What is Virtual Power Plant (VPP) Market Size?

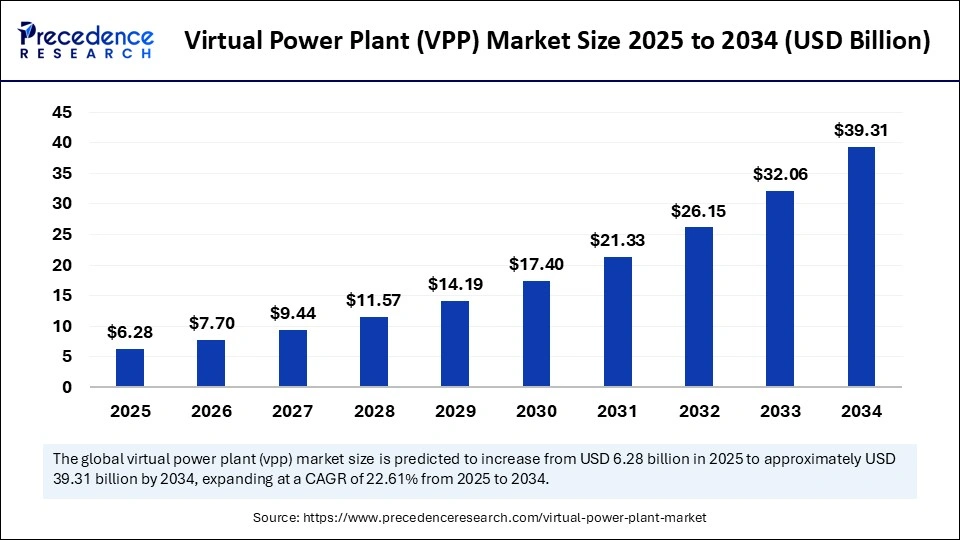

The global virtual power plant (VPP) market size is calculated at USD 6.28 billion in 2025 and is predicted to increase from USD 7.70 billion in 2026 to approximately USD 45.67 billion by 2035, expanding at a CAGR of 22.61% from 2025 to 2034. The market is experiencing substantial growth due to the integration of renewables and the proliferation of distributed energy resources (DERs). The market is further driven by the rising need for advanced software platforms to aggregate and coordinate these assets in real-time, balancing supply and demand to maintain grid stability. The market relies heavily on the integration of IoT and AI to manage data and optimize grid performance.

Market Highlights

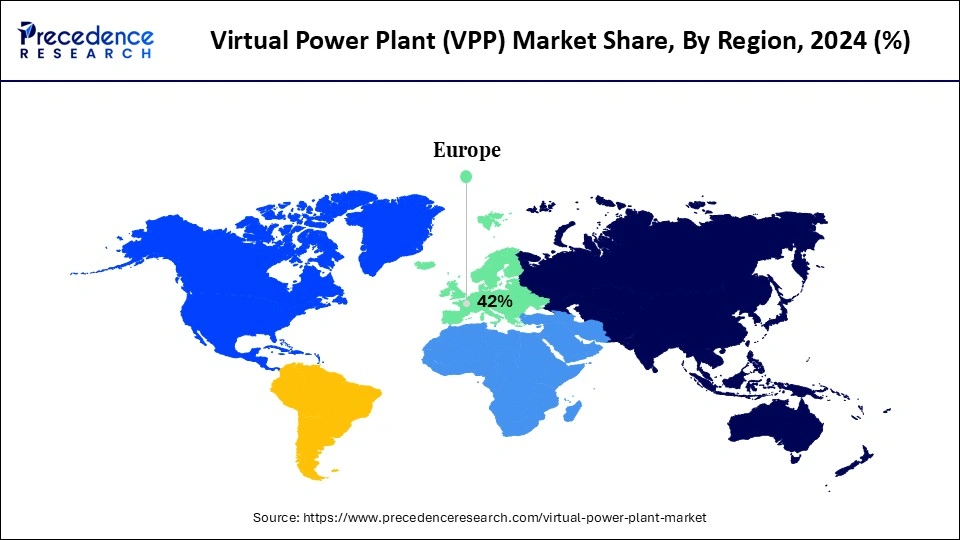

- Europe dominated the global market by holding the largest market share of 41.54% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period.

- By technology, the demand response segment contributed the highest market share of 47.97% in 2025.

- By technology, the mixed-asset configurations segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By component, the software platforms held the major market share of 45.80% share in 2025.

- By component, the services segment is expected to grow at a significant CAGR from 2026 to 2035.

- By power source, the solar photovoltaic (PV) systems segment led the market with 29.20% share in 2025.

- By power source, the battery energy storage systems (BESS) segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By end user, the industrial segment generated the largest market 0f 39.2% in 2025.

- By end user, the commercial segment is expected to experience the fastest CAGR from 2026 to 2035.

Market Size and Forecast

- Market Size in 2025: USD 6.28 Billion

- Market Size in 2026: USD 7.70 Billion

- Forecasted Market Size by 20345: USD 45.67 Billion

- CAGR (2025-2034): 22.61%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How overview spot valuable insights of the virtual power plant market?

The virtual power plant (VPP) market refers to the aggregation and intelligent management of DERs such as solar PV, wind, battery storage, combined heat and power, and electric vehicles to optimize energy production, consumption, and grid stability. VPPs use advanced software, predictive analytics, and communication technologies to coordinate and dispatch energy resources in real time, enabling utilities, grid operators, and large energy consumers to balance supply and demand efficiently. By integrating renewable and conventional assets, VPPs improve energy reliability, reduce operational costs, enhance grid flexibility, and support sustainable and decentralized energy systems globally.

Virtual Power Plant (VPP) Market Outlook

- Industry Growth Overview: The market is poised for explosive growth between 2025 and 2034, driven by the shift toward renewable and DERs like solar and wind. This decentralized approach, enabled by advancements in smart grid, AI, and IoT technologies, enhances grid stability and energy.

- Sustainability Trends: Sustainability is a key market driver, as VPPs enable a cleaner, more resilient energy system. They help reduce carbon emissions by integrating more renewables and optimizing energy consumption, which lowers the need for fossil fuel-based power plants and ensures data privacy for interconnected systems.

- Global Expansion: Market leaders are expanding geographically to address the global push for decarbonization and meet rising energy demand. Expansion is prominent in regions with strong renewable energy targets and grid modernization initiatives, such as North America, Europe, and fast-growing Asia-Pacific markets.

- Major Investors: Significant investment is flowing from venture capital, private equity, and established energy players. Companies like Tesla, Siemens, and ABB, along with investment firms, are backing the development of scalable VPP platforms to achieve high returns by aggregating DERs and providing grid services.

- Startup Ecosystem: The startup ecosystem is maturing, with innovation focused on AI-optimized trading, cloud-based energy management, and Web3 solutions. Emerging firms offer scalable, decentralized solutions that leverage AI and blockchain to integrate a wide range of assets, including electric vehicles and smart home appliances.

How AI is empowering modern development in the virtual power plant market?

Artificial intelligence (AI) plays a vital role in transforming the market by optimizing operations through real-time data analysis, forecasting, and automated decision-making, all of which improve efficiency, profitability, and grid stability. AI aids in managing demand response programs by allowing VPPs to quickly respond to changes in electricity demand and engage end-users to shift non-essential loads during peak times. Additionally, AI enhances renewable energy integration by providing better forecasts for variable sources like solar and wind, thus improving grid stability and reducing reliance on fossil fuels.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.28 Billion |

| Market Size in 2026 | USD 7.70 Billion |

| Market Size by 2035 | USD 45.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.61% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology,Component,Power Source,End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Integration of Renewable Energy Sources

The main driver in the virtual power plant (VPP) market is the increasing integration of renewable energy sources, which leads to the need to manage their intermittent nature while ensuring grid stability. The shift from a centralized to a decentralized, low-carbon energy system requires VPPs to aggregate and balance diverse DERs like solar panels, wind turbines, and energy storage systems. This enables third parties to create their own VPPs, effectively managing renewable variability, improving grid stability, and ensuring a reliable power supply.

Restraint

Lack of Standardized Regulations and Market Frameworks

The primary obstacle in the virtual power plant (VPP) market is the lack of standardized regulations and frameworks across different regions. This inconsistency presents significant challenges for VPP operators and investors, resulting in technical integration issues, high upfront costs, and uncertainty around revenue streams. The virtual power plant market faces a mix of technical, economic, and regulatory hurdles. Still, the absence of a unified and consistent regulatory framework remains a key barrier to widespread adoption and growth.

Opportunity

Integration of Electric Vehicles (EVs) Via Vehicle-To-Grid (V2G) Technology

A key future opportunity in the virtual power plant (VPP) market lies in the integration of electric vehicles (EVs) through Vehicle-to-Grid (V2G) technology to provide grid balancing and stability services. As EV adoption accelerates, these vehicles offer a vast, decentralized energy storage resource. VPPs can harness this capacity to mitigate the intermittency of renewable energy sources. With V2G functionality, EVs are no longer passive energy consumers; they can discharge stored electricity back into the grid during peak demand or grid stress events and recharge during off-peak hours when energy is abundant and less costly.

Virtual Power Plant (VPP) Market Segment Insights

Technology Insights

The demand response segment dominated the virtual power plant (VPP) market, accounting for about 47.97% share in 2024. This is due to its inherent cost-effectiveness, scalability, and ability to provide vital grid flexibility without requiring significant new generation infrastructure. DR solutions can be aggregated from thousands of small, flexible loads and scaled rapidly using advanced software, AI, and IoT technologies to meet immediate grid needs. By focusing on managing and reducing energy consumption during peak periods, rather than solely on energy generation, DR offers immediate, impactful benefits for grid stability and efficiency.

The mixed-asset configurations segment is expected to experience the fastest growth during the projection period. This is because it offers greater flexibility, reliability, and grid-balancing capability by integrating diverse DERs. The increasing share of intermittent renewable sources like solar and wind makes it essential to have flexible solutions that can dynamically balance supply and demand. By orchestrating multiple assets, mixed-asset VPPs can deliver essential auxiliary services to maintain grid stability and resilience, especially during peak demand or during disruptions.

Component Insights

The software platforms segment led the market while holding about 45.80% share in 2024. This is because they provide the core, intelligent functions needed to coordinate the complex task of aggregating geographically dispersed energy resources into one cohesive, grid-responsive system. VPP software employs advanced algorithms, AI, and ML to analyze vast amounts of real-time data to balance supply and demand efficiently. It also enables VPPs to deliver critical grid support and ancillary services, helping to keep the grid stable amid high levels of renewable energy penetration.

The services segment is expected to grow at the fastest CAGR in the upcoming period because VPPs are complex and require ongoing, specialized support to navigate the dynamic, real-time energy landscape. The value shifts from a one-time product sale to continuous operational support, consulting, and maintenance. Service providers offer necessary expertise in navigating regulations, ensuring compliance, and helping VPP participants maximize revenue through effective market strategies.

Power Source Insights

The solar photovoltaic (PV) systems segment dominated the virtual power plant (VPP) market with 29.20% share in 2024. This is due to the widespread adoption of solar, significant cost reductions in solar and storage tech, and the need for VPPs to manage solar's inherent variability and promote grid stability. The variability of solar generation creates operational challenges for traditional grids. The integration of smart inverters, IoT devices, and AI/ML allows VPP platforms to monitor, control, and optimize solar assets in real time, enhancing their value to the grid.

The battery energy storage systems (BESS) segment is expected to grow at the fastest rate in the coming years. This is mainly because BESS plays a critical role in managing the intermittency of renewable energy, which is increasingly integrated into power grids. BESS supports the shift from a centralized power model to a decentralized, multi-directional grid with many prosumers. This trend is driven by reducing battery costs, technological advancements, and strong government policies. The cost of lithium-ion batteries has dropped significantly over the last decade, making them more economically viable.

End User Insights

The industrial segment led the market by capturing about 39.2% share in 2024. This is mainly due to the high, constant energy needs of industrial operations and their requirement for reliable, stable, and cost-effective power management solutions. VPPs offer substantial benefits that directly address these industrial demands. As there is increasing pressure to reduce carbon emissions and comply with strict environmental regulations, VPPs serve as a practical solution for integrating clean energy, lowering greenhouse gases, ensuring grid reliability, and providing backup power during outages.

The commercial segment is expected to grow rapidly over the forecast period, driven by strong financial incentives, predictable energy usage, and existing infrastructure in commercial buildings. These factors allow businesses to efficiently manage energy costs and participate in grid-balancing services. These buildings usually have the necessary infrastructure, including larger roof spaces for significant solar installations and the physical space for battery storage and smart energy management controls. Businesses are increasingly focused on environmental, social, and governance objectives and reducing their carbon footprints.

Virtual Power Plant (VPP) Market Regional Insights

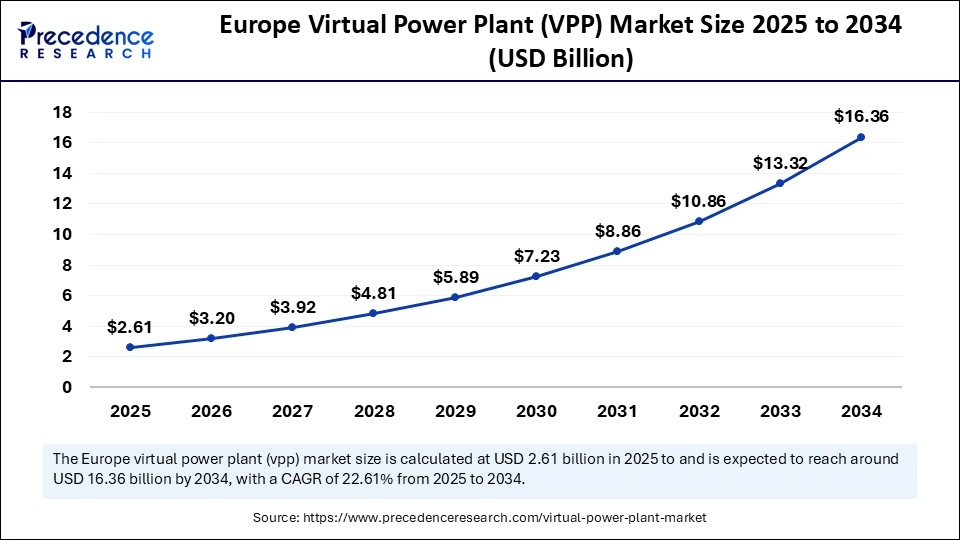

Europe Virtual Power Plant (VPP) Market Size and Growth 2025 to 2034

Europe virtual power plant (VPP) market size is exhibited at USD 2.61 billion in 2025 and is projected to be worth around USD 16.36 billion by 2034, growing at a CAGR of 22.61% from 2025 to 2034.

How Did Europe Dominate the Virtual Power Plant (VPP) Market in 2024?

Europe dominated the virtual power plant (VPP) market with 41.54% share in 2024. This is primarily due to ambitious renewable energy targets, a supportive and evolving regulatory framework, and an advanced, liberalized energy market structure. Europe benefits from well-established power grids and a high adoption rate of smart grid technologies, IoT-enabled devices, and advanced energy management systems. The region is home to major VPP companies and innovators like Siemens, Next Kraftwerke, and Centrica, which foster continuous research, development, and market growth. Liberalized energy markets in countries like Germany and the UK encourage innovative business models to participate in VPP programs.

Germany Virtual Power Plant (VPP) Market Trends

Germany is a major contributor to the market in Europe, leveraging its ambitious Energiewende policy to integrate levels of renewable energy sources (RES) into the grid. The German government provides a supportive regulatory environment, notably through the Renewable Energy Sources Act (EEG). This encourages the development of VPP-compatible assets, an established framework, and technological expertise, positioning Germany as an influential force in the global shift towards a decentralized and flexible energy system.

EEG (Renewable Energy Sources Act) provides the legal and economic basis for the energy transition and incentivizes renewable energy expansion through mechanisms like feed-in tariffs. However, these have evolved to include competitive auctions for larger projects.

The EEG itself is supported by the Special Climate and Transformation Fund (KTF), with around �10.6 billion allocated for financing in 2024.Germany approved a �57 billion green investment plan, focusing on decarbonization and digitalization, which includes backing for hydrogen development.

The government has proposed a $17 billion plan to subsidize hydrogen-ready gas power plants to support the transition from coal.

Asia Pacific is expected to experience the fastest growth in the market during the forecast period. This is mainly due to rapid economic development, soaring energy demand, ambitious government-mandated renewable energy targets, and significant investments in smart grid infrastructure and advanced technologies. The region's fast-developing economies, such as China and India, along with increasing urbanization, are leading to a massive surge in overall energy consumption. This necessitates efficient and flexible energy management solutions like VPPs, enabling real-time monitoring and coordination.

India plays a distinctive role in the global market. This is primarily driven by the government's efforts to foster an environment for growth through initiatives promoting smart grids, rooftop solar, the PM Surya Ghar scheme, and EVs. The recent introduction of draft guidelines for Virtual Power Purchase Agreements (VPPAs) by the Central Electricity Regulatory Commission (CERC) is a significant step towards providing a clear framework for commercial and industrial consumers.

The Central Electricity Regulatory Commission (CERC) has issued draft guidelines for Virtual Power Purchase Agreements (VPPAs) to enable designated consumers to meet their renewable energy commitments.

The PM Surya Ghar, Muft Bijli Yojana, encourages rooftop solar adoption by providing subsidies (up to ?78,000 for systems larger than 3 kW) and promoting net metering, which can integrate household solar into a VPP structure.The government announced ?5,400 crore in viability gap funding (VGF) for developing 30 GWh of battery energy storage systems (BESS), aiming to attract ?33,000 crore in investment.

North America plays a crucial role in the global market, fueled by its advanced energy infrastructure and rapid integration of diverse distributed energy resources (DERs) such as wind, solar, battery storage, and electric vehicles. The region's VPP capacity is growing quickly, driven by the need to balance intermittent renewable energy supply with demand and to enhance grid stability. Central to its role is a focus on technological progress, including developing sophisticated software platforms that utilize AI-based energy management systems, establishing it as the leading hub for VPP innovation.

The U.S. is the leading contributor to the North American market, characterized by supportive regulatory frameworks and significant technological investment. U.S. government agencies like the Federal Energy Regulatory Commission (FERC) have put in place rules to incorporate DERs into energy markets, while key states lead utility pilot programs. Home to major VPP providers such as Tesla, Generac, and Enel X, the U.S. speeds up VPP expansion to meet increasing electricity needs and boost grid resilience.

Latin America is seeing a strategic rise in the market due to the need to harness the region's extensive renewable energy resources, mainly solar, wind, and hydropower. The market benefits from the growing adoption of smart grid technologies and supportive government policies focused on updating aging energy infrastructure. Furthermore, regulatory clarity, grid stability, increasing energy demand, and the push for an energy transition are fueling substantial interest and investment in VPP pilot projects and commercial deployments throughout the region.

Brazil leads the Latin American market by leveraging its extensive renewable energy capacity and a sophisticated electricity grid. The country benefits from a diverse energy mix and an increasing distributed energy resource (DER) base, including small-scale solar and biomass. To manage grid stability and efficiently integrate intermittent renewables, Brazilian utilities and technology providers are investing in advanced VPP platforms. The market is expected to grow substantially with new regulatory frameworks supporting demand response and energy storage integration.

The market in the Middle East and Africa is fueled by its ambitious renewable energy goals and large infrastructure projects. The region's abundant solar resources and the need for efficient energy management in quickly urbanizing areas drive the market. Countries are investing in VPP technology to improve grid reliability, incorporate utility-scale renewable projects, and handle peak demand. Strategic partnerships with international technology companies and government support for smart grid development are crucial for market growth.

Saudi Arabia is a significant contributor to the MEA market, implementing VPP concepts through government initiatives and giga-projects such as NEOM. The country is shifting from a traditional oil-based energy system to a diverse, sustainable energy landscape that includes large solar and wind farms. VPP technology plays a vital role in integrating intermittent renewables, maintaining grid stability, and supporting advanced energy management systems in its smart cities. Strategic government investments and international partnerships are speeding up the adoption of VPP solutions.

The region's specialisation and initiatives to lead the VPP market are in the court of the behind-the-meter (BTM) energy storage and accelerating demand-side flexibility to handle rising demands and offer the best grid reliability services. The regulatory frameworks, AI and software are contributing commendably to the regions' VPP market. North America's VPP market is characterised by upgraded predictive analytics, regulatory frameworks and software refinement. The grid resilience and stability factor is largely considered at the first line of production and manufacturing process.

The region is actively participating in developing more VPP initiatives, initially via development collaborations in Mexico, Brazil, Argentina and Colombia, including pilot projects. These innovative efforts aim to compile distributed energy resources (DERs) such as wind and solar power, which allows demand response and improves grid stability. The developmental partners are highly focused on enhancing grid efficiency, accumulating rooftop solar PV, and collecting data from commercial and residential prosumers in their respective regions.

Regulatory Landscape for the Virtual Power Plant (VPP)

|

Country |

Key Regulatory Body |

Key Regulations and Initiatives |

|

U.S. |

FERC, State PUCs, DOE |

FERC Order 2222: Mandates RTOs/ISOs to allow aggregated DER participation in wholesale markets. IRA: Provides tax credits for VPP technologies like solar and storage. |

|

Germany |

BNetzA, TSOs, DSOs |

Renewable Energy Sources Act (EEG): Primary law setting renewable targets and guiding market mechanisms for integration. Energy Industry Act (EnWG): Governs network access and market rules. |

|

India |

CERC, SERCs, MNRE |

CERC Draft Guidelines for VPPAs: Provides a framework for C&I consumers to meet renewable obligations. Electricity Act, 2003: Foundation for non-conventional energy promotion and regulatory functions. |

Value Chain Analysis

R&D and Technology Development

This focuses on innovation in VPP software, AI algorithms for energy optimization, and secure communication networks.

- Key Players: Siemens, Schneider Electric, GE, IBM, and AutoGrid.

Hardware Manufacturing and Integration

Involves producing physical VPP assets like solar panels, batteries, smart meters, and EV chargers, and integrating them into the VPP platform.

- Key Players: Tesla, ABB, Siemens, Generac, and Bosch.

Software and Aggregation Platforms

This stage uses software to aggregate and coordinate diverse distributed energy resources (DERs) into a unified power plant.

- Key Players: Next Kraftwerke, AutoGrid, Enel X, Flexitricity, and Shell.

Distribution and Grid Integration

This involves connecting the aggregated electricity to the main power grid and coordinating with grid operators.

- Key Players: National Grid ESO, Cardinal Health and McKesson, and VPP operators.

Service Delivery and Market Participation

These VPP operators sell aggregated energy, offer demand response programs, and participate in electricity markets to generate revenue.

- Key Players: Engie, E.ON, NRG Energy, Voltus, and OhmConnect.

Top Companies Competing in the Virtual Power Plant (VPP) Market

Tier I � Major Players

These are dominant global players with a comprehensive portfolio across software, hardware, grid integration, and commercial-scale VPP deployments. Each holds a significant share individually and together they account for approximately 40�50% of the total market revenue.

- Siemens AG: Siemens is a leading player in the market through its DEOP (Decentralized Energy Optimization Platform), enabling real-time monitoring, control, and optimization of distributed energy resources across industrial, commercial, and grid-scale applications.

- Schneider Electric SE: Schneider Electric contributes via its EcoStruxure� platform and through its subsidiary AutoGrid, offering advanced VPP software solutions for energy aggregation, demand response, and AI-driven grid optimization.

- Tesla, Inc.: Tesla operates large-scale VPPs using its Powerwall and Powerpack battery storage systems, integrating thousands of residential and commercial energy assets to deliver grid services, particularly in regions like Australia and California.

- General Electric Company (GE): GE supports the VPP market through GE Digital Energy and its DERMS (Distributed Energy Resource Management System) solutions, which help utilities manage and dispatch decentralized assets for grid flexibility and resilience.

Tier II � Mid-Level Contributors

These companies have a strong presence in regional markets or specific segments of the value chain (e.g., demand response, DER aggregation, energy trading). Collectively, they contribute around 30�35% of the market.

- ABB Ltd.: ABB offers advanced grid automation and control technologies that support the seamless integration and optimization of distributed energy resources, playing a key role in enabling scalable and secure VPP infrastructure globally.

- Next Kraftwerke GmbH: As one of Europe's largest VPP operators, Next Kraftwerke aggregates thousands of decentralized energy units into a cloud-based power plant, enabling real-time energy trading and grid balancing services across multiple markets.

- AutoGrid Systems Inc.: AutoGrid provides AI-powered energy management and VPP software platforms that help utilities and energy providers aggregate and control DERs for demand response, flexibility markets, and predictive analytics.

- Enel X: Enel X operates one of the largest demand response and VPP networks globally, integrating DERs and flexible loads to provide real-time grid services, primarily through its smart energy management platform.

- AGL Energy: AGL Energy is a pioneer in deploying residential and commercial-scale VPPs in Australia, integrating rooftop solar, battery storage, and smart inverters to support grid stability and customer energy optimization.

Tier III � Niche and Regional Players

These are smaller firms or startups focused on local implementations, niche VPP solutions, or specialized technologies. Individually, their market share is modest, but together they contribute around 15�20% of the global revenue.

- Limejump Ltd. (UK)

- Flexitricity Ltd. (UK)

- Sunverge Energy Inc. (U.S.)

- Enbala Power Networks (now part of Generac)

- Blue Pillar

- Other regional utilities and tech startups

Exclusive Analysis on the Virtual Power Plant (VPP) Market

The global virtual power plant (VPP) market is poised for exponential expansion, underpinned by the accelerating decentralization of energy systems and the imperative to modernize grid infrastructure amidst rising renewable penetration. As the energy landscape pivots toward distributed energy resources (DERs), the VPP paradigm presents a transformative opportunity to orchestrate heterogeneous assets, including solar PV, battery storage, EVs, and responsive loads, into a unified, dispatchable, and grid-interactive network.

The confluence of digitalization, advanced analytics, and regulatory support is enabling the VPP market to transcend traditional aggregation models. AI-driven platforms now facilitate granular real-time optimization, predictive load balancing, and market participation, effectively converting previously passive assets into active grid resources. Moreover, the growing integration of EVs via Vehicle-to-Grid (V2G) frameworks is unlocking a massive latent capacity for frequency regulation and peak shaving, representing a largely untapped frontier for grid services monetization.

From a commercial standpoint, revenue streams are becoming increasingly diversified, spanning ancillary services, capacity markets, and real-time energy trading. Market liberalization across regions, notably in the EU, US (FERC Order 2222), and parts of APAC, is dismantling entry barriers, fostering innovation, and incentivizing flexibility markets, which is expected to catalyze third-party VPP operators and software vendors alike.

In summation, the VPP market is not merely a derivative of DER proliferation but a critical enabler of grid resilience and decarbonization. Stakeholders who align early with this digitally enabled, demand-responsive architecture stand to benefit from a compounding advantage, both in terms of technological capability and regulatory alignment. The market's trajectory is less a matter of �if,� and increasingly a matter of �how fast.�

Industry Leader's Announcement

- In May 2025, NRG Energy Inc. announced its acquisition of natural gas generation facilities and a commercial and industrial VPP platform from LS Power for approximately $12 billion. This deal increases NRG's capacity by 13 GW across nine states and enhances its product offerings. NRG's CEO, Larry Coben, highlighted the transaction as a transformative step toward providing reliable energy solutions and driving significant value for stakeholders.

(Source: https://www.businesswire.com)

Recent Developments

- In February 2024, Nokia launched the Nokia Virtual Power Plant (VPP) Controller Software, which enables mobile operators to leverage existing backup batteries at base station sites. This shift from grid power helps reduce energy costs, generate revenues in frequency balancing markets, and lower carbon emissions. The software will be available later this year as part of Nokia's commitment to energy-efficient solutions for mobile networks.

(Source: https://telconews.in) - In June 2025, Enel X introduced the first virtual power plant under the NSW Government's Electricity Infrastructure Roadmap. This initiative adds capacity to the grid without costly infrastructure, helping to prevent blackouts and lower prices. Major energy users are incentivized to reduce consumption during peak times.

(Source: https://www.enelx.com)

Segments Covered in the Report

By Technology

- Demand Response

- Direct Load Control

- Time-of-Use Management

- Distributed Energy Resources (DER) Management

- Solar PV Integration

- Wind Energy Integration

- Battery Energy Storage Systems (BESS)

- Mixed-Asset Configurations

- Hybrid DER Management

- Integrated Demand Response & Storage

- Grid Integration & Control Systems

- Smart Inverters

- SCADA Systems

- Predictive Analytics & AI

- Energy Forecasting

- Predictive Maintenance

By Component

- Software Platforms

- Energy Management Software

- Optimization & Dispatch Software

- Services

- Consulting & Integration

- Operation & Maintenance

- Hardware

- Sensors & Controllers

- Communication Devices

- Communication Infrastructure

- IoT Networks

- Cloud-based Platforms

By Power Source

- Solar Photovoltaic (PV) Systems

- Rooftop PV

- Utility-Scale PV

- Battery Energy Storage Systems (BESS)

- Lithium-Ion

- Flow Batteries

- Wind Energy

- Onshore

- Offshore

- Combined Heat and Power (CHP)

- Electric Vehicles (EVs)

By End User

- Industrial

- Commercial

- Residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content