Hemostasis Products Market Size and Forecast 2025 to 2034

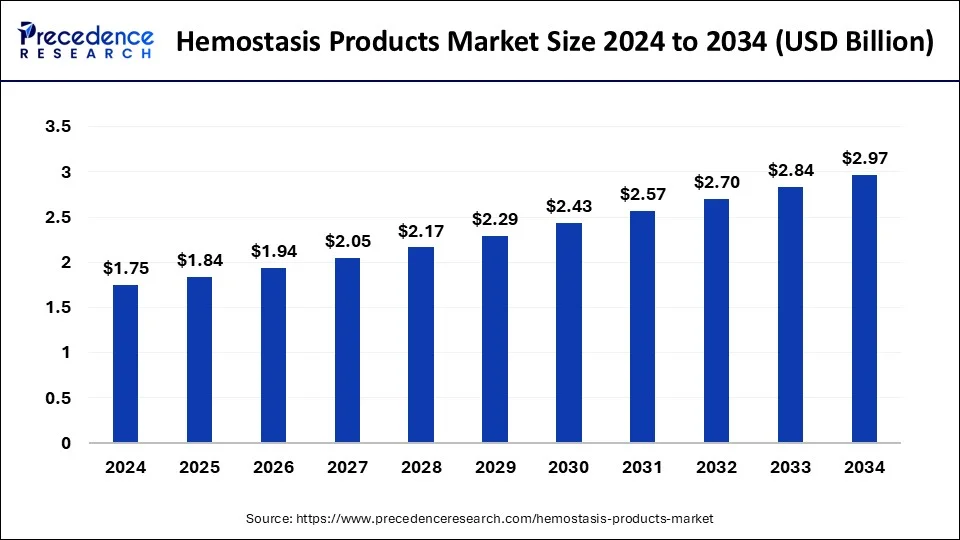

The global hemostasis products market size was estimated at USD 1.75 billion in 2024 and is predicted to increase from USD 1.84 billion in 2025 to approximately USD 2.97 billion by 2034, expanding at a CAGR of 5.47% from 2025 to 2034. Hemostasis products are frequently used during surgical procedures for chronic illnesses such as cancer, heart disease, and liver disease. The need for hemostasis products is predicted to grow as these circumstances become more commonplace worldwide.

Hemostasis Products Market Key Takeaway

- The global hemostasis products market was valued at USD 1.75 billion in 2024.

- It is projected to reach USD 2.97 billion by 2034.

- The hemostasis products market is expected to grow at a CAGR of 5.47% from 2025 to 2034.

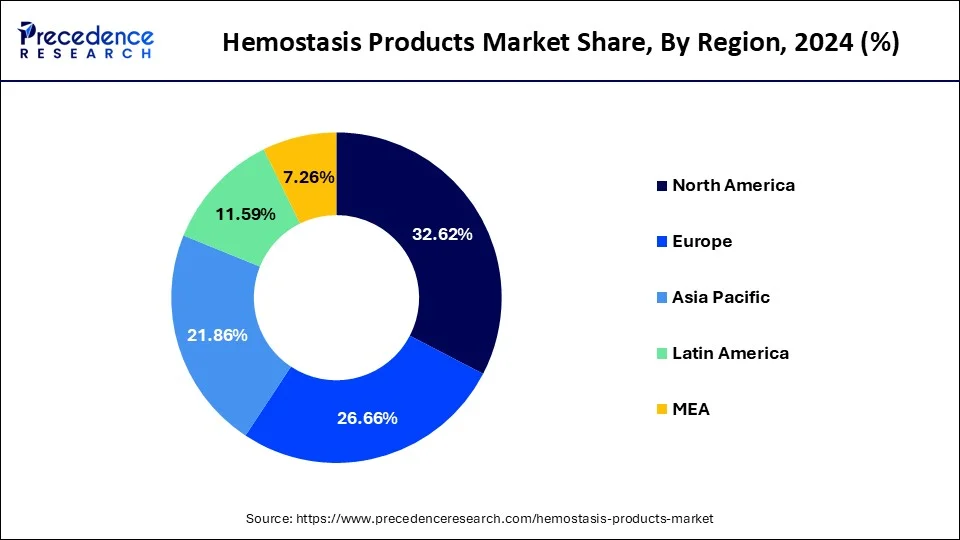

- North America dominated the global market with the largest market share of 32.62% in 2024

- Europe is expected to grow at a solid CAGR during the forecast period.

- By product, the topical hemostat segment contributed the highest market share of 75% in 2024.

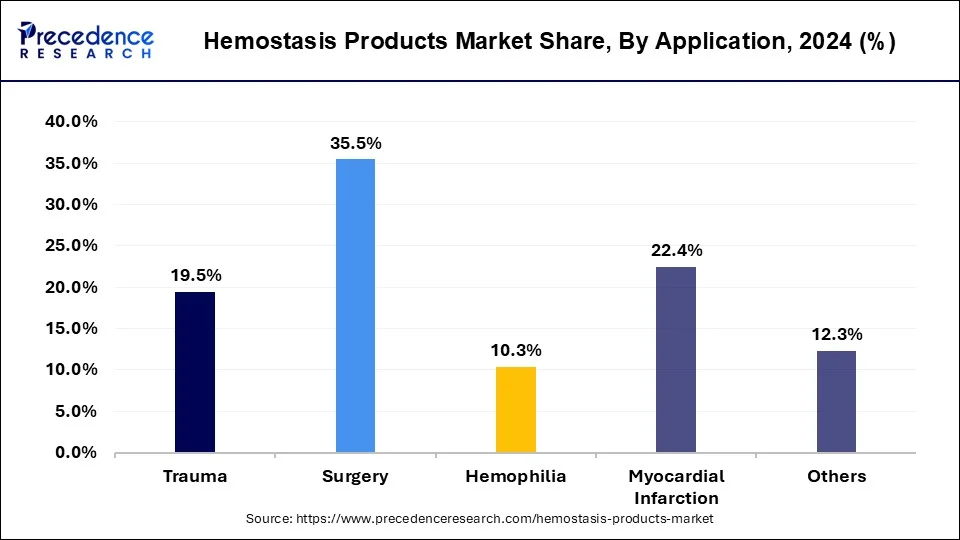

- By application, the surgery segment holds the largest market share of 35.5% in 2024.

- By end use, the hospitals segment captured the biggest market share of 64.53% in 2024.

Hemostasis Products Market Size and Geowth 2025 to 2034

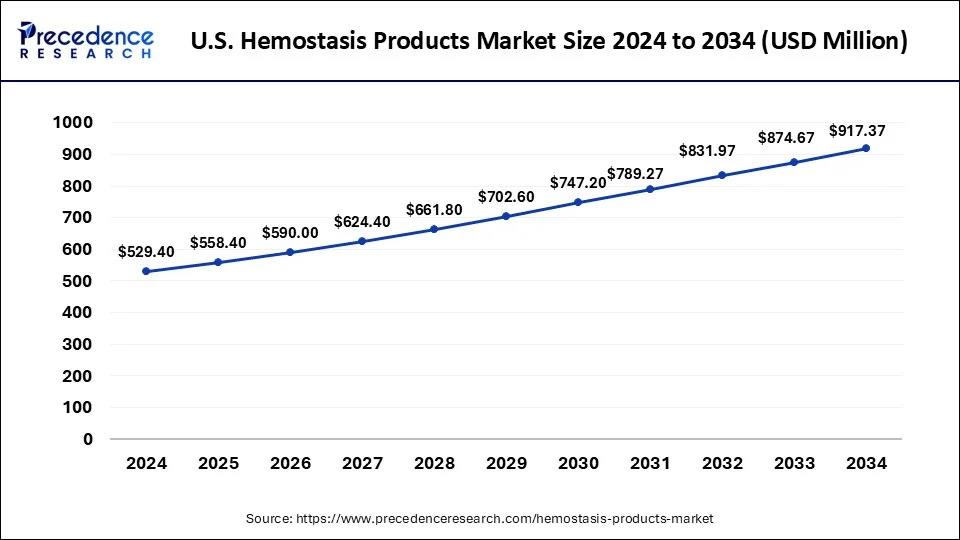

The U.S. hemostasis products market size was valued at USD 529.40 million in 2023 and is projected to reach USD 917.37 million by 2034, registering a CAGR of 5.67% from 2025 to 2034.

North America held the largest share of the hemostasis products market and is expected to maintain this position throughout the forecast period. Hemostasis product sales worldwide are dominated by North America, specifically by the United States and Canada. The frequency of bleeding diseases, the rise in surgical operations, improvements in hemostasis technology, and the aging population all have an impact on the market growth. These developments include the introduction of hemostatic devices, adhesives and sealants, and hemostatic chemicals, which aid in attaining quick hemostasis and lower the possibility of surgical problems. Government organizations like Health Canada in Canada and the Food and Drug Administration (FDA) in the United States strictly oversee the market. Obtaining regulatory permits and adhering to standards are essential for businesses functioning in this industry.

Europe holds a notable share of the global hemostasis products market. Within the larger medical device market in Europe, the hemostasis products market represents a sizeable portion. Hemostasis products are used to treat bleeding disorders like hemophilia, control bleeding during surgical procedures, and treat trauma cases. In a variety of medical settings, such as clinics, ambulatory surgical centers, and hospitals, these products are essential. Chronic conditions, including liver illness, cancer, and cardiovascular disease, can cause bleeding issues. Hemostasis products are in greater demand as these diseases become more common in Europe, and they are used to control bleeding episodes brought on by these illnesses.

Market Overview

The hemostasis products market was projected to be worth several billions of dollars, and forecasts for the coming years indicate that it will continue to rise. The market is growing due to factors such as an aging population and an increase in chronic diseases. Products under the category of hemostasis include a broad range of medications and medical equipment intended to stop bleeding. These goods fall under different categories, such as adhesives, sealants, topical hemostats, and hemostatic agents. Every section addresses clinical requirements and uses.

Applications for hemostasis products can be found in many different medical fields, such as trauma care, general surgery, orthopedic surgery, neurosurgery, and cardiovascular surgery. One major factor driving the industry has been innovation in hemostatic technology. The creation of safer and more effective hemostatic products is the result of developments in materials science, biotechnology, and nanotechnology. The hemostasis products market for these items is rising due to the rise in surgical operations, especially in emerging economies.

In the hemostasis products market, regulatory clearances and compliance criteria are important. To guarantee the safety and effectiveness of their products, companies are required to comply with strict regulatory requirements set by organizations like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). Notwithstanding the market's potential for expansion, producers face considerable obstacles from issues like competitive pricing pressure, reimbursement concerns, and the possibility of product recalls. On the other hand, unexplored markets, scientific breakthroughs, and the creation of specialized hemostatic treatments present numerous potentials.

Hemostasis Products Market Growth Factors

- The need for hemostasis products is mostly driven by the increase in surgical operations, including orthopedic, general, cardiovascular, and trauma cases. The hemostasis products market is growing since these medications are necessary to reduce bleeding during and after procedures.

- Hemorrhagic illnesses, including thrombocytopenia, von Willebrand disease, and hemophilia, are becoming more commonplace worldwide. The need for hemostasis products to control bleeding episodes and enhance patient outcomes is fueled by this trend.

- Continuous improvements in hemostatic technology have resulted in the creation of novel products that are easier to use, less likely to cause side effects and have better hemostatic efficacy. The hemostasis products market is growing because of the launch of enhanced hemostasis solutions, which fill gaps in therapeutic needs and increase the range of applications.

- Beyond conventional surgical settings, hemostasis products are being employed more and more in a variety of medical specialties. Among other fields, they find use in wound care treatment, obstetrics and gynecology, gastrointestinal, and interventional cardiology. The hemostasis products market is growing because of the hemostasis products' expanding indications.

- The rising cost of healthcare in both wealthy and developing nations encourages the purchase of cutting-edge tools and technologies, such as hemostasis supplies. Furthermore, several nations have advantageous reimbursement policies for hemostasis products, which promote their wider adoption and support market expansion.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2024 | USD 1.75 Billion |

| Global Market Size in 2025 | USD 1.84 Billion |

| Global Market Size by 2034 | USD 2.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.47% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamic

Driver

Growing awareness and adoption of minimally invasive surgeries

Hemostasis solutions are essential for preventing bleeding during surgery, and their efficacy is especially important for minimally invasive procedures where access and visibility to the operative site are restricted. Faster hemostasis is made possible by these products, enabling surgeons to perform treatments effectively and safely. Moreover, new hemostasis products created especially for minimally invasive operations have been made possible by technological breakthroughs. Hemostatic agents, sealants, and adhesives are among the goods in this category that are specially designed to satisfy the demands of minimally invasive operations. These demands include ease of application, quick commencement of action, and compatibility with laparoscopic and robotic surgical techniques.

Restraint

Limited clinical evidence

For both patients and clinicians, the hemostasis products market can present serious challenges due to the paucity of clinical data. Hemostasis solutions are essential for maintaining patient safety and good results since they are used to manage bleeding disorders and control bleeding during surgical procedures. Clinical evidence is used by healthcare professionals to assess the effectiveness of various hemostasis products. Uncertainty about the best products for particular patient demographics or clinical settings may arise from a lack of evidence. Limited clinical evidence could make it difficult for hemostasis product producers to set their goods apart from rivals. Firm evidence of superiority or distinct advantages could make it difficult for businesses to increase their market share.

Opportunity

Minimally invasive surgical procedures

Due to a number of factors, including an increase in surgical procedures, improvements in hemostatic products, patient and healthcare professional awareness of the advantages of minimally invasive surgeries, and growing preference for these procedures, the hemostasis products market has been growing steadily. Compared to typical open surgeries, minimally invasive surgical methods have smaller incisions, less stress on the surrounding tissues, quicker recovery periods, and fewer problems. Effective hemostasis, the process of halting bleeding, is necessary for these treatments to be successful.

Product Insights

The topical hemostat segment held the largest share of the hemostasis products market. These products are used to manage wounds or stop bleeding during surgical procedures. They function by either providing a physical barrier to stop bleeding or by encouraging clotting. Pork or cow gelatin has been refined to create these sponges. They take in blood and act as a matrix for the aggregation of platelets and the development of clots. These goods are made from collagen from cattle or horses. They function by encouraging platelet aggregation and starting the clotting cascade. Human or animal fibrinogen and thrombin are used to make these. Together, they create a fibrin clot where the bleeding is occurring.

The hemostasis products market is driven by a number of factors, including the rise in chronic illness prevalence, the number of surgical procedures, and improvements in hemostatic technologies. The development of innovative hemostatic agents and the rising demand for minimally invasive procedures are also anticipated to contribute to the market's growth.

Hemostasis Products Market Revenue, By Product 2022-2024 (USD Billion)

| Product | 2022 | 2023 | 2024 |

| Topical Hemostasis | 1,184.70 | 1,245.50 | 1,311.90 |

| Infusible Hemostasis | 258 | 267.6 | 277.9 |

| Advanced Hemostasis | 145 | 152.2 | 159.4 |

Application Insights

The surgery segment held the largest share of the hemostasis products market. These are materials that are used to stop more bleeding and encourage clotting in areas that are bleeding. Topical hemostatic agents like thrombin, collagen-based hemostats, gelatin sponges, and oxidized regenerated cellulose (ORC) products are a few examples of them. To stop fluid or air leaks, sealants are used to close and seal wounds or incisions. They are particularly helpful in operations involving delicate tissues or organs when suturing would not be sufficient. They can be synthetic or biological in nature. Fibrinogen and thrombin are sometimes added to sealants to replicate the last phases of the body's clotting cascade. These drugs are frequently utilized during surgeries when more conventional hemostasis techniques are either not possible or not sufficient.

Staples and sutures are necessary instruments for attaining hemostasis by sealing wounds or incisions, even though they are not hemostatic agents in and of themselves. However, new developments in hemostasis products have made absorbable sutures covered with hemostatic agents much more effective at stopping bleeding. Hemostasis during surgery can also be achieved through the use of surgical instruments that coagulate blood vessels and tissues using electrocautery, ultrasonic energy, or other sources of energy. These tools aid in successfully blocking blood vessels to stop bleeding. In order to achieve hemostasis, these mechanical devices are employed to obstruct blood arteries or other structures. They are frequently utilized in both open and minimally invasive operations and come in a variety of forms, such as absorbable ligatures and metallic clips.

Hemostasis Products Market Revenue, By Application2022-2024 (USD Billion)

| Application | 2022 | 2023 | 2024 |

| Trauma | 313.1 | 325.9 | 340.6 |

| Surgery | 561.1 | 589.7 | 620.6 |

| Hemophilia | 164.5 | 172.7 | 181 |

| Myocardial Infarction | 354.6 | 372.7 | 392.1 |

| Others | 194.3 | 204.2 | 215 |

End Use Insights

The hospitals segment held the largest share in the hemostasis products market. Because so many surgeries are conducted on their grounds, hospitals are the biggest users of hemostasis supplies. Hemostatic drugs may be needed for a variety of treatments, from simple surgeries to intricate interventions, in order to properly control bleeding. Hospital departments include general surgery, orthopedics, neurosurgery, cardiovascular surgery, obstetrics and gynecology, and trauma care units use hemostasis products. Depending on their particular requirements, each of these professions can need a different kind of hemostatic substance. Severe bleeding and traumatic injury situations are common in hospitals, especially those with emergency rooms. Quick hemostasis is essential in these emergency situations to preserve life.

Hospitals frequently favor advanced hemostasis products, such as hemostatic agents containing recombinant factors or advanced biomaterials, since they provide faster and more effective hemostasis. These goods contribute to shorter recovery periods, less blood loss, and better patient outcomes. In the healthcare industry, big hospitals and hospital networks have a lot of purchasing power. They drive competition among suppliers by negotiating contracts with hemostasis product manufacturers to secure attractive prices and terms. Hospitals follow the rules and regulations that control the use of medical equipment and supplies, including hemostasis products. Adherence to regulations guarantees both patient safety and high-quality healthcare.

Hemostasis Products Market Revenue, By End Use 2022-2024 (USD Billion)

| End-use | 2022 | 2023 | 2024 |

| Hospitals | 1,024.30 | 1,074.50 | 1,128.90 |

| Ambulatory surgical centers | 251.4 | 264.2 | 277.9 |

| Others | 312 | 326.6 | 342.5 |

Hemostasis Products Market Companies

- Terumo Corporation

- Baxter International, Inc.

- Sysmex Asia Pacific Pte. Ltd.

- Abbott Healthcare Private Limited

- CSL Behring LLC

- Grifols

- S.A.

- Dexur Inc.

- Pfizer Inc.

- Tricol Biomedical

- Medtronic Plc.

Recent Developments

- In July 2023, the introduction of PERCLOT Absorbable Hemostatic Powder in the United States was recently announced by Baxter International Inc., a leader in the world of surgical innovation. For individuals with intact coagulation, PERCLOT is a ready-to-use, passive, absorbable hemostatic powder that addresses minor bleeding.

Segment Covered in the Report

By Product

- Topical Hemostasis

- Infusible Hemostasis

- Advanced Hemostasis

By Application

- Surgery

- Trauma

- Hemophilia

- Myocardial Infarction

- Others

By End-use

- Hospitals

- Ambulatory Surgical Center

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting