What is T-cell Immunotherapy Market Size?

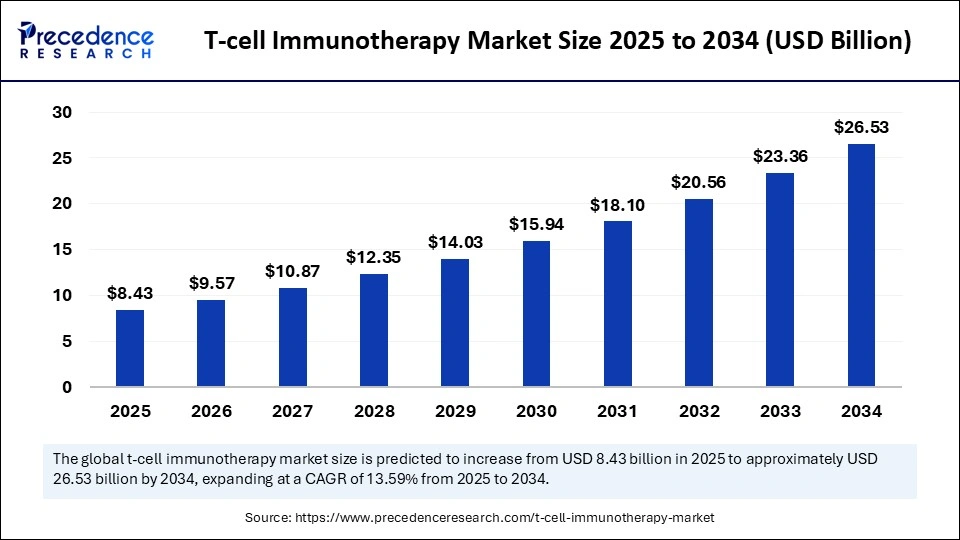

The global T-cell imunotherapy market size accounted for USD 8.43 billion in 2025 and is predicted to increase from USD 9.57 billion in 2026 to approximately USD 26.53 billion by 2034, expanding at a CAGR of 13.59% from 2025 to 2034. The T-cell immunotherapy market is driven by the rising prevalence of cancer, advancements in T-cell engineering technologies, and increasing clinical adoption of personalized, targeted immunotherapies.

Market Highlights

- North America led the T-cell immunotherapy market with largest market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By therapy type, the CAR-T segment held the dominant market share in 2024.

- By therapy type, the allogeneic (off-the-shelf) CAR-T segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By engineering / modification technology type, the viral vectors segment dominated the market in 2024.

- By engineering / modification technology type, the non-viral methods segment is expected to expand at a notable CAGR over the projected period.

- By indication / disease area, the hematologic malignancies segment captured the largest market share in 2024.

- By indication / disease area, the solid tumors segment is expected to expand at a notable CAGR over the projected period.

- By vector / targeting strategy, the single-antigen targeting segment held the biggest market share in 2024.

- By vector / targeting strategy, the dual/multi-antigen targeting segment is expected to expand at the fastest CAGR over the projected period.

- By end user/ care setting, the hospitals segment held a dominant market share in 2024.

- By end user / care setting, the specialty cell therapy centers / infusion centers segment is expected to grow at a fastest CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 8.43 Billion

- Market Size in 2026: USD 9.57 Billion

- Forecasted Market Size by 2034: USD 26.53 Billion

- CAGR (2025-2034): 13.59%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Factors Influence the Growth of the T Cell Immunotherapy Market?

The primary drivers of the T-cell immunotherapy market include the rising global incidence of cancer and the growing adoption of personalized immunotherapies that offer targeted and durable responses. T-cell immunotherapy refers to a form of cellular therapy in which a patient's T cells are modified or enhanced to more effectively recognize and eliminate cancer cells.

Market momentum is further supported by increasing clinical success rates, expanded collaboration between academic institutions and industry stakeholders, and regulatory backing for the advancement of cell-based therapies. In addition, breakthroughs in gene editing technologies and innovations in manufacturing protocols are making these therapies more accessible and cost-effective, thereby accelerating clinical adoption across oncology and emerging autoimmune indications.

T-Cell Immunotherapy Market Outlook

- Market Growth Overview: The T-cell immunotherapy market is poised for robust expansion between 2025 and 2034, driven by increasing cancer prevalence, expanding patient eligibility, and demonstrated clinical efficacy of approved therapies. Improved efficiencies in biomanufacturing, coupled with new global partnerships between research institutes and biopharma companies, are facilitating larger-scale adoption and ensuring the long-term viability of this therapeutic platform.

- Global Expansion: Expansion into emerging regions supports the growth of the market by increasing patient access to innovative treatments and diversifying clinical trial populations, which enhances the robustness of efficacy and safety data. Research and development, along with clinical trial sites, are increasingly distributed globally, primarily across the U.S., China, and the EU, leading to greater market access diversity and pricing pressures. Successful global launches require engagement with local regulators and establishment of domestic manufacturing to reduce logistical delays and maintain cell viability. Additionally, local manufacturing and regulatory collaborations in these areas help reduce costs and logistical barriers, accelerating market penetration and adoption.

- Research & Development:Continued funding from the NIH and academic institutions supports progress in next-generation T-cell receptor (TCR) therapies and allogeneic platforms. This investment is enabling a transition from hematologic cancers to select solid-tumor indications, while facilitating translational de-risking outside of immediate commercial pressures.

- Key Investors: Public funding and government grants play a crucial role in de-risking early-stage scientific research, while strategic private capital focuses on automation in manufacturing and point-of-care production. Investors are increasingly optimistic about scale-out technologies that reduce treatment costs and promote broader hospital adoption.

- Regulatory Landscape: Regulatory bodies such as the FDA and WHO are issuing guidance on CAR-T and other cell and gene therapies, alongside harmonization initiatives. Evolving policies, including recent FDA REMS reassessments, significantly influence market access pathways, post-market obligations, and payer decision-making.

Key Technological Shifts in the T-Cell Immunotherapy Market Driven by AI?

Artificial intelligence is revolutionizing T-cell immunotherapy by accelerating target discovery, protein design, and gene-editing workflows. AI-designed proteins have demonstrated enhanced T-cell production and function in preclinical models, leading to improved production efficiency. AI-generated minibinders have also enhanced T-cell binding and cancer-cell killing, offering promising therapeutic candidates for next-generation T-cell therapies. Computer-based platforms have become indispensable for optimizing CAR design and candidate selection, enabling more efficient preclinical safety profiling and reducing clinical testing risks. The industry momentum is evident, with major pharmaceutical companies forging strategic partnerships with AI-CRISPR firms to expedite immunology programs, thereby shortening the time from discovery to clinic and lowering global development costs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.43 Billion |

| Market Size in 2026 | USD 9.57 Billion |

| Market Size by 2034 | USD 26.53Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.59% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Engineering / Modification Technology,Therapy Type Insights,Indication / Disease Area , Vector / Targeting Strategy , End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How are Advances in Solid Tumor Treatments Impacting the Expansion of the T-Cell Immunotherapy Market??

As the T-cell immunotherapy landscape expands, a primary driver of the market is the growing clinical success in solid tumors, which remains the final frontier for immune-based therapies. In other words, the shift from hematologic malignancies to solid tumors is revolutionary.

For example, in 2025, the first clinical trial in China evaluated CAR-T therapy in gastric and gastro-esophageal junction cancer patients. It was found to improve overall survival by approximately 40% compared to standard therapies, demonstrating a meaningful therapeutic benefit in real-world evidence.

Additionally, the FDA's approval of afamitresgene autoleucel (Tecelra) in August 2024 as the first engineered TCR therapy for a solid tumor (synovial sarcoma) further validated the ability to target solid tumors through innovative T-cell engineering. These are both examples of progress in technologies evaluating antigen targeting, solid tumor microenvironment modulation, and efficiency in cell manufacturing - thereby paving a path for acceptance and worldwide investment in T-cell immunotherapies.

Restraint

What Is Slowing Down the Progress of the T-Cell Immunotherapy Market?

A primary barrier to the T-cell immunotherapy market is the tumor microenvironment (TME), which limits the efficacy of therapies, primarily with solid tumors. The TME consists of immune-suppressive cell types, including regulatory T cells (Tregs), myeloid-derived suppressor cells (MDSCs), and tumor-associated macrophages. These cells secrete immune-suppressive factors, such as TGF-β and IL-10, to inhibit T-cell activation and proliferation. T-cell infiltration is also poor due to the stroma, which consists of dense fibroblasts and abnormal blood vessels. Combined with limited chemokine expression, this makes it difficult for T cells to access cancer cells.

Finally, T-cell exhaustion is a major issue from persistent exposure to tumor antigens, which reduces the persistence and attack ability of these cells. According to a 2025 study published by NIH, immunosuppressive TMEs and limited T-cell infiltration are significant challenges to CAR-T therapies in solid tumors and pose impediments to clinically successful treatments.

Opportunity

Can "Off-the-Shelf" Universal T-cell therapy Transform Immunotherapy?

A significant opportunity within the T cell immunotherapy field lies in the concept of universal, allogeneic ("off-the-shelf") T cell products that do not technically require the harvesting and manipulation of a patient's own T cells. For example, a CRISPR-edited CAR-T therapy recently reported to treat T-cell leukemias can be derived from healthy donor cells, which can then be frozen, bypassing the weeks of wait time for autologous manufacturing.

Additionally, in April 2025, Cellistic launched the Echo-NK platform, allowing scalable manufacturing of off-the-shelf Natural Killer cell therapies targeting blood cancers, solid tumors, and autoimmune diseases.

(https://www.cellistic.com/insights/launch-echo-nk-platform-a-scalable-solution-for-off-the-shelf-allogeneic-immune-cell-therapies )

These developments reduce costs, disrupt logistical hurdles, and potentially increase accessibility in contexts where there are no advanced cell therapy frameworks. With rising demand for rapid, scalable T cell therapies, universal and in vivo approaches may represent the next chapter of clinical uptake.

Segment Insights

Therapy Type Insights

Why Did the CAR-T (Chimeric Antigen Receptor T cells) Segment Lead the Market?

The CAR-T (chimeric antigen receptor T cells) led the T-cell immunotherapy market with the largest share in 2024. This is mainly due to its widespread adoption, particularly for hematologic malignancies such as lymphoma and leukemia. Several CAR-T products have received FDA approval, with many exploring expanded indications, solidifying CAR-T as the benchmark for response and efficacy in engineered T-cell therapies.

The allogeneic (off-the-shelf) CAR-T sub-segment is expected to grow at the fastest rate in the upcoming period, as it aims to overcome supply constraints inherent in autologous approaches. These universal T cells, engineered using gene-editing tools like CRISPR to minimize rejection risk, promise faster, more cost-effective therapies that can be produced at scale, increasing patient access in oncology.

Engineering / Modification Technology Insights

Which Technology Holds the Largest Market Share in 2024?

The viral vectors segment held the largest share of the T-cell immunotherapy market in 2024. Lentiviral and retroviral systems are the predominant vector types due to their well-established use in in vivo gene transfer, rapid and stable transduction, and prolonged expression of CAR or TCR constructs. Indeed, the vast majority of commercially available FDA-approved T-cell immunotherapies, demonstrated to be safe, reliable, and clinically effective across various cancers, are based on engineered T cells utilizing viral vector–based engineering.

The non-viral methods segment is expected to grow at the fastest rate in the upcoming period due to its advantages in safety, scalability, and cost-effectiveness compared to traditional viral vector-based approaches. These methods reduce risks associated with viral integration, enable faster and more flexible manufacturing processes, and support the development of off-the-shelf and personalized therapies, driving greater adoption across clinical applications.

Indication / Disease Area Insights

What Made Hematologic Malignancies the Dominant Segment in the T-Cell Immunotherapy Market?

The hematologic malignancies segment dominated the T-cell immunotherapy market in 2024, driven by strong clinical successes and the commercial approval of multiple CAR-T products for leukemia, lymphoma, and myeloma. The clear identification of target antigens in these malignancies, combined with accessible T cells, has facilitated rapid adoption, making hematologic cancers the most validated and commonly treated indications for T-cell therapies.

Conversely, the solid tumors segment is expected to grow at the fastest CAGR over the forecast period, fueled by extensive research and increasing clinical trials. Advances in overcoming the tumor microenvironment's unique challenges, such as improved T-cell infiltration, novel dual-antigen CARs, logic-gated constructs, and combination therapies with oncolytic viruses, have created a positive outlook for sustained efficacy against solid tumors like glioblastoma, ovarian, and pancreatic cancers.

Vector / Targeting Strategy Insights

How Does the Single-Antigen Targeting Segment Lead the Market in 2024?

The single-antigen targeting segment led the T-cell immunotherapy market in 2024 due to its proven clinical safety and efficacy in patients with hematologic malignancies. Most marketed CAR-T therapies, including those targeting CD19 and BCMA, utilize single-antigen targeting because it offers precise tumor cell recognition with minimal off-target toxicity and consistent therapeutic responses in cancer patients.

The dual/multi-antigen targeting segment is expected to register the fastest CAGR during the forecast period, as it effectively addresses tumor heterogeneity and mitigates the risk of antigen escape—key limitations of single-antigen therapies. By targeting multiple tumor antigens simultaneously, these therapies improve treatment efficacy, durability of response, and broaden applicability across various cancer types, fueling greater clinical adoption and market expansion.

End-User Insights

What Made Hospitals Major End-Users?

The hospitals segment dominated T-cell immunotherapy market in 2024. This is mainly due to their well-developed infrastructure, trained staff, and regulatory compliance necessary for administering complex cell therapies. These facilities act as the primary sites for CAR-T therapy administration, clinical trials, and patient follow-up, whether inpatient or outpatient, while maintaining consistent patient care standards and safety protocols.

The specialty cell therapy centers / infusion centers segment is likely to grow at the fastest rate in the coming years. This is mainly due to their ability to provide more accessible, cost-effective, and patient-centric care compared to traditional hospital settings. These centers offer streamlined outpatient services that reduce hospitalization times, lower treatment costs, and improve patient convenience, aligning with the growing demand for decentralized and scalable delivery of complex T-cell therapies.

Regional Insights

Why Did North America Dominate the Market in 2024?

North America dominated the T-cell immunotherapy market by capturing the largest share in 2024. This is mainly due to its robust clinical trial ecosystem, well-established regulatory pathways, and advanced downstream networks, including CDMOs, commercial manufacturing, and hospital infrastructure, that accelerate the translation of T-cell therapies to patients. The region benefits from effective payer engagement strategies and academic-industry consortiums that leverage commercial pathways to shorten commercialization timelines and de-risk investments, attracting top talent, increasing venture capital, and fostering partnership deals focused on advanced autologous and allogeneic T-cell programs.

Why is the U.S. Considered the Major Contributor to the Market?

The U.S. is a major contributor to the market, driven by regulatory clarity, numerous FDA approvals, and expanded hospital infusion capacity that enable faster market access and higher transaction volumes for T-cell therapies. In June 2025, the FDA relaxed certain REMS (Risk Evaluation and Mitigation Strategy) post-marketing compliance requirements for approved CAR-T therapies, facilitating better compliance, broader adoption, and increased hospital capacity for post-marketing administration. These regulatory advancements, combined with the presence of multiple CDMOs, have solidified the U.S.'s continued leadership in the market. (Source: https://www.fda.gov)

What Factors Contribute to the Asia Pacific T-cell Immunotherapy Market Growth?

Asia Pacific is expected to experience the fastest growth during the forecast period. This is mainly due to the increasing production and adoption of T-cell immunotherapy in Asia Pacific, especially in China, Japan, and South Korea. These three countries are significantly speeding up regulatory approvals and stimulating innovation via funding, collaboration, and clinical development. The relatively low-cost trial ecosystem and the vast population of potential participants make the region very appealing to global biotech/pharmaceutical company innovators of next-generation T-cell therapies.

What Makes India a Regional Growth Engine?

India is quickly establishing itself as a growing player in T-cell immunotherapy, driven by government priorities and academic-industry partnerships. In April 2024, the Indian President launched NexCAR19, the country's first home-grown gene therapy for cancer, developed by IIT Bombay, Tata Memorial Centre, and ImmunoACT, positioning India for a leadership role in global cell therapy.

Additionally, in January of 2025, India commercialized the first global CAR-T therapy for adult B-cell Non-Hodgkin Lymphoma. This affordable, life-saving therapy for aggressive blood cancers is yet again putting India on the immunotherapy world map.

(Source: https://www.newindianexpress.com)

Clinical Trials in T-Cell Immunotherapy (2024-2025)

|

Study Title |

Conditions |

Phases |

Start Date |

|

MRD-Adaptive Guided Immunotherapy With CAR-T for Transplant-Ineligible Patients With Multiple Myeloma |

Multiple Myeloma, Newly Diagnosed |

PHASE2 |

8/10/2025 |

|

Chemoimmunotherapy for ALK+ Relapsed/Refractory ALCL |

Anaplastic Large Cell Lymphoma, ALK-Positive |

PHASE2 |

7/1/2025 |

|

Adjunctive Methylene Blue for Immunotherapy-related CRS and ICANS: Phase I Study |

Cytokine Release Syndrome|ICANS |

PHASE1 |

6/28/2025 |

|

Immunotherapy For Adults With GPC3-Positive Solid Tumors Using IL-15 and IL-21 Armored GPC3-CAR T Cells |

Hepatoblastoma|Hepatocellular Carcinoma|Wilms Tumor|Malignant Rhabdoid Tumor|Yolk Sac Tumor|Rhabdomyosarcoma|Liposarcoma|Embryonal Sarcoma of Liver |

PHASE1 |

6/10/2025 |

|

Targeted Anti-CEA CAR-T Immunotherapy for Advanced Lung Cancer |

Advanced Lung Cancer |

PHASE1 |

5/8/2025 |

|

A Phase I/ II Study of Fragmented Autoantigen Stimulated T-cell-immunotherapy Combined with Radiotherapy (FAST-CR) |

Breast Cancer, Colorectal Cancer|Melanoma|Lung Cancer |

EARLY_PHASE1 |

3/25/2025 |

|

Eight-Treg Study:Trial of Adoptive Immunotherapy With Autologous ex Vivo Expanded Regulatory CD8+ T Cells in Living Donor Kidney Transplant Recipients |

Kidney Transplantation |

PHASE1 |

2/1/2025 |

|

Assessment of PET Tracers to Evaluate T Cell Change and Activation in Relation to Immunotherapy Treatment Response in Non-Small Cell Lung Cancer |

NSCLC |

NA |

12/1/2024 |

|

Biological Tumor Infiltrating Lymphocytes Therapy With Immunotherapy for Colon and Rectum Cancer |

Colorectal Cancer|Colon Cancer|Rectum Cancer |

PHASE1|PHASE2 |

9/29/2024 |

|

Anti-CD19 Chimeric Antigen Receptor T-Cell Immunotherapy for Chronic Lymphocytic Leukemia (CLL) |

B-Cell Chronic Lymphocytic Leukemia|Leukemia, Lymphocytic, Chronic, B-Cell|B-Lymphocytic Leukemia, Chronic |

PHASE1|PHASE2 |

9/3/2024 |

|

TIL Gean Therapy Combined With Immunotherapy for Advanced or Metastatic Refractory Breast Cancer |

Breast Cancer|Breast Carcinoma|Breast Cancer Metastatic|Breast Cancer Triple Negative |

PHASE1|PHASE2 |

8/22/2024 |

|

Cellular Immunotherapy for Immune Tolerance in Past Recipients of HLA Zero-mismatch, Living Donor Kidney Transplants |

Kidney Transplant Rejection |

PHASE2 |

2024-12 |

Top Key Players Operating in the T-Cell Immunotherapy Market

- Tier I – Major Players (~40–50% of Total Market Share)

These companies dominate the T-cell immunotherapy market with significant individual shares, collectively accounting for approximately 40–50% of total market revenue.

- Kite Pharma (Gilead Sciences):

Kite Pharma, a Gilead subsidiary, is a leader in commercializing CAR-T therapies like Yescarta, focusing on lymphoma and other blood cancers. Their robust clinical pipeline and manufacturing capabilities enable rapid scaling and development of next-generation T-cell therapies.

- Bristol Myers Squibb:

Bristol Myers Squibb, after acquiring Celgene, leverages a strong portfolio of T-cell immunotherapies including Breyanzi and Abecma, targeting both hematologic malignancies and solid tumors. The company emphasizes innovation in allogeneic and dual-targeting CAR-T approaches to enhance efficacy and accessibility.

- Juno Therapeutics (Celgene):

Juno Therapeutics, acquired by Celgene and now part of Bristol Myers Squibb, is credited with advancing T-cell therapy technologies and developing CAR-T candidates that have achieved several FDA approvals. Their focus on precision targeting and safety improvements has helped shape the commercial landscape.

- GSK (GlaxoSmithKline):

GSK is rapidly expanding its cell therapy footprint through strategic collaborations and internal development of T-cell therapies, aiming to target both cancer and autoimmune diseases. Their emphasis on gene-editing and allogeneic platforms positions them as an emerging powerhouse in the next wave of T-cell immunotherapies.

Tier II – Mid-Level Contributors (~30–35% of Market Share)

These companies have a strong presence and contribute notably to the market, but are not as dominant as Tier I players. Together, they contribute around 30–35% of the market.

- Adaptimmune Therapeutics

- Allogene Therapeutics

- Cellectis

- Takara Bio

- Unum Therapeutics

Tier III – Niche and Regional Players (~15–20% of Market Share)

These smaller or regionally-focused companies have limited global reach. While their individual contributions are modest, collectively they hold around 15–20% of the market.

- Poseida Therapeutics

- Gracell Biotechnologies

- EsoBiotec

- Innovative Cellular Therapeutics

- Sinobioway Cell Therapy

Recent Developments

- In January 2025, Immuneel Therapeutics launched Qartemi, a CAR T-cell therapy for adult B-cell Non-Hodgkin Lymphoma (B-NHL). It is personalized therapy for adult patients with relapsed or refractory B-NHL.

(Source: https://www.financialexpress.com) - In January 2025, CTMC collaborated with Syenex to advance the scalability and efficiency of engineered T cell therapies. Jay Rosanelli, CEO of Syenex stated, “We're thrilled to partner with CTMC, an organization at the forefront of cell therapy innovation.”

(Source: https://www.businesswire.com)

Expert Analysis on the T-cell Immunotherapy Market

The global T-cell immunotherapy market is poised for exponential expansion, driven by paradigm-shifting advancements in cellular engineering and the escalating prevalence of oncology indications amenable to immune modulation. The convergence of cutting-edge gene-editing technologies, such as CRISPR, and the maturation of allogeneic “off-the-shelf” platforms herald unprecedented scalability and cost optimization, mitigating historical supply chain constraints intrinsic to autologous therapies. This, coupled with an expanding therapeutic horizon beyond hematologic malignancies into solid tumor oncology, underscores a significant inflection point poised to catalyze robust market penetration.

Strategic alliances between biopharma incumbents and AI-powered biotech innovators are accelerating translational research velocity, expediting the clinical development lifecycle while concurrently de-risking R&D expenditures. Geographic diversification into high-growth emerging markets, buoyed by regulatory harmonization and incentivized funding mechanisms, further amplifies addressable market potential. Moreover, advancements in manufacturing automation and decentralized point-of-care production are anticipated to disrupt traditional delivery paradigms, enhancing patient access and adoption rates. Consequently, stakeholders positioned to leverage these multi-dimensional growth vectors stand to capitalize on sustained value creation within this dynamic biotherapeutics landscape.

Segments Covered in the Report

By Therapy Type

- CAR-T (Chimeric Antigen Receptor T cells)

- Autologous CAR-T

- Allogeneic (off-the-shelf) CAR-T

- Dual/multi-antigen CARs

- Armored / TRUCK CARs (cytokine-expressing)

- TCR-engineered T cells

- Class I TCRs (CD8)

- Class II-restricted TCRs (CD4)

- TILs (Tumor-Infiltrating Lymphocytes)

- T-cell receptor mimic (TCRm) therapies

- CAR-NK and CAR-Macrophage (adjacent/competing modalities

By Engineering / Modification Technology

- Viral vectors (lentivirus, retrovirus)

- Non-viral methods (electroporation, transposons — e.g., Sleeping Beauty)

- Gene editing (CRISPR/Cas, TALEN, ZFN)

- mRNA / transient expression platforms

By Indication / Disease Area

- Malignancies

- Leukemia (ALL, AML)

- Lymphoma (NHL, DLBCL)

- Multiple myeloma

- Solid tumors

- Lung, colorectal, pancreatic, ovarian, melanoma, etc.

- Autoimmune & inflammatory indications (experimental)

- Infectious disease (experimental)

By Vector / Targeting Strategy

- Single-antigen targeting (e.g., CD19, BCMA)

- Dual/multi-antigen targeting

- Logic-gated CARs (AND, OR, NOT)

- Affinity-tuned / safety-switched CARs (suicide switches)

By End User / Care Setting

- Hospitals (tertiary/academic cancer centers)

- Specialty cell therapy centers / infusion centers

- Ambulatory surgical centers (emerging)

- Research / clinical trial sites

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content