What is Isononanoic Acid Market Size?

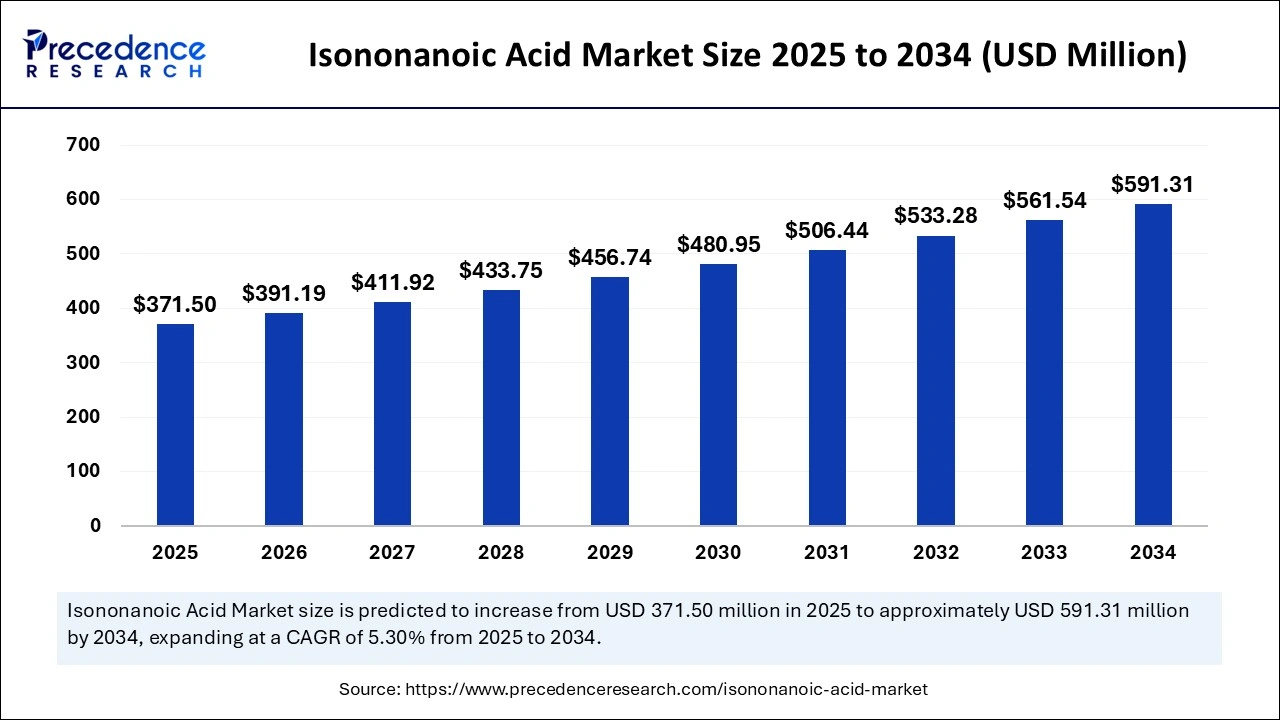

The global isononanoic acid market size accounted for USD 371.50 million in 2025 and is predicted to increase from USD 391.19 million in 2026 to approximately USD 591.31 million by 2034, expanding at a CAGR of 5.30% from 2025 to 2034. The growth of the market can be driven by rising demand for high-performance lubricants and personal care products.

Market Highlights

- Asia Pacific held the largest share of the market in 2024.

- North America is anticipated to witness the fastest growth during the forecast years.

- By product type, the synthetic isononanoic acid segment contributed the largest share of the market in 2024.

- By product type, the natural isononanoic acid segment is expected to show considerable growth over the forecast period.

- By application, the lubricants segment dominated the market in 2024.

- By application, the plasticizers segment is projected to grow at a significant rate in the market in the upcoming period.

- By end-use industry, the automotive segment accounted for the largest market share in 2024.

- By end-use industry, the construction segment is projected to register significant growth rate between 2025 and 2034.

Revolutionizing Neuro Care: TeleSpecialists Launches Hybrid Outpatient Teleneurology Program

Isononanoic acid is a chemical substance with a molecular formula of C9H18O2. Isononanoic acid is a distinct, clear liquid that has a unique odor and does not mix with water. It is primarily used as a surface cleaner or emulsifying agent in lubricants and other cleaning and personal care products. Moreover, it is also used as a precursor in synthesizing chemicals like surfactants and detergents.

The isononanoic acid market is witnessing significant growth due to the increasing demand for high-grade lubricating oils and plasticizers in the automotive, aviation, and manufacturing industries. The attributes of isononanoic acid like thermal stability and resistance to oxidation make it possible to synthesize these high-performance materials. In addition, the growing demand from the personal care & cosmetics industry supports market growth. Isononanoic acid is used to produce emollients and surfactants.

Impact of Artificial Intelligence on the Isononanoic Acid Market

Artificial Intelligence (AI) transforms the landscape of the isononanoic acid market. The use of AI technologies optimizes process efficiency throughout manufacturing, reducing energy use and waste. AI algorithms can be integrated into quality control processes to detect product batch inconsistencies. This ensures higher product quality standards. AI allows the development of eco-friendly production methods while meeting the increasing market demands for sustainable, high-quality chemicals.

Isononanoic Acid Market Growth Factors

- Increasing Demand for High-Performance Lubricants: High-performance lubricant manufacturing depends on isononanoic acid because this acid has both thermal stability and oxidation protection. Isononanoic acid enables the development of durable, high-performance lubricants for industrial equipment.

- Increasing Demand from the Personal care & Cosmetics Industry: The manufacturers of personal care and cosmetic products heavily use isononanoic acid because this ingredient functions as an emollient agent and a surfactant ingredient. Isononanoic acid enhances the texture, stability, and appearance of skincare as well as haircare products.

- Expanding Applications: Isononanoic acid is also used in the production of cleaning solutions like detergents and surfactants.

- Increasing Demand from the Automotive Industry: The demand for isononanoic acid is increasing from the automotive industry. This acid is used to develop lubricants and greases, which enhance vehicle performance while improving fuel efficiency.

Market Outlook

- Industry Growth Offerings- The isononanoic acid industry is growing due to rising demand for high-performance lubricants, coatings, and adhesives, along with increasing adoption of synthetic esters in automotive and industrial applications. Sustainability trends and expanding manufacturing activities further accelerate market expansion.

- Global Expansion- Global expansion of isononanoic acid is driven by growing industrialization, rising demand for advanced lubricants and coatings, and increasing adoption of eco-friendly synthetic esters. Emerging markets, especially in Asia Pacific, are boosting production capacities and broadening international supply chains.

- Startup ecosystem- The isononanoic acid startup ecosystem is expanding as new companies focus on sustainable chemical production, bio-based feedstocks, and high-performance lubricant additives. Innovation in green chemistry, specialty coatings, and advanced materials is attracting investment and enabling niche, technology-driven market entries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 371.50 Million |

| Market Size in 2026 | USD 391.19 Million |

| Market Size by 2034 | USD 591.31 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of the Personal Care & Cosmetics Industry

The expansion of the personal care & cosmetics industry is one of the key factors driving the growth of the isononanoic acid market. This industry heavily uses isononanoic acid in the production of cosmetic products. Isononanoic acid functions as a skin-conditioning agent, improving the texture and moisturization abilities in lotions and creams. The rising demand for organic personal care products opens up new avenues for market growth, prompting the need for the development of bio-based isononanoic acid. With the rising consumer disposable income, spending on skincare, hair care, and other personal care items is rising. This, in turn, boosts the demand for isononanoic acid.

Restraint

High Production Costs and Regulatory Challenges

The isononanoic acid market faces challenges because of the high production costs of isononanoic acid. The complex production method of isononanoic acid requires particular raw materials, which are subject to price volatility. This, in turn, increased production costs. The production of isononanoic acid requires advanced technology, which significantly elevates manufacturing costs. Isononanoic acid production creates difficulties for companies when they seek to sustain profitable prices at a competitive level. In addition, stringent regulations regarding the use and disposal of chemicals restrain the growth of the market.

Opportunity

Increasing Demand for Biodegradable and Sustainable Materials

The growing need for environmentally friendly and sustainable materials creates immense opportunities in the isononanoic acid market. Bio-based isononanoic acid shows promise to become a primary ingredient for producing environmentally friendly plastic materials and lubricants. With the rising production of sustainable packaging solutions and surface coatings, the demand for bio-based isononanoic acid is increasing. In addition, the increasing demand for bio-based high-performance lubricants and coatings in industrial and automotive applications is likely to fuel the growth of the market.

Segment Insights

Product Type Insights

The synthetic isononanoic acid segment led the isononanoic acid market with the largest share in 2024. Its high purity level, consistent quality, and chemical stability make it suitable for high-performance applications. Synthetic isononanoic acid is widely used in the production of lubricants, plasticizers, and coatings. Synthetic isononanoic acid holds the leading position because it satisfies the demands of various industries requiring chemical stability and consistent performance in applications.

The natural isononanoic acid segment is expected to show considerable growth over the forecast period. Natural isononanoic acid derived from renewable sources, which meets the market need for environmentally friendly and biodegradable solutions. The rising concerns regarding environmental sustainability and stringent regulations on synthetic chemicals have encouraged industries to shift toward natural isononanoic acid, which delivers comparable performance to synthetic materials.

Application Insights

The lubricants segment held the largest share of the isononanoic acid market in 2024. Isononanoic acid serves as an essential lubricant ingredient, which enables industries to enhance the thermal stability and oxidative resistance of their products. The extreme temperature tolerance and resistance to degradation properties make isononanoic acid suitable for lubricants. The increased demand for high-performance lubricants for automotive applications and industrial machinery further bolstered the segmental growth. The increased emphasis on improving vehicle fuel efficiency has driven the demand for lubricants. The increasing demand for environmentally friendly lubricants is likely to sustain the segment's long-term growth.

The plasticizers segment is projected to grow at a significant rate in the market in the upcoming period. The growth of the segment can be attributed to the rising demand for high-performance plastics. Plasticizers are used to enhance the flexibility and durability of plastics. Plasticizers enable polymers to stay flexible through wide temperature ranges, which leads to better performance and adaptability to changing environmental conditions. The rising need for improved plastic materials with extended life cycles and flexible properties contributes to segmental growth. The construction and automotive industries heavily use high-performance plastics to create durable components, including pipes as well as automotive parts.

End-use Industry Insights

The automotive segment led the isononanoic acid market with the largest share in 2024. Automotive manufacturers heavily utilize isononanoic acid as a main ingredient in the production of automotive parts since it enhances performance characteristics and corrosion protection. This acid is a key component in synthetic lubricants and greases, which are widely used in automotive applications. The increased demand for high-performance lubricants and coatings for engine applications further bolstered the growth of the segment.

The construction industry segment is anticipated to witness significant growth over the studied period. The isononanoic acid-based products showcase outstanding performance attributes that include strong durability and effective environmental resistance properties, making them suitable for use in construction applications. The rising infrastructure development projects and building renovation activities around the world are boosting the need for superior construction materials. Isononanoic acid is used in the production of plastic pipes and other building materials. This acid maintains the structural integrity of construction materials in challenging environments.

Regional Insights

Asia Pacific Leads 2024 Isononanoic Acid Market on Surging Industrial Demand

Asia Pacific dominated the isononanoic acid market with the largest share in 2024. This is mainly due to the rapid expansion of the automotive, construction, and electronics industry, in which high-performance lubricants, coatings, greases, and adhesives are essential. Isononanoic acid is a key component in the development of lubricants and coatings. The rapid industrialization and increased construction activities significantly boosted the demand for isononanoic acid.

What Makes China a Dominant Force in the Isononanoic Acid Industry?

China is a major player in the Asia Pacific isononanoic acid market. The country is the World's largest producer of automobiles, boosting the demand for lubricants and greases. There is a high demand for plastic products. Moreover, the rising demand for lubricants, adhesives, and coatings is likely to drive the growth of the market.

Why is the Automotive and Construction Boom Accelerating North America's Acid Market Growth?

North America is expected to witness the fastest growth during the forecast period. The rising demand for lubricants, coatings, and adhesives from the automotive industry is expected to drive the market's growth. There is a high demand for natural isononanoic acid because various industries have started adopting sustainable and environmentally friendly materials as a standard industry practice. The rising construction activities are boosting the demand for construction materials like pipes, in which isononanoic acid is important. The region has a well-established chemical industry, contributing to the growth of the market.

Rising Industries Demand Fuels Growth of the U.S. Isononanoic Acid Market

The U.S. isononanoic acid market is growing due to rising demand from industries such as lubricants, cosmetics, and coatings, where it is used for enhancing stability and performance. Increasing adoption of synthetic esters in high-performance lubricants, along with strong growth in personal care formulations, is boosting consumption. Additionally, expanding industrial manufacturing and ongoing product innovations support steady market expansion.

Sustainability And Advanced Manufacturing Drive Europe's Isononanoic Acid Expansion

Europe's isononanoic acid market is growing due to strong demand from the automotive, industrial lubricants, and coatings sectors, where high-performance synthetic esters are widely used. The region's focus on environmentally friendly and low-VOC formulations is also driving adoption in personal care and specialty chemicals. Additionally, technological advancements, strict quality standards, and increased investment in sustainable manufacturing further support market expansion across Europe.

Innovation And Eco-Focused Trends Accelerate the UK Isononanoic Acid Market

The UK isononanoic acid market is expanding due to growing demand for high-performance lubricants, advanced coatings, and premium personal care products. Industries are increasingly shifting toward synthetic esters for better stability, efficiency, and environmental compliance. The country's strong focus on sustainable formulations, coupled with rising industrial activity and continuous innovation in specialty chemicals, is further accelerating market growth.

Value Chain Analysis

- Feedstock Procurement

Companies producing isononanoic acid mainly obtain isononanol (INA), a petrochemical alcohol, as the core feedstock and convert it through oxidation.This streamlined process ensures consistent quality and stable supply for downstream applications.

Key Players: BASF SE, Evonik Industries, OQ Chemicals, KH Neochem, ExxonMobil Chemical. - Chemical Synthesis and Processing

Isononanoic acid is produced through an industrial sequence where diisobutylene (or octenes derived from 2-ethylhexanol) undergoes hydroformylation to form isononanal.The aldehyde is then oxidized to obtain the final carboxylic acid.

Laboratory methods follow the same pathway but allow tighter control over reaction conditions and purification.

Key Players: BASF SE, Evonik Industries, OQ Chemicals, KH Neoche. - Compound Formulation and Blending

Isononanoic acid (INA) is a C9 branched fatty acid with low water solubility, commonly used as a foundation ingredient for creating multiple industrial and cosmetic formulations.Blending or modifying INA varies depending on the performance needs of the final product, such as stability, texture, or functional properties.

Key Players: BASF SE, Evonik Industries, OQ Chemicals, KH Neochem, ExxonMobil Chemical

Key Players in Isononanoic Acid Market and Their Offerings

- Evonik Industries — Supplies C9 oxo-alcohols (isononanol/INA feedstock) and plasticizer intermediates used to make DINP/DINCH and other isononyl-based products for lubricants, PVC and specialty formulations.

- Solvay S.A. — Global specialty-chemicals maker supplying intermediates and formulation technologies for coatings, lubricants and additives; positions itself as a partner for sustainable feedstock and specialty solutions used around INA-derived products.

- Clariant AG — Offers care-chemicals, emulsifiers and specialty additives used in personal-care, metalworking and industrial formulations where INA and its esters serve as emollients, plasticizer precursors or lubricant components.

- LG Chem — Large petrochemicals and advanced-materials supplier whose petrochemical units supply olefins, alcohol intermediates and sustainable polymer solutions that feed into INA derivative markets (lubricants, plastics, coatings).

- LANXESS (Rhein-Chemie) — Through its lubricant-additives and specialty chemicals businesses, provides additive packages, synthetic base-fluid technologies and corrosion/antioxidant solutions used alongside INA-based esters in lubricants and metalworking fluids.

Recent Developments

- In June 2023, KLJ Group, a leading player in the plasticizer industry, invested USD 145 million and established a new plasticizers and phthalic Anhydride production facility at the GIDC Jhagadia Industrial Estate, Bharuch, Gujarat.

- In March 2023, OQ Chemicals unveiled OxBalance Isononanoic Acid as the first globally commercially available isononanoic acid made from circular as well as bio-based feedstocks, which have ISCC PLUS certification. This sustainable, new product provides manufacturers with a renewable chemical substitute to typical isononanoic acid because it contains more than 70% bio-based content.

Segments Covered in the Report

By Product Type

- Synthetic Isononanoic Acid

- Natural Isononanoic acid

By Application

- Lubricants

- Plasticizers

- Coatings

- Adhesives

- Others

By End-use Industry

- Automotive

- Construction

- Electronics

- Personal care

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content