reducing material waste, leading to lower costs and faster time-to-market.

- Growing Adoption of Additive Manufacturing: Industries are increasingly adopting 3D printing for prototyping, production of complex parts, and customization, propelling demand for 3D printing materials and equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.35 Billion |

| Market Size in 2025 | USD 2.98 Billion |

| Market Size in 2024 | USD 2.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Product, End-users, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Customized Products

The rising demand for customized products is a major factor driving the growth of the 3D printing materials and equipment market. Industries such as automotive, aerospace, construction, healthcare, and consumer products are looking for sophisticated solutions to develop complex parts and components with reduced lead times and costs. 3D printing provides these industries with the capabilities to produce tailored solutions. It can be more cost-effective for small batch production and customized components compared to traditional manufacturing methods.

The trend of personalization and customization is rising, particularly in the healthcare sector. This includes the development of patient-specific medical devices, implants, and even organ-printing technologies. These high-strength components and tailored building designs not only enhance efficacy but also reduce complications.

- In October 2023, CurifyLabs launched GMP-produced Pharma Inks for 3D printable medicines, offering a novel solution for producing patient-tailored and personalized medicines in pharmacies and hospitals. This Pharma Kit, comprising automated 3D printing technology with printable pharmaceutical inks, enables wider adoption of personalized medicine for better patient care.

(Source: https://news.curifylabs.com)

Restraint

Elevated Cost of Materials and Shortage of Skilled Labor

The main restraint in the 3D printing materials and equipment market is the elevated cost of materials, particularly metals and specialized plastics, which limits widespread adoption and large-scale production, especially in cost-sensitive sectors that require mass manufacturing. This higher cost stems from the stringent processing and quality testing needed for 3D printing, along with the premium pricing of specialized materials. This further elevates the cost of 3D-printed products. Moreover, overseeing the 3D printing process requires skilled expertise to reduce any defects. Thus, the shortage of skilled professionals significantly affects the growth of the market.

Opportunity

Advancements in 3D Printing Technology

Ongoing research and continuous improvements in 3D printing technology create immense opportunities in the 3D printing materials and equipment market. Advancements in technologies such as FDM, SLS, and SLA lead to faster print speeds, higher resolutions, and more complex geometries, further expanding the scope of applications. Moreover, the emergence of 4D printing is opening up new growth avenues for the market. After printing, the 4D-printed object can change its properties in response to the pre-programmed stimuli, which is beneficial for the aerospace, automotive, construction, and healthcare industries.

Type Insights

How Does the Metals Segment Dominate the 3D printing materials and equipment market in 2024?

The metals segment dominated the market with the largest revenue share in 2024. This is mainly due to the increased preference for metals, particularly titanium and steel, due to their exceptional strength-to-weight ratio, corrosion resistance, and biocompatibility. These superior properties of metals make them ideal for high-performance applications such as aerospace, medical, and automotive. Furthermore, stainless steel has gained immense popularity in 3D printing due to its excellent mechanical properties. Additionally, its ability to be printed with a good surface finish and in large sizes makes it a versatile option for various applications.

The plastics segment is expected to expand at the highest CAGR over the upcoming period, primarily due to their versatility, cost-effectiveness, and wide range of applications. Plastics are generally less expensive than metals or ceramics, making them more accessible for prototyping and small-scale production. Furthermore, advancements in materials science are constantly yielding new plastics with improved properties, making them suitable for various industries with the continuous development of high-performance plastics and the rise of sustainable materials.

Product Insights

Which Product Dominated the 3D printing materials and equipment market in 2024?

The fused deposition modeling (FDM) segment dominated the market in 2024 due to its ease of operation, cost-effectiveness, and wide materials availability. The straightforward process, readily available resources, and the ability to print with various materials make FDM suitable for both hobbyists and industrial applications. Moreover, FDM is used for rapid prototyping in various industries such as manufacturing, construction, aerospace, and healthcare to develop functional parts with good dimensional accuracy.

In November 2024, a study published in the Biomimetics Journal stated that FDM, which involves melting biocompatible polymer filaments and then layering them to create structures, can be utilized for fabricating scaffolds for regenerative medicine and tissue engineering, particularly for hard biological tissues such as bone and teeth.

(Source: https://www.mdpi.com)

The selective laser sintering (SLS) segment is expected to grow at the highest CAGR in the coming years. This is due to its versatility, speed, and cost-effectiveness for digital manufacturing and mass customization. SLS produces parts with excellent mechanical properties, including high strength and durability, making them suitable for functional prototyping and applications in various industries such as aerospace, automotive, and healthcare. Additionally, it is suitable for a range of materials, including nylon, and reduces the time and costs required for production compared to traditional manufacturing methods.

End-User Insights

Why Did the Industrial Segment Dominate the 3D printing materials and equipment market in 2024?

The industrial segment dominated the market by holding the majority of shares in 2024. This is due to the ability of 3D printing technology to deliver high-precision, complex parts, and prototypes quickly and affordably, particularly in industries like aerospace, automotive, and manufacturing. Advancements in software enable engineers to optimize designs for lightweight, strong structures and reduce material waste while improving product performance. 3D printing has emerged as an ideal solution for industries looking to reduce production time. Its ability to produce rapid prototypes of products significantly reduces production costs and time associated with mass production.

The automotive segment is expected to register the fastest CAGR during the forecast period. The segment growth is primarily attributed to the rising demand for customized automotive parts. 3D printing's rapid prototyping capabilities and ability to produce complex, customized components make it suitable for mass production of automotive components. Additionally, 3D printing enables faster testing, iteration, and design changes, resulting in more efficient product development. It allows for the on-demand production of parts, eliminating expensive tooling and molds, which is particularly beneficial for low-volume or niche applications, demonstrating significant cost savings and faster turnaround times.

3D Printing Materials and Equipment Market Companies

- Hoganas AB

- SLM Solutions

- 3D Systems Inc

- Optomec

- Concept Laser GmbH

- LPW Technology, Ltd

- Stratasys Ltd

- Royal DSM N.V

- Arcam AB

- EnvisionTEC GmbH

- Arkema S.A

- Voxeljet AG

- Solidscape Inc

- EOS GmbH (Electro Optical Systems)

- ExOne

Recent Developments

- In May 2025, Peak Technology announced the acquisition of Jinxbot 3D Printing to strengthen the development of fast, complex prototypes in technically demanding industries like semiconductor manufacturing, biomedical, aerospace, and deep tech. The acquisition highlights the trend toward flexible, integrated manufacturing solutions by implementing both design and functional requirements in a short time.

(Source: https://www.3printr.com)

- In March 2025, the space technology division at Airbus delivered a 3D metal printer to ESA. The printer was subsequently sent to the space station in 2024 and installed in the Columbus module by Andreas Mogensen and his colleagues. This technology efficiently produces four metal items using the printer on the space station, allowing astronauts to free up time for other tasks.

(Source: https://www.space.dtu.dk)

- In February 2025, Californian sports equipment brand Cobra Golf launched its new range of 3D printed King Tour Irons. Fabricated using Direct Metal Laser Sintering (DMLS) additive manufacturing, these golf clubs feature a 3D printed lattice structure that reportedly reduces weight by 33% to unlock high-level performance for all players, from Tour pros to mid- and high-handicap golfers.

(Source: https://3dprintingindustry.com)

- In October 2024, polySpectra unveiled its latest product, Cyclic Olefin Resin (COR) Zero, through a Kickstarter campaign. With this launch, the 3D printing materials producer is offering consumers a manufacturing-grade material used with affordable resin 3D printers, bringing industrial-level production capabilities into home workshops and small businesses.

(Source: https://3dprintingindustry.com)

Segments Covered in the Report

By Material Type

- Ceramics

- Plastics

- Metals

- Others

By Product

- Polyjet

- Fuse Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Stereolithography (SLA)

- ColorJet

- Others (MJM, DLP, etc.)

By End-users

- Electronics & Consumer Products

- Automotive

- Medical

- Industrial

- Education

- Aerospace

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content