What is Commercial and Industrial Battery Storage Market Size?

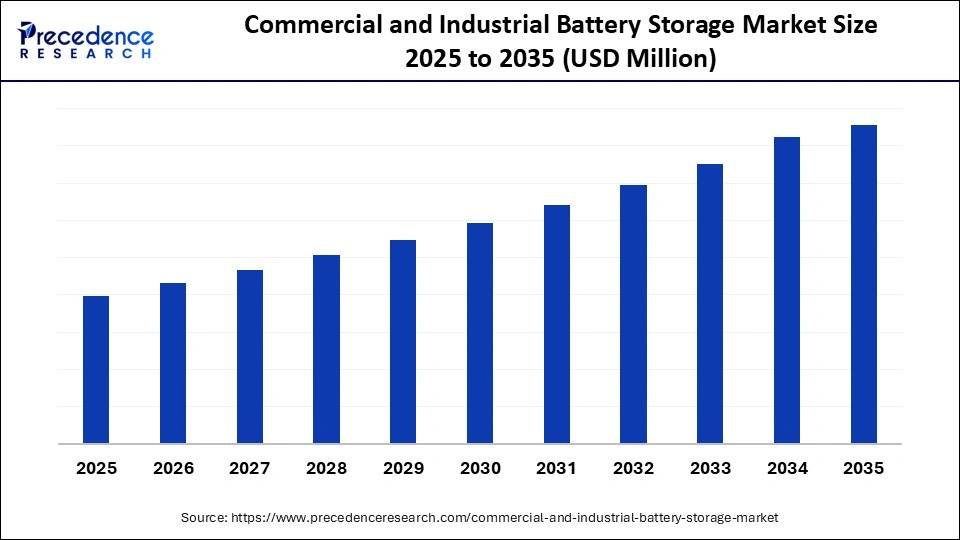

The global commercial and industrial battery storage market is growing rapidly due to rising energy demand, grid stability needs, and renewable integration worldwide. The market is driven by rising energy costs, increasing grid reliability requirements, and the need for integrating renewable energy sources.

Market Highlights

- Asia Pacific held the largest share of the market in 2025.

- The North America is expected to witness the fastest growth during the forecasted years.

- By battery type, the lithium-ion batteries segment held a significant share of the market in 2025.

- By battery type, the flow batteries segment is expected to show considerable growth in the market over the forecast period.

- By capacity range, the 100 kWh – 1 MWh segment held a significant share of the market in 2025.

- By capacity range, the 1 MWh – 10 MWh segment is expected to grow at a faster rate over the forecast period.

- By application, the peak shaving & demand charge management segment held a significant share in 2024.

- By application, the renewable energy integration segment is expected to grow at the fastest CAGR in the market over the forecast period.

- By end-use sector, the industrial facilities segment held a significant share in 2024.

- By end-use sector, the data centers segment is expected to grow at the fastest CAGR in the market over the forecast period.

- By power rating, the 250 kW – 1 MW segment held a significant share in 2024.

- By power rating, the Above 1 MW segment is expected to grow at the fastest CAGR in the market over the forecast period.

Market Overview

The global commercial and industrial battery storage market includes stationary energy storage systems deployed by commercial buildings, industrial facilities, campuses, data centers, manufacturing plants, warehouses, and institutional users to store electricity for on-site consumption. These systems support peak shaving, demand charge management, backup power, renewable energy integration, grid resilience, energy arbitrage, and carbon footprint reduction. The market is driven by the growing investment in battery storage as a key enabler of clean energy, driven by corporate decarbonization commitments and a broader push toward sustainability in energy systems.

The growing adoption of advanced battery technologies, such as improved lithium-ion and new battery chemistries, coupled with intelligent energy management systems, is significantly enhancing the performance, scale, and payback of energy storage solutions. These innovations are particularly important as electricity prices continue to rise and grid instability becomes more prevalent, driving commercial and industrial users to seek decentralized and reliable energy solutions. The shift toward rooftop solar and other distributed energy resources has created a heightened demand for effective energy storage to manage intermittency and maximize self-consumption.

Major Market Trends

- Rising Demand for Energy Independence and Grid Stability: As electricity prices increase and grid reliability becomes more unpredictable, commercial and industrial sectors are increasingly adopting battery storage systems to ensure energy independence. These systems allow businesses to store energy from renewable sources like solar or wind, ensuring a stable power supply even during grid outages or high-demand periods.

- Integration with Renewable Energy Sources: The shift towards rooftop solar and wind energy is driving the demand for battery storage solutions that can store excess energy generated during peak production hours for later use. This integration helps businesses make the most of their renewable energy installations, reducing reliance on traditional power grids and optimizing self-consumption.

- Technological Advancements in Battery Chemistries: Innovations in battery technologies, particularly improvements in lithium-ion batteries and the development of solid-state batteries and flow batteries, are enhancing energy density, efficiency, and lifespan. These advancements are making battery storage solutions more affordable, scalable, and suitable for diverse commercial and industrial applications.

How is AI Influencing the Commercial and Industrial Battery Storage Market?

The integration of Artificial intelligenceis revolutionizing energy management by making it smarter, more efficient, and cost-effective. AI-powered energy management systems and smart grids are being developed to interpret real-time data such as electricity prices, load trends, weather forecasts, and grid status, which allows for the optimization of battery charging and discharging processes. This enables businesses to optimize peak shaving, reduce demand charges, and engage in energy arbitrage, effectively lowering their energy costs while also improving the lifespan of batteries. Additionally, AI algorithms help enhance the integration of renewable energy by more accurately predicting solar and wind generation patterns, reducing intermittency issues, and enabling more predictive dispatch of stored energy, ensuring a stable and efficient energy supply.

Market scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | ByBattery Type,Capacity Range,Application,Power Rating,End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Battery Type Insights

Why Does the Lithium-Ion Batteries Segment Lead the Commercial and Industrial Battery Storage Market?

The lithium-ion battery segment dominated the market, holding the highest share in 2025 because of its performance, high energy density, and good cost-effectiveness. These batteries are well-suited for rapid charging and discharging, making them ideal for applications such as peak shaving, demand charge management, and backup power. Additionally, a mature manufacturing ecosystem and a global supply chain support continuous advancements in lithium-ion battery technology, improving safety, cycle life, and reliability. Integration with advanced battery management systems and AI-powered energy programs further optimizes battery performance and enhances the lifespan of these assets, ensuring greater efficiency and long-term value for users.

The flow batteries segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing demand for long-term and high-cycle energy storage solutions. Flow batteries offer unique advantages, such as the ability to independently scale power and energy capacity, making them particularly suitable for large facilities that require extended discharge times.

Their long service cycle and low performance degradation enhance overall cost-effectiveness over time, providing substantial value in the long run. Additionally, flow batteries are safe because they use non-flammable electrolytes, reducing the risk of fires in industrial environments. As renewable energy usage grows, flow batteries are gaining popularity for smoothing power generation intermittency and improving grid stability, further driving their adoption.

Capacity Range Insights

Why Did the 100 kWh – 1 MWh Segment Dominate the Market?

The 100 kWh -1 MWh segment held the highest share of the market in 2025 because of its versatility in serving a wide range of commercial buildings and mid-sized industrial facilities. This capacity range is ideal for supporting core applications like peak shaving, demand charge management, and short-duration backup power without requiring substantial capital investment. It is widely used in offices, retail complexes, hospitals, warehouses, and light manufacturing facilities, which typically have moderate and predictable energy loads. The key advantages of this segment include faster deployment, easier permitting, and simpler grid interconnection, making it a more accessible and efficient option compared to larger systems.

The 1 MWh -10 MWh is expected to experience significant growth within the market, driven by the need for more cost-effective and energy-resilient solutions for users with energy-intensive demands. This capacity range supports all-day peak loads, load shifting, and extended backup times, making it highly attractive to large industries, logistics centers, campuses, and factories.

Growth in this segment is primarily fueled by the increasing integration of on-site renewable energy systems, which require larger storage capacities to address intermittent issues. Additionally, with the rise in industrial electrification and growing sustainability commitments, there is mounting pressure for businesses to adopt batteries of this range to meet energy needs efficiently and support long-term environmental goals.

Application Insights

Why Did the Peak Shaving & Demand Charge Management Segment Dominate the Market?

Peak shaving & demand charge management segment dominated the commercial and industrial battery storage market with the highest share in 2025. This is mainly due to its ability to significantly reduce energy costs by minimizing demand charges during peak consumption periods. By utilizing battery storage to store energy during off-peak hours and discharge it during peak times, businesses can avoid expensive electricity surcharges, leading to a rapid return on investment. As electricity prices continue to rise and companies seek more efficient energy solutions, the demand for systems that optimize energy usage and improve cost-effectiveness has made this segment highly attractive.

The renewable energy integration segment is expected to grow at a significant CAGR in the upcoming period, as organizations expand their on-site solar and other renewable energy installations. Battery storage allows businesses to store surplus renewable energy for use during periods of low production, improving self-consumption and ensuring greater energy stability. The growing need to decarbonize and transition to sustainable operations is driving the adoption of renewable-plus-storage solutions, supported by favorable policies, declining costs of renewable installations, and advancements in battery technology.

End-Use Sector Insights

Why Did the Industrial Facilities Segment Lead the Commercial and Industrial Battery Storage Market?

The industrial facilities segment led the market and accounted for the largest revenue share in 2025, driven by the significant benefits of battery storage in manufacturing plants, processing units, and heavy industries. These facilities face substantial financial losses from power outages and peak demand charges, making battery storage a valuable investment for peak shaving, load shifting, and backup power, which help stabilize operations and optimize energy costs. Additionally, battery storage supports on-site renewable energy integration, aiding industries in meeting sustainability and decarbonization goals. The growth in adoption is further fueled by increased automation, the electrification of industrial processes, and rising demands for higher energy efficiency, which make battery storage solutions even more essential for modern industrial operations.

The data centers segment is expected to grow at a significant CAGR during the forecast period, driven by the rapid growth of cloud computing, digital workloads, and artificial intelligence applications. Data centers require continuous, reliable power to maintain uptime and protect valuable digital assets, and battery storage systems provide instant backup power, reducing dependency on diesel generators while enhancing overall energy efficiency. Increasing sustainability commitments and regulatory pressure to reduce carbon emissions are also compelling data center operators to adopt battery-based energy solutions, further accelerating the shift towards cleaner, more efficient energy management.

Power Rating Insights

Why Did 250 kW - 1 MW Contribute the Most Revenue in the Market?

The 250 kW - 1 MW contributed the most revenue in 2025 and maintained its dominance. This is because this power range is particularly effective for peak shaving, demand charge control, and providing short-term standby power to smaller facilities such as offices, shopping complexes, factories, hospitals, and light manufacturing plants. The performance, affordability, and ease of installation make these systems highly attractive to a broad range of customers. Additionally, this segment benefits from standardized designs, reduced deployment times, and simplified grid interconnection, while also being compatible with advanced energy management software, which enables system optimization and faster return on investment.

The above 1 MW segment is expected to experience significant growth in the commercial and industrial battery storage market, driven by the increasing demand for high-power and large-scale energy solutions. This power range is ideal for large industrial sites, manufacturing plants, data centers, campuses, and logistics centers, all of which have high instantaneous load requirements. Growth in this segment will be fueled by rising electrification, increased integration of on-site renewable energy, and the need for greater energy resilience. High-power systems in this category enable businesses to extend backup time, better manage peak loads, and participate in grid services like demand response and frequency regulation, further enhancing operational flexibility and energy efficiency.

Regional Insights

Why Did Asia Pacific Lead the Global Commercial and Industrial Battery Storage Market?

Asia Pacific led the commercial and industrial battery storage market, capturing a significant revenue share in 2024, driven by rapid industrialization, urbanization, and rising electricity demand across key economies. Countries like China, Japan, South Korea, and India have made substantial investments in energy storage to support renewable energy integration and address grid reliability challenges. Government policies, strong supportive regulations, and large-scale production have accelerated the deployment of battery storage in commercial and industrial sectors. The growing demand is further fueled by the rise in rooftop solar installations, industrial electrification, and the increasing need for peak shaving and backup power due to the rising cost of electricity and frequent grid instability.

China Commercial and Industrial Battery Storage Market Trends

The market in China is booming, fueled by strong government support for energy storage deployment and the widespread adoption of renewable energy. Demand has surged due to the country's ambitious clean energy goals and the development of large-scale solar and wind energy projects. Battery storage systems are particularly popular in industrial facilities across China, where they help manage peak electricity loads and reduce operational costs. Additionally, battery storage is increasingly being implemented in urban commercial buildings and industrial parks, enhancing energy resilience and supporting China's transition to a more sustainable energy future.

Why is North America Considered the Fastest-Growing Region in the Commercial and Industrial Battery Storage Market?

North America is expected to grow at the fastest CAGR during the forecast period, driven by rising electricity costs, grid reliability challenges, and strong policy support for energy storage solutions. Battery storage is becoming increasingly popular among commercial and industrial customers to reduce demand charges and enhance energy security. The region has seen a significant rise in rooftop solar installations, which has led to a surge in demand for integrated storage solutions.

The value of these systems is further boosted by technological advancements and the widespread adoption of AI-based energy management systems. Additionally, clean energy infrastructure investments are being accelerated by corporate sustainability commitments and decarbonization goals, further driving the growth of battery storage in North America.

U.S Commercial and Industrial Battery Storage Market Analysis

The market in the U.S. is undergoing rapid development due to the growing volatility of energy prices and increasing grid interruptions. Companies are increasingly adopting battery storage systems to optimize peak shaving, ensure backup power, and participate in demand response programs. Favorable regulatory policies and incentives at both federal and state levels are improving the economic feasibility of energy storage projects and accelerating their adoption.

The rising use of renewable energy, particularly solar, has further amplified the need for reliable energy storage solutions. As a result, battery storage systems are being widely implemented across data centers, manufacturing plants, and various commercial facilities to enhance energy efficiency and reliability.

Why is the European Commercial and Industrial Battery Storage Market Experiencing Significant Growth?

The European market is experiencing significant growth, driven by strong decarbonization policies and ambitious renewable energy targets. Rising electricity costs and growing concerns over energy security have prompted companies to adopt battery storage as an effective solution for cost management and ensuring operational redundancy. As the adoption of renewable energy systems in commercial and industrial buildings increases, the need for reliable storage solutions to address energy intermittency has also grown.

Supportive regulatory frameworks and incentives in key European economies are further boosting market penetration. Additionally, sustainability reporting obligations and corporate carbon-cutting commitments are encouraging businesses to invest in clean energy solutions, including battery storage, to meet their environmental goals.

UK Commercial and Industrial Battery Storage Market Trends

The market in the UK is growing rapidly, driven by rising energy costs and the increasing adoption of renewable energy. Government initiatives supporting energy storage and enhancing grid flexibility are further accelerating adoption. The expansion of commercial solar installations is creating greater demand for integrated solutions that include battery storage, allowing businesses to store excess energy and manage consumption more effectively.

Additionally, participation in grid services and demand response programs is opening up new revenue streams for commercial and industrial users. The market's growth is also being fueled by advancements in battery technology and energy management software, which are improving the efficiency, reliability, and cost-effectiveness of storage systems.

Who are the Major Players in the Global Commercial and Industrial Battery Storage Market?

The major players in the commercial and industrial battery storage market include Tesla Inc., LG Energy Solution, Samsung SDI Co., Ltd., BYD Company Ltd., Fluence Energy, Inc., ABB Ltd., Panasonic Corporation, Siemens AG, Hitachi Energy, Schneider Electric SE, EnerSys, General Electric Company, Sungrow Power Supply, NEC Corporation / NEC Energy Solutions, and Saft Groupe S.A.

Recent Developments

- In June 2025, Tesla stated that it would have the first grid-scale battery energy storage station in China, consisting of Megapack batteries, in Shanghai. It is planned as a 4 billion yuan (556.8 million dollars) project with China Kangfu International Leasing Co. and the Shanghai local government that will increase the Tesla presence on the Chinese energy infrastructure market. (Source:https://www.reuters.com)

- In December 2024, Stryten Energy LLC announced that its subsidiary, Stryten Critical E-Storage LLC, was joining Largo Clean Energy Corp. to establish Storion Energy, LLC. The new venture aims at facilitating a domestic, cost-effective supply of electrolytes to vanadium redox flow batteries in long-duration energy storage. (Source:https://www.stryten.com)

- In November 2024, Robin Zeng, founder of CATL, said it would change the company to a company providing green-energy solutions instead of a battery manufacturer. The plan will play a major role in cutting down the development expenses of electric vehicles and transforming the economics of the industry. (Source:https://www.reuters.com)

Segments Covered in the Report

By Battery Type

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Sodium-Sulfur Batteries

- Flow Batteries

- Nickel-Based Batteries

By Capacity Range

- Below 100 kWh

- 100 kWh – 1 MWh

- 1 MWh – 10 MWh

- Above 10 MWh

By Application

- Peak Shaving & Demand Charge Management

- Backup Power & Resilience

- Renewable Energy Integration

- Energy Arbitrage

- Power Quality & Voltage Support

By End-Use Sector

- Commercial Buildings (Offices, Retail, Hospitality)

- Industrial Facilities (Manufacturing, Processing Plants)

- Data Centers

- Healthcare Facilities

- Educational & Institutional Campuses

- Logistics & Warehousing

By Power Rating

- Below 50 kW

- 50–250 kW

- 250 kW – 1 MW

- Above 1 MW

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting