IVF Devices and Consumables Market Size and Forecast 2025 to 2034

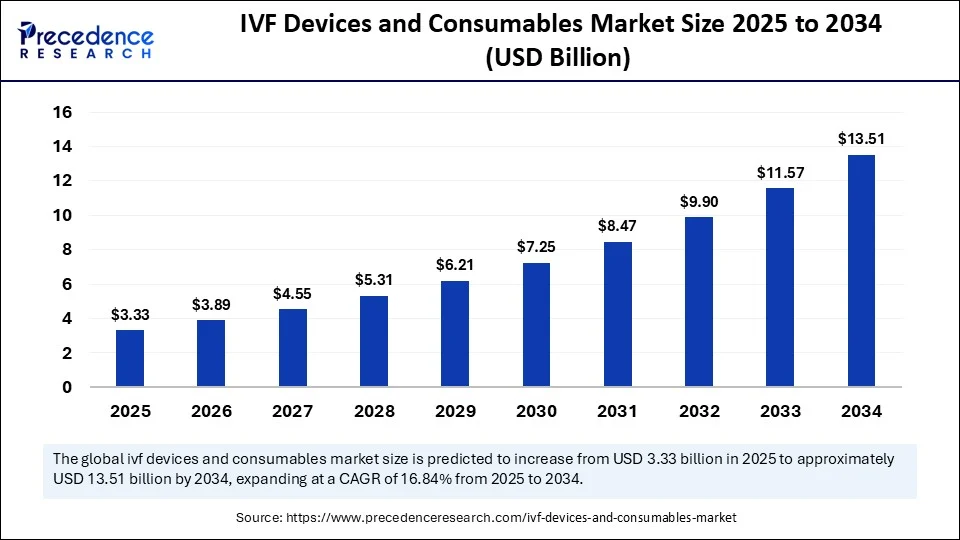

The global IVF devices and consumables market size accounted for USD 2.85 billion in 2024 and is predicted to increase from USD 3.33 billion in 2025 to approximately USD 13.51 billion by 2034, expanding at a CAGR of 16.84% from 2025 to 2034. The increased demand for assisted reproductive technologies (ART), including IVF, is driving the growth of the global IVF devices and consumables market. Growing awareness about the benefits of IVF devices and consumables is contributing to market growth.

IVF Devices and Consumables Market Key Takeaways

- In terms of revenue, the global IVF devices and consumables market was valued at USD 2.85 billion in 2024.

- It is projected to reach USD 13.51 billion by 2034.

- The market is expected to grow at a CAGR of 16.84% from 2025 to 2034.

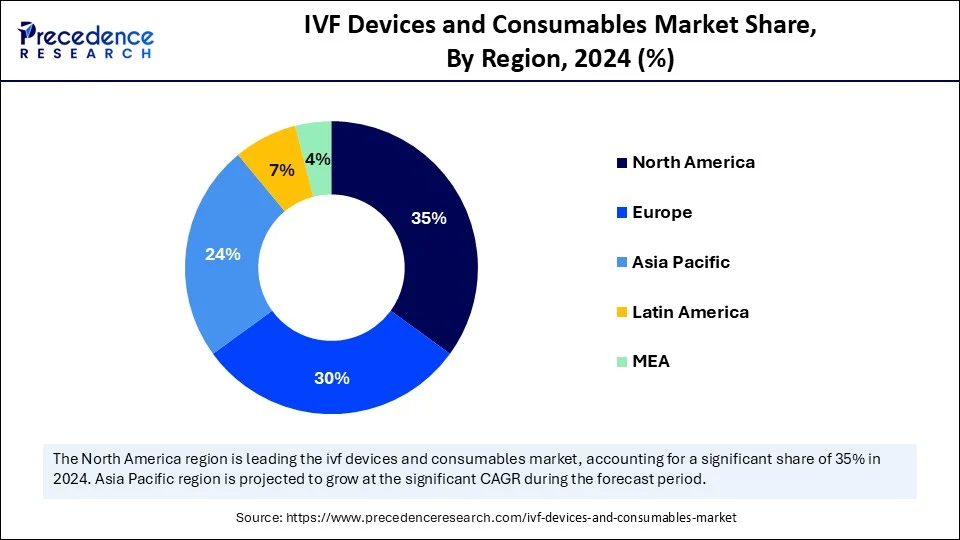

- North America dominated the IVF devices and consumables market with the largest market share of 35% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

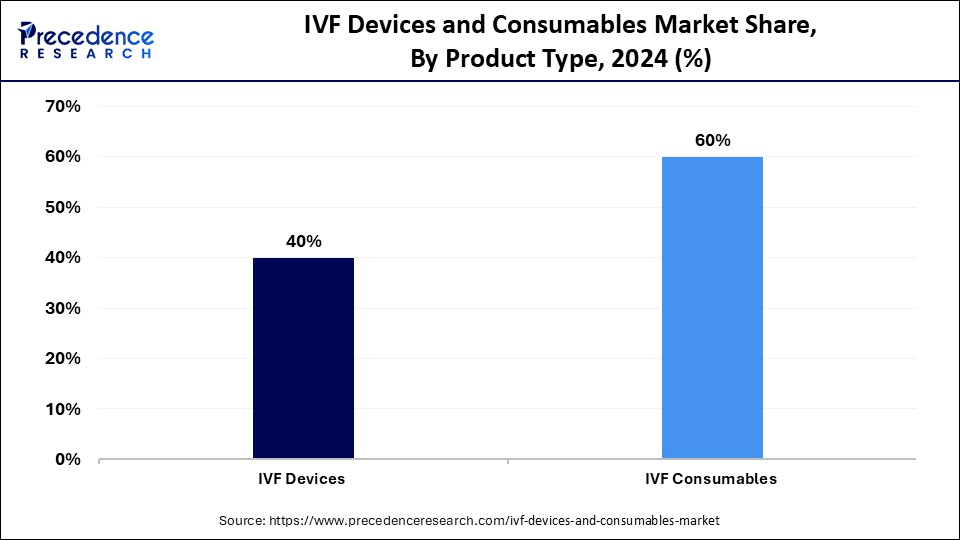

- By product type, the IVF consumables segment held the major market share of 60% in 2024.

- By product type, the IVF devices segment will grow at a significant CAGR between 2025 and 2034.

- By application, the Assisted Reproductive Technology (ART) segment accounted for the biggest market share of 75% in 2024.

- By application, the Research and Academic Institutes segment will grow at a CAGR between 2025 and 2034.

- By technology, the Conventional IVF segment contributed the highest market share of 55% in 2024.

- By technology, the Time-Lapse Imaging Technology segment is expected to expand at a significant CAGR between 2025 and 2034.

- By end use, the Fertility Clinics segment accounted for significant market share of 65% in 2024.

- By end use, the Research Laboratories segment will grow at a CAGR between 2025 and 2034.

- By distribution channel, the Distributors and Dealers segment generated the major market share of 55% in 2024.

- By distribution channel, the Online Sales segment will expand at a significant CAGR between 2025 and 2034

How is AI Revolutionizing the IVF Devices and Consumables Market?

Artificial Intelligence is playing a significant role in revolutionizing the IVF devices and consumables market by enhancing the efficiency and accuracy of procedures. Healthcare providers are shifting their preference for the use of AI-based IVF tools to enhance employee selection, enable predictive maintenance, and optimize ovarian stimulation protocols. AI-enabled tools help to automate employee scoring and track development patterns, ensuring efficiency and patient outcomes. The real-time monitoring, workflow optimization, and uninterrupted operations provided by AI enhance the effectiveness of IVF devices and consumables. Integration of AI in IVF is a promising tool for enhancing success rates.

For Instance, in April 2025, in Guadalajara, Mexico, at Hope IVF Mexico, the world's first baby was born by using a fully automated, AI-based IVF system developed by Conceivable Life Sciences to replace the conventional manual procedure of intracytoplasmic sperm injection (ICSI), which has been used since the 1990s.

(Source:https://www.indiatoday.in)

U.S. IVF Devices and Consumables Market Size and Growth 2025 to 2034

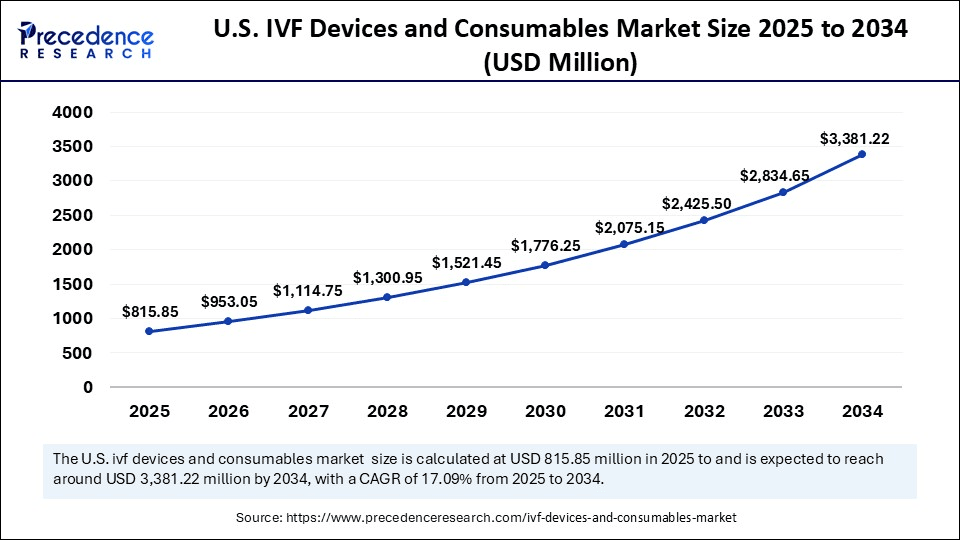

The U.S. IVF devices and consumables market size was exhibited at USD 698.25 million in 2024 and is projected to be worth around USD 3381.22 million by 2034, growing at a CAGR of 17.09% from 2025 to 2034.

North America IVF Devices and Consumables Market

North America dominated the global IVF devices and consumables market with the largest share in 2024. This is mainly due to increased awareness of fertility treatments, increasing infertility rates, favorable reimbursement schemes, and well-established healthcare infrastructure. Governments around the region increased investment in research & development, leading to the development of innovative IVF treatments, such as enhanced embryo selection and culture systems, improving success rates and treatment accessibility. There is a high acceptance and adoption of IVF treatments, contributing to market growth. Moreover, supportive reimbursement policies and insurance coverage for IVF treatments also drive market growth.

In February 2025, Allwin Medical Devices Inc., a US-based manufacturer of medical devices, and Singapore-based Esco partnered to provide science equipment for various global markets, including the IVF market. This partnership aims to expand Esco's IVF instruments portfolio with Allwin Medical's IVF consumables, offering IVF clinicians and embryologists a more complete workflow solution.

(Source: https://www.biospectrumasia.com)

The U.S. is a key player in the regional market, fueled by the rising percentage of women experiencing infertility. Increasing infertility rates and growing awareness of IVF benefits have boosted demand for advanced devices and consumables nationwide. Ongoing technological advancements and the demand for minimally invasive procedures are driving the adoption of IVF devices and consumables.

In February 2025, President Donald Trump signed an executive order to expand access to IVF. This executive order enables access to reliable and affordability access of IVF treatments in the nation.

(Source: https://www.thecut.com)

Asia Pacific IVF Devices and Consumables Market Trends

Asia Pacific is the fastest-growing region in the global market, driven by rising infertility rates, growing awareness of IVF treatments, and technological advancements. Government initiatives, including favorable policies, healthcare funding, awareness campaigns, and investments in local pharmaceutical companies and research & development, are supporting market growth. Furthermore, increasing medical tourism enables access to advanced and specialized IVF treatments, driving market expansion.

China is a major player in the regional market. The growth of the market in the country is driven by its well-established healthcare infrastructure, strong government support, and the presence of a large number of medical device manufacturers. The Chinese government's "Made in China" initiatives have led to the availability of effective and advanced IVF devices, treatments, and consumables.

India is a significant player, driving growth with a large patient pool, increasing infertility cases, and rising awareness of IVF benefits, supported by government and healthcare professional initiatives. Rising investments to improve healthcare infrastructure in India is enhancing access to advanced medical devices and treatments. Initiatives like "Make in India" and awareness campaigns are increasing the adoption of these devices. Medical tourism is also fueling demand for advanced IVF devices and treatments in India.

Europe IVF Devices and Consumables Market Trends

Europe is considered to be a significantly growing area. The growth of the market in the region can be attributed to its well-developed healthcare infrastructure. There are rising cases of infertility and delayed pregnancies, boosting the demand for IVF treatments. The region is a hub for R&D and medical device manufacturing, supporting market growth. Germany is a major player in the market. High healthcare spending and increasing awareness and adoption of IVF treatments drive market growth. The shift to personalized IVF treatments and growth in fertility preservation methods are supporting market growth.

Market Overview

The IVF devices and consumables market refers to the global market for specialized medical devices and consumable products used in in vitro fertilization (IVF) procedures. This includes equipment, instruments, and disposable supplies essential for the processes involved in assisted reproductive technology (ART), such as egg retrieval, fertilization, embryo culture, embryo transfer, and cryopreservation. The market encompasses devices such as incubators, micromanipulators, and imaging systems, as well as consumables, including culture media, catheters, Petri dishes, and syringes. This market is driven by increasing infertility rates, advancements in reproductive technologies, rising awareness of the benefits of IVF, and expanding ART services globally.

More than 1.5 million IVF cycles are performed globally each year, and this number is growing continuously in countries such as Japan, the UAE, and Latin America. Developing countries are witnessing a significant growth rate in the number of cycles performed, at 5-10% per annum, over the last few years.

What are the Key Factors Boosting the Growth of the IVF Devices and Consumables Market?

- Growing Awareness: The awareness about infertility treatments and the benefits of the use of IVF is increasing demand for IVF devices and consumables.

- Rising Infertility Rates: The rates of infertility are increasing across the globe due to changing lifestyles, childbearing delay, environmental influence, and growing conditions like polycystic ovary syndrome (PCOS) are driving the need for IVF devices and consumables.

- Government Initiatives: The government worldwide is implementing supportive policies, funding, and initiatives to enhance public awareness, making IVF treatments more accessible and affordable, which drives market growth.

- Technological Advancements: Advances in reproductive health technologies, such as enhanced embryo culture, imaging systems, preimplantation genetic diagnosis (PGD), and cryopreservation techniques, are enabling high success rates in IVF, thereby shaping market growth.

- Disposable Income Growth: The increasing availability of disposable income, particularly in emerging regions, is making IVF treatment more accessible, enabling individuals to invest in healthcare services, including IVF treatments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.51 Billion |

| Market Size in 2025 | USD 3.33 Billion |

| Market Size in 2024 | USD 2.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End Use, Technology, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Medical Tourism

The growing medical tourism is a major factor driving the demand and adoption of advanced IVF devices and consumables. Patients are traveling abroad to access specialized services and cost-effective treatments. The recent US Tariffs are also a reason for pushing medical tourism. Medical tourism enhances access to the best IVF treatments, offering more favorable regulations, specialized clinics, and greater affordability. The rising need for fertility treatments is also supporting medical tourism, creating essential demand for IVF devices and consumables in various countries.

Restraint

High Cost of Devices and Procedures

The high cost associated with devices and procedures is the major restraint for the market. The cost of a single IVF cycle can range from $1,000 to $10,000, depending on the location and the type of specialized procedures. This cost can limit access to devices and treatments for couples. The cost burden often causes patients to delay treatment. Additionally, the limited insurance coverage and reimbursements for IVF treatments and devices make it difficult for many individuals or couples to afford IVF treatment, which impacts market growth.

Opportunity

Adoption of Minimally Invasive Procedures

The rising adoption of minimally invasive procedures, driven by increased patient demand for improved treatment outcomes, enhances patient outcomes by reducing recovery time, minimizing pain, and allowing for smaller incisions, is driving the demand for specialized IVF devices and consumables. Advanced technologies, such as mini-IVF (low-stimulation protocols) and natural cycle IVF, are trending in the market. Women who seek less medication or consult specific health concerns are major adopters of these techniques. Advancements in cryopreservation methods are enabling significantly better results from frozen embryo transfers.

Additionally, the increasing adoption of robotic assistance for procedures such as enhancing accuracy, reducing complications, and egg retrievals in several clinics is supporting market growth. The ongoing advancement in sperm selection techniques to enhance fertilization success is gaining significant popularity in the healthcare sector, leading to potential growth opportunities for the market.

Product Type Insights

Why Did the IVF Consumables Segment Dominate the Market in 2024?

The IVF consumables segment dominated the IVF devices and consumables market with a 60% revenue share in 2024 due to increased IVF treatments. The need for IVF consumables has increased as they are essential in every stage of the IVF process. The single-use nature of these consumables contributes to their high adoption. IVF consumables, including culture media, catheters, Petri dishes and plates, syringes and needles, disposable gloves, and other essential items such as vials, straws, and pipettes, are required for each IVF cycle, resulting in high demand. The rising demand for IVF treatments significantly bolsters the growth of the segment.

The IVF devices segment is expected to grow at the fastest rate during the forecast period. This is mainly due to the increasing awareness of infertility, growing demand for IVF treatments, and the need for specialized devices. The ongoing advancements in device technologies are the major factors contributing to segment growth. IVF devices include incubators, micromanipulators, cryopreservation equipment, time-lapse imaging systems, laser systems, and IVF workstations. The time-lapse imaging system is the largest sub-segment, which is leading the market due to its significant role in improving embryo selection and enhanced success rates. The increasing adoption of time-lapse imaging systems in hospitals and fertility clinics is contributing to segmental growth.

Application Insights

What Made Assisted Reproductive Technology (ART) the Dominant Segment in the IVF Devices and Consumables Market?

The assisted reproductive technology (ART) segment dominated the market, accounting for 75% of the market share in 2024. This is mainly due to the increased infertility rates and technological advancements. People have become more aware of the benefits and availability of ART, leading to its greater demand. Technological advancements like enhanced incubators and cryopreservation techniques are helping to improve the success rate of ART.

On the other hand, the research and academic institutes segment is expected to grow at the fastest rate over the forecast period, driven by rising innovations and developments of novel techniques. Research and academic institutions are focusing on redefining existing procedures and improving patient safety and treatment outcomes. The prior role of research and academic institutions in the development of new IVF technologies and enhancing existing ones is fostering the segment's growth.

Technology Insights

What Made Conventional IVF the Dominant Segment in the Market in 2024?

The conventional IVF segment dominated the IVF devices and consumables market, capturing a 55% share in 2024. This is mainly due to heightened demand for technologies like micromanipulation tools, culture media, and incubators. Healthcare professionals prefer conventional IVF due to its high success rates, particularly for patients with specific fertility issues. This technology has established significant development in fertility clinics and hospitals. The well-established and widespread use of this IVF technology is making it a dominant segment of the market.

The time-lapse imaging technology segment is expected to grow at the fastest rate in the upcoming period due to its increasing use in embryo selection. This technology enhances the success rate of IVF treatments. The time-lapse imaging technology helps embryologists select viable embryos for transfer, thereby enhancing pregnancy chances. The technology is being widely used to reduce the need for multiple embryo transfers, reducing the risk of multiple pregnancies. Ongoing advancements in reproductive technologies are contributing to the segment's growth.

End Use Insights

Why Did the Fertility Clinics Segment Dominate the IVF Devices and Consumables Market in 2024?

The fertility clinics segment dominated the market with a 65% share in 2024. This is mainly due to increased awareness about fertility treatments. The prevalence of infertility has increased over the years, driving demand for specialized fertility treatments and leading to increased patient volume in fertility clinics. Fertility clinics offer the advanced infrastructure necessary for complex IVF procedures, and they are equipped with specialized expertise, attracting a broader patient base. These clinics offer tailored treatment plans, contributing to the increased demand for IVF devices and consumables in fertility clinics.

The research laboratories segment is expected to grow at a significant CAGR during the projection period. Research laboratories are at the forefront of developing novel and enhanced IVF technologies, including cryopreservation solutions, biopsy tools, and culture media. The role of research laboratories in establishing quality control measures and standardizing protocols for IVF treatment procedures makes them a significant end-user. In addition, rising research to enhance success rates of IVF treatment supports segmental growth.

Distribution Channel Insights

How Does the Distributors and Dealers Segment Dominate the IVF Devices and Consumables Market in 2024?

The distributors and dealers segment dominated the market, accounting for a 55% share in 2024, as they play a critical role in ensuring the widespread availability and accessibility of IVF devices and consumables. Distributors and dealers act as intermediaries, ensuring the timely delivery of IVF devices and consumables from manufacturers to end-users, such as fertility clinics. Distributors and dealers connect manufacturers and ensure a smooth supply chain operation.

The online sales segment is expected to expand at the fastest rate over the forecast period. Online platforms enable direct sales of IVF devices and consumables, increasing the profitability of manufacturers. These platforms enhance accessibility to a range of products, which is particularly beneficial for people in underserved areas. Competitive pricing and offers provided by these platforms encourage patients to repeat purchases. Moreover, these platforms provide doorstep delivery of products, attracting a large patient base.

IVF Devices and Consumables MarketCompanies

- CooperSurgical (subsidiary of a private equity firm)

- Vitrolife AB

- Merck KGaA (MilliporeSigma)

- Cook Medical

- Irvine Scientific (part of JXTG Holdings)

- Esco Micro Pte Ltd

- Hamilton Thorne Ltd

- Genea Biomedx

- Kitazato Corporation

- Origio (part of CooperSurgical)

- Astec Lifesciences

- FUJIFILM Irvine Scientific

- LifeGlobal Group

- Thermo Fisher Scientific

- Eppendorf AG

- Nikon Corporation

- SAGE IVF (part of CooperSurgical)

- Labotect GmbH

- BioIVT

- Vitrolife Sweden AB

Recent Developments

- In June 2025, Esco Medical launched its next-generation, MIRI M Multiroom IVF Incubator (“MIRI M”), a benchtop incubation system, designed for redefined standards of IVF procedures. The systems provide up to 18 independent and movable chambers in IVF technology.

(Source: https://www.esco-medical.com)

- In May 2025, KGMU authorities announced that after a partial suspension over the past few months, the registration of the IVF (in vitro fertilization) facility at Queen Mary's Hospital, King George's Medical University (KGMU) will be fully resumed by July.

(Source: https://www.hindustantimes.com)

Segment Covered in the Report

By Product Type

- IVF Devices

- Incubators

- Micromanipulators

- Cryopreservation Equipment

- Imaging Systems (e.g., Time-Lapse Imaging)

- Others (IVF Workstations, Laser Systems)

- IVF Consumables

- Culture Media

- Petri Dishes and Plates

- Catheters

- Syringes and Needles

- Disposable Gloves

- Other Consumables (Pipettes, Vials, Straws, etc.)

By Application

- Assisted Reproductive Technology (ART)

- Fertility Clinics

- Research and Academic Institutes

- Hospitals and Surgical Centers

By End Use

- Fertility Clinics

- Hospitals

- Research Laboratories

- Diagnostic Centers

By Technology

- Conventional IVF

- Intracytoplasmic Sperm Injection (ICSI)

- Cryopreservation Techniques

- Time-Lapse Imaging Technology

By Distribution Channel

- Direct Sales

- Distributors and Dealers

- Online Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting