Indoor Farming Market Size and Forecast 2025 to 2034

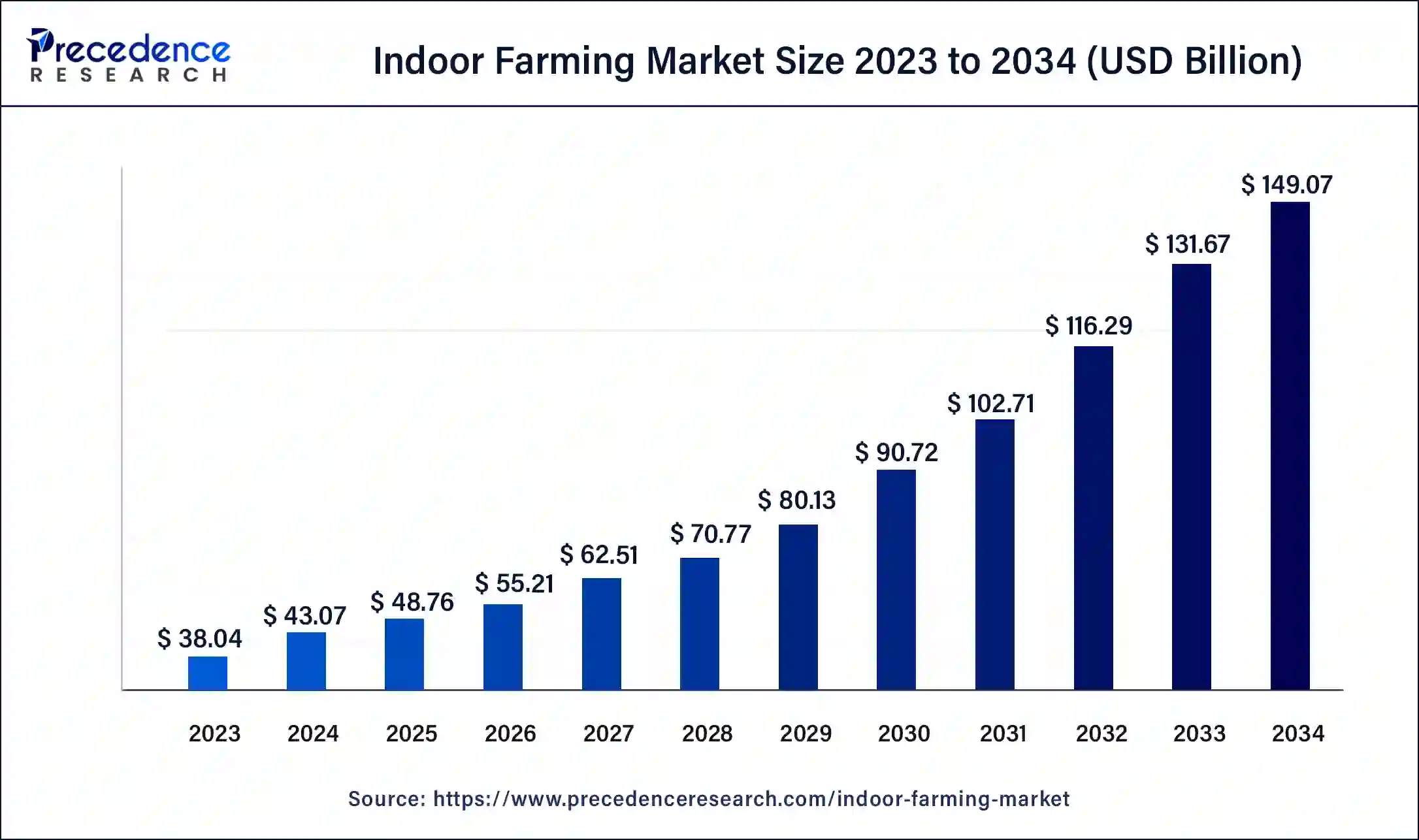

The global indoor farming market size is valued at USD 48.76 billion in 2025 and is predicted to increase from USD 55.21 billion in 2026 to approximately USD 49.07 billion by 2034, expanding at a CAGR of 13.22% from 2025 to 2034. Rising consumer awareness regarding the advantages of consuming fresh and high-quality food is expected to drive the indoor farming market growth.

Indoor Farming Market Key Takeaways

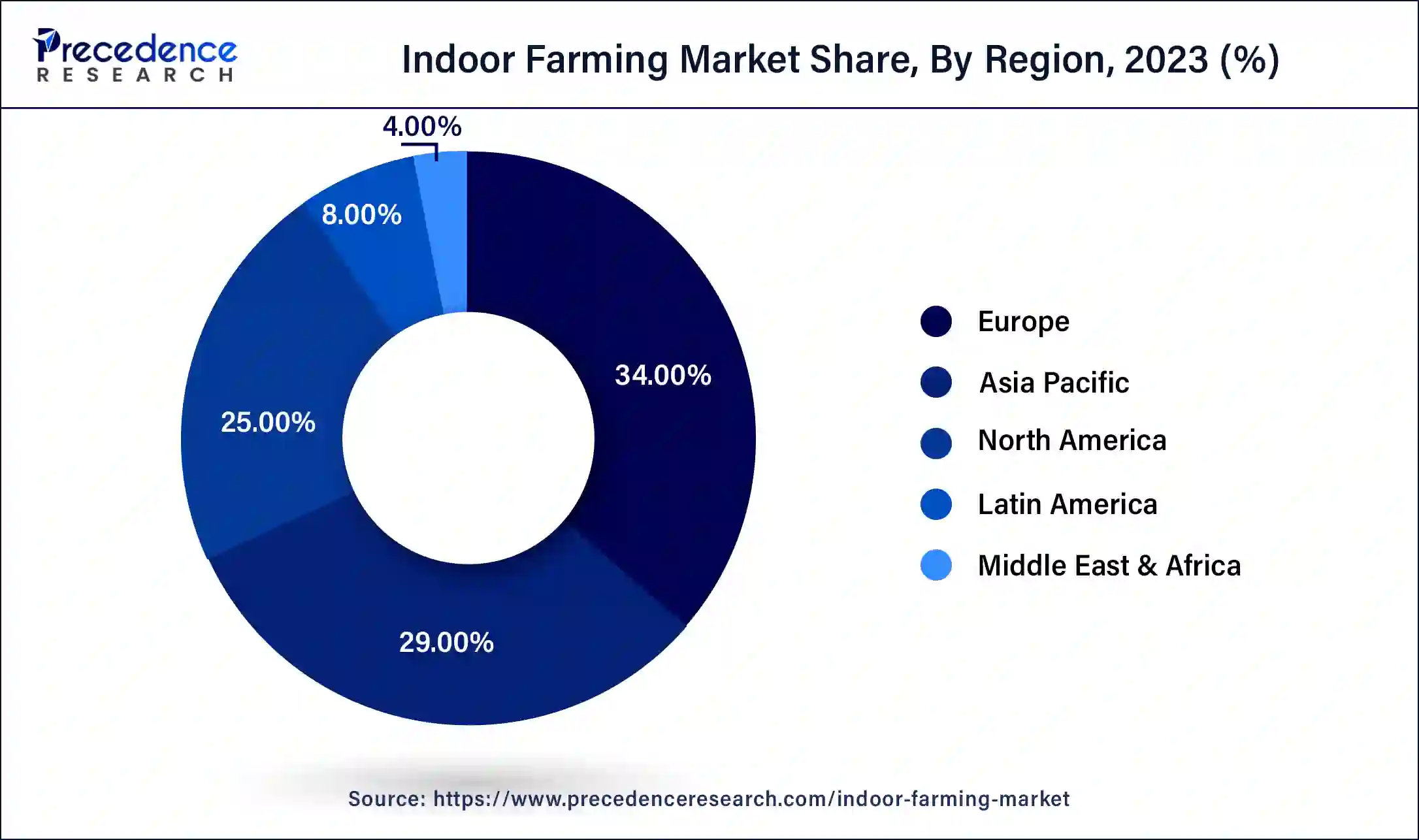

- Europe dominated the global indoor farming market with the highest market share of 34% in 2024.

- Asia Pacific is expected to show the fastest growth in the market during the forecast period.

- By facility type, the greenhouses segment dominated the market in 2024.

- By facility type, the vertical farms segment is expected to grow at the fastest rate in the market over the forecast period.

- By component, the hardware segment led the market in 2024.

- By component, the climate control system segment is projected to show rapid growth in the market during the forecast period.

- By growing mechanism, in 2023, the hydroponics segment dominated the global market.

- By growing mechanism, the aquaponics segment is expected to grow rapidly in the market over the forecast period.

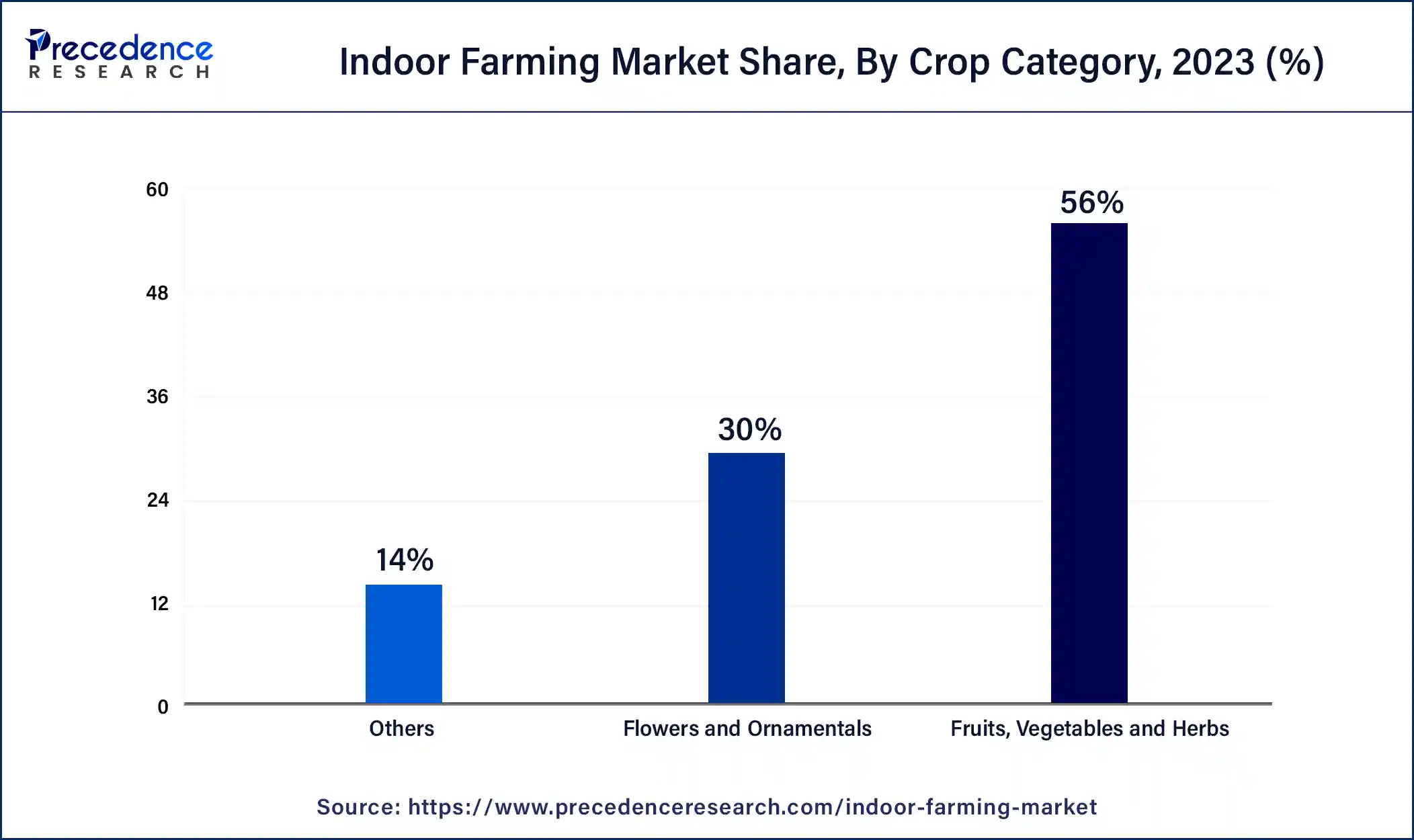

- By crop category, the tomato segment dominated the market in 2024.

- By crop category, the fruits, vegetables, & herbs segment is expected to grow at the fastest rate in the market during the forecast period.

What is Indoor Farming?

Indoor farming is the process of cultivating inside a specific controlled environment, such as within greenhouses or buildings. It uses a variety of techniques to improve plant growth and maximize yield. It is an innovative method of agriculture with the potential to solve problems like resource scarcity and food security. It also provides certain advantages over traditional farming methods. The controlled environment also limits the need for pesticides, which can contribute to the sustainable food system.

How is AI Revolutionizing the Farming Sector?

Applications and solutions that utilize artificial intelligence (AI) in the indoor farming market have been developed to assist farmers in specific and regulated farming by giving them the correct suggestions on crop rotation, water management, and timely harvesting, along with optimal planting, pest attacks, and nutrition management. Additionally, AI enables systems to make proper weather predictions and assess farms for the presence of pets or diseases using provided data like precipitation, wind speed, and temperature.

- In November 2023, GrubMarket announced the launch of Farm-GPT, a groundbreaking new generative artificial intelligence (AI) product designed to empower American farmers and growers with valuable data-driven insights for maximizing profits and optimizing crop selection.

Indoor Farming Market Outlook

- Industry Growth Overview: From 2025 to 2030, the indoor farming market is anticipated to grow quickly as demand increases for pesticide-free, year-round growth produce. Growth is being driven by urban population pressure, growing food-safety concerns, and rapid adoption of vertical farming systems in Asia-Pacific and Europe.

- Sustainability Trends:Sustainability is driving the market as growers change to energy-efficient LEDs, water-recirculation systems, and low-waste hydroponics. With tightening government regulations related to land usage and resource consumption, companies have ramped up R&D initiatives related to renewable substrates and biodegradable growing materials.

- Global Expansion:Leading firms began to expand into Southeast Asia, the Middle East, and Europe in hopes of capitalizing on regions reliant on food imports. Companies have developed localized high-tech farms in order to reduce and streamline the shipping costs associated with providing fresher produce. In addition, many operators have created distribution hubs in the regions they serve to meet customer needs without adding extra transportation to reach urban centers.

- Major Investors:The food production tendencies from private equity and agritech investors emerged because of margins, automation opportunities, and alignment with sustainability and ESG food production practices. Investors backed well-known funds that invested in vertical farm operators and AI programs that help scale commercial indoor farming.

- Startup Ecosystem:The startup ecosystem saw rapid growth, with early-stage firms developing climate-controlled farm pods, sensor-heavy hydroponic units, and AI crop monitoring. Startups funding in the U.S., Japan, and India is offering funding desirable to Wall Street investors for solutions to help limit energy use while optimizing yields on limited land.

What are the Growth Factors in the Indoor Farming Market?

- The increasing population globally, along with the rise in food demand, is expected to drive the indoor farming market growth.

- Advancements in LED lighting and automation can fuel the market growth further.

- Rising consumer interest in safe and sustainable food production methods can boost the indoor farming market growth shortly.

What are the Top Future Trends in the Indoor Farming Market?

- Growth of vertical farming- Vertical farming is becoming more popular for a few key reasons. Using stacked crops makes much better use of space, resources, and allows year-round cropping and high yields in urban areas, meaning it addresses both space and food security issues.

- Advances with LED lights- Many modern LED grow lights are capable of producing specific light spectrums, for example, with the ability to engage in “far-red” delivery variants, while still being more efficient with their electricity consumption. These advancements help by better optimizing photosynthesis, but they also reduce most farms' operational costs.

- Increased automation and AI- It is very common to see farms adopting automation and AI with activities like nutrient delivery, climate control, and growth monitoring. This can improve precision and lower labor costs while improving yield consistency when growing crops in indoor farms.

- Focus on sustainability- Indoor farms are often quick to recycle water, use very low pesticides, and use energy-efficient equipment. All of these practices are what create a sustainable indoor farm and are of great interest to regulatory environments and eco-friendly consumers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 149.07 Billion |

| Market Size in 2026 | USD 55.21 Billion |

| Market Size in 2025 | USD 48.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.22% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Facility Type, Component, Growing Mechanism, Crop Category, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand for nutritious food

Consumers around the globe are adopting healthy and active lifestyles. Hence, the demand for these products has risen drastically, which in turn increased indoor farming as an advanced system of integrations to help grow efficiencies and yields. Moreover, rising technology and health awareness can lead to more demand for nutritious and healthy food. This changing consumer behavior can drive the indoor farming market growth during the forecast period.

- In October 2023, Ancient Nutrition launched the world's first Regenerative Organic Certified nutritional supplement formulas. Ancient Nutrition hopes to lead the way for other brands to follow suit and for consumers to have an option that now supports a movement that goes far beyond organic.

Restraint

Large upfront investments

The amount of energy required to grow and produce can affect the cost of indoor farming. Indoor farming requires lots of energy to take care of yields, which directly affects the farming budget. Also, high electricity cost for indoor farming is expected to hamper the overall growth of the indoor farming market.

Opportunity

The increasing need for food security technology

Food security depends on access, availability, utilization, and stability. In big cities, free land is not readily available, so Indoor farming is the best option. In previous years, food security was the biggest concern due to environmental factors, but nowadays, technological advancements in different farming methods, like indoor farming, are reducing this concern, which can have a positive impact on market expansion. Furthermore, people are consuming safe and highly nutritious value-content food that meets their dietary demands and, therefore, can drive the growth of the indoor farming market.

- In February 2024, Masdar City launches a smart vertical farm with an AgriTech firm in a food security push. Alesca Technologies uses automated equipment and AI software to grow multiple varieties of fresh foods and herbs.

Segment Insights

Facility Type Insights

The greenhouses segment dominated the indoor farming market in 2024. The greenhouse is a closed structure built with transparent material used to grow crops, plants, and flowers. Greenhouses also stimulate higher yield production than conventional farming, which can propel market growth.

- In January 2024, Indoor farming pioneer and fresh food brand Gotham Greens announce the opening of its first high-tech hydroponic greenhouse in Texas and the company's thirteenth greenhouse nationwide, bringing its total footprint to more than 40 acres (1.8 million square feet) across nine U.S. states.

The vertical farms segment is expected to grow at the fastest rate in the indoor farming market over the forecast period. This can be attributed to the rising adoption of eco-friendly production of vegetables and fruits. Indoor farming also protects the crops from harsh weather conditions using innovative techniques. Like controlled environment, agriculture technology, etc.. Such technological advancements can contribute to the market expansion throughout the forecast period.

Component Insights

The hardware segment led the indoor farming market in 2024. This is because hardware plays a key role in maintaining the environment of indoor farms. The segment is further classified into lighting systems, sensors, climate control systems, and irrigation systems, which make the cultivation of indoor crops.

The climate control system segment is projected to show rapid growth in the indoor farming market during the forecast period. The climate control system helps to control the indoor climate with air-conditioning units, humidifiers, chillers, and heaters, among others.

Growing Mechanism Insights

The hydroponics segment dominated the global indoor farming market in 2024. Hydroponics can cultivate food without fertile land by using oxygen-contained water and nutrients to grow plants without soil. In hydroponic greenhouses in Canada, vegetables such as tomatoes, cucumbers, and peppers are grown. The rising population, along with limited resources, can boost the segment's growth soon.

- In June 2023, an Israeli hydroponics start-up expanded into the U.S. The company, known for its technology designed for small-scale hydroponics growers, is setting its sights on North American expansion after successfully selling its products in over 20 countries worldwide.

The aquaponics segment is expected to grow rapidly in the indoor farming market over the forecast period. Aquaponics is the blend of both hydroponics and aquaculture, which also reduces the utilization of toxic chemicals for cultivation. The minimum water wasted is the key benefit of aquaponics over the conventional method of agriculture. Aquaponics uses about 90% less water than traditional farming. These factors can lead to segment growth.

Crop Category Insights

The tomato segment dominated the indoor farming market in 2024. Tomatoes are the largest crop that has been cultivated due to their rapid production rate. However, the lack of good storage facilities, such as poor modes of transport and cold rooms, are the two major factors influencing the tomato segment in the market.

The fruits, vegetables, & herbs segment is expected to grow at the fastest rate in the indoor farming market during the forecast period. This is due to the rising production of commonly grown fruits, herbs, and vegetables like cucumbers, bell peppers, and leafy greens. This crop can deliver maximum profit from their cultivation to companies involved in their manufacturing.

Regional Insights

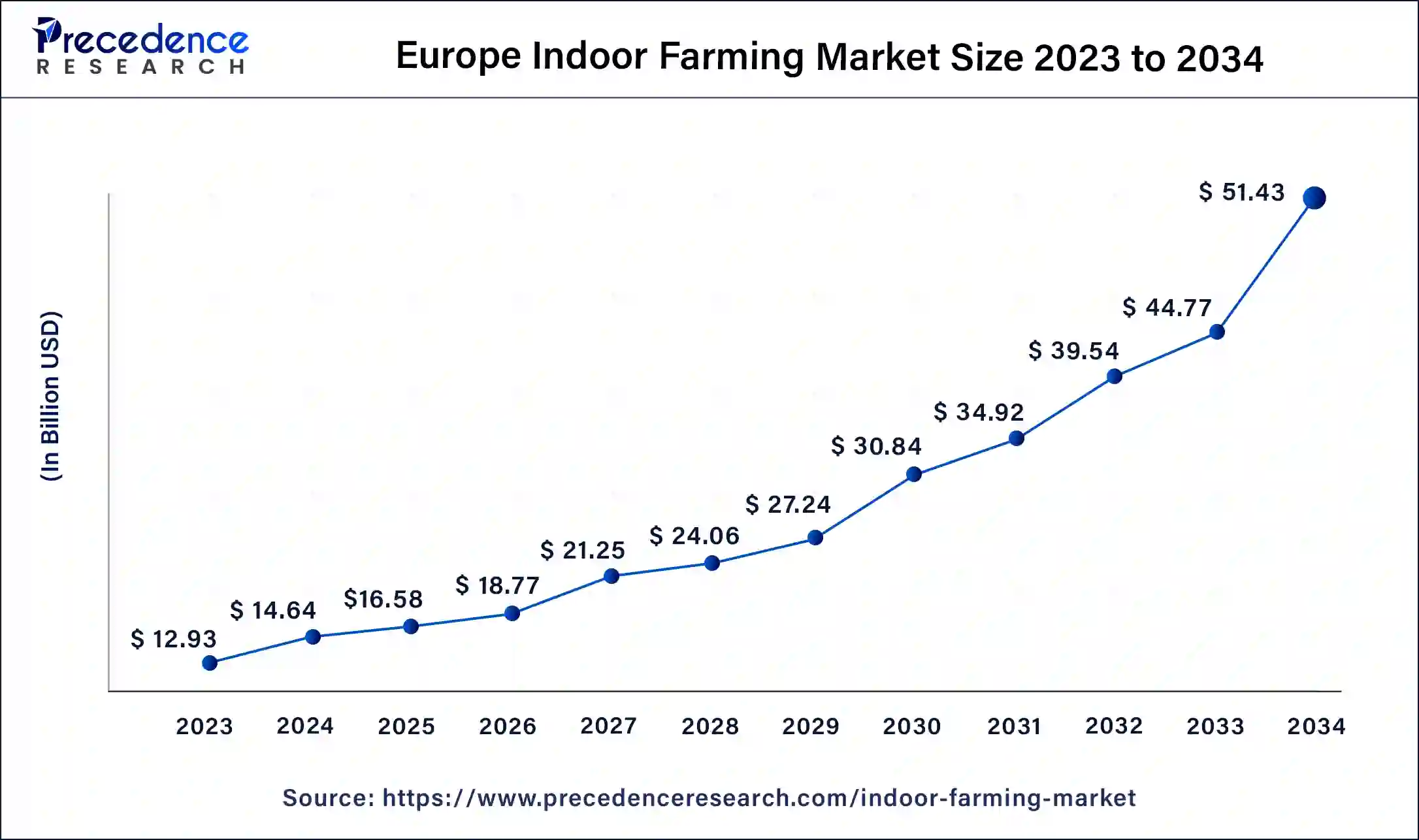

Europe Indoor Farming Market Size and Growth 2025 to 2034

The Europe indoor farming market size is exhibited at USD 16.58 billion in 2025 and is projected to be worth around USD 149.07 billion by 2034, poised to grow at a CAGR of 13.39% from 2025 to 2034.

Europe dominated the global indoor farming market in 2024. The region's growth is driven by a stringent regulatory environment that focuses on food safety and sustainability. This creates a strong need for indoor farming practices which cover all these aspects. Furthermore, European consumers are focusing more on being judicious about the food they consume. They also want fresh and high-quality food with a proper source and grown method. Indoor farms fulfill all these demands by providing unique solutions.

- In May 2024, Robbe's Little Garden and the Metropolia University of Applied Sciences in Myrrmäki entered joint research, testing year-round strawberry cultivation in a closed environment. The so-called Urbanfarmlab is developing solutions that are set to be adopted at an industrial scale.

Europe: Germany Indoor Farming Market Trends

The Germany's market is rapidly expanding, with revenues expected to grow significantly by 2030. While traditional greenhouses currently dominate in revenue, vertical farms are emerging as the fastest-growing facility type. Technologies like hydroponics and aeroponics are increasingly adopted, driven by efficiency in water use and rising automation. Sustainability is a strong driver: indoor farms use significantly less water than conventional agriculture and reduce dependence on soil and pesticides.

Asia Pacific is expected to show the fastest growth in the indoor farming market during the forecast period. The large growing population, which requires a stable food supply, is a key factor driving the growth of the market in this region. China led the market in the region. China's solid technological base with the growing pace of smart factory construction will likely fuel market growth over the forecast period.

Why did North America grow consistently in the indoor farming market?

North America had grown consistently in the market due to consumers' interest in purchasing pesticide-free fresh foods year-round. High rates of adoption of advanced light-emitting diode (LED) systems, digital crop monitoring, and automation in farming supported market growth. The tech sector and early-stage investing supported several companies that began investing in large vertical farms located near metropolitan areas in the U.S. and Canada. Furthermore, opportunities existed within the category of leafy greens, herbs, and berries, as well as smart farming systems.

U.S. Indoor Farming Market Trends

The U.S. led North America in commercial indoor farming due to its high number of operations. Many organizations use artificial intelligence (AI), robotics, and climate-controlled systems to farm crops in proximity to metropolitan areas. Supermarket chains located near indoor farms also collaborated to produce fresh food products for consumers. Venture group investors supported projects of scale in early-stage companies across states like California, New York, and Arizona.

Why did Latin America grow rapidly in the indoor farming market?

Latin American countries grew rapidly in the market as climate risks and unpredictable weather patterns harmed crop viability and overall food supply. Countries in the region were seeking a predictable source of clean, locally grown, fresh produce. Cities were growing, and demand for fresh green in urban centers increased. Businesses were experimenting with hydroponics and vertical farms to avoid reliance on food imports. Furthermore, supermarket supply chains, hotels, and restaurants proved to be excellent opportunities.

Brazil Indoor Farming Market Trends

Brazil was the leading country in the region as indoor agriculture offered a means to manage climate challenges and provide fresh produce to urban areas. Rising numbers of city residents increased demand for stable food choices. Start-ups were experimenting with hydroponics and vertical systems in São Paulo and Rio. Retail chains were increasingly interested in premium greens grown indoors. Public and private investments increased as businesses considered specialty crops with high value and turnover, like fresh herbs and lettuce.

Why did the Middle East & Africa grow steadily in the indoor farming market?

The Middle East and Africa have shown steady growth in indoor farming due to the constraints of normal farming from the extremely poor climate. The countries depended heavily on food imports, so indoor farms represented a steady solution. Government agencies invested in smart farms to curb food insecurity. Significant opportunities exist with automated greenhouses, desert-farming technology, and water-saving technology. A large number of companies partnered with major corporations to build climate-controlled farms.

The UAE Indoor Farming Market Trends

The UAE led the region as it needed local food sources that were stable. Indoor farms could solve the challenges of oppressive heat, water shortages, and limited land availability. The government had made investments in large vertical farm projects and funded research in desert-farming technology. Retailers had an appetite for fresh, pesticide-free greens. Moreover, many international companies built indoor farms around Dubai and Abu Dhabi to advance the market.

Global Pulses Cultivation 2022 statistics

| Major Countries | Area - lakh ha | Production -Lakh Tons | Yield -kg/ha |

| India | 361.11 | 276.69 | 766 |

| Canada | 32.75 | 61.65 | 1882 |

| China | 26.14 | 48.30 | 1848 |

| Russian Federation | 23.08 | 46.07 | 1996 |

| Nigeria | 49.25 | 42.01 | 853 |

| Australia | 23.23 | 41.50 | 1787 |

| Myanmar | 38.09 | 35.84 | 941 |

| Ethiopia | 16.68 | 32.33 | 1938 |

| Nigeria | 60.33 | 29.63 | 491 |

| Others | 329.02 | 359.91 | 1094 34 |

Indoor Farming Market Top 10 Companies

- Argus Control Systems Ltd.

- Certhon

- Richel Group

- Netafim

- General Hydroponics

- Hydrodynamics International

- Illumitex

- Lumigrow

- Signify Holding

- Bowery Farming Inc.

Recent Developments

- In May 2025, Contain, Inc. announced the launch of Insights, a specialized data platform providing detailed information on funding, investors, and farms in the indoor agriculture sector. The platform arrives as the industry navigates significant market challenges while preparing for future growth opportunities.

- In February 2025, Pure Harvest Smart Farms (Pure Harvest), a leading technology-enabled agribusiness, and PlanTFarm, one of Korea's leading smart farming solutions providers, announced the official opening of the redeveloped Al Ain farm, which will serve as a pioneering, multi-use, and high-tech controlled environment agriculture (CEA) farming facility.

- In March 2024, Cox Enterprises announced the launch of Cox Farms, a new business focused on sustainable food and agriculture. Cox Farms includes indoor farming companies Mucci Farms and BrightFarms, and it will continue to pursue additional ventures and investments in the indoor agriculture space. "We are excited to build and scale a better future for farmers and consumers by ensuring a safe, secure, and sustainable food supply, regardless of calendar or climate," said Steve Bradley, president of Cox Farms.

- In 2024, Metropolis Farms Inc. struck a major deal with a grocery store chain to supply them with fresh, locally grown leafy greens cultivated in their indoor vertical farms. This partnership allows Metropolis Farms to scale their production significantly and reach a wider customer base.

- In 2024, Bowery Inc., Building on their success in the Northeast, Bowery announced ambitious plans to expand their vertical farming operations to two new cities in the U.S.

- In January 2023, Priva announced the strategic partnership with Aranet. The partnership aimed to serve the growing demand for more and new greenhouse sensors to generate data. This partnership will bridge the gap between wireless sensor platforms and other data sources in greenhouses.

Segments Covered in the Report

By Facility Type

- Greenhouses

- Vertical Farms

- Shipping Container

- Building-based

- Others

By Component

- Hardware

- Climate Control Systems

- Lighting Systems

- Sensors

- Irrigation Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Managed Services

- Assisted Professional Services

By Growing Mechanism

- Aeroponics

- Hydroponics

- Aquaponics

By Crop Category

- Fruits, Vegetables & Herbs

- Tomato

- Lettuce

- Bell & Chili Peppers

- Strawberry

- Cucumber

- Leafy Greens

- Herbs

- Others

- Flowers & Ornamentals

- Perennials

- Annuals

- Ornamentals

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting