What is the Human Fibrinogen Concentrates Market Size?

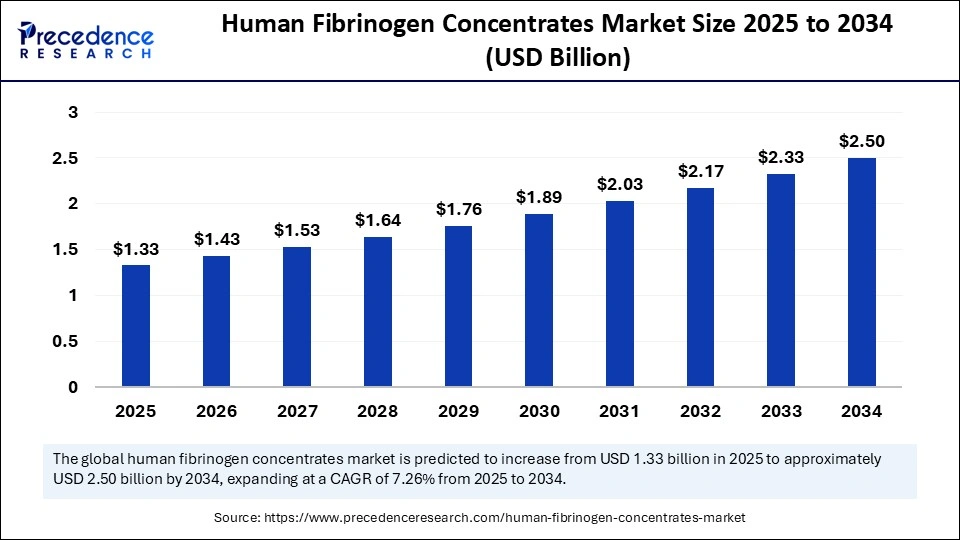

The global human fibrinogen concentrates market size is calculated at USD 1.33 billion in 2025 and is predicted to increase from USD 1.43 billion in 2026 to approximately USD 2.50 billion by 2034, expanding at a CAGR of 7.26% from 2025 to 2034. The increased numbers of surgical procedures and prevalence of bleeding disorders are driving the growth of the human fibrinogen concentrates market.

Market Highlights

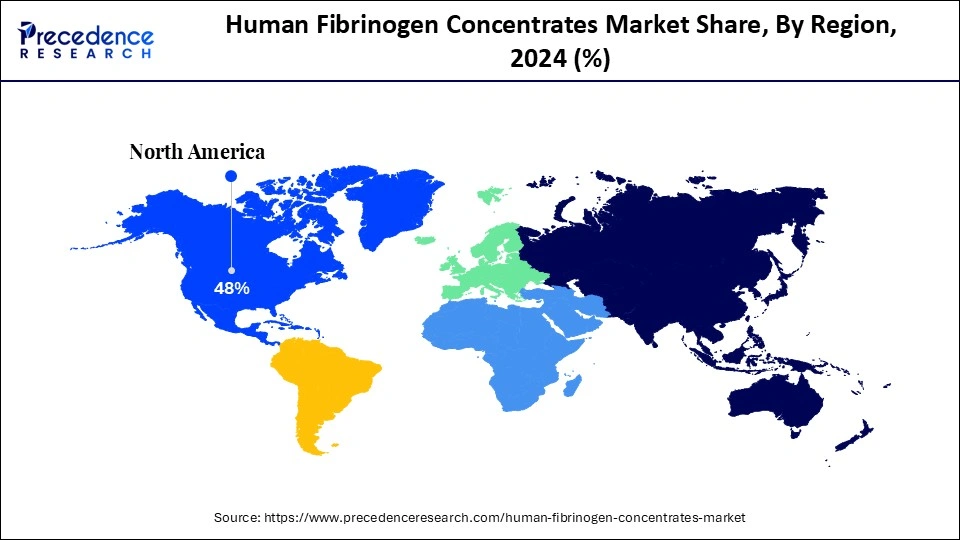

- North America dominated the human fibrinogen concentrates market with the largest share of 48% in 2024.

- Asia Pacific is expected to grow at a strong CAGR of 9.5% from 2025 to 2034.

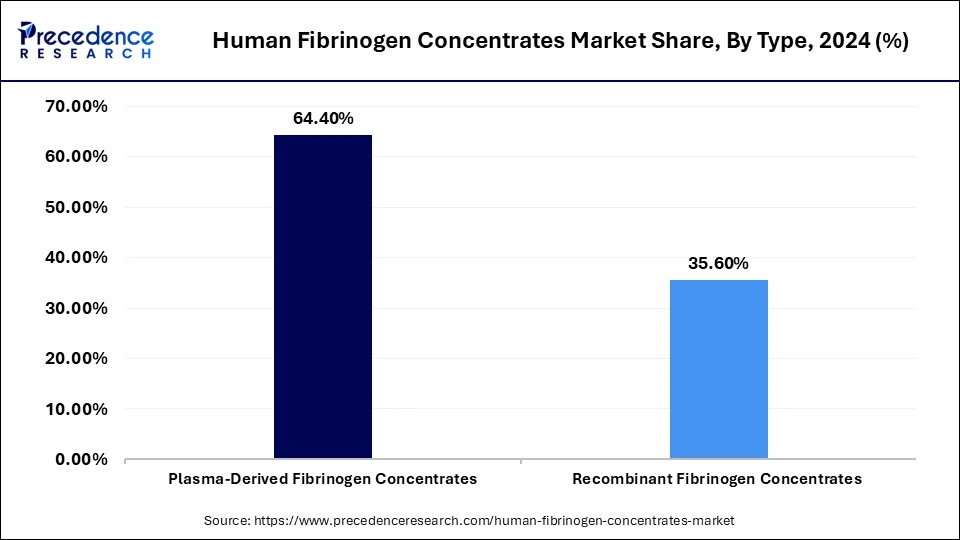

- By type, the plasma-derived fibrinogen concentrates segment contributed the largest market share of 64.4% in 2024.

- By type, the recombinant fibrinogen concentrates segment is growing at the fastest CAGR of 10.4% from 2025 to 2034.

- By application, the congenital fibrinogen deficiency segment led the market while holding the largest share of 42.4% in 2024.

- By application, the acquired fibrinogen deficiency segment is expected to expand at a 9.8% CAGR from 2025 to 2034.

- By distribution channel, the hospital pharmacies segment led the market while holding the largest share of 52.5% in 2024.

- By distribution channel, the online pharmacies segment is poised to grow at a 10% CAGR between 2025 and 2034.

- By end-user, the hospitals segment led the market while holding the largest share of 47.4% in 2024.

- By end-user, the specialty clinics segment is expected to grow at a 10.4% CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 1.33 Billion

- Market Size in 2026: USD 1.43 Billion

- Forecasted Market Size by 2034: USD 2.50 Billion

- CAGR (2025-2034): 7.26%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Human Fibrinogen Concentrates?

The human fibrinogen concentrates market is driven by increasing surgical procedures, the rising prevalence of bleeding disorders, and growing applications in trauma care. The market includes plasma-derived and recombinant fibrinogen formulations used to treat congenital or acquired fibrinogen deficiencies, bleeding disorders, and surgical bleeding. These concentrates restore hemostasis in patients lacking adequate fibrinogen levels and are administered intravenously in trauma, obstetric, and cardiovascular surgeries. The market's growth is driven by increasing awareness of rare coagulation disorders, advancements in plasma fractionation technology, and the rising adoption of fibrinogen concentrates over cryoprecipitate for rapid and safe hemostatic management.

The prevalence of bleeding disorders and complex surgical procedures is driving the adoption of advanced human fibrinogen concentrates. Additionally, advancements in biotechnology and growing awareness among patients and healthcare providers are fueling the demand for fibrinogen concentrate therapy. These concentrates play a critical role in promoting blood clotting during medical interventions.

- Notably, in July 2025, Octapharma secured $29 million in funding for a national clinical trial aimed at evaluating early fibrinogen replacement to improve outcomes in trauma patients with life-threatening bleeding. The study will be led by the University of Colorado Anschutz Medical Campus.(Source: https://www.linkedin.com)

Key Technological Shifts in the Human Fibrinogen Concentrates Market

The human fibrinogen concentrates market is undergoing a significant technological transformation, driven by advancements in biotechnology, particularly recombinant technologies. These innovations are enhancing the production of fibrinogen products that are free from blood-borne pathogens, thereby addressing long-standing safety concerns associated with plasma-derived products. The shift is resulting in safer, more effective formulations, including ready-to-use liquid concentrates that allow for faster administration and improved availability in emergency and surgical settings. This technological evolution is expanding the clinical utility of fibrinogen concentrates across orthopedic surgeries, trauma care, and personalized medicine.

Major players such as CSL Behring, Octapharma AG, Grifols, and LFB Group are investing substantially in next-generation technologies to enhance product safety and simplify administration. For instance, the U.S. FDA approval of Octapharma AG's product for acquired fibrinogen deficiency (AFD) underscores its position as a key innovator in this space.

Human Fibrinogen Concentrates Market Outlook

- Market Growth Outlook: The global human fibrinogen concentrates market is poised for robust growth between 2025 and 2034, driven by the increasing volume of surgical procedures, rising demand for blood-derived products, and continuous advancements in biotechnology. Innovations in plasma fractionation and recombinant technologies are enhancing access to more effective therapies for fibrinogen deficiencies. The rising demand for safer and more efficient fibrinogen concentrates is significantly broadening market penetration worldwide.

- Global Expansion: Emerging countries are witnessing a surge in surgeries and trauma cases, due to population growth, urbanization, and increased road traffic accidents. This directly increases the clinical demand for fibrinogen concentrates, which are vital in managing bleeding complications during major surgeries and trauma-related interventions. Many emerging nations are simplifying regulatory pathways and offering faster market access for essential biologics and plasma-derived therapies. This has encouraged global manufacturers to expand their commercial footprint, set up local manufacturing, and engage in technology transfers.

- Key Industry Players & Investment Dynamics: Major pharmaceutical and biotechnology companies, including CSL Behring, Octapharma AG, LFB Group, Shanghai RAAS Blood Products Co., and Baxter International, are heavily investing in advanced plasma fractionation technologies. These investments are focused on enhancing the safety, efficacy, and scalability of fibrinogen concentrates to meet growing global clinical demand.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.33 Billion |

| Market Size in 2026 | USD 1.43 Billion |

| Market Size by 2034 | USD 2.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Which Type of Concentrates Lead the Human Fibrinogen Concentrates Market?

The plasma-derived fibrinogen concentrates segment led the market with a 64.4% share in 2024 due to their ability to provide a vital supply for treating bleeding disorders and surgical blood loss. The human plasma-derived fibrinogen concentrates have a robust infrastructure and a variety of processes. The plasma-derived fibrinogen concentrates are highly effective in treating bleeding disorders. The well-established infrastructure and strong market availability of plasma-derived fibrinogen concentrates contribute to the segment's growth.

The recombinant fibrinogen concentrates segment is expected to grow at the fastest CAGR of 10.4% in the upcoming period. This is mainly due to the enhanced safety, increased supply, and low-cost potential of recombinant fibrinogen concentrates. The segment's growth is attributed to increased advancements in biotechnology and the preference for recombinant products. These products help to reduce the risk of pathogen transmission. Additionally, technological advancements in cell-free bioreactors and plant-based platforms that bypass donor limitations are fueling the development and adoption of recombinant fibrinogen concentrates.

Application Insights

What Made Congenital Fibrinogen Deficiency the Dominant Segment in the Human Fibrinogen Concentrates Market?

The congenital fibrinogen deficiency segment dominated the market, holding a 42.4% share in 2024 due to its increased prevalence. The increased prevalence of bleeding disorders has boosted the adoption of human fibrinogen concentrates for treatments, due to their high efficacy. The congenital fibrinogen deficiency is a rare genetic disorder characterized by the absence of fibrinogen. The growing need for centralized care networks, along with their forecasting capabilities, enables healthcare providers to manage patient treatments more effectively, fueling the adoption of advanced fibrinogen concentrates in congenital fibrinogen deficiency.

The acquired fibrinogen deficiency segment is expected to grow at a 9.8% CAGR during the projection period due to increased surgical procedures, which drive demand for fibrinogen concentrates in surgical settings. Acquired fibrinogen deficiencies are increased due to the rising number of surgeries, trauma cases, and prevalence of deficiencies themselves. Major pharmaceutical companies are investing heavily in research and development, enabling the development of products to treat this deficiency. The prevalence of spreading disorders, likely diseases, massive transfusion protocols, and disseminated intravascular coagulation has increased. Advancements in biotechnology, including plasma fractionation technologies and recombinant fibrinogen, are enabling high safety and efficacy of treatments for acquired fibrinogen deficiency.

Distribution Channel Insights

What Made Hospital Pharmacies the Dominant Segment in the Human Fibrinogen Concentrates Market?

The hospital pharmacies segment dominated the market with a share of 52.5% in 2024 due to their critical role in managing acute care situations, particularly in trauma, surgery, and bleeding disorder treatments. Hospital pharmacies ensure immediate availability of life-saving medications and treatments, particularly important given the rising number of surgical procedures and bleeding disorders that require urgent care. Their ability to dispense and manage drugs in a controlled and regulated environment enhances patient safety and outcomes, making hospital pharmacies the preferred choice for many patients.

The online pharmacies segment is expected to grow at a 10% CAGR over the forecast period, driven by the increasing adoption of e-commerce platforms and digital health solutions. Online pharmacies play a growing role in the distribution of plasma-derived products, often used in critical care settings. With a strong emphasis on streamlined supply chain operations, patient-centric services, and integration with digital healthcare ecosystems, online pharmacies are well-positioned for significant expansion in the coming years.

End-User Insights

Which End-User Dominates the Human Fibrinogen Concentrates Market in 2024?

In 2024, the hospitals segment dominated the market, capturing a 47.4% share. This is due to their high-volume procedures. Hospitals have immediate and private access to fibrinogen concentrates, making them critical for treating several bleeding cases. The hospital provides access to candidate medicine and medicine. Hospitals are drivers for tumor care and surgical procedures, leading to high hospitalization numbers. The ability of hospitals to manage and dispense medications in a controlled environment makes them the primary preference for patients. The increased number of procedures, such as cardiac, trauma, and obstetrics, fuels the demand for cutting-edge fibrinogen concentrate treatments in hospitals.

The specialty clinics segment is expected to grow at the fastest CAGR of 10.4% in the coming years due to increased adoption of fibrinogen concentrates in the specialty clinics as an alternative to conventional sources, such as cryoprecipitate and fresh frozen plasma (FFP). The specialty clinics are adopting these products' offers, effectiveness, and safety in the treatment of bleeding disorders and surgical bleeding. The use of fibrinogen concentrate products has increased in clinical settings, leading to a boost in the segment's maturity.

Regional Insights

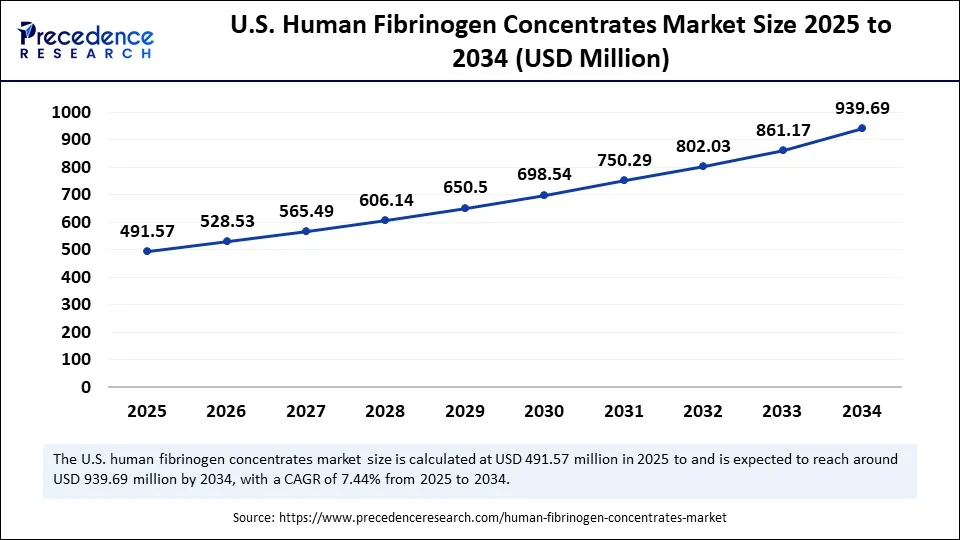

U.S. Human Fibrinogen Concentrates Market Size and Growth 2025 to 2034

The U.S. human fibrinogen concentrates market size is exhibited at USD 491.57 million in 2025 and is projected to be worth around USD 939.69 million by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

What Made North America the Dominant Region in the Human Fibrinogen Concentrates Market?

North America dominated the global human fibrinogen concentrates market while holding a 48% share in 2024. This leadership is primarily driven by the region's aging population and the rising prevalence of bleeding disorders. The growing demand for treatments related to trauma and surgical interventions has accelerated market growth. Moreover, pharmaceutical and biopharmaceutical companies in the region are making significant investments in advanced formulations, including recombinant and lyophilized products. Expanding clinical indications for inherited fibrinogen deficiencies and the increasing focus on surgical blood management are also contributing factors. The presence of a robust healthcare infrastructure, strong regulatory framework, and biotech innovation hubs further supports the development and adoption of advanced fibrinogen concentrate therapies.

U.S. Human Fibrinogen Concentrates Market Trends

The U.S. is a major contributor to the market due to its advanced healthcare infrastructure, high prevalence of bleeding disorders, and the presence of key industry players. Leading companies such as Octapharma AG and CSL Behring are making significant investments to expand their market presence and innovate product offerings. The adoption of fibrinogen concentrates is increasing across U.S. hospitals and specialty clinics, supported by growing awareness and clinical demand. Furthermore, the country's strong focus on research and development, backed by substantial investment, continues to solidify its leadership in the regional market.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to grow at the fastest CAGR of 9.5% in the coming years, driven by increased healthcare spending and rising awareness of bleeding disorders. The region has seen a surge in surgical procedures, particularly in countries like India and China, due to a rapidly aging population and the growing prevalence of bleeding-related conditions, factors that are fueling the demand for fibrinogen concentrates. Additionally, improvements in healthcare infrastructure and greater awareness among both patients and healthcare professionals are further contributing to market expansion. Governments across the region are implementing supportive policies and investing in healthcare systems, which are expected to accelerate the adoption of advanced fibrinogen therapies.

Large Population and Disease Prevalence: Fueling Growth in Emerging Asian Countries

China and India are emerging as major players in the Asia Pacific human fibrinogen concentrates market, driven by their large populations and rapid industrialization. Both countries are making significant investments in biotechnology and pharmaceuticals, supported by government initiatives aimed at strengthening domestic production and accessibility to advanced therapies. In China, rapid urbanization and favorable policies for blood plasma products are accelerating demand for fibrinogen concentrates. Meanwhile, India's expanding population, rising healthcare expenditure, and cost-effective manufacturing capabilities are creating strong growth opportunities in the market.

How is the Opportunistic Rise of Europe in the Human Fibrinogen Concentrates Market?

Europe is expected to grow at a notable rate in the market, driven by rising demand associated with bleeding disorders and surgical procedures. The region's healthcare infrastructure has increasingly adopted novel and advanced therapies, while innovations in plasma processing and growing utilization of liquid fibrinogen concentrates continue to support market maturity. Strategic initiatives, such as the expansion of plasma fractionation facilities and the implementation of value-based pricing models in countries like the UK, are accelerating adoption. Furthermore, the presence of key market players and investments in new fractionation facilities, including CSL Behring's site in Marburg, Germany, are contributing to regional growth.

German Human Fibrinogen Concentrates Market Analysis

Germany is a major player in the regional market due to its strong pharmaceutical manufacturing capabilities and robust healthcare system. The increasing prevalence of bleeding disorders, combined with a well-established regulatory and clinical framework, is boosting demand for advanced fibrinogen therapies. Additionally, innovations in hemostatic treatments and promising clinical developments, such as Grifols' BT524 and Biotest's fibrinogen under U.S. FDA evaluation, are further strengthening Germany's role in driving market growth.

Human Fibrinogen Concentrates Market Value Chain Analysis

- R&D

R&D efforts focused on improving product safety, efficacy, and applicability across a broader range of bleeding disorders. R&D activities include enhancing manufacturing and purification processes, exploring novel therapeutic uses, and conducting preclinical and early-phase trials to support innovation in treatment approaches.

Key Players: CSL Behring, Biotech AG, LFB Group, Octapharma

- Clinical Trials & Regulatory Approvals

Clinical trials are essential to validate the safety and efficacy of human fibrinogen concentrates for both congenital and acquired fibrinogen deficiencies. Trials such as FIBRES have compared fibrinogen concentrates with cryoprecipitate in managing acquired fibrinogen deficiency, providing critical data for regulatory submissions. Approval processes vary by region, requiring compliance with stringent safety and manufacturing standards.

Key Players: Octapharma, Grifols, LFB, CSL Behring

- Formulation & Final Dosage Preparation

The final formulation of human fibrinogen concentrates is derived from pooled human plasma and typically supplied as a lyophilized powder in single-use vials for reconstitution. The dosage forms are designed for rapid administration in acute care settings, particularly for patients with inherited or acquired fibrinogen deficiency experiencing bleeding episodes.

Key Players: Octapharma AG, CSL Behring, Grifols S.A., Shanghai RAAS Blood Products Co., Ltd., Reliance Life Sciences

Top Companies Operating in the Human Fibrinogen Concentrates Market

Tier I — Major Players

These are the dominant, globally scaling companies that lead innovation, distribution, and regulatory presence. Together, they account for around 40 50% of global revenue in this niche.

- CSL Behring: It is a global leader in plasma-derived therapies, offering FDA-approved fibrinogen concentrates like RiaSTAP, and driving innovation through continuous investment in R&D and global plasma collection infrastructure.

- Octapharma AG: The company plays a significant role through its product Fibryga, which is widely used for both congenital and acquired fibrinogen deficiencies, supported by strong clinical trials and global distribution channels.

- LFB Group: It contributes with its fibrinogen product FibCLOT, focused on treating rare bleeding disorders, particularly in Europe, and is recognized for its emphasis on quality plasma fractionation and regulatory compliance.

Tier II — Mid Level Contributors

These firms have strong market presence, often regionally or in specialized product lines, but aren't as dominant as Tier I. Collectively, they contribute ~30 35%.

- Grifols, S.A.: It leverages its global plasma collection network and advanced fractionation technologies to produce high-purity fibrinogen concentrates, supporting both clinical and surgical applications, especially in Europe and North America.

- Shanghai RAAS Blood Products Co., Ltd.: It is a key player in China's plasma-derived product market, supplying fibrinogen concentrates to meet growing domestic demand, backed by government support and expanding healthcare infrastructure.

- Baxter International: The company contributes through its historical expertise in blood and plasma therapies, and while not a leading fibrinogen brand owner, it maintains a strong presence in the broader hemostatic and surgical bleeding management market.

Tier III — Niche & Regional Players

These are smaller, localized, or specialized companies whose contributions are modest individually, but cumulatively make up ~15 20%.

- Hualan Biological Engineering Inc.: The company plays a significant role in China's plasma-derived therapeutics sector, producing human fibrinogen concentrates for domestic clinical use, with a focus on expanding R&D and GMP-compliant manufacturing capacity.

- Jiangxi Boya Bio Pharmaceutical: It contributes to the Chinese market with its portfolio of plasma-derived products, including fibrinogen concentrates, catering to rising regional demand for bleeding disorder treatments and surgical hemostasis.

- Green Cross Corporation (now GC Pharma): It is a major South Korean biopharmaceutical firm, supplies fibrinogen concentrates domestically and across select global markets, leveraging its advanced plasma fractionation and regulatory compliance capabilities.

- Harbin Pacific Biopharmaceutical Co., Ltd.: It focuses on plasma product innovation and manufacturing within China, contributing to the market by producing fibrinogen concentrates that support clinical and surgical use under national health initiatives.

Recent Developments

- In June 2025, the positive result of the Phase III study data on fibrinogen concentrate, BT524, was announced by Biotest. This study is published in a pre-reviewed journal, eClinicalMedicine, published by the Lancet Discovery Science Suite. BT524 is non-inferior to the standard of care (SOC).

(Source: https://www.eqs-news.com) - In July 2024, the US Food and Drug Administration (FDA) approved Octpharma's human fibrinogen concentrate to treat acquired fibrinogen deficiency (AFD), a condition of compromises blood clot formation and heightens the risk of severe haemorrhage. This is the first drug gaining FDA approval for this therapeutic class.(Source: https://www.octapharma.com)

Exclusive Analysis on the Human Fibrinogen Concentrates Market

The global human fibrinogen concentrates market is poised for robust growth over the forecast period, underpinned by a confluence of macro and microeconomic factors that underscore its strategic relevance in the broader hemostatic therapeutics landscape. The market's trajectory is being shaped by an increasing clinical and regulatory emphasis on targeted hemostasis management, especially in trauma care, congenital fibrinogen deficiencies, and perioperative bleeding scenarios, conditions where traditional cryoprecipitate is being phased out in favor of pathogen-reduced, lyophilized fibrinogen formulations.

On the supply side, technological sophistication in plasma fractionation, coupled with regulatory advancements enabling rapid market access (notably in the U.S., EU, and APAC), is catalyzing innovation and commercialization of next-generation fibrinogen concentrates. Meanwhile, biopharma firms are investing significantly in recombinant platforms and ready-to-use liquid formulations, presenting clear white space for differentiation across therapeutic indications, dosage formats, and delivery logistics.

Emerging economies, particularly across Asia Pacific and Latin America, present an untapped market opportunity, as growing surgical volumes, expanded critical care infrastructure, and government-backed rare disease awareness programs converge to amplify demand. Simultaneously, the shift toward value-based healthcare and outcome-driven procurement in developed regions is encouraging hospitals and payers to transition from legacy plasma derivatives to validated, cost-effective fibrinogen concentrates with improved shelf life and reconstitution profiles.

Strategic partnerships between plasma-derived product manufacturers and CROs, along with accelerated clinical trial pipelines in acquired fibrinogen deficiency (AFD), trauma, and postpartum hemorrhage, further reflect the market's maturation. From a portfolio standpoint, the market remains moderately consolidated, with Tier I players accounting for over 45% of the total market revenue, indicating ongoing consolidation potential and M&A attractiveness, especially in high-growth, compliance-ready manufacturing geographies.

In conclusion, the market stands at an inflection point where therapeutic need, technological evolution, and policy alignment are converging to create a high-value, innovation-driven ecosystem with significant headroom for growth across both established and emerging economies.

Segment Covered in the Report

By Type

- Plasma-Derived Fibrinogen Concentrates

- Recombinant Fibrinogen Concentrates

By Application

- Congenital Fibrinogen Deficiency

- Acquired Fibrinogen Deficiency

- Surgical Bleeding

- Trauma

- Obstetric Bleeding

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Center

- Research & Academic Institutes

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content