What is the Demand-Side Management (DSM) Services Market Size?

The global demand-side management (DSM) services market is expanding rapidly as utilities and industries adopt advanced energy optimization, load management, and smart grid solutions to cut costs and improve efficiency.The market is driven by rising energy-efficiency initiatives, grid modernization efforts, and increased adoption of smart technologies across the commercial and residential sectors.

Market Highlights

- North America led the demand-side management (DSM) services market with approximately 37% of the market share in 2024.

- The Asia Pacific is estimated to expand the fastest CAGR of 17.40% between 2025 and 2034.

- By service type, the energy efficiency services segment held approximately 40% of the market share in 2024.

- By service type, the demand response services segment is growing at the fastest CAGR between 2025 and 2034.

- By solution type, the software & analytics segment captured around 38% of market share in 2024.

- By solution type, the managed DSM services segment is expected to expand at a notable CAGR 15% from 2025 to 2034.

- By end-user, the utility companies segment held more than 45% of market share in 2024.

- By end-user, the aggregators & energy service providers segment is growing a notable CAGR of 16% from 2025 to 2034.

- By technology integration, the smart meters & AMI segment accounted for major market share of 40% in 2024.

- By technology integration, the AI-based load forecasting & DER-integrated DSM segment is expected to expand at a notable CAGR of 18% between 2025 and 2034.

Increasing Demand for Real-Time Service Optimization: Dynamic Analytics and Autonomous Response Systems

The increasing demand for fast resolution of customer needs and optimization of field services is driving demand-side service management a step closer to the mainstream. The demand-side service management market emphasizes platforms that intelligently align service delivery with changes in customer demand, leveraging analytics, automation, and dynamic scheduling and rescheduling. Using the DSSM system will lessen service inefficiency in service operations. DSSM represents technology-centric systems that leverage advanced demand models to allocate resources and optimize service delivery across industries such as utilities, telecom, logistics, and retail.

Organizations are increasingly relying on DSSM solutions to ensure SLA compliance, reduce operational costs, and expedite response times to service disruptions. As fiscal pressure for digital transformation increases, implementing DSSM solutions will be critical to the service infrastructure to facilitate a shift from reactive to proactive workflows, and ultimately to predictive workflow delivery. Outcome-based service delivery will become standard in contemporary service ecosystems.

AI-Powered Grid Intelligence Driving Smarter Energy Demand Control: Predictive Load Balancing and Automated Efficiency

Artificial intelligence is revolutionizing demand-side management by enabling real-time load forecasting, automated demand response, and dynamic pricing, thereby improving the integration of renewables and reducing stress during peak load. For example, along with manufacturers, Google has partnered with two U.S. electric utilities to reduce its AI data center power consumption during peak grid loads by 2025. The utility pilot programs are also introducing machine learning applications to improve short-term solar and load forecasting, helping smooth out variability.

In April 2024, Brillion introduced its AI-powered utility-customer-engagement application suite that supports energy-efficiency, clean energy, and DSM programmes by enabling utilities to scale interactions, personalise messaging, automate workflows, and track incentive participation across end-users.

Distributors in India are modernizing their grids, utilizing AI plus storage for more effective load balancing. The Union of Concerned Scientists in the US and other international agencies warn that the workloads required to train and run AI applications will sharply raise overall electricity demand, despite the fact that AI will drive advances in efficiency, adding yet another regulatory and cybersecurity consideration for regulators to manage.

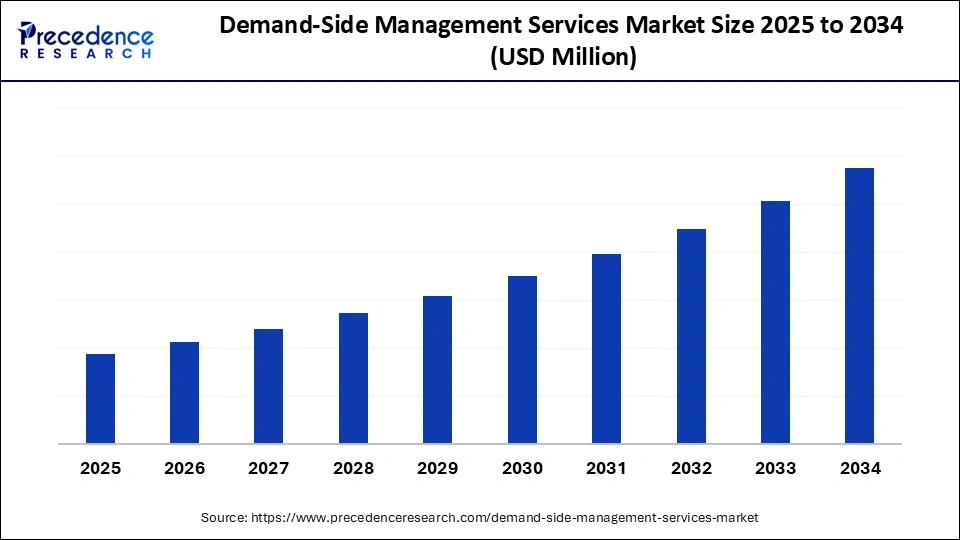

Demand-Side Management (DSM) Services Market Outlook

Demand-side management is on the rise as grids experience higher peak-load pressures. Utilities are increasingly relying on demand response to balance demand, defer infrastructure upgrades, and increase system resilience as electrification in transport, industry, and buildings spreads across the globe.

Participation in demand-side management programs is being promoted across Asia, Europe, and North America, as governments support the flexible use of electricity. Advancements in digital infrastructure, greater penetration of renewables, and expanding smart meter coverage are facilitating increased participation by residential, commercial, and industrial consumers.

Many DSM programs and policies include energy-efficiency measures to leverage energy savings as storage alternatives. More rigorous energy-efficiency mandates are becoming increasingly prevalent in various countries. As clean-energy legislation continues to grow, energy efficiency will be recognized as a key opportunity to manage demand, especially for electrifying transportation.

Governments are ramping up support for demand-side management through the application of variable or dynamic tariffs, incentives for demand response, and mandated energy-efficiency improvements. National energy offices are increasingly helping advance flexible consumption models to stabilize the grid, manage the integration of renewables, and minimize reliability risks during extreme weather events.

The demand-response programs provide decarbonization opportunities by displacing peaking fossil-fuel units, facilitating renewable integration, and reducing system emissions. As a growing number of countries work to establish clean-energy targets, flexible load from consumer behavior has emerged as a critical tool for supporting climate goals and ensuring grid stability.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Solution Type, End-User, Technology Integration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand-Side Management (DSM) Services Market Segment Insights

Service Type Insights

Energy Efficiency Services: This segment led the market in 2024 with a dominating share of around 40%, as long-term reductions in energy consumption are a priority for organizations. Services consist of upgrades to equipment, efficient lighting and HVAC systems to reduce operating expenses. Real-Time Energy Monitoring & Analytics enhances efficiency efforts and provides continuous visibility of energy utilization and load profiles, which help users recognize anomalies, improve forecasting and refine consumption.

Demand Response (DR) Services: This segment is the fastest-growing category in the demand-side management (DSM) services market, as utilities increasingly rely on flexible load management to stabilize the grid. Through DR programs, consumers are financially incentivized to consumptions during periods of high demand or curtail usage in when demand is the highest which addresses renewable variability and grid congestion. Load shifting and peak load reduction (both somewhat period-specific DR programs) provide additional system resiliency by shifting energy-intensive activities to off-peak periods.

Distributed Energy Optimization Services: These services are becoming more relevant as distributed energy resources, such as solar, storage and EV chargers, become more commonplace. Distributed energy optimization services can help coordinate decentralized assets, enable bidirectional energy flows, and improve grid flexibility. They can enable owners or end-users to optimize on-site generation, reduce grid services, and trade energy to local energy markets, further improving the situation overall with DSM.

Solution Type Insights

Software & Analytics Platforms: This segment accounts for the largest share of the demand-side management (DSM) services market at 38% because they perform pivotal functions in real-time monitoring, load forecasting, and automated energy control. Utilities and enterprises utilize software and analytics platforms to improve consumption patterns and reduce waste, which, for example, helps to integrate distributed energy resources. Hardware components, including meters, sensors, and controllers, work in concert with software to facilitate accurate data collection and communication, serving as the essential foundation on which software is built to provide DSM intelligence.

Managed DSM Services: The segment is quickly becoming the area of greatest growth, with an approximately 15% expected CAGR, when utilities build programs to procure energy optimization, grid balancing, and program management through external contracted services. Managed DSM Services provides utilities with a comprehensive offering focused on analytics, customer enrolment management, and demand response implementation for utility customers, ultimately relieving utilities of the operational burden. Integrated DSM Platforms with DER control complement these transformations by incorporating distributed energy resources into a unified management platform.

Integrated DSM Platforms with DER Control: This segment is becoming a central part of energy management as grid infrastructure increasingly relies on solar generation, stored energy, and electric vehicle charging. Integrated DSM Platforms with DER Control further manage distributed energy resources to optimize load periods and bi-directional flows across grid infrastructure. They allow services to deliver stability to grids with greater integration of renewable energy, while also giving energy users a higher level of participation in local flexibility markets. Integrated DSM Platforms with DER Control enable more predictable business models across each input to a co-productive DSM equation, ultimately building more value into the DSM value chain.

End User Insights

Utility Companies: This segment has approximately 45% market share and leads the demand-side management (DSM) services market, implementing large-scale load control, peak shaving, and grid balancing initiatives. Utilities use DSM to manage demand fluctuations, ease infrastructure strain, and integrate renewables into the grid. Large Commercial Enterprises support these efforts by using demand-side management tools that facilitate load monitoring and link energy-efficient appliances and systems to minimize end-user operational costs across energy-intensive facilities.

Aggregators & Energy Service Providers: This segment is the fastest-growing end-user segment, with an expected CAGR of approximately 16%, as it enables consumers to participate in flexibility markets, virtual power plants, and coordinated demand response programs. These organizations aggregate distributed loads, storage devices, electric vehicle charging, and solar systems to provide scaled services to the grid. Markers of rapid growth in this area include regional trends toward decentralization and the liberalization of energy markets.

Smart Homes / Residential Customers: This segment represents an important, growing demand-side management market driven by the adoption of smart meters, automation systems, and connected devices. Increasingly, homeowners are using smart thermostats, solar systems, and electric vehicle chargers, which facilitate shifting loads, optimize home energy consumption, and reduce household energy bills. Adapting to these innovations and growing awareness of energy efficiency will continue to drive DSM adoption for the residential market.

Technology Integration Insights

Smart Meters & Advanced Metering Infrastructure (AMI): This segment accounts for nearly 40% of the demand-side management (DSM) services market and dominates demand-side management services technology, thanks to its role in delivering accurate, real-time consumption data. Smart meters enable utilities to accurately charge customers, identify load patterns, and apply time-of-use rates. Similarly, Building Automation & BEMS Integration bolsters DSM by leveraging technology to control HVAC, lighting, and other equipment, thereby improving efficiency across commercial and industrial buildings.

AI-Based Load Forecasting Tools and DER-Integrated DSM: These segments are the fastest-growing categories with an approximately 18% CAGR as electrical grids become more complex. AI systems enhance the accuracy of predicting loads and things, helping shape demand early rather than sustaining the load. In tandem with DER Integration (solar, storage, EVs, etc.), they facilitate the required levels of dynamic load control, flexibility, and advanced demand response strategies in the modern smart grid.

IoT Sensors & Controllers: This segment is seeing notable growth, as it helps expand DSM capabilities through continuous consumption monitoring, automated adjustments, and remote device management. IoT Sensors and Controllers interconnect equipment, appliances, and distributed assets to provide one point of control. As adoption increases, the granularity of load visibility, rapid demand response, and coordinated energy optimization across residential, commercial, and industrial settings will be enhanced.

Demand-Side Management (DSM) Services Market Regional Insights

North America retains its leadership position with approximately 37% share of the demand-side management (DSM) services market, largely due to regulatory rigor, established smart-grid systems, and the adoption of demand response (DR) programs in wholesale electricity markets. Operators in the U.S. and Canada are increasingly employing DSM strategies to mitigate the impact of rising summer and winter peaks. The oversupply of electric loads from electrification, heating/cooling loads, and intermittent renewable generation continues to create above-average Electric Peak demand. Recent grid operator and federal-level studies have demonstrated that advanced-meter penetration exceeds 50% in households across the U.S., facilitating time-of-use tariffs, behavioural DSM, and, in some cases, multi-area DR dispatch.

Utilities are actively expanding virtual power plant (VPP) partnerships to aggregate loads from residential and commercial customers and provide grid services. State and provincial entities are also amending interconnection agreements and developing aggregator and performance-based regulatory frameworks to incentivize flexible demand as an alternative to capacity expansion while addressing grid reliability.

The United States hosts numerous DSM-driven programs. Federal and ISO entities have driven DR programs that are integrated into capacity, balancing, and ancillary markets. The DOE, FERC and ISO quantity studies demonstrate an amplifying reliance on DSM to offset multi-gigawatt peaking loads associated with extreme weather patterns. These studies also highlight the advances made on large-scale access to smart meters and the expansion of VPP programs to employ more residential, commercial and industrial participation.

In April 2025, consulting firm ICF won over US$35 million in demand-side management contracts from a major utility, leveraging its AI-powered analytics platform to design, implement, and evaluate residential and commercial energy-saving programmes.

The Asia Pacific is experiencing rapid growth, with an estimated CAGR of 17.40% in the demand-side management (DSM) services market, as countries aim to enhance grid reliability while integrating high levels of renewable capacity and increasing electrification. Large utilities in China, India, Japan, South Korea, and Australia are rolling out smart meters, conducting DR pilots, or testing VPPs and digital load-management platforms. National energy ministries and system operators are integrating DSM and distributed flexibility into long-term planning processes to cope with peak demand and defer grid reinforcement.

India has agricultural DSM programs, Australia is forecasting consumer energy resources, and China is rolling out industrial DR programs, illustrating progress from pilots to structured market participation. Policy in the region is starting to signal a new innovation phase in which flexible demand enabled by technology is seen as part of the solution to stabilize rapidly evolving grids.

China Demand-Side Management (DSM) Services Market Trends

China is leading the region in DSM deployment with high penetration of smart meters, industrial DR schemes, and provincial pilot programs that incorporate dispatchable loads into grid operator decisions. Government and TSO announcements demonstrate an increasing emphasis on flexible demand to manage the growth of renewable capacity. Participation in DR programs has shifted from demonstration programs to commercial strains.

The uptake of DSM in Europe is gaining momentum as grid operators seek to manage increasing renewable energy penetration and the greater need for flexibility in both energy generation and consumer demand. ENTSO-E initiatives, revisions to national demand-response network codes, and reforms to national policy environments are beginning to unlock wholesale energy, balancing, and capacity markets for aggregated loads. Increasingly, nations are rolling out digital metering systems, developing consumer engagement programs to enable flexibility, and enabling behind-the-meter participation, all to support decarbonization policies and reduce grid congestion. The progressive electrification of both heating and mobility is forcing regulators to increasingly encourage dynamic tariffs, including flexible pricing, which will likewise provide incentives and/or enable participation in flexibility markets. Thus, DSM is emerging as an important non-wires solution across Europe.

Germany Demand-Side Management (DSM) Services Market Trends

Germany is the leading country for DSM development in Europe, supported by the rollout of smart metering programs, industrial load-facility programs, and improved market access for aggregators. Grid operators are increasingly procuring demand flexibility from both the electric and gas utility sectors to support the integration of renewable energy. In Germany, national government-level reforms, together with regional test platforms, have therefore focused on various systems, including automated demand response and enhancing access to DSP-style vehicle-storage format services, as well as SI-styled DSM balancing and congestion management services.

- In November 2025, GE Vernova outlined a coordinated energy-system strategy for Germany, emphasizing how demand-side management, alongside grid expansion, flexibility, and dispatchable generation, is critical for a reliable, affordable, low-carbon power future.

The MEA region is emerging as a market for demand-side management (DSM) services, but is driven by conflicting priorities: Gulf countries focus on reducing peak demand and improving energy efficiency, while African countries emphasize DSM to address supply constraints and grid reliability needs. Gulf utilities are implementing smart meters, DR pilot projects, and peak-shaving programs to manage loads driven increasingly high by extreme temperatures. Increasing digitalization and solar integration, and embracing electrification trends, will further support these utilities in pursuing DSM as a potentially more cost-effective strategy to add new generation capacity. When strategically deployed, the utilities will calculate that DSM will support their efforts to reduce outages and general system stress.

South Africa Demand-Side Management (DSM) Services Market Trends

South Africa has been the most active in DSM activities across the region. Much of this is due to utilities and regulators collectively incorporating demand-side reduction into the national energy plan to address peak shortages and load shedding. DSM programs centered on industrial load management, promoting energy-efficient appliances, and establishing time-of-use tariffs are expanding. DSM is quickly emerging as a practical tool to avoid outages, stabilize the grid, and defer new capacity investments.

Demand-Side Management (DSM) Services Market Companies

C3 AI Energy Management: AI-driven platform for forecasting, disaggregation, peak management and facility energy optimization.

Dexma/Spacewell Energy platform: real-time monitoring, analytics and AI recommendations for building energy savings.

Demand Response Management Software (DRMS) and Power Xpert (PXEVA) for DR orchestration and real-time power analytics.

Emerson Energy Manager (edge app) and Ovation DCS for real-time energy monitoring and plant/BESS optimization.

eSight cloud EMS collects meter data for visualization, analysis, reporting and M&V across portfolios.

Grid Solutions (GridBeats/Grid IQ): grid analytics, meter data and outage/demand forecasting platforms.

Honeywell Forge Sustainability (Power Manager) and EBI for demand/power management and supply-side optimization.

IBM TRIRIGA, Maximo and IoT for Energy facility/asset energy management, analytics and utility DSM use-cases.

OpenBlue and Metasys AI-enabled building energy management, portfolio optimization and demand-response orchestration.

OptimumLOOP / OptiCx patented chilled-water plant relational control software for continuous system-level optimization.

Recent Developments

- In November 2025, Schneider Electric and Bloomberg New Economy launched the Energy Technology Coalition to accelerate the adoption of smart-demand technologies such as AI-enabled grid management, digital twins, and demand-side automation, aiming to boost efficiency and flexibility in energy consumption globally.(Source: https://www.eco-business.com)

- In November 2025, Indian Institute of Technology Delhi (IIT Delhi) and ERLDC (Eastern Regional Load Dispatch Centre) unveiled an AI-based home-energy-management system enabling households in India to monitor and control electricity use, respond to real-time pricing and flexible loads, thereby supporting grid stability and demand-side flexibility.(Source: https://bestcolleges.indiatoday.in)

- In March 2025, DeepIntent unveiled its DeepIntent Cortex platform, a next-generation demand-side platform (DSP) for healthcare advertising that uses AI and health-data integration while not energy-DSM, the term demand-side is similarly applied in this context of managing demand flows via digital tools.(Source: https://www.prnewswire.com)

Demand-Side Management (DSM) Services MarketSegments Covered in the Report

By Service Type

- Energy Efficiency Services

- Demand Response (DR) Services

- Load Shifting & Peak Load Reduction

- Real-Time Energy Monitoring & Analytics- Extra

- Behavioral DSM Programs

- Distributed Energy Optimization Services

By Solution Type

- Software & Analytics Platforms

- Hardware (meters, sensors, controllers)- extra

- Managed DSM Services

- Integrated DSM Platforms with DER Control

By End-User

- Utility Companies

- Large Commercial Enterprises- extra

- Manufacturing & Industrial Sites

- Smart Homes / Residential Customers

- Aggregators & Energy Service Providers

By Technology Integration

- Smart Meters & Advanced Metering Infrastructure (AMI)

- IoT Sensors & Controllers

- AI-Based Load Forecasting Tools

- Building Automation & BEMS Integration- Extra

- DER Integration (solar, storage, EVs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting