Enterprise Networking Market Size and Forecast 2025 to 2034

The global enterprise networking market size was estimated at USD 213.70 billion in 2024 and is predicted to increase from USD 226.16 billion in 2025 to approximately USD 376.61 billion by 2034, expanding at a CAGR of 5.83% from 2025 to 2034.The rising demand for network systems to connect, supply, and retrieve information among various companies is driving the growth of the enterprise networking market.

Enterprise Networking Market Key Takeaways

- In terms of revenue, the global enterprise networking market was valued at USD 213.70 billion in 2024.

- It is projected to reach USD 376.61 billion by 2034.

- The market is expected to grow at a CAGR of 5.83% from 2025 to 2034.

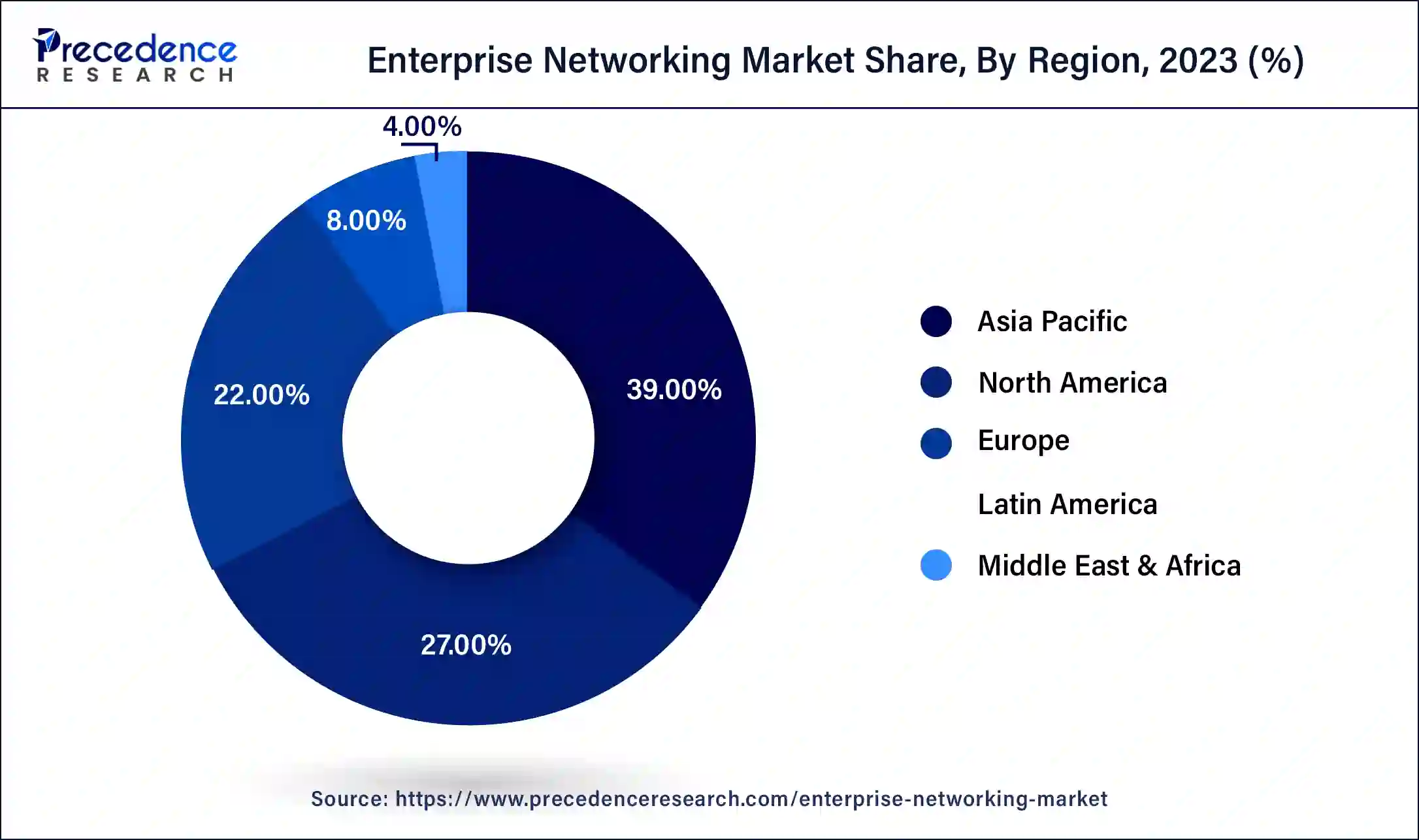

- Asia Pacific dominated the global enterprise networking market with the largest market share of 39% in 2024.

- The Middle East & Africa is expected to grow at a significant rate in the market over the forecast period.

- By equipment, the ethernet switch segment contributed more than 39% of market share in 2024.

- By equipment, the WLAN segment is expected to grow at the fastest rate in the market over the forecast period.

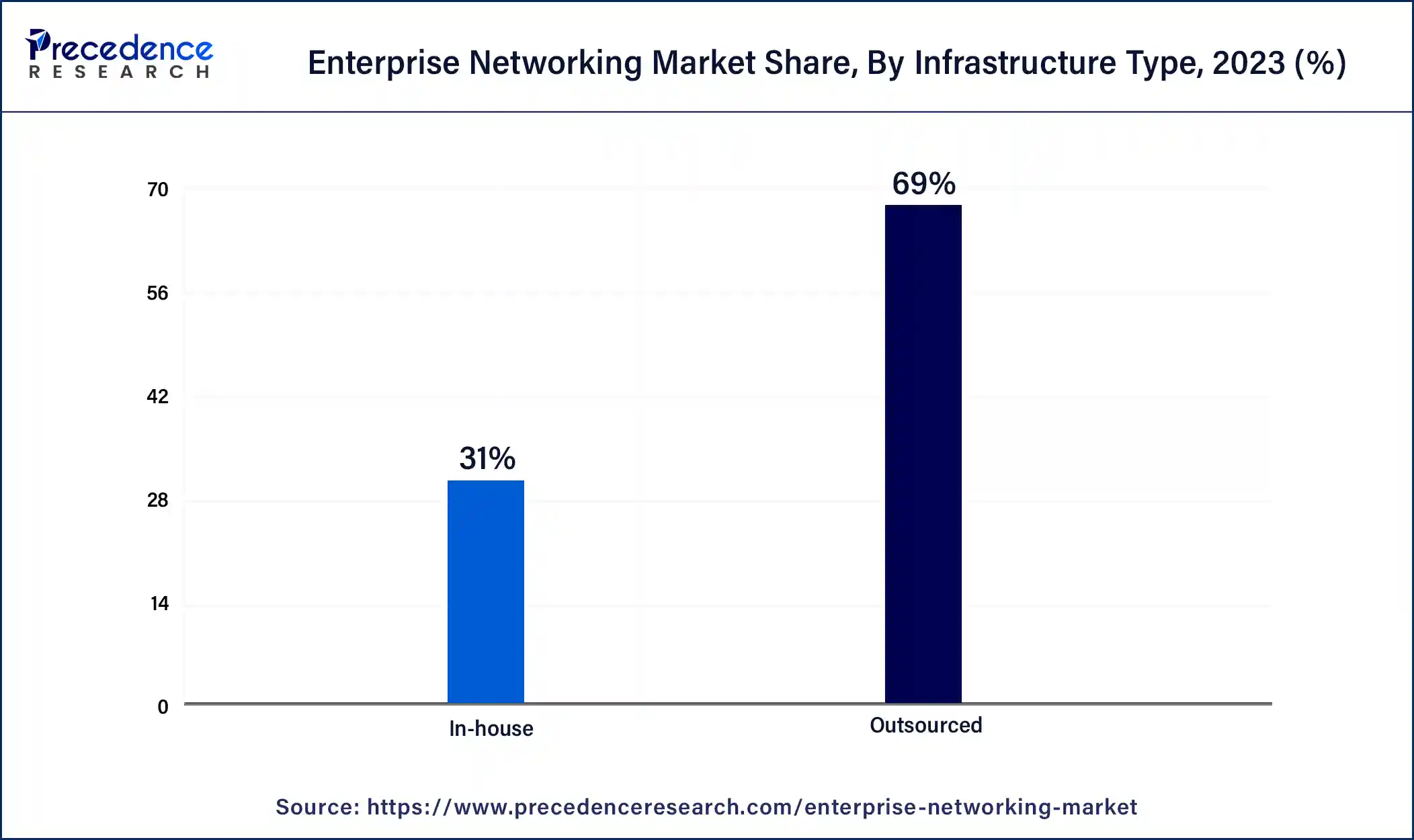

- By infrastructure type, the outsourced segment accounted for the highest market share of 69% in 2024.

- By infrastructure type, the in-house segment is anticipated to grow at the fastest rate in the market during the forecast period.

How AI Changing is the IT Networking Industry

Artificial intelligence is transforming the information technology industry through several integration efforts. The application of AI is improving cyber security, streamlining hybrid work environments and assisting with traffic management. The use of AI-based Intelligent Programmable Automation Controllers is helping with the automation of network operations from setup to running and autonomous scanning and patching when faced with issues. The use of these controllers offers both flexibility and adaptability to network administrators.

- In July 2024, IBM and Vapor IO collaborated to deliver a hybrid multicloud networking software. The IBM Hybrid Cloud Mesh interoperates with Vapor IO's Kinetic Grid Platform to harness the full potential of hybrid, multicloud and edge computing environments.

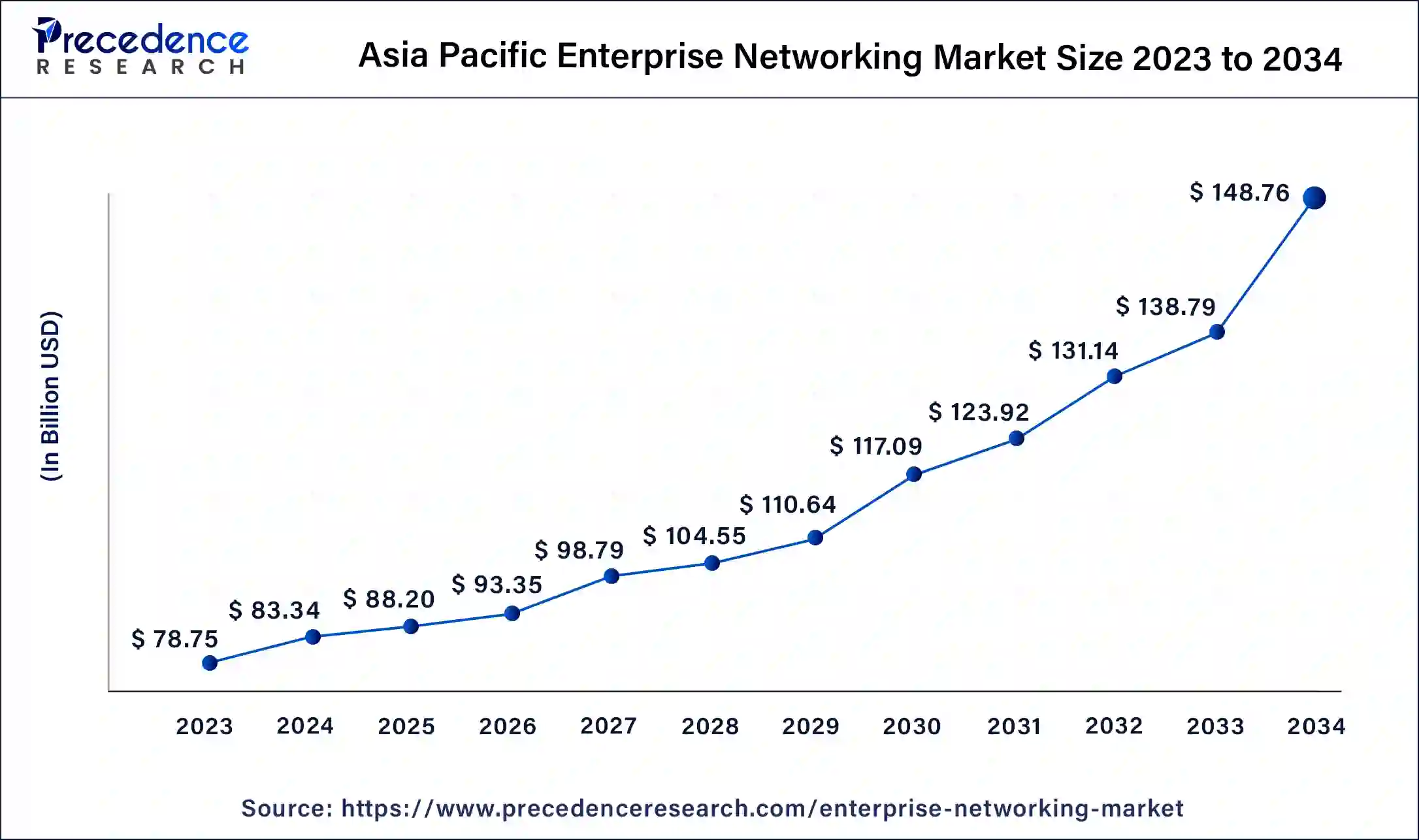

Asia Pacific Enterprise Networking Market Size and Growth 2025 to 2034

The Asia Pacific enterprise networking market size was exhibited at USD 83.34 billion in 2024 and is projected to be worth around USD 148.76 billion by 2034, poised to grow at a CAGR of 5.95% from 2025 to 2034.

Asia Pacific dominated the global enterprise networking market in 2024. The region's expansive population, rapidly advancing economy, and thriving IT sector make it a prime area for enterprise networking solutions. Digital transformation efforts in countries such as India and China are driving a surge in the adoption of sophisticated networking technologies.

- In May 2024, NTT Docomo Inc. announced its plan to establish a company to supervise its overseas businesses in July. With its domestic cell phone market hitting a wall, Docomo will strengthen sales of its corporate services and new telecommunications infrastructure in Southeast Asia and North America, which have high future growth potential, according to sources.

The growth of cloud services, the rise of e-commerce, and the widespread use of smartphones and IoT devices are generating a strong need for scalable and reliable networking infrastructure. Furthermore, the increasing demand for high-speed connectivity, the proliferation of mobile devices, and the expansion of data centers are poised to offer significant opportunities for growth in the enterprise networking market.

China's Digital Transformation Fostering Market Growth

China is leading the regional market, driven by countries' rapid digital transformation initiatives, due to an increased shift toward cloud-based applications and widespread internet usage. China, focusing on Industry 4.0, drives the adoption of scalable networking solutions. Technological advancements like the adoption of AI and automation technologies are improving network security and management in enterprises, making them more ideal application. Additionally, a strong focus on advancing cybersecurity is fueling the market.

- In March 2024, the Cyberspace Administration of China (CAC) issued the long-awaited Provisions on Promoting and Regulating Cross-Border Data Transfer (CBDT Provisions). This provision issued for busieness to lessen the cases in which companies need to complete the formal mechanisms established in the PIPL to transfer data outside of Mainland China, which had been: an official security assessment by the CAC, a security certification by a third party, or execution of the standard contractual clauses (SCCs) with the receiving party (collectively, CBDT Mechanisms).

Middle East & Africa is expected to grow at a significant rate in the enterprise networking market over the forecast period. The expansion of the market in the region can be attributed to advancements in the telecom sector and a shift in industrial focus towards fostering new economic growth. Routers are anticipated to see slower adoption rates due to the advanced functionality of Ethernet switches, which can handle a broader range of routing protocols. This has led many enterprises to favor switches over routers. Simultaneously, the ongoing digital transformation and the increasing rollout of high-speed fifth-generation (5G) networks are driving the market's growth prospects.

- In May 2024, Huawei launched the Xinghe Intelligent Network for the Middle East and Central Asia to Accelerate Industrial Intelligence. The Middle East and Central Asia leg of Huawei Network Summit 2024, themed ‘Innovations Never Stop,' was successfully held in Baku, Azerbaijan.

Market Overview

An enterprise network comprises routers, switches, and wireless access points, facilitating data transfers between desktops, servers, and other devices. It serves as the foundation for organizational communication, linking devices within various departments. Typically, these networks are configured to enhance data access, provide analytical insights, and aid employees in problem-solving. Furthermore, government initiatives to accelerate digital transformation are driving up the demand for routers, switches, and wireless LAN networks, which are anticipated to propel market growth in the future. The enterprise networking market offers diverse networking requirements of businesses, from small and medium-sized enterprises (SMEs) to large multinational corporations, spanning industries such as healthcare, education, finance, manufacturing, and retail.

Enterprise Networking Market Growth Factors

- The rising adoption of digital technology by enterprises can fuel the growth of the enterprise networking market soon.

- Businesses are investing in networking solutions with strong security capabilities to protect their data and networks from cyberattacks, which can lead to market growth.

- There is an increasing need for networking solutions that can accommodate a dispersed workforce and give them safe, remote access to the company resources that can contribute to the enterprise networking market expansion.

- Increasing globalization is expected to further boost the enterprise networking market.

Enterprise Networking Market

| Report Coverage | Details |

| Market Size by 2034 | USD 376.61 Billion |

| Market Size in 2025 | USD 226.16 Billion |

| Market Size in 2024 | USD 213.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.83% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment, Infrastructure Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing adoption of wireless devices

The rising prevalence of smartphones, tablets, laptops, and other wireless devices in the workplace has impelled a growing need for enterprise networking solutions that can support numerous devices while maintaining reliable connectivity. Additionally, the increasing demand for wireless access, which allows employees to work flexibly from any location within the network's coverage, is significantly contributing to market growth. The trend of Bring Your Device (BYOD), where employees use their personal devices for professional tasks, is also positively influencing the enterprise networking market prospects. Moreover, the integration of wireless devices with cloud computing and edge computing has introduced new networking requirements.

- In June 2024, NETGEAR, Inc., the leading provider of innovative and secure solutions for people to connect and manage their digital lives, expanded its WiFi 7 mesh and standalone router lines with the new Orbi 770 Tri-band Mesh System and Nighthawk RS300 Router. NETGEAR's most affordable WiFi 7 products to date build on the company's promise to provide powerful WiFi performance and secure connectivity.

Restraint

High initial investment and operational costs

In the enterprise networking market, the costs associated with establishing and maintaining a robust networking infrastructure can be substantial and encompasses expenses for software licenses, hardware components, and professional services needed for installation and configuration. Budget constraints often hinder small and medium-sized enterprises from investing in advanced networking solutions. Moreover, the ongoing financial burden is compounded by additional operational costs related to maintenance, upgrades, and network management, which can impede market growth further.

Opportunity

Internet-based networking

Artificial intelligence (AI) and machine learning (ML) are integral to intent-based networking (IBN), which automates tasks such as network configuration, monitoring, and troubleshooting, enhances efficiency, and minimizes manual intervention. By investing in these advanced technologies, organizations can boost network performance, lower operational expenses, and increase overall productivity. The enterprise networking market is ripe with opportunities for adopting cutting-edge solutions like IBN, network automation, and orchestration. Furthermore, this market presents prospects for providers of robust network analytics platforms, which empower organizations to make informed, data-driven decisions and improve network efficiency and reliability.

- In February 2024, Ericsson introduced AI-powered premium 5G intent-based operations. Leading technology and service providers deploy artificial intelligence and automation use case libraries to simplify network operations by managing conflicting intents to meet desired business outcomes.

Equipment Insights

The ethernet switch segment dominated the enterprise networking market in 2024. Ethernet switches facilitate connections between devices by forwarding ethernet frames among the devices linked to the switches. The growing need for high-speed Ethernet switches is anticipated to create new growth opportunities for market players shortly. Also, government efforts to accelerate digital transformation have increased the demand for switches, routers, and wireless LAN networks, which are expected to drive market growth moving forward.

- In July 2024, Moxa launched a High-bandwidth Ethernet Switch Portfolio. The new MRX Series Layer 3 rackmount Ethernet switches support 64 ports with up to 16 ports of 10GbE speed to accelerate data aggregation for industrial applications and help users build high-bandwidth network infrastructure to realize IT/OT convergence with the EDS-4000/G4000 Series Layer 2 DIN-rail Ethernet switches supporting 2.5GbE uplink options.

The WLAN segment is expected to grow at the fastest rate in the enterprise networking market over the forecast period. LAN/WAN solutions serve as the core of enterprise networking by offering connectivity and enabling data sharing both within and between organizational sites. These solutions support organizations in creating secure and efficient communication networks, focusing on smooth data and information exchange. Essential components of LAN/WAN solutions include technologies like Ethernet, routers, switches, and protocols such as TCP/IP, which are important for the construction and management of enterprise networks.

Infrastructure Type Insights

The outsourced segment led the enterprise networking market in 2024. This can be attributed to corporate networking outsourcing, which is when businesses seek to reduce expenses, concentrate on their primary functions, enhance performance, access specialized expertise, and ensure continuous operations while leveraging the latest technological advancements and industry trends. Additionally, outsourcing makes organizations shift network management and maintenance responsibilities to external service providers, which allows them to reallocate internal resources toward strategic initiatives that foster business growth and innovation.

The in-house segment is anticipated to grow at the fastest rate in the enterprise networking market during the forecast period. Managing networking product production in-house can reduce costs associated with outsourcing. When manufacturing is handled internally, companies have full control over the output of their products. Additionally, production fluctuations can be managed effectively by adjusting labor and equipment to meet varying demands. By overseeing the entire process, businesses can better maintain product quality, which is essential for maintaining high standards. This emphasis on quality control has led to a growing trend of using in-house production facilities.

Enterprise Networking Market Companies

- Arista Networks Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Extreme Networks

- Fortinet Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Netscout Systems Inc.

- Nokia Corporation

- Riverbed Technology

Recent Developments

- In April 2025, Dell'Oro Group, the trusted source for market information about the telecommunications, security, networks, and data center industries launched its its new Virtual Broadband Network Gateway (vBNG) Advanced Research Report, analyzes the global shift to virtual BNGs, providing market insights, vendor performance, deployment trends, and a 5-year forecast by operator type and region. The first report about this network gateway is planned to be released in May 2025.

- In April 2025, Amazon launched its first 27 satellites for Kuiper broadband internet constellation into space from Florida, kicking off the long-delayed deployment of an internet-from-space network that will rival SpaceX's Starlink.

- In March 2025, Broadcom Inc. launched its VeloSky, a converged networking solution that enables Communications Service Providers (CSPs) at the Mobile World Congress 2025. The network solutions are designed to offer integrated fiber, cellular, and satellite connectivity through a single appliance.

- In February 2024, Huawei launched the Enterprise Network Integration Service Solution 3.1, which provides standardized processes, scenario-oriented planning and design, and automated network migration capabilities.

- In February 2024, Highway 9 Networks emerged from stealth with a SaaS-driven private mobile network offering designed to merge 5G mobile networking with more traditional enterprise networking. The company has raised a little over $25 million in funding from investors, including Mayfield, General Catalyst, and Detroit Ventures, to build out its vision.

- In January 2024, Australian operator Telstra acquired Melbourne-based enterprise network and security integrator O2 Networks. The acquisition was made to bolster Telstra's network application and services (NAS) portfolio as it continues to pursue opportunities in the enterprise space.

- In May 2023, Broadcom Inc. and Apple Inc. unveiled a substantial partnership focusing on the development and production of critical 5G radio frequency components in the U.S.

- In May 2023, Dell Technologies Inc. and NVIDIA announced a joint initiative, ‘Project Helix,' to make it easier for businesses to build and use generative AI models on-premises. This will further enable them to quickly and securely deliver better customer service, market intelligence, enterprise search, and a range of other capabilities.

Segments Covered in the Report

By Equipment

- Ethernet Switch

- Enterprise Routers

- WLAN

- Network Security

By Infrastructure Type

- In-House

- Outsourced

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting