What is Well Logging Tools Market Size?

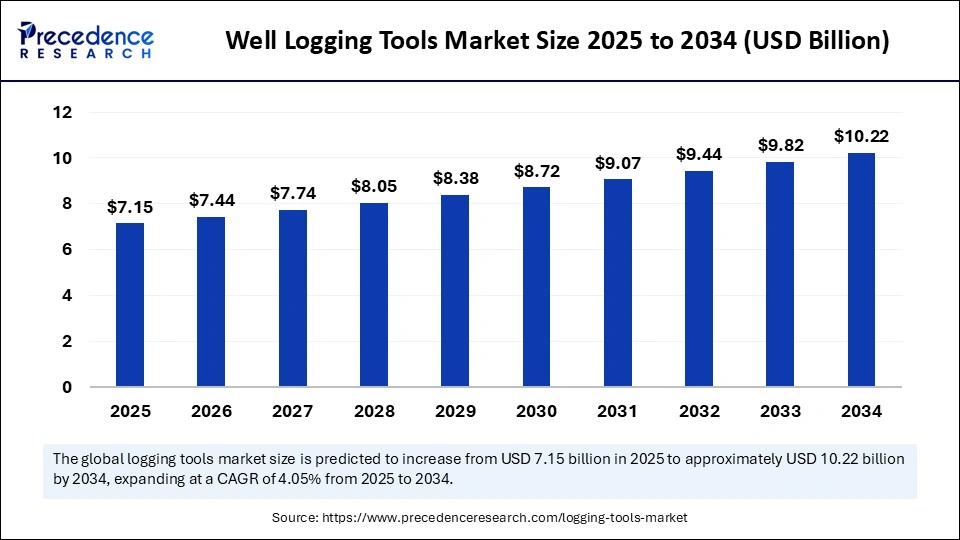

The global well logging tools market size is calculated at USD 7.15 billion in 2025 and is predicted to increase from USD 7.44 billion in 2026 to approximately USD 10.22 billion by 2034, expanding at a CAGR of 4.05% from 2025 to 2034. This market is growing due to increasing demand for efficient subsurface exploration and production in the oil and gas industry.

Market Highlights

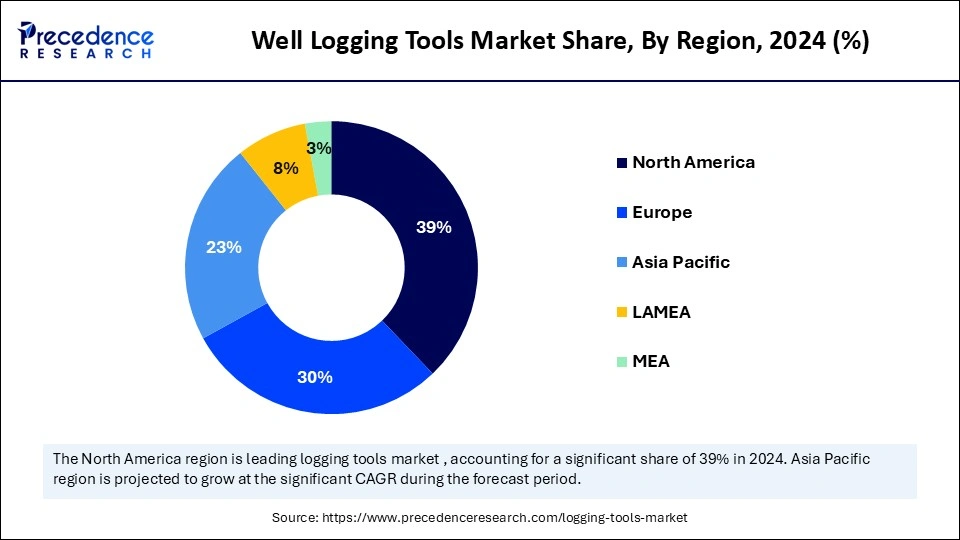

- By region, North America dominated the market, holding the largest market share of 39% in 2024.

- By region, the Middle East & Africa is expected to grow at a notable CAGR of 7% from 2025 to 2034.

- By tool type, the wireline logging tools segment held the largest share of the market at 42% in 2024.

- By tool type, the logging-while-drilling tools segment is growing at the fastest rate from 2025 to 2034.

- By type of measurement, the gamma ray logging tools segment contributed the highest market share of 28% in 2024.

- By type of measurement, the imaging & formation evaluation tools segment is expected to expand at a solid CAGR of 7.2% from 2025 to 2034.

- By application, the oil & gas exploration segment held the major market share of 44% in 2024.

- By application, the reservoir characterization & evaluation is expected to grow at the fastest rate of 6.8% from 2025 to 2034.

- By end user, the oil & gas operators/exploration companies segment accounted for the biggest share at 48% in 2024.

- By end user, the service providers & logging contractors segment is expected to grow at the fastest rate of 6.5% from 2025 to 2034.

- By logging method, the open-hole logging segment captured the highest market share of 52% in 2024.

- By logging method, the extended-reach & deepwater logging segment is expected to grow at the fastest rate of 7.1% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 7.15 Billion

- Market Size in 2026: USD 7.44 Billion

- Forecasted Market Size by 2034: USD 10.22 Billion

- CAGR (2025-2034): 4.05%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Key Technologies Shifts in the Well Logging Tools Market

- Advanced Measurement Techniques: Introducing high-resolution logging instruments for more precise reservoir characterization, such as multi-parameter sensors, nuclear magnetic resonance, and ultrasonic.

- Digital and Real-Time Logging: Artificial Intelligencecloud-based analytics and real-time data collection combine to make quicker decision-making and increased operational effectiveness.

Wireless and Downhole Communication: Development of advanced telemetry systems for continuous high-speed data transmission from downhole to surface.

Market Overview

What is the Well Logging Tools Market?

The well logging tools market is growing as oil and gas firms prioritize precise subsurface analysis and effective reservoir management. Developments in digital real-time and automated logging technologies fuel global adoption. Market expansion is further supported by expanding exploration efforts in both onshore and offshore fields.

Market Outlook

- Industry Growth Overview: The market is expanding due to advancements in technology, like automated real-time and digital logging tools that increase operational effectiveness and decrease downtime. Growth is further stimulated by increased investments in energy infrastructure and improved recovery methods.

- Sustainability Trends:Eco-friendly and energy-efficient logging tools are gaining traction, helping operators reduce environmental impact. Integrating digital solutions improves operational safety and reduces resource consumption.

- Startup Ecosystem: AI-based data analytics, smart logging tools, and small automated systems for harsh environments are all examples of how startups are fostering innovation. Collaboration with well-known oilfield service providers is speeding up market penetration and technology adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.15 Billion |

| Market Size in 2026 | USD 7.44 Billion |

| Market Size by 2034 | USD 10.22Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Tool Type,Type of Measurement, End user,Logging Method, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Innovations & Future Outlook in Well Logging Tools

|

Trend Area |

Description |

Impact on the U.S. Market |

Impact on the UAE Market |

|

AI-Based predictive logging |

Use machine learning to forecast formation data before drilling. |

Cuts exploration time and boosts efficiency |

Speeds up decision-making in new fields |

|

Quantum sensor logging |

Delivers ultra-precise subsurface readings |

Improves accuracy in shale formations |

Enhances mapping of carbonate reservoirs |

|

Carbon Capture Logging |

Specialized tools assess carbon storage capacity and monitor CO2 injection wells. |

Aligns with U.S. decarbonization and energy transition goals. |

Aligns with the UAE Net Zero 2050 goals |

|

Autonomous Downhole Tools |

Robots perform data collection without wireline support |

Reduces downtime in mature wells |

This initiative enables eco-friendly drilling campaigns aligned with ADNOC's sustainability targets. |

Segmental Insights

Tool Type Insights

What Made the Wireline Logging Tools Segment Dominate the Well Logging Tools Market in 2024?

The wireline logging tools segment dominated the market with a 42% share in 2024, driven by its extensive application in precise subsurface assessment, reliability in data collection, and the capacity to function in challenging well conditions. Because they work well and can be used with a variety of logging measurements, wireline tools are still the tool of choice for oil and gas operators.

The logging while drilling tools segment is expected to be the fastest growing segment with a 7% CAGR in the market during the forecast period. Modern exploration projects are becoming increasingly interested in LWD tools because they enable real-time data acquisition during drilling, reduce operational time, and enhance decision-making in difficult well conditions.

Type of Measurement Insights

Why Did Gamma Ray Logging Tools Dominate the Well Logging Tools Market in 2024?

The gamma ray logging tools segment dominated the well logging tools market with a 28% share in 2024, driven by its essential role for identifying lithology, assessing formations, and coordinating surface layers. Regular well evaluation favors it due to its dependability, affordability, and ease of use.

The imaging & formation evaluation tools segment is expected to be the fastest-growing segment with a 7.2% growth rate in the market during the forecast period. It offers high-resolution visualization of wellbore and formation features, enhancing reservoir characterization and drilling accuracy.

Application Insights

What Made the Oil & Gas Exploration Segment Dominate the Well Logging Tools Market in 2024?

The oil & gas exploration segment dominated the well logging tools market with a 44% share in 2024, driven by the increasing number of exploration projects and the need for accurate subsurface mapping to maximize hydrocarbon recovery. These tools offer vital information that improves production planning and lowers drilling risks.

The reservoir characterization & evaluation segment is expected to be the fastest-growing segment with a 6.8% CAGR in the market during the forecast period, driven by the rising demand for advanced analysis of reservoir properties to maximize hydrocarbon extraction and improve field development strategies.

End User Insights

Why Did the Oil & Gas Operators/Exploration Companies Segment Dominate the Well Logging Tools Market in 2024?

The oil & gas operators/exploration companies segment dominated the well logging tools industry with a 48% share in 2024, as these businesses are the main users of logging equipment for precise and effective exploration, drilling, and production operations. Domination is a result of their strong investment skills and emphasis on optimizing asset performance.

The service providers & logging contractors segment is expected to grow at the fastest rate of 6.5% in the market during the forecast period. As the demand for advanced services rises globally, these businesses are providing integrated data-driven logging solutions by utilizing digital transformation. The expanding cooperation between technology developers and oilfield services providers further accelerates growth.

Logging Method Insights

Why Did the Open-Hope Logging Segment Dominate the Market for Well Logging Tools in 2024?

Open-hope logging segment dominated the market with a 52% share in 2024. Driven by its common use in exploration wells is simple to use and can be used with a variety of measurement instruments. Better reservoir analysis is made possible by the useful information it offers before casing installation. Improved sensor accuracy and ongoing developments in real-time data transmission are advantageous to this segment.

The extended reach & deepwater logging segment is expected to be the fastest-growing segment with a 7.1% CAGR in the well logging tools market during the forecast period, driven by the increase in offshore drilling projects and the need for cutting-edge technologies to operate in deepwater wells. Exploration in complex environments like the Gulf of Mexico and offshore Africa is increasing, which supports the growth of these activities.

Regional Insights

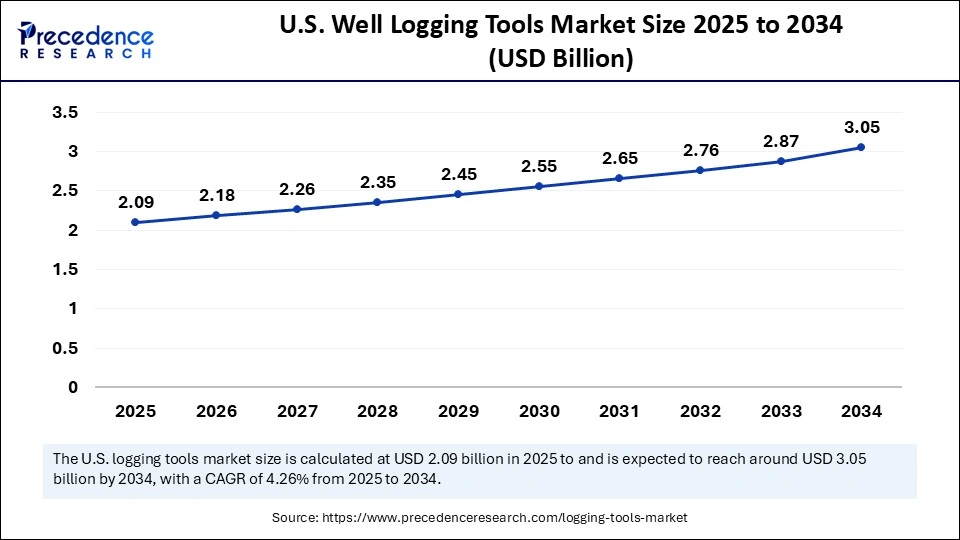

U.S. Well Logging Tools Market Size and Growth 2025 to 2034

The U.S. well logging tools market size is exhibited at USD 2.09 billion in 2025 and is projected to be worth around USD 3.05 billion by 2034, growing at a CAGR of 4.26% from 2025 to 2034.

What Made North America Dominate the Well Logging Tools Market in 2024?

North America dominated the market with a 39% share in 2024, driven by modern drilling technologies, many important oilfield service companies, and ongoing investments in unconventional reserves like tight oil and shale gas, all of which benefit the area. The use of sophisticated wireline and logging while drilling technologies in onshore and offshore basins has increased due to the growing need for reservoir characterization and real-time formation evaluation.

U.S. Well Logging Tools Market Trends

The U.S. leads the well logging tools market in 2024, driven by consistent investments in unconventional energy projects, sophisticated oilfield services, and vigorous shale exploration. Demand is further fueled by the widespread use of real-time data systems and digital oilfield solutions in important production basins.

The Middle East & Africa are expected to be the fastest-growing segment in the market during the forecast period, driven by government-led efforts to increase hydrocarbon production and ongoing exploration projects in unexplored reserves. Logging technologies are being adopted quickly throughout the region due to the growing need for effective formation of evaluation tools to support high-output drilling campaigns.

Why is Middle East and Africa the Fastest-Growing the Well Logging Tools Market?

The Middle East and Africa (MEA) region is emerging as the fastest-growing market for well logging tools due to its abundant hydrocarbon reserves and rising exploration and production activities. As mature oilfields reach declining output levels, operators are investing in new wells and enhanced recovery operations, driving the demand for precise subsurface characterization. The adoption of advanced technologies such as digital logging, real-time data analytics, and automation is further improving operational efficiency and reservoir management. Additionally, supportive government policies, fiscal incentives, and infrastructure investments from national oil companies are fostering upstream growth, making the MEA region a key hotspot for well logging tool deployment.

UAE Well Logging Tools Market Trends

The United Arab Emirates is witnessing rapid growth in the well logging tools market, driven by ADNOC's significant expenditures in cutting-edge technologies for drilling and formation assessment. Modern logging tools are being adopted nationwide more quickly thanks to growing exploration programs and a strong emphasis on production efficiency.

Top Companies in the Well Logging Tools Market

- Schlumberger Limited: Schlumberger is the global leader in well logging and formation evaluation equipment, offering a full suite of open-hole, cased-hole, and logging-while-drilling systems. Its advanced technologies like Litho Scanner and Sonic Scanner provide high-resolution subsurface data for accurate reservoir modeling. The company continues to integrate AI, cloud analytics, and digital twins to enhance real-time well analysis and productivity.

- Halliburton: Halliburton delivers a wide range of well logging tools and equipment designed for formation evaluation, well integrity analysis, and production optimization. Its advanced sensor technologies and wireline services provide detailed rock and fluid characterization. The company's investment in digital oilfield solutions enhances data acquisition, processing, and visualization across the exploration-to-production cycle.

- Baker Hughes: Baker Hughes develops precision well logging equipment including wireline, acoustic, and nuclear logging tools optimized for complex drilling environments. Its technology enables real-time pressure, porosity, and lithology analysis, improving reservoir interpretation and drilling efficiency. The company is also pioneering digital platforms that integrate subsurface data for faster and more informed decision-making.

- CNPC (China National Petroleum Corporation): CNPC offers comprehensive well logging systems and services, supporting both conventional and unconventional resource exploration. The company's logging technologies are used extensively across Asia, the Middle East, and Africa. CNPC focuses on developing high-temperature and high-pressure logging tools to improve formation evaluation accuracy in deep and challenging wells.

- GE Oil & Gas:Now part of Baker Hughes (as BHGE), GE Oil & Gas historically specialized in advanced measurement and logging instrumentation integrated with digital industrial systems. Its solutions focus on data connectivity, predictive maintenance, and real-time well monitoring. The company's strength lies in combining industrial IoT and analytics for enhanced operational reliability in well logging operations

Other Companies in the Market

- Century Geophysical, L.L.C.: Manufactures portable and downhole well logging systems, known for rugged designs used in groundwater, mineral, and geothermal exploration.

- Horizon Well Logging: Specializes in surface logging and data acquisition equipment, offering geological and gas monitoring tools for drilling operations.

- Hotwell: Designs and manufactures well logging tools and sensors for high-temperature and high-pressure environments, widely used in geothermal and oilfield applications.

- Keller America, Inc.: Produces precision pressure and level instrumentation used in logging and subsurface monitoring systems for oil, gas, and groundwater applications.

- Mount Sopris Instrument: A leading provider of borehole geophysical logging tools and data acquisition systems, serving water well, mining, and geotechnical industries.

- MXROS: Offers advanced logging systems and downhole measurement technologies for oilfield and mining sectors, focusing on real-time data transmission and analysis.

- Robertson Geologging Ltd.: Supplies a full range of slimline borehole logging equipment and software for groundwater, mining, and civil engineering applications.

- Felix Technology Inc.: Develops compact logging equipment and data acquisition systems tailored for wireline and memory logging in small-scale and remote operations.

- DGRT Pty Ltd.: Provides specialized well logging instruments and field service tools for geotechnical and mineral exploration applications.

- ANTARES Datensysteme GmbH: Focuses on data acquisition, control systems, and software integration for well logging, geophysical measurements, and laboratory applications.

Recent Developments

- In September 2025, Researchers introduced WLFM, a foundation model for multitasking and cross-well geological interpretation, achieving significant improvements in porosity estimation and lithology classification.(Source: https://arxiv.org)

- In July 2025, SLB launched OnWave, an autonomous logging platform that acquires multiple high-fidelity formation evaluation measurements downhole without the need for a wireline unit or cable. The cable-free design reduces deployment time by more than half, allowing drill pipe rotation and mud circulation during logging to improve safety and reduce tool sticking. (Source: https://www.slb.com)

Segments Covered in the Report

By Tool Type

- Wireline Logging Tools

- Open-Hole Tools

- Cased-Hole Tools

- Formation Evaluation Tools

- Logging While Drilling (LWD) Tools

- Measurement While Drilling (MWD) Tools

- Formation Evaluation LWD Tools

- Mud Logging Tools

- Gas Detection & Analysis Tools

- Cuttings Analysis Tools

- Other Specialized Logging Tools

- Nuclear Logging Tools

- Acoustic / Sonic Tools

- Resistivity & Imaging Tools

- Magnetic & Density Logging Tools

By Type of Measurement

- Gamma Ray Logging Tools

- Resistivity / Conductivity Tools

- Density & Porosity Tools

- Neutron Logging Tools

- Sonic / Acoustic Logging Tools

- Nuclear Magnetic Resonance (NMR) Tools

- Imaging & Formation Evaluation Tools

- Other Specialty Logging Tools

By Application

- Oil & Gas Exploration

- Onshore Exploration

- Offshore Exploration

- Reservoir Characterization & Evaluation

- Well Completion & Stimulation Analysis

- Production Monitoring & Optimization

- Geothermal Energy Wells

- Mining & Mineral Exploration

By End User

- Oil & Gas Operators / Exploration Companies

- Service Providers & Logging Contractors

- National Oil Companies (NOCs)

- Independent & Private Exploration Firms

- Geothermal Energy Companies

- Mining & Mineral Companies

By Logging Method

- Open-Hole Logging

- Cased-Hole Logging

- Directional / Horizontal Well Logging

- Extended Reach & Deepwater Logging

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting