What is the Distributed Energy Resource Management Systems Market Size?

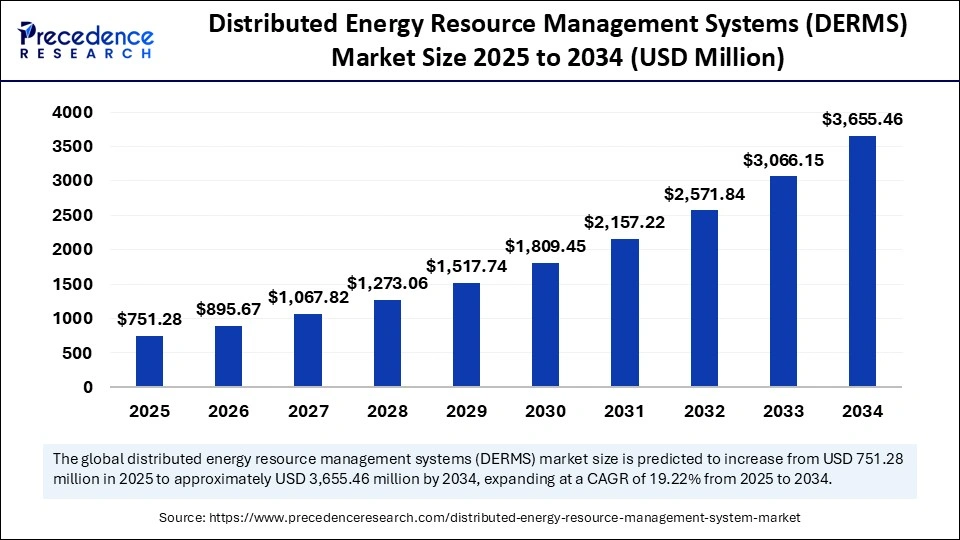

The global distributed energy resource management systems market size is calculated at USD 751.28 million in 2025 and is predicted to increase from USD 895.67 million in 2026 to approximately USD 3,655.46 million by 2034, expanding at a CAGR of 19.22% from 2025 to 2034. The market for distributed energy resource management systems is driven by rising renewable integration, grid modernization initiatives, and increasing demand for energy efficiency and reliability.

Market Highlights

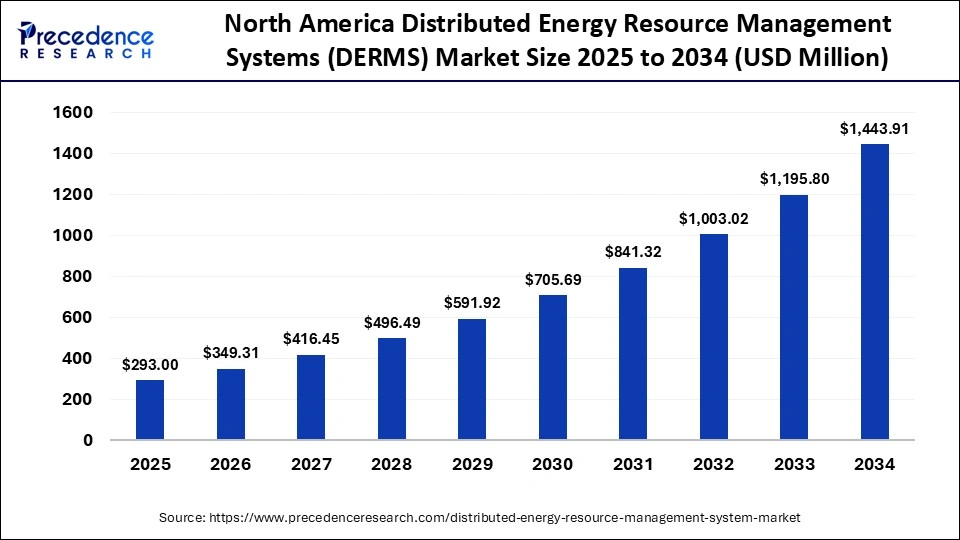

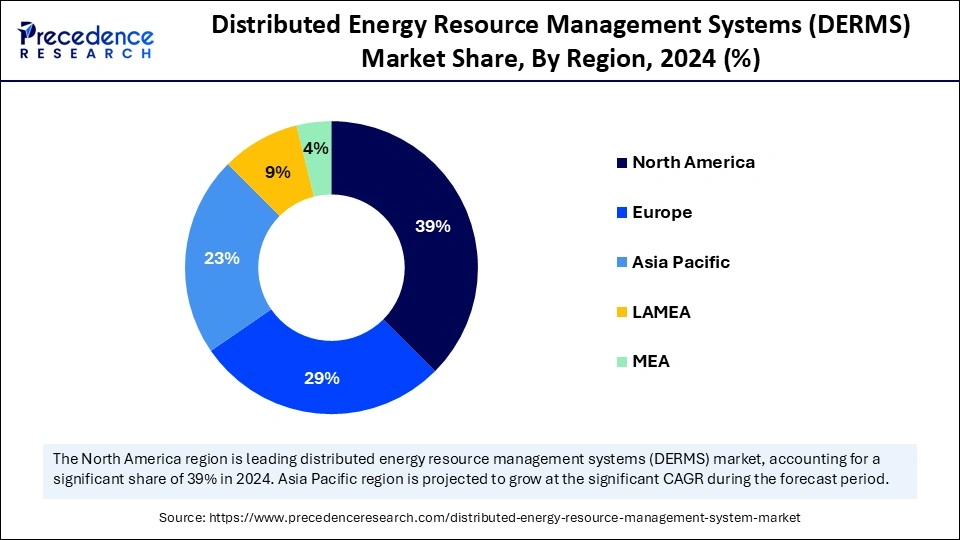

- North America accounted for the highest market share of 39% in 2024.

- The Asia Pacific is estimated to expand at a double-digit CAGR of 22% between 2025 and 2034.

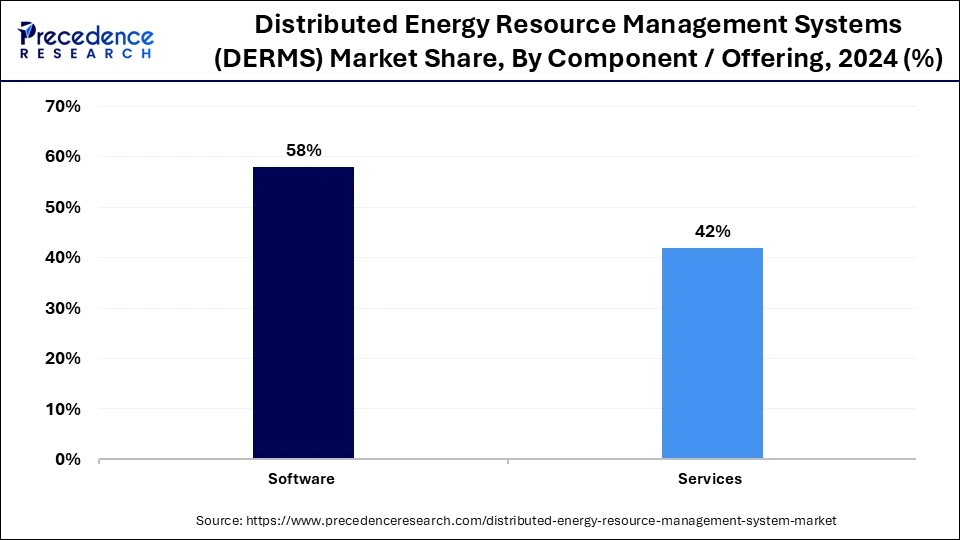

- By component/offering, the software segment captured approximately 58% of market share in 2024.

- By component/offering, the services segment is growing at the fastest CAGR from 2025 to 2034.

- By application/DER type, the solar PV DERs segment held the largest market share of 38% in 2024.

- By application/DER type, the proteomics segment is expected to expand at a notable CAGR between 2025 and 2034.

- By end-use sector, the commercial and industrial (C&I) DERs segment contributed the highest market share of 40% in 2024.

- By end-use sector, the residential DERs segment is growing at a high CAGR from 2025 to 2034.

- By deployment mode, the on-premise/utility controlled DERMS segment contributed the biggest market share of 50% in 2024.

- By deployment mode, the cloud / SaaS DERMS platforms segment is anticipated to grow at an approximately 21% CAGR between 2025 and 2034.

Factors Contributing to Market Growth of Distributed Energy Resource Management Systems

The increased integration of renewable energy and the rise in demand for grid reliability are major catalysts for the distributed energy resource management systems (DERMS) market. DERMS are software platforms that manage, control, and optimize distributed energy resources (DERs), including solar arrays, wind turbines, battery storage, and electric vehicles (EVs) in the grid environment.

These systems provide utilities and grid operators the capacity to optimize efficiency, manage supply and demand in real time, and address grid stability as decentralization grows. Comprehensive distributed energy resource management systems utilization will be essential as countries push for increased clean energy and modernize the grid infrastructure. DERMS will be the fundamental building blocks for optimizing the management of increasingly complex energy ecosystems, supporting decarbonization objectives, and enabling robust, flexible power networks worldwide.

Empowering Tomorrow's Grid with Smart Energy Management with Artificial Intelligence

Artificial intelligence is transforming the world of distributed energy resource (DER) management, enabling smarter, faster, and more adaptable energy systems. AI-enabled platforms analyse large volumes of real-time data from solar panels, wind farms, and storage facilities to identify changes in energy production and consumption, maintain grid balance, and optimize power distribution. More and more utilities are using AI to anticipate demand, automate control actions, and manage grid instability that can occur when renewable generation exceeds peak demand.

Recent trends show that two-thirds of energy companies are implementing AI to expand operation intelligence and efficiencies. In changing the field from reactive management strategies to predictive optimization and through the evolution of bringing DER networks to self-learning, energy systems can become more efficient and resilient while facilitating a data-enabled pathway to sustainable energy futures.

- In March 2025, NVIDIA and EPRI launched the Open Power AI Consortium to develop open-source AI models for utilities, accelerating grid modernization and distributed energy integration globally.

Distributed Energy Resource Management Systems Market Outlook

The increasing influx of distributed energy resources (DERs) such as rooftop solar, battery storage, and EV chargers has pushed utilities to adopt platforms that provide real-time visibility, aggregation, and control. Research by the National Renewable Energy Laboratory shows DERMS plays a critical role in enabling grid flexibility, resilience, and decentralized dispatch.

Across regions, Asia Pacific represented about 34% of DERMS adoption in 2024, while the U.S. grid-modernisation push via the Grid Modernization Initiative signals growing rollout in North America.

A considerable amount of government investment is being allocated to DERMS-enabled projects: for example, the U.S. DOE has set aside up to US$ 50 million in 2024 to demonstrate large-scale DER and distributed energy resource management systems integration across multiple states.

One of the strongest drivers is the urgency for grid flexibility and decarbonisation: as more DERs connect, utilities will need DERMS to manage variability and hold system stability; regulators are also creating new grid services and non-wires alternatives, which will intensify adoption.

High upfront integration costs, legacy infrastructure conflicts, and no standardised interoperability are delaying deployment. The U.S. governmentscybersecurity roadmap specifically identifies DERMS integration and data-interface standardisation as a gap.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 751.28 Million |

| Market Size in 2026 | USD 895.67 Million |

| Market Size by 2034 | USD 3,655.46 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component/Offering, Application/DER Type, End-Use Sector, Deployment Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Distributed Energy Resource Management Systems Market Segmental Insights

Component/ Offering Insights

The software portion dominates the distributed energy resource management systems market, with approximately 58% share, as it provides centralized coordination and optimization of distributed energy resources. Software module enhancements, such as DER orchestration, forecasting & analytics, and virtual power plant management, enable real-time decision-making and predictive load management while readily integrating renewables.

The services segment is set to be the fastest-growing in the market for distributed energy resource management systems, as adoption of consulting, system integration, and managed distributed energy resource management systems services has increased. Both utilities and enterprises are looking for external expertise to help them deploy, integrate, and maintain complex energy systems more efficiently. Managed service models will enable operators to reduce operational overhead, improve performance, and adapt quickly to changes in regulatory and grid requirements, all of which have driven significant growth in demand for professional and technical services.

Managed DERMS services, which fall within the services category, are also gaining traction as utilities see the benefit of leveraging externally managed services that are far more scalable and cost-effective than deploying their own internal infrastructure. These services provide ongoing monitoring and optimization, as well as maintenance of distributed assets, under flexible, subscription, or performance-based contracts. This flexible service structure enables energy providers to focus on innovation and customer engagement while relying on a robust, expert-managed digital ecosystem.

Application/DER Type Insights

The solar photovoltaic (PV) ders segment dominates the distributed energy resource management systems market, holding approximately 38% share, due to its presence in the residential, commercial, and utility markets. DERMS (distributed energy resource systems) management platforms are unable to efficiently manage solar variability, enable smart forecasting, and balance energy across a variety of rooftop and utility-scale PV locations. When solar plants are integrated into the grid as a very intelligent, data-driven control system, this significantly increases the grid overall resilience and promises a rapid rate of decarbonization.

The energy storage systems (ESS) segment is set to be the fastest-growing, with an estimated CAGR between 17% and 22%, driven by demand for grid flexibility and energy balancing. As the penetration rate of renewables increases, they also become ESS-integrated with distributed energy resource management systems in real time, shifting and balancing energy loads, regulating frequency, and providing backup power. Battery storage systems meaningfully impact overall stability with integration and support the use and smart management of renewable excess energy.

This segment services the interface between transportation and energy. DERMS solutions help coordinate EV charging loads across scales and enable counter-bi-directional energy flow across EVs and the grid locally. Each fleet of EVs can be aggregated as a distributed energy asset that supports demand response, peak load reduction, and grid balancing.

End-Use Sector Insights

The commercial and industrial (C&I) segment leads with nearly 40% market share, as businesses increasingly use distributed energy resource management systems to reduce operational costs, minimize energy use, and support their sustainability commitments. Manufacturing plants, data centers, and large commercial spaces have used DERMS for demand response, load balancing, and on-site renewable energy integration. Strong adoption across both developed and emerging markets continues in the C&I sector, driven by the need for energy reliability, cost savings, and carbon reductions.

The residential segment has been the fastest growing, partly aided by the proliferation of rooftop solar, home energy storage, and advanced smart meters. Homeowners are using DERMS solutions to monitor and manage their distributed energy assets in real time, enabling greater energy autonomy and reduced reliance on the grid.

The utility or grid operator segment is emerging as an important area of growth due to the need for improved visibility and control across larger, more complex energy networks. Utilities are now implementing distributed energy resource management systems to coordinate various distributed energy resources, support grid modernization, and improve outage management. Utility distributed energy resource modeling (DERMS) can enable real-time grid balancing, voltage optimization, and predictive maintenance, thereby improving reliability and responsiveness to new challenges.

Deployment Model Insights

The on-premise or utility-controlled model maintains the largest market share, with about 50%, because utilities prefer in-house control over mission-critical grid operations and data security. A utility-controlled model offers greater reliability, customization, and regulatory compliance. On-premise models are also favored for large-scale or national grid operations, where they prioritize sovereignty over energy data and low-latency communication to ensure system stability and operational resilience.

The cloud or SaaS-based model is set to be the fastest-growing, with an approximately 21% CAGR, driven by its reliability, flexibility, and lower upfront costs. Cloud-based DERMS platforms help utilities, aggregators, and energy service providers to remotely procure analytics, real-time data, and control functions. This model enables easier deployment of new DER asset integrations and facilitates quicker software updates. This model is therefore well-suited for modern digital grids and smaller operators seeking agile deployment with fewer infrastructure dependencies.

The hybrid deployment model is increasingly common because it combines the control of on-premise systems and the agility of cloud-based management. This model supports utilities keeping sensitive grid operations in-house, using cloud-based analytics for forecasting, optimization, and predictive maintenance compared to the previous two models.

Distributed Energy Resource Management Systems MarketRegional Insights

The North America distributed energy resource management systems market size is estimated at USD 293.00 million in 2025 and is projected to reach approximately USD 1,443.91 million by 2034, with a 19.37% CAGR from 2025 to 2034.

Why North America Dominates the Distributed Energy Resource Management Systems Market?

North America led the distributed energy resource management systems market, with an approximate share of 39%, due to the number of federal and state programs, utility pilots, and rules applied by operators that are establishing operational and procurement pathways for DER orchestration at the distribution scale. The U.S. agency and labs have been issuing roadmaps and orchestration guidelines that formalize DSO/utility functions, interconnection automation, and data exchanges, thereby reducing uncertainty in deploying DERMS. The participation of aggregated DERs in wholesale markets is established by rules and demand-response processes (within RTOs/ISOs). Therefore, you see utilities focusing on solutions that include AMI, telemetry, and dispatch interfaces into existing ADMS/SCADA stacks.

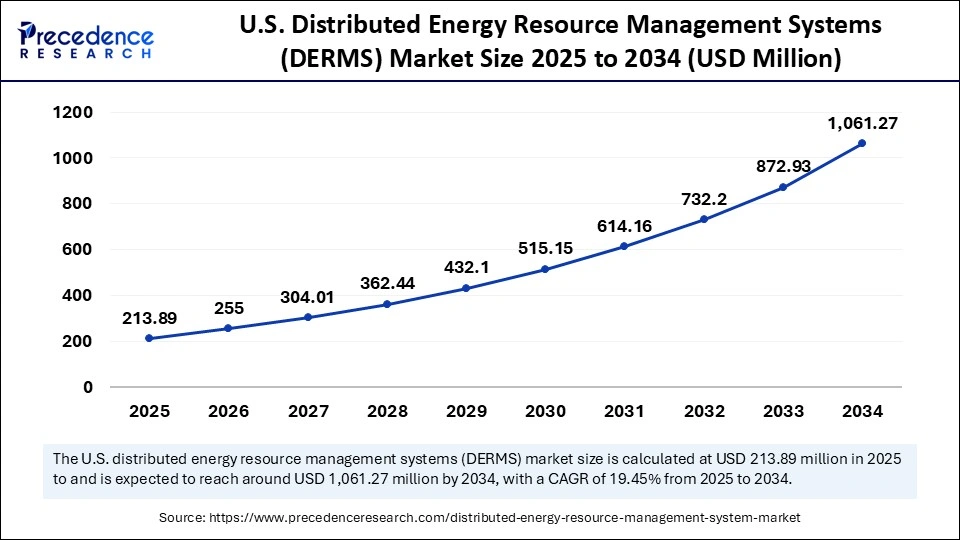

The U.S. distributed energy resource management systems market market size is calculated at USD 213.89 million in 2025 and is expected to reach nearly USD 1,061.27 million in 2034, accelerating at a strong CAGR of 19.45% between 2025 and 2034.

U.S. Distributed Energy Resource Management Systems Market Trend

The leadership of the United States is being driven by the Department of Energy and national lab programs, which are issuing increasingly sophisticated DER distribution orchestration and interconnection guidance, along with active ISO or RTO market rules permitting aggregated DER participation. These efforts clarify how distributed resources should be modeled, tested, and connected to the grid, providing developers with clearer technical pathways and helping utilities manage large volumes of new devices.

These policy and operational clarifications reduce project risk and accelerate utility procurement of DERMS to manage congestion, support VPP aggregation, and identify non-wire alternatives. By providing standardized rules and better operational visibility, utilities can integrate solar, storage, EV charging, and flexible loads more confidently and cost-effectively. This structured approach supports broader grid modernization goals and strengthens the overall role of DER in the United States energy transition.

Canada Distributed Energy Resource Management Systems Market Trend

Canada is making substantial strides in DER orchestration implementation through both major federal programs and utility grid modernization efforts. For example, Natural Resources Canada (NRCan) has funded a DER management platform project that optimizes distributed resources while expanding participation in electricity markets. In August 2025, Ontario received federal funding of over US$13 million to support smart grid demonstration projects that allow customers with solar panels & batteries to sell energy back to the grid, an important step towards two-way distribution systems. From a business analytics perspective, Canadas utilities are also moving into procurement of orchestration platforms and market agent aggregators to capitalize on DERs, reduce asset stress, and enable flexibility.

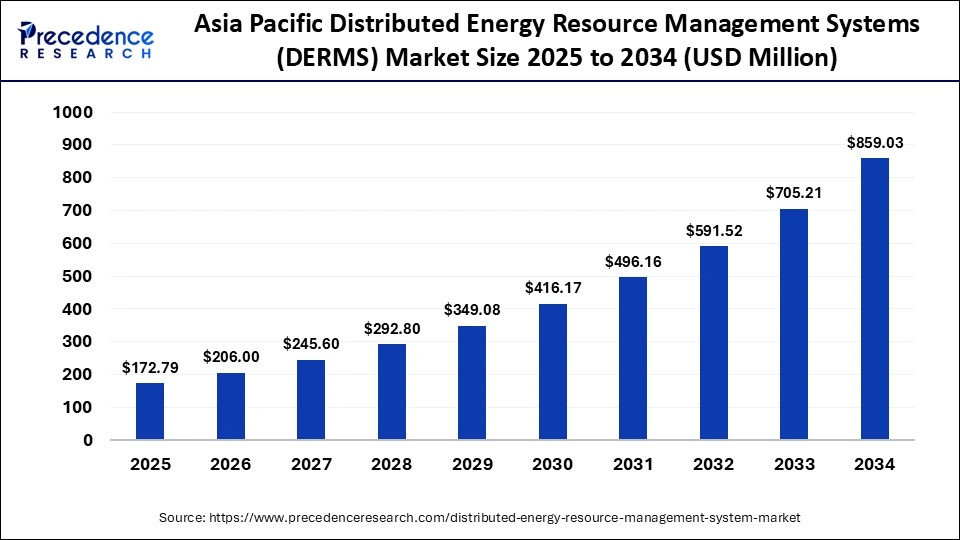

The Asia Pacific distributed energy resource management systems market market size is expected to be worth USD 859.03 million by 2034, increasing from USD 172.79 million by 2025, growing at a CAGR of 19.48% from 2025 to 2034.

What Makes the Asia Pacific Distributed Energy Resource Management Systems Market the Fastest-Growing Region?

The Asia Pacific distributed energy resource management systems region is driven by demand: significant annual growth in renewables and battery storage, accelerated electrification, and national programs to expand storage and VPP pilots have created urgent needs for distribution-level orchestration. To manage local congestion and minimize curtailments, grid operators and system planners in Australia and China have prioritized DER integration, upgrades to standards, and VPP demonstrations.

This is now translating into DERMS trials and purchasing programs. Utilities will also use DER orchestration to access flexibility and defer projects when upgrades for transmission or wires are slow and/or expensive; these uses create compelling commercial use cases for bi-directional software orchestration for utilities, developers, and industrial consumers across the region.

India Distributed Energy Resource Management Systems Market Trend

India is swiftly establishing its position as a major DER-orchestration opportunity, driven by strong national-level policies that promote distributed renewable energy and supporting technologies close to the point of consumption. Given the large rural population and patchy grid infrastructure, distributed renewable and storage systems (mini-grids, rooftop solar + batteries) provide a double benefit: reducing transmission losses and increasing reliability, which is an important function of distributed energy resource management systems.

Several aspects of India regulatory framework (net metering, open access for C&I loads) and continued subsidies for solar pumps and residential rooftop systems further support business models in which distributed energy resource management system software can be applied to coordinate assets, manage dispatch, and enable grid integration.

China Distributed Energy Resource Management Systems Market Trend

China is accelerating the adoption of DERMS through industrial-scale AI initiatives; the Open Power AI Consortium, which includes utilities, technology companies, and academia, is developing AI models for specific industries to optimize distributed energy assets, interconnection studies, and grid operations. These projects support Chinas large new solar/storage build-out and position orchestrators to leverage AI-enabled asset and grid modeling intelligence to develop distributed energy resource management systems quickly and effectively.

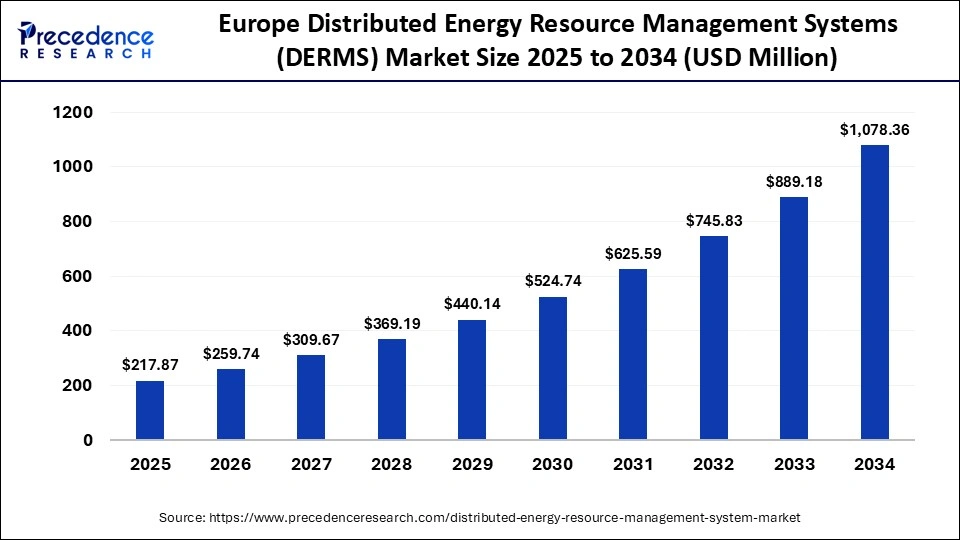

The Europe distributed energy resource management systems market market size has grown strongly in recent years. It will grow from USD 217.87 million in 2025 to USD 1,078.36 million in 2034, expanding at a compound annual growth rate (CAGR) of 19.42% between 2025 and 2034.

What makes Europe a flourishing Distributed Energy Resource Management Systems Market?

The regulatory and technical impetus in Europe for quantified flexibility needs, new market design rules, and TSO/DSO coordination requirements have elevated distribution flexibility as a procurement priority. Recently enacted EU rules require national flexibility assessments, and DSOs are now required to cooperate with TSOs, leading them to seek orchestration and market-enabling software solutions to manage congestion, local markets, and ancillary services.

Buyers in Europe are focused on standards, cybersecurity, and adherence to EU interoperability frameworks, which has led them to prefer procuring distributed energy resource management system projects to be undertaken alongside regulatory or pilot programs, and national flexibility studies, rather than stand-alone vendor pilot tests. Regulatory assurance reduces risk and makes modular, standards-compliant DERMS commercially viable.

Germany Distributed Energy Resource Management Systems Market Trend

The expansion of renewables and recent EU flexibility obligations in Germany are driving DSOs to procure software-enabled congestion management and flexibility. Pilot projects in Germany, along with network planning, use grid models and existing market signals to coordinate storage, rooftop PV, and demand response, thereby putting DERMS at a premium if it can integrate with existing AMI, grid models, and EU technical/cyber requirements.

Distributed Energy Resource Management Systems Market Companies

ABB Abilit Energy Manager is the digital solution to monitor and optimize energy consumption and CO2 footprint, giving the chance to make faster and better decisions based on data insights.

Offers a Distributed Energy Resource Management System (DERMS) called GridOS DERMS.

its Distributed Energy Resource Management System (DERMS) as a cross-platform solution for more flexible and scalable management of distributed energy resources.

EcoStruxure DERMS is a grid-aware solution tailored for the needs of utilities, enabling both the efficient operation and planning of the active grids.

developed a comprehensive real-time intelligent energy networking platform, GridOS®, which includes DER management and a Grid-of-Grids vision.

Provides a Distributed Energy Resource Management System (DERMS), Strata Grid, and cloud-based DER portfolio management software Cirrus Flex.

Uses its IntelliFLEX and IntelliSOURCE platforms to help utilities manage, orchestrate, and optimize various distributed energy resources (DERs) like solar, EVs, and batteries.

Offers a Distributed Energy Resource Management System (DERMS) solution through its subsidiary, AspenTech.

Offers a product called Oracle Utilities DERMS to help utilities manage the increasing adoption of distributed energy resources (DERs).

Recent Developments

- In March 2025, Mitsubishi Electric Power Products, Incs subsidiary Smarter Grid Solutions Limited and Clean Power Research have completed the integration of SGSs Strata Grid DERMS and Clean Power PowerClerk workflow-automation platform, enabling streamlined DER registration and real-time control of front- and behind-the-meter assets for utilities.(Source: https://www.businesswire.com)

- In March 2025, Oracle Corporation launched enhancements to its Utilities Network Management System (NMS) that bolster its Advanced Distribution Management System (ADMS) capabilities, improving forecasting, DER orchestration, and resilience against extreme weather through upgraded modules.(Source: https://www.oracle.com)

- In August 2024, Tesla launched its Powerwall 3 in the Australia and New Zealand markets, a home-battery system integrating solar inverter and lithium-iron-phosphate chemistry, offering higher output and whole-home backup capabilities.(Source: https://www.ess-news.com)

Distributed Energy Resource Management Systems MarketSegments Covered in the Report

By Component/Offering

- Software

- DER orchestration modules

- Forecasting & analytics modules

- VPP management modules

- Services

- Consulting & system integration

- Maintenance & support services

- Managed DERMS services

By Application/DER Type

- Solar Photovoltaic (PV) DERs

- Energy Storage Systems (ESS)

- Wind DERs

- EV Charging/Vehicle-to-Grid Integration

- Microgrids & Hybrid DER Systems

By End-Use Sector

- Residential DERs

- Commercial & Industrial (C&I) DERs

- Utility-Scale/Grid Operator DERs

- Microgrid/Campus DERs

By Deployment Model

- On-Premise / Utility Controlled DERMS

- Cloud / SaaS DERMS Platforms

- Hybrid On-Premise + Cloud

- Managed Service DERMS (outsourced)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting