What is the Interplanetary Networking Market Size?

The global interplanetary networking market is witnessing rapid growth as NASA, ESA, and private players build delay-tolerant networks to enable reliable data transmission between planets and spacecraft.The increasing demand for high-speed and internet even in remote areas, growing launch of satellite constellations for low-latency data transmission, and collaboration between government and private companies to support telecommunication through space technology are supporting the market's growth hugely.

Interplanetary Networking Market Key Takeaways

- North America dominated the interplanetary networking market with the largest market share of 45% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By component, the hardware segment held the biggest market share of 50% in 2024.

- By component, the software segment is expected to witness the fastest CAGR during the foreseeable period.

- By technology, the RF communication segment captured the highest market share of 45% in 2024.

- By technology, the optical communication segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the satellite communication segment contributed the maximum market share of 40% in 2024.

- By application, the space exploration and space tourism segment is expected to witness the fastest CAGR during the foreseeable period.

- By end user, the government space agencies segment held the largest market share of 55% in 2024

- By end user, the commercial space companies' segment is expected to witness the fastest CAGR during the foreseeable period.

- By deployment model, the ground-to-space networks segment generated the major market share of 50% in 2024.

- By deployment model, the space-to-space networks segment is expected to witness the fastest CAGR during the foreseeable period.

Market Overview

The interplanetary networking market refers to the development and deployment of communication technologies and protocols that enable data transfer across planets, spacecraft, satellites, and space stations. Based on Delay-Tolerant Networking (DTN) and advanced space-based communication architectures, it ensures reliable, secure, and scalable connectivity over vast distances with high latency. This market is driven by increasing deep-space missions, satellite exploration, Mars colonization projects, commercial space programs, and demand for continuous communication between Earth and extraterrestrial bodies.

How is AI Transforming the Interplanetary Networking Market?

Artificial intelligence is transforming the interplanetary networking market by allowing for autonomous operations, increasing data management for efficient data transmission in a delay-tolerant networking (DTN) environment with the help of adaptive routines and predictive buffering. This helps to enhance signal processing by using real-time decoding and anomaly detection, and helps predictive maintenance for better communication infrastructure to ensure uptime even in a challenging space environment. AI enables satellites to make their own decisions by using data and minimizes human intervention every time. Also, satellite networks can optimize by using AI systems to manage bandwidth allocation and enhance signal quality through dynamic beamforming, along with payload control.

What are the Key Trends in the Interplanetary Networking Market?

- Delay Tolerant Networking: A significant trend that supports the growth of the Interplanetary networking includes dependency on delay-tolerant networking. There are some inherently present disconnections in space communication techniques, and this can be resolved by a store-and-forward mechanism, which further manages variable delays too. Also, the bundle protocol is a major implementation that stores data in bundles at intermediate nodes until a reliable path is available for further destinations, by which data can travel safely.

- Development of Lunar networks: Another major trend that the interplanetary networking market is witnessing includes the development of lunar networks. This network is particularly developed for the moon, along with initiatives like NASA's LunaNet and ESA's Moonlight. These programs are aiming to offer navigation and communication services and are gaining traction from commercial companies. Also, projects like Lockheed Martin's Pony Express 2 showcase the possibility of tactical communication by using small satellites that create a mesh-like relay network for edge users, which is highly stable and resilient.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

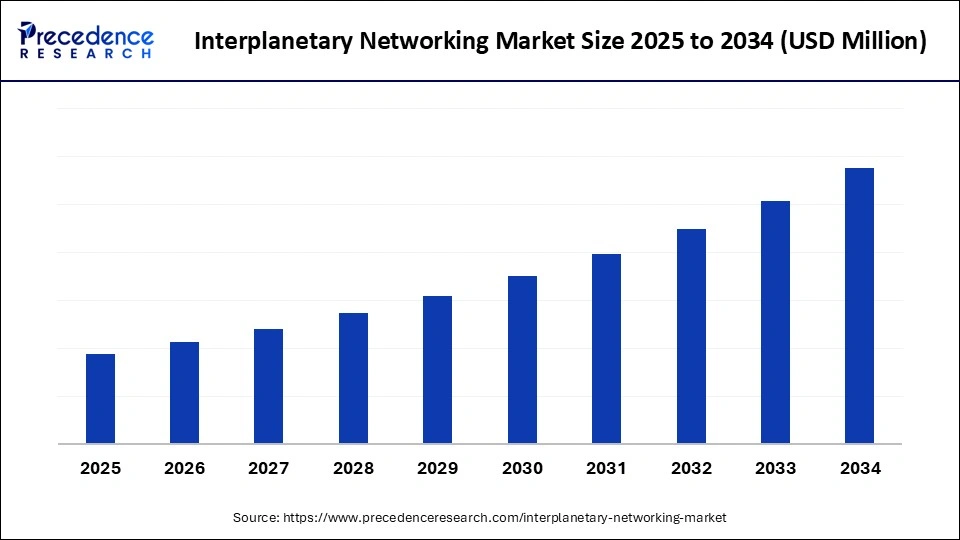

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Application, End-User, Deployment Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Development of Robotic Systems with Autonomous Spacecrafts

One of the major driving factors for the growth of the interplanetary networking market is the advancement in robotic systems along with automation processes in spacecraft, shaping the future of the market prominently. These systems are made up of advanced sensors and communication modules that allow them to work independently and send data back to the earth station for further analysis and decoding. Also, the development of autonomous platforms helps real-time data monitoring and control, which supports enhancements of efficiency and safety of the various ambitious space programs.

Restraint

Complexity in Coordinating Communication

Operational challenges like complexity in coordinating communication between various spacecrafts, celestial objects, planetary bodies, and Earth stations that are built to receive these signals. The interplanetary internet needs a highly synchronized network of nodes that can depend on data efficiency even in network disruptions. A more complex task is to ensure the interoperability and compatibility of these nodes, which requires careful planning and management. Also, challenges like unclear regulations and compliance on the deployment of interplanetary internet, some operational issues, along with technical challenges to build and preserve adaptable communication space infrastructure, need to be resolved.

Opportunity

Commercialization of Space Resources

A significant opportunity that interplanetary networking holds is the potential commercialization of space resources like asteroid mining and lunar exploration for various minerals and rare elements that can be utilized for innovations in technological areas. The interplanetary internet offers companies the chance to explore and extract valuable resources from distant planetary bodies. This is possible by using reliable communication channels for data exchange and remote operations. This capability will revolutionize leading industries like manufacturing and energy by integrating space-derived materials and elements through the use of a terrestrial supply chain. Another promising avenue will be the expansion of satellite-based services such as remote sensing, satellite internet, and earth observation.

Component Insights

How do Hardware Components help Propel the Interplanetary Networking Market Growth?

The hardware segment held the largest market share of nearly 50% in 2024. The reasons behind the segment's expansion include basic need for core equipment, the growing deployment of 5G networks, and the requirement for robust infrastructure to support digital transformation, increasing setup of data centers, and cloud computing. The hardware, such as routers, switches, and appliances related to security, has become crucial for any network to function and provide advanced features like 5G, network slicing, and AI-based capabilities.

The software segment is expected to witness the fastest CAGR during the foreseeable period. The fundamental changes across businesses and governments to digital processes generate a huge requirement for new and enhanced software solutions to manage operations, analyze data, and improve consumers' experiences. The increasing application of AI and ML in software applications enables advanced automation, increased decision-making, and more customized consumer experiences, which further increases demand.

Technology Insights

Why the RF Communication Segment Dominates the Interplanetary Networking Market?

The RF communication segment held the largest market share of nearly 45% in 2024. Radio frequency communication provides a balance of deep atmospheric penetration and wide-area coverage, which is highly critical for long-distance. Furthermore, radio frequency provides reliable signal transmission even through the difficult situations of space and planetary environments, ensuring critical command, control, and data exchange. Also, RF communication uses different frequency bands that offer various trade-offs for data throughput, antenna size, coverage, and enable optimized communication for specific missions and phase requirements.

The optical communication segment is expected to witness the fastest CAGR during the foreseeable period. The segment is growing due to increasing demand for high-speed data, high-bandwidth transmission processes driven by the deployment of technologies like IoT and 5G, cloud computing, and data-driven applications. Also, optical technology provides benefits like low latency, high-speed data transfer, strength for immense electromagnetic data volumes, and connectivity, which is essential for emerging technologies.

Application Insights

What are the Benefits of Satellite Communication in the Interplanetary Networking Market?

The satellite communication segment held the largest market in 2024. The satellite communication sector is well well-established leader in the global and space-based networking domain due to its unique ability to offer global coverage, offer digital services even in underserved or remote areas, and support applications from broadband internet to the defense sector. Satellite technology gives scalable solutions for conventional infrastructure and its drawbacks. Further, it supports constant deployment and advancements like LEO satellites, which are crucial for the improvement of latency and capacity for various industries and their applications.

The space exploration and space tourism segment is expected to witness the fastest CAGR during the foreseeable period. Leading factors like ongoing innovation in rocket technology, spacecraft designing, and launch systems are supporting space travel and its commercialization by offering a safer place with a more budget-friendly approach. Also, the growing number of private companies like Tesla, Blue Origin, and Virgin Galactic are heavily investing to fuel the development of space tourism with cost-effective offerings.

End User Insights

What is the Reason Behind the Dominance of Government Space Agencies in the Interplanetary Networking Market?

The government space agencies segment held the largest market share of nearly 55% in 2024. A major reason for the segment's dominance in the global market is the government's significant funding for space agencies with long-term goals and initiatives for scientific exploration, along with national security. Also, government agencies are increasingly collaborating with private companies and international partners to foster the culture of scientific research and its applications to gain insights for a country's overall development, majorly.

The commercial space companies' segment is expected to witness the fastest CAGR during the foreseeable period. A significant factor for segment growth includes increasing growth in satellite-based services like global internet connectivity and earth observation, which is supported by the launch of small satellite constellations such as Starlink by Tesla. Also, reusable rocket technology is on the verge of growing dominantly in the interplanetary networking market by making space access reasonable for everyone.

Deployment Model Insights

Why is the Ground-to-Space Deployment Model Preferred in the Interplanetary Networking Market?

The ground-to-space networks segment held the largest market share. A significant driving factor for the ground-to-space deployment model is the growing demand for reliable, high-speed internet access, specifically in remote areas where robust infrastructure to provide internet is unavailable. Also, the improvements in radio frequency and optical communication technologies further enable faster and more reliable data transmission between Earth and outer space.

The space-to-space networks segment is expected to witness the fastest CAGR during the foreseeable period. The increasing deployment of large satellite constellations to gain high-speed internet in regions with terrestrial service limitations is a major driving factor for the market's growth. The corresponding need for advanced components like compact propellant systems and power supplies has witnessed a surge in demand due to satellite complexities and their frequent launches for various reasons.

Regional Insights

How do Governments in North America Support the Interplanetary Networking Market?

North America held the largest market share of nearly 45% in 2024. The region's growth is attributed to several impacting factors like huge foundational government investment for space-based missions, international cooperation, presence of major aerospace and defense space companies, emergence of space-based services, along with private-public space sector partnership to develop a robust ecosystem for space missions. NASA is a renowned space tech company that is actively working with commercial companies to build a strong communication infrastructure to support future missions. Also, institutional knowledge and operational control for interplanetary networking are concentrated in North America.

In addition to this, the emergence of private space companies such as SpaceX and Blue Origin is further accelerating the market's growth by presenting innovative technologies to support space missions. They have developed advanced launch capabilities and massive low-earth orbit satellite constellations like Starlink, which is crucial for an interplanetary network. Along with this, the U.S. government has specifically invested heavily in the deep space communication sector, mainly through NASA and its Jet Propulsion Laboratory, for the next 60 years.

Which Factors Support Growth of the Asia Pacific Interplanetary Networking Market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region's growth is attributed to the various prominent factors such as increasing digital transformation, growing rate of ongoing urbanization, along with significant government investment to strengthen networking and telecommunication systems, and supportive policies, which are proliferating increasing demand for satellite-based connectivity to support remote areas.

Applications like 5G and IoT are further accelerating the market's growth in the region by providing robust technological platforms. Moreover, the rise of low-earth orbit satellites for various commercial services and high-throughput satellites is are critical factor in the region's economy and its growth. Also, the Asia Pacific serves as a gateway due to its geographical position, along with its advanced telecommunication network, which supports nearby regions for seamless data transmission and hosting services.

Value Chain Analysis

- Raw Material Sourcing

This is an initial stage that involves the procurement of specialized and robust space-grade networking equipment, like materials made for a challenging spec environment and radiation-hardened components.

Key players: Airbus, Blue Origin, Karkhana.io, and GIOBSI India sourcing.

- Component Manufacturing

The segment involves the production of hardware and software necessary for the interplanetary network and its seamless operations. It includes a diverse range of equipment, small devices, and crucial components for advanced terminals.

Key players: Intel Corp.. Honeywell International Inc., Northrop Corp., Spatiam Corp., TE Connectivity

- Maintenance, Repair and Overhaul (MRO)

This is a critical stage, once a vital part of interplanetary networking is developed fully and deployed. It supports maintenance of this system with precise attention and repair when needed. It's basically an after-service offered by leading companies.

Key players: Boeing, Lufthansa Technik, STS Aviation Group, Black Swan Space.

Interplanetary Networking Market Companies

- NASA (National Aeronautics and Space Administration)

- European Space Agency (ESA)

- SpaceX

- Blue Origin

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Boeing Defense, Space and Security

- Thales Alenia Space

- Airbus Defence and Space

- Raytheon Technologies Corporation

- China National Space Administration (CNSA)

- Indian Space Research Organisation (ISRO)

- Japan Aerospace Exploration Agency (JAXA)

- Roscosmos State Corporation

- Sierra Space (Sierra Nevada Corporation)

- L3Harris Technologies, Inc.

- SES S.A.

- Telesat Canada

- Inmarsat Global Limited

- Viasat, Inc.

Recent Developments

- In April 2025, the radio antennas of NASA, Canberra Deep Space Network, which were deployed in Australia have completed their 60th anniversary on 19th March. This facility is now preparing to increase its network's capacity by adding a new deep space station 33, which will be a 34-meter wide multifrequency beam-waveguide antenna. (Source:https://www.jpl.nasa.gov)

- In September 2025, the Starlink 17-10 mission by SpaceX will add another 24 broadband internet satellites to low-earth orbit constellations. After its liftoff, space will have more than 8,400 satellites in low Earth orbit.(Source: https://spaceflightnow.com)

Segments Covered in the Report

By Component

- Hardware (Antennas, Transceivers, Routers, Modems, Terminals)

- Software (DTN Protocols, AI-based Traffic Management, Security Solutions)

- Services (Integration, Mission Support, Maintenance, Managed Services)

By Technology

- Delay-Tolerant Networking (DTN)

- Optical (Laser) Communication

- RF Communication

- Hybrid Communication Systems

- AI and Quantum-based Networking

By Application

- Space Exploration (Mars Missions, Lunar Missions)

- Satellite Communication (LEO, MEO, GEO constellations)

- Deep-Space Probes and Rovers

- Space Stations and Orbital Habitats

- Defense and Security in Space

- Commercial Space Tourism and Private Missions

By End-User

- Government Space Agencies (NASA, ESA, ISRO, CNSA, JAXA, Roscosmos)

- Defense Organizations

- Commercial Space Companies (SpaceX, Blue Origin, etc.)

- Research Institutions and Universities

By Deployment Model

- Ground-to-Space Networks

- Space-to-Space Networks

- Planetary Surface Networks

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting