What is the Industrial Fasteners Market Size?

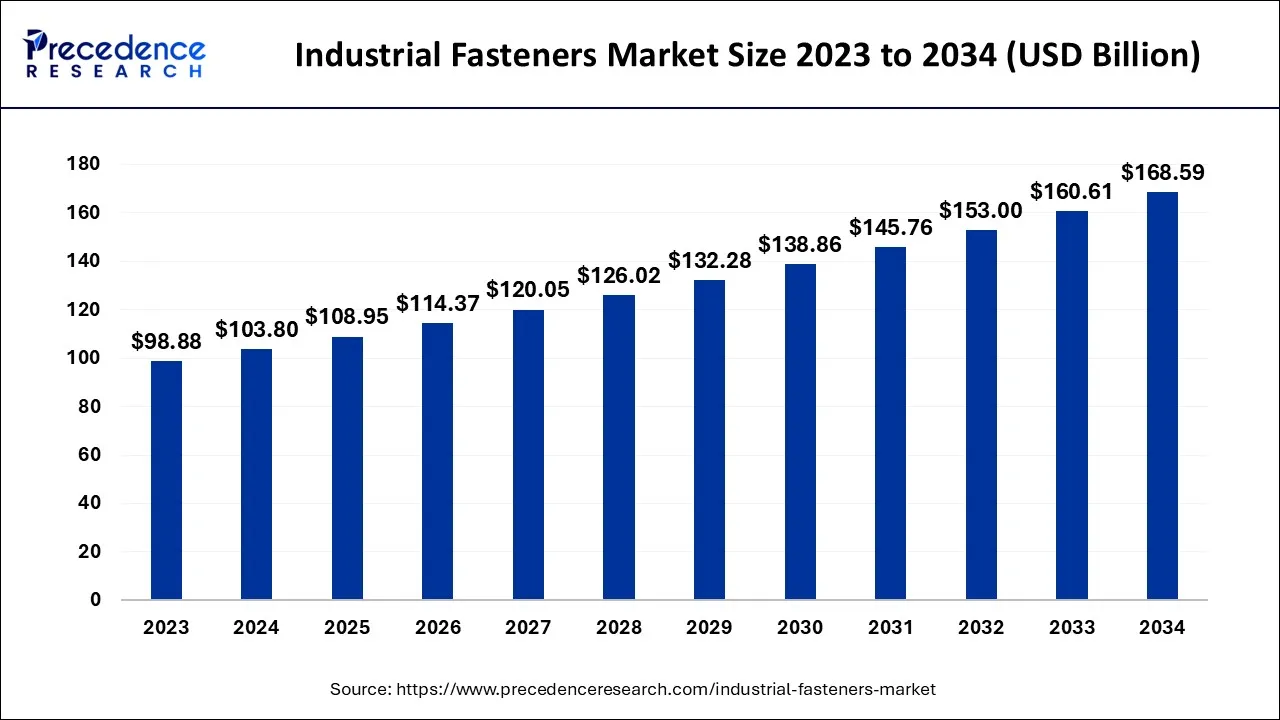

The global industrial fasteners market size is calculated at USD 108.95 billion in 2025 and is predicted to increase from USD 114.37 billion in 2026 to approximately USD 176.32 billion by 2035, expanding at a CAGR of 4.32% from 2026 to 2035.

Industrial Fasteners Market Key Takeaways

- In terms of revenue, the market is valued at $108.95billion in 2025.

- It is projected to reach $176.32billion by 2035.

- The market is expected to grow at a CAGR of 4.32% from 2026 to 2035.

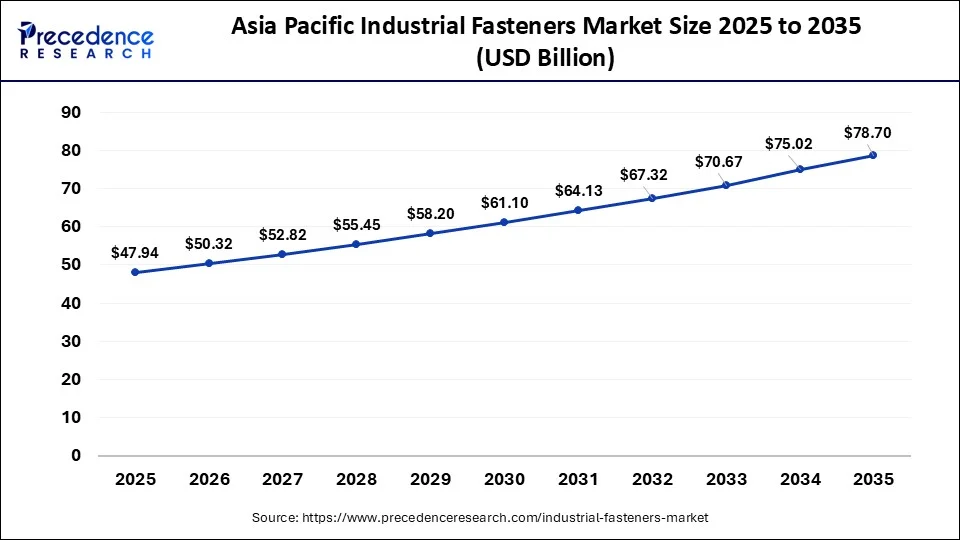

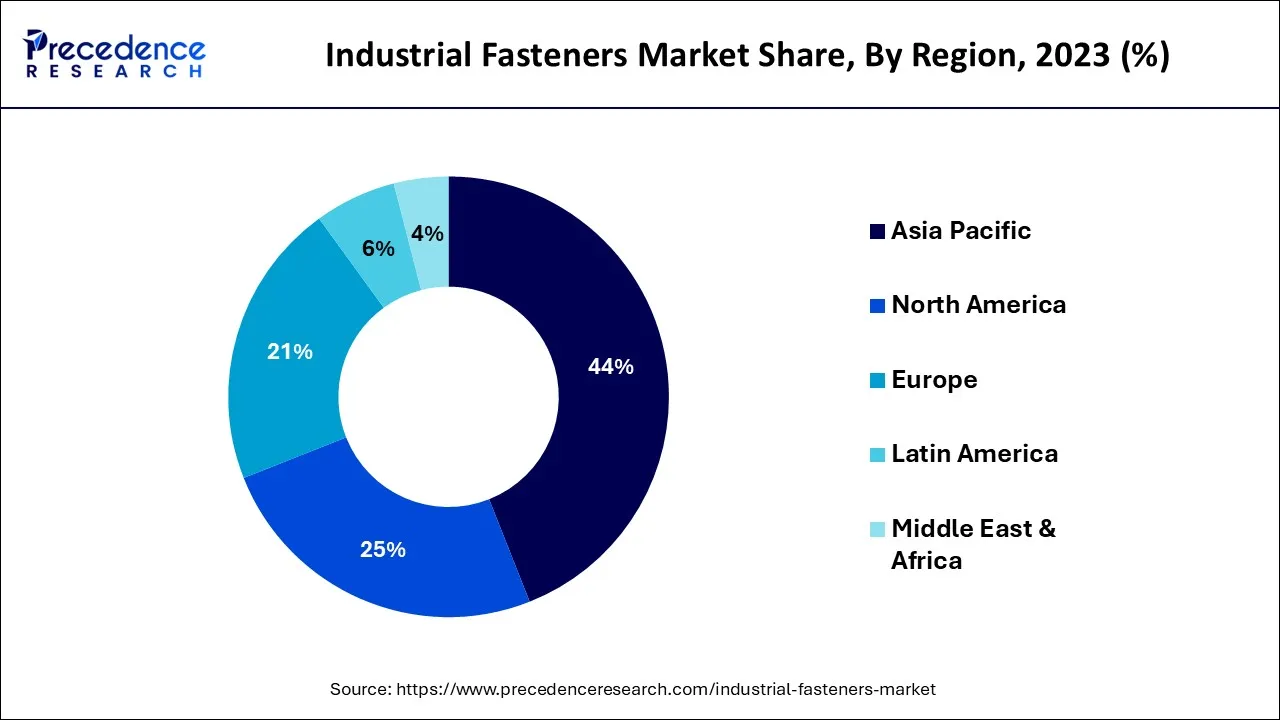

- Asia Pacific dominated the market and contributed more than 44% of revenue share in 2025, while market size accounted for USD 45.67 billion in 2025 and is projected to be worth around USD 75.02 billion by 2035, poised to grow at a CAGR of 5.09% from 2026 to 2035.

- North America region generated more than 25% of revenue share in 2025.

- By raw materials, the metal fasteners segment dominated the market with the largest market share of 92.50% in 2025.

- By raw materials, the plastic fasteners segment is expected to expand at a fastest CAGR of 5.73% between 2026 and 2035.

- By product, the externally threaded fasteners segment dominated the market with the largest revenue share of 49% in 2025.

- By product, the non-thread fasteners segment is estimated to grow at 4.5% between 2025 and 2035.

- By application, the automotive segment accounted for the largest market share of 32% in 2025.

What are Industrial Fasteners?

Industrial fasteners are industrial tools for devices, that are observed as a main component that is widely utilized for safety of industrial devices and products by joining joints. Most of the industrial fasteners are mechanical in nature. The fasteners include screws, bolts, nuts, rods, anchors, and sockets. Industrial fasteners can be used in assembly equipment, tools, and related supplies for the installation of machinery. Industrial fasteners could be useful in various sectors like the electronics and automobile industries. Industrial fasteners are also used in day-to-day consumer goods such as vehicles, furniture, lighting, etc. Increasing global investment in the building and construction industry will result in higher demand for industrial fasteners across the globe, the element is observed to accelerate the market's growth.

The globally leading provider of fasteners and other supportive components, LISI Group, published its revenue report. The revenue for the LISI Group's first quarter of 2024 was 401.3 million Euros and 17.2% increase from the prior year.

How is AI contributing to the Industrial Fasteners Industry?

AI is used to improve the quality of fasteners in the accuracy of inspection and consistency of production with fastener machine learning and computer vision. It assists in predicting maintenance through equipment performance data. Pattern recognition helps AI to optimize inventory and demand planning. Generative modelling tools are beneficial to design processes. Smart fasteners get the ability to be monitored in real-time.

Industrial Fasteners Market Growth Factors

Industrial fasteners are rapidly being deployed in the construction and automotive industry; the overall development of these industries is observed to play a significant role in the growth of the industrial fasteners market. Industrial fasteners are observed to be semi-permeant or sometimes permeant solutions for applications. Growing industrialization across the globe results in higher growth for the industrial fasteners market. The growing development in the construction industry notably impacted the growth of the market.

The increase in research and development programs positively impacts the market's development that highlights the development of new and advanced industrial fasteners. Growing real estate infrastructure in urban areas like residential buildings, commercial buildings, and bridges has resulted in the substantial growth of the market. Moreover, the factor that supplements the growth of the market is increasing technological advancements in industrial fasteners for producing lightweight products that can be useful in the automotive and other industrial sectors.

Market Outlook

- Industry Growth Overview: Industry demand is boosted in the automotive, aerospace, and construction industries through technological advances in manufacturing.

- Global Expansion: North America develops electric mobility, aerospace, and infrastructure modernization projects.

- Major investors: Illinois Tool Works, Stanley Black and Decker, SFS Group AG, LISI Group, Nifco, Inc., Fontana

Gruppo expand growth plans in fastening technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 176.32 Billion |

| Market Size in 2025 | USD 108.95 Billion |

| Market Size in 2026 | USD 114.37 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.32% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Material, Product, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing construction activities

The booming construction sector across the world will positively impact the growth of the market. In the building sector, fasteners are used to assemble items on a temporary basis. In order to guarantee a secure and lasting final framework, each construction project needs a distinctive kind of fastener. Because each piece of equipment, machinery, or vehicle needs these fasteners to keep it together, fasteners play a crucial role in construction. Fasteners are the primary elements that are used in a variety of industries, including automation, manufacturing, infrastructure, and others, where a variety of products are created that involve the assembly of machinery or components from various vehicles. The market for industrial fasteners is expected to rise as a result of the rising demand from several sectors.

Restraint

High installation prices

The drawback of employing fasteners is that their installation frequently necessitates specialist equipment, which can raise project costs and complexity. It takes considerably more time and effort to install other kinds since they call for extra measures like pre-drilling holes or using thread-locking compounds. Last but not least, depending on your application, some kinds could not be strong enough or robust enough for long-term usage, which might result in expensive repairs down the line if not addressed correctly from the outset. Such expenses are observed to cause a restraint for the market.

Opportunity

Increasing demand from the aerospace industry

Standard fasteners including rivets, screws, nuts, pins, bolts, and collars are often used in the aircraft sector. Aerospace technology and equipment must be built to withstand harsh conditions, right down to the fasteners that hold them together, as they are frequently exposed to them. Examples of such extreme environments include elevated temperatures and pressures from leaving the earth's atmosphere and contact with burning rocket fuel. Because of this, a variety of high-quality fastener designs have been created, each of which has unique features and meets the standards and requirements of the aerospace sector. With the expansion of the aerospace industry, the demand for advanced and high-quality fasteners will grow while opening substantial opportunities for the market to grow.

Segment Insights

Raw Material Insights

The metal fasteners segment dominated the market with the highest revenue in 2025, the segment will continue to sustain its position throughout the forecast period. Higher tensile strength is expected to boost the demand for the market in several industries. There are various metal fasteners like steel, alloy, bronze, titanium, etc. Industrial equipment like bolts, screws, river clamps, etc. is made up of metal. The easy availability of metal materials promotes the segment's growth. Metals offer better resistance and strength capacity than other fasteners for industrial and construction use. The metal has a strong holding capacity, so it is widely preferred in the industrial sector. All these factors collectively fuel the segment's growth.

The plastics fasteners segment is expected to increase its market share during the forecast period. Plastic fasteners attract consumers with lower prices and easy availability. Plastic fasteners are gaining demand from the automotive and aerospace industries due to their lightweight properties. Plastic fasteners are corrosion resistive and chemical-resistive. Lightweight, lower cost and easy availability of plastic material fuel the growth of the segment.

Product Insights

The externally threaded segment dominated the market with the highest market share in 2025. The growth of the segment is expected to grow with the most commonly used by the various industries demand. Bolts, screws, and studs are a few examples of threaded fasteners. In order to establish a strong, temporary connection that may be removed as needed, bolts are frequently utilized with nuts, washers, and other accessories. By establishing a clamp load while the nut on the bolt is tightened, friction is produced, holding the fastener in place.

The non-threaded segment is expected to grow at a considerable rate during the predicted timeframe. The most popular non-threaded fasteners are blind and solid rivets. A number of non-thread pins are also utilized for fastening. Steel, copper, aluminum, brass, and stainless-steel solid rivets come in a variety of sizes and forms. Solid rivets are robust, have a complete look, and withstand vibration when used properly. The availability of variety of designs, dimensions, and materials, including steel, aluminum, and stainless steel for non-threaded fasteners promotes the segment's growth. Increasing demand for nonthreaded fasteners in the construction industry will likely boost the growth of the segment.

Application Insights

The automotive segment dominated the market with the largest market share in 2025. Increasing automotive manufacturing plants across the world will anticipate the demand for industrial fasteners in the automotive industries. Fasteners like nuts, bolts, screws, panels, rivets, studs, etc. are heavily used in the automotive industry. Thus, the automotive segment will continue its dominance during the forecast period due to the higher demand for fasteners. The rising production of electric vehicles highlights the demand for lightweight fasteners, this element is expected to fuel the market's expansion in the upcoming period.

The aerospace segment is expected to witness notable growth during the forecast period. In the manufacturing of aircraft, there is an enormous requirement for high-quality and reliable fasteners. With the rising production of airplanes and aircraft, especially for defense purposes, the aerospace segment is expected to be propelled.

Regional Insights

What is the Asia Pacific Industrial Fasteners Market Size?

The Asia Pacific industrial fasteners market size is exhibited at USD 47.94 billion in 2025 and is projected to be worth around USD 78.70 billion by 2035, growing at a CAGR of 5.08% from 2026 to 2035.

Asia Pacific dominated the market with the largest market revenue in 2025. The region will continue its dominance over the forecast period. Growth in the market is attributed to the increasing population and the rising need for residential buildings considering the population in countries such as India and China. Other infrastructural developments also contribute to the demand for industrial fasteners in the region. Increasing industrial development in the region will also boost the demand for the market.

Asia Pacific is expected to account for 44% of global sales in the year 2025. There is a stronger growth rate expected in China, India, and Southeast Asia in the year.

China Industrial Fasteners Market Trends

China is a fastener manufacturing industry providing a robust manufacturing ecosystem and a vast system of suppliers. The car and construction industries support industrial production. The existence of many mid-sized manufacturers enhances the supply capacities domestically and promotes regular export activity in the infrastructure and engineering markets of the globe.

North America is expected to grow at a significant rate during the forecast period. Increasing manufacturing units in multiple industries such as automotive, electronics, aerospace, etc will likely boost the demand for industrial fasteners in the region. Increasing research and development programs and activities are expected to create demand for lightweight industrial fasteners in the market. Moreover, a well-established infrastructure for the development of new components will support the market's growth in the region.

In addition, the presence of major key players in the region contributes to the market's expansion. Bossard is a major fasteners manufacturer in North America serving OEMs globally in various markets such as rail, electric vehicle EV, industrial automobile and robotics. Major manufacturers in North America depend upon the products and services of Bossard.

U.S. Industrial Fasteners Market Trends

The U.S. is a significant importer as well as consumer of specialized fasteners. The demand for precision components is driven by the aerospace and defense industries. Increasing the number of electric vehicles is helping in the usage of more fasteners. The engineering applications demand advanced engineering solutions with high strength capable of withstanding complex manufacturing and modernization efforts.

Growth in the fasteners market across Europe has primarily been driven by rising automotive production; Germany alone produced more than 4 million vehicles in 2024. France and the UK have also seen significant growth in exports, attributed to aerospace and the demand for high-performance fasteners. EU regulations for more lightweight and sustainable manufacturing have led to the more rapid acceptance of new fastening technologies. Furthermore, heightened investment in infrastructure projects throughout Eastern Europe and significant growth in renewable energy installations are contributing to greater consumption of industrial fasteners.

- In April 2025, TFC Europe, an AFC Industries company, acquired German fastener company Verucon Fasteners and Logistics GmbH. Erucon supplies fasteners and offers services to a wide variety of manufacturing sectors throughout Germany and other markets worldwide.

What are the Advancements in the Industrial Fasteners Industry in Latin America?

Latin America is expected to witness substantial growth in the market. This growth is driven by the expanding manufacturing sector, particularly in countries like Brazil and Mexico. The region is also witnessing an increasing demand for industrial fasteners in the construction and automotive domains, fueled by supportive government policies. Companies in the region are also focusing on cost-effective production methods and are expanding their distribution networks in order to meet the rising demand.

Brazil Industrial Fasteners Market Trends: The country is witnessing a rising demand for industrial fasteners due to rising poultry equipment, paper industry machinery manufacturers, equipment of the textile industry, plastic and rubber manufacturers. Industry players are increasingly focusing on value-added services, customization, and supply chain optimization to improve competitiveness and responsiveness to customer needs.

What are the Key Trends in the Industrial Fasteners Market in the Middle East and Africa Region?

The Middle East and Africa are witnessing steady growth in the market, driven by increasing infrastructure projects and industrialization efforts, particularly in countries like the UAE, Saudi Arabia, and South Africa. Government initiatives aimed at boosting manufacturing capabilities and foreign investments are underway, leading to market development. The competitive landscape in this region still appears to be in its developing stages. Companies are focusing on establishing partnerships and expanding their presence to cater to the growing demand.

Saudi Arabia Industrial Fasteners Market Trends: The region's market landscape needs high-quality fasteners in order to support various industries, including construction, oil, and gas. As the country continues to evolve, opportunities for growth and investments are expected to increase.

Value Chain Analysis of the Industrial Fasteners Market

- Raw Material Sourcing: This stage deals with the sourcing of metallic and non-metallic raw materials like carbon steel, alloy steel, stainless steel, aluminum, brass, copper, and titanium.

Key Players: Nippon, Tata, Alcoa - Manufacturing Process: This stage deals with the production process. It includes various processes like cold heading, forging, threading, and heat treatments.

Key Players: Hilti, Bossard, Nifco - Distribution Process: In this stage, the finished fasteners are distributed through OEM supply contracts, industrial distributors, and vendor-managed inventory systems.

Key Players: Brennan Industries, RS Group, Fastenal

Industrial Fasteners Market Companies

- Arconic Fastening Systems and Rings: It offers aerospace-quality lockbolts, structural blind fasteners, quick-release and self-locking nuts, installation technologies, and self-locking nuts to the industrial world.

- Acument Global Technologies, Inc.: Provides designed assembly solutions that have TORX STRUX clinch fasteners and Mag-Form thread-forming technologies.

- ATF, Inc.: Provides specialty cold-formed metals such as Delta PT thread-forming metal automotive and industrial components.

Other Major Key Players

- Dokka Fasteners A S

- LISI Group - Link Solutions for Industry

- Nippon Industrial Fasteners Company (Nifco)

- Hilti Corporation

- MW Industries, Inc.

- Birmingham Fasteners and Supply, Inc.

- SESCO Industries, Inc.

Recent Development

- In April 2025, Huyett, a distributor of industrial fasteners, launched its new threaded fastener lines. This release includes over 60,000 products in five major categories: bolts, screws, nuts, washers, and anchors. The expansion offers reliability, flexibility, and quick market response, empowering distributors to meet customer demands efficiently in quantities convenient to them.

- In May 2024, IperionX Limited and Vegas Fastener Manufacturing, LLC (Vegas Fastener) partnered to develop and manufacture titanium alloy fasteners and precision components, with IperionX having advanced titanium products. Additionally, they will design, engineer, and produce titanium fasteners for critical sectors, including aerospace, naval, oil and gas, power generation, pulp and paper, and chemical industries.

- In January 2025, Anchor Bolt & Supply, a trusted supplier of high-quality fasteners and industrial hardware, announced a partnership with Birmingham Fastener, the leading manufacturer and distributor of American-made fasteners. The collaboration combines the strengths of both companies to give customers in West Texas better quality, service, and inventory.

- In June 2023, India's Fasteners Show, the premier platform for promoting and showcasing the fasteners, fastening technologies, and fixings was arranged in Pune. 150 manufacturers and suppliers from India and abroad participated as exhibitors. The show aimed to play an important part in the growth of “Make in India” initiatives.

- In March 2023, the leading North American supplier and manufacturer of fixturing accessories, clamps, rollers, bumper, and machine tool components “FixtureWorks” offered the complete range of ball lock fasteners and quick-release clamps. They help in locating, fastening, and alignment.

- In June 2023 Ducab group, the United Arab Emirates of biggest end-to-end manufacturing and prover firms announced that they expanding operations with the launch of its smart advanced factory “Blade” for the future project based on the Fourth Industrial Revolution (Industry4.0).

Segments Covered in the Report

By Raw Material

- Metal Fasteners

- Plastic Fasteners

By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home Appliances

- Lawns And Gardens

- Motors And Pumps

- Furniture

- Plumbing Products

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting