What is the Building Energy Management Services Market Size?

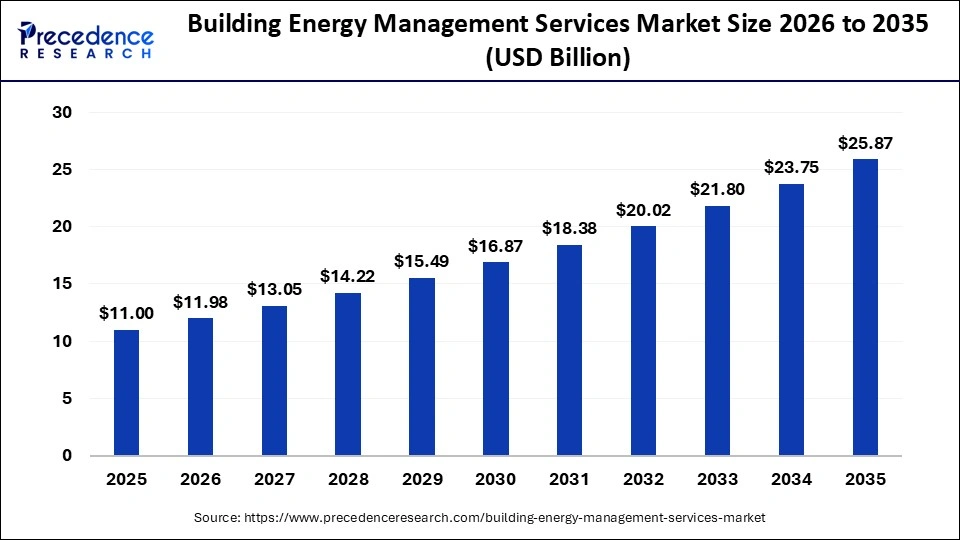

The global building energy management services market size is calculated at USD 11.00 billion in 2025 and is predicted to increase from USD 11.98 billion in 2026 to approximately USD 25.87 billion by 2035, expanding at a CAGR of 8.93% from 2026 to 2035. The market is expanding due to the increasing energy-intensive building construction, the integration of smart technologies such as IoT, AI/ML, and cloud computing to develop smart cities, and energy-use regulations or environmental conservation, further propelling the market's growth.

Market Highlights

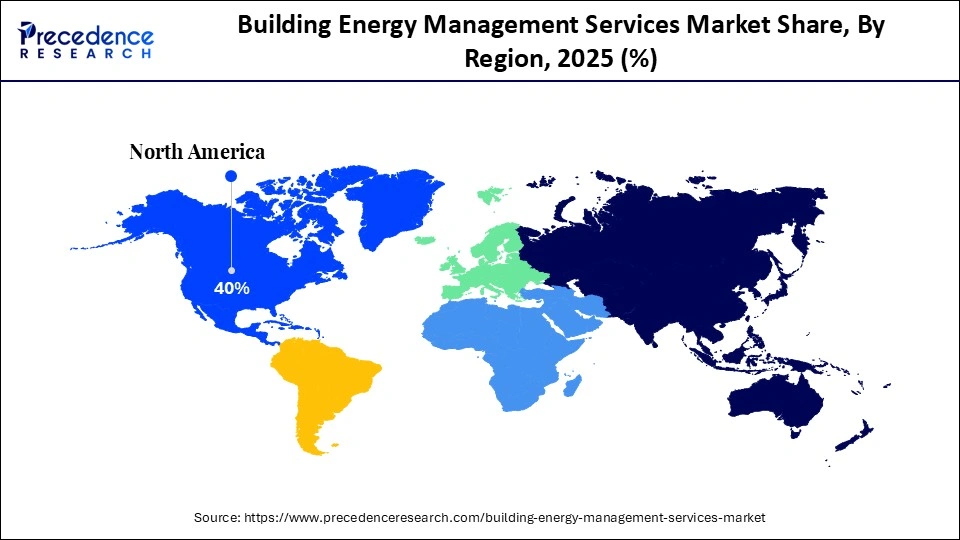

- North America accounted for the largest market share of 40% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of nearly 14.50% from 2026 to 2035.

- By service type, the energy audit and assessment services held the major market share of 35% in 2025.

- By service type, the O&M managed performance contracting services segment is growing at a solid CAGR of 11% from 2026 to 2035.

- By building type/end user, the commercial buildings segment contributed the biggest market share of 40% in 2025.

- By building type/end user, the institutional buildings segment is expanding at a solid CAGR of 12% from 2026 to 2035.

- By building systems focus, the HVAC systems services segment contributed the highest market share of 38% in 2025.

- By building a systems focus, the integration with the BEMS/IoT platforms segment is poised to grow at a notable CAGR of nearly 14% from 2026 to 2035.

Building Energy Management Services Market

The building energy management services market comprises professional services that optimize energy use in buildings. These services include energy audits, system design and integration, installation, commissioning, monitoring and verification (M&V), O&M (operations & maintenance) support, retro-commissioning, efficiency upgrades (HVAC, lighting, envelope), and performance-based energy contracting.

These services are applied across commercial, institutional, residential, and industrial buildings. They are critical for reducing operating costs, complying with green building standards, achieving sustainability goals, and integrating smart building/IoT platforms. Growth is driven by rising energy costs, regulatory mandates for building energy efficiency, increasing retrofits of aging infrastructure, digitalization of building operations, and the push for net-zero buildings globally.

AI Shifts in Building Energy Management Services Market

AI is revolutionizing the building energy management services market by offering unmatched levels of optimization and better management as compared to traditional methods. AI integration with BEMS can be broken down into three components: predictive analytics for energy usage, optimal energy distribution, and fault detection and maintenance.

AI algorithms analyze historical data and compare it with current trends to predict future energy usage patterns precisely. AI-powered building energy management services can offer energy resources allocation across subsystems of specific building systems. Such dynamic changes ensure energy resources can be utilized efficiently where they are actually needed. AI can further help detect faults and potential energy outages by analyzing real-time data collected from IoT sensors using pre-defined rules.

Building Energy Management Services Market Outlook

The building energy management services market is expanding primarily due to the growing emphasis on sustainability and energy efficiency by leading organizations across sectors, recognizing the need to minimize operational costs.

The increasing focus on renewable energy sources in the energy management for building. Many organizations are looking to reduce their carbon footprints to comply with strict environmental safety regulations, and this is considered a major trend in building energy management services, as it further aligns with the country's energy transition goals.

The market is seeing substantial investment from leading marketers such as Siemens, Schneider Electric, and Honeywell, which are providing integrated HVAC platforms. Johnson's controls integrate solutions with HVAC systems, while Cisco offers networked building management that aligns with cybersecurity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.00 Billion |

| Market Size in 2026 | USD 11.98 Billion |

| Market Size by 2035 | USD 25.87 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Building Type/End-User, Building Systems Focus, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Building Energy Management Services Market Segmental Insights

Service Type Insights

Energy Audit & Assessment Services: Energy audit & assessment services held the largest market share of 35% in 2025, driven by mandates for energy audits that offer benefits such as significant cost savings, lower energy bills, improved energy efficiency, safety improvements, environmental benefits, and increased comfort for occupants. Energy audits can reveal poor energy management and loopholes and help sustain effective maintenance practices.

O&M & Managed Performance Contracting Services: The O&M-managed performance contracting services segment is expected to witness the fastest CAGR of nearly 11% over the foreseeable period. The segment is growing due to factors such as no upfront costs, fixed energy savings with financial predictability, enhanced operational efficiency, and improved asset management. Effective implementation of O&M programs helps ensure compliance with stringent energy codes over the long term.

Building Type/End User Insights

Commercial Buildings: The commercial buildings segment held the largest market share, nearly 40%, in 2025. According to the UK Green Building Council, commercial buildings account for 10% of the country's CO2 emissions when it heats up. Thus, commercial buildings prefer to leverage energy management services that minimize operational costs and enhance building sustainability.

Institutional Buildings: The institutional buildings segment is expected to experience the highest CAGR of nearly 12% over the foreseeable period. The segment is growing due to the increasing construction of institutional buildings, owing to the rapid urbanization, where energy is crucial to manage. Thus, institutional building leverages energy management services to reduce overall costs, enhance energy efficiency, and mitigate environmental footprints.

Building Systems Focus Insights

HVAC Systems Services: The HVAC systems services segment held the largest market share, at 38%, in 2025. The segment is dominating due to factors such as rising urbanization, data center development, and the growing integration of smart technologies into building energy management, especially in countries like India and China. Also, smart HVAC systems help buildings meet certification requirements and align with climate goals.

Integration with BEMS/IoT Platforms: The integration with the BEMS/IoT platforms segment is expected to witness the fastest CAGR of nearly 14% during the foreseeable period. The segment is growing due to its ability to address key modern imperatives, such as real-time data analytics, substantial cost savings, improved operational efficiency, and compliance with environmental safety regulations, while advancing construction and energy management practices.

Building Energy Management Services Market Regional Insights

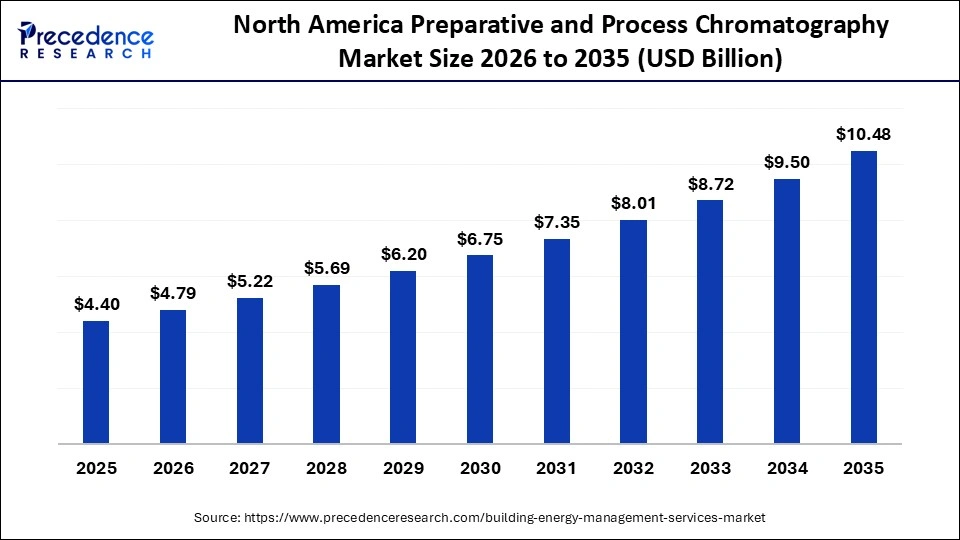

The North America building energy management services market size is estimated at USD 4.40 billion in 2025 and is projected to reach approximately USD 10.48 billion by 2035, with a 9.07% CAGR from 2026 to 2035.

What Factors Made North America a Dominant Region in the Building Energy Management Services Market?

North America held the largest market share, at nearly 40%, in 2025. The market is primarily driven by growing energy consumption in highly developed residential and commercial buildings in the region, as well as by the increasing emphasis on energy efficiency and sustainability. North America is a frontier in embracing cutting-edge technologies across sectors, including building energy management, where the integration of AI, IoT, and cloud computing enables efficient building energy management.

The growing trend of smart buildings and rapid urbanization further accelerates the market's growth, as such developments require advanced energy management systems to deliver better solutions and reduce costs. Thus, a combination of factors, including economic growth, technological revolutions, an evolving regulatory landscape, and heightened environmental safety awareness, is fueling the global building energy management services market.

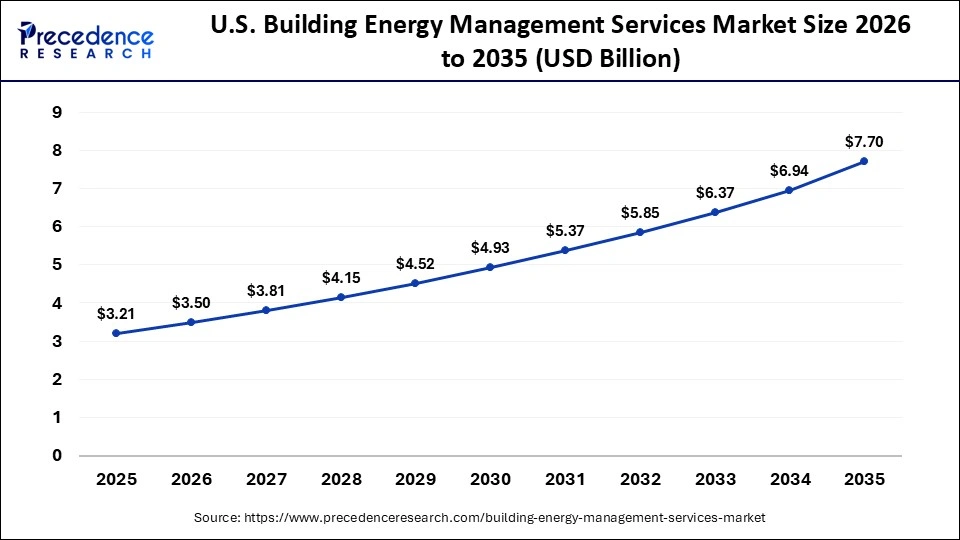

The U.S. building energy management services market size is calculated at USD 3.21 billion in 2025 and is expected to reach nearly USD 7.70 billion in 2035, accelerating at a strong CAGR of 9.14% between 2026 and 2035.

The U.S. Building Energy Management Services Market Trends

The U.S. building energy management services market is leading globally due to key trends such as data-based decision-making, the growing integration of renewable energy resources, the increasing penetration of energy-intensive services, and the growth of the energy-as-a-service sector. The growing shift towards real-time data analysis to monitor and control energy consumption in buildings highlights the increasing reliance on technology to manage energy savings in the United States.

Asia Pacific is expected to witness the fastest CAGR of nearly 14.50% during the foreseeable period of 2026-2035. The region is expanding due to the government's substantial investments in R&D for energy generation and energy-saving technologies, the increasing integration of IoT systems with buildings for smart city development, and growing awareness of the need to reduce carbon emissions driven by the rapid development of building structures.

Additionally, the market is driven by well-established multinational and local companies, as well as their ongoing innovative services in building energy management, and by strategic partnerships among key players.

China Building Energy Management Services Market Analysis

The market is witnessing significant growth in the country due to strong government policies to support, increasing awareness of climate change, and aggressive efforts to mitigate carbon footprints through building development. The Chinese government is further implementing smart grid technologies and cloud-based BEMS to manage energy distribution and support renewable energy integration, thereby necessitating robust building energy management solutions and fueling the market's growth.

Stringent regulations on energy use drive the market to curb unnecessary carbon emissions, the EU's national target of ‘Zero Emission', rising energy costs, and the need to integrate renewable energy sources into building energy management. Also, digital transformation, such as IoT sensors and AI/ML-powered cloud computing to develop smart buildings, mandates energy regulations.

Europe has already established regulations for energy efficiency and sustainability targets, along with several directive programs, including guidelines for energy savings, emissions reductions, and the integration of energy-efficient technologies in building development to meet strict environmental safety standards.

Germany Building Energy Management Services Market Trends

The market in Germany is expanding significantly as national authorities reshape energy saving practices and promote modern efficiency standards. The country continues to upgrade its approach to building performance through tighter regulations, structured incentive schemes, and updated guidance for heating, cooling, and ventilation systems. These efforts encourage property owners, facility managers, and service providers to adopt solutions that improve operational efficiency and reduce long term energy consumption. The shift aligns with Germany's broader climate commitments, which place buildings at the centre of national decarbonization strategies.

Growth is supported by the integration of smart technologies, including IoT based monitoring systems, advanced sensors, and cloud connected control platforms. These technologies allow continuous tracking of energy use across lighting, HVAC systems, and distributed energy assets.

The region is experiencing a rapid surge in energy management services due to the growing demand for home energy management systems in the MEA region, rising concerns about energy efficiency, and rapid technological advances, including smart grid adoption and communication infrastructure.

Home area networks are witnessing substantial changes across the power/energy consumption domain, including energy conservation at building premises, energy conservation methodologies, and other techniques, which the region's energy services providers are embracing as they prioritize sustainability, further fueling the market's growth.

Saudi Arabia Building Energy Management Services Market Trends

The Saudi Arabia building energy management services market is expanding due to a combination of government programs, national development strategies, and rapid modernization of the built environment. Vision 2030 places strong emphasis on sustainability, efficient resource use, and improved building performance, which encourages public and private entities to upgrade energy systems across commercial, residential, and industrial facilities. These priorities push the market toward advanced solutions that reduce consumption, enhance operational control, and support long-term environmental goals.

Strict energy mandates reinforce this momentum. The Saudi Building Codes require energy-efficient design principles, updated insulation standards, and construction techniques that minimize energy loss. Compliance with these codes encourages developers and facility managers to adopt building energy management systems that monitor heating, cooling, ventilation, and lighting performance more accurately.

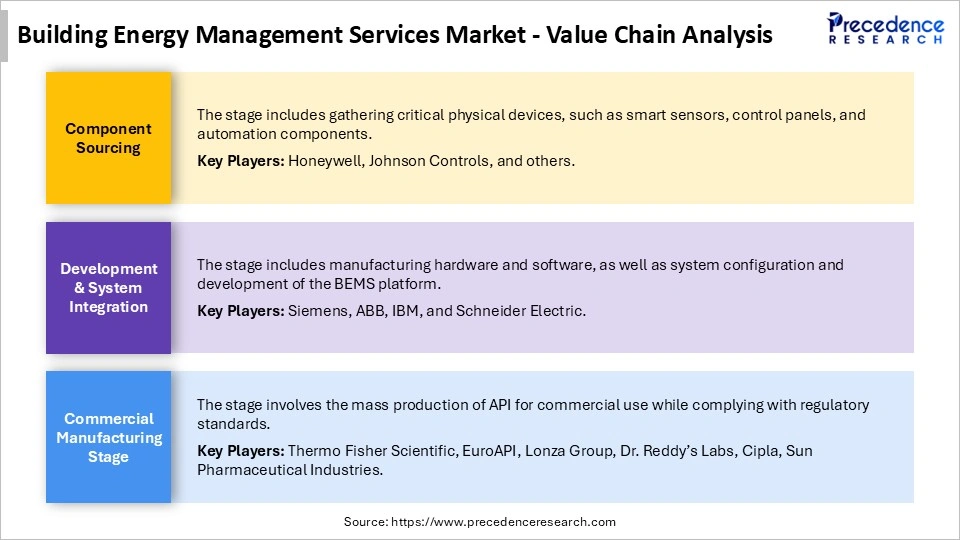

Building Energy Management Services Market Value Chain

Top Companies in Building Energy Management Services Market & their Offerings

- Schneider Electric

- ABB Ltd

- Honeywell

- Siemens

- Johnson Controls

- Emerson Electric Co.

- General Electric

- IBM

- C3.ai

- Cisco

- Emporia Energy

- GridPoint

- Trance Technology

- Building Energy

Recent Developments

- In September 2025, KPMG announced that AI systems can reduce building energy waste by up to 30%. This initiative leverages advanced AI capabilities to optimize building efficiency and sustainability efforts.

- In August 2025, Trane launched the BrainBox AI Lab to advance building energy management and sustainability solutions. This new lab will focus on autonomous control systems, predictive modeling, and advanced algorithms to reduce emissions.

Building Energy Management Services MarketSegments Covered in the Report

By Service Type

- Energy Audit & Assessment Services

- Design & Integration Services (BEMS, building controls)

- Commissioning & Retro-Commissioning Services

- Monitoring & Verification (M&V) Services

- O&M & Managed Performance Contracting Services

- Upgrades & Retrofit Services (lighting, HVAC, envelope)

By Building Type/End-User

- Commercial Buildings

- Offices, Retail Centers, Hotels

- Institutional Buildings

- Schools, Universities, Hospitals, Government

- Residential Buildings

- Multi-Family, Apartment Complexes

- Industrial Buildings

- Manufacturing Plants, Warehouses

By Building Systems Focus

- HVAC Systems Services

- Lighting & Controls Services

- Building Envelope & Façade Services

- Integration with BEMS/IoT Platforms

- Renewable & Storage Integration Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content