What is the Healthcare and Fitness Club Market Size?

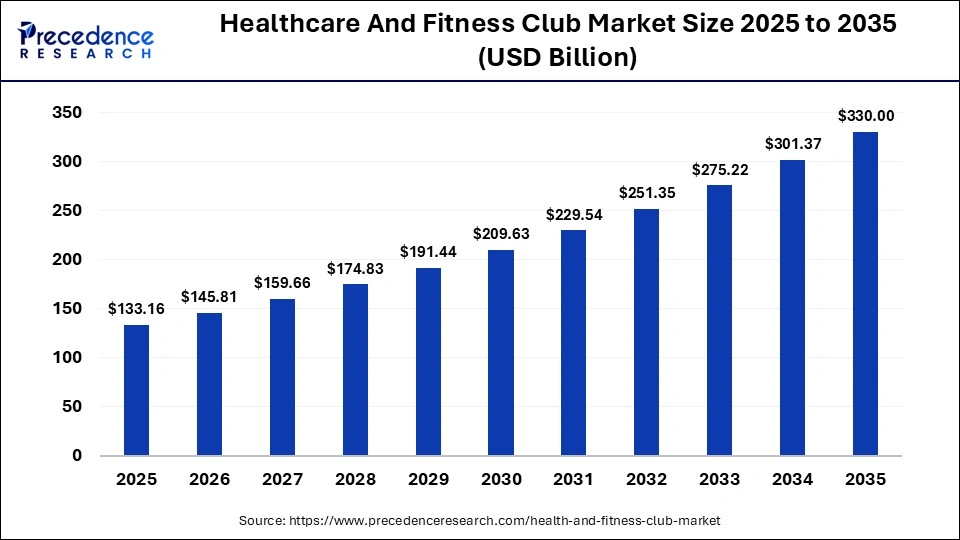

The global healthcare and fitness club market size was calculated at USD 133.16 billion in 2025 and is predicted to increase from USD 145.81 billion in 2026 to approximately USD 330 billion by 2035, expanding at a CAGR of 9.5% from 2026 to 2035. The healthcare and fitness club market is growing due to rising awareness, increasing lifestyle-related diseases, and growing consumer investment in preventive wellness and active living.

Market Highlights

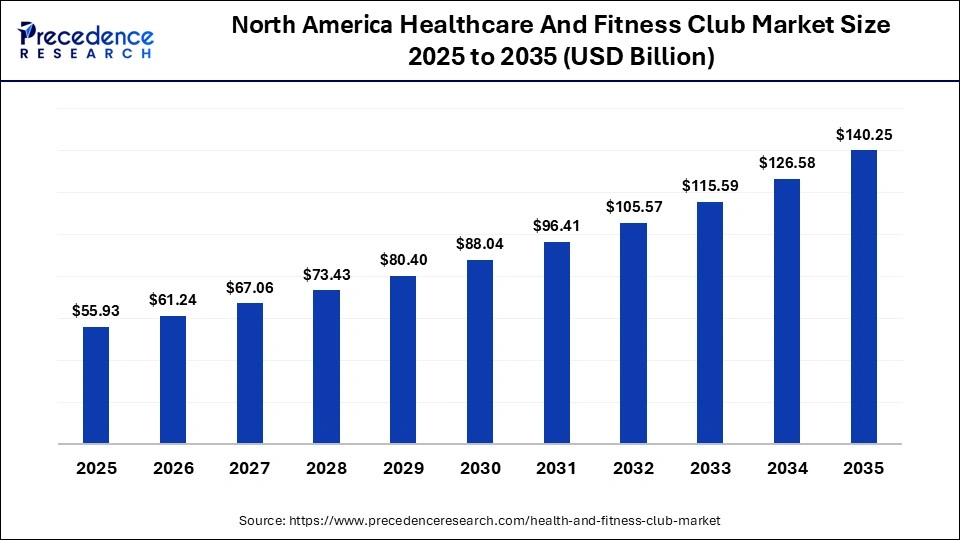

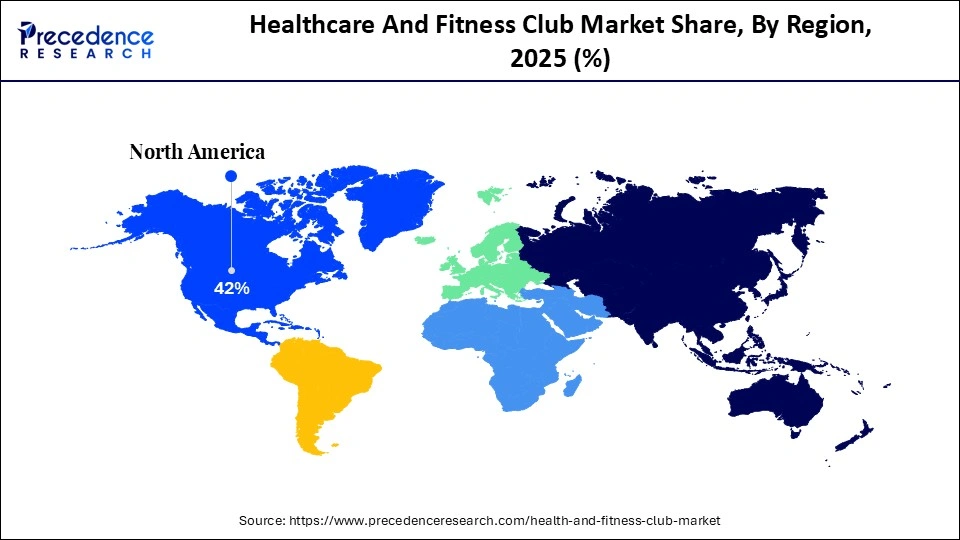

- North America dominated the global market with the largest market share of 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

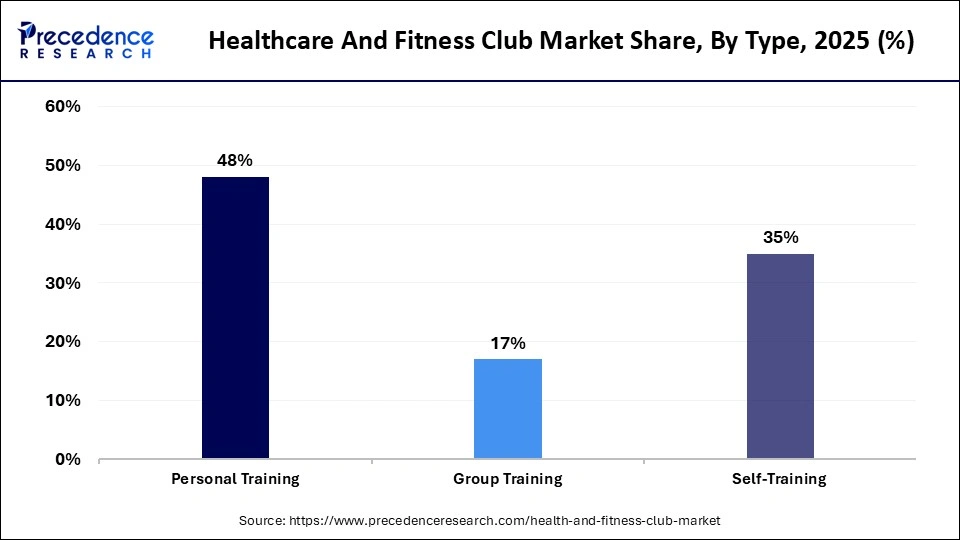

- By type, the personal training segment held the biggest market share of 48% in 2025.

- By type, the self-training segment is expanding at the fastest CAGR between 2026 and 2035.

- By age group, the 20-40 year age group segment contributed the highest share in 2025.

- By age group, the 40-55 years age group segment is growing at a strong CAGR between 2026 and 2035.

Why is the Healthcare and Fitness Club Market Expanding Rapidly?

The healthcare and fitness club market is witnessing strong growth as health, fitness, and general well-being become more important to consumers. Gym memberships, wellness programs, and fitness subscriptions are being encouraged by the rise in lifestyle disease cases and rising disposable income. Furthermore, the incorporation of technology-driven solutions such as wearable technology and fintech applications is changing consumer behavior and accelerating market uptake.

Growing awareness of preventive healthcare is increasing long-term engagement with structured fitness and wellness services. Expansion of boutique fitness studios and personalized training models is attracting a broader consumer base. In parallel, integration of digital platforms for booking, tracking, and virtual coaching is improving accessibility and member retention.

What Makes the Healthcare and Fitness Club Market Resilient?

The healthcare and fitness club market remains resilient due to long-term commitment to fitness and wellness, growing awareness of lifestyle-related illnesses, and sustained demand for preventive healthcare. Consumers continue to prioritize health even during economic slowdowns, supporting consistent membership retention and adoption of digital fitness and corporate wellness initiatives.

Recurring subscription-based revenue models are providing predictable cash flows for operators. Diversification into hybrid offerings that combine in-club and digital services is reducing dependency on physical attendance alone. In addition, employer-sponsored wellness programs are reinforcing stable demand across economic cycles.

How is AI Revolutionizing the Healthcare and Fitness Club Market?

Artificial intelligence is transforming the healthcare and fitness club industry by enabling personalized workout plans, predictive health monitoring, and real-time performance tracking. AI-driven analytics assists clubs in designing targeted wellness programs, improving operational efficiency, and optimizing member engagement. Furthermore, wearable technology and AI-powered smart fitness applications are enhancing user experience, encouraging regular participation, and supporting preventive healthcare initiatives.

AI-based recommendation engines are also tailoring nutrition guidance and recovery programs based on individual health data. Predictive analytics is helping fitness centers anticipate member churn and optimize pricing and retention strategies. Integration of AI with virtual coaching and on-demand fitness content is expanding access beyond physical club locations. In parallel, data-driven insights are enabling fitness providers to align services more closely with long-term health outcomes.

Healthcare and Fitness Club Market Trends

- Rising digital and virtual fitness with AI-powered apps, online classes, and smart wearable integration.

- Growing focus on preventive healthcare through personalized training and wellness programs.

- Popularity of boutique and specialized fitness centers offering yoga, pilates, HIIT, and functional training.

- Corporate wellness adoption as companies invest in employee health and productivity programs.

- Integration of data analytics to track performance and engagement and optimize fitness offerings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 133.16 Billion |

| Market Size in 2026 | USD 145.81 Billion |

| Market Size by 2035 | USD 330.00 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.5% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Age Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

What Made the Personal Training Segment Dominate the Healthcare and Fitness Club Market?

The personal training segment dominated the healthcare and fitness club market in 2025 because there is a growing need for individualized training plans and one-on-one coaching. Customers, particularly novices and those with health issues, prefer personal trainers for goal-oriented fitness programs, injury prevention, and quicker results. Its strong market share is still fueled by the individualized care and expert advice provided by personal training.

Self-training segment is set to be the fastest growing during the forecasted period, driven by the growing use of wearable technology, smartphone apps, and digital fitness tools. A growing number of consumers are choosing autonomous, flexible exercise regimens that can be monitored and improved with AI-based fitness platforms. Growth in the healthcare and fitness club market is being accelerated by cost-effectiveness, accessibility to on-demand exercise content, and convenience.

Healthcare and Fitness Club MarketAge Group Insights

Why Did the 20-40 Year Age Group Segment Dominate the Healthcare and Fitness Club Market?

The 20-40 year age group dominated the healthcare and fitness club market in 2025, since this group actively makes investments in their physical health and well-being. Strong fitness awareness, increased disposable income, and high participation in group classes, gym memberships, and intense workouts all contribute to the segment's leadership.

The 40-55 years age group segment is expected to be the fastest-growing in the market, fueled by a growing emphasis on managing weight, preventing chronic diseases, and preventive healthcare. A growing number of people in this age range are enrolling in fitness clubs for wellness programs focused on joint health and general mobility, as well as guided exercises and functional training.

Regional Insights

How Big is the North America Healthcare and Fitness Club Market Size?

The North America healthcare and fitness club market size is estimated at USD 55.93 billion in 2025 and is projected to reach approximately USD 140.25 billion by 2035, with a 9.63% CAGR from 2026 to 2035.

Why Did North America Dominate the Healthcare and Fitness Club Market?

North America dominates the healthcare and fitness club market because premium fitness services are widely used, there is a strong gym culture, and people are highly conscious of their health. The region's top spot is a result of its sophisticated fitness infrastructure, high membership penetration, and incorporation of technology-driven training solutions.

High disposable incomes and willingness to spend on wellness subscriptions are sustaining premium pricing models. Strong presence of large fitness chains and franchised clubs is enabling wide geographic coverage and standardized service quality. Early adoption of digital fitness platforms, wearables, and data-driven training programs is enhancing member engagement. In addition, widespread corporate wellness initiatives are reinforcing long-term demand across working populations.

What is the Size of the U.S. Healthcare and Fitness Club Market?

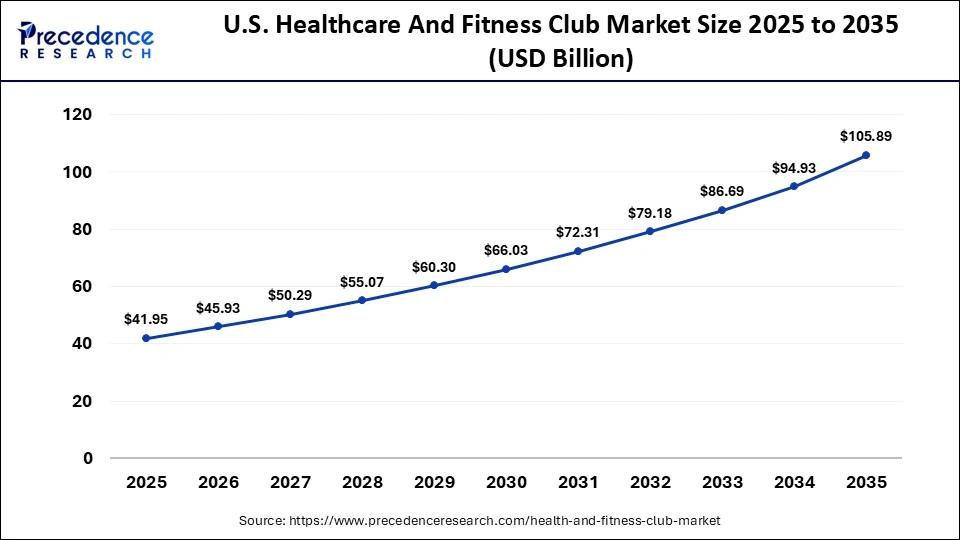

The U.S. healthcare and fitness club market size is calculated at USD 41.95 billion in 2025 and is expected to reach nearly USD 105.89 billion in 2035, accelerating at a strong CAGR of 9.7% between 2026 and 2035.

U.S. Healthcare and Fitness Club Market Trends

The U.S. healthcare and fitness club market is driven by a strong gym culture, a high level of health consciousness, and a broad acceptance of individualized and technologically advanced fitness solutions. Growing interest in preventive healthcare and mental wellness, as well as increased demand for digital workout platforms, boutique fitness centers, and personal training, continue to fuel consistent market growth nationwide.

Why Is Asia Pacific Set to Be the Fastest-Growing Region in the Market for Health and Fitness Clubs?

Asia Pacific is the fastest-growing region in the healthcare and fitness club market, fueled by rising urbanization, increasing disposable income, and growing health consciousness. Expansion of affordable fitness chains, digital fitness platforms, and government initiatives promoting active lifestyles are accelerating market growth across the region. Rapid growth of middle-class populations is increasing demand for structured fitness and wellness services. Higher penetration of smartphones and fitness apps is supporting hybrid and app-based fitness models. Rising prevalence of lifestyle-related diseases is encouraging preventive health engagement. In parallel, investment by domestic and international fitness brands is expanding club networks across major Asia Pacific cities.

India Healthcare and Fitness Club Market Trends

India represents a rapidly growing market for health and fitness clubs due to the growing urbanization, rising disposable incomes, and increased knowledge of health risks associated with lifestyle choices. The market is expanding, especially among young and middle-aged consumers, thanks to the growth of inexpensive gym chains, the increasing popularity of group fitness classes and personal training, and the growing use of digital fitness apps.

What Will Shape Future Demand in the Healthcare and Fitness Club Market?

Future demand is expected to be driven by the growing focus on holistic wellness, including nutrition, mental health, and customized exercise programs. Accessibility and convenience will be further increased by the growing use of wearable technology, virtual training platforms, and AI-powered fitness apps. Furthermore, growing corporate wellness programs and health-conscious lifestyles will keep driving market expansion on a global scale.

Rising consumer preference for personalized and data-driven fitness experiences is increasing long-term member engagement. Expansion of hybrid fitness models that combine physical clubs with digital services is improving scalability and reach. Growing integration of health monitoring, recovery, and lifestyle coaching within fitness clubs is broadening service offerings. In parallel, aging populations and preventive healthcare awareness are reinforcing sustained demand across global markets.

Who are the Major Players in the Global Healthcare and Fitness Club Market?

The major players in the healthcare and fitness club market include Planet Fitness, Anytime Fitness, Life Time, Inc., LA Fitness, Equinox Group, Crunch Fitness, Gold's Gym, 24 Hour Fitness, Basic-Fit, PureGym, Xponential Fitness, F45 Training.

Recent Developments

- In January 2026, Studio Pilates International announced a major U.S. expansion. The brand accelerated its growth with plans for multiple new openings across the country, including flagship locations in New York City and Elgin, South Carolina. This strategic move aims to meet the increasing consumer demand for high-intensity, reformer-based Pilates through its signature technology-driven workout model.(Source: https://www.prnewswire.com)

- In January 2026, PureGym Launched "Feel PureGym Good" Campaign. The global gym operator launched a new brand strategy and advertising campaign focusing on the post-exercise "feel-good glow" across its network. This initiative aims to shift the narrative from physical appearance to the mental health benefits of exercise, encouraging members to embrace the positive mood boost associated with a workout.(Source: https://www.healthclubmanagement.co)

Segments Covered in the Report

By Type

- Personal Training

- Group Training

- Self-Training

By Age Group

- Up to 20 Years

- Between 20 and 40 Years

- 40 to 55 Years

- Over 55 Years

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting