What is the Invoice Financing Platform Market Size?

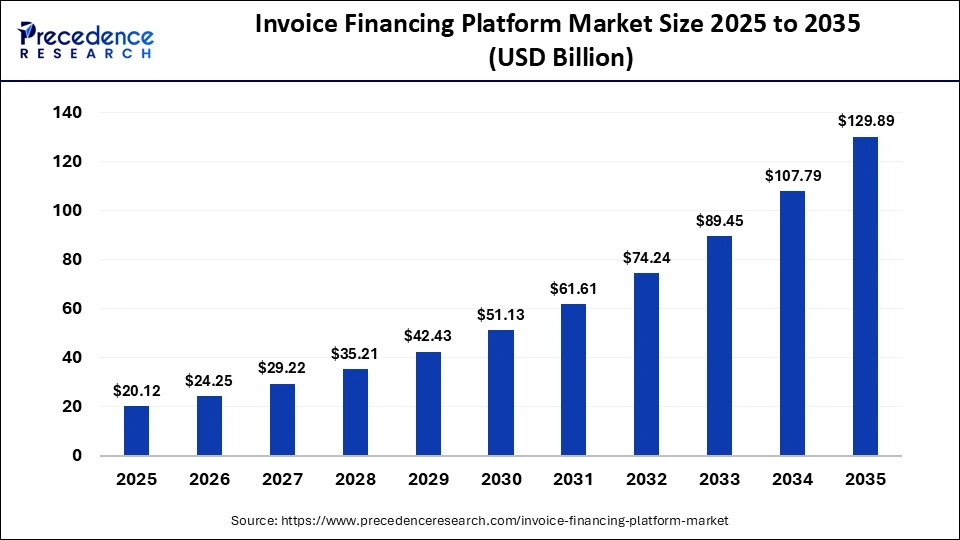

The global invoice financing platform market size was calculated at USD 20.12 billion in 2025 and is predicted to increase from USD 24.25 billion in 2026 to approximately USD 129.89 billion by 2035, expanding at a CAGR of 20.50% from 2026 to 2035. This market is growing rapidly as businesses increasingly adopt digital platforms to unlock working capital, improve cash flow, and streamline receivables financing through faster and more transparent funding solutions.

Market Highlights

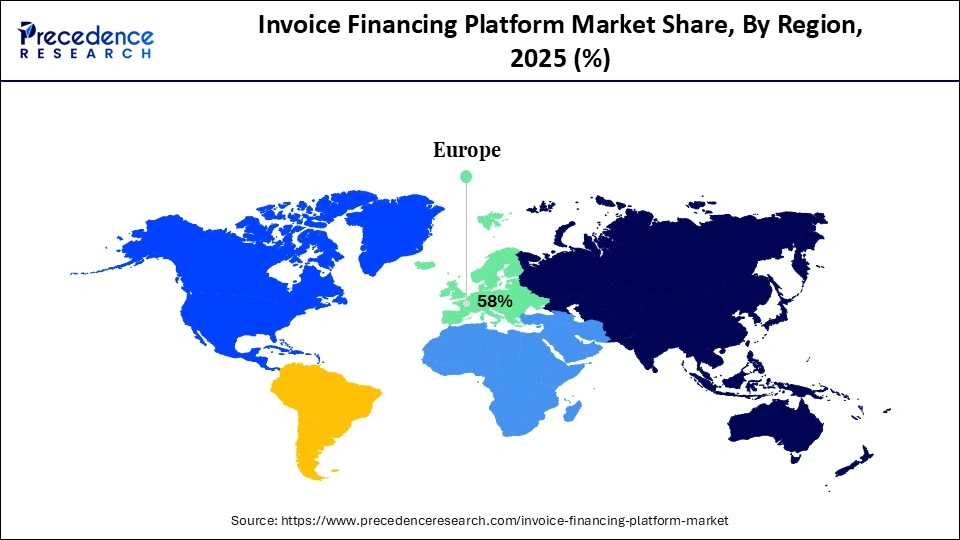

- Europe dominated the market with a major revenue share of approximately 58% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

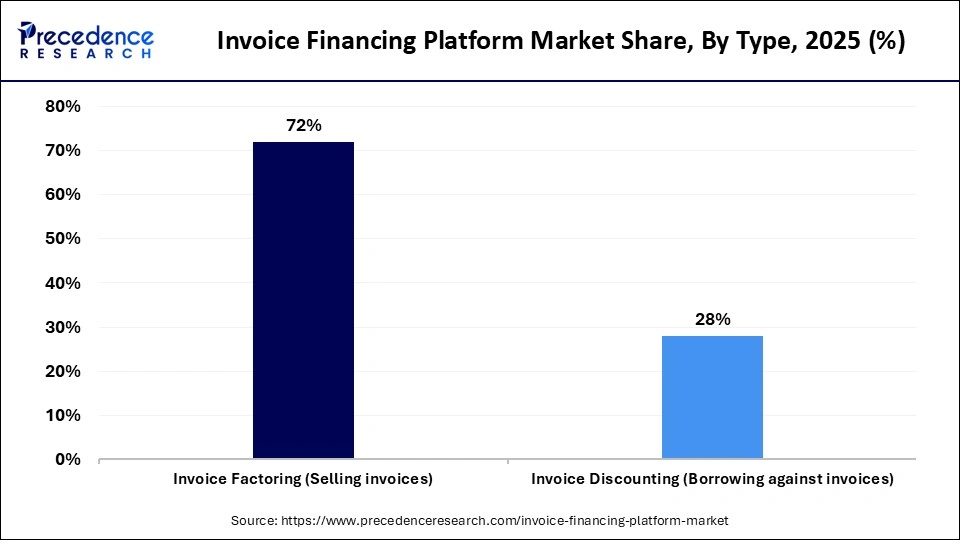

- By type, the invoice factoring segment generated the biggest market share of 72% in 2025.

- By type, the invoice discounting segment is expected to expand at the fastest CAGR between 2026 and 2035.

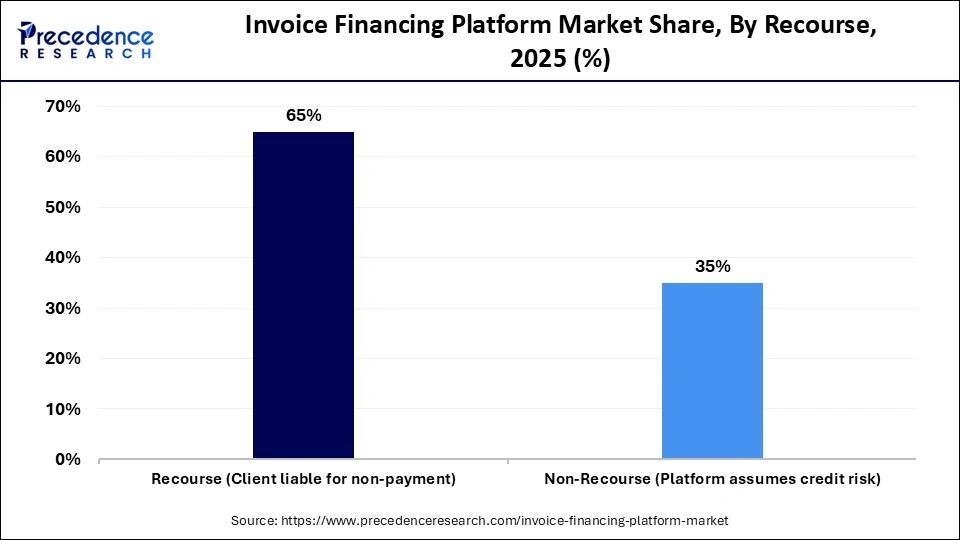

- By recourse, the recourse segment contributed the highest market share of approximately 65% in 2025.

- By recourse, the non-recourse segment is growing at a strong CAGR between 2026 and 2035.

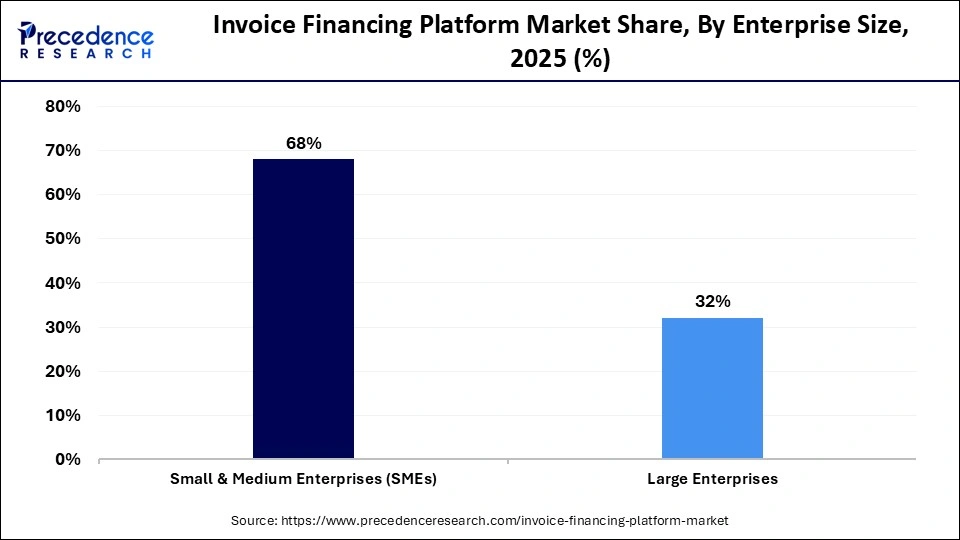

- By enterprise size, the SMEs segment held a major market share of approximately 68% in 2025.

- By industry, the manufacturing segment generated the biggest market share of approximately 24% in 2025.

- By industry, the healthcare segment is expected to expand at a significant CAGR between 2026 and 2035.

Market Overview

The invoice financing platform market is expanding as businesses, particularly small and medium-sized enterprises, seek faster access to working capital. Fintech innovations and digital platforms are making invoice financing quicker, more transparent, and easier to manage. While adoption is strongest in North America and Europe, the Asia-Pacific region is witnessing rapid growth driven by SME expansion and supportive regulatory frameworks. These platforms enhance financial flexibility, reduce reliance on traditional bank loans, and help businesses improve overall cash flow management.

How are Invoice Financing Platforms Boosting Cash Flow?

Invoice financing platforms boost cash flow by enabling businesses to convert outstanding invoices into immediate working capital instead of waiting for customer payments. Through digital processing, quick credit assessments, and automated approvals, these platforms provide faster access to funds while reducing administrative burden. This helps companies maintain liquidity, manage operational expenses, and support growth without taking on traditional debt.

What are the Major Trends Influencing the Market?

- Digital Transformation: The growing adoption of cloud-based and mobile platforms is enabling faster invoice processing, improved accessibility, and greater transparency in financing operations.

- AI & Automation: Artificial intelligence is being widely used for credit scoring, risk assessment, and fraud detection, helping platforms enhance accuracy, reduce defaults, and streamline decision-making.

- SME Focus: There is increasing demand from small and medium-sized enterprises for quick and flexible working capital solutions, driving the expansion of digital invoice financing services.

- Integration with ERP Systems: Platforms are integrating with accounting and ERP software to ensure seamless data flow, minimize manual intervention, and improve operational efficiency.

- Real-Time Financing: Instant approvals and faster payouts are becoming industry standards, allowing businesses to access funds almost immediately after invoice submission.

- Blockchain Adoption: The use of blockchain technology is enhancing security, traceability, and transparency in invoice transactions, reducing fraud risks and improving trust among stakeholders.

- Partnerships & Collaborations: Fintech companies are partnering with banks and financial institutions to broaden service offerings, expand geographic reach, and strengthen liquidity support for businesses.

Future Growth Outlook

- Untapped SME Market: A significant number of small and medium-sized enterprises remain underserved by traditional financing institutions, creating strong growth opportunities for digital invoice financing platforms to bridge this funding gap.

- Cross-Border Financing: Platforms are expanding capabilities to support international trade by facilitating cross-border invoice financing, multi-currency settlements, and faster global payment processing.

- Regulatory Support: Government initiatives promoting digital lending, fintech innovation, and financial inclusion are encouraging broader adoption of invoice financing platforms.

- Customized Financing Solutions: Platforms are increasingly offering industry-specific financing models tailored to the unique cash flow cycles and operational needs of different sectors.

- Integration with Supply Chains: Invoice financing is being embedded into supply chain management systems, enabling seamless funding options within procurement and vendor payment workflows.

- Value-Added Services: Providers are enhancing their offerings with additional services such as credit monitoring, invoice factoring, dynamic discounting, and receivables management to create comprehensive financial ecosystems for businesses.

How is AI Revolutionizing the Invoice Financing Platform Market?

Faster credit evaluations, real-time risk analysis, and predictive cash flow management are all made possible by artificial intelligence, which is revolutionizing invoice financing. AI systems examine past payment records and consumer behavior to expedite approvals and lower default rates. Furthermore, machine learning ensures increased security and confidence between companies and financiers by assisting in the detection of fraudulent invoices. Platforms can provide smarter, quicker, and more individualized financing options with AI integration, facilitating SMEs' access to working capital globally.

How Does Invoice Financing Generate High ROI?

By turning past due invoices into quick cash, increasing liquidity, and lowering borrowing costs for companies, invoice financing platforms provide a high return on investment. Businesses can now swiftly reinvest in operations, inventory, and growth without taking on more long-term debt thanks to this. Additionally, quicker cash cycles improve businesses' scalability and overall financial stability.

The model is efficient and portable for lenders and investors because it offers stable returns and reduced default risk through short-term asset-backed financing with tech-driven risk assessment. Diversified portfolios of invoices further minimize exposure, and digital platforms increase margin efficiency and reduce operating expenses. The overall performance of investments is strengthened by this combination of risk mitigation and recurrent transaction volumes.

Why is the Invoice Financing Platform Market Considered Resilient in Economic Uncertainty?

The invoice financing platform market is considered resilient because it is closely related to continuing commerce and business dealing which go on even in recessionary times. Platform usage usually rises because of business with tighter credit requirements and delayed payments, which increases demand for speedy working capital solutions. Invoice financings short term asset backed structure lowers lenders long term exposure and credit risks. Furthermore, digital platforms that use AI-driven risk assessment and diverse invoice pools improve stability, enabling the market to be flexible and long-lasting throughout different economic cycles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.12 Billion |

| Market Size in 2026 | USD 24.25 Billion |

| Market Size by 2035 | USD 129.89 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 20.50% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Recourse, Enterprise Size, Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

What Made Invoice Factoring the Dominant Segment in the Invoice Financing Platform Market?

The invoice factoring segment dominated the market with a 72% share in 2025, as businesses turned to third parties to convert receivables into quick cash flow solutions. This approach reduces credit risk and collection burdens, particularly for SMEs, while meeting the high demand from working capital-intensive and export-oriented industries. Its structured risk assessment model also makes it attractive to lenders seeking steady returns, helping the segment maintain market leadership.

The invoice discounting segment is expected to grow at the fastest CAGR in the coming years, because people are increasingly choosing private financing options. This approach allows companies to access short-term liquidity while retaining full control over customer relationships. The rise of digital fintech platforms is accelerating growth by streamlining approval processes, and the flexibility to fund specific invoices makes it particularly appealing to mid-sized businesses.

Recourse Insights

Why Did the Recourse Segment Dominate the Invoice Financing Platform Market?

The recourse segment dominated the market with a 65% market share in 2025 due to its lower financing costs compared to non-recourse options. Lenders face reduced risk since companies remain responsible if clients fail to pay invoices. Its strong market presence is supported by wide accessibility and adoption among SMEs, particularly during periods of economic stability and predictable payment cycles, making this model highly attractive.

The non-recourse segment is expected to grow at the fastest CAGR in the coming years as businesses seek to mitigate the risk of client defaults during the period of economic uncertainty. By transferring credit risk to the financing provider, this model offers greater financial stability. Growth is further driven by rising international trade and increasing concerns over insolvency, encouraging companies to adopt this safer financing structure.

Enterprise Size Insights

What Made SMEs the Leading Segment in the Invoice Financing Platform Market?

The SMEs segment dominated the market with the largest share of 68% in 2025 and is expected to grow at the fastest CAGR in the upcoming period. This is because these businesses rely heavily on external working capital solutions due to limited access to traditional bank loans. The need for faster cash cycle management, high invoice volumes, and delayed payment terms in B2B transactions further drives their adoption of invoice financing platforms. Growth is supported by streamlined procedures, flexible financing options, and the rapid digitalization of emerging economies, with mobile-based platforms enabling micro and small businesses to reach a broader audience.

Industry Insights

Why Did the Manufacturing Segment Dominate the Invoice Financing Platform Market?

The manufacturing segment dominated the market with a 24% share in 2025 because it typically faces long payment cycles and high working capital demands due to bulk orders and extensive supply chain operations. Businesses in this sector frequently require short-term liquidity to manage production costs, procure raw materials, and fulfill large orders. Additionally, consistent demand from both domestic and export markets, along with seasonal production fluctuations, makes invoice financing an essential tool for maintaining smooth operations and financial stability.

The healthcare segment is expected to grow at a significant CAGR in the coming years, as delayed receivables and service-based contracts increase the need for financing. The rise of digital transformation, outsourced services, and complex healthcare reimbursements is driving demand for flexible liquidity solutions. High invoice volumes and growing tech startup activity in the sector are further boosting the adoption of alternative financing models in the healthcare sector.

Regional Insights

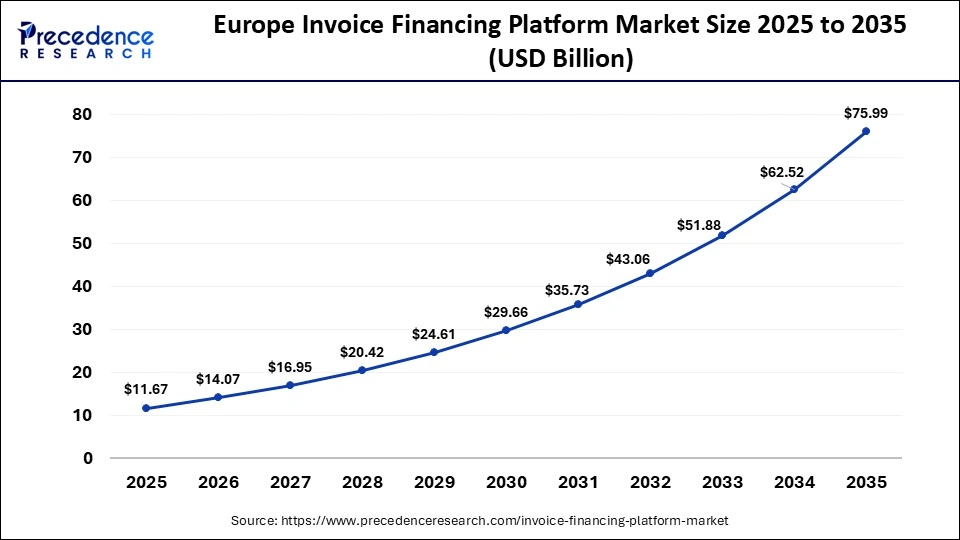

What is the Europe Invoice Financing Platform Market Size and Growth Rate?

The Europe invoice financing platform market size has grown strongly in recent years. It will grow from USD 11.67 billion in 2025 to USD 75.99 billion in 2035, expanding at a compound annual growth rate (CAGR) of 24.30% between 2026 and 2035.

What Made Europe the Dominant Region in the Invoice Financing Platform Market?

Europe dominated the market while holding a 58% share in 2025. The region's dominance in the market is attributed to strong regulatory frameworks and a well-established factoring ecosystem. Widespread adoption was supported by advanced fintech infrastructure and high SME penetration, while government initiatives promoting alternative finance solutions reinforced regional leadership. Additionally, cross-border trade within the EU significantly contributes to overall invoice financing volumes.

Germany Invoice Financing Platform Market Trends

The market in Germany is growing steadily as SMEs seek quicker access to working capital. Digital platforms, supported by automated processes and partnerships with banks and insurers, are simplifying invoice discounting and helping companies manage cash flow more efficiently. Market growth is further fueled by rising digital adoption and increasing demand for flexible financing solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years, driven by rapid fintech adoption and the growth of SMEs. Rising e-commerce, cross-border trade, and expanding digital payment ecosystems are fueling demand for invoice financing. Market expansion is further supported by supportive government policies, increasing financial inclusion, and the rapid rollout of digital invoice financing platforms in emerging economies such as India and Southeast Asia.

India Invoice Financing Platform Market Trends

The India invoice financing platform market is expanding rapidly, driven by strong demand for these platforms from MSMEs. Regulatory platforms like TReDS enable small businesses to convert unpaid invoices into instant liquidity, providing quick, collateral-free funding. Market growth is further accelerated by increasing fintech participation and government-backed digital infrastructure supporting seamless financing solutions.

Who are the Major Players in the Global Invoice Financing Platform Market?

The major players in the invoice financing platform market include Aria, AwanTunai, Billie, BillMart, Candex, CapBay, Drip Capital, eCapital, Factris, FastPay, Finverity, FundThrough, Incomlend, Invoicemart, IwocaPay, KredX, Kriya, Lendo, Lianyirong Digital Technology Group, M1xchange, Moneytech, Nvoicepay, Sonovate, and Taulia.

Recent Developments

- In September 2025, Triver raised a major funding round to scale its AI‑driven embedded invoice financing, enabling small businesses to convert outstanding invoices into working capital quickly and strengthen cash flow access for more clients. (Source: https://financialit.net)

- In January 2026, CredAble and Citi announced a global technology partnership. This partnership focuses on the launch of a white-label digital validation solution and the digitization of global trade finance controls.(Source: https://financialit.net)

- In February 2026, Alaan announced a record-breaking $48 million Series A funding round and launched SuperPay to facilitate global supplier payment transfers. Alaan also announced a new finance-operations platform specifically for UAE-based businesses (Source: https://financialit.net)

- In January 2026, CredAble and Citi announced a global technology partnership to modernize trade finance controls. They launched a white-label digital validation solution for trade assets and announced the digitization of global e-invoicing and tax compliance(Source: https://thepaypers.com)

Segments Covered in the Report

By Type

- Invoice Factoring

- Invoice Discounting

By Recourse

- Recourse

- Non-Recourse

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Industry

- Manufacturing & Logistics

- Healthcare

- Construction

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting