Wireless Temperature Sensors Market Size and Forecast 2025 to 2034

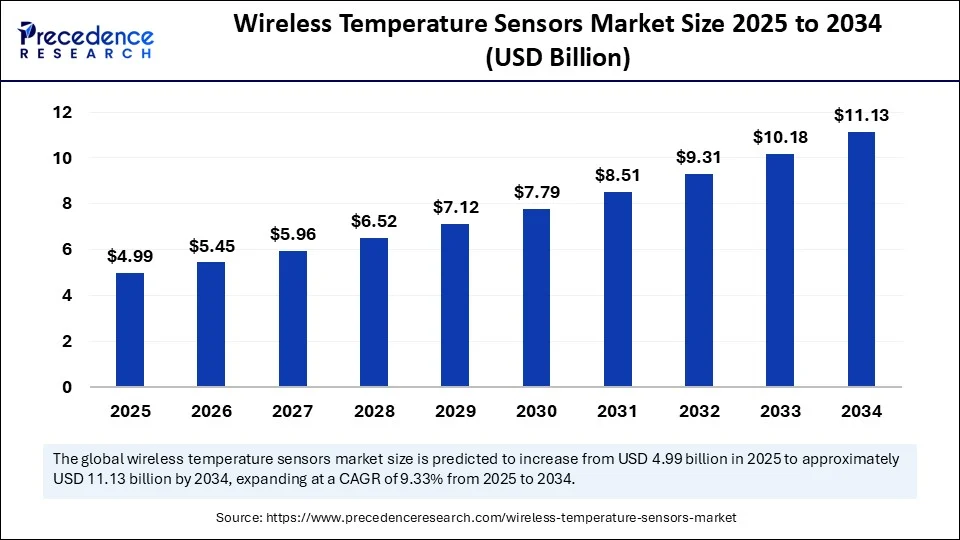

The global wireless temperature sensors market size was calculated at USD 4.56 billion in 2024 and is predicted to increase from USD 4.99 billion in 2025 to approximately USD 11.13 billion by 2034, expanding at a CAGR of 9.33% from 2025 to 2034. The market is growing due to the rising demand for real-time monitoring and automation across industries such as healthcare, manufacturing, and smart homes.

Wireless Temperature Sensors Market Key Takeaways

- In terms of revenue, the global wireless temperature sensors market was valued at USD 4.56 billion in 2024.

- It is projected to reach USD 11.13 billion by 2034

- The market is expected to grow at a CAGR of 9.33% from 2025 to 2034.

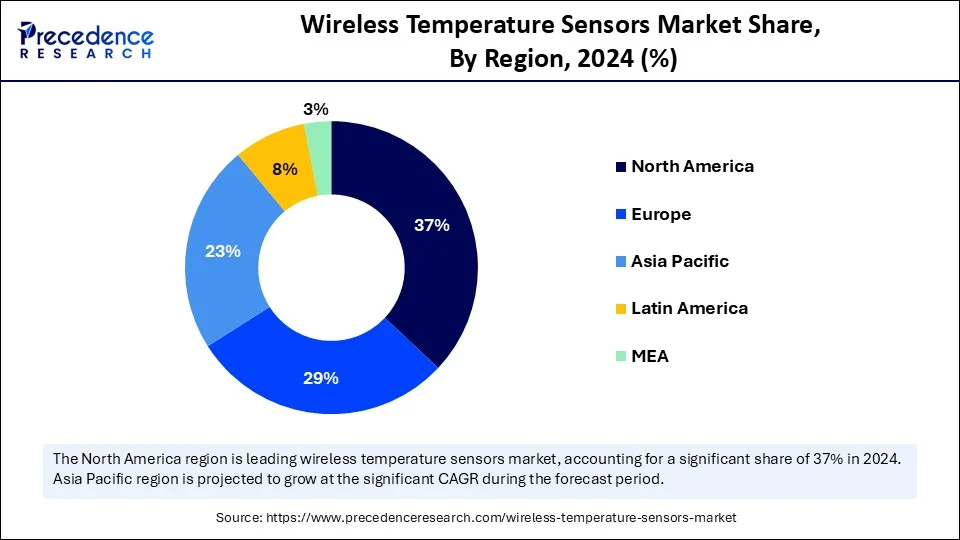

- North America dominated the wireless temperature sensors market with the largest market share of 37% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product/sensor type, the semiconductor (IC) temperature sensors segment held the biggest market share of 35% in 2024.

- By product/sensor type, the RTD (resistance temperature detector) wireless sensors segment is expected to grow at the fastest CAGR during the forecast period.

- By communication protocol, short-range wireless: Wi-Fi (2.4/5 HGz) segment captured the highest market share of 30% in 2024.

- By communication protocol, the LPWAN/long range low power: LoRaWAN/LoRa and Sigfox segment is projected to grow at the fastest CAGR during the forecast period.

- By solution type/Offering, the integrated offering combining hardware with a cloud-based SaaS platform segment held the largest share of 45% in 2024.

- By solution type/offering, the managed services/end-to-end monitoring segment is the fastest-growing during the study period.

- By range & deployment class, the short-range wireless sensors (up to 100m) segment generated the major market share of 50% in 2024.

- By range & deployment class, the long range (LPWAN, km scale) segment is emerging as the fastest growing during the forecast period.

- By industry vertical, on cold chain & logistics vertical segment accounted for the significant market share of 28% in 2024.

- By industry vertical, the healthcare & pharma segment is expected to grow at the fastest CAGR during the forecast period.

- By sales distribution channel, the system integrators & channel partners segment held the biggest market share of 40% in 2024.

- By sales distribution channel, the direct sales segment is expected to grow at the fastest CAGR during the forecast period.

How Is AI Transforming the Efficiency of the Wireless Temperature Sensors Market?

AI is transforming the adoption and efficiency of the wireless temperature sensors market by enabling smarter data processing, predictive insights, and real-time decision-making across industries. Businesses can develop predictive maintenance, anomaly detection, and energy optimization by combining AI with sensor networking, going beyond basic temperature monitoring. AI-driven sensor data analysis in healthcare facilities, remote patient monitoring, and safe vaccine storage, while in manufacturing and logistics, it improves cold chain management and process automation. Furthermore, wireless temperature sensors become more dependable and affordable thanks to AI algorithms that enhance sensor calibration, lower errors, and increase device lifespan. This speeds up the sensor's adoption in smart homes, industrial automation, and environmental monitoring.

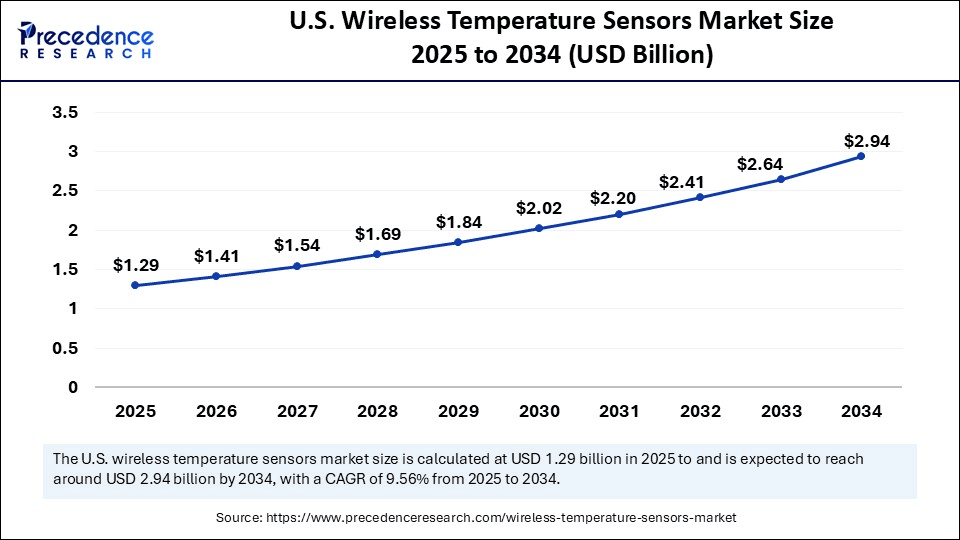

U.S. Wireless Temperature Sensors Market Size and Growth 2025 to 2034

The U.S. wireless temperature sensors market size was exhibited at USD 1.18 billion in 2024 and is projected to be worth around USD 2.94 billion by 2034, growing at a CAGR of 9.59% from 2025 to 2034.

Why Does North America Dominate the Market in 2024?

North America leads the global wireless temperature sensors market, reinforced by sophisticated cold chain systems, robust healthcare infrastructure, and technology adoption driven by regulations. Innovation and scalability are improved by the presence of leading industry players. A more developed IoT ecosystem speeds up adoption. Leadership is further reinforced by federal investment in climate technology. Dominance is also maintained by growing demands for adherence to food safety and pharmaceutical regulations. Long-term market leadership is ensured by the region's early adoption of next-generation IoT solutions.

Asia Pacific is the fastest-growing region, fueled by rapid growth in logistics, healthcare infrastructure, and e-commerce-driven supply chains. Global players looking to expand are drawn to manufacturing hubs. Strong government backing for digitization accelerates the pace of adoption. Cold chain and healthcare investments are being further bolstered by the rapidly expanding middle class in the region. Another factor driving the adoption of wireless temperature sensors is the growing need for energy-efficient systems.

Market Overview

Wireless temperature sensors are sensing devices that measure temperature and transmit the readings wirelessly to a gateway, cloud platform, or local receiver. They combine a temperature sensing element (thermistor, RTD, thermocouple, or semiconductor sensor) with a radio/communication module and power management (battery, energy harvesting, or mains). Typical solutions include the sensor node, optional local gateway, and cloud or on-prem software (for alerting, logging, analytics, and API integration). The wireless temperature sensors market supplies these systems that are used for environmental monitoring, cold-chain and logistics, industrial process control, building automation, healthcare and pharma storage, data-center monitoring, and smart agriculture.

How Is the Wireless Temperature Sensor Market Evolving in Today's Technology-Driven Landscape?

The wireless temperature sensor market is evolving rapidly in today's technology-driven landscape as industries increasingly adopt IoT, smart devices, and automation to achieve real-time monitoring and operational efficiency. Since these sensors can provide precise temperature tracking without the drawbacks of wired systems, they are being incorporated into a variety of industries, including healthcare, automotive manufacturing, and smart homes. Adoption is being further accelerated by the push for safety compliance, energy efficiency, and predictive maintenance, while performance and scalability are being improved by developments in low-power wireless communication, cloud integration, and AI analytics, a key component of networked and intelligent ecosystems. Wireless temperature sensors are growing in importance as the digital revolution continues.

Wireless Temperature Sensors Market Growth Factors

- Rising Adoption of IoT and Smart Devices: The increasing integration of IoT-enabled systems and smart infrastructure is boosting the demand for wireless temperature sensors for real-time monitoring and automation.

- Expansion in Healthcare Applications: Growing use of wireless sensors for patient monitoring, cold chain management of vaccines, and medical equipment safety is driving market growth.

- Industrial Automation and Predictive Maintenance: Manufacturing and industrial facilities are increasingly deploying wireless temperature sensors to enhance operational efficiency, safety, and predictive maintenance.

- Smart home and Building Automation: The surge in smart homes and energy-efficient buildings is fueling demand for wireless sensors for HVAC control, appliance monitoring, and environmental regulation.

- Rising Food Safety and Cold Chain Monitoring Needs: The food & beverage industry is adopting wireless temperature sensors to ensure compliance with safety regulations and maintain product quality during storage and transportation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.13 Billion |

| Market Size in 2025 | USD 4.99 Billion |

| Market Size in 2024 | USD 4.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product / Sensor Type, Communication Protocol / Connectivity, Solution Type / Offering, Range & Deployment Class, Industry Vertical / End-User, Sales / Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Real-Time Data

Real-time data is becoming more and more important to sectors like manufacturing, logistics, and healthcare to increase productivity and safety. Wireless temperature sensors are a popular option in automated settings because they allow for continuous monitoring without the drawbacks of wired systems. This increases decision-making accuracy and decreases downtime has led to more adoption of products from the wireless temperature sensors market. The adoption of sensors in factories and smart warehouses is being further accelerated by the growing trend of Industry 4.0.

Expansion of Healthcare and Pharmaceutical Application

One of the main sectors driving growth is the healthcare industry, where sensors are used for patient monitoring, vaccines, and medication cold chain management, and hospital environment maintenance. The growing use of digital health is increasing this demand even more. Wireless sensors are becoming essential as telemedicine and remote patient care investments increase. Additionally, the pharmaceutical sector's emphasis on accurate transportation and storage improves the wireless temperature sensors market penetration.

Restraints

High Initial Installation and Integration Costs

Even with their long-term advantages, small and medium-sized businesses may find the initial cost of wireless temperature sensors and the costs associated with integrating IoT platforms prohibitive. Budgetary restrictions deter many businesses from investing, particularly in developing nations. Adoption is also slowed down by the expense of updating outdated systems to accommodate wireless infrastructure.

Concerns Over Data Security and Privacy

Wireless temperature sensors depend on cloud connectivity and Internet of Things networks. They are susceptible to illegal access, data breaches, and cyberattacks. Particularly cautious are sectors that deal with sensitive data like healthcare and pharmaceuticals. This makes adherence to stringent cybersecurity standards and data encryption essential but expensive. HIPAA compliance and growing worries about GDPR also present challenges.

Opportunities

Growing Adoption in Smart Homes and Building Automation

The market for wireless temperature sensors is expanding due to the growing popularity of smart homes and intelligent building management systems. These sensors contribute to increased occupant comfort, energy efficiency, and HVAC system optimization. It is anticipated that demand for these solutions will increase as green building initiatives and urbanization pick up speed. Their value is further increased by integration with smart appliances and voice assistants.

Expansion of Cold Chain Logistics and Food Safety Monitoring

The need for cold chain monitoring is growing as the international trade in perishable goods increases. To maintain product quality during storage and transit, and to guarantee adherence to food safety laws, wireless temperature sensors are essential. There is more room for expansion due to the expanding e-commerce grocery market and the demand for frozen and fresh goods. The adoption of smart logistics hubs and automated warehouses is also being fueled by investments.

Product/Sensor Type Insights

Why Did the Semiconductor (IC) Temperature Sensors Segment Dominate the Wireless Temperature Sensors Market in 2024?

Semiconductor (IC) temperature sensors dominate the wireless temperature sensor market because they are inexpensive, small, and integrate with IoT ecosystems. They are very versatile because they can deliver accurate data in a variety of settings. Further encouraging widespread adoption is their compatibility with wearable technology, smartphones, and smart home appliances. They continue to be the go-to option for mass-scale applications due to their low power consumption and smooth integration into microcontrollers. Their continued dominance is guaranteed by their increasing use in connected devices and industrial automation.

RTD (Resistance Temperature Detector) wireless sensors, especially PT100 and PT1000, are the fastest growing because of their accuracy in high-pressure situations. They are being used more and more in biotech labs, pharmaceuticals, and aerospace monitoring. Due to industry demands for extremely accurate temperature monitoring, RTDs are finding new uses in critical settings. They are also a compelling option due to their longer lifespan and stability in extremely high and low temperatures. Their adoption is being aided by increased investments in high-value logistics and pharmaceutical R&D.

Communication Protocol Insights

Why Did the Short-Range Wireless: Wi-Fi (2.4/5 GHz) Segment Dominate the Wireless Temperature Sensors Market in 2024?

Short-range wireless: Wi-Fi (2.4/5 GHz) segment dominated the wireless temperature sensors market in 2024 due to its ease of deployment, high bandwidth, and compatibility with cloud platforms. Facilities like warehouses and laboratories benefit from real-time analytics and reliable connectivity. Their reliance on existing infrastructure keeps costs low. Wi-Fi upgrades, including Wi-Fi 6, further strengthen its market presence. With the global ubiquity, Wi-Fi remains the first choice for enterprises seeking simplicity and performance.

LPWAN / long-range low power: LoRaWAN / LoRa and Sigfox are the fastest growing, providing coverage for kilometers while using little power. They work particularly well in remote areas where wide area monitoring is crucial, such as in logistics and agriculture. They are ideal for extensive IoT deployments due to their high scalability and low operating costs. Adoption is accelerating because of governments supporting connected infrastructure and smart cities. LPWAN is positioned as the future backbone for IoT connectivity because of this momentum.

- On 9 January 2025, Semtech launched a LoRa Plus LR2021 Transceiver featuring LoRa Gen-4 capabilities for enhanced long-range, low-power connectivity.(Source: https://www.semtech.com)

Solution Type/ Offering Insights

Why Did the Integrated Offerings Combining Hardware With a Cloud-Based SaaS Platform Segment Dominate the Market in 2024?

Integrated offerings combining hardware with cloud-based SaaS platforms dominate the wireless temperature sensors market. Businesses value these solutions for their built-in monitoring, alerts, analytics, and compliance reporting. Real-time dashboards and predictive tools help enterprises of all scales improve operational resilience. Their flexibility supports multiple industries, from food safety to pharma compliance. As organizations prioritize data-driven decisions, SaaS led monitoring systems remain indispensable.

Managed services / end-to-end monitoring as a service (including installation, calibration, and maintenance) are rapidly gaining traction in the wireless temperature sensors market because subscription-based models relieve technical and regulatory burdens, and they facilitate adoption, particularly in highly regulated industries like cold chain logistics and healthcare. Internal resources are not strained by these services, which guarantee ongoing monitoring. Businesses consider them to be risk and economical solutions. OPEX-based models are becoming more and more in demand, which is driving this market.

- In April 2025, Sensitech showcased its latest managed cold chain monitoring services at LogiPharma 2025.(Source: https://www.sensitech.com)

Range & Deployment Class Insights

Why Short-Range Wireless Sensors (Up to 100m) Segment Dominates the Wireless Temperature Sensors Market in 2024?

Short-range wireless sensors (up to 100m) remain dominant in hospitals, labs, and retail settings due to their affordability, simplicity of setup, and compatibility with current Wi-Fi infrastructure, particularly in smaller settings where accuracy and dependability and crucial. Pharmacy storage, grocery stores, and office surveillance all make extensive use of them. The simplicity and affordability of short-range solutions guarantee their dominance going forward.

Long-range (LPWAN, km scale) is the fastest-growing segment in the wireless temperature sensors market due to its low power consumption, which makes it perfect for cold chain transportation networks, energy, and agriculture. Their simplicity and scalability make them a promising part of the IoT in the future. Bridging the gap between rural operations and urban centers requires long-term solutions. Long-range solutions will become more and more in demand as the global logistics chain grows.

Industry Vertical/ End User Insights

Why Cold Chain & Logistics Vertical Segment Dominates the Market in 2024?

Cold-chain & logistics vertical led the wireless temperature sensors market, driven by the high expense of temperature excursions, international food and pharmaceutical trade, and regulatory compliance. Accurate ongoing monitoring is essential in this field. For logistics players, sensors are essential because of spoilage losses. This industry is expected to continue to be the most prevalent user due to growing globalization.

Healthcare & pharma, especially for vaccines, labs, and clinical trials, are fastest fastest-growing segments. The demand for extremely dependable temperature systems is still being driven by digital transformation, and the pandemic hastened adoption. Further driving the need for sophisticated monitoring is the emergence of personalized medicine. Global biopharma R&D investments are bolstering this growth trajectory.

Sales Distribution Channel Insights

The system integrators & channel partners segment leads the wireless temperature sensors market, providing full solution packages including hardware deployment and regulatory compliance. Large organizations choose them because of their extensive networks and turnkey approach. They provide packaged solutions that simplify things for customers. Their industry-wide expertise strengthens their dominance.

Direct sales are expanding fast as manufacturers engage directly with enterprises, offer custom bundles, and accelerate product improvements through direct feedback. This model shortens the sales cycle and fosters deeper customer trust. Companies seeking cost transparency prefer direct vendor engagement. As a result, direct sales are scaling rapidly.

Wireless Temperature Sensors Market Companies

- Honeywell International Inc.

- Schneider Electric SE

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- Monnit Corporation

- OMEGA Engineering, Inc.

- Vaisala Oyj

- Sensaphone (Sensaphone Corporation)

- Dwyer Instruments, Inc.

- Swift Sensors (Swift Sensors, Inc.)

- UbiBot (UbiBot, Inc.)

- Yokogawa Electric Corporation

- Microchip Technology Inc.

- JUMO GmbH & Co. KG

- Axzon, Inc.

Recent Developments

- On 24 March 2025, Johnson Controls launched the NSW8000 Series wireless network sensor, a multisensory offering real-time temperature and relative humidity monitoring, occupancy detection, and optional CO2 sensing, fully integrated with Metasys building automation systems.

(Source: https://facilityexecutive.com) - In May 2025, Enless Wireless announced the upcoming release of a new LoRaWN temperature sensor with a black bulb probe, designed to measure resultant temperature key for optimizing occupant comfort and energy performance in building management systems.(Source: https://enless-wireless.com)

Segments Covered in the Report

By Product / Sensor Type

- Thermistor-based wireless temperature sensors

- RTD (Resistance Temperature Detector) wireless sensors (PT100/PT1000)

- Thermocouple wireless sensors (Type K, J, T, etc.)

- Semiconductor (IC) temperature sensors (integrated silicon sensors)

- Digital temperature sensors (I²C/SPI output)

- Multi-parameter sensors with temperature (temp + RH, temp + COâ‚‚, etc.)

By Communication Protocol / Connectivity

- Short-range wireless: Wi-Fi (2.4/5 GHz)

- Short-range low-power: Bluetooth / Bluetooth Low Energy (BLE)

- Mesh/building automation: Zigbee / Thread

- Industrial wireless: WirelessHART, ISA100.11a

- LPWAN / long-range low-power: LoRaWAN / LoRa, Sigfox

- Cellular IoT: NB-IoT / LTE-M / 2G/3G/4G

- Proprietary RF (sub-GHz ISM bands, e.g., 868 / 915 MHz)

- Power over Ethernet (PoE) connected sensors (hybrid wired/wireless architectures)

By Solution Type / Offering

- Hardware only (sensors/gateways)

- Hardware + local gateway + on-prem software

- Hardware + cloud SaaS platform (monitoring, alerts, analytics)

- Managed services / end-to-end monitoring as a service (including installation, calibration, maintenance)

By Range & Deployment Class

- Short-range (up to ~100 m line-of-sight)

- Mid-range (100–2000 m / via gateways)

- Long-range (LPWAN, km scale)

By Industry Vertical / End-User

- Cold-chain & logistics (transport, warehousing, cold storage)

- Food & beverage processing and retail

- Healthcare & pharma (vaccines, labs, blood banks)

- Industrial & manufacturing (process monitoring)

- Oil & gas and chemical plants

- Utilities & energy (power plants, substations)

- Commercial buildings & HVAC / building automation

- Data centers & telecom rooms

- Agriculture/greenhouses / vertical farms

- Smart cities & environmental monitoring

- Education/research labs

- Retail (refrigeration monitoring)

By Sales / Distribution Channel

- Direct sales (OEM / enterprise)

- System integrators & channel partners

- Distribution/resellers / value-added distributors

- Online / e-commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting