What is the Hydrogen Technology Testing, Inspection, and Certification Market Size?

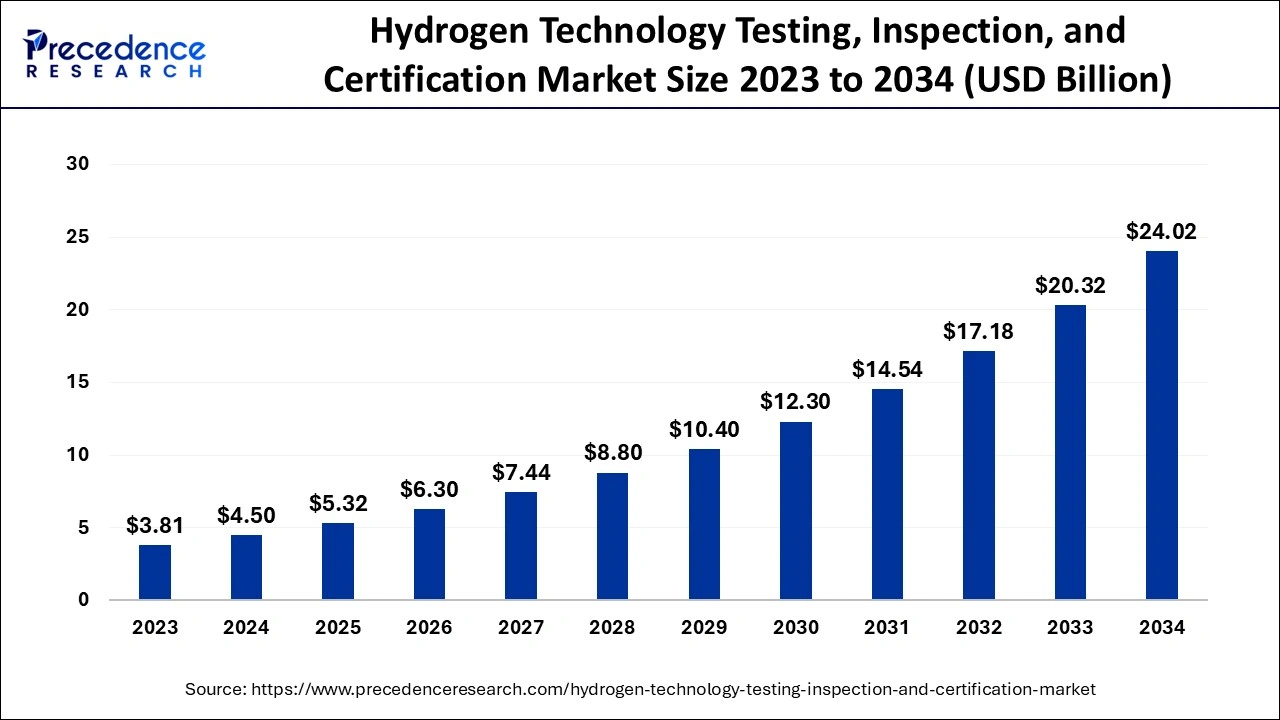

The global hydrogen technology testing, inspection, and certification market size was calculated at USD 5.41 billion in 2025 and is predicted to increase from USD 6.63 billion in 2026 to approximately USD 29.93 billion by 2035, expanding at a CAGR of 18.23% from 2026 to 2035.

Hydrogen Technology Testing, Inspection, and Certification Market Key Takeaways

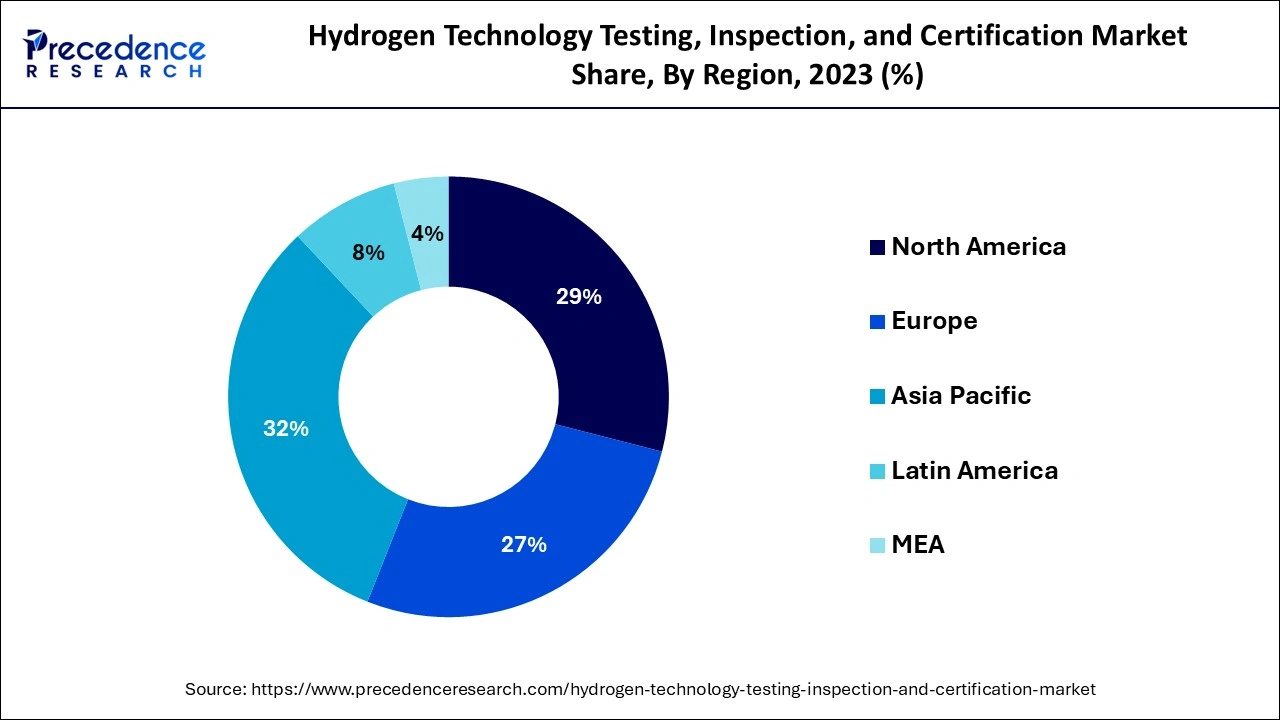

- Asia Pacific accounted for the largest market share of 38.53% in 2025.

- North America is anticipated to witness the fastest growth during the forecasted years.

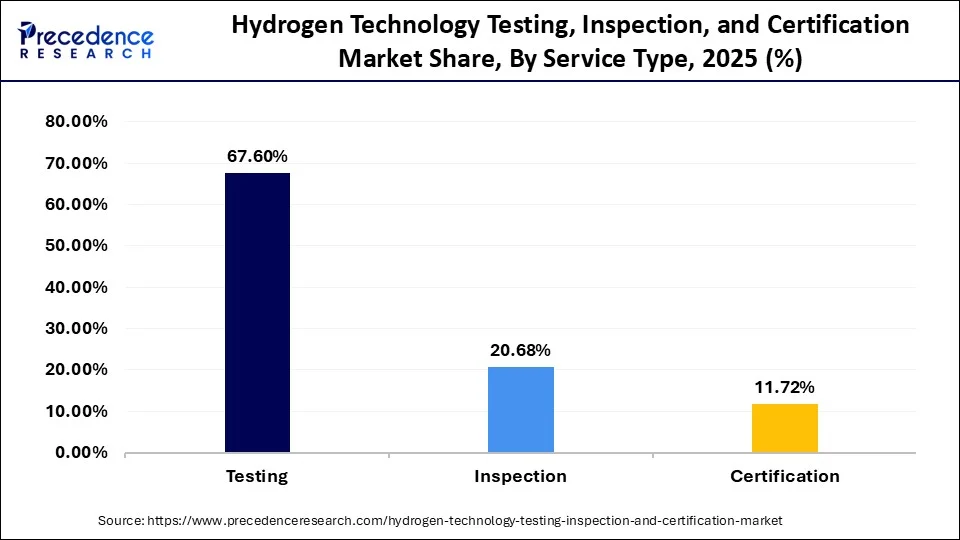

- By service type, the testing segment contributed the biggest market share of 67.60% in 2025.

- By service type, the inspection segment will register the fastest growth in the market over the forecast period.

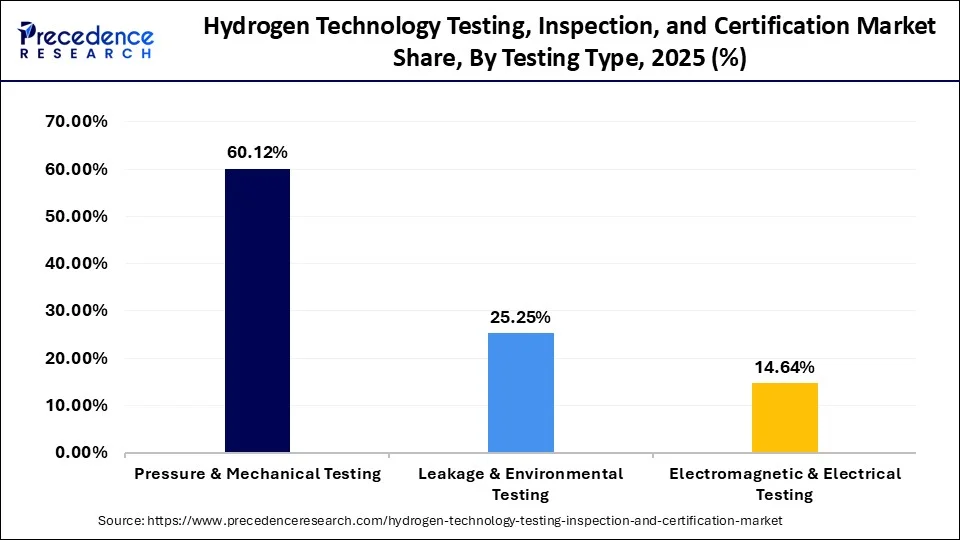

- By testing type, the pressure & mechanical testing segment accounted for the largest share of the market in 2025.

- By testing type, the electromagnetic & electrical testing segment is expected to witness rapid growth in the market in the coming years.

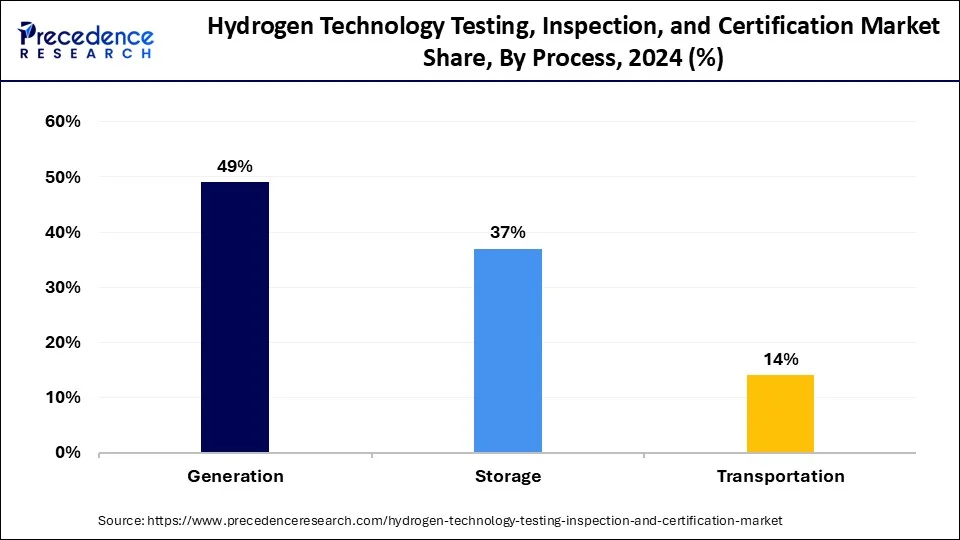

- By process, the generation segment led the market with the largest market share of 75.48% in 2025.

- By process, the storage segment will witness rapid expansion over the forecast period.

- By end-user application, the industrial & chemical processing segment led the global market in 2025.

- By end-user application, the energy & power generation segment will register the fastest growth in the market over the forecast period.

Market Overview

The hydrogen technology testing, inspection, and certification market is experiencing significant growth due to the global inclination toward cleaner energy resources. Since industries and governments have been inclined to use hydrogen adoption to meet targets like decarbonization. To ensure the safety, compliance, and performance of hydrogen-based technology, testing, inspection, and certification (TIC) services are crucial. The market covers various spectrum of services such as testing of hydrogen fuel cells, storage systems, electrolyzers, and transportation systems.

By region, North America and Europe are the frontiers of the global hydrogen technology testing, inspection, and certification market; on the contrary, Asia Pacific is emerging as a major key player in the global market, fuelling the growth of the market further. The rising production of green hydrogen is increasing the strength of the market. Also, significant players in the market are collaborating with governments and institutes to work on the project for green hydrogen.

AI Impact on the Hydrogen Technology Testing, Inspection, and Certification Market

Artificial Intelligence (AI) is playing a revolutionary role in the global hydrogen technology testing, inspection, and certification market in terms of safety, accuracy, and efficiency. AI-based technology can be integrated into TIC processes to improve certification processes. Predictive maintenance with AI can help to identify system failure before it occurs, especially in the hydrogen infrastructure. This will help enable preventive action that minimizes downtime and risks to safety. Furthermore, AI has the ability to handle complex data and perform accurate simulations, help handle safety standards, and speed up the certification process, which is generally time-consuming otherwise. Since the global inclination towards green energy has risen, AI is supporting hydrogen technology equally.

Hydrogen Technology Testing, Inspection, and Certification Market Growth Factors

- Increasing awareness about the decarbonization and adverse effects of carbon emission on the climate.

- Global push towards green hydrogen, further fuelling the global hydrogen technology testing, inspection, and certification market.

- Governments and institutes are increasing investment in R and D of green hydrogen.

- Industries like energy, heavy manufacturing, and transportation are seeking green hydrogen due to the strict regulations about emissions.

- The global shift towards green energy resources.

Hydrogen technology testing, inspection, and certification market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rising government initiatives aimed at strengthening the hydrogen infrastructure coupled with technological advancements in the hydrogen testing sector.

- Major Investors: Numerous hydrogen testing companies are actively entering this market, drawn by collaborations, R&D and business expansions. Various market players such as DEKRA SE, TÜV SÜD, DNV GL and some others have started investing rapidly for developing advanced solutions for testing hydrogen technology.

- Startup Ecosystem: Various startup brands are engaged in developing hydrogen testing solutions. The prominent startup brands dealing in hydrogen testing and inspection consists of Stardour, Atmonia, Beyond Aero and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 29.93 Billion |

| Market Size in 2026 | USD 6.63 Billion |

| Market Size in 2025 | USD 5.41 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.23% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Testing Type, Process, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Accelerating demand for clean energy in diverse sectors

The major driver for the hydrogen technology testing, inspection, and certification market is accelerating demand for clean energy resources for diverse sectors to achieve goals like decarbonization. Governments and leading institutes are investing heavily in the development of hydrogen technology since it's the prime component of the energy transition. The market is experiencing robust growth due to hydrogen fuel cells and hydrogen storage systems becoming more critical aspects for transportation and power generation. In addition to this, the technological advancements in hydrogen technology to create clean energy are prominent.

Restraint

Complexity in infrastructure development

The major restraining factor for the development of the hydrogen technology testing, inspection, and certification market is the high cost and complexity of developing a robust infrastructure to store the hydrogen in one place. Advanced and specialized technology is further required for the production, storage, and transportation of hydrogen, which is costly matter to implement practically and risky as well since hydrogen is quite an unstable gas, highly inflammable, and it's difficult to store at normal temperature, it requires the highly pressurized environment to store the hydrogen.

Opportunity

Emphasis on the production of green hydrogen

The significant opportunity that the hydrogen technology testing, inspection, and certification market holds is the increasing emphasis on producing green hydrogen in substantial amounts since it has various applications in diverse sectors. Governments and major institutes are prioritizing green energy to achieve the carbon-neutral goal; the demand for green hydrogen is surging significantly on a global scale.

Green hydrogen projects across Asia, Europe, and North America contribute substantially to the hydrogen technology testing, inspection, and certification market. Sectors like transportation, power generation, and heavy industries found numerous applications of green hydrogen since it offers comprehensive solutions to the sectors due to their innovative approach to safety efficiency and following regulatory compliance. Also, the increasing number of government initiatives to invest in green hydrogen and its production is observed.

Segment Insights

Service Type Insights

What made testing the dominant segment in the market?

The testing segment dominated the market with a 67.60% share in 2025, driven by the vital need to guarantee hydrogen system performance and safety. Comprehensive evaluations, such as pressure, mechanical, and material assessments, are part of testing and are crucial for preventing production, storage, and transportation failures. Maintaining operational effectiveness and adhering to strict safety and legal requirements depend on this service. The demand for testing services is further strengthened by the increasing use of hydrogen in the energy and industrial sectors.

The inspection segment is expected to grow at the fastest rate in the coming years, driven by the need for real-time condition monitoring of hydrogen equipment and the growing regulatory requirements. On-site inspections, structural analyses, and recurring compliance reviews are examples of inspection services that help avoid mishaps and downtime. Demand for trustworthy inspection services is being driven by the quick development of hydrogen infrastructure, including storage facilities and refueling stations. To increase accuracy and efficiency, businesses are investing in cutting-edge inspection technologies like drones and sensors.

Hydrogen Technology Testing, Inspection, and Certification Market, By Service Type, 2023-2025 (USD Million)

| By Service Type | 2023 | 2024 | 2025 |

| Testing | 2,550.54 | 2,987.52 | 3,658.65 |

| Inspection | 740.68 | 891.25 | 1,119.11 |

| Certification | 409.34 | 498.70 | 634.37 |

Testing Type Insights

What made pressure & mechanical testing the leading segment in the market?

The pressure & mechanical testing segment led the hydrogen technology testing, inspection, and certification market in 2025, since these tests guarantee the robustness and security of hydrogen production systems, pipelines, and storage tanks. They assist in locating potential failure points, leaks, and structural flaws that could cause mishaps or energy losses. Thorough mechanical testing is essential because hydrogen is extremely flammable and sensitive to pressure changes. This segment's dominance is further reinforced by industrial adoption and the growing use of high-pressure storage systems in energy applications.

The electromagnetic & electrical testing segment is growing rapidly because fuel cells and electrochemical hydrogen technologies are becoming increasingly popular. These tests guarantee that sensors, monitoring devices, and electrical parts in hydrogen systems operate as intended. Electromagnetic and electrical testing is becoming more necessary as hydrogen-powered cars, electrolyzers, and storage units proliferate. The industry gains advancements in automated inspection systems and smart testing apparatus, which boost efficiency and safety.

Hydrogen Technology Testing, Inspection, and Certification Market, By TestingType, 2023-2025 (USD Million)

| By Testing Type | 2023 | 2024 | 2025 |

| Pressure & Mechanical Testing | 1,568.08 | 1,816.15 | 2,199.42 |

| Leakage & Environmental Testing | 625.82 | 743.76 | 923.72 |

| Electromagnetic & Electrical Testing | 356.63 | 427.61 | 535.51 |

Process Insights

What made generation the leading segment in the market?

The generation segment led the hydrogen technology testing, inspection, and certification market with a 75.48% share in 2025, since testing is essential for efficiency, safety, and quality control during the production of hydrogen. During production, this entails testing the system integrity, storage readiness pressure, and purity of hydrogen. Production facilities depend on extensive testing to maximize output and avoid contamination. The generation segment continues to contribute the most to market revenue despite growing industrial hydrogen production and the expansion of green hydrogen plants.

The storage segment is expected to expand at the highest CAGR because of the growing demand for effective and safe hydrogen storage systems. High-pressure hydrogen can be safely handled by storage tanks, pipelines, and refueling systems thanks to testing and certification. The growth of energy storage applications, industrial storage hubs, and hydrogen refueling stations is what propels growth. The demand for testing and certification services in this market is also rising due to advancements in storage technologies such as composite pressure vessels and cryogenic systems.

Hydrogen Technology Testing, Inspection, and Certification Market, By Process, 2023-2025 (USD Million)

| By Process | 2023 | 2024 | 2025 |

| Generation | 2,846.22 | 3,333.47 | 4,085.19 |

| Storage | 367.11 | 450.97 | 577.63 |

| Transportation & Distribution | 487.23 | 593.02 | 749.31 |

End-User Application Insights

Why did the industrial & chemical processing segment dominate the market?

The industrial & chemical processing segment dominated the hydrogen technology testing, inspection, and certification market in 2025. This is mainly due to the extensive use of hydrogen in industrial manufacturing, refinery operations, and chemical synthesis. Since hydrogen is necessary to produce ammonia, methanol, and other chemicals, testing and certification are crucial. Businesses in this industry place a high priority on process effectiveness and safety, which contributes to the steady demand for testing and certification services. Strict adherence to regulations in chemical processing reinforces this segment's dominance in the market.

The energy & power generation segment is expected to grow at a rapid pace, fueled by the growing use of hydrogen in renewable energy and clean energy projects. Power plants, fuel cells, and grid stabilization systems all use hydrogen, necessitating thorough testing and inspection. The need for specialized testing services is fueled by the global movement toward carbon neutrality and green hydrogen initiatives. Government incentives for clean energy projects and the expansion of power generation facilities into emerging markets both contribute to this segment's explosive growth.

Hydrogen Technology Testing, Inspection, and Certification Market, By End-User Application, 2023-2025 (USD Million)

| By End-use Application | 2023 | 2024 | 2025 |

| Mobility & Transportation | 231.14 | 287.81 | 373.25 |

| Energy & Power Generation | 204.90 | 255.34 | 332.36 |

| Industrial & Chemical Processing | 3,264.51 | 3,834.31 | 4,706.52 |

Regional Insights

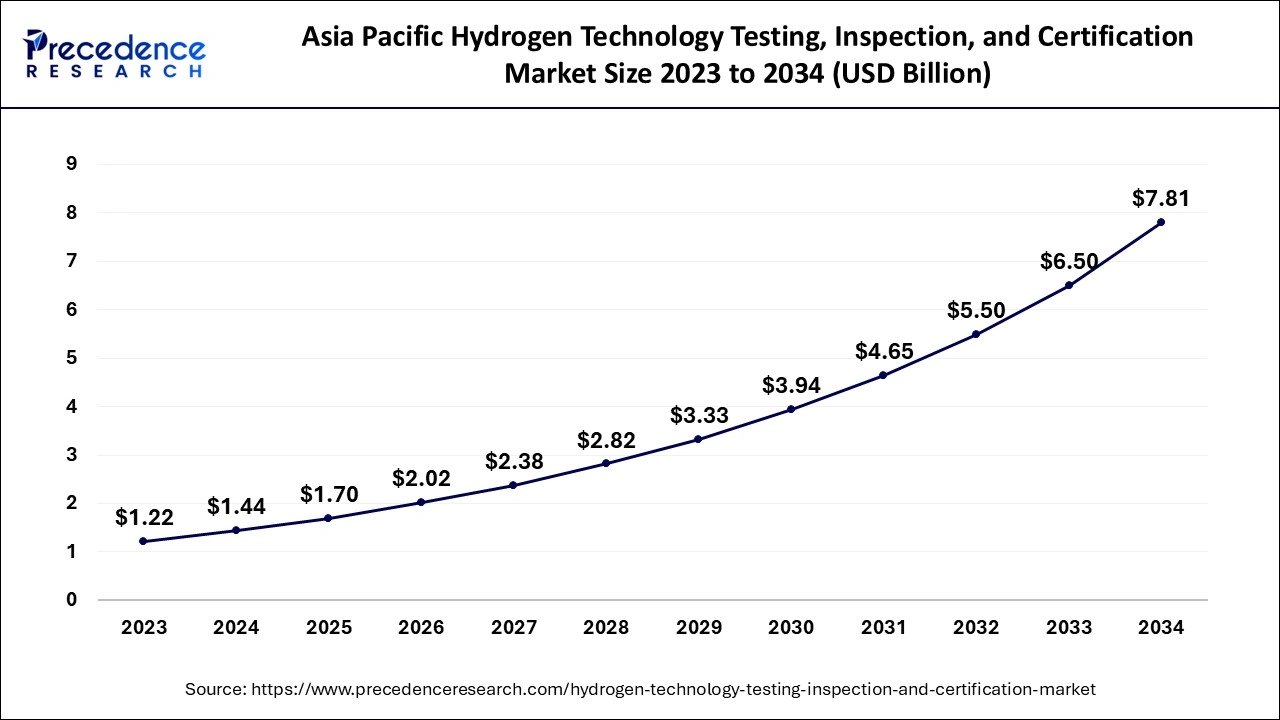

Asia Pacific Hydrogen Technology Testing, Inspection, and Certification Market Size and Growth 2026 to 2035

The Asia Pacific hydrogen technology testing, inspection, and certification market size was exhibited at USD 2.09 billion in 2025 and is predicted to be worth around USD 12.00 billion by 2035, growing at a CAGR of 18.59% from 2026 to 2035.

Asia Pacific accounted for the largest share of the hydrogen technology testing, inspection, and certification market in 2025. The market is proliferating due to evolving countries like Japan, China, and South Korea as they are making substantial investments to expand the projects for green hydrogen, and it is driven by ambitious projects like energy transitions. Furthermore, there is a significant government investment in hydrogen infrastructure, such as production facilities and technological advancements in fuel cell technologies.

North America is anticipated to witness the fastest growth in the hydrogen technology testing, inspection, and certification market during the forecasted years due to the region's strong emphasis on developing green energy, which is highly supported by the initiatives taken by institutes and government policies to produce more clean energy to reduce carbon footprints. Also, hydrogen refueling centers should be established, and research and development should be conducted to create safe and clean energy. North America has the highest standards for quality and safety regulations.

What led Europe to hold a significant share of the hydrogen technology testing, inspection, and certification market?

Europe held a significant share of the market. The increasing adoption of hydrogen trucks in numerous countries such as Italy, Germany, UK, France and some others for lowering emission has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the hydrogen infrastructure is expected to drive the growth of the hydrogen technology testing, inspection, and certification market in this region.

Why Latin America held a considerable share of the hydrogen technology testing, inspection, and certification market?

Latin America held a considerable share of the industry. The growing emphasis of airline companies to adopt green hydrogen in numerous countries such as Brazil and Argentina has driven the market growth. Also, rapid investment by market players for opening hydrogen R&D centers is expected to boost the growth of the hydrogen technology testing, inspection, and certification market in this region.

How is Middle East & Africa contributing to the hydrogen technology testing, inspection, and certification market?

The Middle East & Africa held a notable share of the market. The rising demand for clean energy in numerous countries such as UAE, Saudi Arabia, South Africa and some others has boosted the industrial expansion. Additionally, surging investment by government for opening new hydrogen testing facilities is expected to propel the growth of the hydrogen technology testing, inspection, and certification market in this region.

Hydrogen Technology Testing, Inspection, And Certification Market Companies

- SGS SA: SGS SA is a Swiss multinational company headquartered in Geneva that is the world's leading inspection, testing, and certification (TIC) company. SGS provides services to ensure products meet health, safety, and regulatory standards across a wide range of industries, including agriculture, chemicals, consumer goods, and energy.

- Bureau Veritas SA: Bureau Veritas SA is a French company founded in 1828 that provides inspection, testing, and certification (TIC) services globally. The company helps clients ensure their assets, products, and processes meet quality, health, safety, environmental, and social responsibility standards.

- Intertek Group plc: Intertek Group plc is a British multinational company that provides quality assurance services through testing, inspection, and certification (ATIC) for businesses worldwide. It offers a wide range of services including testing, inspection, certification, auditing, and advisory services.

- DEKRA SE: DEKRA SE is a German company that is a leading global expert organization specializing in safety services for testing, inspection, and certification. It manages the operating business of its parent company, DEKRA e.V., and provides services across the road, work, and home environments.

- TÜV SÜD: TÜV SÜD is a global company providing testing, inspection, auditing, certification, and training services to enhance safety, security, and sustainability. Its mission is to inspire trust in technology by managing its related risks and facilitating change, with a focus on protecting people, the environment, and assets.

- DNV GL: DNV is an international assurance and risk management company that was formed as DNV GL in 2013 through a merger between Det Norske Veritas (DNV) and Germanischer Lloyd (GL). It is a global leader in classification, technical assurance, software, and expert advisory services for industries including maritime, oil and gas, and renewable energy.

- TÜV Rhineland: TÜV Rheinland is a German multinational company and a leading global provider of testing and inspection services. This company offers training, consulting, and project management, and maintains a significant international presence with operations in over 50 countries.

Other Major Key Players

- Applus+

- TÜV NORD GROUP

- UL LLC

Recent Developments

- In November 2025, Southwest Research Institute (SwRI) inaugurated a new hydrogen research and testing center. This new center is opened to enhance the hydrogen testing capabilities across the world.

(Source: https://www.eurekalert.org) - In February 2025, Fabrum opened a new hydrogen test facility in Christchurch Airport. This facility is inaugurated to test green hydrogen-powered technologies.

(Source: https://www.christchurchairport.co.nz) - In February 2025, UBCO partnered with FortisBC. This partnership is done for opening a new hydrogen research lab in British Columbia.

(Source: https://news.ok.ubc.ca) - In January 2024, Baker Hughes Company launched a new Hydrogen Testing Facility designed to validate its NovaLT industrial turbines for operation with hydrogen blends up to 100%. The facility features a test bench capable of full-load testing and offers complete fuel flexibility, accommodating pressures up to 300 bars and a storage capacity of 2,450 kg.

- In November 2023, Element Materials Technology, a London-based provider of TIC services, initiated the first phase of a USD 10 million investment program. This investment involves acquiring advanced hydrogen testing equipment and expanding its global team dedicated to hydrogen technologies.

- In September 2023, Intertek Group plc, a global leader in Total Quality Assurance, enhanced its quality, safety, and sustainability services by launching Intertek Hydrogen Assurance. This comprehensive advisory and assurance platform offers companies unparalleled access to hydrogen expertise and engineering resources, supporting their projects and processes throughout the hydrogen value chain.

Segments Covered in the Report

By Service Type

- Testing

- Inspection

- Certification

By Testing Type

- Pressure & Mechanical Testing

- Overpressure, Burst, and Flow Testing

- Pressure Cycle and Fatigue Testing

- Proof and Hydraulic Testing

- Leakage & Environmental Testing

- Helium Leak Testing & Tightness Verification

- Hydrogen Permeation Testing

- Environmental Simulation [Temperature, Humidity, Vibration]

- Electromagnetic & Electrical Testing

- Electromagnetic Compatibility [EMC]

- Electrical Safety and Grid Integration Testing

By Process

- Generation

- Storage

- Transportation & Distribution

By End-use Application

- Mobility & Transportation

- Automotive [Passenger Cars, Light Commercial Vehicles]

- Heavy-Duty Transport [Trucks, Buses, Rail]

- Aerospace & Aviation [Unmanned Aerial Vehicles, Hydrogen Turbines]

- Marine & Shipping [Hydrogen-powered Vessels]

- Energy & Power Generation

- Stationary Fuel Cells [Primary & Backup Power]

- Power-to-X Systems

- Residential and Commerical Heating [Hydrogen Blending]

- Industrial & Chemical Processing

- Refining & Petrochemicals [Hydrocracking, Desulfurization]

- Chemical Production [Ammonia, Methanol]

- Metal & Steel Manufacturing [Direct Reduced Iron]

- Glass and Food Industries

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting