Immunotherapy Drugs Market Size and Forecast 2025 to 2034

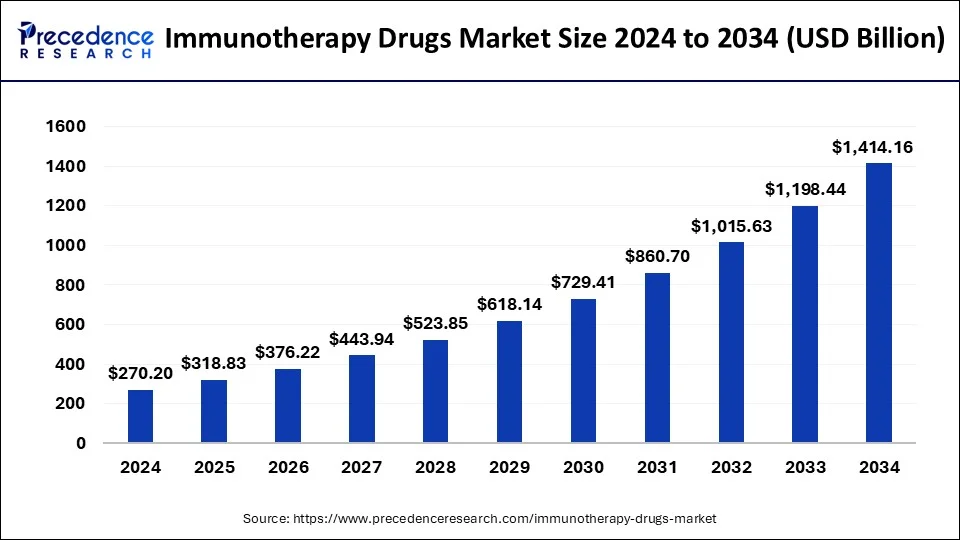

The global immunotherapy drugs market size was estimated at USD 270.2 billion in 2024 and is predicted to increase from USD 318.83 billion in 2025 to approximately USD 1,414.16 billion by 2034, expanding at a CAGR of 18% from 2025 to 2034.

Immunotherapy Drugs Market Key Takeaway

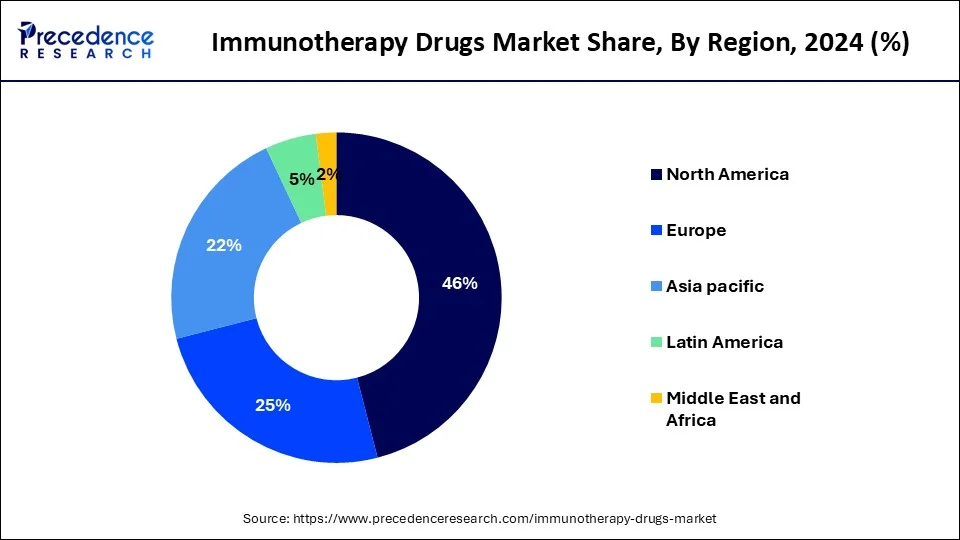

- North America dominated the global market with the largest market share of 46% in 2024.

- By indication type, the cancer segment held the highest market share of 92% in 2024.

- By drug type, the monoclonal antibodies segment captured the biggest market share of 77% in 2024.

U.S. Immunotherapy Drugs Market Size and Growth 2025 to 2034

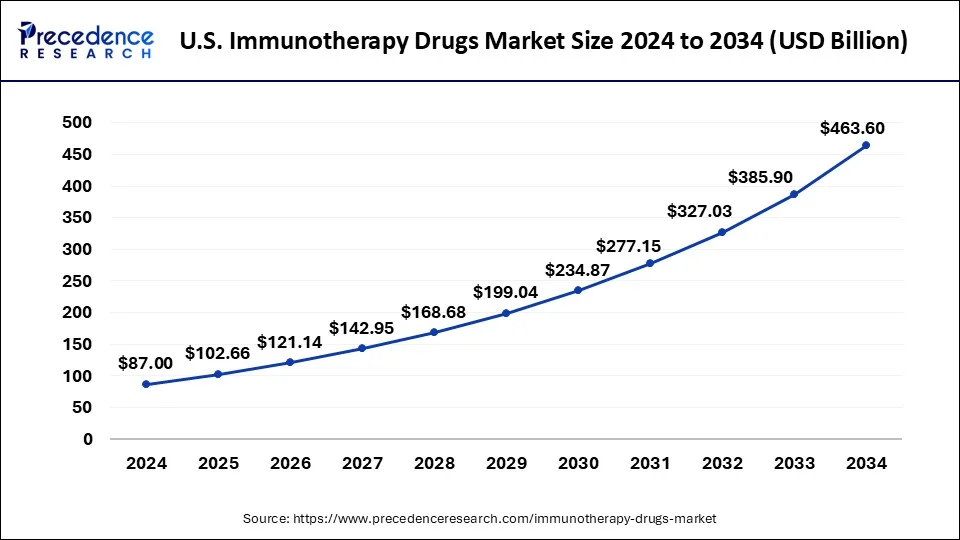

The U.S. immunotherapy drugs market size accounted for USD 87 billion in 2024 and is expected to be worth around USD 463.60 billion by 2034, growing at a CAGR of 18.21% from 2025 to 2034.

North America dominated the global immunotherapy market in 2024. This can be attributed to the increased prevalence of the chronic diseases in the major market like US. Around half of the US population is suffering from one or more chronic diseases. This has resulted in the increased healthcare expenditure. Moreover, as per the American Cancer Society, over 1.8 million new cancer cases and 606,520 deaths were reported in the US in 2020. The colorectal cancer, lungs cancer, prostate cancer, and breast cancer are the most prominent types of cancers in US. The increased awareness among the US population regarding the immunotherapy drugs coupled with the increased healthcare expenditure and enhanced access to the healthcare facilities has augmented the market growth in this region. The presence of developed healthcare infrastructure and presence of several top biopharmaceutical companies has significantly contributed towards the market growth.

Asia Pacific is estimated to be the most opportunistic market during the forecast period owing to the rising prevalence of target diseases among the population. According to the International Journal of General Medicine 2018, the mortality from the chronic diseases is rapidly rising in the low and middle income countries, accounting for around 75% of the global deaths from the chronic diseases. The alarming rise in the number of chronic diseases and deaths due to it is expected to spur the demand for the immunotherapy drugs in this region. Moreover, the rising government expenditure on the development of healthcare infrastructure and improving the access to the healthcare facilities is significantly fostering the growth of the immunotherapy drugs market in Asia Pacific.

Immunotherapy Drugs Market Growth Factors

The rising prevalence of chronic diseases, rising healthcare expenditure, and growing adoption of the targeted therapy among the population are the major factors that propels the growth of the global immunotherapy drugs market. The growing popularity of the biosimilars owing to the approvals received by certain biosimilar drugs from the authorities like FDA and EMA is expected to be an important driving factor in the forthcoming years. The growing investments in the research and development by the biotechnology and pharmaceutical companies, rising number of research labs, and growing research collaborations by the key market players are the several crucial factors that are expected to have a significant impact on the market growth during the forecast period. The rapidly growing biopharmaceutical industry owing to the rising government support and rising corporate investments will augment the growth of the immunotherapy drugs market. Furthermore, the rising awareness regarding the benefits of the immunotherapy drugs over the traditional treatment procedures is significantly spurring the demand for the immunotherapy drugs.

Traditional therapies were expensive and were inefficient in treating the diseases. For instance, the chemotherapy used for the treatment of cancer, was very toxic. It involved the risks of organ failure, reoccurrence of cancer, and various other side-effects, which may cost the life of the patient even after receiving the treatment. The immunotherapy has low side-effects can are free from the risks that were associated with the traditional chemotherapy. This has significantly driven the demand for the immunotherapy drugs across the globe.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 270.2 Billion |

| Market Size in 2024 | USD 318.83 Billion |

| Market Size in 2034 | USD 1,414.16 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 18% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Therapeutic Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Drug Type Insights

Based on the drug type, the monoclonal antibodies segment dominated the global immunotherapy market in 2024. The monoclonal antibodies are considered to be the most effective type of immunotherapy that cures various chronic diseases. The higher safety of the immunotherapy owing to the lower toxicity results in minimal or no side effects. The increasing popularity of the monoclonal antibodies due to its low side-effects is fueling the demand for the monoclonal antibodies. The government authorities like FDA and EMA are playing a crucial role in the rising adoption of the monoclonal antibodies. In 2017, the FDA and EMA collectively approved 73 monoclonal antibodies.

The vaccines segment is estimated to be the fastest-growing segment during the forecast period. The rising burden of various infections and diseases is fueling the investments on the development of vaccines. For instance, in 2020, the rapid spread of the COVID-19 disease have positively impacted the growth of this segment as the top pharmaceutical companies were engaged in the development of immunotherapy-based vaccines and drugs.

Therapeutic Area Analysis

Cancer was the most dominant therapeutic area in 2024. This is attributed to the increased prevalence of cancer across the globe. As per the GLOBOCAN, a report published by the International Agency for Research on Cancer, around 19.3 million new cancer cases and 10 million cancer deaths were reported across the globe, in 2020. The new cancer cases are expected to rise by 47% from 2020 to 2040, globally. Therefore, it is estimated that around 28.4 million new cancer cases will be recorded in 2040 across the globe. The most prominent type of cancer includes lungs cancer, prostate cancer, breast cancer, and colorectal cancer. The increased demand for the immunotherapy drugs to treat cancer has fostered the growth of this segment and the rapidly growing cases of cancer are anticipated to sustain the dominance of this segment throughout the forecast period. Moreover, the immunotherapy drugs targets the cancer cells in the body and treats I without harming the normal cells, which leads to low or no side-effects. These advantages of the new immunotherapy drugs over the traditional chemotherapy are compelling the patients to adopt the immunotherapy drugs that foster the growth of this segment, globally.

Immunotherapy Drugs Market Companies

- F. Hoffmann-La Roche AG

- GlaxoSmithKline plc.

- AbbVie, Inc.

- Amgen, Inc.

- Merck & Co., Inc.

- Alligator Bioscience

- UbiVac

- Bristol-Myers Squibb

- Novartis International AG

- AstraZeneca plc

Key Developments

- In July 2019, Allergan Plc and Amgen, Inc. KANJINTITM, a biosimilar to Herceptin, and MVASi, a biosimilar to Avastin in the US. MVASI was the first cancer biosimilar that got the FDA approval.

- In May 2020, VinsBioproducts Ltd. collaborated with the University of Hyderabad and the CSIR Center for Cellular and Molecular Biology, in India to develop immunotherapy treatment for COVID-19.

- The various developmental strategies like partnerships, acquisitions, mergers, collaborations, and new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Market Segmentation

By Drug Type

- Monoclonal Antibodies

- Vaccines

- Interleukins

- Interferons Alpha & Beta

- Others

By Therapeutic Area

- Cancer

- Infectious Diseases

- Autoimmune & Inflammatory Diseases

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting