What is the Impact Resistant Glass Market Size?

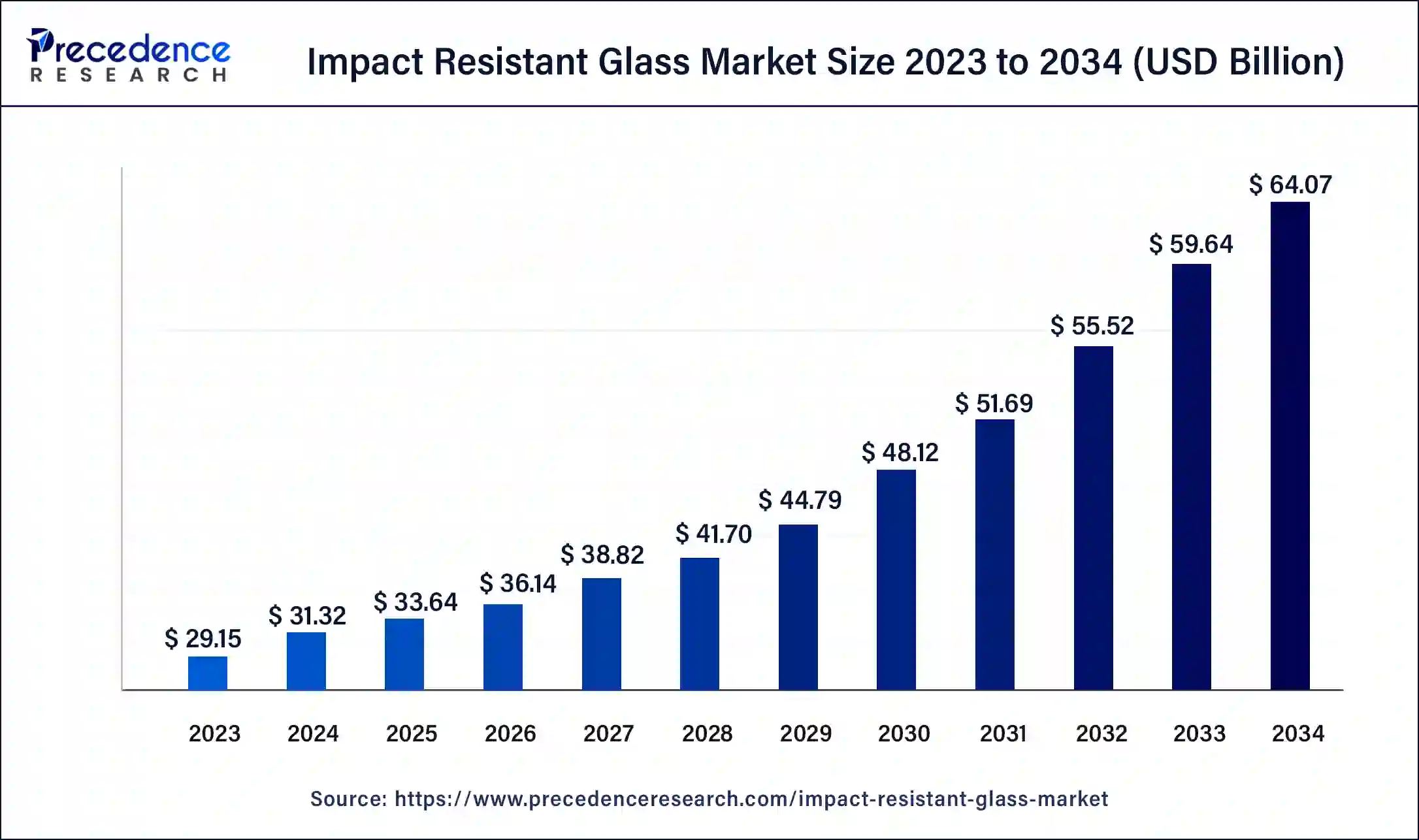

The global impact resistant glass market size is valued at USD 33.64 billion in 2025 and is predicted to increase from USD 36.14 billion in 2026 to approximately USD 64.07 billion by 2034, at a CAGR of 7.42% from 2025 to 2034. The increasing demand for protective glasses around the world has driven the growth of the impact resistant glass market.

Impact Resistant Glass Market Key Takeaways

- The global impact resistant glass market was valued at USD 31.32 billion in 2024.

- It is projected to reach USD 64.07 billion by 2034.

- The impact resistant glass market is expected to grow at a CAGR of 7.42% from 2025 to 2034.

- Asia Pacific led the impact resistant glass market with the highest share in 2024.

- North America is expected to grow at the fastest growth rate during the forecast period.

- By interlayer, the polyvinyl butyral segment held the largest share of the market in 2024.

- By interlayer, the ethylene vinyl acetate segment is expected to grow at a notable rate during the forecast period.

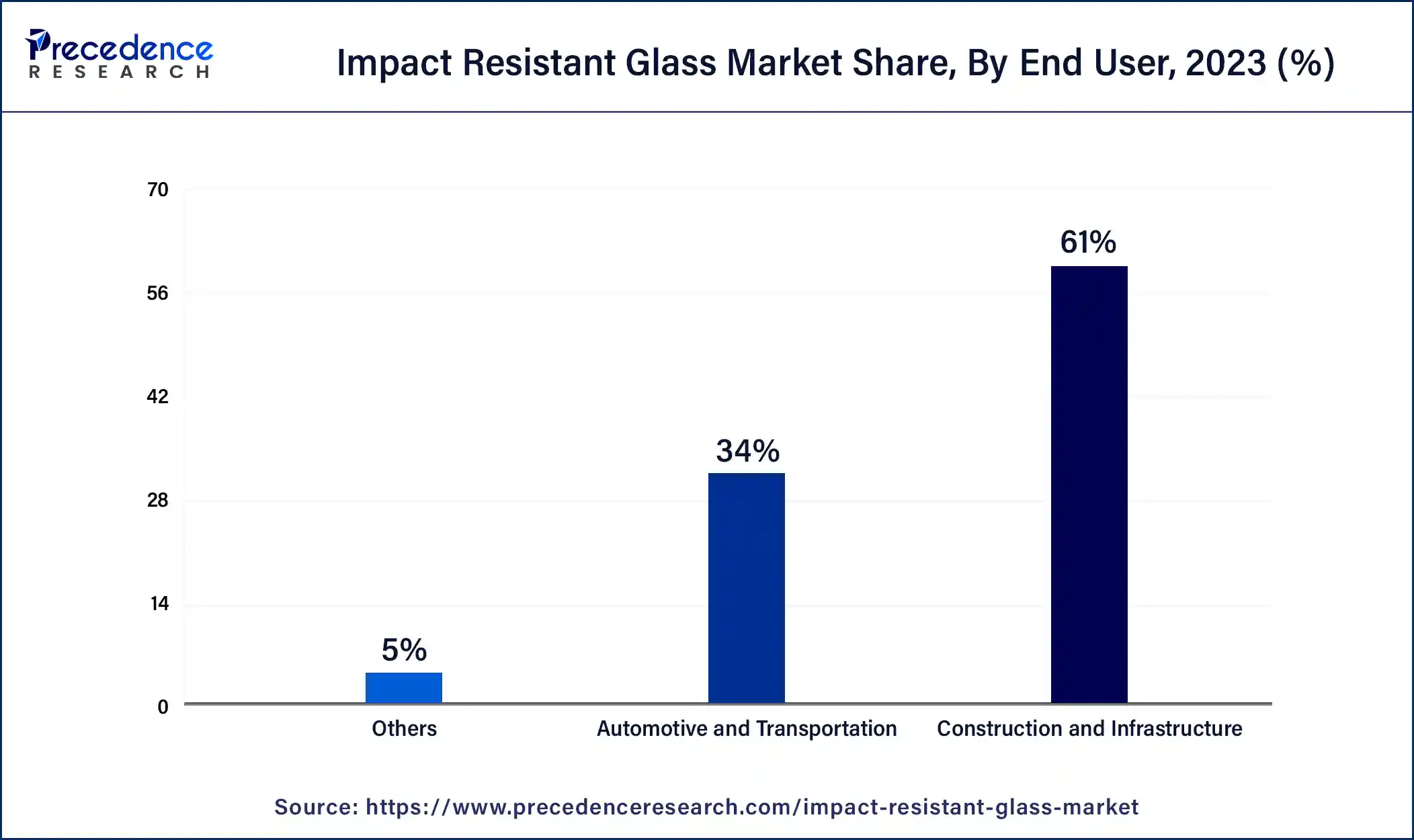

- By end-user, the construction and infrastructure segment contributed the biggest market share of 61% in 2024.

- By end-user, the automotive and transportation segment is expected to grow at the fastest CAGR during the forecast period.

What is Impact Resistant Glass?

The impact resistant glass market is an important specialty glass sector industry. This industry deals with the manufacturing and distribution of impact-resistant glass to numerous industries around the world. These glasses are designed to withstand high-speed hurricanes and provide scratch resistance. This industry is generally driven by rising demand for UV-protected glasses along with the rising use of double-glazing glasses. Impact-resistant glasses are manufactured using various types of interlayers such as polyvinyl butyral, lonoplast polymer, ethylene vinyl acetate, and others. These glasses are used in several end-user industries, including construction and infrastructure, automotive & transportation, and some others. This industry is expected to grow significantly with the rise in the advanced materials industry.

- According to the annual report of Nippon Sheet Glass published in 2023, the company's architectural segment contributed around 48%, and the automotive segment's share was 47% of the total revenue (763,521 million yen).

What is the role of AI in the Impact Resistant Glass Industry?

There are various advancements taking place in the AI technologies. Currently, most manufacturing companies have started integrating AI into the production process to increase overall output. Impact-resistant glass manufacturers are using AI to analyze and detect loopholes in finished products. Also, the integration of artificial intelligence (AI) in the glass industry enhances the batching and melting processes that are crucial for manufacturing high-quality, impact-resistant glasses. Thus, the integration of AI by glass manufacturers is playing a vital role in shaping the industry in a positive direction.

- In August 2023, Age announced a partnership with Inspektlabs. This partnership aims to develop an AI solution for advanced testing of automotive glass damage assessment.

What are the Growth Factors in the Impact Resistant Glass Market?

- The rise in the number of construction activities.

- Rising awareness associated with impact resistant glasses.

- Growing demand for vehicles with sunroof and moonroof.

- The increasing application of bulletproof glasses for security purposes.

- Technological advancements in impact resistant glass market.

- Increasing use of shatterproof glasses in professional cameras.

- Impact-resistant glasses are used in houses to provide storm and wind resistance.

- Rising demand for non-breakable glasses in the automotive industry.

- There is an upsurge in demand for impact resistance from the aerospace and defense sectors.

- The growing use of polyvinyl butyral (PVB) glasses in architectural buildings.

Top 10 Sunroof Manufacturers

- Webasto Group

- Aisin Corporation

- Inalfa Roof Systems

- CIE Automotive

- BOS GMBH & CO. KG

- Yachiyo Industry

- Inteva Products

- Yutian Gaunjia (Mobitech)

- Magna International

- Signature Automotive Products

Impact Resistant Glass Market Outlook

- Industry Growth Overview: Between 2025 and 2030, growth in the market for impact-resistant glass is projected to continue steadily due to demand from construction, automotive, and defense. The growth was fueled by safety regulations, heightened infrastructure upgrades, and increased adoption of laminated and tempered glass in high-risk areas in North America and the Asia Pacific.

- Sustainability Trends: Sustainability pressed manufacturers to move toward recyclable interlayers, energy-efficient coating technologies, and low-emission manufacturing. In order to meet the tightening of green building regulations, particularly in Europe, companies increased R&D in eco-friendly laminates. This trend improved demand for durable, low-carbon safety glass alternatives.

- Global Expansion: Major players expanded their supply chains into Southeast Asia, the Middle East, and Latin America to respond to increased construction activity and builder-favorable building codes. Companies developed lines of clean production methods and new regional processing units to raise response times and reduce logistics downtime or cost in this fast-paced market segment.

- Key Investor: Private equity and strategic funders exhibited enthusiasm due to significant safety compliance requirements, stable margins, and long-term infrastructure spending. As a result, more focused capital to underwrite companies developing next-generation lamination films, blast-resistant glass, and smart glazing was coming into focus.

- Startup Ecosystem: Startups specializing in smart impact-resistance materials, nano-reinforced interlayers, and armored lightweight glazing trends. Younger firms building multi-functional glass with integrated sensors and enhanced shatter resistance created significant interest, leading to increasing VC capital.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 64.07 Billion |

| Market Size in 2025 | USD 33.64 Billion |

| Market Size in 2026 | USD 36.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Interlayer, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

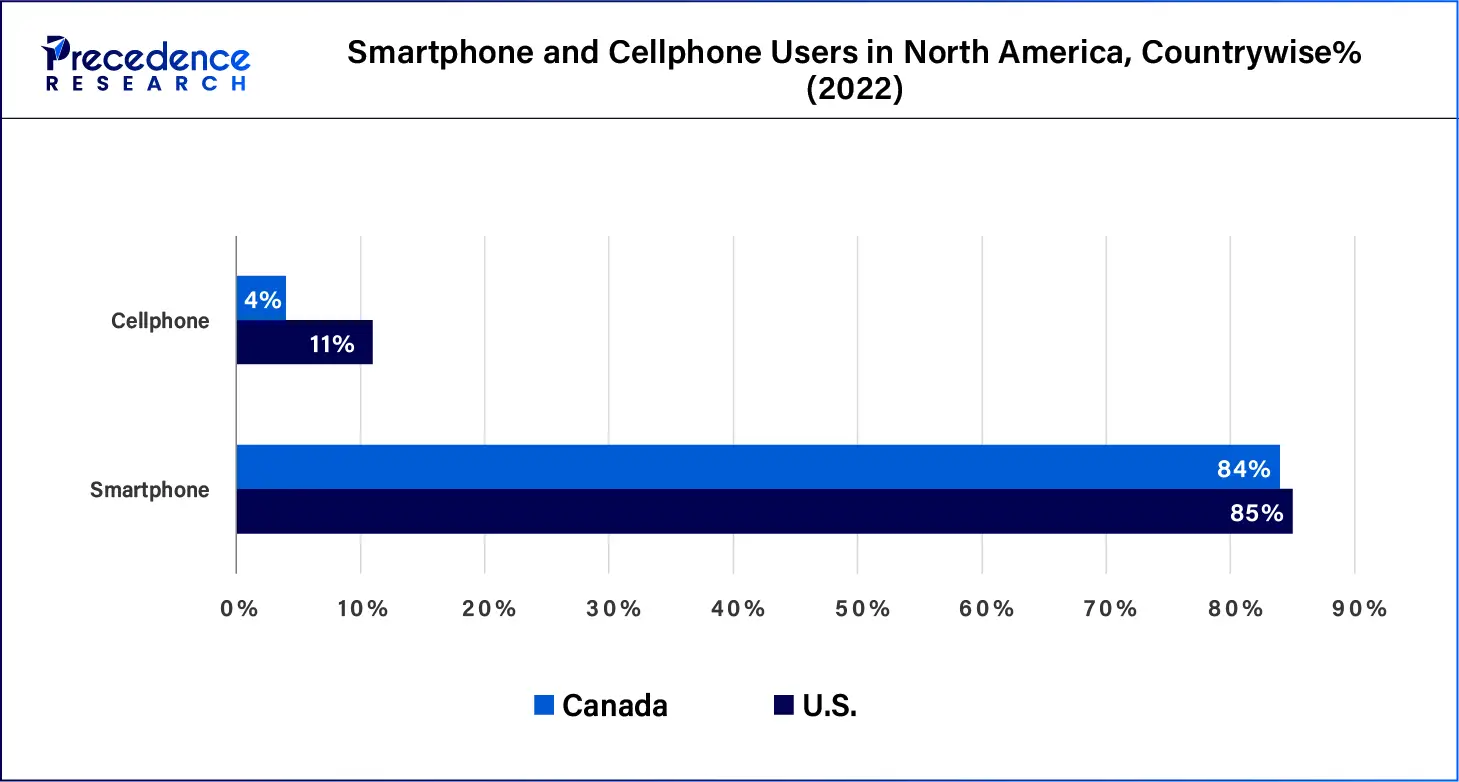

Rising demand for advanced smartphones around the world

The smartphone industry has been growing rapidly with the developments in telecom infrastructure across the world. The demand for smartphones has increased drastically with the rising trend of online gaming, video editing, social media applications, knowledge gaining, and some others among the people of the world. With the rising application of smartphones, the demand for non-breakable glasses in manufacturing smartphone displays has increased rapidly. Thus, the increasing demand for advanced smartphones around the world is expected to drive the growth of the impact resistant glass market during the forecast period.

- In August 2024, Google launched the Pixel 9 Pro. This smartphone comes with gorilla glass Victus 2 protection in the front and back.

- In April 2024, Corning Incorporated announced that the Samsung S24 Ultra will be equipped with Corning Gorilla Armor cover material. Gorilla Armor provides a superior combination of visual clarity and durability for delivering a crisp display in sunlight, along with enhanced protection against damage.

Restraint

Increasing prices of raw materials along with unskilled workforce

The impact-resistant glass industry has undergone several problems in the past, and numerous problems are arising in current times. The prices of raw materials such as polyvinyl butyral, ethylene vinyl acetate, and others that are used in manufacturing impact-resistant glasses have increased rapidly, which hampers industrial growth. Also, the lack of skilled workers in the glass industry is another factor that restrains the impact resistant glass market growth.

Opportunity

Advancements in self-healing glasses

Research and development activities associated with self-healing glasses have gained traction at present. Researchers and scientists are conducting numerous experiments to develop self-healing glasses from peptides and water molecules. Also, the rising emphasis on manufacturing self-healing glass from chalcogenide is an ongoing practice in the impact resistant glass industry. Thus, the advancements in self-healing glasses are expected to create ample growth opportunities for the market players in the years to come.

- In July 2024, the professors of the University of Central Florida developed a self-healing glass using chalcogen elements such as selenium, sulfur, and tellurium.

Interlayer Insights

The polyvinyl butyral segment dominated the impact resistant glass market in 2024. The demand for polyvinyl butyral interlayers has increased in the automotive industry for windshield manufacturing, which has driven market growth. Also, the rising application of PVB interlayer in side door windows and architectural glasses is boosting the market growth. Moreover, the growing demand for PVB interlayer due to several characteristics such as sound insulation, impact resistance, optical clarity, elasticity, and others propels market growth to some extent. Furthermore, the growing demand for safety glasses from commercial and industrial sectors has fostered the growth of the impact resistant glass market during the forecast period.

- In June 2024, Trosifol launched SentryGlas. SentryGlas is an impact-resistant glass that is manufactured using a polyvinyl butyral interlayer to provide maximum safety and durability.

The ethylene vinyl acetate segment is expected to exhibit a notable growth rate during the forecast period. The rising demand for high-adhesion and transparent glass in the military sector has driven market growth. Also, the upsurge in demand for weather-resistant glass from the residential sector is likely to propel the market growth. Moreover, the advantages of EVA interlayer, such as UV protection, superior transparency, design flexibility, and some others, contribute positively to industrial growth. Furthermore, the growing application of EVA interlayer in manufacturing safety glasses due to high water resistance capability is expected to boost the growth of the impact resistant glass market during the forecast period.

End User Insights

The construction and infrastructure segment held a dominant share of the impact resistant glass market in 2024. The rising demand for advanced impact resistant glasses in government buildings has driven the market growth. Also, the increase in the number of residential buildings has increased the demand for window and door glasses, which in turn increased the demand for impact-resistant glasses, thereby driving the market growth. Moreover, the ongoing development of impact resistant glass for commercial purposes with enhanced safety and durability has propelled the market growth. Furthermore, the upsurge in demand for hurricane-resistant glasses and impact-resistant windows to conserve energy is expected to foster the growth of the impact resistant glass market during the forecast period.

- In September 2023, AIS Glass Solutions Limited acquired Balaji Building Technologies Limited. This acquisition was made to develop impact-resistant glasses for architecture and buildings.

The automotive and transportation segment is expected to grow at the fastest growth rate during the forecast period. The growing developments in the automotive industry around the world have boosted the impact resistant glass market growth. Also, the rising application of tempered glass in automotive windows is likely to propel the market growth. Moreover, the upsurge in demand for PVB interlayer glasses in the automotive industry to manufacture strong windshields has fostered market growth. Furthermore, the increasing demand for automotive displays and sunroofs in modern vehicles has shaped the growth of the resistant glass industry in a positive manner.

- In May 2022, AGP launched VarioLux. VarioLux is a panoramic glass roof that is highly durable and provides an enhanced driving experience due to high visibility.

Regional Insights

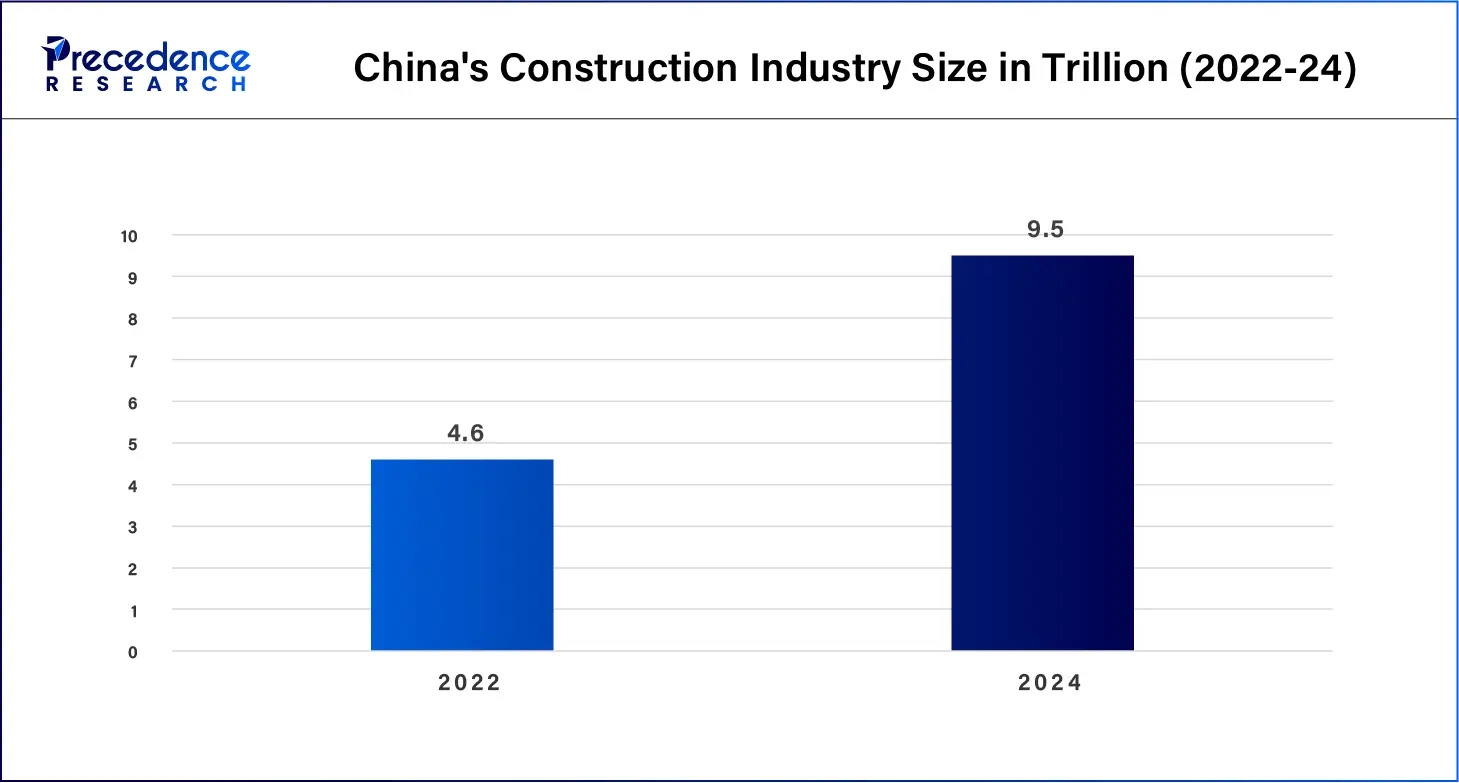

Asia Pacific held the largest share of the impact resistant glass market in 2024. The growing development of the construction industry in countries such as India, Japan, Singapore, China, South Korea, and others has boosted market growth. Also, the rise in the number of office buildings and financial institutions in India and South Korea has propelled industrial growth.

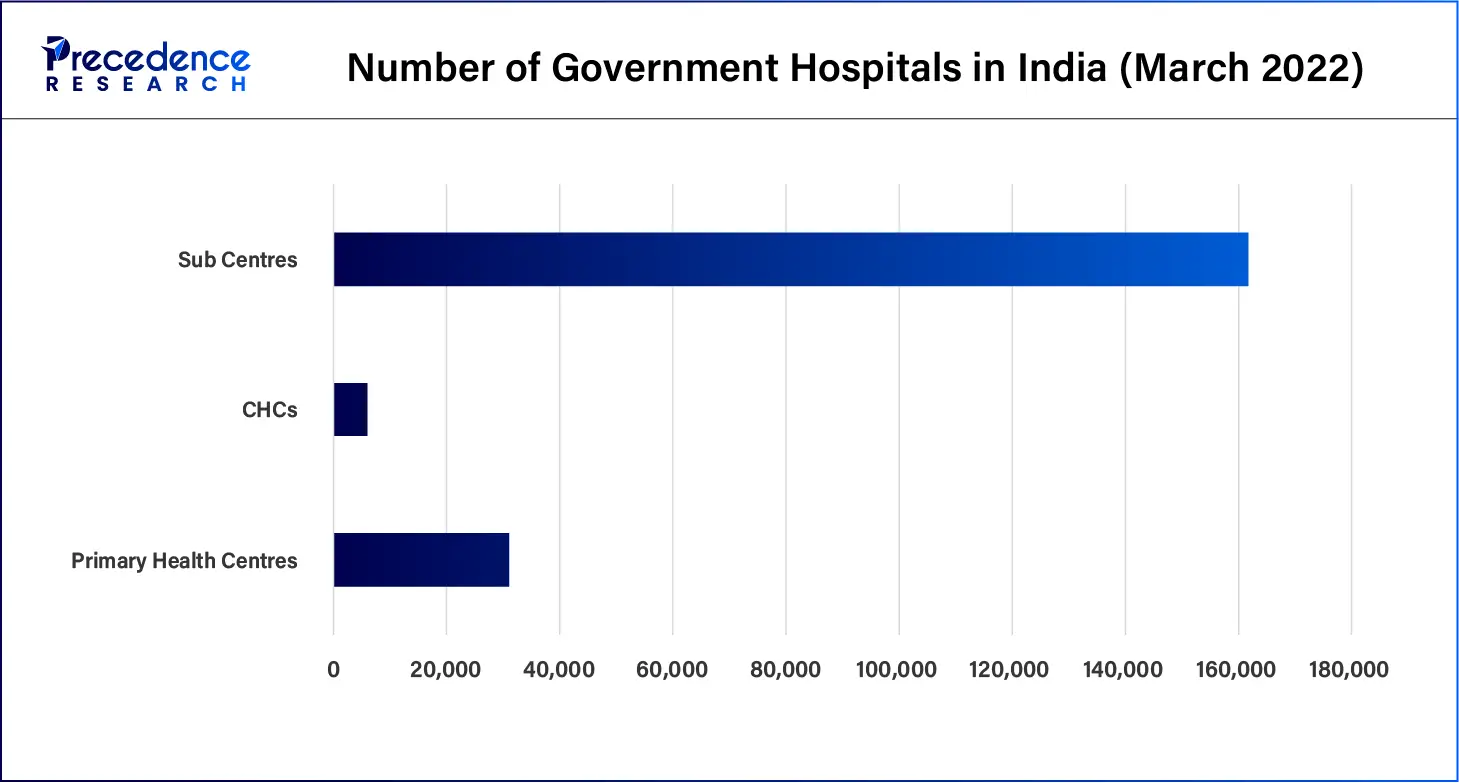

The electronics industry in China is well-established, with several market giants such as Huawei, BYD Electronic, Lenovo, Hisense, Goertek, Xiaomi, and others manufacturing various electronic products that require high-quality glasses, which in turn is likely to propel the market growth. Moreover, the rise in the number of private and government hospitals has increased the demand for impact-resistant glasses, thereby positively boosting the industry.

- In July 2024, Lenovo launched YOGA Air 14s. YOGA Air 14s is an AI-enabled laptop with Corning Gorilla Glass Protection.

This region comprises several local manufacturers of impact-resistant glass, such as AGC, Nippon Sheet Glass, Qingdao Kangdeli Industrial, Fuyao Glass Industry Group, and some others are constantly developing numerous varieties of high-quality impact-resistant glass for different industries in the Asia Pacific region, which in turn is expected to drive the growth of the impact resistant glass market.

- In April 2024, AGC launched a new series of cover glasses. This high-performance cover glass has been launched for use in in-car displays and comes with superior impact and scratch resistance capabilities.

North America is estimated to be the fastest-growing region during the forecast period. The aerospace and defense industry in this region is well-established, with numerous market players such as Lockheed Martin, Northrop Grumman, Raytheon, L3Harris, Boeing, and some others increasing the demand for impact-resistant glasses.

- In June 2024, Boeing announced that the Starliner Spacecraft had been successfully launched by NASA. This marks a significant landmark in the company's success in the area of space exploration.

The automotive industry in North America is highly developed due to the presence of automotive giants such as Ford, Tesla, Rivian, Tesla General Motors, and some others that are engaged in manufacturing different classes of vehicles, which increases the demand for impact-resistant glasses. Also, the demand for sunroof-equipped vehicles has increased the application of impact-resistant glasses, thereby driving impact resistant glass market growth.

- In May 2024, Chevrolet launched Equinox in the U.S. This is a powerful SUV that comes with a huge panoramic sunroof that enhances the driving experience.

This region consists of local market players of impact-resistant glass such as Corning, Cardinal Glass, Guardian Industries, and some others that are constantly engaged in manufacturing superior-grade impact-resistant glass for various applications and adopting several strategies, which in turn drives the growth of the impact resistant glass market in this region.

- In October 2023, Guardian Glass launched SunGuard SNX 70+ coated glass in the U.S. SunGuard SNX 70+ coated glass provides superior thermal performance and high visible light transmission.

North America: U.S. Impact Resistant Glass Market Trends

The U.S. impact resistant glass market is growing steadily, driven by stricter safety codes and resilience requirements in construction, especially in hurricane- and disaster prone regions. There's increasing demand from the automotive sector as safety glass regulations and consumer preference for durable glazing rise. Technological advances like improved interlayer materials (e.g., PVB, ionoplast) are enhancing both strength and multifunctional performance. Manufacturers are also innovating with smart features, such as self-cleaning or multi functional coatings, to combine protection with energy efficiency.

What made Europe grow steadily in the Global Impact Resistant Glass Market?

Steady growth was experienced across the European region due to a strong focus on safety, due to the EU legislation on building, and the building industry's focus on sustainability and technology in glazing, such as glass manufacturing and glazing systems. Renovation and retrofitting of buildings fueled demand for impact-resistant glass, many of which had prioritized energy efficiency upgrades using impact resistant glass. Growth opportunities not only came from green buildings but also from transit hubs (bus and rail) and renovations of heritage buildings.

Germany Impact Resistant Glass Market Trends

Germany was the lead country in the region based on a strong base of engineering and rigid requirements for safety, both in buildings and the building industry. Builders positioned laminated and tempered glass in factories, shopping malls, and train or bus stations. Germany has also made investments in energy-efficient and low-emissions products, along with more advanced products, which also supported demand for fill and total build-out of modern, safe buildings.

Why did Latin America Experience steady growth in the Global Impact Resistant Glass Market?

Latin America experienced steady growth from urbanization, safety awareness, and commercial development. There was an upgrade of airports, shopping malls, and public buildings; thus, there was an increase in demand for impact resistant glass construction. Weather-related growth in higher-risk areas also spurred the use of stronger glazing. There were prospects for laminated glass that was cost-sensitive, providing housing and more security in construction.

Brazil Impact Resistant Glass Market Trends

Brazil led the Latin America region because of the size and pace of construction in cities and heightened social safety in buildings. Shopping centers, office buildings, and transport facilities were increasingly built using laminated and tempered glass. The Brazilian government also funded the construction of modern sports stadiums and airports, which increased the demand for impact resistant glass. Brazil would remain the lead market in Latin America due to rising safety standards and local manufacturing.

What Made the Middle East and African Region grow rapidly in the Global Impact Resistant Glass Market?

Growth in the Middle East and Africa was driven by large projects, new city developments, and investments into airports and malls. The extreme climate and associated security needs increased demand for impact resistant glass. Moreover, opportunities in the region arose from luxury buildings, smart city projects, and public infrastructure. The region embraced specialized glazing to act against heat, as well as for safety and energy efficiency.

The UAE Impact Resistant Glass Market Trends

The UAE was the leading country in the region due to large towers, hotels, and transportation investments. Builders were using high-strength glass for its safety, protection from heat, and aesthetics. Confidence in new smart cities, luxury buildings, and growing the overall construction economy added to the market potential. Furthermore, the UAE also continued to invest deeply in advanced manufacturing, allowing for the widespread availability of laminated glass quality.

Impact Resistant Glass Market Companies

- Saint-Gobain

- AGC

- Corning

- Schott

- Nippon Sheet Glass

- Guardian Industries

- Fuyao Glass Industry Group

- Pilkington

- Central Glass Company

- Sekurit

- Cardinal Glass

- Vitro

- CGS Holding

- Xinyi Glass

- Qingdao Kangdeli Industrial

Recent Developments

- In January 2024, Haas Door launched COM & RES 2400 and RES 2500. COM & RES 2400 and RES 2500 are impact-resistant windows that increase aesthetic appeal and functionality along with enhanced safety.

- In September 2023, PGT Innovations launched Diamond Glass. Diamond Glass is an ultra-lightweight and laminated glass that features corning architectural, technical glass that is around 45% lighter and 3 times more scratch-resistant as compared to traditional laminated glass.

- In March 2023, NT Window launched an 1800 series impact resistant window. This window provides an additional layer of safety for homeowners and additional features such as blocking UV rays and enhanced noise insulation, along with additional home security.

- In March 2023, Faour Glass Technologies launched SLIMPACT XL Single Lite Windows. SLIMPACT XL Single Lite Windows provides hurricane resistance with a wide range of heights and widths.

- In February 2023, YKK AP launched YHS 50 TU. YHS 50 TU is a high-performance, impact-resistant glass that provides features such as hurricane resistance, blast mitigation, thermal resistance, and others.

- In June 2022, Pilkington IGP announced the opening of a manufacturing facility in Ostro??ka, Poland. This manufacturing plant is aimed to develop insulating glasses for numerous end-users.

Segments Covered in the Report

By Interlayer

- Polyvinyl Butyral

- Lonoplast Polymer

- Ethylene Vinyl Acetate

- Others

By End User

- Construction and Infrastructure

- Automotive and Transportation

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content