HMI Sensors in Wearables Market Size and Forecast 2025 to 2034

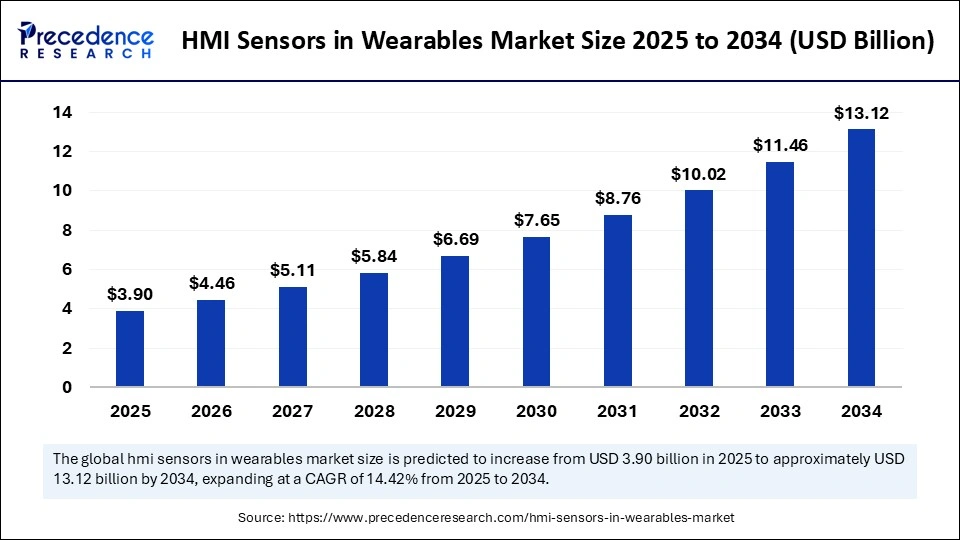

The global HMI sensors in wearables market size accounted for USD 3.41 billion in 2024 and is predicted to increase from USD 3.90 billion in 2025 to approximately USD 13.12 billion by 2034, expanding at a CAGR of 14.42% from 2025 to 2034.The growth of the market is driven by the rising adoption of smart and connected wearable devices.

HMI Sensors in Wearables Market Key Takeaways

- In terms of revenue, the HMI sensors in wearables market is valued at $3.9 billion in 2025.

- It is projected to reach $13.12 billion by 2034.

- The market is expected to grow at a CAGR of 14.42% from 2025 to 2034.

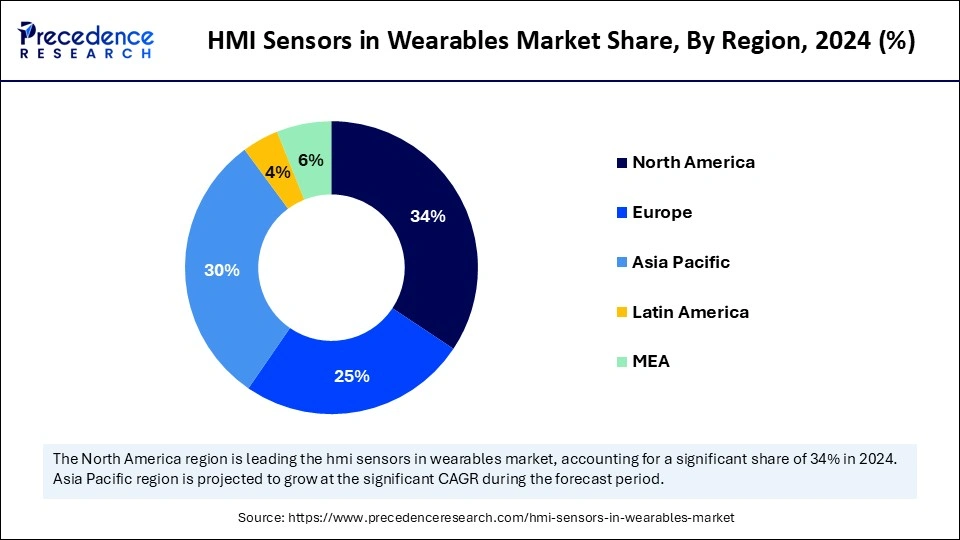

- North America dominated the HMI sensors in wearables market with the largest revenue share of 34% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 16.51% during the forecast period.

- By sensor type, the touch sensors segment held a significant revenue share of 25% in 2024.

- By sensor type, the voice and audio sensors segment is expected to grow at a solid CAGR of 19.5% in the coming years from 2025 to 2034.

- By device type, the smartwatches & fitness bands segment dominated the market with the largest share in 2024.

- By device type, the smart glasses/AR glasses segment is projected to grow at the fastest CAGR in the upcoming period from 2025 to 2034.

- By application, the health & fitness monitoring segment led the market in 2024.

- By application, the gaming & immersive experience segment is expected to grow at a significant CAGR during the forecast period.

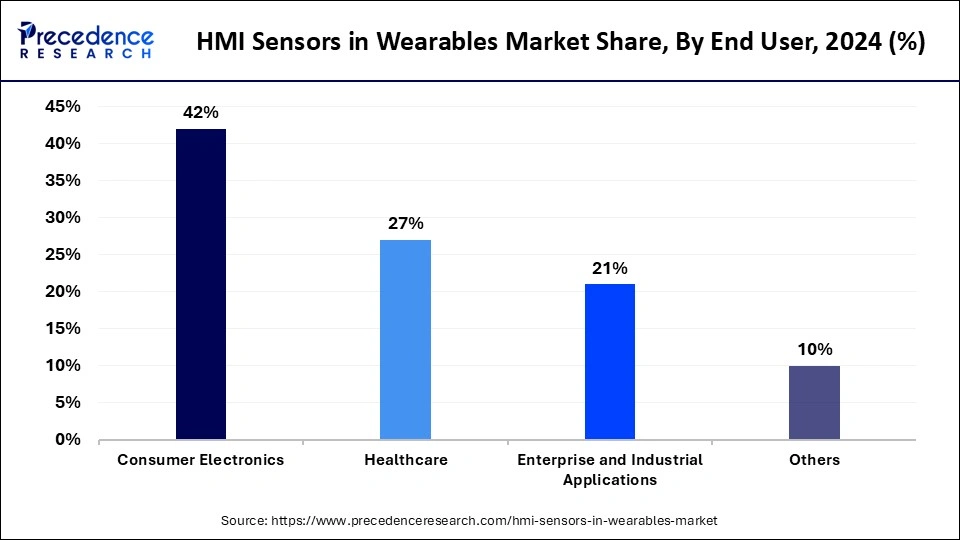

- By end user, the consumer electronics segment contributed the highest revenue share of 42% in 2024.

- By end user, the healthcare segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

How is AI enhancing the performance of HMI sensors in wearable devices?

Artificial Intelligence significantly enhances the performance of HMI sensors in wearables by enabling more accurate signal processing, real-time gesture and voice recognition, and adaptive user interfaces. Wearables can more accurately interpret complex biometric data, including heart rate and stress levels, thanks to machine learning, which will provide more individualized and predictive health insights. Additionally, AI enables context-aware interactions, which lead gadgets to adapt to their use behavior, and it optimizes power consumption through clever sensor usage management. Wearable technology becomes smarter, more user-friendly, and uses less energy as a result, providing a smooth and responsive user experience.

- On 28 March 2025, Google Pixel Buds Pro 2 launched, featuring AI-powered voice assistants with multilingual support and new air gesture controls. The earbuds adapt to diverse acoustic environments and offer real-time translation capabilities. Enhanced gesture recognition allows users to control media and calls without touching the device.

https://blog.google.com/

U.S. HMI Sensors in Wearables Market Size and Growth 2025 to 2034

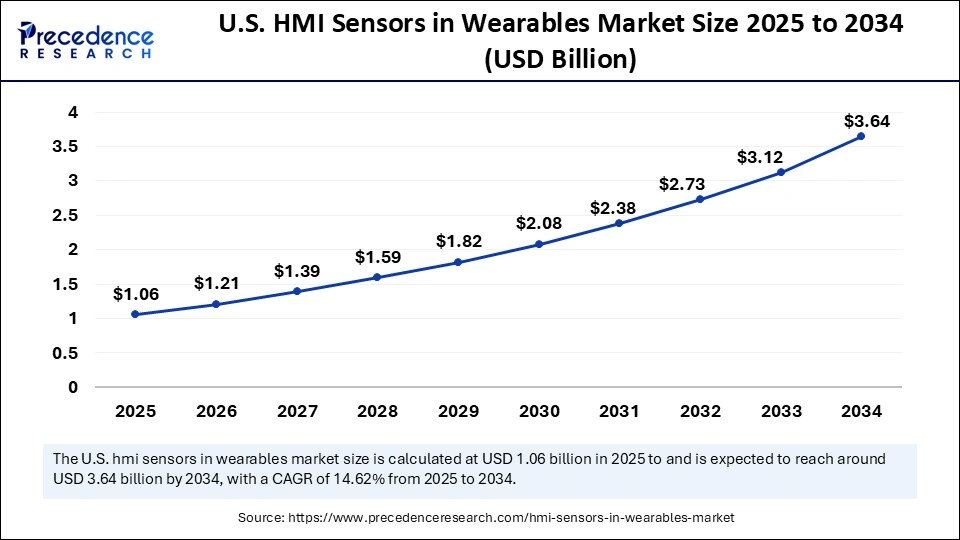

The U.S. HMI sensors in wearables market size was exhibited at USD 0.93 billion in 2024 and is projected to be worth around USD 3.64 billion by 2034, growing at a CAGR of 14.62% from 2025 to 2034.

North America dominated the HMI sensors in wearables market by holding the largest share in 2024. This is mainly due to the early adoption of wearable technology and high consumer demand for smart wearables. The region is home to a large number of market players, leading to rapid innovations in wearable technology. Smartwatches, fitness trackers, and augmented reality wearables are widely adopted due to high levels of innovation, substantial R&D investment, and a strong digital health infrastructure. The region's emphasis on connected lifestyles, preventive healthcare, and fitness keeps driving market expansion.

Asia Pacific is expected to grow at the fastest rate in the upcoming years. The growth of the market in the region is attributed to the growing middle-class population, a sizable tech-savvy populace, and rising smartphone penetration. Along with growing health consciousness and government programs supporting digital health solutions, wearables that are both reasonably priced and packed with features are gaining traction. The rising awareness among people about the benefits of wearable devices in healthcare is supporting the growth of the market.

Europe is considered to be a significantly growing area. The growth of the HMI sensors in wearables market can be attributed to the increasing interest in digital health and wellness tracking solutions. Strong regulatory frameworks about data privacy and a preference for high-quality smartwatches and AR devices contribute to steady growth. There is high adoption of smart gadgets, contributing to the growth of the market in the region.

Market Overview

The HMI sensors in wearables market is growing rapidly due to the growing popularity of smart wearables, increased health consciousness, and improvements in touch and voice sensors. By permitting smooth hands-free interactions and ongoing health monitoring, these sensors improve the user experience. Furthermore, wearable technology is becoming smarter and more customized as a result of the integration of AI and IoT technologies. The rising acceptance of wearables among athletes and sports people is boosting the growth of the market.

HMI Sensors in Wearables MarketGrowth Factors

- Increasing focus on preventive healthcare is driving the demand for real-time health tracking.

- Increasing adoption of smart wearable devices like smartwatches and fitness bands supports the growth of the market. These devices are becoming mainstream due to their multifunctionality and stylish appeal.

- Advancements in sensor technology boost the growth of the market. Innovations in ultra-thin, flexible, and energy-efficient sensors are expanding product capabilities.

- Growing demand for hands-free and intuitive interfaces boosts the market's growth. Voice and gesture controls offer a more natural way to interact with devices.

- Expansion of telehealth and remote patient monitoring further drives the growth of the market. HMI sensor-enabled wearables support continuous health data collection and remote diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.12 Billion |

| Market Size in 2025 | USD 3.90 Billion |

| Market Size in 2024 | USD 3.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sensor Type, Device Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing consumer preference for intuitive hands-free device interfaces

Consumers are favoring more convenient and organic ways to engage with gadgets. Touch voice and gesture-activated HMI sensors provide smooth hands-free experiences, making wearable more convenient and pleasurable to use daily. Smart assistants and voice-activated technology are becoming more and more common in daily life, which is consistent with this trend. The market-based based is increased by improved user interfaces that lower barriers for older or disabled users.

Increasing disposable income and tech-savvy populations

Wearable device adoption is increasing in regions like Asia Pacific and Latin America due to rising incomes and increased awareness of the advantages of wearable technology. HMI sensors are becoming more and more popular as a large number of people adopt smart wearables. Innovative wearables that are affordable and suited to local demands are also being produced by local manufacturers. It is anticipated that this expansion will reduce the technological divide between developed and developing nations.

Rising acceptance of wearables in healthcare

The rising acceptance of wearable devices in healthcare is driving the growth of the HMI sensors in wearables market. Wearable devices enable real-time vital sign monitoring, including heart rate, oxygen levels, and sleep patterns. These devices are becoming more and more popular as people are becoming more conscious of their health. By facilitating remote consultations and diagnostics, these devices lower the need for in-person visits. Through early detection and prompt interventions like synergy, they not only relieve the strain on healthcare systems but also provide users with the ability to better manage their health.

Restraints

Data privacy and security concerns

Data privacy and security concerns hamper the growth of the HMI sensors in wearables market. Health metrics and biometric identifiers are among the sensitive personal data that wearables gather, raising concerns about data privacy. It can be difficult and expensive to ensure safe data storage and transmission while adhering to stringent regulations. Any data breach or misuse can erode consumer confidence and impede adoption.

- In March 2025, a wearable fitness app suffered a vulnerability that exposed encrypted biometric data during cloud synchronization. This incident underscored ongoing risks in protecting health data on interconnected devices and drove increased investments in end-to-end encryption and decentralized data storage solutions.

Integration complexity

The integration of several HMI sensors (bio gesture, voice, and touch) into a small wearable device is technically difficult. Sensor fusion calls for complex hardware coordination and algorithms, which can lengthen the time and expense of product development. The seamless integration process is further complicated by limited processing power and space.

- In January 2025, a major AR headset maker delayed its product launch due to difficulties in compactly integrating eye-tracking, voice recognition, and gesture sensors while maintaining device comfort (Tech Innovations Weekly, Jan 2025). The complexity of sensor fusion and miniaturization continues to challenge developers aiming for lightweight, multifunctional wearables.

Opportunities

Health and fitness monitoring expansion

The demand for wearable devices with cutting-edge HMI sensors that can precisely track vital signs, physical activity, and sleep patterns is driven by the increased emphasis on health and fitness. These sensors make wearables an essential tool for both patients and healthcare professionals by enabling real-time monitoring and personalized health insights that support chronic disease management and preventive care. Various market players are launching innovative products to support market growth.

- On 10 February 2025, Apple announced the Apple Watch Series 9 featuring continuous blood glucose monitoring prototypes. This breakthrough allows noninvasive glucose tracking, potentially transforming diabetes management. Apple emphasized the watch's improved sensor accuracy and extended battery life to support 24/7 health monitoring.

(Source:https://www.apple.com)

Voice and gesture-controlled interfaces

Wearable technology can now be controlled intuitively and hands-free, thanks to advancements in voice and gesture recognition technologies. These HMI sensors facilitate smooth and natural interactions, which improve usability in dynamic settings like while exercising or moving around and pave the way for cutting-edge AR/VR and smart glasses applications.

- On 15 January 2025, Amazon introduced Echo Frames Gen 3 with enhanced voice recognition and gesture controls for sign language. This generation supports seamless transitions between voice commands and silent gesture inputs. Amazon also partnered with accessibility organizations to improve usability for hearing-impaired users.

(Source: https://www.amazon.com)

Augmented and virtual reality integration

With the rising popularity of AR and VR wearables, the demand for advanced HMI sensors is rising for eye tracking. These sensors give devices the ability to comprehend the environment and user focus, which is essential for enterprise applications, training gaming, and remote help. This makes it possible to create immersive interactive experiences.

- On 5 January 2025, Meta released Quest 4 with next-gen eye-tracking and hand gesture AI for ultra-immersive VR experiences (Meta Newsroom). The headset delivers lower latency and higher resolution for more natural interactions. Meta also introduced new developer tools to create applications optimized for eye-tracking and AI-enhanced gestures. (Source: https://about.fb.com)

- On 12 February 2025, Microsoft unveiled HoloLens 4, boosting spatial sensing and environmental awareness for advanced enterprise use (Microsoft Blog). The device supports complex mixed reality workflows, enabling improved remote collaboration. Microsoft emphasized enhanced comfort and extended battery life for all-day productivity.

(Source: https://blogs.microsoft.com)

Sensor Type Insights

The touch sensors segment dominated the HMI sensors in wearables market in 2024 due to their user-friendliness, simplicity, and high responsiveness. They are widely used in fitness trackers, smartwatches, and medical wearables, and they allow for easy navigation, fast feature access, and productive interaction with a low learning curve. They are the preferred interface for the majority of consumer wearables due to their compatibility with small form factors and dependability in a variety of settings. As the most advanced HMI interface, capacitive and resistive touch technologies continue to advance, improving sensitivity and accuracy even more.

The voice & audio sensors segment is expected to expand at the fastest rate in the coming years, driven by developments in natural language processing and voice recognition with AI. These sensors allow for hands-free real-time communication, which makes them perfect for AR/VR devices, smartwatches, and earbuds, particularly in assistive fitness and navigation applications. Voice interfaces provide convenient accessibility and multitasking capabilities as customers look for more seamless and context-aware experiences. This growth trajectory is being further accelerated by the incorporation of voice assistants such as Alexa, Google Assistant, and Siri into wearables.

Device Type Insights

The smartwatches & fitness bands segment dominated the HMI sensors in wearables market in 2024 because of their multipurpose use in health monitoring and broad consumer acceptance. These gadgets, which have touch-based HMI sensors, give users instant access to critical information like heart rate, sleep patterns, and alerts. Because of their low cost, stylish appearance, and compatibility with smartphones, they have become indispensable in daily life. Smartwatches and bands continue to be the main forces behind the global adoption of wearable technology due to ongoing improvements in battery life, sensor accuracy, and fitness-tracking algorithms.

The smart glasses/AR glasses segment is projected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to its lightweight designs, AI-powered interfaces, and advancements in immersive technology. With the use of voice control gesture recognition and real-time visual overlays, these gadgets are revolutionizing HMI by providing hands-free and contextual experiences. A variety of new uses for smart glasses are emerging, ranging from gaming and remote assistance to workplace training and navigation. This market is expected to grow rapidly in both the consumer and business sectors as a result of the significant investments made by tech giants in AR ecosystems.

Application Insights

The health & fitness monitoring segment dominated the HMI sensors in wearables market in 2024, owing to a greater focus on chronic disease management and health awareness. When combined with cutting-edge HMI sensors like accelerometers, heart rate monitors, and SpO2 sensors, wearables offer real-time information on stress levels, physical activity, sleep patterns, and general well-being. Healthcare providers are increasingly using these devices for preventive care and remote monitoring, while consumers depend on them for tracking their health. Their contribution to proactive health management keeps the market demand high.

The gaming & immersive experience segment is expected to grow at a significant rate during the forecast period, driven by the need for more in-depth user engagement and the growth of AR/VR innovation. Advanced HMI sensors are used by gadgets like haptic gloves, AR glasses, and smart headsets to detect eye movements, track gestures in real-time, and interact with space. The boundaries between the real and virtual worlds are blurred by these technologies, incredibly immersive and interactive gameplay. Entertainment training and virtual collaboration are being redefined by immersive wearables as content ecosystems grow and 5G allows for low-latency performance.

End User Insights

The consumer electronics segment held the largest share of the HMI sensors in the wearables market in 2024, driven by the widespread adoption of smartwatches, fitness bands, and audio wearables that cater to everyday lifestyle and entertainment needs. These devices focus on features like fitness tracking, notifications, music control, and seamless smartphone integration, making them popular among a broad user base. Continuous innovation in design, user interface, and connectivity keeps this segment at the forefront of wearable technology.

The healthcare segment is anticipated to grow at the fastest rate in the upcoming period. This is mainly due to a growing need for individualized health insights, chronic disease management, and remote patient monitoring. High-tech HMI sensors make it possible to precisely track vital signs, activity levels, and other biometric information that is essential for early diagnosis and preventative care. Medical-grade wearables are becoming more and more popular as a result of increased investments in digital health infrastructure and growing health consciousness.

HMI Sensors in Wearables MarketCompanies

- ams-OSRAM AG

- Bosch Sensortec GmbH

- Infineon Technologies AG

- Shenzhen Goodix Technology Co., Ltd.

- Microchip Technology Inc.

- NXP Semiconductors

- STMicroelectronics

- Synaptics Incorporated

Sensirion AG - TDK Corporation

- Texas Instruments Incorporated

- UltraSense Systems Inc.

Recent Developments

- On 10 January 2025, Doublepoint and Bosch Sensortec announced the launch of the WowMouse app for Apple Watch, enabling ultra-low-latency gesture control using on-wrist HMI sensors. This innovation transforms wearable control, making gesture-based interaction seamless, power-efficient, and widely accessible.

https://www.counterpointresearch.com/insight/key-wearables-themes-at-ces-2025-ai-health-luxury - In August 2023, Exor announced the launch of its latest product, the Exor X5 Wireless HMI (Human Machine Interface). The cutting-edge device is designed to revolutionize the way industrial operators interact with their machines and equipment.

https://metrology.news/next-generation-wireless-hmi-with-built-in-web-server-launched/

Segments Covered in the Report

By Sensor Type

- Touch Sensors

- Motion Sensors

- Biometric Sensors

- Voice & Audio Sensors

- Environmental Sensors

- Others

By Device Type

- Smartwatches & Fitness Bands

- Smart Glasses/AR Glasses

- Smart Clothing

- Smart Rings/Wristbands

- Hearables/Earbuds

- Head-Mounted Displays (HMDs)

- Others

By Application

- Health & Fitness Monitoring

- Gesture and Motion Control

- Communication & Voice Interaction

- Ambient Sensing & Personalization

- Gaming & Immersive Experience

- Others

By End User

- Consumer Electronics

- Healthcare

- Enterprise & Industrial Applications

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting