Laboratory Filtration Market Size and Forecast 2025 to 2034

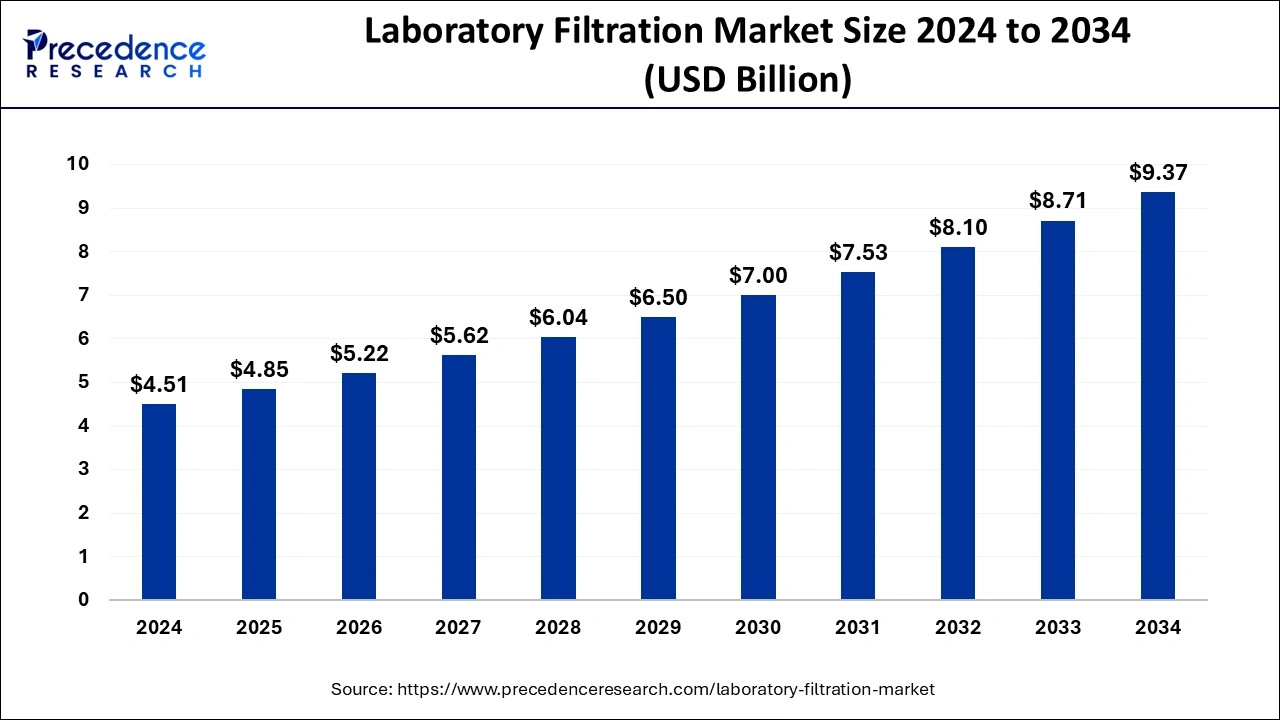

The global laboratory filtration market size was expected to be valued at USD 4.51 billion in 2024 and is anticipated to reach around USD 9.37 billion by 2034, expanding at a CAGR of 7.59% over the forecast period from 2025 to 2034. The rising application of filtration technology in various end-user industries is the key factor driving the market growth. Also, increasing demand for more efficient filters coupled with the rising expenditure on Research and Development can fuel market growth further.

Laboratory Filtration Market Key Takeaways

- In terms of revenue, the laboratory filtration market is valued at $4.85 billion in 2025.

- It is projected to reach $9.37 billion by 2034.

- The laboratory filtration market is expected to grow at a CAGR of 7.59% from 2025 to 2034.

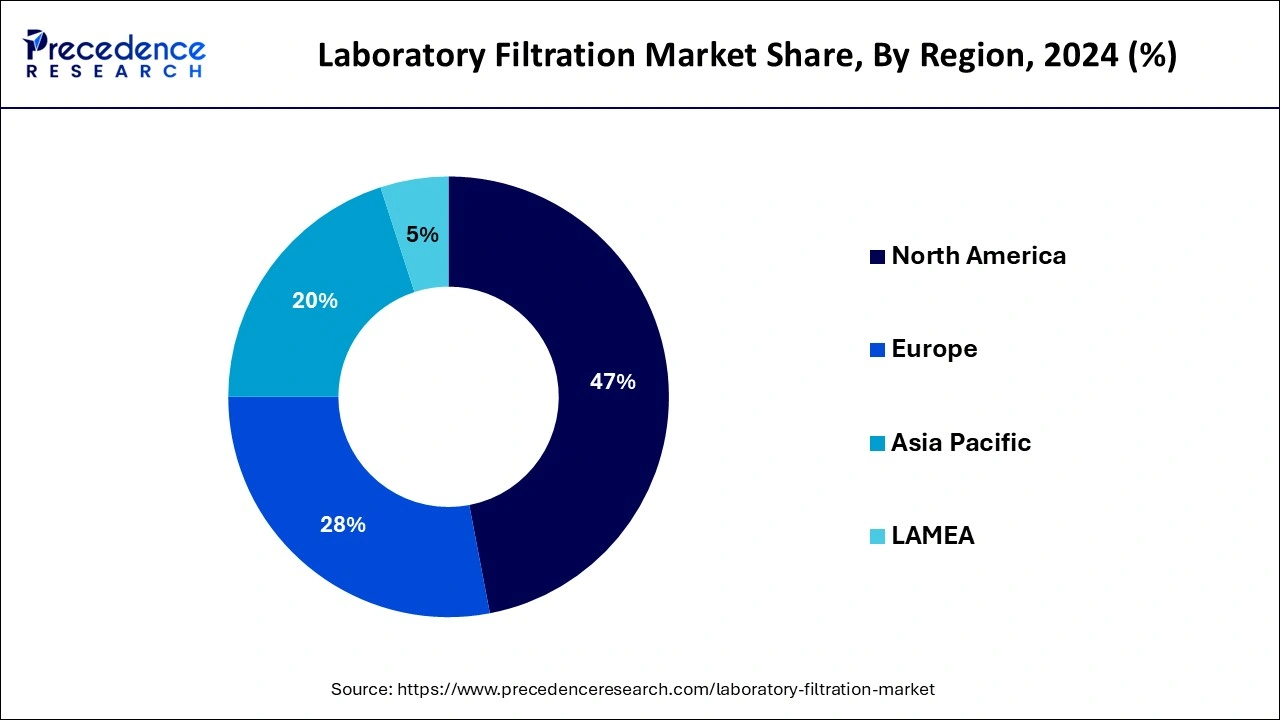

- In 2024, North America has captured about 47% of the total revenue share.

- Asia pacific region is expected to grow at fastest rate over the forecast period.

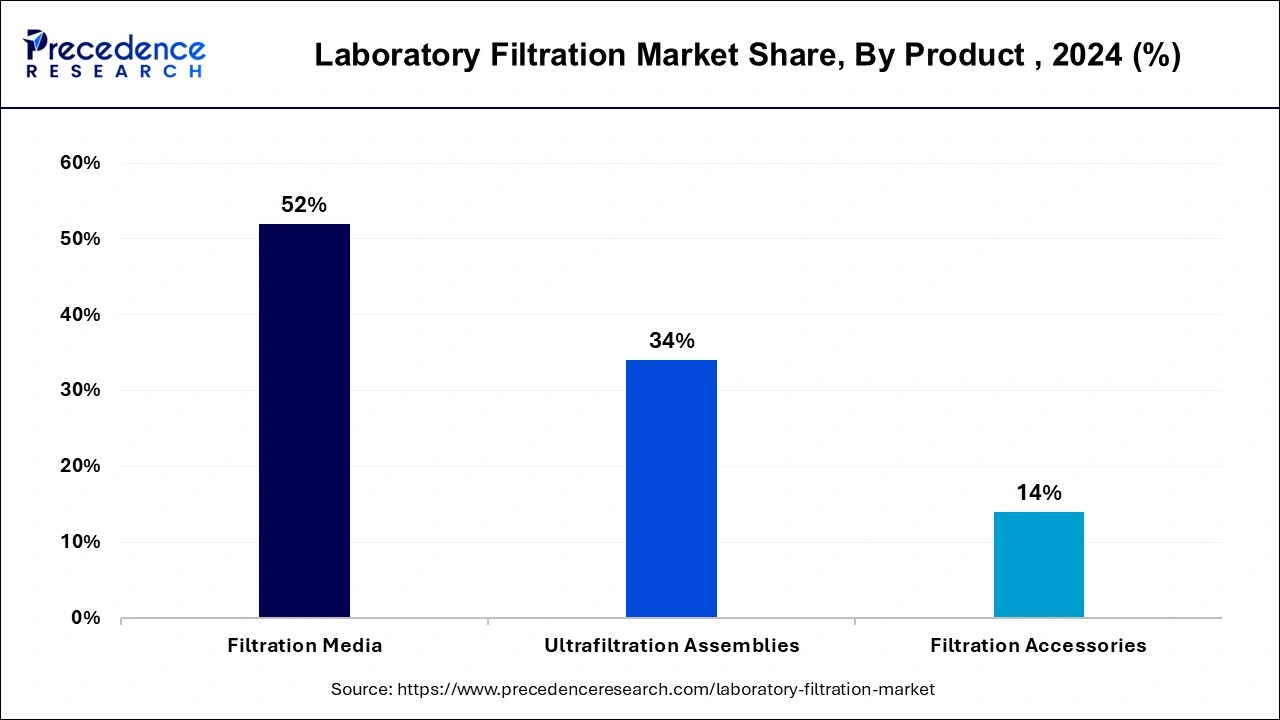

- By product, the filtration media segment has held a 52% revenue share in 2024.

- By product, the ultrafiltration assemblies' segment is anticipated to grow at the fastest rate over the projected period.

- By technology, the microfiltration segment has generated the highest revenue share in 2024.

- By technology, the ultrafiltration segment is expected to grow at the fastest rate over the forecast period.

Role of AI in Laboratory Workflows

Integration of AI in laboratory workflow operations is transforming the market. Labs can use AI to accurately track and identify samples by combining them with image recognition systems or barcodes, decreasing the prevalence of human errors. Furthermore, AI can automate data extraction by utilizing NLP to manage unstructured text can identify correlations, patterns, or anomalies in much-complicated data.

- In February 2025, Krutrim, India's first AI unicorn, announced the launch of Krutrim AI Lab, the country's first AI frontier research lab. This pioneering initiative is set to make AI research accessible, attract the best talent, and establish India as a global leader in open-source AI.

U.S. Laboratory Filtration Market Size and Growth 2025 to 2034

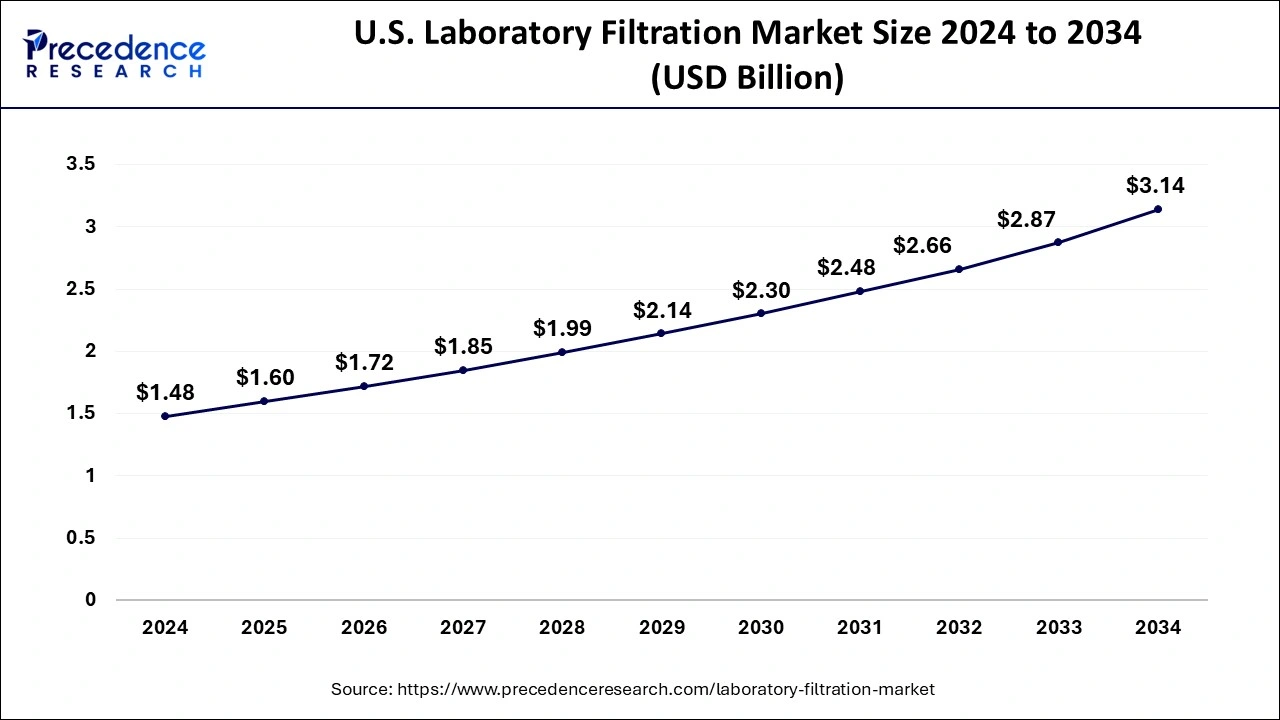

The U.S. laboratory filtration market size was exhibited at USD 1.48 billion in 2024 and is projected to be worth around USD 3.14 billion by 2034, growing at a CAGR of 7.81% from 2025 to 2034.

In 2024, the laboratory filtration market in the world was dominated by North America, with about 47% of the market.North America is the largest market for laboratory filtration products for basic research because there are significant manufacturers of filtration products, established laboratories, and growing government funding.

The two primary causes of the large base of the target population in North America are the rise in target diseases and treatment demand. The region has adopted laboratory filtration products at a faster rate than the nation as a whole due to rising industrialization and the accessibility of new products.

The Asia-Pacific region is anticipated to grow during the forecast period due to the rise in participants. Facility. Food and beverage manufacturers are launching more high-quality products, and numerousgeneric drugmanufacturing industries exist in these areas.

Market Overview

The primary drivers of the market growth are the expanding use of filtration technology in the biopharmaceutical, pharmaceutical, beverage, and food industries and the growing preference for filters with higher levels of efficiency. Bioburden reduction, oil and gas filtration, Sterilized filtration, air filtration, and membrane filtration are all features of filtration products.

Industries are creating novel technologies for high-volume filtration processes used in biopharmaceutical and pharmaceutical businesses. For example, a 3M Purification, Inc. particulate filter with developed pleat significantly high filtration surface area while retaining standard filter measurements.

Research laboratories, virus removal, microbial analysis, and water purification facilities are just a few companies where laboratory filtration is used. Throughout the forecast period, growth is anticipated to be fuelled by rising requirements for high-utilization filtration products and services during the down-streaming process, increasing use of analysis tools, and introducing sophisticated filtration techniques for ultra-purification.

A diverse selection of ash-free filter papers and qualitative filter papers are available from Macherey-Nagel and a few other businesses, including GE Healthcare and Hahnemühle, and are intended for routine quantitative analysis and general laboratory filtration procedures.

Due to increased research and development spending in these regions and rising demand for improved laboratory filters, it is predicted that opportunities in underserved, evolving markets with high potential will drive the expansion of the laboratory filtration market.

The market is anticipated to experience significant opportunities for growth during the forecast period due to the rapid development of nanofiber technology and the quick expansion of filtration technologies in pharmaceutical, biopharmaceutical, and other laboratories. Growing investment in cell-based research and developing nations around the world also help to create significant growth opportunities for industry participants.

Laboratory Filtration Market Growth Factors

- The ongoing development of nanofiber technology is expected to boost market growth soon.

- Rising investment in cell-based research in emerging economies can propel market growth over the forecast period.

- The growing use of analysis tools and the introduction of new filtration techniques will likely contribute to the market expansion shortly.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.51 Billion |

| Market Size in 2025 | USD 4.85 Billion |

| Market Size by 2034 | USD 9.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.59% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Proficiency in research and development

Rising investment in research and development, particularly in developed and developing economies, will further open up profitable market expansion opportunities for medical devices and instruments. The market rate of growth is also being boosted by biopharmaceutical and pharmaceutical countries' capabilities in research and development to incorporate cutting-edge technologies in healthcare facilities.

The utilization of filtration technology growing

The key factors expected to drive the growth are the rising demand for filters with higher rates of productivity as well as the rising use of filtering technology in the biopharmaceutical, pharmaceutical, beverage, and food industry sectors. Filtration devices can be used for sterilization, air, bioburden reduction, oil and gas, and membrane filtration.

Companies are creating significant volume filtration processes for the biopharmaceutical and pharmaceutical industries. For example, 3M Purification, Inc.'s particle filter uses cutting-edge pleat technology to increase the filtration surface area while maintaining the exact filter dimensions.

Research labs, virus removal, microbiological analysis, and water purification treatment facilities are among the companies that use laboratory filtration. During the forecast period, growth is anticipated to be fueled by the development of sophisticated filtering technologies for ultra-purification, rising analytical instrument usage, and increasing demand for high-utilization filtration products during the down-streaming process.

The filtration process reduces the number of contaminants like suspended particles, viruses, bacteria, parasites, algae, and fungi. The method of laboratory filtration has several benefits, such as the effective removal of inorganic salts and other contaminants with high boiling points and the fact that distilled water is adequately pure for most laboratory uses. Particles and bacteria more significant than the pore size of a filter are excluded. Ultrafilters can eliminate endotoxins, colloids, and microorganisms for a cheap and simple replacement.

- In January 2025, SGS announced the launch of Germany's first commercial cell sorting service via fluorescent-activated cell sorting (FACS) for the biopharmaceutical industry. This service uses the BD FACSAria Fusion system to support the development of advanced therapeutic medicinal products (ATMPs) and drive innovation in cell and gene therapy.

Restraint

Consumers have a high price sensitivity.

The biotechnology and pharmaceutical industries, end users of laboratory equipment, currently struggle with cost containment despite their demands for better and more sophisticated products. Therefore, there is more pressure on laboratory filtration equipment and accessories suppliers to provide high-quality goods at competitive prices. Due to this affordability, the market for laboratory filtration equipment has experienced price immobility.

Decreased profit margins are also a result of producers not being able to pass on Research and development costs and other expands in production costs to end users due to the fierce competition in the majority of laboratory filtration markets.

Opportunity

Utilization of laboratory filtration technology growing

Biopharmaceutical companies manufacture small-molecule drugs and components on a large scale. These companies face several challenges when producing medicines, which include cost control and quality improvement. Filters are installed in numerous locations to stop contamination and eliminate organisms during production.

Examples of the different types of laboratory equipment used include sterilization filters and bioburden reduction filters. Sterilizing filters are becoming more common as they are quickly used to protect product quality during loading and manufacturing techniques. To control bacteria and other organisms, laboratory filtration equipment and supplies are also used at various stages of the manufacturing process. Utilization of laboratory filtration technology growing

Biopharmaceutical companies manufacture small-molecule drugs and components on a large scale. These companies face several challenges when producing medicines, which include cost control and quality improvement. Filters are installed in numerous locations to stop contamination and eliminate organisms during production.

Examples of the different types of laboratory equipment used include sterilization filters and bioburden reduction filters. Sterilizing filters are becoming more common as they are quickly used to protect product quality during loading and manufacturing techniques. To control bacteria and other organisms, laboratory filtration equipment and supplies are also used at various stages of the manufacturing process.

- In November 2024, A brand-new lineup of superior filtration systems for pharmaceutical applications was released by Thermo Fisher Scientific, which aims to enhance drug development processes. These filters provide the highest levels of particle removal and sterility assurance.

- In December 2023, ABB Robotics and XtalPi entered a strategic collaboration to produce a range of automated laboratory workstations in China. The new, automated laboratories will boost the productivity of R&D processes in biopharmaceuticals, chemical engineering and chemistry, and new energy materials.

Product Insights

The laboratory filtration market is divided into filtration media, filtration accessories, filtration assemblies, and others based on the type of product. Membrane filters, filtration microplates, filter papers, syringeless filters, capsule filters, syringe filters, and other types of filters are subcategories of filtration media.

The further sub-segmentation of filter papers includes cellulose, quartz filter papers, and a glass microfiber. Microfiltration assemblies, ultrafiltration assemblies, vacuum filtration assemblies and reverse osmosis assemblies are additional categories of filtration assemblies. Filter holders, cartridge filters, filter flasks, filter dispensers, filter housings, filter funnels, seals, vacuum pumps, and other items are further divided into the category of filtration accessories.

The filtration media segment dominated the market in 2024. The dominance of the segment can be attributed to the rising application of filtration media in microfiltration, microbial analysis, and ultrafiltration. However, filtration media are sub segmented into filter papers, syringeless filters, syringe filters, Membrane filters, and other types of filters.

The ultrafiltration assemblies' segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment can be linked to the increasing utilization of this technique to remove particles with sizes above 10–20 nm. Furthermore, in this technique, external hydrostatic pressure pushes a material through a membrane, which is capable of removing the target compound from the solution.

Technology Insights

The dominant market technologies are reverse osmosis, nanofiltration, vacuum filtration, ultrafiltration, and microfiltration. In 2024, this industry was dominated by the microfiltration subsegment. Removing nanoparticles using a membrane filter, a microporous medium, is known as microfiltration technology.

Many companies use microfilters, solid-liquid phase separation and cold sterilization of API and enzymes. It is extensively used in applications involving milk protein fractionation. Applications involve cell restoration from fermentation broths, clarification of corn syrup, milk protein fractionation, and CIP chemical recovery.

Ultrafiltration is among the fastest rapidly growing technologies, with a significant CAGR anticipated throughout the forecast period. Compared to traditional techniques, the ultrafiltration component provides advantages like easier product handling, lower energy consumption, and gentle product handling. The market is anticipated to expand due to the expanding use of ultrafiltration in water purification systems, the food processing industry, and nutrient bio separation.

In 2024, this industry was dominated by the microfiltration subsegment. Removing nanoparticles using a membrane filter, a microporous medium, is known as microfiltration technology.

Many companies use microfilters, solid-liquid phase separation, and cold sterilization of API and enzymes. It is extensively used in applications involving milk protein fractionation. Applications involve cell restoration from fermentation broths, clarification of corn syrup, milk protein fractionation, and CIP chemical recovery.

The ultrafiltration segment is expected to grow at the fastest rate over the forecast period. Compared to traditional techniques, the ultrafiltration component provides advantages like easier product handling, lower energy consumption, and gentle product handling. The market is anticipated to expand due to the expanding use of ultrafiltration in water purification systems, the food processing industry, and nutrient bio separation.

End User Insights

The laboratory filtration market is divided into four end-user groups based on industry: biotechnology and pharmaceutical firms, hospitals and diagnostic labs, the beverage and food sector, and academic and research organizations. The market share leader in 2024 was the biotechnology and pharmaceutical sector, and it is anticipated that this position will not change throughout the forecast.

Latest Announcement by Market Leaders

- In April 2024,3M announced its first-quarter results and initiated its 2024 financial earnings outlook reflecting Solventum as a discontinued operation for the full year, including Q1. We delivered results that were better than our expectations as we returned to organic growth and achieved double-digit adjusted earnings growth, said by CEO.

- In December 2024, Thermo Fisher Scientific Inc., the world leader in serving science, announced that it had completed the repurchase of $1 billion (1.9 million shares) of its common stock. As of December 3, 2024, $3 billion remained available under the company's share repurchase authorization.

Laboratory Filtration Market Companies

- 3M Company

- Veolia Water Technologies.

- Advantec Toyo Roshi Kaisha Ltd.

- 3M Purification Inc.

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich

- Agilent Technologies Inc.

- Sterlitech Corporation

- Amd Manufacturing Inc.

- Ahlstrom-Munksj

- Sartorius Group

- Merck KGaA

- Cantel Medical Corporation

- Danaher Corporation

- Cole-Parmer Instrument Company LLC

- Merck Millipore

- GE Healthcare

- Hawach Scientific Co. Ltd.

- GVS S.p.A

- Macherey-Nagel GmbH & Co. KG.

Recent Developments

- In February 2025, Capita plc launched 'AI Catalyst Lab', a dedicated team focused on identifying, testing, and scaling AI solutions that drive measurable business outcomes for both Capita and its clients. Capita is also working on a number of AI accelerators to address various industry needs, including contact center transformation, learning, and workforce development.

- In June 2024, Cytiva introduced Supor Prime sterilizing grade filters, enhancing laboratory filtration for high-concentration biologic drugs. The innovation boosts yields, reduces blockages, and minimizes filtration losses, addressing the growing demand for self-administered subcutaneous therapies.

- In October 2024, Asahi Kasei Medical introduced the Planova™ FG1, a next-generation virus removal filter, that enhances laboratory filtration for biopharmaceutical production. Featuring seven times the flux of previous models, it boosts productivity and shortens virus filtration time. The FG1 ensures high protein filtration and virus removal without prefilters, aligning with CIP and SIP processes.

- January 2021- The 24-well format of the Acroprep high-volume 24-well filter plates, introduced by Pall Laboratory, enables laboratories to work on everything from harvest, cellular metabolism, and biomolecule isolation to the final section.

- September 2020- Merck Milipore declared the donation of research tools and supplies worth DR 1.2 billion to Indonesia's Eijkman Institute for Molecular Biology (USD 0.086 million). The grant helps the Institute's initiatives to quicken vaccine development research.

Segments Covered in the Report

By Product

- Filtration Media

- Membrane Filters

- Filter Paper

- Cellulose Filter Papers

- Quartz Filter

- Glass Microfiber Filter Papers

- Syringeless Filters

- Syringe Filters

- Capsule Filters

- Other Filtration Media

- Filtration Microplates

- Filtration Assemblies

- Ultrafiltration Assemblies

- Vacuum Filtration Assemblies

- Microfiltration Assemblies

- Reverse Osmosis Assemblies

- Other Filtration Assemblies

- Filtration Accessories

- Filter Dispensers

- Filter Holders

- Filter Flasks

- Filter Funnels

- Filter Housings

- Cartridge Filters

- Vacuum Pumps

- Seals

- Other Laboratory Filtration Accessories

By Technology

- Nanofiltration

- Microfiltration

- Vacuum Filtration

- Reverse Osmosis

- Ultrafiltration

By End User:

- Academic and Research Institutes

- Pharmaceutical and Biopharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting