The biopharmaceutical industry is witnessing a structural shift in R&D partnerships, where suppliers share risk, expertise, and strategic vision transforming the innovation process into an integrated, knowledge-driven ecosystem.

The biopharmaceutical industry is undergoing a paradigm reconfiguration in how it conceptualizes and conducts R&D. At the heart of this transformation lies the rapid evolution of partnerships between pharmaceutical innovators and their R&D suppliers partnerships that have graduated for beyond transactional procurement into multi-dimensional ecosystems of shared expertise, risk, and strategic foresight. This article examines the accelerating sophistication of these alliances, delineates the archetypes of modern partnership models, and illuminates a fascinating intellectual lineage connecting the structural elegance of Paninian linguistics to the chemical architecture underpinning Mendeleev’s Periodic Table. The synthesis presented herein argues that today’s most successful pharma supplier collaborations are not merely operational necessities but intellectual synapses that collectively catalyze the next epoch of biopharmaceutical advancement.

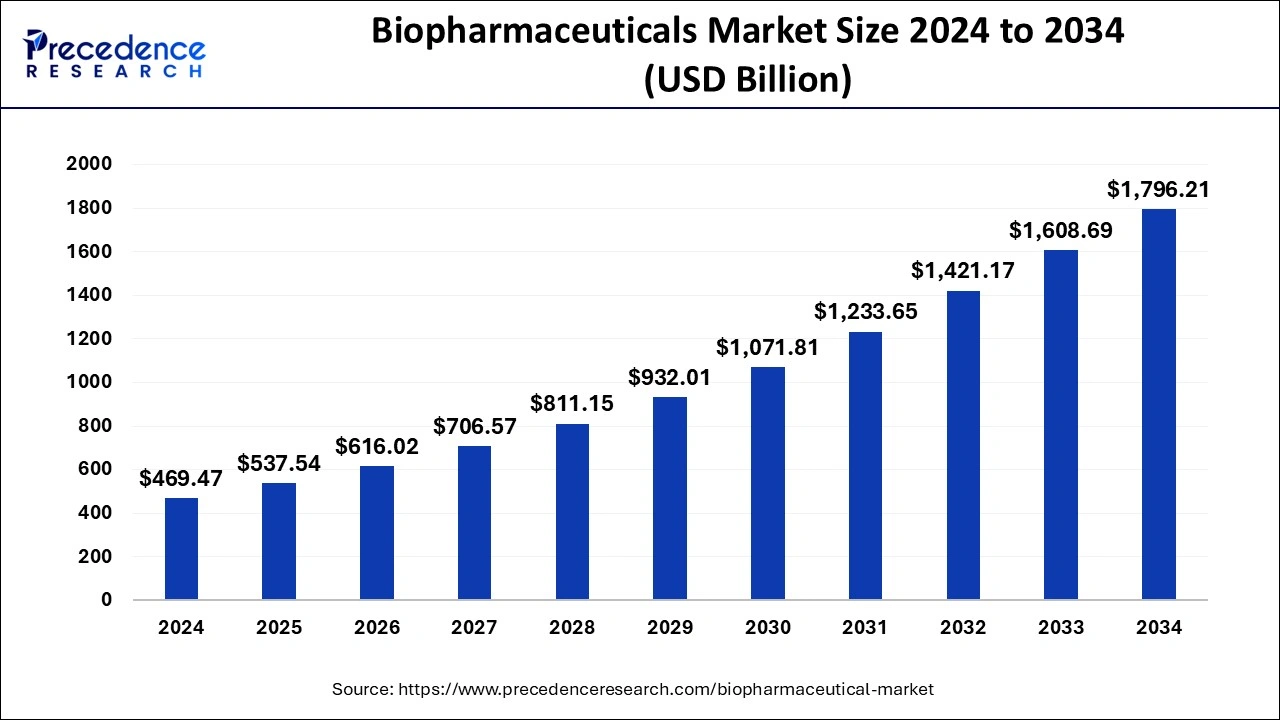

What is the Biopharmaceutical Market Size?

The global biopharmaceuticals market size was estimated at USD 469.47 billion in 2024 and is anticipated to reach around USD 1796.21 billion by 2034, expanding at a CAGR of 14.36% from 2025 to 2034.

What Industry Context and Strategic Imperatives say?

That the biopharmaceutical industry is undergoing a structural recalibration. Pipeline diversification, compressed development timelines, digital integration, and modality-specific expertise have expanded the strategic importance of suppliers in the R&D value chain. Suppliers in the R&D value chain. our experts analyzed that suppliers today contribute to:

- Complex analytical method development.

- Advanced materials and consumables for biologics.

- Data-driven predictive modelling for scale-up.

- Regulatory-ready documentation and validation systems.

- Sustainable and cost-efficient bioprocessing frameworks.

Pharma R&D organizations, recognising the operational risks of fragmented capabilities, now view suppliers as strategic co-innovators rather than peripheral vendors. This shift marks the convergence of two parallel pressures: scientific complexity and market competitiveness. Pharma organisations now rely on suppliers not as peripheral providers but as epistemic allies, co-curators of discovery platforms, co-engineers of processes, and co-architects of translation strategies. This relational metamorphosis is as conceptual as it is operational: it reframes innovation as a shared pilgrimage rather than a solitary conquest.

Evolving Pharma- Supplier Relationships: A Transformational Narrative

Precedence analysis suggests that the supplier relationship once lived in the shadow of procurement, governed by cost containment and standard fulfilment metrics. Today, it occupies a central strategic horizon, driven by breakthroughs that demand unprecedented collaboration.

- Cultural Refabrication: both parties increasingly adopt a shared lexicon around quality, reproducibility, risk management, and regulatory alignment. The cultural synchrony dissolve communication frictions and enables seamless scientific dialogue.

- Interdisciplinary Confluence: Supplier expertise in analytics, bioinformatics, synthetic biology, and scalable process engineering merges with pharma’s clinical insight and therapeutic vision, producing a holistic innovation engine.

- Speed as a Collective Imperative: Accelerated timelines for IND submissions, platform technology adoption, and process optimization have compelled teams to collaborate synchronously instead of sequentially.

- Data-Driven Transparency: Digital ecosystems enable real-time exchange of experimental metadata, batch information, assay parameters, and performance trends, thus establishing a trust-rich environment.

- Co-responsibility for Quality and Compliance: Suppliers contribute not just materials but validation packages, audit readiness, regulatory fluency, and traceability frameworks, helping pharma navigate compliance complexities with greater ease.

How are Partnership Archetypes the Emerging Operating Model?

As biopharmaceutical R&D becomes increasingly multimodal and technologically intensive, supplier relationships are converging into a new operating model built around clearly defined partnership archetypes. Instead of treating suppliers as a monolithic group, pharma organizations are segmenting them based on capability depth, strategic relevance, and co-innovation potential. This archetype-driven model shifts the ecosystem from transactional procurement to a structured capability network where each supplier plays a differentiated, strategically aligned role. By stratifying partnerships, companies can allocate governance, investment, and collaboration resources more deliberately focusing transactional efficiency where appropriate while cultivating deep integration with suppliers who influence modality viability, analytical robustness, and development scalability. These archetypes collectively form the backbone of a more resilient, agile, and innovation-ready R&D environment.

The implications for industry leaders are nothing short of groundbreaking! Worldwide has dramatically broadened its horizons by diving into the investment of R&D for the biopharmaceutical industry. After extensive analysis and thorough research, our experts are thrilled to present this compelling diagram, showcasing the exciting outputs that lie ahead.

Both Europe and the USA are global leaders in pharmaceutical research and development (R&D). The pharmaceutical industry in these regions is characterized by substantial investment in innovation, supported by robust regulatory frameworks, advanced scientific infrastructure, and a highly skilled workforce. However, there are notable differences in how research activities are organized and executed between the two.

U.S. pharmaceutical companies tend to adopt a more aggressive and competitive approach to R&D, focusing on rapid innovation cycles. In contrast, European enterprises often prioritize thorough regulatory compliance and collaborative R&D frameworks, which may foster a more cautious pace.

Percentage of Supplier Relationships: In the USA, supplier relationships constitute approximately 70% of R&D activities, while in Europe, this percentage is around 60%. The higher engagement in the USA can be attributed to the aggressive drive for innovation and the need for rapid development cycle.

The pharma research activities in Europe and the USA illustrate a dual narrative: both are rich in innovation and collaboration, yet they also reflect differing cultural, regulatory, and operational dynamics. As the industry progresses, the trend of viewing suppliers as co-innovators is gaining traction on both sides of the Atlantic, fostering a collaborative ecosystem that is essential for addressing the complexities of modern drug development. Adjustments in funding, regulatory frameworks, and collaborative approaches will play critical roles in shaping the future landscape of pharmaceutical R&D in both regions.

How the Shiva Sutras Inspired Structural Thinking in Chemistry and Biopharmacology

Although separated by millennia, Panini’s Shiva Sutras and modern chemical sciences share a profound intellectual kinship: both distil vast complexity into elegant, predictive structure. The Sutras, with their astonishing economy of expression and taxonomic precision, demonstrate a philosophical architecture in which meaning emerges from intrinsic properties and relational patterns. Mendeleev’s Periodic Table reflects this same cognitive discipline an insistence that order is not imposed but revealed.

The resonance of this structural ethos permeates today’s biopharmaceutical industry. Modern drug discovery, with its dependence on structure activity relationships, molecular classification algorithms, high-throughput screening, and machine-learning-driven property prediction, thrives on the same principles of abstraction, pattern recognition, and hierarchical organization that Panini perfected.

The logic of the Sutras grouping based on fundamental attributes, encoding transformation rules, and enabling predictive insight echoes in everything from computational chemistry pipelines to biologics engineering, synthetic route optimization, and the modularity of digital R&D platforms. In effect, the ancient linguistic framework has become an intellectual ancestor to the modern scientific operating system: enabling chemists, pharmacologists, and data scientists to navigate molecular universes with the same clarity and foresight that Panini once brought to language.

Some additional points that our experts have found out that:

- The Shiva Sutras’ principle of compression without loss of meaning parallels how modern biopharma compresses vast genomic, proteomic, and chemical datasets into predictive models.

- Their rule-based transformational logic informs how reaction pathways, metabolic maps, and molecular modifications are computationally simulated.

- Their hierarchical grouping mirrors how the industry clusters modalities, targets, scaffolds, and mechanisms of action.

- Their predictive potency like forecasting phonetic transitions aligns with AI-driven forecasting of molecule stability, ADME properties, and therapeutic behaviour.

- Their systemic elegance is reflected in today’s push toward minimal-reactant synthesis, green chemistry, and modular process design.

| Mendeleev’s Given Name | Morden Name |

| Eka-aluminum | Gallium |

| Eka-Boron | Scandium |

| Eka-Silicon | Germanium |

| Tri-manganese | Rhenium |

| Devi-trillium | Polonium |

The table of elements established by Mendeleev has not only shaped our understanding of chemistry but has also profoundly influenced the Research and Development practices within the biopharmaceutical industry. This intellectual lineage, akin to the principles of Shiva beejas, showcases a historical continuity in the evolution of scientific inquiry, leading us to sophisticated methodologies that underpin modern drug discovery and development. From the time of Dhanvantari, the ancient deity of Ayurvedic medicine, to the cutting-edge advancements in biophysics today, this journey reflects a relentless pursuit of knowledge and innovation. The practices rooted in these foundational elements continue to modernize, driving the creation of more effective and safer medications.

As the industry embraces these evolved methodologies, we witness a transformation from antiquated models to holistic R&D strategies. This global shift fosters an environment where collaborative efforts and advanced technological integration enhance our ability to deliver innovative therapies. Leaders in the field advocate for this integrated approach, asserting that the adoption of these practices worldwide is crucial for advancing pharmaceutical care and meeting the ever-evolving needs of patients.

How are Revenue Sources Funding The R&D in Pharma?

In the pharmaceutical sector, revenues have historically served as a primary source for financing research and development (R&D) in established firms with marketable brand-name drugs. These drugs tend to yield substantial cash flows due to their relatively low manufacturing and distribution costs compared to their sales revenues. Consequently, established companies often prefer utilizing current revenues to fund R&D rather than relying on external financing options such as venture capital. However, the proportion of R&D financed directly through internal revenues has diminished in recent years, largely because a growing segment of R&D is being undertaken by research-centric companies with limited or non-existent product portfolios. Over the last decade, smaller and emerging pharmaceutical firms have increasingly contributed to the development of new drugs; however, these firms typically have low revenue streams and, in some cases, none at all compelling them to seek external funding sources, particularly venture capital and strategic partnerships with larger pharmaceutical entities.

While venture capital constitutes a modest fraction of total R&D expenditures within the pharmaceutical industry, its impact is significantly more pronounced among smaller firms when compared to their larger counterparts. Additionally, drug development is also conducted within academic research settings. Universities often receive grants from the National Institutes of Health (NIH) to pursue basic biomedical research but may also engage in collaborations with private pharmaceutical companies, which can fund applied research aimed at drug development. In these partnerships, the funding for R&D often derives primarily from the revenues of established pharmaceutical firms, reinforcing their role as key players in advancing drug discovery.

The Phase in R&D

Preclinical Phase: In the drug development landscape, preclinical research represents a substantial investment, albeit shorter in duration compared to clinical trials. Pharmaceutical companies often engage in the simultaneous development of multiple drug candidates during this phase, a majority of which do not advance to, or complete, clinical trials. An analysis leveraging data from major pharmaceutical firms reveals that preclinical expenditures typically account for an average of 31 percent of a company's overall drug R&D budget, translating to millions allocated for each approved new drug.

Clinical Trials Phase: The financial outlay for clinical trials significantly surpasses that of the preclinical stage due to the larger scale and extended duration of these studies. Clinical trials are categorized into several phases:

- Phase I Trials: Known as human-safety trials, these initial studies evaluate the safety profile of a potential drug at various dosage levels, typically involving a small cohort of healthy volunteers. In cases involving compounds with considerable expected toxicity, patients diagnosed with the targeted condition may be included.

- Phase II Trials: This phase expands the participant pool, focusing exclusively on individuals with the targeted medical condition. The primary aim is to assess the drug's biological activity and to systematically identify and characterize any adverse effects.

- Phase III Trials: These trials are considerably larger in scale and aim to rigorously evaluate the clinical efficacy of the drug. Completion can span several years, with the required sample size proportionate to the drug's expected therapeutic effect compared to placebo; notably, smaller expected effects demand larger patient cohorts to differentiate genuine treatment outcomes from random variations in results.

- Phase IV Trials: Also referred to as pharmacovigilance trials, these studies are conducted post-market approval to monitor long-term safety and efficacy. They are essential for identifying side effects that were not evident in earlier trials and for assessing the drug's effectiveness over extended periods.

In general, only those candidates complete the first three phases qualify for FDA review and potential approval. There are instances where the FDA may approve drugs without a completed phase III trial. Furthermore, phase IV trials may be mandated by the FDA to assess adverse reactions that may surface when the drug is utilized in broader populations. Pharmaceutical companies might also voluntarily conduct phase IV trials to demonstrate the comparative superiority of their products against existing therapies for marketing purposes.

How the R&D Tax Advantage is Rebuilding the Economics of Pharma Innovation?

In the pharmaceutical sector where discovery timelines are long, risk profiles are formidable, and capital intensity is unparalleled tax incentives for R&D serve as a vital accelerant of innovation. These benefits operate not merely as fiscal relief but as strategic enablers, allowing companies to pursue ambitious scientific programs that might otherwise be economically prohibitive. By reducing the effective cost of experimentation, governments encourage organisations to expand early-stage research, invest in emerging therapeutic modalities, and cultivate deeper technological capabilities. The outcome is a virtuous cycle: enhanced competitiveness for the industry, enriched scientific ecosystems for the nation, and faster societal access to life-changing therapies.

To capture this value, companies will need to do the R&D, tax incentives are profoundly catalytic. They free up capital for exploratory pipelines, make sophisticated analytical platforms more financially viable, and reduce the burden associated with scaling biologics and advanced therapies. These incentives also elevate collaboration incentives, encouraging partnerships with universities, CROs, CDMOs, and deep-tech suppliers by lowering the cost barrier to joint development. For companies operating global R&D hubs, such benefits help optimise network design, ensuring research activities are in jurisdictions that reward long-term scientific investment.

The Architecture of Alliance: What Makes R&D partnership Flourish

Pharmaceutical R&D thrives in environments where complexity is managed through coordination, clarity, and cohesive orchestration. Successful partnerships require deliberate design an operating philosophy that integrates scientific depth with organizational intelligence. The following enablers define the strategic underpinnings of high-performance collaborations.

- Shared Scientific Vision and Intellectual Alignment:

At the heart of every successful R&D partnership lies an alignment of scientific purpose. Suppliers who understand the therapeutic intent, molecular modality, and anticipated development challenges are better positioned to offer informed recommendations, design robust assays, and anticipate downstream impediments.

- Shared vocabulary and scientific rationale.

- Alignements on risk tolerance and quality expectations

- Transparent exchange of platform evolution plans.

This intellectual compatibility ensures both entities operate from the same epistemic foundation, allowing innovation to progress with greater coherence. Integrated Technical Competence: Suppliers increasingly function as nodes of specialised expertise whether in chromatography, lipid nanoparticle formulation, bioinformatic analytics, or controlled-environment instrumentation. Their expertise bolsters R&D throughput, troubleshooting speed, and experimental reproducibility.

Key indicators of strong technical integration include:

- Supplier scientists embedded into R&D teams.

- Co-development of analytical and bioprocess methods.

- Joint QbD (Quality-by-Design) frameworks and assay robustness plans.

- Early manufacturability assessments for new modalities.

Technical intimacy enables rapid iteration cycles, reduces operational misalignment, and strengthens scientific decision pathways.

- Codified Governance and Role Clarity: High-performing partnerships do not rely on informal goodwill alone. They establish crisp governance mechanisms that delineate expectations, escalation pathways, and accountability structures.

Elements of mature governance include:

- Quarterly Business Reviews evaluating performance, risks, and forward workflows.

- Steering committees that allocate resources, decide co-investments, and arbitrate priorities.

- Tiered service-level agreements calibrated to supplier archetypes.

- Joint scorecards tracking cycle time, quality, and innovation contributions.

Such codified systems ensure partnership stability even amid high scientific volatility.

- Digital Transparency and Data Interoperability: Modern R&D ecosystems depend on digital coherence. Supplier relationships flourish when there is seamless, secure, and real-time information flow between entities.

This includes:

- Digital dashboards integrated with inventory, QC metrics, batch data, and instrument telemetry.

- Cloud-based platforms for method updates and experimental documentation.

- Predictive analytics for reagent demand, instrument maintenance, and supply continuity.

Data interoperability eliminates blind spots, enhances traceability, and improves regulatory readiness.

- Cultural Symbiosis and Trust: Trust is the invisible currency that underwrites complex scientific collaboration. Cultural alignment ensures that both parties converge on values such as quality rigor, intellectual honesty, scientific discipline, and operational foresight. a trust-centric culture yields:

- Faster cycle-time approvals.

- Openness to sharing experimental failures and challenges.

- A willingness to co-own risks and co-develop solutions.

It transforms the partnership from transactional to transformational.

- Mutual Investment in Capability Building: Partnership maturity is accelerated when suppliers and pharma jointly invest in the capabilities required for long-term innovation. examples include Co-funded pilot labs, dedicated innovation cells, Joint training academies and shared digital twins or process-simulation tools. These investments elevate both partners’ sophistication and align incentives around sustained success.

Procurement: The Silent Engine Behind Partnership Excellence

Procurement has quietly ascended from a transactional cost arbiter to the silent engine of partnership excellence in biopharmaceutical R&D an architect of scientific enablement that seamlessly integrates commercial foresight with technical acuity. By shifting from conventional price-led segmentation to capability-centric category intelligence mapping, analytical reagents, omics instrumentation, RNA materials, vector consumables, and cell culture systems procurement now distinguishes suppliers not by unit cost but by their strategic indispensability to scientific progress.

Its adoption of total-cost-of-ownership frameworks allows R&D organizations to account for hidden burdens such as reagent variability, delayed shipments, instrument downtime, and reproducibility failures, ensuring supplier performance is evaluated through the lens of scientific reliability rather than mere commercial arithmetic. Simultaneously, procurement orchestrates resilience through multi-sourcing models, geographically diverse supply nodes, contingency inventories, and risk-buffering mechanisms that guard against disruptions capable of derailing experimental pipelines or regulatory timelines.

The emergence of digital procurement ecosystems, automated demand-linked PO systems, AI-based forecasting engines, predictive dashboards, and analytics for degradation risks transforms procurement from a reactive custodian to a predictive strategist. Looking ahead, pharmaceutical R&D partnerships will evolve into federated innovation ecosystems defined by AI-native collaboration models, modality-specific supplier clusters, jointly owned digital twins simulating reaction kinetics and scale-up constraints, and a shared commitment to sustainability through greener solvents, biodegradable materials, energy-efficient instrumentation, and circular reagent economies.

As co-investment in automation platforms, analytics engines, and collaborative assay hubs becomes the norm, suppliers and innovators will operate less as separate entities and more as co-architects of a unified scientific continuum. Ultimately, the future of pharmaceutical R&D will be built upon a symphony of shared intelligence where procurement conducts the harmony between capability, risk, transparency, and trust, and where partnerships become the very infrastructure of progress, enabling the industry to advance from molecule to medicine with unparalleled precision, coherence, and collective ingenuity.

Trust, Ethics, and Responsible Acceleration

In the rapidly evolving landscape of biopharmaceutical R&D, establishing trust and adhering to ethical standards are paramount for fostering effective collaborations between pharmaceutical companies and their suppliers. As partnerships become more integrated and collaborative, the ethical considerations surrounding data sharing, intellectual property, and regulatory compliance play a crucial role in ensuring the success of these alliances. Here are several key areas to consider regarding trust, ethics, and responsible accelerations in this context:

- Building Trust through Transparency: Open communication is essential in nurture trust among partners. Sharing data and insights transparently fosters an environment where all parties can collaborate effectively, leading to enhanced innovation and improved outcomes. The establishment of clear protocols for data sharing and usage ensures that all partners understand their responsibilities and rights regarding shared information.

- Ethical Data Management: With the prominence of data-driven approaches in R&D, ethical management of data, including patient information and research findings, is vital. Ensuring compliance with regulations such as GDPR and HIPAA not only protects individuals' privacy but also builds trust among stakeholders. Employing ethical frameworks for predictive modeling and analytics can mitigate the risk of bias and enhance the integrity of research results.

- Intellectual Property Considerations: Defining clear agreements regarding intellectual property rights in partnerships helps prevent disputes and builds confidence among collaborators. Respecting each other's contributions and acknowledging intellectual contributions are fundamental to sustaining long-term relationships.

- Regulatory Compliance as a Shared Responsibility: Both pharmaceutical companies and suppliers must actively engage in ensuring compliance with regulatory standards throughout the R&D process. This co-responsibility fosters a culture of quality and accountability, minimizing risks associated with non-compliance.

- Regular audits, shared quality metrics, and collaborative regulatory strategies enhance the integrated approach toward maintaining high standards.

- Sustainable Practices in R&D: Aligning R&D efforts with sustainable practices is not only an ethical imperative but also a strategic advantage. Developing eco-friendly processes and materials can enhance a company's reputation and commitment to corporate social responsibility. Partners should collectively identify opportunities for reducing environmental impact and promoting sustainable innovations, thereby contributing to a more responsible industry.

- Fostering a Culture of Ethical Collaboration: Encouraging a culture that prioritizes ethical decision-making and accountability among all partners is essential. Training programs and workshops focused on ethics in research can promote awareness and instill values that align with responsible practices. Celebrating ethical successes and recognizing teams that exemplify integrity can reinforce the importance of ethics in collaborative efforts.

as the biopharmaceutical industry accelerates towards a more integrated and innovative future, trust and ethical considerations will serve as the bedrock for successful partnerships. By prioritizing transparency, ethical data management, and shared responsibility, industry players can navigate the complexities of collaboration while fostering an environment ripe for breakthrough advancements. Emphasizing these principles will not only enhance the R&D process but also contribute to a more accountable and trustworthy biopharmaceutical landscape.

The path Forward: Meds and Suppliers Native Future

The future of the pharma R&D supplier–partnership market is poised for a profound metamorphosis, shaped by converging forces of scientific complexity, digital augmentation, regulatory evolution, and geopolitical reconfiguration. As therapeutic modalities proliferate from RNA platforms and precision biologics to cell therapies, gene editing constructs, and next-generation delivery systems, the supplier ecosystem will no longer function as a peripheral support scaffold but rather as a strategic co-creator of innovation.

Pharmaceutical companies will increasingly rely on suppliers not merely for materials or instrumentation but for deep scientific collaboration, shared analytical intelligence, and co-owned technological platforms that compress timelines and enhance predictive accuracy. This transition will be driven by the sheer complexity of modern R&D, where the interdependencies between chemistry, biology, computation, and manufacturing are too intricate for any single entity to master in isolation.

As such, the supplier pharma partnership paradigm will advance toward federated architectures, where workflows, digital twins, and data environments become interoperable across organizational boundaries. Jointly curated knowledge engines spanning structural biology, informatics, assay development, and manufacturability prediction will form a collective memory for the ecosystem, enabling all parties to move with greater coherence and speed. Suppliers with niche expertise in vector engineering, lipid nanoparticle formulation, advanced chromatography, omics instrumentation, and microfluidics will find their strategic value amplified, as their capabilities directly influence the viability of emerging therapeutic modalities. This will initiate a recalibration of market power, with high-capability suppliers gaining disproportionate influence in determining the pace and direction of pipeline innovation.

Digital transformation, long espoused but only partially realised, will finally achieve structural maturity in this market. Artificial intelligence will operate as the connective tissue enabling seamless, real-time data exchanges between pharma and suppliers. AI-driven forecasting will optimise reagent consumption, predict supply bottlenecks, and advise on alternative materials with greater fidelity than human judgement alone. Predictive maintenance models will monitor equipment health across partner sites, reducing instrument downtime that would otherwise interrupt critical experiments.

Automated machine-to-machine communication across labs, suppliers, and logistics networks will replace slow, manual, error-prone processes. Procurement functions historically reactive and fragmented will evolve into algorithmically enhanced decision engines that conduct risk simulation, capability clustering, sentiment analysis of supplier behaviors, and dynamic reprioritization of spend.

The future market will not merely reward cost efficiency; it will elevate those suppliers capable of delivering digital transparency, data-rich products, and software-embedded instrumentation that integrates directly into pharma's R&D operating systems. This co-digitalization will also catalyze the rise of API-like supplier entities that provide modular, plug-and-play scientific capabilities accessible through digital interfaces, enabling rapid onboarding, validation, and integration into experimental workflows. The supplier landscape will thus shift from static procurement catalogues to dynamic ecosystems of interoperable scientific services, each delivering continuous intelligence rather than intermittent shipments.

Conclusion

The evolution of pharma supplier R&D partnerships marks a decisive inflection point for the biopharmaceutical industry a transition from transactional exchanges to deeply interwoven architectures of shared intelligence, capability, and ambition. As therapeutic modalities grow more complex and the scientific frontier expands, no single organization can shoulder the burden of innovation alone; the future belongs to federated ecosystems where pharma innovators and their suppliers operate as co-architects of discovery. the evolving landscape of biopharmaceutical R&D underscores a fundamental transformation in how pharmaceutical organizations engage with their suppliers.

As the industry faces the dual challenges of increasing scientific complexity and market competitiveness, the shift from viewing suppliers merely as vendors to recognizing them as strategic co-innovators marks a significant milestone. This new paradigm encourages a collaborative approach to innovation, where ideas and expertise are shared across disciplines, fostering a culture that prioritizes quality, compliance, and speed. The emergence of partnership archetypes as a new operating model further refines this collaboration, enabling organizations to strategically align resources and governance in a way that enhances both operational efficiency and innovation potential. By segmenting suppliers based on their strengths and capabilities, pharma companies can leverage unique insights and technologies that contribute to the entire R&D process, driving advancements that are both sustainable and compliant with regulatory standards.

As industry leaders navigate this complex terrain, the emphasis on co-responsibility and shared success will not only enhance competitive positioning but also catalyze breakthroughs in biopharmaceutical development. Embracing these profound changes will ultimately pave the way for a more agile, resilient, and innovative future in health care, where the synergy between pharma and suppliers becomes a cornerstone of success and progress.

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation