Locomotive Market Size?

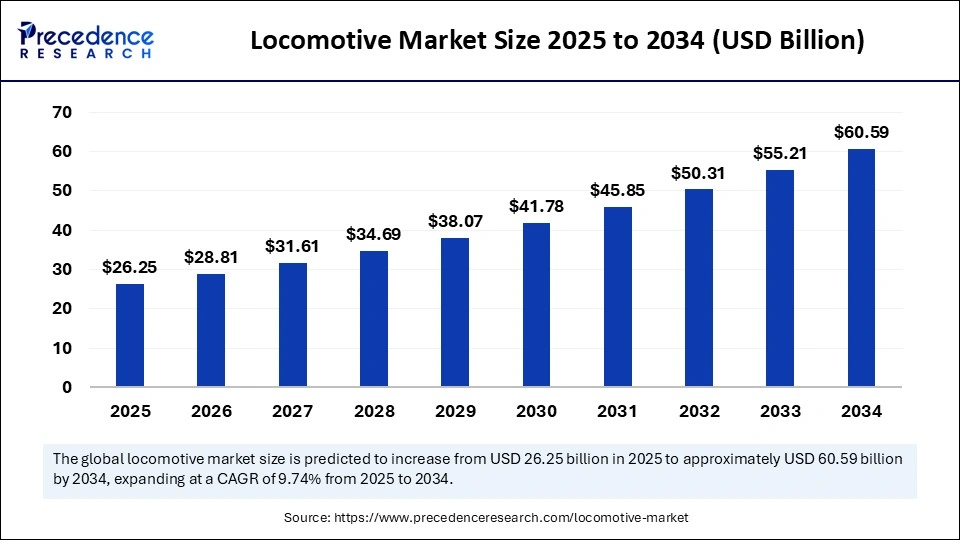

The global locomotive market size accounted for USD 26.25 billion in 2025 and is predicted to increase from USD 28.81 billion in 2026 to approximately USD 60.59 billion by 2034, expanding at a CAGR of 9.74% from 2025 to 2034. The locomotive market is experiencing rapid growth, driven by advancements in digital technologies, automation, and the push for sustainable transportation. As global rail infrastructure modernizes, the demand for intelligence and energy-efficient locomotives rises across freight and passenger segments.

Market Highlights

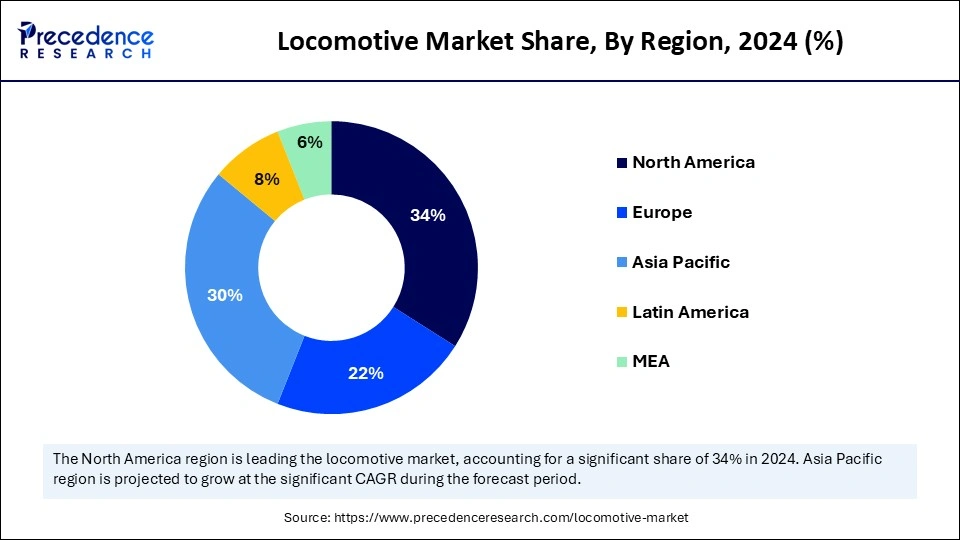

- North America dominated the global market with the largest market share of 34% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 11.44% between 2025 and 2034.

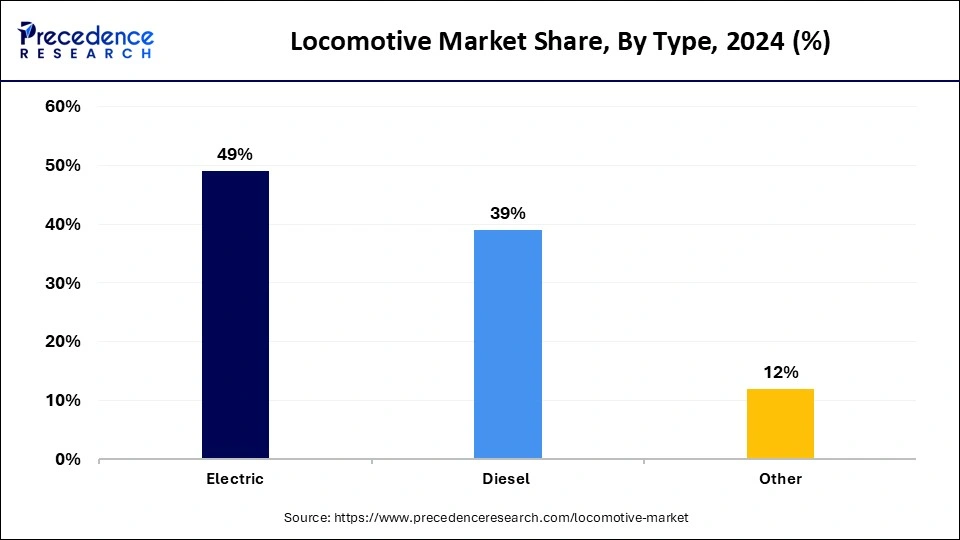

- By type, the electric segment held the largest market share of 49% in 2024.

- By type, the diesel segment is expected to grow at a significant CAGR of 8.83% in the upcoming period.

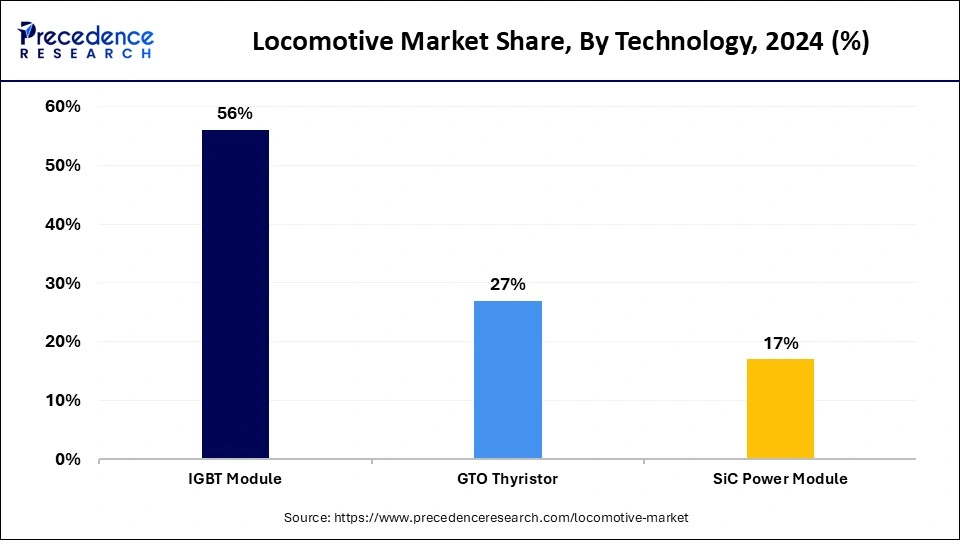

- By technology, the IGBT module segment captured the biggest market share of 56% in 2024.

- By technology, the SiC power module segment is expected to expand at the fastest CAGR of 13.24% during the assessment years.

- By component, the rectifier Segment contributed the market with a major share 27% in 2024.

- By component, the traction motor segment is expected to grow at the fastest CAGR of 10.42% between 2025 and 2034.

- By end use, the passengers segment generated the highest market share of 48% in 2024.

- By end use, the freight segment is expected to grow at a considerable CAGR of 8.93% during the forecast period.

What is the impact of AI on the locomotive market?

Artificial intelligence is rapidly reshaping the locomotive market by enhancing predictive maintenance, optimizing fuel usage, and enabling semi-autonomous rail operation. AI enables self-driving locomotives, improving efficiency and safety. Major players like Siemens Mobility, GE Transportation, and Alstom are integrating AI driver analytics into their rail systems. For instance, Siemens railing X platform uses AI to monitor train components in real-time, reducing downtime by up to 30%. AI is not just optimizing operational efficiency; it is enabling smarter routing, real-time tracking, and reducing carbon footprints, aligning with global climate goals.

What is the locomotive market?

The locomotive market is undergoing a significant transformation as nations modernize their rail networks and prioritize environmentally friendly transportation. There is a growing shift toward cleaner propulsion systems, such as governments and companies respond to environmental pressures and sustainability goals. Digitalization is playing a major role, with new technologies like smart traffic management systems, AI-powered diagnostics, and connected infrastructure being integrated into modern locomotives. These innovations are improving efficiency, safety, and performance, making rail a more attractive option for freight and passenger travel alike. Companies are also increasingly collaborating on advanced rail solutions, and major regions across the globe are investing in future-ready rail systems that blend automation, energy efficiency, and real-time data insights.

What are the Key Trends in the Locomotive Market?

- Shift Toward Green Propulsion: There is a growing transition from diesel-powered engines to hydrogen fuel cells and battery-electric locomotives. This shift is driven by global sustainability targets and regulatory pressures to reduce emissions in the rail sector.

- AI-driven Operations and Predictive Maintenance: Artificial Intelligence is playing a critical role in enhancing fleet management, route optimization, and early fault detection. Locomotive systems now use real-time data to minimize downtime and increase efficiency.

- Digital Twin and Smart Rail Infrastructure: Rail manufacturers are integrating digital twin technologies to simulate and optimize train performance before deployment. Smart infrastructure, like automated signaling and IoT-connected tracks, is also improving safety and traffic control.

- Autonomous and Semi-Autonomous Locomotives: Autonomy in rail transport is advancing, with semi-autonomous freight locomotives already being tested and deployed in select regions. These innovations aim to reduce human error and operational costs.

- Increased Investments in Rail Electrification: Governments and private operators are investing in electrifying existing rail lines, especially in regions where diesel locomotives still dominate. Electrification reduces long-term operating costs and supports climate initiatives.

- Public-Private Partnerships (PPP): To fund modernization and expansion, countries are embracing PPP models, which bring innovation, efficiency, and risk-sharing to large-scale rail projects.

Market Outlook

- Industry Growth Overview: The locomotive market is increasing, driven by savings in rail infrastructure, regulatory support for electrification, and the requirement for more sustainable transportation. Growing urbanization is increasing the demand for effective urban passenger rail solutions.

- Global Expansion: The locomotive market is increasingly global, driven by environmental challenges is a strong push for additional sustainable transport choices, leading to growing investment in hybrid and electric locomotives to lower greenhouse gas emissions. North America is dominated in the market by a growing shift toward battery-electric and hybrid models due to stringent emission guidelines.

- Major investors: Major investors in the locomotive industry include large, established worldwide manufacturers and different public and private investors that fund or hold stakes in these companies and related rail infrastructure companies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.25 Billion |

| Market Size in 2026 | USD 28.81 Billion |

| Market Size by 2034 | USD 60.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Component, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for Freight Transport and Push Toward Sustainable Transportation

With the rising global trade and e-commerce activities, the demand for freight is increasing, which is a major factor driving the growth of the locomotive market. Locomotives offer efficient and cost-effective freight transport, making them highly attractive to businesses. Moreover, the global push toward sustainable transportation is another major factor driving market growth. Governments and transit authorities are prioritizing low-emission and zero-emission rail systems, driving demand for hydrogen-powered, battery-electric, and hybrid locomotives.

Regulatory frameworks promoting carbon neutrality, along with climate change commitments like the Paris agreement, are compelling rail operators to replace diesel fleets with eco-friendly alternatives. Additionally, increased public and private investments in the electrification of rail networks and smart mobility infrastructure are accelerating innovation and adoption. As a result, sustainability has become both a compliance requirement and a compliance requirement and a competitive advantage for rail companies.

Restraint

High Initial Investments and Regulatory Challenges

Despite strong growth potential, the locomotive market faces several barriers. One of the most pressing challenges is the high initial investment required to purchase and maintain locomotives. This creates an entry barrier for some operators. Adopting next-generation technologies, such as hydrogen and electric propulsion systems, also require substantial investments. Many rail operators, particularly in developing regions, struggle with limited budgets and rely on older equipment incompatible with modern upgrades. Moreover, a complex regulatory environment, long approval cycles, and infrastructure gaps can delay implementation. Technical limitations in fuel storage, charging infrastructure, and interoperability between different infrastructure, and interoperability between different systems further complicate the transition to smart and green rail solutions.

Opportunity

Technological Advances

The locomotive market is rich with immense opportunities as emerging technologies are reshaping traditional rail systems. The rise of AI, IoT, and cloud computing in rail operations opens doors to smarter, safer, and more efficient transport networks. There's substantial potential in digital signaling, predictive maintenance, autonomous train control, and real-time traffic management, especially in developing countries upgrading outdated rail infrastructure. Additionally, growing urbanization and the need for high-speed regional connectivity are pushing demand for advanced locomotives in both passenger and freight segments. New infrastructure projects, cross-border rail initiatives, and smart city integration present lucrative long-term growth prospects for manufacturers and tech providers alike.

Segment Insights

Type Insights

Why did the Electric Segment Dominate the Market in 2024?

The electric segment dominated the locomotive market with the largest revenue share of 49% in 2024. This is mainly due to the perceived benefits of electric locomotives such as energy efficiency, lower operating costs, and reduced emissions. Unlike their diesel counterparts, electric locomotives offer higher acceleration, quieter operation, and are easier to maintain. As many countries electrify their rail networks to meet sustainability targets, the demand for these locomotives is soaring. Additionally, government incentives and infrastructure investments are further accelerating the adoption of electric rail transport across both urban and intercity routes.

On the other hand, the diesel segment is expected to expand with remarkable CAGR of 8.83% in the upcoming period, as global climate concerns intensify. These locomotives combine conventional engines with electric or alternative fuel sources, allowing rail operators to cut emissions while retaining flexibility on partially electrified lines. This approach is especially attractive in regions where full electrification is still years away, making hybrid models a practical and transitional solution.

Technology Insights

What Made IGBT Modules the Dominant Segment in the Locomotive Market?

The IGBT (Insulated-Gate Bipolar Transistor) modules segment dominated the market with a major share of 56% in 2024 due to their high efficiency, fast switching capabilities, and robustness in handling high voltage and current loads. These modules are crucial in modern electric and hybrid locomotives, where energy conversion and speed control are vital. Their ability to support regenerative braking and improve traction system performance makes them the go-to choice for high-performance, energy-efficient trains.

Meanwhile, the SiC power module segment is predicted to grow at the fastest CAGR 13.24% during the assessment years as they offer superior thermal conductivity, energy efficiency, and reduced size compared to traditional silicon modules. These benefits lead to lighter locomotives with better performance and lower cooling requirements. SiC modules are especially appealing for next-generation high-speed and battery-electric locomotives, where efficiency and space savings are crucial.

Component Insights

How Does the Rectifiers Segment Dominate the Market?

The rectifier segment dominated the locomotive market with the highest share of 27% in 2024. Rectifiers are critical components in electric locomotives, converting alternating current (AC) from the grid to direct current (DC) needed for traction motors. Rectifiers are essential in nearly all electric rail systems, especially in regions with high electrification. As more countries adopt electric rail solutions, the demand for efficient and reliable rectifiers continues to grow.

The traction motor segment is anticipated to expand at the fastest CAGR 10.42% during the projected period. Traction motors, which drive the wheels of a locomotive, are gaining momentum due to increasing demand for higher speed, better torque control, and energy recovery systems. Innovations in electric traction motors, especially those paired with advanced power electronics, are enabling smoother, more efficient rail operations. Their role in hybrid and battery-electric systems further support segmental growth.

End Use Insights

Why did the Passengers Segment Dominated the Locomotive Market in 2024?

The passengers segment dominated the market with the largest market share 48% in 2024 due to the increased demand for mass urban transit, intercity rail, and high-speed trains. Urbanization and population growth are pushing governments to expand commuter and metro systems. Electric and hybrid passenger trains are also favored for their quiet operation and lower emissions, making them ideal for city centers and densely populated corridors.

Meanwhile, the freight segment is expected to grow at a considerable CAGR 8.93% during the forecast period as global logistics demand expands. The need for cost-effective, long-haul, and bulk transportation, especially for industries like mining, agriculture, and energy, is fueling investments in efficient freight rail systems. With countries aiming to reduce truck-based emissions, shifting to rail freight is becoming a strategic and eco-friendly choice for supply chains.

Regional Insights

U.S. Locomotive Market Size and Growth 2025 to 2034

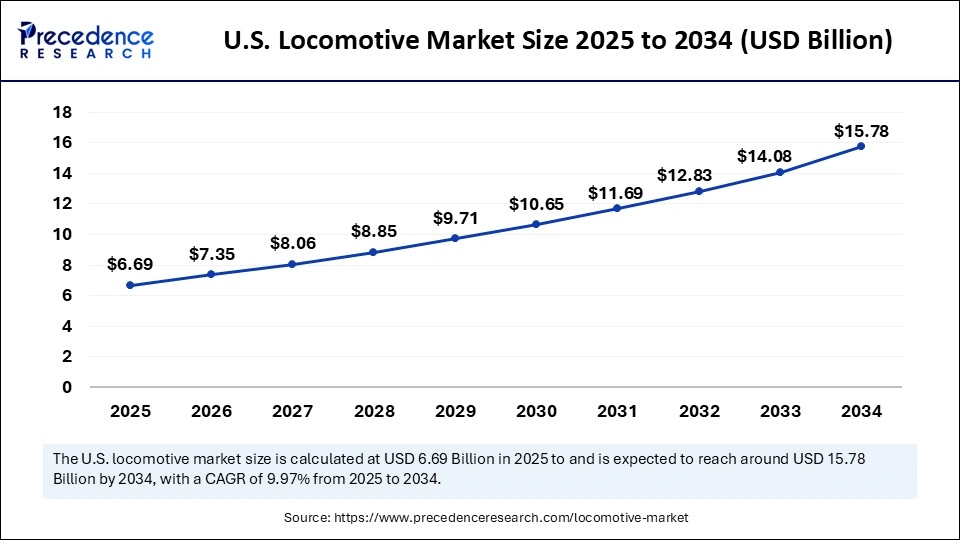

The U.S. locomotive market size is exhibited at USD 6.69 billion in 2025 and is projected to be worth around USD 15.78 billion by 2034, growing at a CAGR of 9.97% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Market?

North America registered dominance in the locomotive market by holding the largest share of 34% in 2024. This is mainly due to its robust and well-established freight rail system, which is vital for transporting bulk goods over long distances. This infrastructure makes freight locomotives a necessity for efficient logistics. Significant investments in rail infrastructure and technology have facilitated developments in the locomotive sector. The presence of major locomotive manufacturers in the region provides both stability and innovation in product offerings.

The U.S. and Canada are major players in the market within North America. There is a strong emphasis on technological advancements, particularly retrofitting existing diesel locomotives with fuel-efficient engines. The integration of AI-powered diagnostic systems enhances predictive maintenance, ensuring locomotives operate at peak efficiency. Regulatory Support for Emission Reductions. There is also a strong focus on regulatory measures aimed at reducing transportation emissions, which fosters the shift toward hybrid-electric and battery-powered locomotives. This shift is especially beneficial for short-line operations, where efficiency is paramount. The commercial-scale deployment of autonomous rail technology and increased involvement from the private sector are further consolidating North America's leadership in the locomotive market.

Why Is Asia-Pacific Racing Ahead as the Fastest Growing Region?

Asia Pacific is expected to grow at the fastest rate in the upcoming period, driven by rapid urbanization, population growth, and a relentless push for infrastructure modernization. Countries like India, China, Japan, and Southeast Asian nations are investing heavily in rail to improve both passenger mobility and freight logistics. These nations are not only increasing rail capacity but also localizing manufacturing, which reduces costs and speeds up deployment. China is expanding its already massive high-speed rail network, while India is overhauling its aging locomotive fleet with a focus on electrification, AI integration, and green energy adoption.

Governments across the region are offering subsidies and strategic funding for hydrogen-powered and battery-electric locomotives, aligning with climate action plans. Asia-Pacific also benefits from regional megaprojects like trans-Asian rail corridors, which aim to improve cross-border connectivity and reduce reliance on road transport. With a mix of emerging markets scaling up rail networks and advanced economies investing in smart rail technology, the region presents unmatched growth potential in both passenger and freight segments.

How is Europe Gaining Momentum in the Locomotive Revolution?

Europe is considered to be a significantly growing area. Europe's commitment to green mobility, digitization, and cross-border rail integration drives the growth of the amrket. The EU's strong environmental policies are pushing operators to phase out diesel locomotives and embrace hydrogen fuel cells and battery-powered trains. Major economies like Germany, France, and the UK are at the forefront of deploying intelligent rail systems, AI-based monitoring tools, and digital signaling infrastructure.

Eastern European countries are rapidly upgrading their networks, bridging the technology gap with Western Europe. The European Green Deal, along with initiatives like “Shift2Rail,” provides continuous funding and regulatory support to accelerate innovation. Europe's strong emphasis on intermodal connectivity, where rail links seamlessly with ports, logistics hubs, and air transport, further fuels locomotive demand. As a result, the continent is becoming a hub for advanced, low-emission, and AI-integrated locomotives, driving steady and sustainable market growth.

In December 2024, Germany accelerated its commitment to green transportation with the launch of the Mireo plus H, a new generation of hydrogen-powered trains developed by Siemens Mobility. Designed as a clean alternative to diesel locomotives, these innovative trains mark a significant milestone in the country's transition to a carbon-neutral transport sector. Miero Plus operates using hydrogen fuel cells that generate electricity by combining hydrogen and oxygen, emitting only water vapor as a byproduct. This makes it a zero-emission solution ideal for non-electrified rail lines, where electrification infrastructure is either economically unfeasible or environmentally disruptive.

South America: Urbanization is growing

South America is significantly growing in the market as the increasing requirement for effective public transportation in expanding urban centers is a significant driver for the advancement of rail systems, including passenger trains and light rail. There is an increasing emphasis on rail as an ecologically friendly substitute to road transport, which is leading to growing investment in rail projects.

Brazil: Infrastructure investment and modernization

The Brazilian government is vigorously working to entice private capital to progress its rail sector through the National Railway Plan and by providing concessions for main projects. Brazil has the ninth-largest railway network in the world by length. A combination of private spending, international collaboration, and government initiatives to enhance logistics for its massive agricultural and removal exports.

MEA: Technological modernization

MEA is significantly growing in the market as there is a strong focus on acceptance of advanced technologies such as Communication-Based Train Control (CBTC), AI-driven, and IoT predictive maintenance to confirm operational and safety efficacy in novel and upgraded systems. Capitalizing on modern rail infrastructure supports regional economies in expanding beyond oil and gas, and helps growth in sectors such as manufacturing, mining, and tourism.

South Africa: Increasing government investment and initiatives

South Africa is rich in minerals like diamonds, gold, coal, platinum, and iron ore. The most economical way to transport these bulk commodities from inland mines to coastal ports for export is by heavy-haul rail; this drove the early construction and continuing maintenance of the railway network.

Locomotive Market- Value Chain Analysis

- Raw Material Sourcing:

It involves different forms of steel, such as plates, bars, billets, castings, and forgings, non-ferrous metals, such as copper and aluminum, and specialized mechanisms, such as engines, motors, and electronic control systems.

Key Players: Hitachi Rail and Stadler Rail AG - Package Design and Prototyping:

It contributes engineering processes applied to design, conceptualize, and create early functional models of novel rolling stock, components, and systems before mass manufacturing.

Key Players: Alstom and Wabtec Corporation - Recycling and Waste Management:

The methodical handling of waste from railway processes, including dismantling old rolling stock, and managing waste from passenger regions and maintenance depots.

Key Players: CRRC Corporation Limited and Siemens Mobility

Top Vendors in the Locomotive Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

AEG Power Solutions B.V. |

Netherlands |

World-class engineering |

AEG Power Solutions has been selected to provide power supply services for a 100 MW electrolysis plant in Germany. |

|

Alstom |

France |

Leadership in sustainable mobility solutions |

In November 2025, Alstom, a global leader in smart and sustainable mobility, and Ukrainian Railways announced an agreement to supply 55 Traxx locomotives. |

|

Bharat Heavy Electricals Limited |

India |

Superior execution capabilities |

The company secured a ₹22.87 crore order from Indian Railways' South Western Railway division and accepted a ₹2,600 crore Letter of Intent (LoI) from MB Power (Madhya Pradesh) Limited. |

|

CRRC Corporation Limited |

China |

Comprehensive product portfolio |

In November 2025, CRRC Zhuzhou Locomotive Co., Ltd. developed a novel electric and intelligent integrated heavy-duty truck to support the green transformation of China's logistics sector. |

|

Hitachi, Ltd. |

Japan |

Diverse business portfolio |

In September 2025, Hitachi Rail's lighthouse digital factory formally opened in Maryland, representing a strategic investment by Hitachi Group in North America. The new carbon-neutral factory, featuring over $30M in digital enhancements, is set to deliver railcars for customers across North America. |

Recent Developments

- In June 2025, India's Prime Minister officially launched the first D9-9000 horsepower electric locomotive, marking a significant step in the country's rail modernization. This high-capacity locomotive is the result of advanced engineering, with key components manufactured by Siemens Mobility across several Indian cities, including Nashik, Aurangabad, and Mumbai. The launch highlights India's growing focus on domestic production and cutting-edge electric rail technology.(source: https://www.msn.com)

- In June 2025, Union Pacific's commemorative Abraham Lincoln locomotive will be featured at the College World Series in Omaha, giving the public a rare up-close look at this symbolic engine. The locomotive honors the legacy of President Lincoln, who played a key role in the development of America's transcontinental railroad. This event blends baseball and history, drawing attention to both heritage and modern rail operations.

(source: https://www.trains.com) - In June 2025, Ireland welcomes historic American locomotives to their new home. Two vintage American-made locomotives that first arrived in Ireland in the 1960s have been successfully relocated to County Down. These engines, which once played a role in Ireland's railway history, are now turning heads again as they reach their new destination. Their transport and preservation celebrate a unique link between American engineering and Irish rail heritage.

(source: https://www.belfasttelegraph.co.uk) - In June 2025, Norfolk Southern has showcased its latest heritage locomotive, painted in the classic livery of the Delaware & Hudson Railway, as part of its tribute series. This new unit reflects the rich history of American railroads and connects modern operations with historical roots. It is the latest in a series of locomotives designed to honor past rail companies that helped shape the industry.(source: https://www.trains.com)

Segments Covered in the Report

By Type

- Diesel

- Electric

- Other

By Technology

- IGBT Module

- GTO Thyristor

- SiC Power Module

By Component

- Rectifier

- Inverter

- Traction Motor

- Alternator

- Auxiliary Power Unit (APU)

- Others

By End Use

- Freight

- Passengers

- Switcher

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting