Industrial PC Market Size and Forecast 2025 to 2034

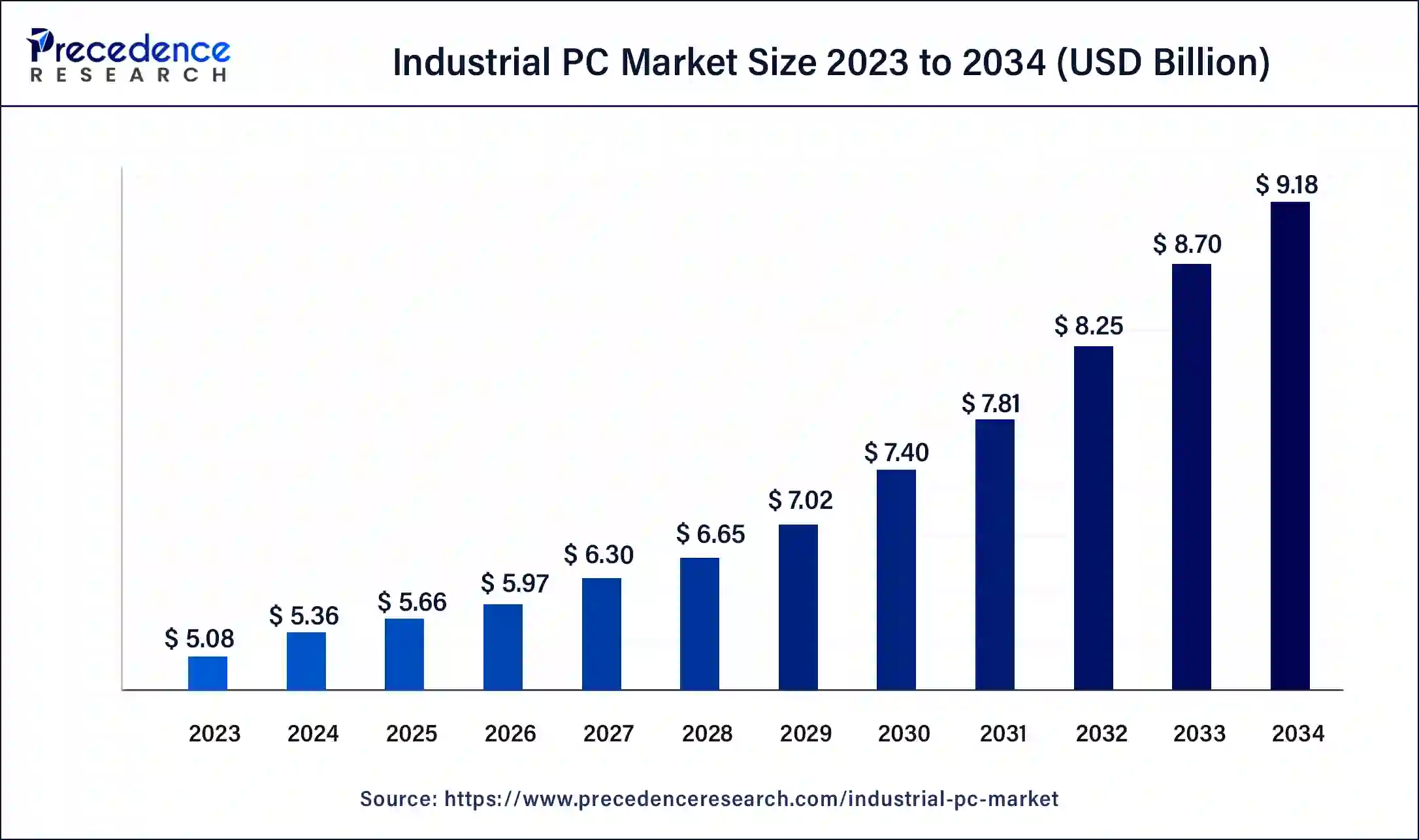

The global industrial PC market size was estimated at USD 5.36 billion in 2024 and is predicted to increase from USD 5.66 billion in 2025 to approximately USD 9.18 billion by 2034, expanding at a CAGR of 5.53% from 2025 to 2034. The market growth is attributed to the growing demand for IPCs with high processing capabilities and extensive memory

Industrial PC Market Key Takeaways

- In terms of revenue, the global industrial PC market was valued at USD 5.36 billion in 2024.

- It is projected to reach USD 9.18billion by 2034.

- The market is expected to grow at a CAGR of 5.53% from 2025 to 2034.

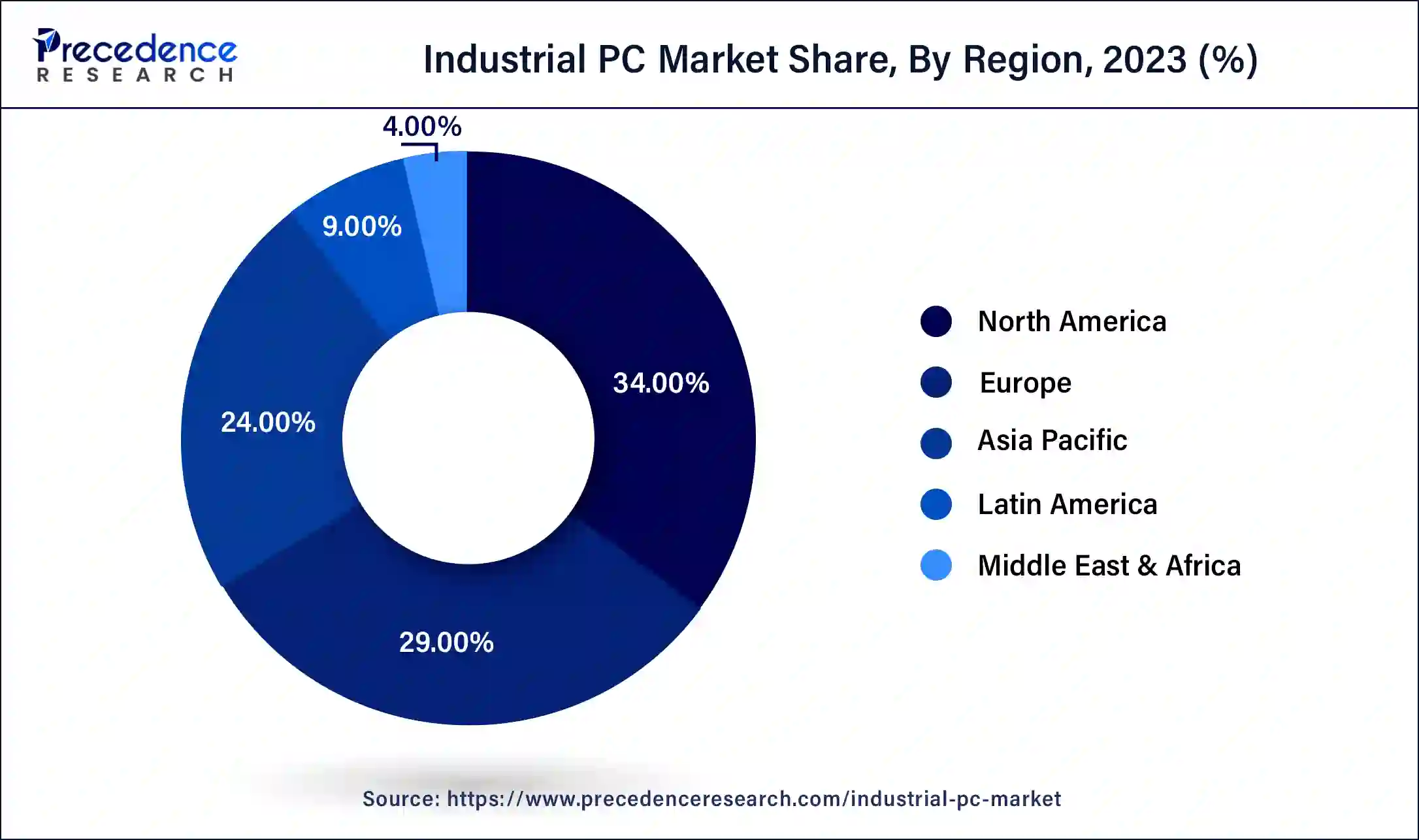

- North America dominated the industrial PC market with the biggest market share of 34% in 2024.

- Asia Pacific is expected to grow with the fastest CAGR in the market during the forecast period.

- By type, the panel IPC dominated the global market in 2024.

- By type, the embedded IPC segment is projected to grow rapidly in the market in the future years.

- By specification, the data storage medium segment held the largest share of the market in 2024.

- By specification, the maximum RAM capacity segment is projected to expand significantly in the market in the coming years.

- By sales channel, the direct sales segment dominated the market in 2024.

- By sales channel, the indirect sales segment is projected to grow significantly in the market in the coming years.

- By end-user industries, the process industrial segment held the largest share of the market in 20234.

- By end-user industries, the discrete industrial segment is projected to grow rapidly in the market in the future years.

U.S. Industrial PC Market Size and Growth 2025 to 2034

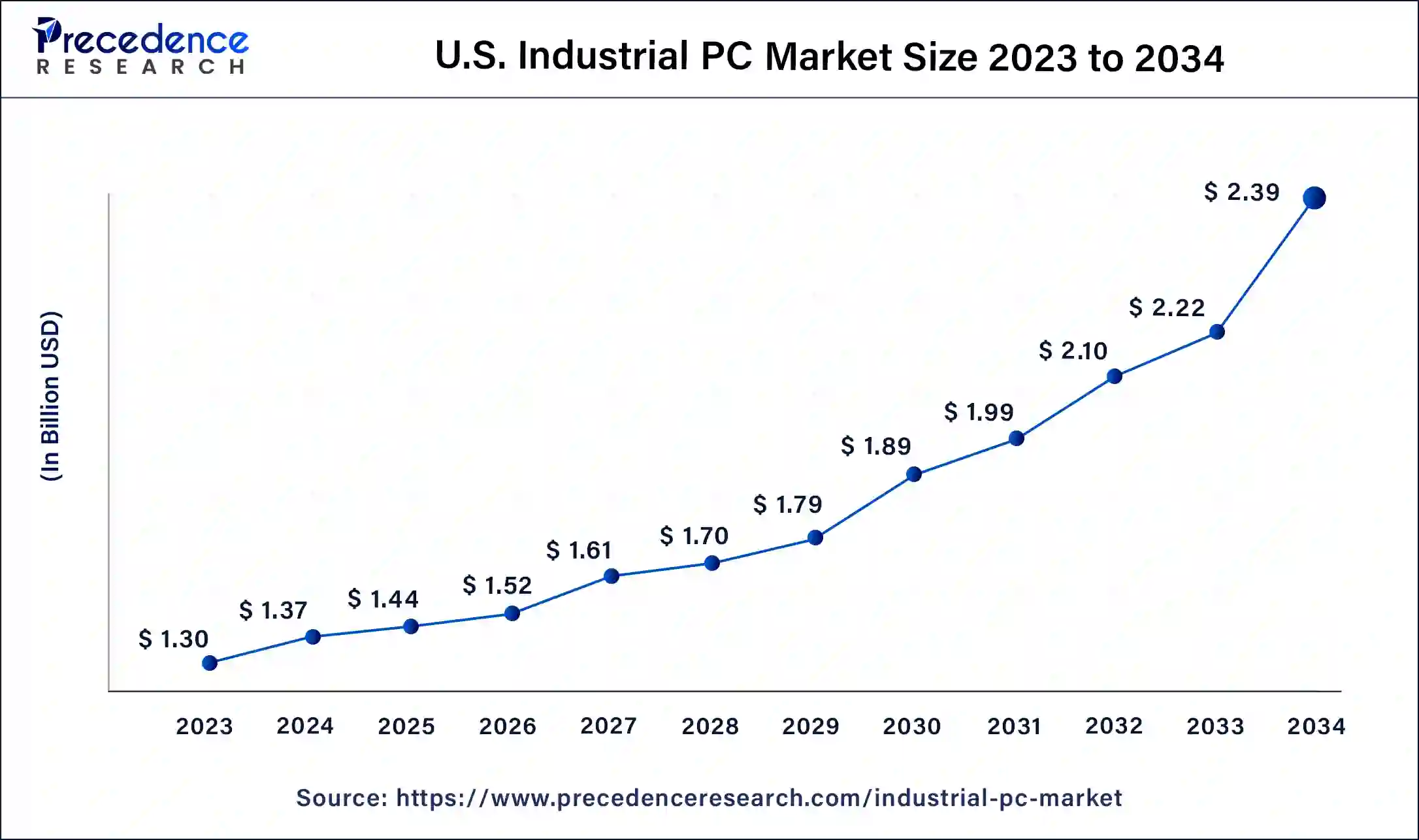

The U.S. industrial PC market size was exhibited at USD 1.37 billion in 2024 and is projected to be worth around USD 2.39 billion by 2034, poised to grow at a CAGR of 5.72% from 2025 to 2034.

North America dominated the industrial PC market in 2024 due to the well-established industry landscape and relentless incorporation of innovative technologies. Prospective buyers are drawn from several industries, including the energy, manufacturing, and aeronautics industries, which utilize industrial PCs for various purposes. Industries are incorporating automation and digital solutions into their operations, which creates demand for industrial PC solutions that are capable of handling operations efficiently. Additionally, the major industrial PC manufacturers and technology innovators present in this region boost the market.

Asia Pacific is expected to grow with the fastest CAGR in the industrial PC market during the forecast period, owing to the high industrialization and increased expenditure on infrastructure in APAC countries. The growing manufacturing industry, especially in this region such as China, India, and Japan, creates demand for industrial PCs. The growing progress of smart manufacturing solutions, automation, and digital transformation in industries present in Asia Pacific further fuels the market.

Market Overview

Industrial PCs (IPCs) are specifically built as durable computers meant to work in extreme conditions for industrial settings, such as industrial plants, construction sites, and open spaces. These systems were developed to be dust-proof, moistureproof, and impervious to high and low temperatures. They are built to operate over a broad temperature spectrum and support industrial protocols.

Industrial PCs are used for automation, monitoring, and control. Their higher computing capabilities support higher levels of automation and integration with internet of things (IoT) to allow for real-time data processing. The growing need for complicated automation solutions for efficient and reliable computing platforms to perform tasks that are intricate and massive in terms of volume boosts the industrial PC market.

Impact of Artificial Intelligence on the Industrial PC Market

In the industrial PC market, employers integrate artificial intelligence into their affairs to reduce some operations cycle time and avoid constant interruptions. This use of AI technologies enables the analysis of data in real-time with the goal of optimizing the use of resources without waste. Businesses are in a position to obtain high productivity levels, and at the same time, lower operating expenses have to be incurred. Furthermore, AI reduces the chances of interruption of operations by enabling it to anticipate equipment failures before their occurrence.

Industrial PC Market Growth Factors

- The integration of Industrial IoT (IIoT) technologies drives the demand for industrial PCs capable of handling large volumes of data and facilitating seamless connectivity between devices.

- The global expansion of manufacturing and production facilities, particularly in developing regions, creates a growing need for reliable IPCs.

- The rise of smart city initiatives, which incorporate advanced technologies for urban management, boosts the demand for the industrial PC market in infrastructure projects.

- Stricter safety and regulatory standards in industries such as pharmaceuticals, chemicals, and food processing drive the adoption of the industrial PC market that offers precise control and monitoring capabilities.

- The growing need for high-performance computing in applications such as real-time data processing, simulation, and complex analytics fuels the demand for the industrial PC market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.18 Billion |

| Market Size in 2025 | USD 5.66 Billion |

| Market Size in 2024 | USD 5.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Specification, Sales Channel, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Adoption of IoT and Industry 4.0

Increasing adoption of the Internet of Things (IoT) and Industry 4.0 technologies is anticipated to boost demand for the industrial PC market. Smart technology is embedded in industries to enable the constant exchange of information between equipment, sensors, and applications, which in turn requires robust data processing systems.

Industrial PCs, together with rich processing power and a greater number of network connection interfaces, provide tremendous support for real-time data analysis, monitoring, and maintenance. This creates demand for Industry 4.0 technology, which accentuates the need for such high-performance computing systems. Additionally, the viability of industrial PCs in supporting IoT solutions makes it possible for businesses to develop their IoT features incrementally, thus boosting the industrial PC market in the coming years.

- According to a report published by the National Association of Software and Service Companies, Industry 4.0 is at an inflection point in Indian manufacturing. It is projected that by 2025, more than two-thirds of Indian manufacturers will embrace digital transformation. This is expected to contribute to the goal of raising India's manufacturing GDP to 25%.

Growing demand for automation

Growing demand for automation across various industries is projected to drive the industrial PC market significantly. Businesses incorporate fully automated systems to increase the overall efficiency of a given company or corporation, ultimately lowering operational costs and increasing quality. This shift toward automation creates a need for computing systems that are strong and stable enough to perform highly complicated processes in real time.

Industrial PCs work as controllers of machinery, supervisors of production lines, and maintainers of precision in manufacturing. Furthermore, flexibility in choice and customization capabilities make IPCs adapt to different demands of the selected sectors, including the automobile, food, and beverage industries. Furthermore, the increase in the adoption of smart manufacturing systems fuels the growing need for computing hardware, thereby driving the industrial PC market.

Restraint

Hamper high initial costs

High initial costs are anticipated to hinder the growth of the industrial PC market. Due to the enhanced hardware features and high-tech characteristics that form the basis of an industrial PC, it features much higher initial costs than a normal PC. The costs, including those of training, software, hardware, and licenses, are relatively high, especially for small and medium-sized enterprises that run on small budgets. Furthermore, integrating the integrated PCs into the existing systems costs is costly and further hampers the market in the coming years.

Opportunity

High demand for smart manufacturing

High demand for smart manufacturing is expected to create favorable opportunities for the players competing in the industrial PC market. Due to high computation power and real-time data analysis, industrial PCs have become a critical component in the development of smart manufacturing techniques. Key players require industrial PCs as part of solutions for increasing production and decreasing costs.

Recent trends are facilitating the industrial PC market expansion, particularly in developing countries where Industry has a high demand for computing capacities, for which industrial PCs are suitable. The requirements for flexible and easily expandible computing systems in the developing production processes also support the use of industrial PCs. Additionally, the rise of next-generation technologies for smart manufacturing further fuels the demand for industrial PCs.

Type Insights

The panel IPC dominated the global industrial PC market in 2024 due to their effective design, which allowed the display and computing units to be in one housing unit. They are ideal for environments that require space-saving products. Automotive, manufacturing, and energy are some of the industries that incorporate panel IPCs due to their ergonomic front end and modularity. Furthermore, growing innovation in these types of solutions further contributes to boosting the segment in the coming years.

- In June 2024, Delta Electronics, Inc., a leading electronic solutions manufacturing company, announced the launch of its latest new series of Industrial Panel PCs. These PCs are designed to boost efficiency and reliability in critical operations across various industries. The PPCs are available in 12-inch, 15-inch, and 19-inch models. They offer multi-point capacitive touch screens, robust processor options, and a fanless design, setting a new standard for performance in industrial settings. They are suitable for various applications, such as woodworking, food and beverage, and automotive.

The embedded IPC segment is projected to grow rapidly in the industrial PC market in the future years owing to its small size and integrated characteristics. These IPCs are considered in applications where the size is a problem and functional aspects are essential. Transportation, healthcare, and the automation industry are expected to be major contributors to the growth of this segment as they require robust and integrated computing solutions. Embedded IPCs offer high reliability and the flexibility of being customized with specific attributes of different industrial needs. Additionally, the increasing trend of IoT and Industry 4 creates a growing need for small-sized, powerful embedded IPC.

Specification Insights

The data storage medium segment held the largest share of the industrial PC market in 2024 due to their higher performance and steadiness than those of HDDs. Increased rates of access and data transfer rates in the industry led to the use of SSDs for their much lower latency and higher rates of read and write. The manufacturing, transportation, and energy industries especially use SSDs. Additionally, SSDs are energy efficient and produce low heat, which makes them durable and meets their demand.

The maximum RAM capacity segment is projected to expand significantly in the industrial PC market in the coming years owing to the growing demands of industrial applications for high performance. Industries are embracing the use of more sophisticated technologies, such as machine learning, artificial intelligence, and real-time data analysis, which require industrial PCs with bigger RAM capacity. These applications require large amounts of memory to work on large amounts of data at high speeds.

The increase in the use of automation and smart manufacturing also requires industrial PCs with large RAM for efficient handling of these tasks. Additionally, the demand for higher RAM capacity is growing rapidly in industries, including healthcare, automotive, and aerospace industries, which are seeking accuracy and speed as assets of these industries.

Sales Channel Insights

The direct sales segment dominated the industrial PC market in 2024. Direct sales help to develop stronger ties with customers and help producers receive often-needed insightful feedback. This is due to the trend of customization and accurate specification needed in industrial uses that have made organizations buy high-end and different industrial PCs directly. Furthermore, direct sales channels offer custom solutions and a lot of hand-holding, which further boosts the segment.

The indirect sales segment is projected to grow significantly in the industrial PC market in the coming years owing to the growing popularity of multichannel selling and the growing global markets. These sales include all the distributors, resellers, and value-added partners who offer services such as installation, maintenance, and technical support. Moreover, the increasing system sophistication of industrial PC systems and the demand for integrated services are also drivers to encompass indirect channels, thus fuelling the market.

End-user Industries Insights

The process industrial segment held the largest share of the industrial PC market in 2024 due to the importance of operational and highly efficient computing systems in energy generation and control. Industrial PCs are used mainly to control and monitor power generation processes in the generation, transmission, and distribution companies.

Increased automation and ICT applications for the optimization of energy distribution and the improvement of grid management create demand for industrial PCs in industrial processes. Additionally, technological advancements in the energy and power industry, especially concerning renewable energy and smart grid technology, further propel the demand for industrial PCs.

The discrete industrial segment is projected to grow rapidly in the industrial PC market in the future years, owing to the rising demand for advanced and reliable industrial PCs in the semiconductor and electronics sector. The rising requirement for precision in operations, data processing, and speed and automation in semiconductor fabrication processes serve to amplify the demand for advanced industrial PCs. These PCs have the computational capacity needed for controlling complex line operations, processes, and quality assurance, as well as tracking other essential variables in real-time. Furthermore, the trend of IoT, artificial intelligence, and other complex electronics applications created a need for high-performance computing, including industrial PCs.

Industrial PC Markets Companies

- Omron Corporation

- Siemens AG

- Kontron AG

- Mitsubishi Electric Corporation

- Advantech Co., Ltd.

- Rockwell Automation

- Beckhoff Automation GMBH & Co.

Recent Developments

- In February 2024, Emerson Electric Co. announced the new PACSystems™ Compact Industrial PC (IPC). This rugged industrial computer is designed to handle a wide range of machine and discrete part manufacturing automation applications. The new solution is built to serve manufacturing sites and OEM machine builders who need a ruggedized, compact, durable IPC to cost-effectively support their Industrial Internet of Things (IIoT) and other digital transformation initiatives.

- In April 2024, industrial computer hardware manufacturer and solution provider OnLogic unveiled their new Tacton Series of rugged panel PCs and industrial touchscreen displays. The Tacton Series is designed to empower innovators with the tools they need for advanced automation, industrial control, and data visualization.

Segments Covered in the Report

By Type

- Rack Mount IPC

- Panel IPC

- DIN Rail IPC

- Embedded IPC

By Specification

- Maximum RAM Capacity

- Data Storage Medium

- Display Type

By Sales Channel

- Indirect Sales

- Direct Sales

By End-user

- Discrete Industrial

- Process Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting