What is Industrial Laser Gases Market Size?

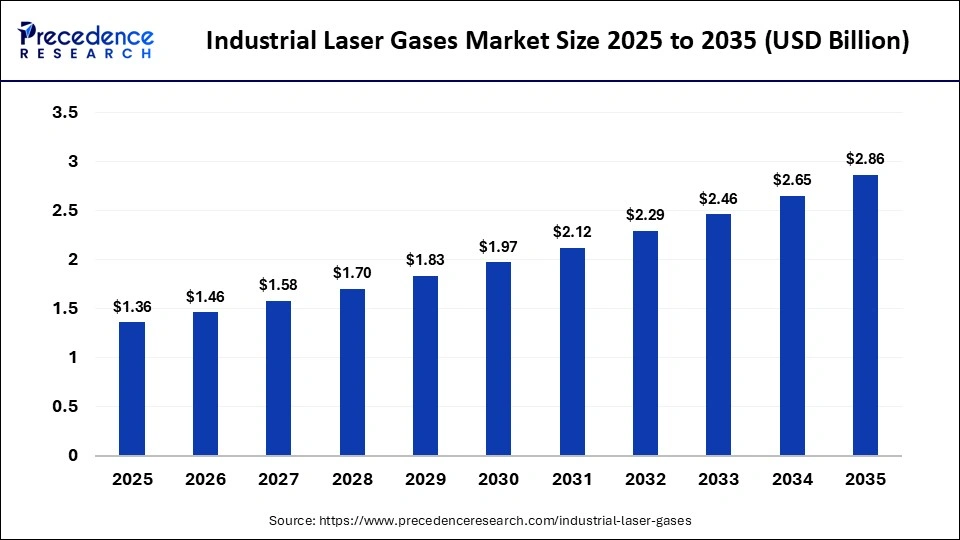

The global industrial laser gases market size was calculated at USD 1.36 billion in 2025 and is predicted to increase from USD 1.46 billion in 2026 to approximately USD 2.86 billion by 2035, expanding at a CAGR of 7.71% from 2026 to 2035. The market is expanding as adoption of laser cutting, welding, and marking rises across automotive, aerospace, and electronics, with demand driven by precision manufacturing and automation, supporting steady double-digit growth forecasts.

Market Highlights

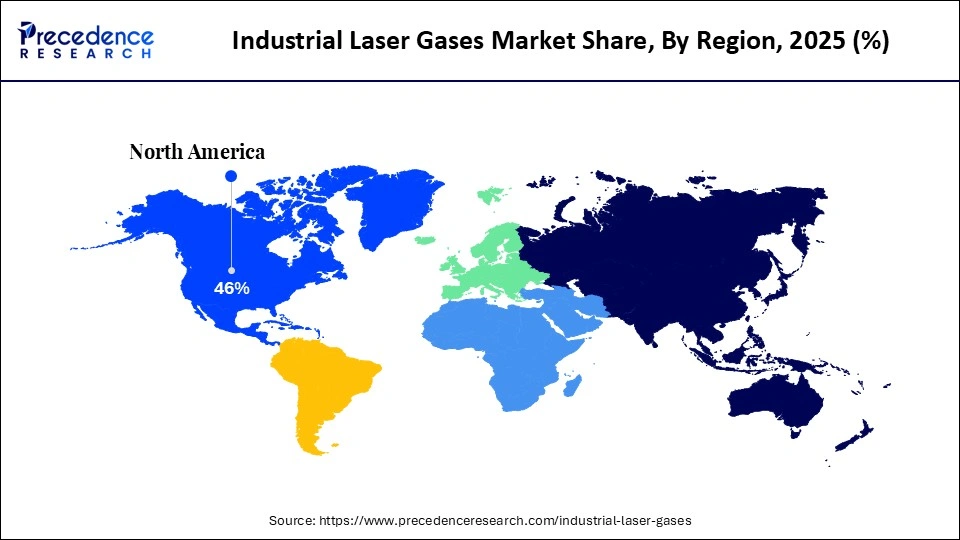

- Asia-Pacific led the industrial laser gases market with the largest share of approximately 46% in 2025.

- North America is expected to expand the fastest CAGR in the market between 2026 and 2035.

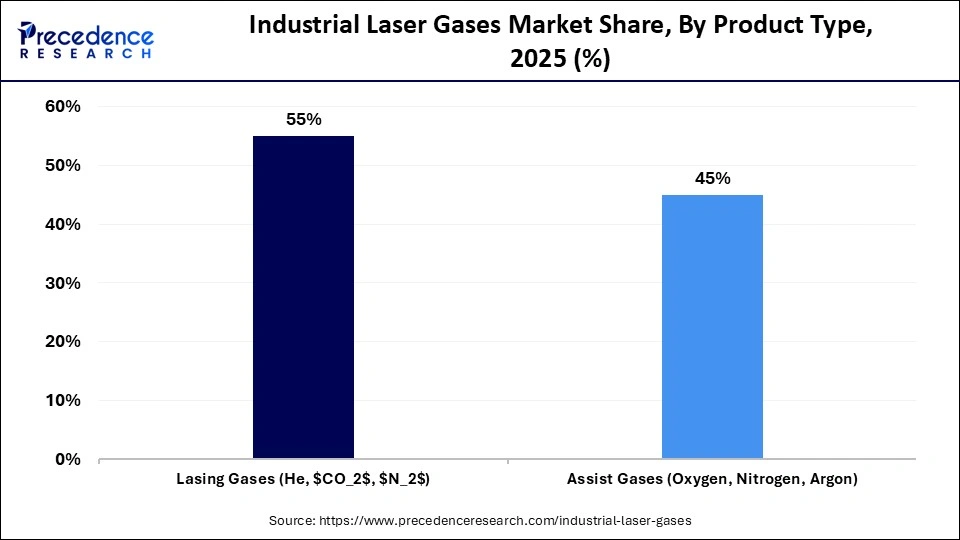

- By product type, the lasing gases segment dominated the market in 2025 with approximately 55% market share.

- By product type, the assist gases segment is expected to grow at a strong CAGR between 2026 and 2035.

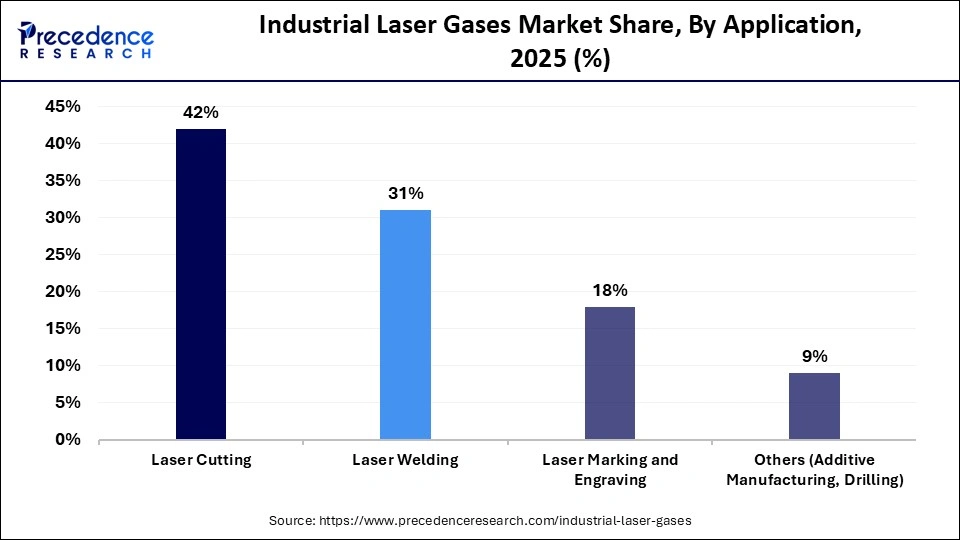

- By application, the laser cutting segment held the largest revenue share of approximately 42% in the market in 2025.

- By application, the laser welding segment is expected to grow at a solid CAGR between 2026 and 2035.

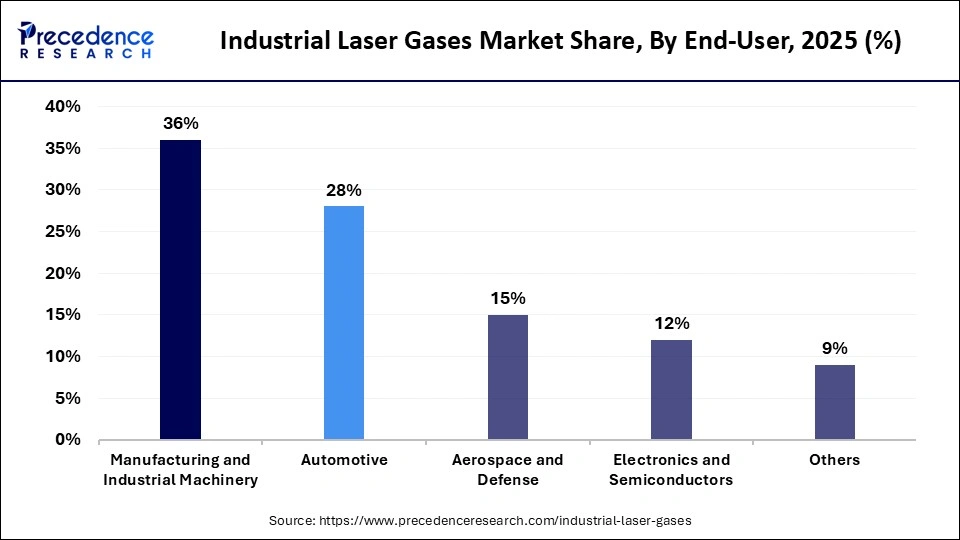

- By end-user, the manufacturing & industrial machinery segment captured the biggest revenue share of approximately 36% in 2025.

- By end-user, the automotive segment is expected to expand at the fastest CAGR from 2026 to 2035.

What Role Do Laser Gases Play in Precision Manufacturing?

The industrial laser gases market encompasses both specialty and bulk gases (i.e., nitrogen, oxygen, carbon dioxide & noble gases) that serve as either the medium for the laser beam or assist in producing or cooling it in an industrial laser system. These industrial laser gases are fundamental to the production process since they allow for stable beam quality to provide precise cuts, welds, engravings, and surface treatments across all industries.

The market will continue to thrive in the adoption of laser-powered manufacturing methods due to their accuracy, speed, and lower material waste as compared with traditional manufacturing techniques. Growth in this market is directly related to increased metal fabrication, reduced weights of automobiles, the miniaturization of electronics, and semiconductors. The continued adoption of automation and the transition to smart factories will only increase the demand for very high-purity, application-specific gas mixtures. Furthermore, as the industry moves toward energy-efficient laser technology and cleaner processing environments, industrial laser gases will continue to be critical components enabling future manufacturing processes.

Growth through AI technology in the Industrial Laser Gases market

The market has been transformed by artificial intelligence (AI) technologies that provide greater operational intelligence to manufacturers, improve gas supply reliability, and produce gases more cost-effectively through AI-based sensors and analytics that optimize gas consumption, delivery accuracy, and purity of gases used with precision lasers, which reduce excess gas usage and create greater confidence in gas reliability to laser manufacturers. Predictive maintenance algorithms can reduce downtime of production facilities, and real-time monitoring will improve process control throughout the gas supply chain.

Currently, the increased adoption of AI in laser systems and gas management is evidenced by manufacturers using IoT and machine learning to automate operational processes in support of "Industry 4.0" technology. This increased use of automation and AI will therefore lead to both more efficient operation and a competitive advantage for businesses providing high-quality/highly intelligent gases for precision laser applications, due to increasing demand for those gases.

Key Trends in Industrial Laser Gases Market

- Growth in Automation: The increased automation of production lines within industries has led to a growing requirement for precision, high-speed cutting, welding, and engraving through the use of laser gases. This trend can be observed within many of the main industry sectors, particularly automotive and electronics.

- Green Gas Movement: The establishment of stricter environmental regulations has forced manufacturers to explore cleaner alternatives for laser gases with lower emissions, as well as to develop technologies that will assist them in producing products with environmentally sustainable practices.

- Global Expansion: The rapid rate of industrial growth, in addition to significant investment in smart manufacturing, is contributing to a dramatic increase in consumption and market expansion of industrial laser gas compared to other regional areas.

- Innovation in Multi-Gas Blends: The development of multi-gas blends designed for specific laser types is improving the efficiency of processing, the performance, and reliability of laser systems when used in precision manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.36 Billion |

| Market Size in 2026 | USD 1.46 Billion |

| Market Size by 2035 | USD 2.86 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component,Application, Deployment,Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Outlook

Product Type Insights

Which Product Type Segment Dominated the Industrial Laser Gases Market?

The lasing gases segment dominated the market with a share of approximately 55% in 2025, because they are essential in generating lasers and therefore have a direct impact on laser beam quality, beam stability, and laser system efficiency. Demand is steady because they are widely used in heavy industrial applications such as cutting, welding, and engraving, where high power is required as well as precision in the laser beam.

The assist gases segment is expected to be the fastest-growing in the market over the studied period. Demand for assist gases is increasing exponentially due to the growing use of fiber and COâ‚‚ laser cutting systems, in which assist gases help improve cutting speed, cut edge quality, and oxidation control. Additionally, the growing trends of using cleaner and more precise manufacturing processes in industries such as automotive, fabrication, and electronics are driving accelerated use of assist gases globally.

Application Insights

Why Did the Laser Cutting Segment Dominate the Industrial Laser Gases Market?

The laser cutting segment held a dominant position in the market with a share of approximately 42% in 2025, due to the extensive use of lasers for numerous applications, including metal fabrication, automotive parts, construction equipment, and industrial machinery. For laser cutting to operate effectively, it requires both the energy of the laser and the assist gas to provide precision cuts, clear edges, and rapid throughput. As a result, this process is becoming increasingly popular within industries that produce large volumes of product.

The laser welding segment is expected to grow with the highest CAGR in the market during the studied years, due to increased demand for lightweight construction materials, electric vehicles, and automated production lines. To achieve strong welds and a minimum amount of defects, laser welding must occur in a controlled gas environment. The increased use of laser welding in automotive body assembly, battery assembly, and aerospace components has greatly increased the need for gases used in the process.

End-User Insights

Which End-User Segment Led the Industrial Laser Gases Market?

The manufacturing & industrial machinery segment led the market with a share of approximately 36% in 2025, due to the ongoing high utilization of laser cutting, welding, and marking processes in the metalworking and fabrication industries, as well as the heavy equipment manufacturing sector, creating a continuous need for industrial laser gases across these industries. The heavy focus on productivity, precision, and automation across manufacturing firms ensures ongoing high levels of consumption of both lasing and non-lasing (i.e., assistance) gases across various industrial manufacturing processes.

The automotive segment is expected to expand rapidly in the market in the coming years, driven by the rising volume of new electric vehicles being produced and the significant increase in the use of lightweight materials in automotive vehicle manufacturing, as well as the increasing amount of automation in automotive vehicle production. Due to the prevalence of laser-based processes used for body welding, cutting components, and assembling batteries, this further drives the need for high-purity industrial laser gases that are designed for specific application requirements.

Regional Insights

How Big is the North America Industrial Laser Gases Market Size?

The North America industrial laser gases market size is estimated at USD 625.60 million in 2025 and is projected to reach approximately USD 1329.90 billion by 2035, with a 7.83% CAGR from 2026 to 2035.

North America is expected to witness the fastest growth during the predicted timeframe, due to the area's established advanced manufacturing sectors, including electronic, automotive, and aerospace, all of which require precise cutting and welding. This region also has an extensive industrial infrastructure, early adoption of laser technologies, and extensive amount of research and development on laser gas applications. Continuous innovation and implementation of lasers across industries have resulted in a mature ecosystem for laser gases; hence, there is a steady and high-quality demand for specialty gases associated with multiple types of end-use operations.

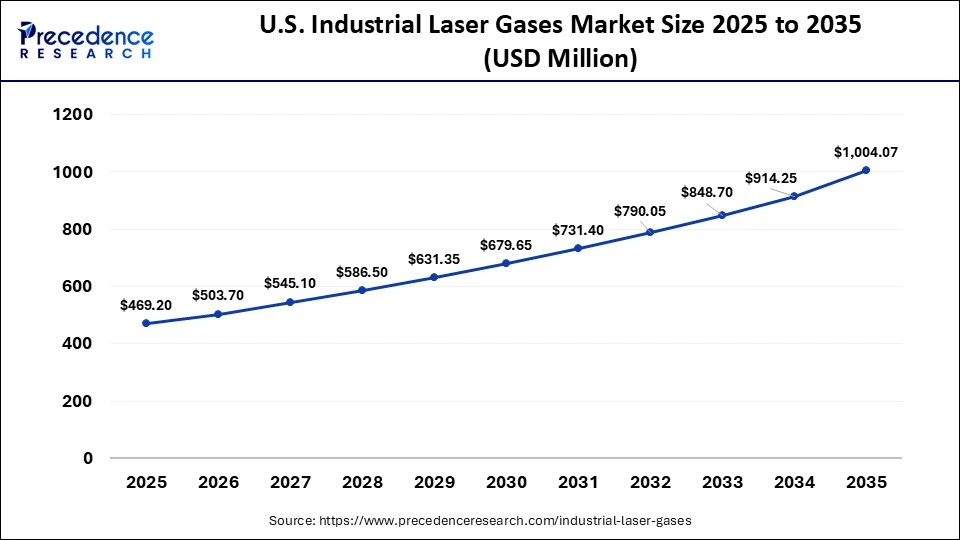

What is the Size of the U.S. Industrial Laser Gases Market?

The U.S. industrial laser gases market size is calculated at USD 469.20 billion in 2025 and is expected to reach nearly USD 1004.07 billion in 2035, accelerating at a strong CAGR of 7.90% between 2026 to 2035.

Which Factors Drive the Industrial Laser Gases Market in Asia-Pacific?

Asia-Pacific held a major revenue share of approximately 46% in 2025. The rise in production in different sectors, such as electronics, automotive, and metal fabrication, contributes to market growth. Upgraded production capabilities, infrastructure expansion, and a transition towards high-precision manufacturing are all driving demand for laser gases. With numerous smart factories being built and many traditional manufacturing processes moving to lasers, there is a strong demand for laser gases throughout the region. Government bodies launch initiatives to promote indigenous manufacturing through key initiatives like Made in China and Make in India, promoting the use of laser gases.

China Industrial Laser Gases Market Trends

China's manufacturing ecosystem is well-established and quickly embracing advanced laser technologies. Companies in China are widely using lasers for consumer goods, such as electronic devices, automotive parts, and large equipment, among others. As Chinese manufacturers continue to upgrade their manufacturing processes through improved precision fabrication techniques, they will be using more industrial laser gases than ever before.

There are numerous advancements in the development of laser technologies and applications through many large-scale industrial clusters located throughout the country. China is a driving force behind continued regional growth and a major contributor to the emergence of laser-assisted manufacturing technologies across the region. China is home to about 15 local and 11 international industrial laser manufacturers.

How is North America Growing in the Industrial Laser Gases Market?

North America is expected to witness the fastest growth during the predicted timeframe, due to the area's established advanced manufacturing sectors, including electronic, automotive, and aerospace, all of which require precise cutting and welding. This region also has an extensive industrial infrastructure, early adoption of laser technologies, and extensive amount of research and development on laser gas applications. Continuous innovation and implementation of lasers across industries have resulted in a mature ecosystem for laser gases; hence, there is a steady and high-quality demand for specialty gases associated with multiple types of end-use operations.

U.S. Industrial Laser Gases Market Trends

The U.S. is the leading country in North America with regard to industrial laser gas usage, mainly because it has a high level of high-tech manufacturing activity, a large number of cutting-edge research institutions, and a significant number of large OEMs using laser systems to create parts to exacting specifications. All these issues require precise laser gas usage. With strong supplier relationships and partnerships between industry and research, the U.S. remains at the forefront of laser gas usage in North America.

Industrial Laser Gases MarketValue Chain Analysis

- Quality Testing and Certification

Industrial laser gases undergo rigorous testing to ensure safety, meeting process control demands and complying with regulations. Gases are tested according to pharmacopoeia standards (EP, USP, JP), ISO 9001, and ISO 8573.

Key Players: SGS, Linde Gas, Laser Gases, and Prewel Labs. - Packaging and Labelling

Appropriate packaging and labelling of industrial laser gases are essential for hazard identification and legal and technical compliance. Lasers are labelled based on the EN IEC 60825-1 standard labels.

Key Players: Air Products, Hindcam, ACI Laser GmbH, and DesignPro Automation. - Distribution to Industrial Users

Laser gases are distributed to industries through distributors or suppliers that work closely with customers and laser manufacturers.

Key Players: BOC Gases, Atlas Copco, Indogas Pvt. Ltd., and Laser Gases. - Waste Management and Recycling

Continuous efforts are made to manage laser gas waste and recycle industrial laser gases to reduce cost and environmental impact.

Key Players: Kanken Techno Co. Ltd. and Santytech.

Who are the major players in the global industrial laser gases market?

The major players in the industrial laser gases market include Air Liquide S.A., Linde plc, Air Products and Chemicals, Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Iwatani Corporation, Gulf Cryo, Buzwair Industrial Gases Factories, Matheson Tri-Gas, Inc., Praxair Technology, Inc., Coregas Pty Ltd, SOL Group, Advanced Specialty Gases, Purity Cylinder Gases, Inc., and Cryogas Equipment Pvt. Ltd.

Recent Developments in the Industrial Laser Gases Market

- In November 2025, Additive Industries launched the MetalFab 420K, a modular Laser Beam Powder Bed Fusion Additive Manufacturing machine to enable higher productivity rates while maintaining high material quality levels. The machine enables homogenous and high-velocity gas flow to ensure consistency and quality across the powder bed.(Source: https://www.metal-am.com)

- In April 2025, Beamer Laser Marking Systems began a new growth phase by acquiring Fonon Quantum Technologies, Inc., to expand innovation and market reach with integrated advanced laser solutions. The acquisition was made to enhance access to advanced laser technologies, including laser cleaning, cutting, and welding for Beamer customers.(Source: https://www.businesswire.com)

- In October 2024, Honeywell agreed to buy Air Products' liquefied natural gas (LNG) process technology and equipment business for about $1.81 billion in cash, boosting its energy transition solutions globally. The new offering includes natural gas pre-treatment and state-of-the-art liquefaction using digital automation technologies.(Source: https://www.airproducts.com)

Segments Covered in the Report

By Product Type

- Lasing Gases (He, CO2, Ne)

- Assist Gases (Oxygen, Nitrogen, Argon)

By Application

- Laser Cutting

- Laser Welding

- Laser Marking & Engraving

- Others (Additive Manufacturing, Drilling)

By End-User

- Manufacturing & Industrial Machinery

- Automotive

- Aerospace & Defense

- Electronics & Semiconductors

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting