What is the High-Nickel Cathode Materials Market Size?

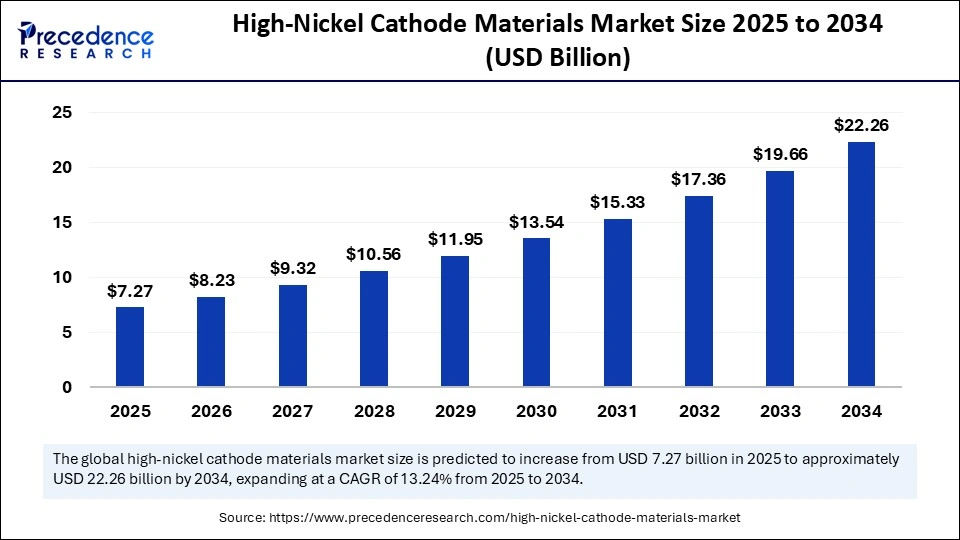

The global high-nickel cathode materials market size accounted for USD 7.27 billion in 2025 and is predicted to increase from USD 8.23 billion in 2026 to approximately USD 22.26 billion by 2034, expanding at a CAGR of 13.24% from 2025 to 2034. This market is growing due to the increasing demand for high-performance electric vehicles, which require batteries with higher energy density and longer range.

Market Highlights

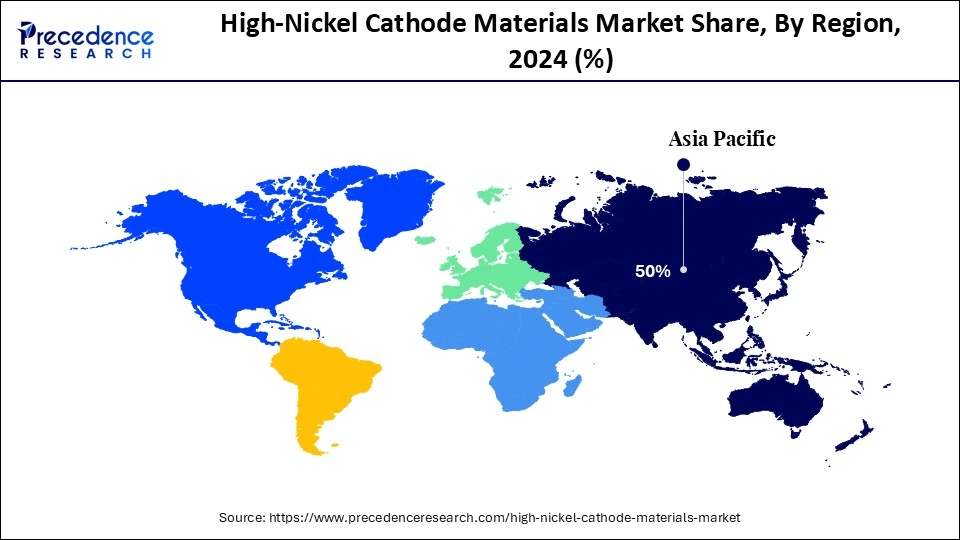

- By region, Asia Pacific dominated the market, holding the largest market share of 50% in 2024.

- By region, North America is expected to grow at a notable rate in the high-nickel cathode materials market.

- By product type, the NCM811 segment held the largest share of the market at 45% in 2024 and is expected to grow at the fastest rate during the forecast period.

- By application, the electric vehicles segment held the largest market share of 60% in 2024.

- By application, the energy storage systems (ESS) segment is expected to grow at the fastest rate during the forecast period.

- By end-user, the automotive manufacturers segment held the largest share at 50% in the high-nickel cathode materials market during 2024.

- By end-user, the consumer electronics segment is expected to grow at the fastest rate during the forecast period between 2025 and 2034.

- By distribution, the direct sales to the OEMs segment are expected to grow at the fastest rate of 55% in the high-nickel cathode materials market.

- By distribution, the advanced high-nickel with reduced cobalt segment held the largest share in the market for high-nickel cathode materials in 2024.

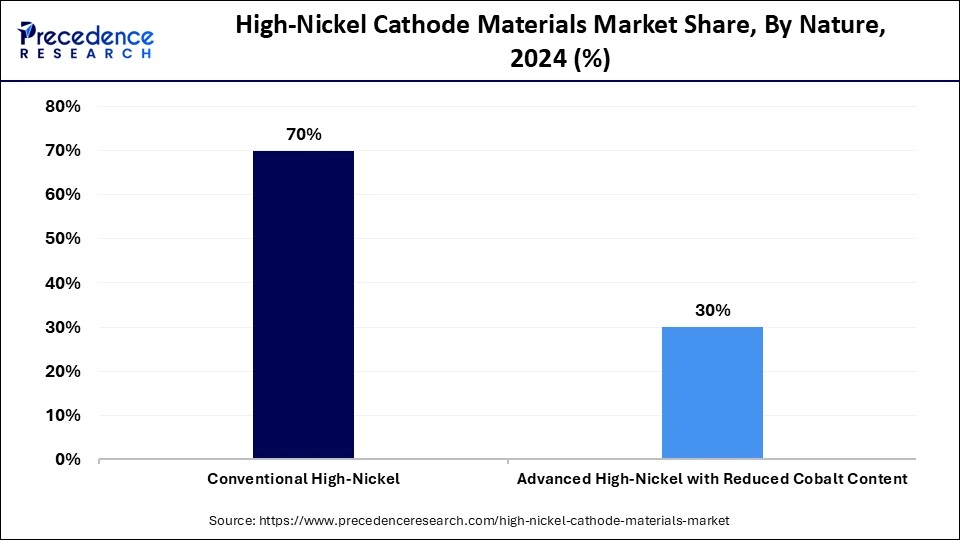

- By nature, the conventional high-nickel segment contributed the highest market share of 70% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 7.27 Billion

- Market Size in 2026: USD 8.23 Billion

- Forecasted Market Size by 2034: USD 22.26 Billion

- CAGR (2025-2034): 13.24%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

What is the high-nickel cathode materials market?

The high-nickel cathode materials market is witnessing steady growth, fueled by the growing need for high-energy-density batteries for energy storage and electric vehicle applications. Compared to low-nickel substitutes, these materials, such as NCM811 and NCA, offer improved performance and longer driving ranges. Further driving market expansion are rising investments in electric vehiclebattery manufacturing and government incentives for the use of clean energy. However, manufacturers continue to prioritize issues with cost and thermal stability.

- In March 2025, LG Chem announced it would showcase its LG Precursor Free cathode materials (precursor-free high nickel cathode tech)

(Source: https://www.lgcorp.com)

Key Technologies Shifts in the High-Nickel Cathode Materials Market

- All Dry, Low Waste Manufacturing: High-nickel cathode battery manufacturers are shifting to all-dry, low-waste, or zero-waste production techniques. By removing hazardous solvents and reducing waste, these procedures mitigate their negative environmental impact while enhancing the performance and consistency of the materials. Novonix and other companies are at the forefront of this field.

- Gradient and Advanced Material Designs: The movement of lithium ions and the distribution of stress are optimized by new material design techniques such as gradient architectures within cathode particles. This enhances the safety and durability of high-nickel batteries by improving battery stability, cycle life, and overall efficiency.

- Incorporation of Additional Metals: Producers are incorporating metals like iron and aluminum into nickel-rich cathodes to boost energy density and lessen reliance on cobalt. These developments enhance sustainability, reduce material costs, and maintain high performance.

High-Nickel Cathode Materials Market Outlook

- Industry Growth Overview: The high nickel cathode materials market is rapidly expanding, primarily stimulated by improvements in battery technology and the expanding use of electric vehicles, longer driving ranges, and better battery performance, and supported by high nickel cathodes' superior energy density.

- Sustainability Trends: All increasingly important areas of focus in the high nickel cathode industry are sustainability. To improve material consistency and reduce their environmental impact, manufacturers are implementing eco-friendly procedures, such as all-dry, low-waste production methods.

- Startup Ecosystem: The high-nickel cathode materials space is witnessing a surge in innovative startups that are driving new technologies and processes. These companies focus on enhancing material stability, performance, and sustainability, while also developing innovative recycling methods.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.27 Billion |

| Market Size in 2026 | USD 8.23 Billion |

| Market Size by 2034 | USD 22.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-User Demographics, Distribution Channel, Nature, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraints

High Production & Processing Costs

Strict process control is necessary when manufacturing high-nickel cathodes (e.g., three moisture limits on impurities) and high-purity precursors, which raise the price. Fluctuations in the prices of raw materials, such as nickel and cobalt, directly impact the profit margins of cathode makers.

- In August 2025, POSCO Future M announced it developed a protype ultra-high voltage mid-nickel cathode material using single crystal surface cathodes material using single crystal surface coating, aiming to improve stability without excessive cost.(Source: https://www.mk.co.kr)

Opportunity

Rising Electric Vehicle (EV) Adoption

Automakers are continually seeking high-nickel cathode materials with higher energy density to enhance driving range. The global surge in demand for electric vehicles offers a huge opportunity for high-nickel cathode materials. Governments are promoting large-scale battery manufacturing through their strict EV policies, subsidies, and carbon neutrality objectives. Automakers and material suppliers are working together to develop innovative nickel-rich chemistries, which is expected to spur growth in the coming years in the high-nickel cathode materials market.

Segmental Insights

Product Type Insights

Why Did NCM811 Dominate the High-Nickel Cathode Materials Market in 2024?

The NCM811 segment dominates the high-nickel cathode material market with a 45% share in 2024, due to its proven dependability, affordability, and high energy density, making it a popular choice for electric vehicle batteries. Because of its balanced nickel, cobalt, and manganese composition, which enables manufacturers to achieve longer battery life and improved driving range, it is the go-to option for widespread EV adoption.

The NCM811 segment is also expected to be the fastest-growing in the market during the forecast period due to its exceptional energy density and extended cycle life, which make it ideal for high-end electric cars and high-performance applications. Its adoption in the energy storage and automotive industries is also being accelerated by ongoing R&D efforts to minimize cobalt content and improve safety.

Application Insights

What Made the Electric Vehicles Segment Dominate the High-Nickel Cathode Materials Sector?

The electric vehicle segment dominated the high-nickel cathode materials market with a 60% share in 2024, driven by the increasing popularity of long-range EVs and high-energy-density batteries. To increase efficiency and reduce the use of cobalt, automakers are transitioning toward nickel-rich chemistries, such as NCM 811 and NCA. Supportive government EV policies and advancements in battery efficiency have further strengthened this segment's dominance.

The energy storage systems segment is expected to be the fastest-growing in the market for high-nickel cathode materials during the forecast period, driven by the increasing demand for effective grid-scale storage and the growing adoption of renewable energy. Superior durability and energy density make high-nickel materials ideal for smart grid and renewable energy storage applications.

- In August 2025, Trina Storage launched its Elementa 2 Pro platform (a turnkey grid-scale energy storage solution) in North America.

(Source: https://www.energy-storage.news)

End-User Insights

Why Did the Automotive Manufacturers Segment Dominate the High-Nickel Cathode Materials Market in 2024?

The automotive manufacturers segment dominated the high-nickel cathode materials market with an approximately 50% share in 2024, driven by the adoption of high-nickel batteries to increase EV range and lower costs, as seen in major ORMs like Tesla and Hyundai. Partnerships with material suppliers and the expansion of EV production have fueled this dominance.

The consumer electronics segment is expected to be the fastest-growing in the market during the forecast period, as the demand for small, durable batteries for wearables, laptops, and smartphones continues to increase. This segment's growth is being further accelerated by the proliferation of 5G and AI-powered devices.

Distribution Insights

Why Did Direct Sales to the OEMs Segment Dominate the High-Nickel Cathode Materials Market?

Direct sales to the OEMs segment have dominated the market, with an approximate 55% share in 2024, as major battery manufacturers signed long-term supply agreements with cathode suppliers. This model ensures production consistency, cost-effectiveness, and quality control. This model allowed OEMs to secure their supply chains and manage costs effectively in a high-demand market.

Battery manufacturers are expected to be the fastest-growing segment in the market during the forecast period, driven by the expansion of gigafactories and independent producers sourcing materials directly. This vertical integration allows them to meet the soaring demand for electric vehicles (EVs) and energy storage batteries.

Nature Insights

Why Did the Conventional High-Nickel Segment Dominate the High-Nickel Cathode Materials Market in 2024?

The conventional high-nickel segment dominated the market with approximately 70% share in 2024, owing to its reliability, cost-effectiveness, and widespread industrial adoption. Proven formulations, such as NCM 622 and NCM 811, remain industry standards. Conventional chemistries benefited from established manufacturing processes and integrated supply chains, supporting high-volume production for numerous automakers.

Advanced high-nickel alloys with reduced cobalt are expected to be the fastest-growing segment in the market during the forecast period, as R&D focuses on safer, longer-lasting, and more sustainable cobalt-free chemistries for next-generation batteries.

High Nickel Cathodes: Where the Market is Growing and How to Act

| Segments | Fastest Growing | Growth Signals | Benefits | Company Moves | Recommendations |

| Product Type | NCA | Growing demand for instalment EVs with high energy density with thermal strength | Perfect for high-performance EVs, balances range & security | Umicore: Partnering with Tesla & EV startups | Consider NCA for high-end EV models; establish supplier partnerships to secure supply |

| By Application | Energy Storage Systems | ESS adoption is rising with renewable energy projects | Hold up grid integration & storage solutions | LG Chem: Supplying vital EV OEMs | Target EV battery makers now explore ESS for future growth |

| By End User | Consumer Electronics | Portable devices & EV growth driving high nickel command | High reliability and thermal strength | Panasonic: Batteries for electronics and EVs | Strength OEM relationships; diversify into electronics & ESS |

| By Distribution | Battery Manufacturers | OEM seeking stable supply & faster adoption cycles | Faster decision cycles secure contracts | Umicore: Long-term OEM contracts | Strengthen OEM ties; explore battery producer partnerships |

| By Nature | Advanced High Nickel with Reduced Cobalt | Reduced cobalt demand is increasing due to sustainability & cost | Lower material costs, ESG compliance | Sumitomo: High-purity powders, cobalt, lower trials | Adopt modern high-nickel cathodes for sustainability goals |

Regional Insights

Asia Pacific High-Nickel Cathode Materials Market Size and Growth 2025 to 2034

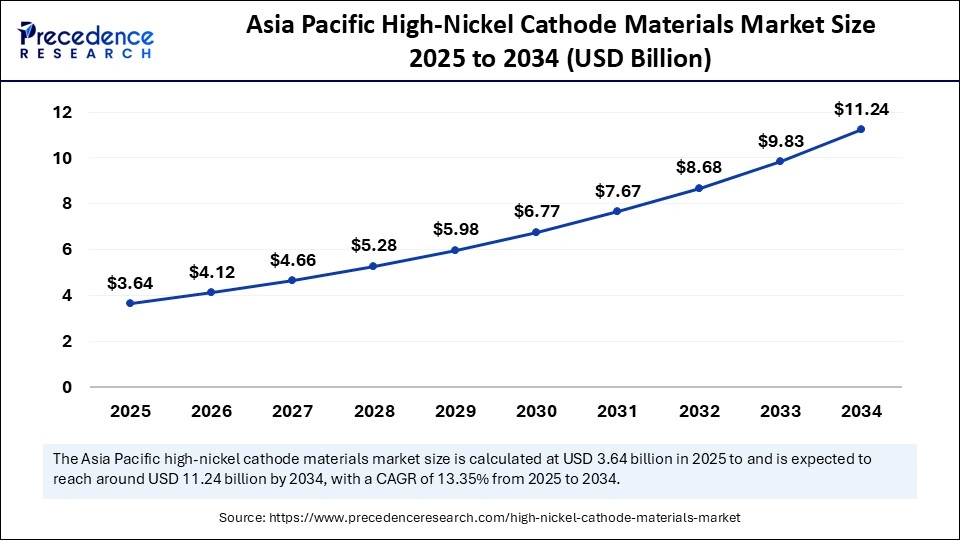

The Asia Pacific high-nickel cathode materials market size is exhibited at USD 3.64 billion in 2025 and is projected to be worth around USD 11.24 billion by 2034, growing at a CAGR of 13.35% from 2025 to 2034.

What Made Asia Pacific Dominate the Market for High-Nickel Cathode Materials?

Asia-Pacific dominated the market with approximately 50% share in 2024 because of significant investments in battery gigafactories and EV manufacturing. The region has established itself as a global leader thanks to robust government incentives, growing R&D capabilities, expansion, and technological advancements.

India High-Nickel Cathode Materials Market

India is witnessing growing demand for the high-nickel cathode market due to the growing use of EVs and government programs like the FAME scheme. Investments in gigafactories and domestic battery production are strengthening the nation's position in the regional battery market.

North America is expected to be the fastest-growing market during the forecast period, driven by significant investments in EV infrastructure and government-supported clean energy initiatives. The region is experiencing rapid market expansion due to new gigafactory projects, Inflation, and growing demand for locally sourced materials.

Canada High-Nickel Cathode Materials Market

Canada's high-nickel cathode market is growing due to the development of local battery manufacturing and recycling, the availability of raw materials, and EV incentives. Initiatives for sustainable supply chains are drawing more capital to the cathode manufacturing industry.

Country-Level Investments/Funding Trends for high-nickel cathode materials market

| Country | Investment Context | Key Funding/Investment Trends |

| United States | The second-largest market, driven by growth in EV battery manufacturing Supported by government incentives, |

|

| Germany | European market leader focused on advanced battery chemistries (e.g., NMC 811) for the growing EV sector. |

|

| India | Rapidly developing market with strong government support for EV and battery manufacturing. |

|

| UAE | Emerging MEA hub using strategic investments to develop local battery capabilities |

|

Top Companies in the High-Nickel Cathode Materials Market

- LG Energy Solution: LG Energy Solution is a global leader in advanced battery technologies, actively developing high-nickel NCM and NCMA cathode chemistries to enhance energy density and longevity in EV batteries. The company's focus on sustainable raw material sourcing and closed-loop recycling supports its transition to next-generation lithium-ion and solid-state battery systems.

- Contemporary Amperex Technology Co. Limited (CATL): CATL leads the global EV battery market with large-scale production of NCM and NCA high-nickel cathode materials for electric vehicles and energy storage systems.Its R&D focuses on improving thermal stability and cost efficiency, with proprietary technologies enabling batteries exceeding 500 Wh/kg for high-performance EVs.

- Samsung SDI: Samsung SDI develops high-nickel cathode materials such as NCA and NCMA for long-range electric vehicles and premium energy storage systems. The company emphasizes performance optimization and fast-charging capability through advanced cathode coating and particle design technologies.

- SK Innovation: SK Innovation produces high-nickel NCM cathode materials (up to 90% nickel) to achieve higher energy densities and extended battery life. It is expanding production across the U.S. and Europe to supply major automakers, leveraging its proprietary Z-fold and thermal management designs for EV batteries.

- Panasonic Energy: Panasonic is a pioneer in high-nickel NCA cathode chemistry, used extensively in Tesla's EV batteries for superior energy density and durability. The company continues R&D in next-gen high-nickel and cobalt-free cathodes to enhance sustainability and cost competitiveness.

- BYD Company Ltd.: BYD manufactures both LFP and high-nickel NCM batteries, targeting balanced performance and energy density for its EV lineup. The company's vertical integration strategy enables control over cathode material sourcing, production, and recycling for maximum efficiency.

- BASF SE: BASF develops advanced high-nickel cathode materials, including NCM 811 and NCMA, with a focus on enhanced thermal stability and reduced cobalt dependency.Its European production network supports the EV supply chain for OEMs through sustainable and scalable cathode material manufacturing.

- Umicore: Umicore is a major supplier of high-nickel NMC cathode materials, with a focus on sustainable battery chemistry and closed-loop recycling. Its upcoming European cathode production sites will strengthen regional EV battery independence and reduce carbon footprint.

- POSCO Chemical: POSCO Chemical manufactures high-nickel NCM and NCMA cathodes through integrated raw material sourcing and advanced synthesis technology. The company is rapidly expanding its global supply to automakers and battery producers, leveraging its strong ties with LGES and GM.

- China Northern Rare Earth Group High-Tech Co.: A key supplier of high-purity rare earths and nickel-based materials supporting cathode production for lithium-ion batteries. The company plays a strategic role in China's domestic high-nickel cathode supply chain, aiding large-scale EV battery manufacturing.

Recent Developments

- In September 2025, EcoPro announced a strategic partnership to establish a long-term supply of recycled NCM hydroxide for battery production. The agreement outlines EcoPro's intent to purchase NCM hydroxide produced from recycled Li-ion battery waste at Green Li-ions' U.S. facility in Atoka, Oklahoma. This collaboration aims to enhance the sustainability of the battery supply chain by integrating recycled materials into production processes.

(Source: https://www.greenli-ion.com) - In September 2025, POSCO Future M completed pilot development of ultra-high nickel cathode materials for premium electric vehicles and high voltage mid nickel cathode materials for standard EVs. The company currently produces and supplies premium cathode materials centered on N8x and expects to further strengthen its business competitiveness in the cathode materials market by responding to diverse customer demand through mass production and supply of these newly developed materials.(Source: https://newsroom.posco.com)

Segments Covered in the Report

By Product Type

- NCM (Nickel Cobalt Manganese)

- NCM811: 8 parts nickel, 1 part cobalt, 1 part manganese

- NCM622: 6 parts nickel, 2 parts cobalt, 2 parts manganese

- NCM523: 5 parts nickel, 2 parts cobalt, 3 parts manganese

- NCA (Nickel Cobalt Aluminum)

- Other Variants: Including NCMA (Nickel Cobalt Manganese Aluminum)

By Application

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics

- Power Tools

- Aerospace & Defense

By End-User Demographics

- Automotive Manufacturers

- Electronics Companies

- Energy Providers

- Industrial Users

By Distribution Channel

- Direct Sales to OEMs

- Battery Manufacturers

- Third-Party Distributors

By Nature

- Conventional High-Nickel

- Advanced High-Nickel with Reduced Cobalt Content

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting