What is the Energy Portfolio Management Market Size?

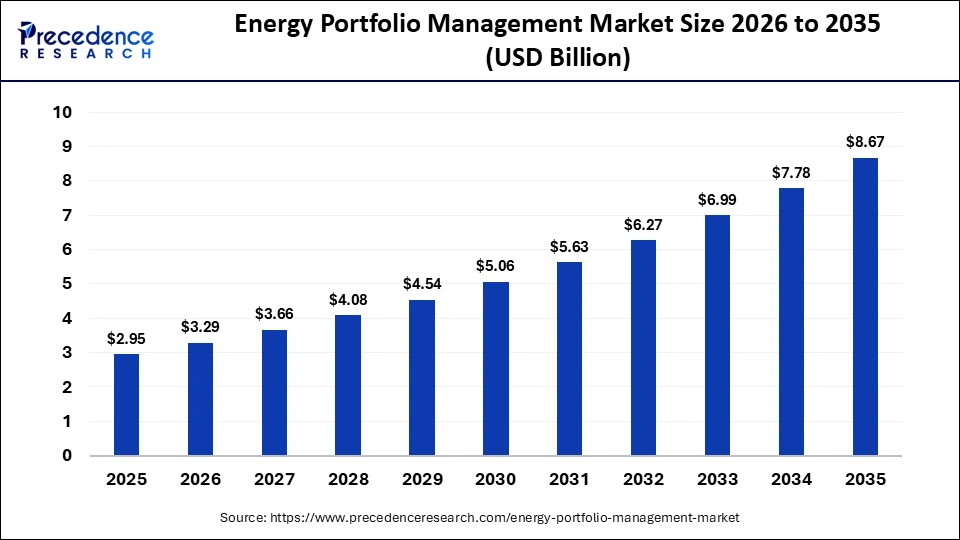

The global energy portfolio management market size accounted for USD 2.95 billion in 2025 and is predicted to increase from USD 3.29 billion in 2026 to approximately USD 8.67 billion by 2035, expanding at a CAGR of 11.38% from 2026 to 2035. The market for energy portfolio management is experiencing robust growth, driven by increasing demand for real-time monitoring and decision-making tools to optimize energy procurement and trading strategies.

Market Highlights

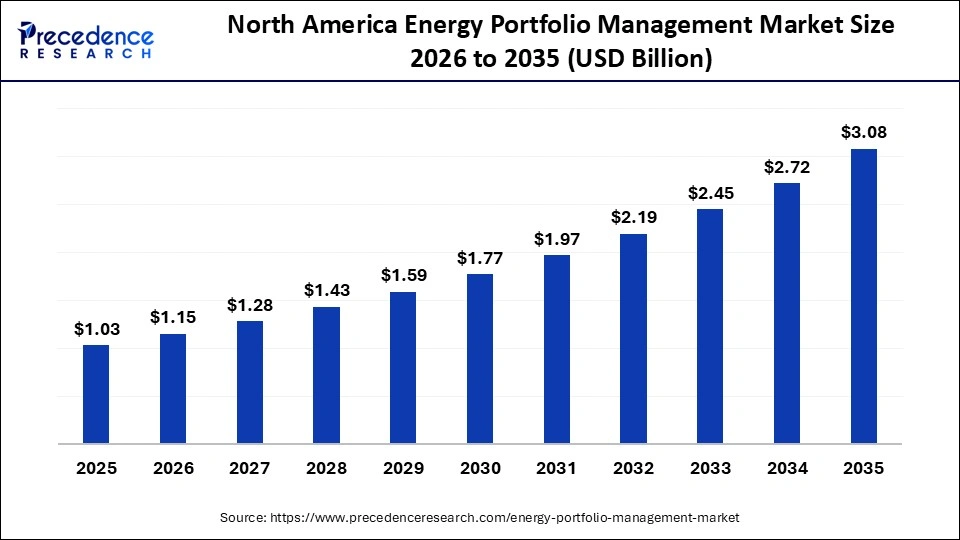

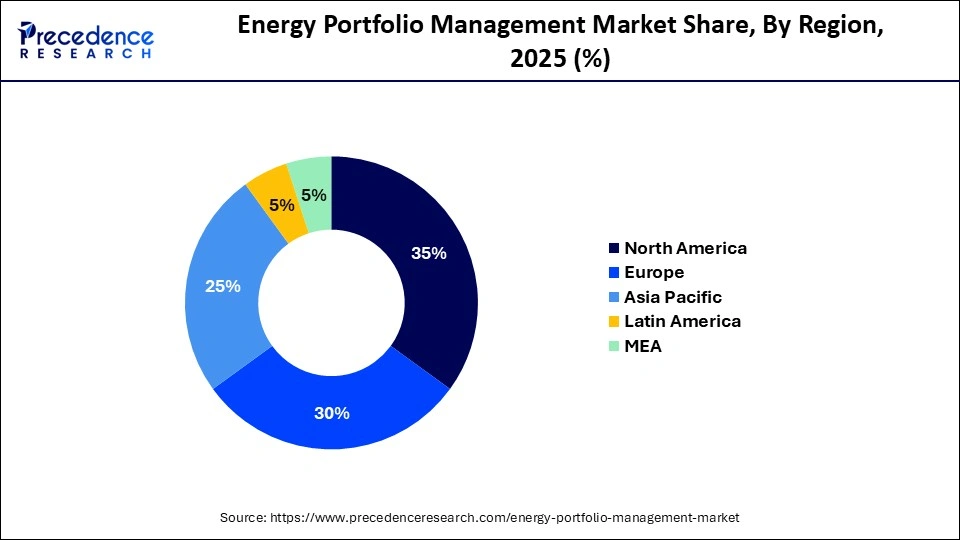

- North America dominated the market, holding the largest market share of 35% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

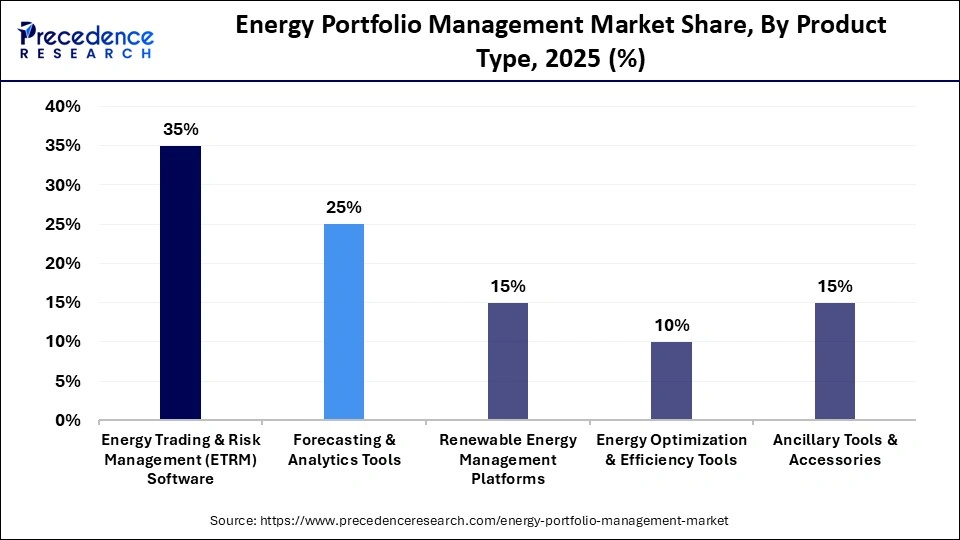

- By product type, the energy trading & risk management (ETRM) software segment held the largest major market share of 35% in 2025.

- By product type, the forecasting & analytics tools segment is growing at a remarkable CAGR between 2026 and 2035.

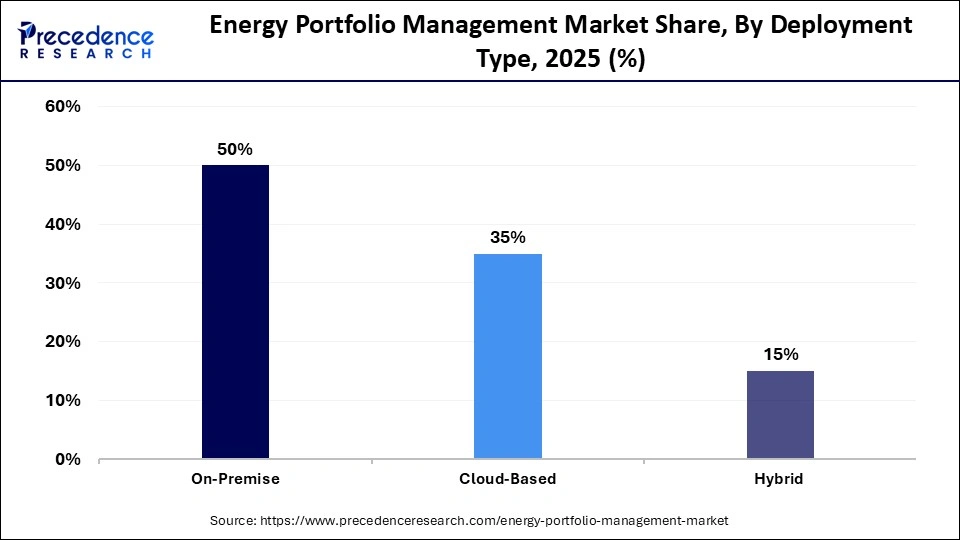

- By deployment type, the on-premise segment contributed the highest market share of 50% in 2025.

- By deployment type, the cloud-based segment is expanding at a significant CAGR between 2026 and 2035.

- By application, the electric utilities & power generation segment captured the biggest market share of 30% in 2025.

- By application, the renewable energy operators segment is poised to grow at a notable CAGR between 2026 and 2035.

- By technology, the advanced analytics & AI algorithms segment accounted for the largest market share of 40% in 2025.

- By technology, the machine learning forecasting models segment is set to grow at a remarkable CAGR between 2026 and 2035.

A New Age for Energy and Commodity Trading

The energy portfolio management market comprises software, platforms, and services that allow utilities, energy producers, traders, and large energy consumers to optimize, monitor, and manage diversified energy portfolios across conventional and renewable sources. These systems combine advanced analytics, load-forecasting engines, market-simulation tools, and integrated risk-management modules to support operational and financial decision-making. Energy portfolio management platforms often include trading interfaces connected to day-ahead, intraday, and balancing markets, enabling real-time participation in electricity, gas, and renewable certificate markets.

Modern solutions incorporate renewable energy management capabilities that track production variability, forecast wind and solar output using machine learning models, and align renewable procurement with regulatory requirements. They support risk mitigation through tools that calculate value-at-risk, monitor hedging effectiveness, and assess exposure to market price fluctuations.

Integrating AI Into Energy and Resources Initiatives

As AI technology continues to evolve, AI integration is significantly accelerating growth in the energy portfolio management market by providing high-resolution, data-driven insights and advanced automation across trading, forecasting, and asset optimization. AI systems now support real-time monitoring of grid conditions, market prices, plant performance, and renewable output, allowing utilities and energy producers to make decisions that respond to rapidly changing operating environments. In asset-heavy sectors, AI-enabled predictive maintenance models analyse vibration signals, thermal images, and historical fault data to anticipate equipment failures and reduce downtime. These models became widely adopted after 2018, when major utilities began integrating condition-monitoring data directly into centralized portfolio management systems.

Forecasting capabilities have improved substantially with machine learning. Machine learning models incorporate weather forecasts, historical consumption patterns, satellite irradiance data, turbine performance curves, and regional grid load behaviour to generate accurate demand and supply predictions. These techniques are now used in markets such as the European day-ahead and intraday markets, the California ISO, and the Australian National Electricity Market, where sub-hourly forecasting is required to manage high renewable penetration.

Energy Portfolio Management Market Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to grow at an accelerated pace. The market is driven by rising energy market volatility, increasing adoption of renewable energy, digital transformation initiatives, and the growing need for efficient energy procurement and cost management.

- Global Expansion: Several key players in the energy portfolio management market are actively expanding their geographical presence through strategic investments, acquisitions, and new facilities. For instance, in September 2025, Hitachi Energy, a wholly owned subsidiary of Hitachi, Ltd., and global leader in electrification, announced a historic investment of more than $1 billion USD to expand the production of critical electrical grid infrastructure in the United States. These investments, among the largest in the U.S. electrical industry, include approximately $457 million USD for a new large power transformer facility in South Boston, Virginia, along with significant expansions of existing facilities nationwide.

- Sustainability Trends: The rising global push towards a net-zero, low-carbon economy. Energy Portfolio Management (EPM) is increasingly focused on strategies to significantly reduce an organization's carbon footprint by transitioning from fossil fuels to cleaner energy sources such as wind, solar, and green hydrogen.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.95 Billion |

| Market Size in 2026 | USD 3.29 Billion |

| Market Size by 2035 | USD 8.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.38% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Deployment Type, Application, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Energy Portfolio Management Market Segmental Insights

Product Type Insights

Energy Trading & Risk Management (ETRM) Software: The energy trading & risk management (ETRM) software segment held the largest market share of 35% in 2025. The segment's growth is driven by rising energy price volatility, the increasing complexity of integrating renewable energy sources, and stringent regulatory compliance. ETRM software manages the entire energy trading lifecycle, capturing deals, tracking physical commodity flows, analyzing risk, and settling energy commodity transactions.

Forecasting & Analytics Tools: On the other hand, the forecasting & analytics tools segment is expected to grow at a remarkable CAGR during the forecasted period between 2026-2035. The segment's growth is supported by the rising complexity of energy markets and the growing need for operational efficiency and risk minimization. Moreover, the growing integration of renewables, such as solar and wind power, and energy storage assets increases the need for advanced analytics and AI/ML tools.

Deployment Type Insights

On-Premise: The on-premise segment dominates the energy portfolio management market with a 50% share. This leadership is driven by the operational requirements of utilities, energy traders, and grid operators who rely on low-latency systems for high-stakes decision-making. In wholesale power markets such as the PJM Interconnection, the ERCOT market in Texas, and the European Energy Exchange (EEX), trading desks operate on millisecond-level execution windows. These environments require computational models, risk engines, and optimization algorithms to run locally to avoid delays associated with cloud routing. On-premises systems provide deterministic performance and reduced latency, which is essential for real-time bidding, automated dispatch optimization, and intraday balancing strategies.

Cloud-Based: On the other hand, the cloud-based segment is the fastest-growing in the energy portfolio management sector, with a high expected CAGR. Cloud-based deployment model offering various benefits such as cost-effectiveness, flexibility, and scalability. Cloud solutions enable faster deployment and real-time analytics, making them highly popular in the energy portfolio management market.

Application Insights

Electric Utilities & Power Generation: The electric utilities & power generation segment dominated the energy portfolio management market, accounting for 30% of the market share. Energy Portfolio Management (EPM) is crucial for electric utilities and power generators as they transform the market landscape. Energy Portfolio Management (EPM) provides effective tools for managing a diverse portfolio of generation assets, including gas, coal, nuclear, hydro, solar, and wind.

Renewable Energy Operators: On the other hand, the renewable energy operators segment is the fastest-growing in the energy portfolio management market with a high CAGR, since renewable energy operators are a rapidly expanding segment within the energy portfolio management (EPM) market. Energy portfolio management tools assist in managing distributed energy resources and integrating them into aging grid infrastructure. Additionally, supportive government incentives, tax credits, and stringent corporate sustainability goals increase the demand for strong EPM systems.

Technology/Mode of Action Insights

Advanced Analytics & AI Algorithms: The advanced analytics & AI algorithms segment dominates the energy portfolio management market, accounting for 40% of the market share. Advanced analytics and AI algorithms enhance efficiency, sustainability, and profitability in a complex and volatile landscape. AI algorithms effectively analyze large datasets, including weather patterns, historical trends, and real-time grid conditions, to predict energy demand and supply.

Machine Learning Forecasting Models: On the other hand, the machine learning forecasting models segment is the fastest-growing segment of the energy portfolio management market, with the highest growth rate. Machine learning forecasting models are crucial tools and have become increasingly popular among energy operators, utilities, and traders. Machine learning forecasting models help operators effectively balance the grid.

Energy Portfolio Management MarketRegional Insights

The North America energy portfolio management market size is estimated at USD 1.03 billion in 2025 and is projected to reach approximately USD 3.08 billion by 2035, with a 11.58% CAGR from 2026 to 2035.

What Caused North America to Dominate the Energy Portfolio Management Market During 2025?

North America dominated the energy portfolio management market, accounting for 40% of the market in 2025. The region's leadership is supported by sustained investments in renewable energy infrastructure, digital grid modernization, and advanced analytics capabilities across utilities, independent power producers, and large commercial energy buyers. The United States and Canada have expanded wind and solar generation significantly over the past decade, driven by state-level Renewable Portfolio Standards introduced beginning in 1999, the extension of federal Investment Tax Credits for solar, and Production Tax Credits for wind. These policies created a large and diverse renewable asset base that requires sophisticated portfolio management tools to model intermittency, optimize dispatch, and coordinate trading positions in markets such as PJM, ERCOT, NYISO, and CAISO.

The region has also seen rapid adoption of advanced analytics to support real-time decision making. Utilities increasingly deploy machine learning models for demand forecasting, renewable output prediction, congestion management, and storage optimization. These models are integrated into enterprise portfolio systems to manage price volatility, reduce imbalance charges, and enhance hedging strategies. Digital platforms are further supported by the rollout of smart meters and grid sensors under programs such as the U.S. Smart Grid Investment Grant Program, which initiated large-scale deployments after 2010 and continues to influence data availability for modern analytics.

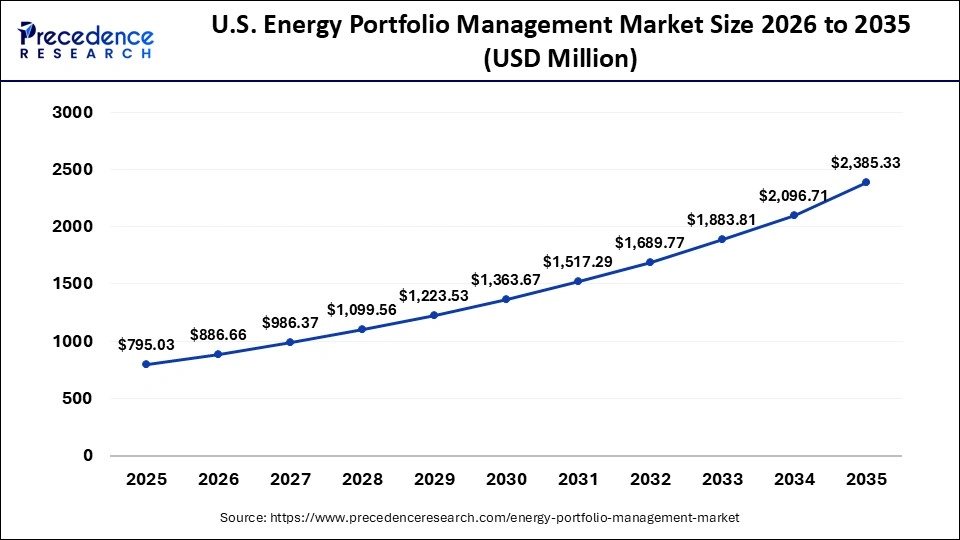

The U.S. energy portfolio management market size is calculated at USD 795.03 million in 2025 and is expected to reach nearly USD 2,385.33 million in 2035, accelerating at a strong CAGR of 11.61% between 2026 and 2035.

United States Energy Portfolio Management Market Trends

The United States is a major contributor to the energy portfolio management market, with growth driven by a combination of factors, including rising complexity in energy systems, the growing shift towards renewables (solar, wind) and energy storage, and the increasing emphasis on sustainability. Government incentives such as the Inflation Reduction Act, energy security concerns, and climate initiatives have led to an increasing investment in clean energy and infrastructure. The country is experiencing widespread adoption of advanced technologies, such as AI, machine learning, and cloud-based energy monitoring solutions, to achieve high efficiency, resilience, and sustainability.

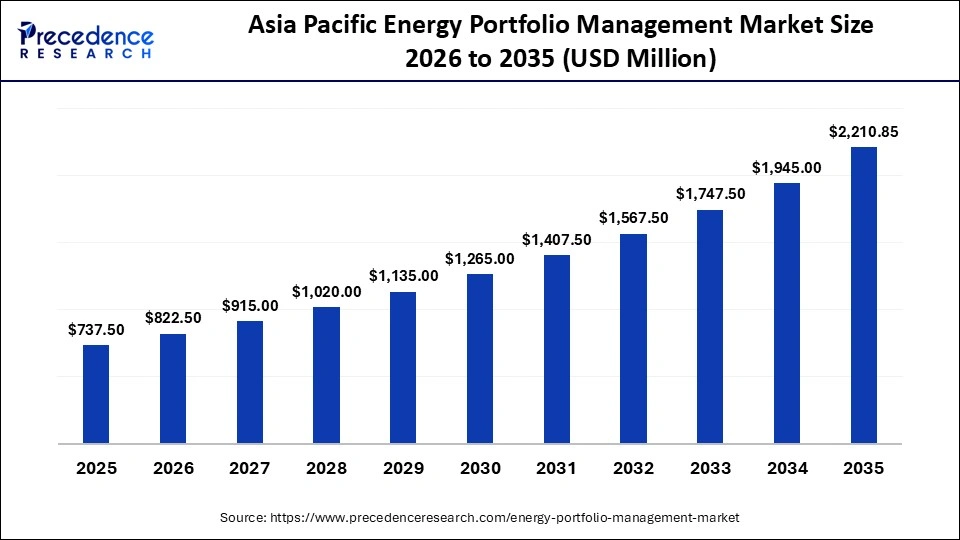

The Asia Pacific energy portfolio management market size is expected to be worth USD 2,210.85 million by 2035, increasing from USD 737.50 million by 2025, growing at a CAGR of 11.60% from 2026 to 2035.

Why Is the Asia Pacific Region Set to Be the Fastest-Growing in the Energy Portfolio Management Market?

Asia Pacific is the fastest-growing region in the energy portfolio management market, with a CAGR of 20%, driven by rapid industrialization, strong policy initiatives, increased focus on grid modernization, rising energy demand, significant investments in renewable energy infrastructure, and the integration of AI, ML, and cloud-based platforms. The increasing complexity of energy markets is driving the need for integrated portfolio management solutions.

The region is a significant leader in new renewable energy installations and accounts for more than half of the world's installed clean energy capacity. The government is implementing favorable policies that incentivize the adoption of renewable energy sources, driving strong demand for energy portfolio management solutions.

In September 2025, the Andhra Pradesh Chief Secretary directed power utilities to maximise hydel power generation during the rainy season to meet the State's rising energy demand. He announced that an Energy Portfolio Management System (EPMS) app would be used to transform short-term power procurement and bring operational efficiency. The results of the pilot will be studied to support wider adoption, with a focus on optimising power purchase costs.

China's Energy Portfolio Management Market Trends

The country holds a substantial market share in the energy portfolio management market, and growth is largely driven by well-established regulatory frameworks, an increasing focus on sustainability goals, the rapid expansion of the energy sector, the rapid transition to cleaner energy sources, and a rising government push for decarbonization. Moreover, increasing investments in clean energy projects and the rising need for integrated energy solutions to manage diverse energy sources are expected to drive market growth during the forecast period.

The Europe energy portfolio management market size has grown strongly in recent years. It will grow from USD 885.00 million in 2025 to USD 2,644.35 million in 2035, expanding at a compound annual growth rate (CAGR) of 11.57% between 2026 and 2035.

Is Europe Responsible for Growth in the Energy Portfolio Management Market?

The European region holds a notable market share in energy portfolio management, supported by strong national and regional policies that prioritize decarbonization, digitalization, and the large-scale integration of renewable energy. Countries such as Spain, the UK, Germany, and the Netherlands have adopted ambitious climate and energy frameworks that directly increase the demand for sophisticated portfolio optimization tools. Europe's net zero commitments, including the EU target for climate neutrality by 2050 and national policies such as Germany's 2045 net zero target and the UK's 2050 net zero legislation, require utilities and energy producers to manage increasingly complex energy mixes that combine intermittent renewables, storage assets, and flexible demand resources.

This policy environment accelerates the adoption of advanced energy portfolio management systems. Spain's regulatory updates, which fall under Royal Decree 960/2020, have restructured renewable auctions and grid access rules, requiring high-precision forecasting and market participation models. Germany's ongoing reforms to the Renewable Energy Sources Act are influencing bidding strategies in day-ahead and intraday markets, making real-time analytics and automated dispatch optimization essential for asset owners.

Germany Energy Portfolio Management Industry Trends

Germany leads the energy portfolio management industry. The country's growth is primarily driven by an increasing demand for sophisticated systems to manage diverse, complex energy portfolios and mitigate risks. The regulatory compliance and risk management requirements in energy trading and procurement are propelling the market's growth in the region. The country set ambitious net-zero targets and introduced several policies to accelerate the adoption of cleaner energy sources. Government-led policy aiming for 80 percent renewable electricity by 2030 and net-zero emissions by 2045.

The advanced recycling market in the Middle East & Africa is accelerating, supported by explicit national targets and new circular-economy policies. The UAE's Circular Economy Policy 2021-2031 sets capacity building and material-reuse priorities that directly enable investment in chemical and advanced recycling facilities. Saudi Arabia's Vision 2030 and linked projects, including the Riyadh Integrated Waste Management plan, set municipal diversion and recycling targets such as a national recycling rate goal of around 35% and project-level goals to divert 81% of municipal solid waste from landfill in Riyadh.

Today's baseline recycling performance in several Gulf countries remains low. Reports note current municipal recycling rates near 7% in parts of the Gulf, which highlights the scale of infrastructure gaps that advanced recycling can address if policies and investment follow through. These targets create procurement certainty for recycling technologies and feedstock for advanced conversion plants.

South Africa Energy Portfolio Management Market Trends

The country is experiencing remarkable growth. The country's growth is also characterized by rapid urbanization, increasing demand for sustainable solutions, stringent government regulations on carbon emissions, and energy efficiency. In addition, the rising integration of renewable energy sources and smart grid technologies, as well as increasing government initiatives toward sustainability, are expected to drive market expansion during the forecast period.

Key Players in the Energy Portfolio Management Market

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Oracle Corporation

- IBM Corporation

- GE Digital

- Hitachi ABB Power Grids

- Openlink Financial LLC

- Allegro Development Corp.

- Aspect Enterprise Solutions

- Eka Software Solutions

- Enverus

- W Energy Software

- Power Factors

- Energy Exemplar

- AspenTech

- Ventyx

- Calypso Technology Inc.

- PLEXOS Solutions

- Eka Energy Solutions

Recent Developments

- In February 2024, Stem announced its new PowerTrack Asset Performance Management (APM) suite, a powerful software solution enabling owners, operators, and asset managers to centralize and streamline the management of storage, solar, and hybrid energy asset portfolios. The suite includes highly configurable, persona-based dashboards and workflows, allowing users to create and customize the interface and data that matter most to them. (Source: https://investors.stem.com)

- In July 2025, Hitachi, Ltd., and Hartree Partners Singapore Pte. Limited, known for its strength in commodity trading, signed a Memorandum of Understanding (MoU) to jointly explore the development of digital infrastructure in Japan. Under this MoU, the three companies will jointly explore funding schemes to meet the capital needs for the development of grid-scale storage batteries to support grid stabilization and large-scale digital infrastructure in Japan that requires substantial amounts of electricity.(Source: https://www.hitachi.com)

Energy Portfolio Management MarketSegments Covered in the Report

By Product Type

- Energy Trading & Risk Management (ETRM) Software

- Commodity trading modules

- Risk management analytics

- Forecasting & Analytics Tools

- Load & demand forecasting

- Price & market trend analytics

- Renewable Energy Management Platforms

- Solar & wind integration

- Storage & microgrid management

- Energy Optimization & Efficiency Tools

- Energy usage optimization

- Automated efficiency reporting

- Ancillary Tools & Accessories

- Dashboards & reporting modules

- Integration APIs & connectors

By Deployment Type

- On-Premise

- Cloud-Based

- Hybrid (On-Premise + Cloud)

By Application

- Electric Utilities & Power Generation

- Oil & Gas Companies

- Renewable Energy Operators

- Industrial & Commercial Energy Users

- Trading & Market Analytics Firms

- Other Applications

By Technology

- Advanced Analytics & AI Algorithms

- Machine Learning Forecasting Models

- Blockchain & Smart Contract Integration

- IoT & Smart Metering Integration

- Other Technologies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting