What is India Construction Chemicals Market Size?

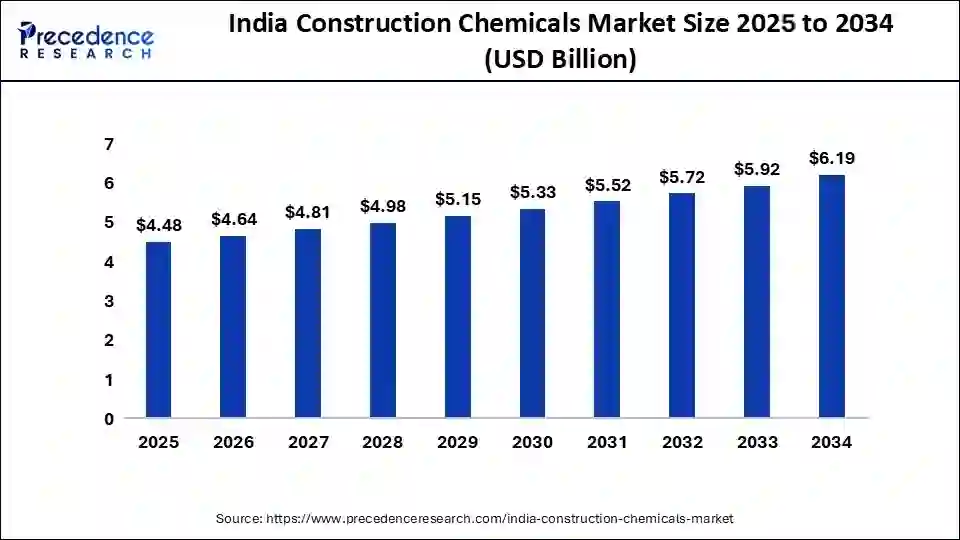

The India construction chemicals market size accounted for USD 4.48 billion in 2025 and is predicted to increase from USD 4.64 billion in 2026 to approximately USD 6.19 billion by 2034, expanding at a CAGR of 3.63% from 2025 to 2034. The expanding infrastructure developments are driving the market. The demand for sustainable construction practices and eco-friendly materials has increased, fueling the market expansion.

Market Highlights

- North India dominated the India construction chemicals market in 2024.

- South India is expected to grow significantly over the forecast period.

- By type, the concrete admixtures segment dominated the market in 2024.

- By type, the waterproofing adhesives segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the non-residential segment led the market in 2024.

- By application, the residential segment is estimated to grow at the fastest CAGR over the forecast period.

What are the Initiatives in Eco-friendly Construction in India?

The India construction chemicals market has witnessed transformative growth driven by government initiatives, infrastructure developments, rapid urbanization, residential and non-residential construction projects, smart house trends, and concerns for sustainable construction. India is undergoing extreme infrastructure growth, including smart cities, highways, metro rail, and real estate, raising demand for innovative construction solutions.

The India construction chemicals market witnessed rapid demand for concrete admixtures, specialized underground construction solutions, and sustainable innovations. Heavy monsoons and high humidity improve the durability, strength, and workability of concrete. Eco-friendly construction practices are emerging in the Indian construction chemicals industry. The year 2024 was marked by significant activities of the Indian government in the chemicals and petrochemicals industry, including construction chemicals. The Indian government's implementation of "India Chem 2024" was aimed at enhancing the country's economy and reducing its dependence on imports.

Government encouragement for the adoption of construction chemicals is emerging in research and development activities in India's construction chemicals market. Government initiatives like Pradhan Mantri Awas Yojana (PMAY), the National Building Code (NBC), PM Gati Shakti, Affordable Housing for All, and the Smart Cities Projects have created a fertile ground for key vendors to provide high-performance solutions tailored to India's evolving needs. India's growing emphasis on transportation and energy infrastructures is further contributing to the demand for specialized products.

How is AI Governing the India Construction Chemicals Market?

Artificial Intelligence is the extreme revolution in the India construction chemicals market. Manufacturing companies are integrating AI for predictive maintenance, process optimization, quality control, supply chain optimization, and compliance with regulatory standards. With the rising demand for efficiency, sustainability, and smart manufacturing, companies are becoming essential to adopting AI.

AI's ability to provide tailored, customized solutions, sustainable practices, and the discovery and development of new construction chemicals with advanced capabilities boost its popularity. The trend of sustainable construction and government encouragement for green buildings are transforming the Indian construction chemical industry, leading attention toward AI adoption.

Industrial leaders conducting events or discussions and investment approaches. The ICC's 18th Annual India Chemical Industry Outlook 2025 in Mumbai for AI, sustainability, and innovation is poised to shape India's USD 1 trillion chemical future. Additionally, events like India Inc. on the Move 2025, leveraging AI are important for the construction chemical industry in India.

- In February 2025, the sixth edition of India Inc. on the Move 2025, held at Andaz Delhi, Aerocity, with the theme ‘Unleashing AI Now for Accelerating Smart and Sustainable Manufacturing,' attracted over 1,200 attendees.

India Construction Chemicals Market Growth Factors

- Infrastructure development: Government initiatives such as the Sagar Mala Project and Bharatmala Pariyojana are driving developments in Indian infrastructure, making it essential for the adoption of construction chemicals.

- Rapid urbanization and industrialization: India has witnessed rapid growth in urbanization and industrialization in the major cities, driving demand for high- and better-quality construction structures.

- Climate factors: India's high humidity and heavy monsoon climate challenges drive demand for advanced, high-strength, and durable construction chemicals.

- Adoption of advanced construction technologies: The adoption of advanced construction technologies like prefabricated construction and 3D printing has taken place in the Indian market, driving an essential need for specialized construction chemicals.

- Government initiatives: The India construction chemicals market has witnessed rapid growth due to government initiatives and regulations like the Pradhan Mantri Awas Yojana (PMAY) and the National Building Code (NBC). Government investments in infrastructure projects like smart city projects and national infrastructure pipelines are contributing to the demand for construction chemicals.

India Construction Chemicals Market Outlook:

- Industry Overview: India is fostering urbanization, infrastructure development, and an emphasis on durable and sustainable building practices.

- Major Investors: Pidilite Industries, Sika AG, Saint-Gobain, and Asian Paints are strengthening their investments in capitalization of India's rising infrastructure and real estate development.

- Startup Ecosystem: NOVACRET, a Bengaluru-based startup that focuses on exploring green concrete solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.48 Billion |

| Market Size in 2026 | USD 4.33 Billion |

| Market Size by 2034 | USD 6.19 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.63% |

| Dominated Region | North India |

| Fastest Growing Market | South India |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, and Application. |

Market Dynamics

Drivers

Demand for high-quality and durable construction chemicals

Rapid urbanization and industrial development such as roads, bridges, airports, and smart homes, Bridges, airports, and smart homes are contributing to high demand for high-quality and durable construction chemicals. India has witnessed growth in awareness about quality and durability to ensure the sustainability and longevity of the buildings.

Climate challenges further contribute to the need for high-strength and durable construction chemicals. The growing demand for green buildings is fueling the need for eco-friendly and sustainable construction chemicals. The India construction chemicals market growth is further driven by the government's implementation of strength quality standards for construction chemicals, leading to high-quality product demands.

- In January 2025, Master Builders Solutions announced the setting up of a cutting-edge manufacturing plant in Taloja, near Mumbai, with an initial investment of INR 20 crore. The facility will be a hub for a research and development (R&D) center for the development of customized solutions tailored to India's unique construction challenges, such as extreme climatic conditions and diverse soil types.

Restraint

Volatility in raw material prices

The raw materials of construction chemicals, such as petrochemicals and crude oil, are very volatile, making it difficult for manufacturers to maintain profit margins and stable prices. The cost associated with transportation further influences the portability of construction chemical manufacturers. The dependence on imports of raw materials further contributed to price fluctuations and availability. War material costs lead to increased production costs and reduced demand rates.

Opportunity

Demand for sustainable construction chemicals

India has increased demand for sustainable construction chemicals, driven by government initiatives and a focus on sustainable and high-performance building materials. The Indian government is implementing environmental regulations like the Environment Protection Act, driving the adoption of sustainable construction products.

The ongoing push for green building initiatives and sustainable construction practices is shifting countries' construction industries toward eco-friendly construction chemicals. The rising use of recyclable materials in construction chemicals and the rising popularity of water-based chemicals are contributing to market growth. The growing demand for low or zero-volatile organic compounds (VOCs) and products that improve thermal insulation and energy efficiency is expected to drive significant approaches in novel innovation and developments.

Segment Insights

Type Insights

The concrete admixtures segment dominated the India construction chemicals market in 2024. Concrete admixtures improve concrete properties like workability, strength, and durability. These properties enable concrete mixtures to meet the needs of specific environmental conditions. The demand for concrete admixtures has increased in India, driven by increased residential, commercial, and infrastructure constructions. Residential construction projects are higher adopters of concrete admixtures, driven by the requirement of specialized high-performance structures in the industry. The rising Indian emphasis on sustainable construction practices and eco-friendly materials is expected to witness growth in the adoption of concrete admixtures.

- In January 2025, Master Builders Solutions announced its expansion in India by leveraging its expertise and advanced solutions in the Indian market. The increasing demand for sustainable, high-performance construction materials across various sectors in India is contributing to this scale-up.

The waterproofing adhesives segment is expected to grow at the fastest CAGR over the forecast period due to countries' climate challenges and an increased number of constructions. India has high humidity and heavy monsoons, which drive the need for waterproofing adhesives. The rapidly growing buildings, bridges, and tunnels are necessitating water-resistance solutions. The increasing use of waterproofing adhesives in infrastructure construction projects is leveraging the segment growth. Additionally, government initiatives and regulations like Pradhan Mantri Awas Yojana (PMAY) and the National Building Code (NBC) are encouraging the adoption of waterproofing adhesives in construction projects.

Application Insights

The non-residential segment led the India construction chemicals market in 2024. The non-residential construction includes commercial, industrial, institutional, and infrastructure construction projects. The increase in investments in non-residential construction projects a driving segment growth. Government initiatives, direct investments, and demand for modern office spaces are the factors contributing to the growth of non-residential construction in India. Large population bases and rapidly expanding organizations are seeking high- and better-quality structures. Additionally, the increased focus on sustainable construction and green building materials a driving the adoption of eco-friendly construction chemicals in residential construction projects.

The residential segment is estimated to grow at the fastest CAGR over the forecast period. Residential construction projects such as urbanization and housing in India have witnessed extreme demand for chemical materials like adhesives, sealants, and concrete admixtures. The growing middle-class population of India has increased the demand for modern homes and amenities with durability, safety, and quality of structures. Government initiatives like Pradhan Mantri Awas Yojana and smart city projects are driving growth in residential construction activities.

Indian Geographical Insights

Which Factors Fuel the Market in the North Part of India?

North India dominated the Indian construction chemicals market in 2024 due to rapid urbanization, industrial construction, and high population. Cities like Delhi, Gurugram, and Noida have witnessed rapid urbanization, driving demand for construction chemicals. North India is a hub for several large-scale infrastructure projects like the Delhi- Mumbai industrial corridor and the Amritsar- Delhi- Kolkata industrial corridor. The presence of Master Builder Solutions enables access to advanced construction chemical facilities in the northern part of India. Government initiatives such as the smart city mission promote smart city development and infrastructure growth in north India.

Robust Infrastructure Developments Boosting South Indian Market

South India is expected to grow significantly in the India construction chemicals market over the forecast period. The southeast part of India, including states like Tamil Nadu, Karnataka, and Andhra Pradesh, has witnessed extreme growth in infrastructure development and the construction industry. Expanding urbanization in cities like Bangalore, Chennai, and Hyderabad has increased the demand for construction chemicals. The demand for chemicals like concrete admixtures and protective coatings is high in South India. Government initiatives and the presence of key market players are boosting the market expansion.

India Construction Chemicals Market: Value Chain Analysis

- Feedstock Procurement : It is mainly leveraging sourcing from the petrochemical industry, which supplies fundamental building blocks, including ethylene, propylene, benzene, and others.

Key Players: Deepak Nitrite, Reliance Industries, HOCL, etc. - Quality Testing and Certification: This is prominently done by the Bureau of Indian Standards (BIS), which employs the ISI Mark to denote conformity.

Key Players: TÜV SÜD, Bureau Veritas, Intertek, and Cotecna. - Regulatory Compliance and Safety Monitoring: Companies usually follow Chemical (Management and Safety) Rules (CMSR) 2021 and the Bureau of Indian Standards (BIS) Act 2016, which require proper classification, labelling, and quality standards.

Key Players: SGS India, DEKRA India, UL Solutions, etc.

Key Players in India Construction Chemicals Market and Their Offerings

- Sika India Pvt. Ltd.- It mainly facilitates diverse construction chemicals for sealing, bonding, waterproofing, and concrete repair, like admixtures, mortars, protective coatings, flooring systems, and tile installation solutions.

- Saint-Gobain- A major company provides a variety of products for tile and stone, waterproofing, and concrete solutions, mainly through its brands Weber and Chryso.

- Pidilite Industries Ltd.- This specialises in waterproofing, repair and restoration, adhesives, grouts, and tiling solutions under brands, such as Dr. Fixit & Roff.

- Ruia Chemicals Pvt. Ltd.- A company offers acrylic membranes and integral compounds, concrete admixtures, like polycarboxylate ethers, and epoxy and polyester resins.

- Chembond Chemicals Limited- this explores different admixtures, waterproofing compounds, sealants, grouts, repair mortars, and floor hardeners.

Leader's Announcements

- In January 2025, Dr. Boris Gorella, CEO and Chairman of Master Builder Solutions GmbH, announced that India's dynamic construction ecosystem is aligning perfectly with the company's vision of providing high-performance and sustainable solutions. With the immense growth potential of the construction industry, India will play a central role in our growth strategy.

Recent Developments

- In March 2024, Pidilite Industries Limited, a leading manufacturer of adhesives, sealants, construction chemicals, and craftsmen products, launched its latest variant, Fevikwik Gel.

- In July 2024, the 4th edition of the NextGen Chemical and Petrochemical Summit 2024 was organized by the Indian Chemical News in Mumbai for leading stakeholders to discuss challenges and opportunities for the construction chemicals industry.

- In May 2024, Saint-Gobain acquired FOSROC, and MAPEI S.p.A. launched a new hybrid adhesive and sealant, Mapeflex MS 55, in the India construction chemicals market.

In February 2024, Pidilite Industries Ltd. launched a novel range of eco-friendly construction chemicals to meet with a green building market in India.

Segment Covered in the Report

By Type

- Concrete Admixture

- Surface Treatment

- Repair and Rehabilitation

- Protective Coatings

- Industrial Flooring

- Waterproofing Adhesives

- Sealants

- Grout and Anchor

- Cement Grinding Aids

By Application

- Residential

- Non-Residential

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting