Distributed Energy Resources (DER) Technology Market Size and Forecast 2025 to 2034

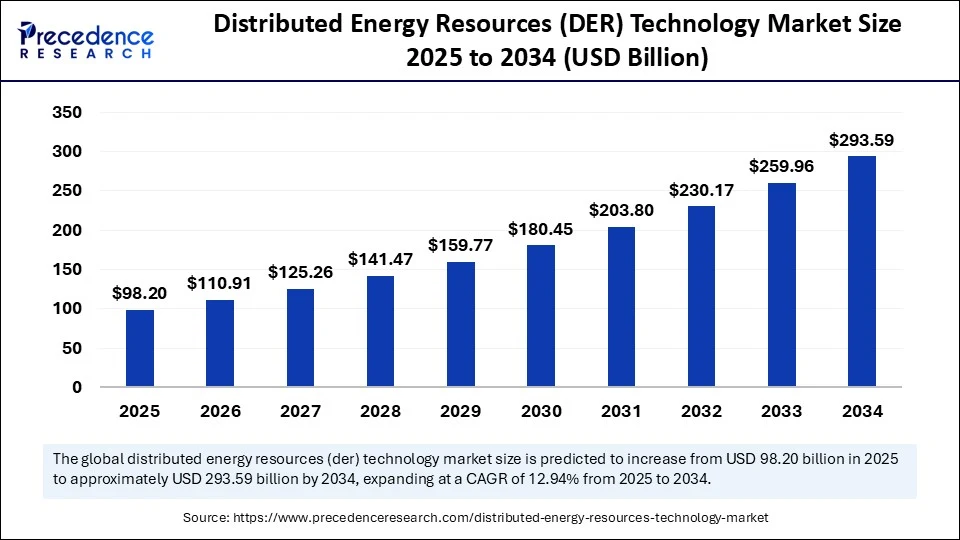

The global distributed energy resources (DER) technology market size accounted for USD 86.95 billion in 2024 and is predicted to increase from USD 98.20 billion in 2025 to approximately USD 293.59 billion by 2034, expanding at a CAGR of 12.94% from 2025 to 2034. Advancements in energy storage and smart grid technologies, the need for greater flexibility and grid resilience, and supportive governmental policies are driving the growth of the market.

Distributed Energy Resources (DER) Technology MarketKey Takeaways

- In terms of revenue, the global distributed energy resources (DER) technology market was valued at USD 86.95 billion in 2024.

- It is projected to reach USD 293.59 billion by 2034.

- The market is expected to grow at a CAGR of 12.94% from 2025 to 2034.

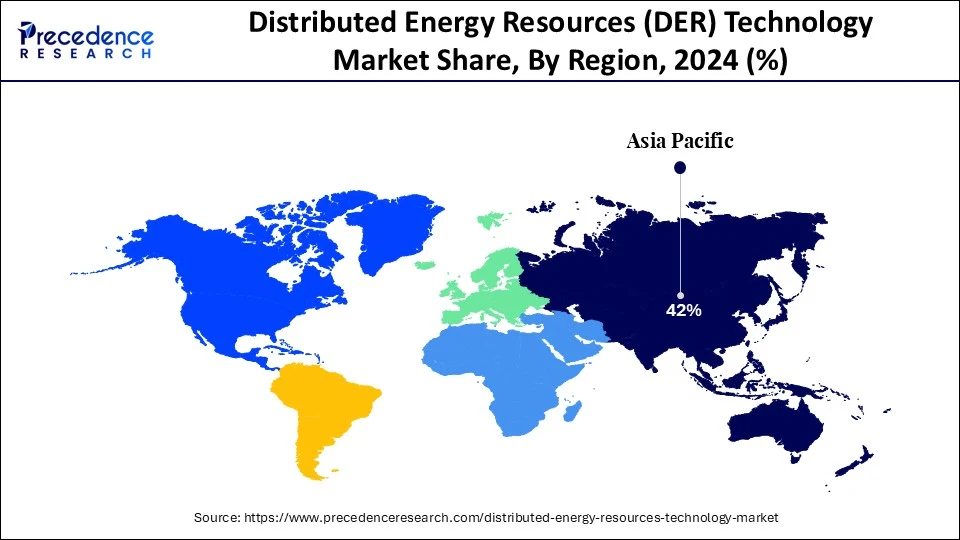

- Asia Pacific dominated the distributed energy resources (DER) technology market with the largest market share of 42% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By technology, the solar PV (distributed rooftop + small ground-mount) segment held the biggest market share of 38% in 2024.

- By technology, the battery energy storage systems segment is expected to grow at the fastest rate during the forecast period.

- By product/hardware, the inverters & converters segment captured the maximum market share of 30% in the 2024 market and is projected to experience the highest growth CAGR between 2025 and 2034.

- By system architecture/integration mode, the grid-tied DER segment contributed the highest market share of 60% in the 2024 distributed energy resources (DER) technology market.

- By system architecture/integration mode, the hybrid systems segment is set to experience the fastest CAGR from 2025 to 2034.

- By end-use/ application vertical, the residential segment held the maximum market share of 46% in the 2024.

- By end-use/ application vertical, the data centers & cloud edge facilities segment is anticipated to grow with the highest CAGR during the studied years.

- By power/capacity range, the residential/small (<10kW) segment accounted for a considerable market share of 42% in 2024.

- By power/capacity range, the large distributed/ VPP clusters (>50 MW, VPPs) segment is projected to expand rapidly in the coming years.

How is Artificial Intelligence (AI) Transforming the Distributed Energy Resources (DER) Technology Market?

Artificial intelligence (AI) is transforming the distributed energy resources (DER) technology. Improve grid reliability by strategically deploying DERs in areas with known grid constraints, ensuring effective energy distribution. It reduces cost by prioritizing investments where they are most needed and leveraging customer participation in energy programs to offset infrastructure expenses. AI improves exploration processes in fossil fuel extraction while minimizing environmental impact.

Grid management system powered by AI optimizes energy distribution networks, adapting to fluctuating demand and integrating diverse energy sources without extra effort. AI models consume enormous amounts of fossil fuel-based electricity, significantly contributing to greenhouse gas emissions. The need for advanced cooling systems in AI data centers also leads to excessive water consumption, which may have serious environmental consequences in regions experiencing water scarcity.

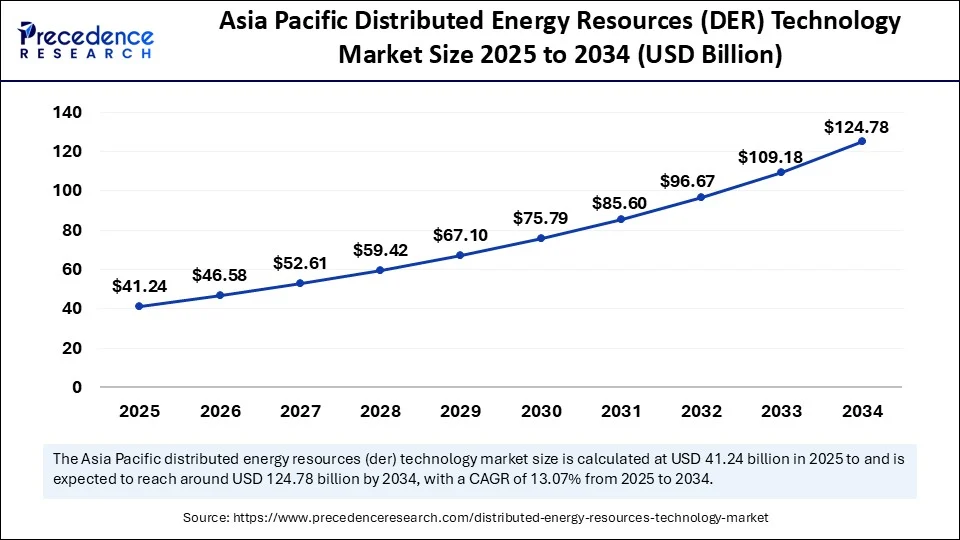

Asia Pacific Distributed Energy Resources (DER) Technology Market Size and Growth 2025 to 2034

The Asia Pacific distributed energy resources (DER) technology market size was exhibited at USD 36.52 billion in 2024 and is projected to be worth around USD 124.78 billion by 2034, growing at a CAGR of 13.07% from 2025 to 2034.

Asia Pacific held a significant share of 42% in the distributed energy resources (DER) technology market in 2024. Rising electricity prices, policy frameworks, regulatory support, technological innovation, energy independence, and rising demand for renewable energy are driving the market in the Asia Pacific region.

In addition, strong policy frameworks and government incentives are catalyzing DER adoption across countries like China, India, Japan, and South Korea. These nations have introduced favorable regulations, subsidies, and net metering programs to encourage the deployment of renewable-based distributed energy systems, especially in rural and underserved regions.

North America is anticipated to grow at the fastest rate in the market during the forecast period. Shift toward decentralized, localized energy production and consumption, transforming the energy grid, reducing transmission and distribution losses, supporting the transition to renewable energy, enhancing grid resilience, and empowering consumers are contributing to the growth of the distributed energy resources (DER) technology market in the North American region.

Additionally, DER technologies are playing a critical role in supporting the transition to renewable energy sources. As utility-scale solar and wind projects expand, DER systems are providing the flexibility and storage capacity needed to manage intermittency and ensure grid stability. The integration ofsmart grids and AI-driven energy management systems is further enhancing the ability to balance supply and demand in real time, creating a more resilient and adaptive energy ecosystem.

Market Overview

The distributed energy resources (DER) technology market refers to the production, distribution, and use of DER technologies are decentralized electricity-generation, storage, and control assets, including solar PV, wind, batteries, fuel cells, combined heat & power, microturbines, power electronics, EV chargers, and software/control systems that operate at or near the point of consumption and can operate independently or in coordination with the grid to provide energy, flexibility, resilience, and grid services. Distributed energy resources (DER) are small-scale energy systems that power a nearby location.

The benefits of DER are undeniable. By using the seamless integration of renewables like wind and solar, along with advanced technologies like smart energy management and DERMS. DERs promote sustainable practices while reducing emissions and operational costs. DERs are small-scale energy systems that power a nearby location. These factors help the growth of the distributed energy resources (DER) technology market.

What Factors Are Fueling the Rapid Expansion of the Distributed Energy Resources (DER) Technology Market?

- Rising renewable energy adoption: Renewable energy technology's environmental and economic benefits include generating energy that produces no greenhouse gas emissions from fossil fuels and reduces some types of air pollution. Diversifying energy supply and reducing dependence on imported fuels. It also includes the benefits of needing less maintenance costs, creates lots of jobs, can increase public health, is environmentally friendly, reliable, and sources will not run out.

- Supportive policies: Using distributed energy resources (DERs) at scales provides an opportunity to enhance electric system efficiency, reduce consumer costs, and combat emissions. DERs include benefits like storage resources, demand response, energy efficiency, distributed generation closer to the load, such as rooftop solar, and more. Supportive policies ensure compliance with laws and regulations, give guidance for decision-making, and streamline internal processes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 293.59 Billion |

| Market Size in 2025 | USD 98.20 Billion |

| Market Size in 2024 | USD 86.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.94% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product/Hardware, System Architecture / Integration Mode,End-use / Application Vertical, Power/Capacity Range, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological advancement

The benefits of technological advancements in distributed energy resources (DER) technology include AI complements humans, agriculture, accelerated innovation and research, solves complex problems, minimizing errors, medical advances, improved employee experience, business, better workforce productivity, availability, efficiency, automation, AI job market, automate repetitive tasks, innovation, eliminate repetitive tasks, cost reduction, fewer human errors, decision making, research and data analysis, personalization, increased efficiency, and improved customer experience.

Restraint

Cybersecurity risks

The cybersecurity risks include constantly evolving threats, potential for human error, skill shortage, user inconvenience, privacy concerns, false sense of security, cost, and complexity. It also includes the development of medical conditions, identity theft, hacker attacks, cyberbullying, and leakage of sensitive information. Common types of security risks include phishing, insider threats, ransomware, malware infections, and data breaches. These risks can compromise sensitive information, disrupt operations, and result in financial and reputational damage.

Opportunity

Improving grid resilience: By improving grid resilience, it minimizes the frequency and duration of power outages, ensuring a more consistent and dependable supply of electricity. By reducing disruptions to industries and businesses, a resilient grid helps maintain economic productivity and stability. Severe flooding can damage underground transformers, and powerful winds can damage power lines. Resilience means anticipating these events and testing strategies to overcome them, so communities can access critical infrastructure when they need it most. Consumer can better manage their own energy consumption and costs due to they have easier access to their own data.

Technology Insights

The solar PV (distributed rooftop + small ground-mount) segment held the largest share of 38% in the 2024 distributed energy resources (DER) technology market. The benefits of solar PV (distributed rooftop + small ground-mount) include scalability, aesthetic benefits, reduced risk of roof damage, design flexibility, enhanced accessibility, and enhanced efficiency. It also includes the advantages of selling extra energy to the grid, cutting our carbon dioxide emissions, solar electricity is a clean and renewable energy source, and cutting electricity bills. The battery energy storage systems segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The benefits of battery energy storage systems include offering a reliable way to stabilize the grid, reduce costs, and expand access to homegrown renewable power.

Product/Hardware Insights

The inverters & converters segment peaked with the largest share of 30% in the 2024 market and is projected to experience the highest growth rate in the market between 2025 and 2034. An inverter is an energy-saving technology that mitigates wasted operation in air conditioners by efficiently controlling motor speed. Inverter air conditioners adjust the temperature in a room by changing how fast their motors run without cycling on and off. It plays an important role in on-grid and solar power. Electricity is transmitted over power lines and also stored in batteries as DC.

System Architecture/Integration Mode Insights

The grid-tied DER segment held the largest share of 60% in the 2024 distributed energy resources (DER) technology market. The grid-tied solar system offers a blend of environmental sustainability, cost efficiency, and energy reliability. By providing effortless integration with the grid, allowing net metering, and reducing carbon footprints, these systems present a compelling option for anyone looking to harness solar energy.

The hybrid systems segment is set to experience the fastest rate of the market from 2025 to 2034. Various hybrid systems include energy storage, meaning you can store excess energy generated during sunny or windy days and use it when power grids go down. Hybrid systems provide increased flexibility by allowing us to select the specific instruments for our system, regardless of the bus, and to expand the system.

End-use/Application Vertical Insights

The residential segment held the largest share of 46% in the 2024 distributed energy resources (DER) technology market. More advanced applications that the technology allows include creating dynamic DER microgrids to minimize the impact of outages. DER are small-scale energy systems that power a nearby location. DER can be connected to electric grids or isolated.

The data centers & cloud edge facilities segment is anticipated to grow with the highest CAGR in the market during the studied years. DERs can reliably meet the increasing energy needs of data centers, allowing for reducing costs, cutting pollution, and embedding flexibility that can grow and adapt with the facility's unique needs.

Power/Capacity Range Insights

The residential/small (<10kW) segment accounted for a considerable share of 42% of the market in 2024. Replacing old power generation equipment with cleaner, more efficient DER technologies may also reduce emissions. Distributed energy resources are small-scale energy supply or demand resources that are interconnected to the electric grid.

The large distributed/ VPP clusters (>50 MW, VPPs) segment is projected to expand rapidly in the market in the coming years. A virtual power plant (VPP) integrates many DERs, including gas turbines, wind, solar, and energy storage systems, to balance supply and demand while improving sustainability, flexibility, and reliability. VPP can enhance the response speed of the power supply and demand balance, improve resource allocation, and, to a specific extent, reduce dispatching costs and the impact of electricity price fluctuations.

Distributed Energy Resources (DER) Technology Market Companies

- Siemens Energy

- ABB

- Schneider Electric

- General Electric (GE Renewable Energy / GE Grid Solutions)

- Hitachi Energy (Hitachi + ABB Power Grids combined portfolio)

- Eaton

- Caterpillar

- Cummins

- Tesla (Energy)

- BYD

- LG Energy Solution/ LG Chem (energy storage)

- Samsung SDI

- Panasonic Energy

- Sungrow

- Huawei Digital Power

- SolarEdge Technologies

- Enphase Energy

- SMA Solar Technology

- FIMER

- CATL (Contemporary Amperex Technology Co., Ltd.)

Recent Developments

- In May 2025, the launch of a new Apache Kafka-based software development kit (SDK) to enable faster and more scalable integration of distributed energy resources (DERs) into utility demand-side flexibility programs was announced by Uplight, a clean energy technology company that unlocks grid capacity by activating customers and their connected devices to generate, shift, and save energy. (Source: https://www.globenewswire.com)

- In March 2025, a whole-system streamlining service for distributed energy was launched by UKPN (UK Power Networks) and NESO (National Energy System Operator). A new service to streamline energy market access and enable faster grid connection for distributed energy assets was launched. (Source: https://www.solarpowerportal.co.uk)

Segments Coverd in the Report

By Technology

- Solar PV (rooftop, BIPV, ground-mount distributed)

- Wind (small/distributed wind turbines)

- Battery Energy Storage Systems (Li-ion, Flow batteries, Lead-acid, Sodium-ion, Solid-state)

- Thermal Storage (sensible, latent)

- Fuel Cells (PEM, SOFC, MCFC)

- Combined Heat & Power (micro-CHP)

- Microturbines

- Reciprocating Generators (natural gas/diesel)

- Flywheels

- Hydrogen Electrolysers (For hydrogen DER)

- Power-to-X DER (e.g., Power-to-Hydrogen)

By Product/Hardware

- PV Modules (monocrystalline, polycrystalline, thin film)

- Inverters & Converters (string, central, hybrid, DC-coupled, AC-coupled)

- Battery Packs & Racks (residential, commercial, utility-scale BESS)

- Power Conversion Systems (PCS)

- Microgrid Controllers (hardware controllers)

- Distributed Generators (gensets, microturbines)

- EV Chargers (AC chargers, DC fast chargers, V2G-capable chargers)

- Smart Switchgear & Protection Devices (reclosers, smart breakers)

- Metering Hardware (advanced meters, CTs/VTs)

- Thermal generation hardware (boilers, CHP units)

By System Architecture / Integration Mode

- Standalone DER

- Grid-tied DER

- Hybrid systems

- Microgrids

- Virtual Power Plants (VPPs)

By End-use / Application Vertical

- Residential

- Commercial

- Industrial & Manufacturing

- Institutional

- Telecom & Remote Sites

- Data Centers & Cloud-edge facilities

- Transportation

- Agriculture

By Power/Capacity Range

- Residential / Small (<10 kW)

- Small Commercial (10 kW–100 kW)

- Commercial & Industrial (100 kW–5 MW)

- Utility distributed (5 MW–50 MW)

- Large distributed / VPP clusters (>50 MW aggregated)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting