Distributed Generation Market Size and Forecast 2025 to 2034

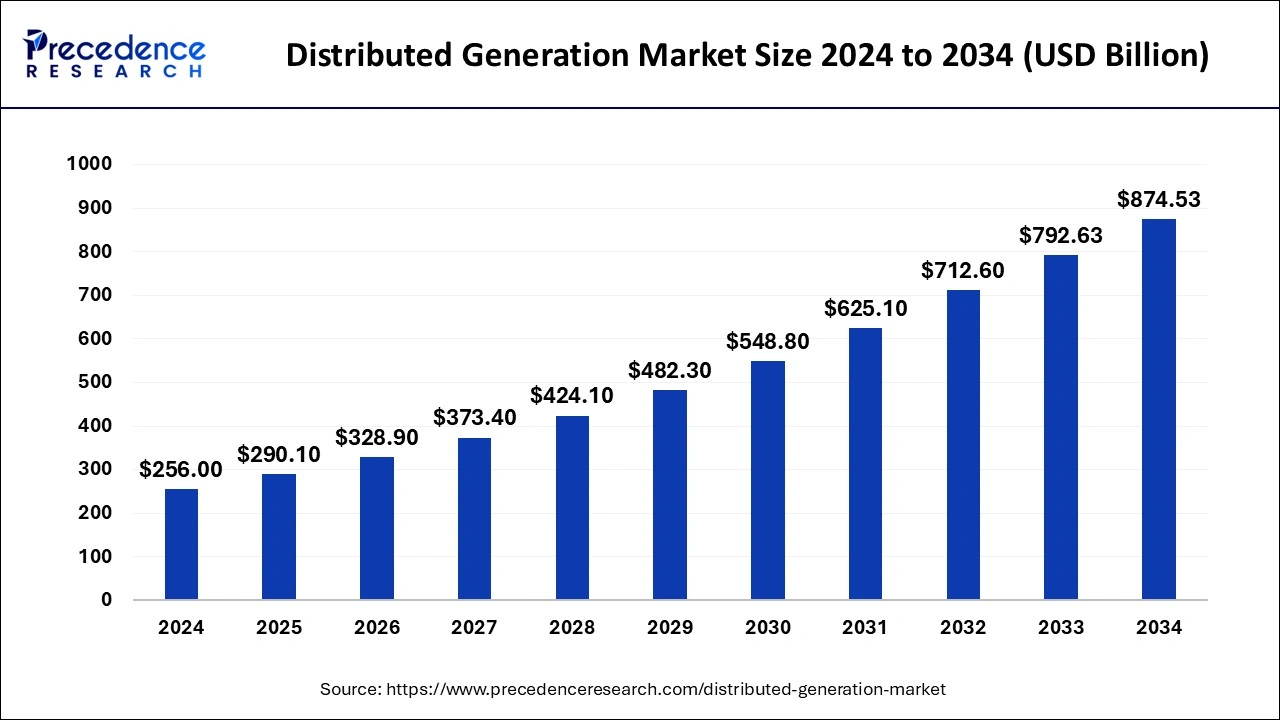

The global distributed generation market size was estimated at USD 256 billion in 2024 and is anticipated to reach around USD 874.53 billion by 2034, expanding at a CAGR of 13.07% from 2025 to 2034. The growth of the distributed generation market is driven by the rising demand for electricity and the increasing adoption of renewable energy sources.

Distributed Generation Market Key Takeaways

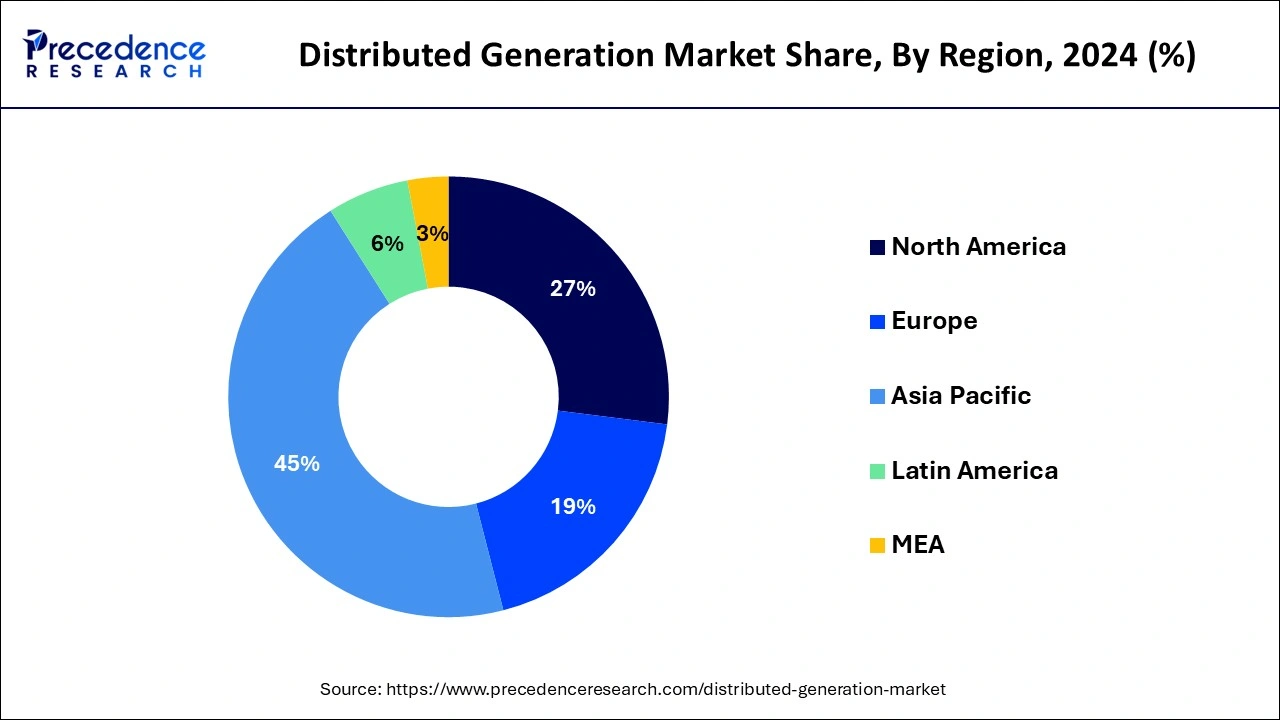

- Asia Pacific dominated the global distributed generation market with the largest market share of 45% in 2024.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By technology, the fuel cell segment contributed the highest market share in 2024.

- By technology, the public medical devices payers segment is expected to grow at a significant CAGR from 2025 to 2034.

- By end user, the commercial and industrial segment captured the biggest market share in 2024.

- By end user, the residential segments is estimated to be the fastest-growing segment during the forecast period.

Impact of AI on the Distributed Generation Market

Artificial intelligence (AI) has a notable impact on the market for distributed generation. AI algorithms help analyze energy consumption and generation patterns. This allows distributed generation systems like solar panels and wind turbines to optimize their output. AI also monitors energy storage systems by processing data in real-time, further helping efficiently store and distribute energy. AI also improves the efficiency of distributed generation systems by detecting potential failures.

Asia Pacific Distributed Generation Market Size and Growth 2025 to 2034

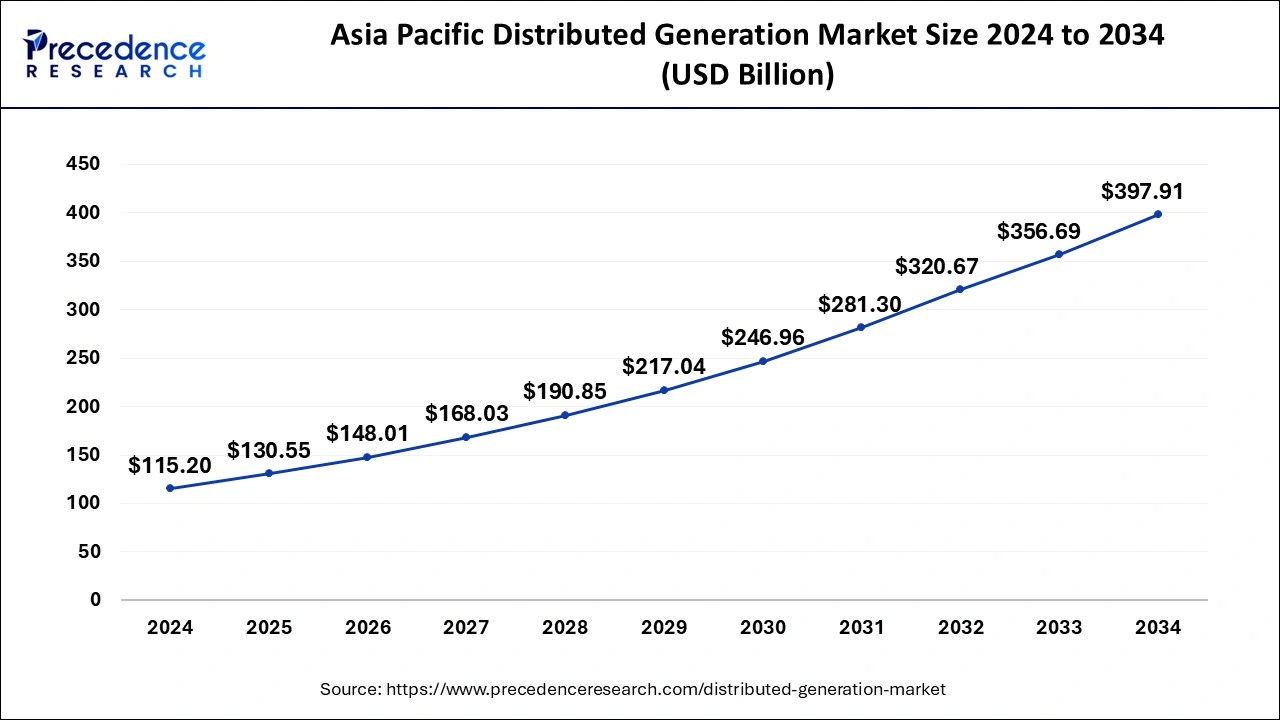

The Asia Pacific distributed generation market size was evaluated at USD 115.20 billion in 2024 and is predicted to be worth around USD 397.91 billion by 2034, rising at a CAGR of 13.20% from 2025 to 2034.

Asia Pacific dominated the global distributed generationmarket with the largest market share of 45% in 2024. This is simply attributed to the increased adoption of renewable energy sources, rising investments in the industrialization and urbanization, rapidly growing infrastructural developments, and increasing government initiatives to encourage the deployment of renewable and green & clean energy sources. Moreover, with the growing industrialization, the demand for the efficient and uninterrupted power supply is growing significantly, which is fueling the growth of the distributed generation market in Asia Pacific.

North America is estimated to witness a significant growth rate during the forecast period. The huge demand for the wind energy in North America and rapidly growing demand for the solar energy across the commercial and industrial units is expected to fuel the demand for the distributed generation technologies.

The European countries such as Germany and Italy have huge demand for the wind and solar energy. This is attributed to the strict government norms regarding the use of renewable energy. The fuel cells are witnessing huge demand in overall Europe owing to its higher energy efficiency. The increased awareness regarding the climate change and negative effects of carbon emission has resulted in the huge demand for the clean and green energy in Europe. The government has strict regulations regarding the industrial and commercial use of energy pertaining to the renewable sources, which has fueled the growth of the distributed generation market in Europe.

Market Overview

Distributed generation is an electricity generation system that generates electricity at or near the point of use. Distributed generation technology is more affordable and cheaper than traditional energy generation systems, which favors the adoption of distributed generation. Moreover, the availability of a wide variety of sources such as wind, solar, microturbines, gas turbines, reciprocating engines, and fuel cells further promotes the adoption of distributed generation systems across commercial and residential sectors. Rapid industrialization and rapid urbanization are among the major factors that are estimated to drive the growth of the distributed generation market in the coming years.

Distributed Generation Market Growth Factors

- With the growing concerns about environmental sustainability, there is a heightened adoption of renewable energy sources, such as solar panels and wind turbines, which boosts the growth of the market.

- There is a rapid shift toward distributed generation systems. The capability of distributed generation to fulfill the energy needs of businesses is a major factor boosting their adoption.

- Governments of various nations are providing incentives and subsidies to commercial and industrial sectors to achieve the target of net zero, encouraging them to shift toward clean energy sources, which fuels the growth of the market.

- The increasing need for uninterrupted and efficient power supply drives the demand for distributed generation systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 290.1 Billion |

| Market Size by 2034 | USD 874.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End User, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Distributed Generation Market Dynamics

Driver

Rising Electricity Demand

The need for electricity is increasing due to rapid industrialization and urbanization. As nations expand their industries and urban areas grow to accommodate increasing populations, the demand for electricity surges. The costs of renewable energy technologies, such as solar and wind power, have been reduced over the past decade. This decline in cost has made these alternatives more accessible and affordable. In addition, increasing awareness of the adverse

effects of fuel-based energy generation systems on the environment prompts governments, organizations, and individuals to seek cleaner and more sustainable energy sources.

Restraint

Power Generation Fluctuations

Solar and wind power generation are inherently intermittent energy sources, meaning their output can vary significantly depending on weather conditions. For instance, solar energy production highly depends on sunlight availability, while wind energy relies on wind speed and direction. This variability poses challenges when integrating large amounts of distributed generation into the existing electrical grid. Such integration can lead to technical difficulties, including voltage fluctuations, that can disrupt the stability of the grid and create issues related to power quality.

Opportunity

Technological Advancements

Advancements in energy storage technologies, such as lithium-ion and solid-state batteries, create immense opportunities in the market. These innovations play a crucial role in efficiently integrating renewable energy sources into the existing power grid. These technologies improve

energy storage capabilities, addressing the intermittent issues associated with renewable power generation and ensuring a more reliable and stable energy supply.

Technology Insights

The fuel cell segment contributed the highest market share in 2024.The increased adoption of the fuel cells in the distributed generation system owing to various benefits such as high efficiency, lower emissions, and capability of converting chemical energy into electrical energy has fostered the growth of this segment. The fuel cells provide 60% higher efficiencies, which is a major driver of the fuel cell segment.

The solar PV segment is expected to be the fastest-growing segment during the forecast period. The government subsidies for the adoption of solar energy and declining costs of the solar equipment over the past few years has increased the demand for the solar PV distributed generation market. Moreover, the rising government and corporate efforts to reduce carbon footprint and achieve sustainability in the long term, majority of the industries are shifting towards the adoption of solar sources of energy.

End User Insights

The commercial and industrial segment captured the biggest market share in 2024. This is attributed to the increased government initiatives to promote the adoption of the renewable energy sources across the commercial and industrial sectors in the form of subsidies and incentives. Moreover, the reducing equipment costs and increased demand for the uninterrupted power supply has fostered the growth of this segment. Moreover, the increased efforts of the government to industrialize and urbanize the rural regions are supporting the growth of the commercial & industrial segment and hence this segment is expected to dominate throughout the forecast period.

On the other hand, the residential segment is estimated to be the most opportunistic segment during the forecast period. The rising number of big residential complexes and rapid urbanization of the rural regions are the most prominent factors that drive the growth of the residential segment. The increasing adoption of the distributed generation systems for heating, ventilation, cooling, and cooking applications is expected to spur the demand in the residential segment.

Distributed Generation Market Companies

- Siemens

- General Electric

- Mitsubishi

- Schneider

- Caterpillar Power Plants

- Doosan Fuel Cell America

- Vestas Wind Systems A/S

- Rolls-Royce Power Systems AG

- Toyota Turbine and Systems Inc.

- Capstone Turbine Corporation

Latest Announcement by Industry Leader

- In February 2024, Nextracker announced that it has surpassed 600 projects delivered in its distributed generation (DG) portfolio. Dan Shugar, CEO of Nextracker, said that distributed generation technology is essential for addressing energy grid challenges and meeting the increasing demand for clean energy.

Recent Developments

- In April 2023, UL Solutions, in cooperation with the U.S. Department of Energy's National Renewable Energy Laboratory (NREL), has published UL 2941, the Outline of Investigation (OOI) for cybersecurity of distributed energy and inverter-based resources. UL 2941 provides testable requirements for energy storage and generation technologies on the distribution grid.

- In April 2023, Google and EDPR NA Distributed Generation signed an agreement to develop over 80 distributed solar projects of 500 MW capacity.

Segments Covered in the Report

By Technology

- Fuel Cells

- Micro-Turbines

- Wind Turbines

- Combustion Turbines

- Micro-hydropower

- Reciprocating Engines

- Solar PV

- Others

By End User

- Commercial

- Industrial

- Residential

By Application

- On-Grid

- Off-Grid

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting