What is the In-vehicle Infotainment Market Size?

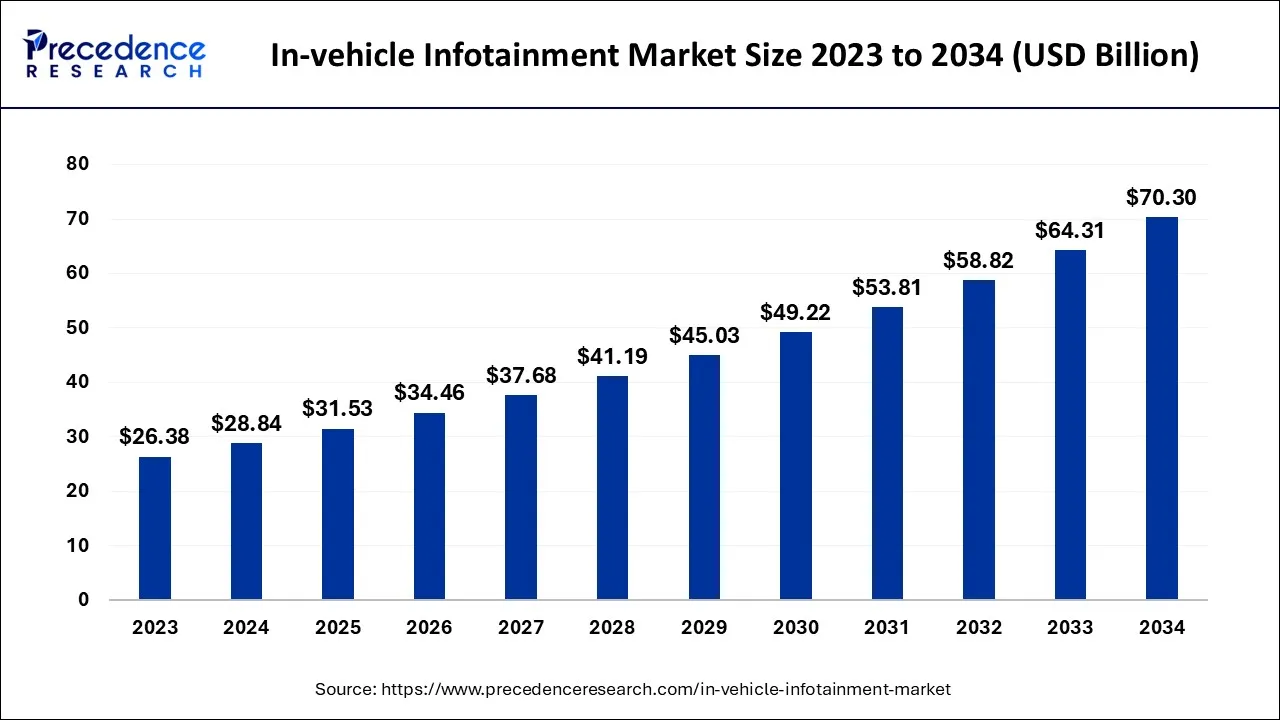

The global in-vehicle infotainment market size is accounted at USD 31.53 billion in 2025 and predicted to increase from USD 34.46 billion in 2026 to approximately USD 76.29 billion by 2035, representing a CAGR of 9.24% from 2026 to 2035. Technological advancements such as driver assistance, smart navigation and voice recognition are considered to boost the market's growth.

In-vehicle Infotainment Market Key Takeaways

- North America accounted for the maximum revenue share in the market.

- The hardware component segment captured the major share of the market.

- The passenger vehicle segment is forecasted to grow remarkable CAGR between 2026 and 2035.

- The display unit product type segment leads the market.

- The front-row location segment dominates the market.

- The 5G connectivity segment is predicted to dominate the market between 2026 and 2035.

Strategic Overview of the Global In-vehicle Infotainment Industry

The automotive sector is leaning toward developing a revolutionary system to enable improved connectivity, boost vehicle safety, and enhance the in-car user experience. The in-vehicle infotainment system is an essential technology that serves as the focal point of all conventional automotive systems and integrates their capabilities to be controlled and monitored from one central unit. The in-vehicle infotainment system is a combination of the system that offers entertainment as well as information. A few prominent features of in-vehicle infotainment systems are high-resolution screens, smartphone pairing, digital tuners, multi-standard radio systems, advanced vehicular functions and android auto compatibility.

Moreover, an advanced in-vehicle infotainment system comprises a control panel. The newest in-car entertainment systems have voice commands, a touchscreen panel on the head unit, a button panel, and steering wheel controls that can be used to access and operate every feature. To provide entertainment and information to the driver and passengers, in-vehicle infotainment integrates with numerous different in-vehicle and external systems. The in-vehicle infotainment system offers an enjoyable and safe driving experience by allowing the integration of other smart devices, such as smartphones.

The improved technology that boosts the user's safety while driving has increased the demand for advanced in-vehicle infotainment systems in the global market. Considering the rising importance of electric vehicles, multiple prominent key players in the market have already taken the infotainment systems on next level through their electric cars. Tesla Model X, Tesla Model S, BMW iDrive, Audi MMI and Ford Sync are top electric cars with advanced infotainment systems with touchscreen displays, cloud-based connectivity and aesthetic looks.

Artificial Intelligence: The Next Growth Catalyst in In-vehicle Infotainment

AI is fundamentally impacting the in-vehicle infotainment market by transforming systems into intuitive, personalized, and safer driving companions. Through the use of natural language processing and machine learning, AI enables seamless voice recognition and hands-free control, which minimizes driver distraction and enhances safety.

Furthermore, AI algorithms analyze driver habits and preferences to offer customized media playlists, climate control settings, and predictive navigation, creating a highly tailored in-car experience that is a key market differentiator. This shift from traditional, hardware-defined systems to software-defined, AI-powered environments is driving significant market growth and attracting substantial investment from major automakers and tech giants like Google and NVIDIA.

Market Outlook

- Market Growth Overview: The in-vehicle infotainment market is expected to grow significantly between 2025 and 2034, driven by generative AI and voice assistants, integration of smartphone mirroring technologies, expansion of 5G infrastructure is crucial, enabling real-time data processing, low latency communication, and new services, and demand for large displays.

- Sustainability Trends: Sustainability trends involve energy-efficient software and hardware, the use of sustainable and recycled materials, and software-enabled eco-driving and efficiency.

- Major Investors: Major investors in the market include Automotive OEMs, General Motors, Ford Motor Company, Harman International, and Robert Bosch GmbH.

- Startup Economy: The startup economy is focused on developing innovative software solutions, specialized hardware, and unique user experiences that often get acquired or integrated by established automakers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.53 Billion |

| Market Size by 2035 | USD 76.29 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.24% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Vehicle, By Product Type, By Location, and By Connectivity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

In-vehicle Infotainment Market Dynamics

The global in-vehicle infotainment market is expected to grow significantly due to rising demand for luxurious, smart and advanced vehicles across the globe. The rapid adoption of cloud technology in automobiles for various purposes has raised the demand for advanced in-vehicle infotainment systems. The automobile industry, and the infotainment market in particular, is evolving in the direction of cloud technologies; this is the significant variable that plays a critical role in the advancements of in-vehicle infotainment. The easy user interface of in-vehicle infotainment systems that integrates smartphones for numerous operations is fueling the market's growth. Rising demand for entertainment while driving is boosting the development of the market. The rapidly growing automotive industry, new product launches and increasing deployment of automated driving assistance systems in cars are a few other factors to fuel the growth of the global in-vehicle infotainment market. Moreover, the rising importance of Original Equipment Manufacturers (OEM) has forced many automotive companies to invest in the in-vehicle infotainment market, boosting the market's growth.

However, the risk of cyber attacks will likely hinder the market's growth. Additional data expenses required in the vehicles' infotainment systems are another factor restraining the market's development. Moreover, advanced and touchscreen infotainment systems are costly; this hampers the purchase as well as installation rate of advanced infotainment systems. Furthermore, the cost related to routine maintenance of software and hardware involved in the infotainment system is a major restraining factor for the market's growth.

Component Insights

Based on components, the global in-vehicle infotainment market is segmented into software and hardware. The hardware segment acquires the largest share of the global in-vehicle infotainment market. At the same time, the software segment is expected to witness significant growth in the upcoming years. The hardware component in the in-vehicle infotainment system is the interface of the system. Hardware provides easy connectivity with external devices as well as networks, and this helps in the integration of smartphone and infotainment systems effectively and efficiently.

Vehicle Insights

Based on vehicle, the global in-vehicle infotainment market is segmented into passenger cars, light commercial vehicles and heavy commercial vehicles. The rapidly increasing sale of passenger cars/vehicles has shown a positive influence on the passenger car segment. Strong demand for luxurious SUVs in the passenger vehicle segment is forecasted to have a significant effect on the market for automotive infotainment systems.

The desire for personal transportation and rising consumer purchasing power primarily drive the global passenger vehicle market. Advanced infotainment systems are needed since luxury automobiles have more advanced technology and safety features. The availability of options such as free services, better financing, and many others have changed consumer behavior.

Product Type Insights

Based on product type, the global in-vehicle infotainment market is segmented into the audio unit, display unit, heads-up display, navigation unit and communication unit. The display unit segment dominates the global in-vehicle infotainment market; the segment is expected to maintain growth during the forecast period. Display unit offers video streaming, weather forecast, navigation, calling access and many other benefits for front row location in a vehicle. The rising deployment of touchscreen display units for faster and easy access is boosting the growth of the segment. Moreover, the navigation unit segment is increasing significantly due to rising dependence on the global navigation satellite system.

Furthermore, High-end infotainment systems typically involve automotive heads-up displays, which reflect real-time car data onto a transparent screen built into the windscreen. Heads-up display supply driver with crucial data like speed, navigation maps, electronic digital cluster, multimedia options, etc. This helps in minimizing the driver's distraction.

Location Insights

Based on location, the global in-vehicle infotainment market is segmented into the front row and rear row. The front row location segment leads in the global in-vehicle infotainment market. Generally, the infotainment system is installed in the front row of the vehicle for proper display. The in-vehicle infotainment system installed in the front row is preferred for offering a realistic experience. The infotainment system that includes woofers, amplifiers and speakers needs to reproduce the sound correctly. The segment is growing with the rising deployment of small-sized speakers at the top of the front doors to offer proper distribution of sound.

Moreover, with increasing awareness about kids' safety and security, the demand for rear row mounted cameras is expected to boost. Considering the safety concern, the rear row segment is predicted to gain a significant increase in the upcoming years. Along with the safety, rear row infotainment systems allow movie streaming, gaming and many other entertaining activities with a seat-back display.

Connectivity Insights

Based on connectivity, the global in-vehicle infotainment market is segmented into 3G, 4G and 5G. The 5G connectivity segment is projected to dominate the global in-vehicle infotainment market during the estimated period. Vehicles will be able to carry out whole new functions due to the brand-new mobile network standard 5G. It will be feasible to have future mobility, automated driving, and better vehicle multimedia and entertainment systems. In addition to other infotainment amenities, 5G connectivity will allow a seamless streaming experience, and the integration of traffic and weather forecasts is possible with the fastest mobile network service.

More immediate data transfer and cheaper operating expenses are two advantages of 5G connectivity. Due to these features, worldwide automakers are emphasizing the rollout of 5G technology. The 5G network provides real-time data that enables the driver to conclude immediately. The speed of navigation in cars will be faster than ever. Moreover, 5G connectivity will increase the dependence on the infotainment system, which will boost the growth of the overall market.

Regional Insights

Geographically, North America acquires the largest revenue share in the global in-vehicle infotainment market. Rising concerns about safety while driving are considered the major driving factor for the market's growth. The growing automotive industry, rise in adoption of connected cars, and rapid deployment of advanced technology in the region are a few other factors to fuel the market growth. Europe is the prominently growing marketplace for in-vehicle infotainment systems owing to the rapidly revolutionizing automotive industry. The presence of major automotive brands such as BMW, Mercedes, Renault and Daimler has provided lucrative opportunities for the in-vehicle infotainment market to grow in recent years. Germany and France are significant contributors to the market's growth in Europe. The rising adoption of electric cars in the region is seen as an essential driver for the market to uplift during the projected period.

Asia Pacific is expected to witness a significant increase in the in-vehicle infotainment market during the forecast period. China is the largest marketplace in the Asia Pacific owing to its widespread automotive industry and availability of low-cost raw materials. India, Japan and South Korea are anticipated to show gains in upcoming years. Moreover, the rising adoption of smart integrated car infotainment systems and the deployment of artificial intelligence and virtual reality (VR) in the automotive industry are a few other factors to boost the market's growth.

Emerging economies and developing infrastructure of the automotive industry are projected to propel the growth of the in-vehicle infotainment market in Latin America. The presence of prominent automakers in the gulf countries of the Middle East is considered to boost the market's growth in the region. The market shows steady growth in Africa.

U.S. In-vehicle Infotainment Market Trend

In the U.S. market, the shifting towards software-defined vehicles, enabling dynamic features and new revenue models. Deep integration of AI, especially generative voice assistants and personalized settings, is enhancing the user experience while minimizing driver distraction. Advanced connectivity via 5G and V2X communication is facilitating real-time services and improved safety.

China In-vehicle Infotainment Market Trend

China's market is experiencing robust growth driven by proactive government support for intelligent connected vehicles and extensive 5G infrastructure. Chinese automakers lead in the adoption of software-defined vehicles, leveraging OTA updates and deep AI integration to create intuitive, personalized user experiences. The industry is focused on the digital cockpit featuring advanced displayers and AR, with a strong emphasis on localized UX and seamless integration with existing digital ecosystems.

How did Europe gain a notable share in the In-vehicle Infotainment Market?

Europe's pioneering premium user experiences through sophisticated systems like BMW's iDrive and Mercedes-Benz's MBUX. Strict safety and assistance features are integrated within IVI systems. The region's rapid adoption of electric vehicles has accelerated the demand for sophisticated digital cockpits and connectivity solutions specific to EVs.

Germany In-vehicle Infotainment Market Trends

Germany's market is advancing rapidly through the integration of pioneering AI-driven voice assistants and a robust shift to software-defined vehicles with over-the-air updates. The industry is heavily investing in immersive digital cockpits featuring large displays, enhanced by advanced 5G connectivity and V2X communication for improved safety and real-time services.

Value Chain Analysis of the In-vehicle Infotainment Market

- Technology & Solution Development (R&D/Software Development)

This initial stage involves the core research, design, and development of software stacks, operating systems, AI algorithms for voice recognition, and connectivity protocols (like 5G and V2X).

Key players: Google, Apple, Microsoft, NVIDIA, Qualcomm, Elektrobit, and Aptiv. - Hardware Manufacturing & Supply (Inbound Logistics/Operations)

This stage involves the design and production of physical components such as display panels, head units, semiconductors (SoCs), speakers, and integrated control modules.

Key Players: LG Display, Samsung Display, Qualcomm and NVIDIA, Bosch, Continental AG, and Harmon International. - System Integration & Assembly (Operations/Outbound Logistics)

Integrators bridge the gap between various hardware components and the software platforms, ensuring seamless functionality within the complex vehicle architecture and interacting with other systems like ADAS and engine management.

Key Players: Bosch, Continental AG, Denso Corporation, Aptiv, and OEMs. - Sales & Distribution (Marketing & Sales)

This stage focuses on marketing the IVI systems as a key selling point of the vehicle to end consumers and managing the sales channels.

Key Players: Automotive OEMs - Post-Sale Services & Upgrades (Service)

The final stage involves offering ongoing customer support, maintenance, troubleshooting, and delivering over-the-air (OTA) software updates for feature enhancements and bug fixes.

Key Players: Automotive OEMs, Amazon Web Services (AWS), and Microsoft Azure.

Top Companies in the In-vehicle Infotainment Market & Their Offerings:

- Harman International (A Samsung Company): Harman International is a major Tier-1 supplier that designs and engineers connected products and solutions for automakers worldwide, including advanced infotainment systems, premium audio equipment, and cloud services.

- Panasonic Corporation: Panasonic provides extensive automotive solutions, from advanced battery technology for EVs to sophisticated IVI systems, head-up displays, and ADAS components.

- Alps Alpine Co Ltd: Specializing in electronic components and automotive information systems, Alps Alpine develops high-performance IVI head units, touch screens, and input devices. They contribute by supplying essential hardware components that enable the intuitive and reliable user interfaces within modern vehicles.

- Robert Bosch GmbH: As one of the world's leading Tier-1 automotive suppliers, Bosch provides a vast array of components and software for IVI systems, including cockpit computers, display control units, and connectivity modules.

- Continental AG: Continental offers cutting-edge automotive technology, including high-performance cockpit computing platforms, connected services, and display solutions for the IVI market. They contribute by providing advanced electronics and software that enable the digital transformation of vehicles into connected and intelligent mobility platforms.

- Clarion Corporation (A Hitachi Group Company): Clarion specializes in car audio and navigation systems, offering integrated in-vehicle infotainment units and cloud-based information services. They contribute by providing functional and cost-effective head units and connectivity solutions for a wide range of vehicle manufacturers.

- Sin Seiki Ltd (now a part of Alps Alpine): This company has been integrated into Alps Alpine, combining their expertise in automotive electronic components and human-machine interface (HMI) solutions. Their collective contribution provides automakers with a broader, more integrated portfolio of components for IVI systems.

- JVC Kenwood: JVC Kenwood develops and manufactures automotive electronics, including premium car audio and navigation systems, as well as dashcams and other connected devices.

Recent Developments in the In-vehicle Infotainment Industry:

- In January 2025, BMW Panoramic iDrive Technology, Unveiled at CES, this new product features a windshield-spanning display running on Operating System X (based on Android Open Source Project). It includes 3D head-up displays and enhanced AI-powered Intelligent Personal Assistant capabilities. (https://www.bmwgroup.com)

- In June 2025, Harman introduced its Neo QLED automotive display technology, which debuted in the Tata Harrier. EV, marking the first in-vehicle use of this high-quality display technology. (https://news.harman.com)

In-vehicle Infotainment Market Companies

- Harman International

- Panasonic Corporation

- Alps Alpine Co Ltd

- Robert Bosch GmbH

- Continental AG

- Clarion Corporation

- Sin Seiki Ltd

- JVC Kenwood

Recent Developments

- In January 2023, the Audi-backed startup company, Holoride launched a new device at CES 2023 in Las Vegas to bring virtual reality entertainment to every car. A corporation that has relied on alliances with automakers for its expansion has reached a turning point with the release of this product.

- In January 2023, a globally leading company, Amazon, launched a new dashboard camera, ‘Ring Car Cam', at CES 2023 in Las Vegas to prevent car theft. The device can record activities and movement outside and inside the vehicle. It also has a sensor to detect external disturbances.

- In January 2023, At the US technology trade event CES 2023, Japanese manufacturers Honda and software and entertainment company Sony presented their first concept automobile, the Afeela. Honda will oversee the production of the vehicles, while Sony will be in charge of image, sensing, telecommunication, network, and entertainment technology for the car.

- In December 2022, an e-commerce platform for car infotainment systems, Motorogue, announced its expansion Pan-India with a dedicated franchise model. Motorouge provides stereo speakers, amplifiers, subwoofers and other car accessories.

- In October 2022, A cooperation between AirConsole and the BMW Group was announced for bringing casual gaming to new BMW automobiles. This partnership aims to supply gaming over the air and controlled with cellphones with the help of AirConsole technology.

- In October 2022, Apple and Mercedes-Benz announced that Apple Music's highly acclaimed Spatial Audio, which supports Dolby Atmos, is now accessible as a native experience in Mercedes-Benz vehicles for the first time. This collaborative effort aims to give customers the finest music experience.

Segments Covered in the Report

By Component

- Software

- Hardware

By Vehicle

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Product Type

- Audio Unit

- Display Unit

- Heads-Up Display

- Navigation Unit

- Communication Unit

By Location

- Front Row

- Rear Row

By Connectivity

- 3G

- 4G

- 5G

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting