What is the Intrauterine Devices Market Size?

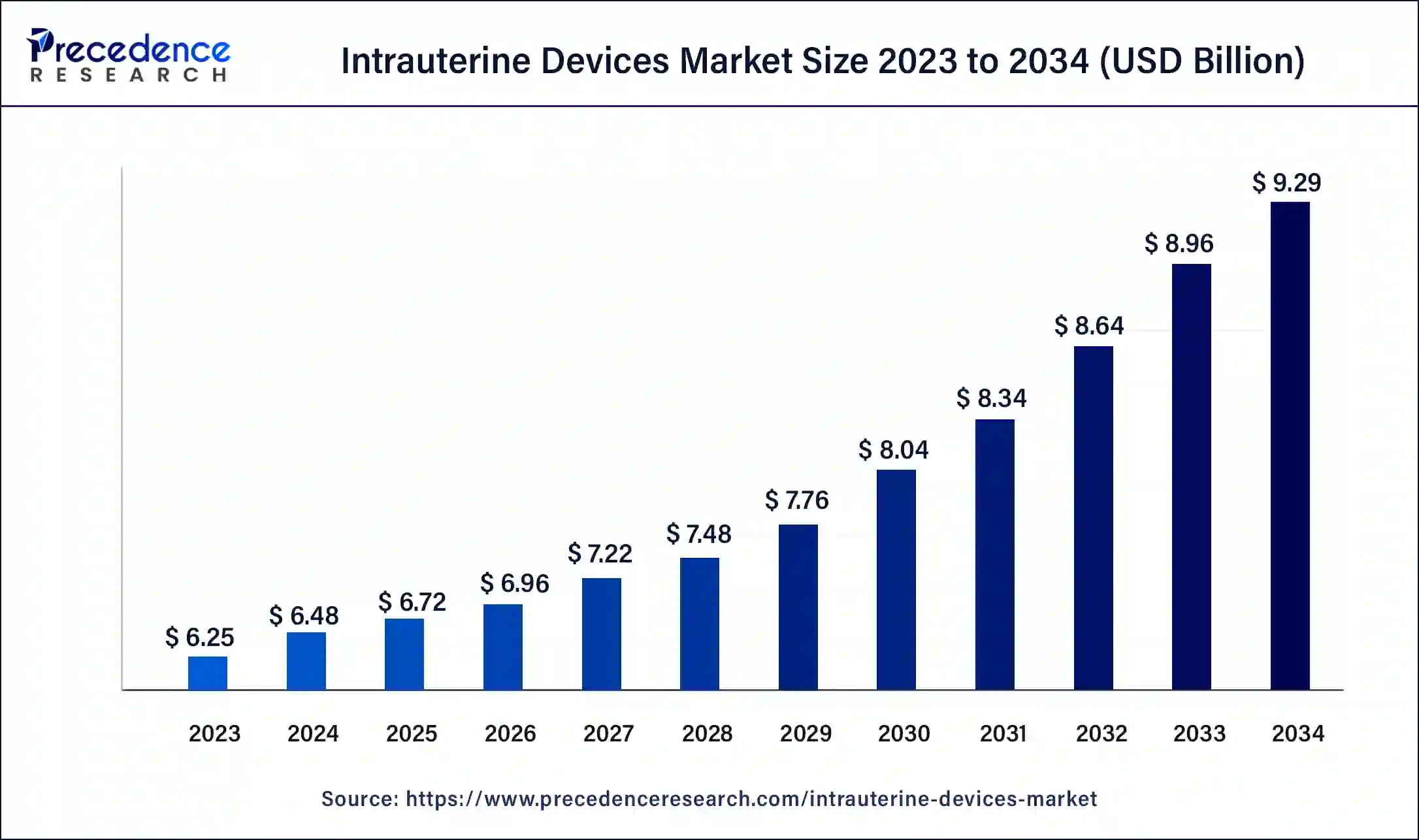

The global intrauterine devices market size is valued at USD 6.72 billion in 2025 and is predicted to increase from USD 6.96 billion in 2026 to approximately USD 9.29 billion by 2034, expanding at a CAGR of 3.67% from 2025 to 2034.

Intrauterine Devices Market Key Takeaways

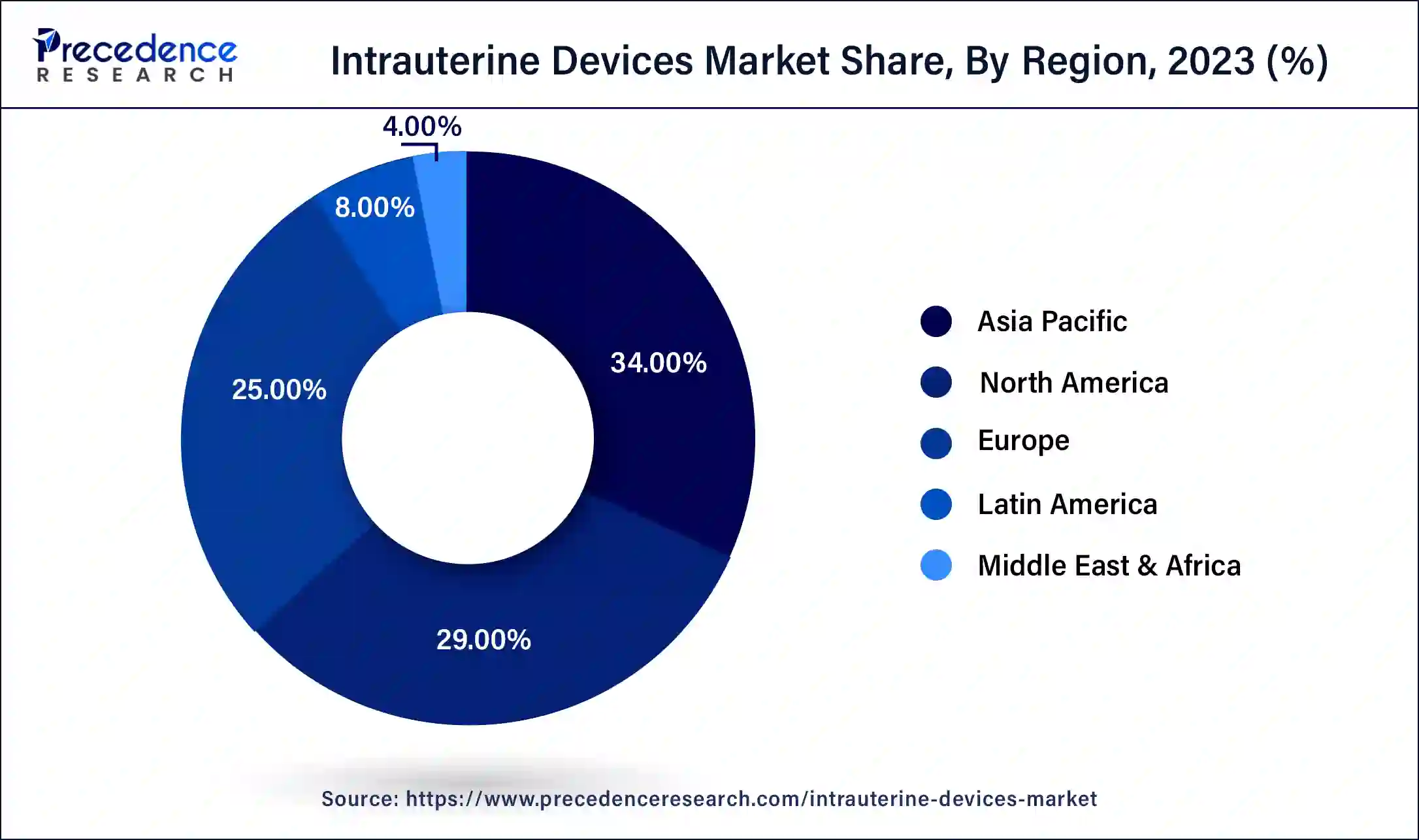

- Asia Pacific contributed the highest market share of 34% in 2024.

- North America is projected to see notable growth in the intrauterine devices market in the coming years.

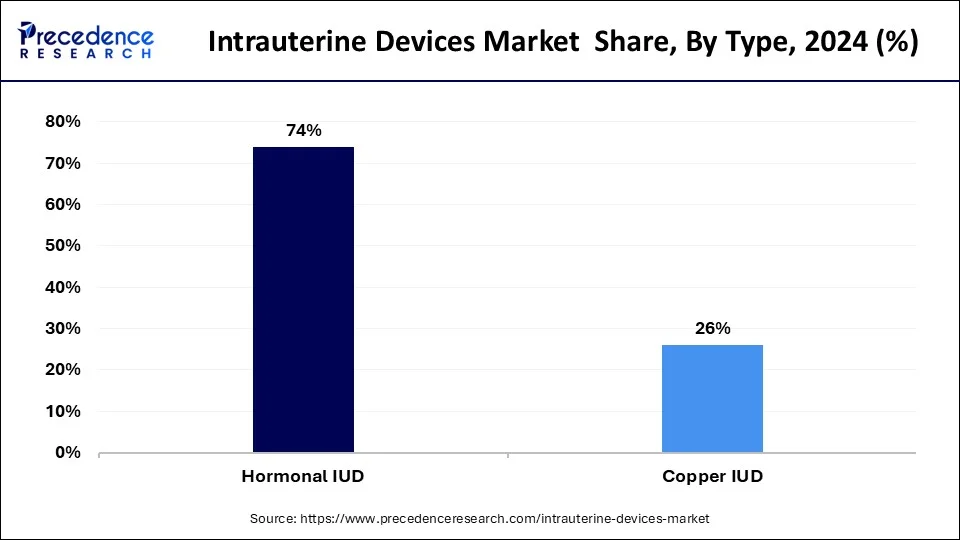

- By type, the hormonal IUD segment generated the highest market share of 74% in 2024.

- By type, the copper IUD segment is observed to witness a significant rate of growth during the forecast period.

- By distribution channel, the hospital segment accounted for the highest market share of 55% in 2024.

- By distribution channel, the gynecology clinics segment is predicted to witness significant growth in the market over the forecast period.

What are Intrauterine Devices?

Intrauterine devices, commonly known as IUDs, are small, T-shaped devices that are inserted into the uterus to prevent pregnancies. Earlier versions of IUDs all used copper to prevent conception; thus, the devices were widely known as the ‘copper T.' However, modern intrauterine devices now come in two types: copper and hormonal.

Intrauterine devices are reliable, long-lasting, and reversible, making them a popular choice of contraception. Increasing consumer awareness around various methods of contraception and pregnancy prevention is leading to more individuals opting for long-term contraceptives, driving demand in the intrauterine devices market. However, the nature of the devices requires insertion by a trained healthcare professional, restricting their adoption in regions where access to physicians and trained nurses is limited. Innovations in intrauterine device technologies and material usage provide opportunities for expansion of the intrauterine devices market.

How is artificial intelligence transforming the contraception sector?

Artificial Intelligence is making waves in the medical sector, including in sexual and reproductive healthcare. Machine learning is currently being applied to radiology and pathology to optimize the processing of large volumes of medical imaging data. Generative AI and large language models are also being employed to address a varying set of health needs through remote consultation via. chatbots and virtual assistants. Reproductive health services use AI tools such as conversational agents, which prove crucial in an area where patient anonymity is desirable.

Predictive AI capabilities also have the potential to address the need for targeted healthcare interventions, especially in areas where there is a shortfall of human resources, such as with maternal health or the management of STIs. AI is being used to analyze a person's medical records, lifestyle, and other wellness parameters to suggest the most suitable and effective form of contraception for them and even forecast the incidence of infertility.

- According to research published in NPJ Digit Med in 2023, apps such as OptiBPTM are currently being used for estimating blood pressure (BP) across remote areas in Bangladesh, South Africa, and Tanzania. The app aimed to combat undetected and unmonitored hypertension, a condition that disproportionately affects the pregnant population where the occurrence of hypertensive disorders is common.

Intrauterine Devices Market Outlook

- Industry Growth Overview: The intrauterine devices market is anticipated to grow steadily between 2025 and 2030, driven by growing awareness of long-term contraception, robust government family planning initiatives, and increasing preferences for non-hormonal options. Adoptions grew rapidly in Asia-Pacific and North America, where women preferred effective, low-maintenance options.

- Sustainability Trends: Sustainability influenced product innovation, leading to a growing interest in biodegradable materials, safer polymers, and reduced packaging waste. As governments across the globe began advocating for safer reproductive health products and lower environmental impacts along medical supply chains, manufacturers increased studies on the components of eco-friendly devices.

- Global Expansion:Key companies' ownership expanded into Asia-Pacific, Latin America, and Eastern Europe due to increased demand and to expand access to reproductive healthcare. Many companies have built distribution networks and partnered with public health agencies to provide options to underrepresented populations, while also supporting government efforts to provide contraception options nationally.

- Major Investors:Investors focused on private equity and healthcare became increasingly active on the back of steady demand, stable margins, and long-standing relevance to the public health landscape. There was investment in firms working on next-generation hormonal intrauterine devices (IUDs) and enhanced copper devices, demonstrating confidence in sustained market adoption.

- Startup Ecosystem:The startup ecosystem has advanced, with nascent companies investing in novel insertion approaches, more user-friendly designs, and digital monitoring technologies. Emerging firms based in the U.S., India, and Europe completed financing rounds, claiming they would provide safer material alternatives, easier insertion systems, and increased comfort for users.

What are the Growth Factors in the Intrauterine Devices Market?

- Global awareness campaigns on family planning and the benefits of long-term contraception are driving the adoption of IUDs, especially in emerging economies.

- Global awareness campaigns on family planning and the benefits of long-term contraception are driving the adoption of IUDs, especially in emerging economies.

- Increased endorsement from gynecologists and family planning professionals due to the safety, efficacy, and ease of use of IUDs is further supporting intrauterine devices market growth.

- Continuous R&D and advancements in IUD designs, such as hormonal IUDs that offer additional health benefits, are making these devices more appealing to women.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.29 Billion |

| Market Size in 2026 | USD 6.96 Billion |

| Market Size in 2025 | USD 6.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.67% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type,Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising awareness around contraception and preventing unwanted pregnancies

Government efforts on a global scale to tackle issues related to population explosion and the advent of the internet have led to increased awareness among consumers concerning different methods of contraception and their efficacy. Among the various forms of contraception, intrauterine devices are popular as they are seen as a long-term, reliable, and reversible method for women, offering high pregnancy prevention rates (total pregnancy rate of 1.7 per 100 women for the first 3 years of use), and a low expulsion rate (first-year expulsion rates of the IUD are commonly quoted as 2%-10%). Depending on the IUD's make and model, it has a lifespan between 5 and 10 years. This is driving demand in the intrauterine devices market.

- According to a 2022 survey published in Digital Health, in Australia, the average yearly rates of intrauterine device insertion increased noticeably from 25.1–26.3 in 2018–2019 to 29.3–31.2 per 100,000 population in 2020–2021, a notable 12–18% increase. The survey found that by June 2020, the search term frequency for the two intrauterine device-related topics returned to much higher levels post-pandemic, with a 50% increase for ‘Progestin IUDs' and 54% for ‘Intrauterine device,' respectively. The study found a moderately strong correlation between intrauterine device insertion rates and Google search trends around intrauterine devices.

Investment initiatives in contraceptives on a global scale

Several government programs have been initiated worldwide for the promotion of family planning, tackling issues such as unwanted pregnancies. Organizations such as the National Institutes of Health (NIH), the Agency for International Development (AID), private foundations, as well as pharmaceutical companies, and venture capitalists are pledging significant investments in reproductive care. The United States Agency for International Development has partnered with country governments and local stakeholders since 2017 to procure and distribute over 563.5 million contraceptives, valued at US$ 251 million. According to the 2022 United Nations World Family Planning Report, in sub-Saharan Africa, there has been an increased share in the use of implants and injectables due to extensive investment by international donors and efforts by local authorities over the past two decades. There are also notable investments in developing new contraceptive technology to reduce repeat clinical visits. These investments are further boosting growth in the intrauterine devices market.

Restraints

Lack of skilled professionals, especially in underdeveloped areas

Unlike other contraceptive methods, such as condoms or the pill, intrauterine devices are less accessible. Individuals cannot do IUD insertions, requiring trained healthcare professionals and specialized tools to administer them. Individuals wanting to use IUDs for pregnancy prevention are thus forced to rely on local healthcare facilities and clinicians to access this form of birth control. According to 2019 data published by the United Nations, 340 million people used either the male condom or the pill compared to 159 million using IUDs. The ease of use of other contraception methods is proving to be a significant challenge for growth in the intrauterine devices market.

Patient anxieties around intrauterine device insertion

Another common barrier to the use of IUDs is the fear of pain during insertion and anxiety surrounding the experience. Most women experience cramping during the insertion procedure but report that their healthcare providers fail to give them access to adequate pain management before, during, or after the procedure and even invalidate or minimize their pain. Research shows that clinicians in the United States were much more likely to prescribe sedatives for women in pain rather than pain medication compared to their prescriptions for pain in men.

Providers were also half as likely to prescribe Black patients pain medication as their white counterparts, compounding the effect for Black women. A 2015 study found that among women who had never given birth, 42% said that during the IUD placement, they experienced severe pain, with 35% rating it as moderately painful and 23% reporting it as mildly painful.

Opportunity

Development of new IUD technologies

Innovations in the sexual and reproductive healthcare sector are leading to the development of new types of IUDs as well as monitoring systems for serious issues such as IUD malpositioning, which increases the risk of ectopic pregnancies and life-threatening bleeding. In 2023, researchers at Cornell created the MyUD device, which incorporates a strain-sensitive circuit and resonant inductive coupling technology to detect malpositioning of the IUD within the uterus. The device is set up to warn users of any abnormal strain on the IUD that may result in displacement, perforation, expulsion, or embedment. New developments in the reproductive healthcare space are expected to drive future growth in the intrauterine devices market.

Segment Insight

Type Insights

The hormonal IUD segment held a dominant presence in the market in 2024. Hormone IUDs work by releasing small amounts of progestin hormone Levonorgestrel over a period of time. Levonorgestrel thickens the cervical mucus, making it harder for sperm to swim toward the fallopian tubes. The hormone also works to thin the uterus lining and partially suppresses ovulation. Hormonal IUDs have also been found to ease menstrual pain and heavy bleeding and may even stop periods altogether. Hormonal IUDs provide a 99.8% pregnancy prevention rate and are also helpful in the treatment of menorrhagia and dysmenorrhea, making them a popular choice among modern contraceptives.

- A survey conducted by researchers at the National Cancer Institute, Division of Cancer Epidemiology and Genetics found that between 2015 and 2017, 76.5% of women in the United States were using hormonal IUDs, with especially higher use among obese women.

The copper IUD segment is observed to grow at a notable rate during the forecast period in the intrauterine devices market. Copper IUDs work by triggering an immune response in the body, causing inflammation in the uterus which prevents pregnancy. Copper IUDs were the most widespread form of IUDs used before the development of Levonorgestrel-based IUDs. They continue to remain popular in middle and low-income countries due to their longevity (10-year lifespan) and lower cost.

Distribution Channel Insights

In 2024, the hospital segment led the global intrauterine devices market. IUDs require administration by trained professionals, and hospitals worldwide are the primary providers of family planning services, including counseling and follow-up visits. The number of patient visits for family planning to hospitals is also expected to drive further growth in the market.

The gynecology clinics segment is predicted to witness significant growth in the market over the forecast period. Gynecology clinics are increasingly catering to women's reproductive healthcare needs, especially in areas where healthcare infrastructure is lacking. These clinics provide services such as pap smears, breast cancer screenings, pelvic pain evaluations, and helping patients find the most suitable contraception method.

Regional Insights

Asia Pacific Intrauterine Devices Market Size and Growth 2025 to 2034

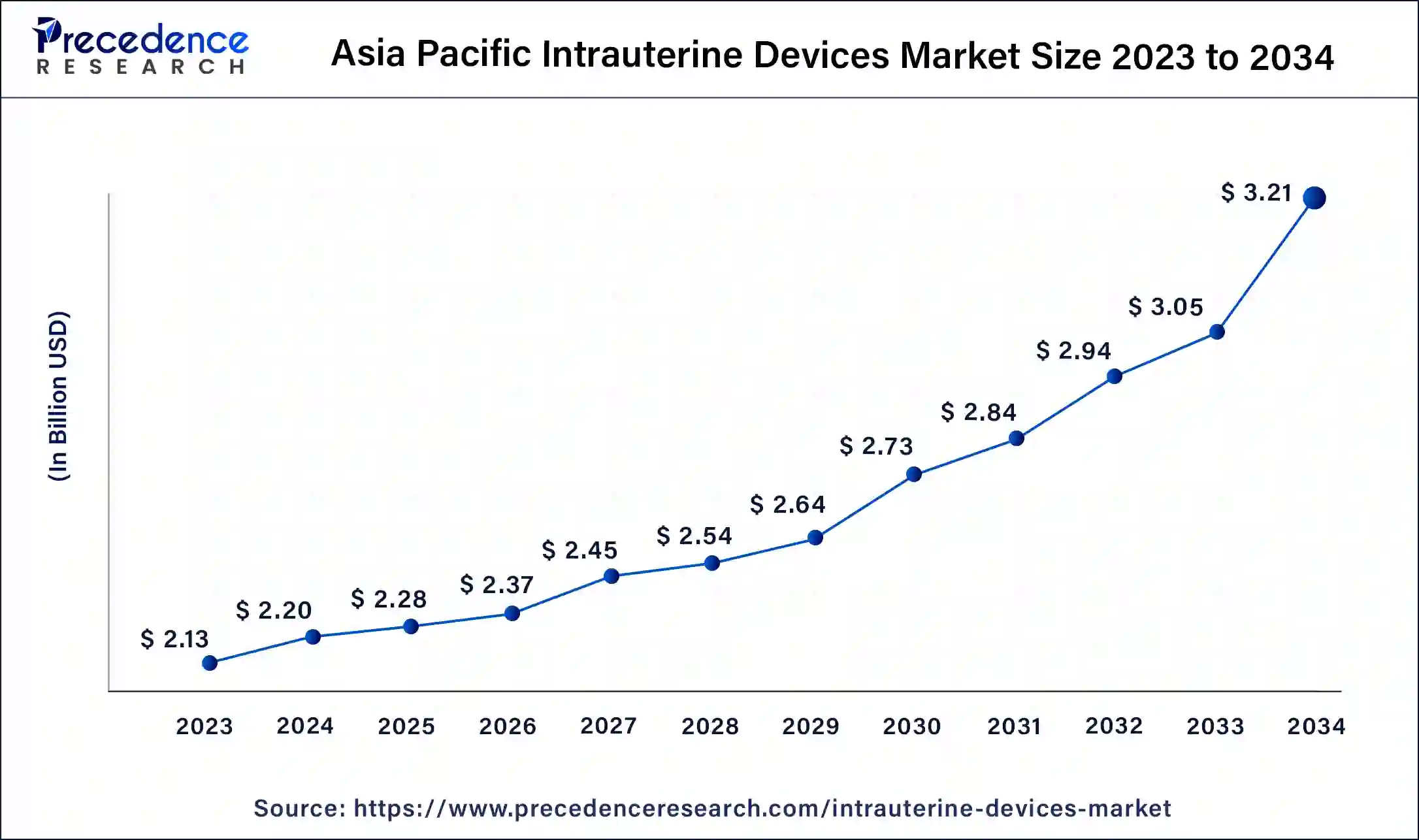

The Asia Pacific intrauterine devices market size is accounted at USD 2.28 billion in 2025 and is projected to be worth around USD 3.21 billion by 2034, poised to grow at a CAGR of 3.85% from 2025 to 2034.

Asia Pacific held the largest share of the intrauterine devices market in 2024. High population growth and rapid urbanization have increased the demand for contraception, with several government initiatives in the region being undertaken to promote family planning. Higher healthcare infrastructure spending, women empowerment initiatives, and the rising acceptance of modern contraception are all driving growth in the intrauterine devices market. Among countries in the region, China held a significant share of the market while India is expected to see a high CAGR in the space during the forecast period. Indian government initiatives such as ‘Mission Parivar Vikas' are being undertaken to improve access to contraceptives and family planning services in 145 districts across seven states.

Asia Pacific: China Intrauterine Devices Market Trends

China's market is being driven by growing awareness of long acting reversible contraception, with many women opting for reliable, low-maintenance options. Hormonal IUDs are gaining ground over copper ones, supported by technological improvements that increase comfort and efficacy. Government policies and family planning initiatives continue to promote IUD usage, expanding access, especially in less-served or rural areas.

North America is projected to see notable growth in the intrauterine devices market in the coming years. The growing awareness and popularity of long-term birth control measures in the region are contributing to demand. According to the United States National Center for Health Statistics' National Survey of Family Growth, 20.4% of sexually experienced women had used an IUD between 2015 and 2019, with 15.3% of them using hormonal IUDs.

North America: U.S. Intrauterine Devices Market Trends

The U.S. market is expanding as long acting, reversible contraceptives become more widely accepted. Hormonal IUDs dominate the market, thanks to their high efficacy and added benefits like lighter menstrual bleeding. Innovations are underway, with newer devices made from softer materials and improved applicators to enhance comfort and ease of insertion. Supportive public health programs and increasing provider training are also helping boost the adoption of IUDs across diverse age groups.

Why did Europe have Rapid Growth in the Intrauterine Devices Market?

Europe had rapid growth in the market due to women trusting long-acting contraceptive options, as well as the support from public health systems in each country. Almost every country has national programs promoting access to modern contraception. High levels of awareness, well-trained doctors, and high levels of access to health care practitioners all resulted in further market growth for long-acting contraceptive methods.

Germany Intrauterine Devices Market Trends

Germany remained the flagship country due to its well-functioning health care system, good insurance coverage on reproductive health, and high levels of awareness about reproductive health. Women preferred long acting and reliable contraceptive options, which led to increased adoption of IUDs in Germany.

Furthermore, doctors and clinics were well-trained on new IUD devices and offered new options for patients. Opportunities in Germany came in the form of newer hormonal IUDs, better materials than plastics, and digital health tools for patient monitoring and re-engagement on follow-ups.

Why did Latin America have Steady Growth in the Intrauterine Devices Market?

Latin America saw steady growth due to supportive government investment in reproductive health programs and access to modern contraceptives. Many women favored the IUD due to lower long-term costs and confidence in safety. Improvements in healthcare and informative campaigns helped increase access. The region offered opportunities in affordable copper devices, youth health programs, and rural distribution networks.

Brazil Intrauterine Devices Market Trends

Brazil continued to be the leading market due to investment in urban healthcare networks and growing awareness of long-term birth control. Women trusted the safety and convenience of IUDs. Public health programs and NGOs have provided access in lower-income communities. Opportunities emerged from affordable devices, increased training for nurses, and new hormonal IUDs that were better designed for wider, longer-term use across different age groups.

Why did the Middle East & Africa have Rapid Growth in the Intrauterine Devices Market?

The Middle East & Africa exhibited notable growth driven by increased attention to women's health, greater access to healthcare services, and strong support from international health agencies, which have made women's health part of global and regional initiatives. Many countries made improvements to their family planning programs in ways that made it easier for people to access IUDs. There was growth in demand for low-cost, long-acting options, and opportunities to engage in the potential market by use of training programs, rural clinics, and new device design, particularly suitable for the younger generation.

South Africa Intrauterine Devices Market Trends

South Africa continued to be the largest market in the region due to its more advanced healthcare infrastructure, in addition to the presence of strong partnerships with national and global health organizations. As awareness improved, women very slowly began to adopt long-acting contraception. Some clinics offered both hormonal and copper IUDs for use. There were opportunities for greater adoption through scaling service provision to rural regions, training more healthcare workers, and introducing similarly designed newer devices that placed a greater emphasis on comfort and safety.

Intrauterine Devices Market Companies

- Bayer AG

- AbbVie Inc.

- CooperSurgical Inc.

- Pregna International Limited.

- SMB Corporation of India

- Mona Lisa N.V.

- DKT International

- EUROGINE, S.L.

- Prosan International BV

- OCON Medical Ltd.

Recent Innovation in Intrauterine Devices Market

- In July 2024, Researchers at the University of Western Ontario announced the ongoing development of an iron IUD, which they claim will be a better alternative to copper IUDs. The new contraceptive will use iron or zinc with a specially developed polymer coating to create a device with fewer side effects.

- In July 2024, Israeli women's health company OCON Therapeutics raised US$10 million to expand its health solutions, including painless and effective IUDs and treatment for endometriosis. The company has raised a total of $40 million to date, including the most recent round of funding.

- In November 2023, pharmaceutical giant Bayer announced a development and license agreement with CrossBay Medical to create a single-handed inserter for intrauterine devices. The project involves integrating CrossBay's CrossGlide technology with Bayer's hormonal IUD portfolio.

Segments Covered in the Report

By Type

- Hormonal IUD

- Copper IUD

By Distribution Channel

- Hospital

- Gynecology Clinics

- Community Health Care Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting