What is the Electric Traction Motor Market Size?

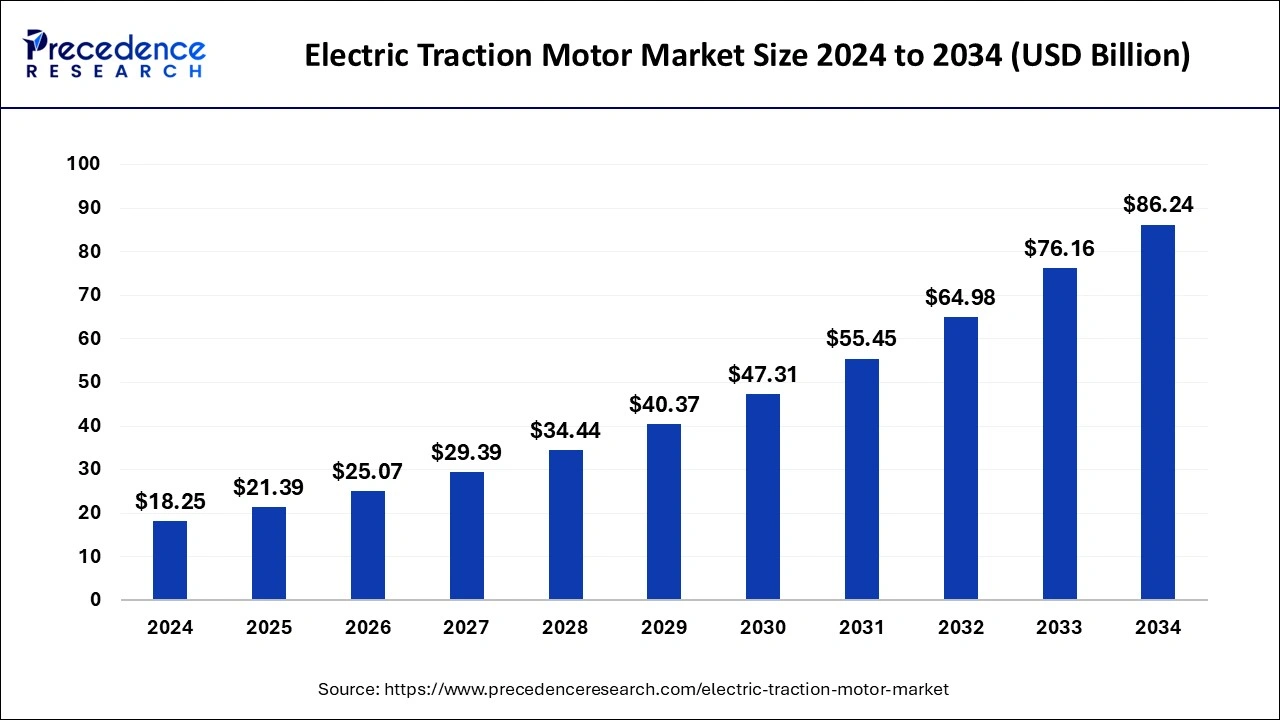

The global electric traction motor market size was accounted for USD 21.39billion in 2025, and is expected to reach around USD 97.05 billion by 2035, expanding at a CAGR of 16.33% from 2026 to 2035.

Electric Traction Motor Market Key Takeaways

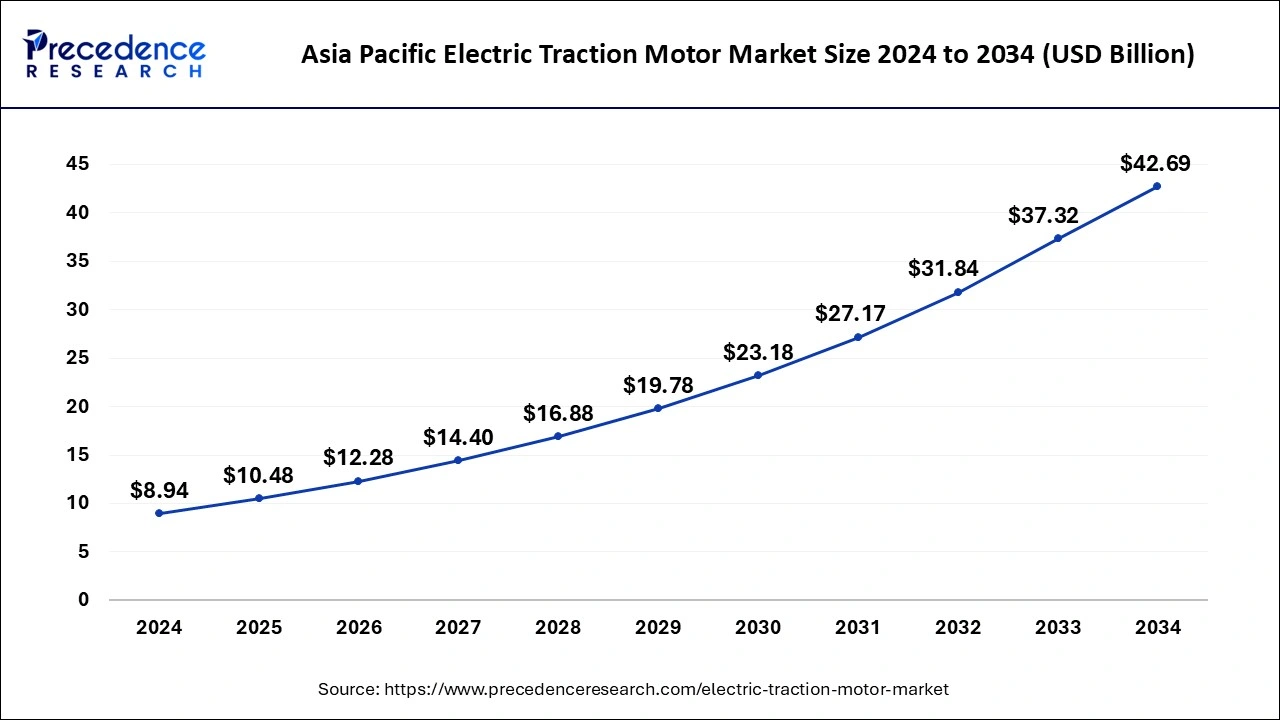

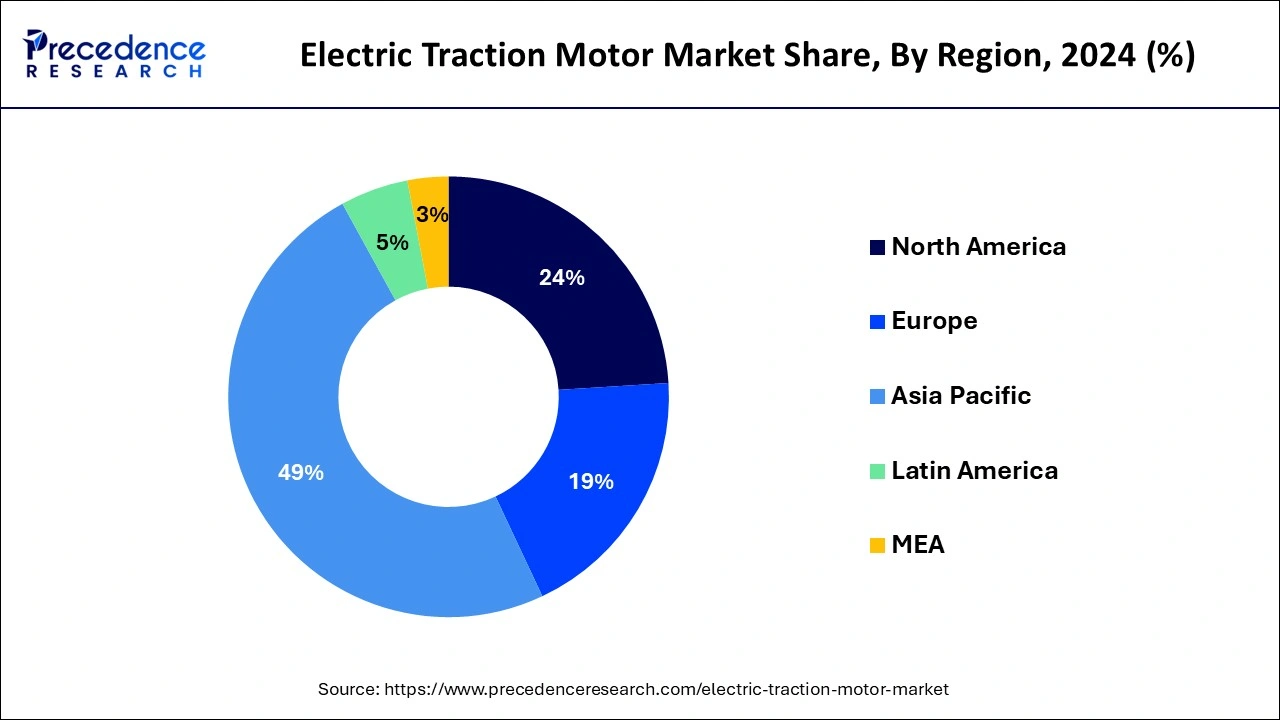

- Asia Pacific hit revenue share up to 49% in 2025.

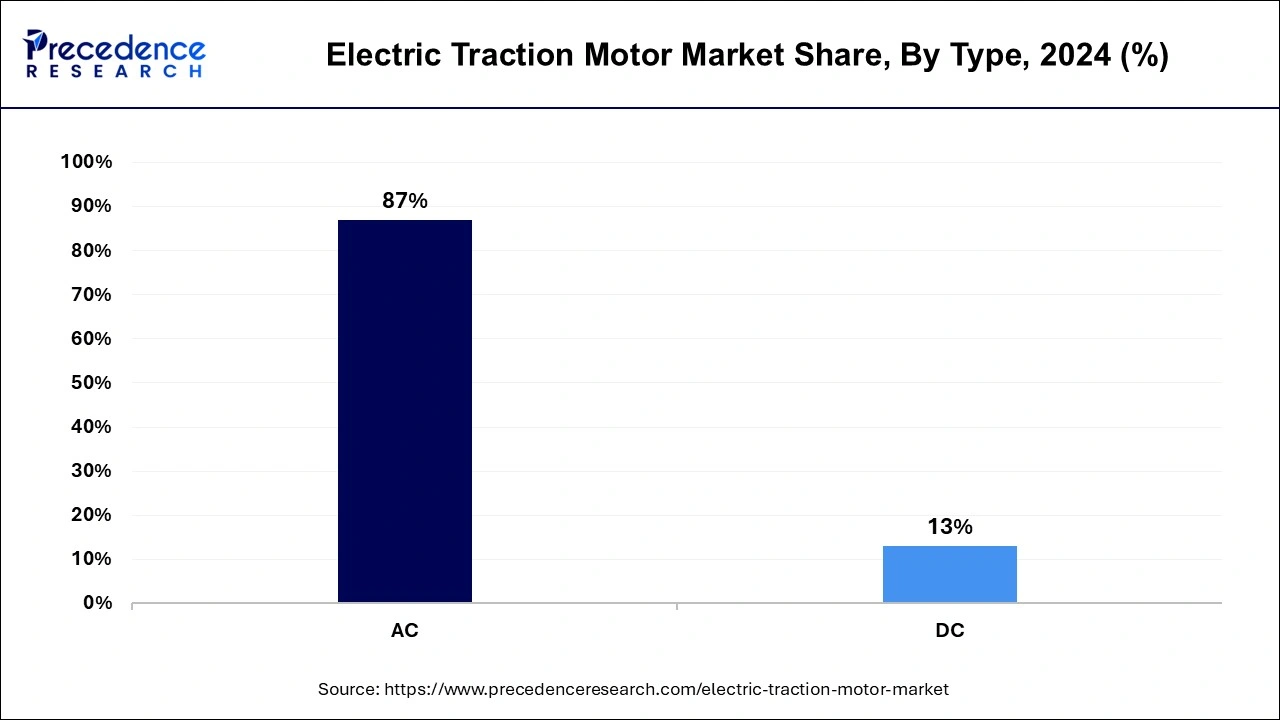

- By type, the AC segment has contributed the highest revenue share of over 87% in 2025.

- DC segment has generated a market share of around 13% in 2025.

Market Overview

The rising investments in electric vehicles and rising demand for energy-efficient motors are driving the market growth. Due to the low power consumption and great efficiency of EV traction motors, EV sales are on the rise. Furthermore, the demand for EVs is being driven by strict environmental laws and emission standards to protect environmental sustainability, generating ideal conditions for market growth.

Global sales of hybrid electric vehicles (HEVs) have surged as a result of a growing public preference for zero-emission automobiles. Consequently, it is anticipated that the market would benefit from the increased production of HEVs. Additionally, the government is launching a number of programmes to increase the sales of EVs, such as tax breaks and discounts, which is propelling the EV traction motor market.

Vehicles with traction motors are entirely hybrid and battery electric (BEVs). By offering almost zero emissions and exceptional fuel efficiency at ever-lower prices, BEVs and HEVs have been quickly gaining acceptance in the worldwide automotive industry. Globally, a large number of vehicle OEMs are currently developing innovative HEV and EV concepts. Additionally, avoiding electrical and magnetic losses is crucial if users are to receive the optimum range and fuel economy.

Additionally, structural, thermal, and electromagnetic concerns that are essential to vehicle performance, dependability, and cost must be taken into account by engineers during installation. Compared to conventional motors, traction motors for electric vehicles often operate more quietly and accelerate more quickly. Additionally, unlike conventional cars, electric vehicles traction does not require a multi-speed transmission since, in contrast to reciprocating engines, electric motors have a more advantageous torque-speed connection that allows them to deliver the most torque even at the lowest speed. Additionally, scientific developments in fields like nanotechnology and material science are concentrated on lowering cost and weight while extending the lifespan and functionality of traction motors, making EVs more accessible.

Electric Traction Motor Market Growth Factors

The global market for electric traction motors is being driven by increasing investments in the railway industry, a high demand for powerful motors for propulsion applications, and a growing focus on electric cars to reduce carbon emissions. Due to rising investments in railway projects, particularly those involving high-speed rail and metro trains, nations like India, Australia, and South Korea are also seeing positive growth in the electric traction motor market. Additionally, it is anticipated that price fluctuations for raw materials like copper and aluminium would restrain the market's expansion for electric traction motors.

Market Outlook

- Industry Growth Overview: With growing adoption of electric vehicles, the increased push for rail electrification, and government mandates for greater efficiency in electric traction motors, there's tremendous traction in both sales and rapid growth trends.

- Sustainability Trends: Electric traction motor manufacturers are making a conscious effort to provide products that utilize rare earth free materials, recyclable materials, manufacturing processes that are energy efficient and products produced with the goal of reduced lifecycle emissions.

- Global Expansion: Many developing countries are investing significantly in electric transportation infrastructure, so motor suppliers around the world can expand their manufacturing operations and establish new partnerships within certain geographical areas.

- Startup Ecosystem: Startups are seeking to disrupt the market by creating new and innovative software programs to provide customers with advanced motor control capabilities, developing compact motor architectures, and using artificial intelligence (AI) technologies to develop more efficient motors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.39Billion |

| Market Size by 2035 | USD 97.05Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.33% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Type, Power Rating, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Demand for the energy-efficient motor: An important driver propelling the market for electric traction motors is the increased need for energy-efficient motors. Vehicle energy efficiency allows for minimal maintenance and energy savings. Prices for fossil fuels are continually changing. However, the market for electric traction is significantly impacted by the growing cost of gasoline. This is why electric traction motor driven cars are becoming more and more common. Also, in the approaching years, it will become more commonplace to cut carbon emissions.

- Favourable government policies - The usage of electric traction motors is encouraged by governmental legislation. These motors are advantageous because they conserve energy and lessen environmental pollutants. There will be strict rules to limit carbon emissions in the future years. It will lead to the adoption of eco-friendly technology. The market for electric traction will benefit from the implementation of environmental regulations. During the projected period, the market's income and demand will peak.

Key Market Challenges

Motor failure is a major limitation: A machine's or technology's motor is a crucial component. The traction motor's difficulties have a significant negative impact on demand as a whole. To address this problem, the major market participants are increasing their R&D spending. The market demand and market development, however, will be greatly impacted by engine overheating and failure.

The complex process for manufacturing of electric traction motors: High-end raw constituents are required to produce this energy-efficient technology. In the process, premium metals like copper and aluminium are employed. The electric traction motor, however, has difficulties due to the fluctuating price of raw materials. Several market irregularities are brought on by the low or high price fluctuations of raw materials. The reliability as well as safety of the operation of an electric traction motor can be impacted by selecting low-cost raw material substitutes. The cost of raw materials is a significant obstacle for the market's top competitors.

Key Market Opportunities

- Use of electric traction motors in hybrid and fully electric vehicles- The main devices in hybrid and all-electric cars that transform electrical energy into mechanical energy are called traction motors. For initial propulsion and to give the vehicle rotational torque, electric traction motors are included in electric cars. The need for traction motors has significantly increased as a result of advancements in hybrid vehicle technology. Because they are more lightweight than induction motors and have a more compact design, electric traction motors like permanent magnet synchronous motors are frequently utilised in electric cars. Another significant reason driving the expansion of the market for electric traction motors is the growing awareness of the negative impacts of carbon emissions from moving automobiles. Despite the fact that electric buses are being bought quickly in Europe, India, and Latin America, 98% of the electric bus stock is in China. As a result, the market for electric traction motors is anticipated to rise over the next several years as electric car demand increases.

- Rising Investments from key players - In the future years, there will likely be a lot of investments in the market for electric traction motors. The market will be more profitable as a result of the increasing investments from major firms. Additionally, this is a time when many new, cutting-edge traction motors are introduced. 3.3 billion records were invested in the North American market. More investments from additional market participants are revealed by the overall geographical study. The introduction of a hybrid electric traction motor will open up several market expansion opportunities. In China, there is already a very high demand for electric automobiles. The Asia Pacific market has more than 12.43 million sales. More potential for market expansion will arise from the introduction of hybrid traction in additional locations. Additionally, electric traction motors lower vehicle carbon emissions. Many countries are increasing their investments in carbon emission-reduction technology. In the future, there will be more government control of the usage of energy-efficient equipment. It is yet another element contributing to the market expansion for electric traction motors.

Segment Insights

Vehicle Type Insights

A battery-powered vehicle is one that runs entirely on chemical energy from rechargeable battery packs. Instead of using traditional IC engines for propulsion, battery electric vehicles employ motor controllers and electric motors. Due to a significant shift in consumer attitude toward zero emission vehicles, the BEV category is anticipated to dominate the market for electric vehicle traction motors throughout the forecast period. The BEV market is anticipated to rise as a result of technological developments including long-range batteries with quick charging capabilities. To enable EVs to go up to 200 miles on a single charge, the market is heading toward battery capacities of 60kWh. The higher battery capacity is anticipated to positively affect the market for electric vehicle traction motors by cascading the demand for battery electric vehicles. Greater government involvement also has a significant impact on encouraging people to purchase BEVs.

Type Insights

During the anticipated period, the AC segment is anticipated to be the market's biggest by type for electric traction motors. The benefits of AC motors include ease of manufacture as they don't require any mechanical parts to work, as well as being lighter than DC motors for the same power. Utilizing cutting-edge electronics enables the AC units to work meticulously and effectively to increase traction and adhesion.

It can be precisely monitored by microprocessors, which also aids in redeveloping current till it stops. At low speeds, DC regeneration falls rapidly. In the current industrial area, these items are most frequently employed in a variety of applications, including electric cars, conveyors, and industrial gear. In the automotive industry, AC motors are used more frequently. These are the elements that are anticipated to boost demand for AC motors.

Regional Insights

What is the Asia Pacific Electric Traction Motor Market Size?

The Asia Pacific electric traction motor market size was estimated at USD 10.48 billion in 2025 and is predicted to be worth around USD 48.13 billion by 2035, at a CAGR of 16.47% from 2026 to 2035.

The market for EV traction motors in Asia Pacific became the biggest in 2025 and is predicted to develop at the quickest rate over the forecast period. Industry leaders in the area blame the growth of industrial facilities for this. Due to the cheap access to labour and raw materials in China, the largest industrial facilities have been seen to start operating there. Over the past ten years, the Chinese government has invested more than $50 billion in the establishment of factories producing electric vehicles and their components. To increase the demand for EVs, the Chinese government has also decreased the number of conventional car licenses accessible. Over the projection period, North America is anticipated to experience a significant CAGR of over 35%. In terms of the sales of EV traction motors, it is likewise a significant region. The existence of reputable electric car manufacturers accounts for the region's greater proportion. However, in 2018, Europe had a market share of over 20%. Over the projected period, rising BEV demand is anticipated to fuel market expansion in the area.

Europe's Electric Vehicle (EV) Revolution

Electric vehicles became popular in Europe due to stricter emission standards, rapid growth in EV sales, and superior automotive engineering skills present across the continent. Manufacturers are primarily focused on producing energy-efficient vehicles that are lightweight (in terms of the electric motor) and can be integrated properly into EVs.

Germany is the fastest-growing nation based on the number of OEMs based in the country (global manufacturers), as well as government subsidies for EV purchasing and continual innovations for electric drivetrains.

Latin America's Slow Adoption of Electrification

While growth in EVs across Latin America has been relatively steady/not much difference from year-to-year due to urban transportation system electrification (transitioning the way people get around), updating existing public transport infrastructure (adding new buses & new train stations that connect to EVs), and increasing imports of EVs, some new government-based policies have helped facilitate this growth.

Brazil has experienced phenomenal growth due to multiple government-sponsored EV projects, in addition to significant automotive manufacturing investments being made.

Middle East and Africa: Infrastructure Will Drive Growth

Electric vehicle growth in MEA will be driven primarily by new construction/installation of rail tracks that are already accessible by electric trains, as well as recently developed smart city projects. Continued trends of "green" solutions to urban transportation will also drive electric vehicle growth.

Saudi Arabia is experiencing rapid growth as large investments in new infrastructure (highways, public transport) are made to support national electric vehicle programs.

Value Chain Analysis of the Electric Traction Motor Market

- Raw Material Sourcing: Copper winding, silicon steel lamination, rare earth magnet, power semiconductor, and insulation material are all needed to create electric traction motors.

Key Players: Lynas Rare Earths, Hitachi Metals, and BASF. - Component Manufacturing & Motor Assembly: The electric traction motor manufacturing process begins with fabricating the rotor and stator and winding wires around the rotor. In addition, inverters are integrated into the motor with thermal management systems and precise assembly to create the finished product.

Key Players: Nidec Corporation, Bosch Mobility Solutions, and Siemens. - Distribution, OEM Integration & Aftermarket Services: Electric traction motors are primarily distributed to EV OEMs (Original Equipment Manufacturers) and the rail and industrial mobility industries. Vehicle architecture compliance, software calibration, and rigorous performance validation are required for the integration of electric traction motor systems.

Key Players: ABB, Dana Incorporated, and Mitsubishi Electric.

Electric Traction Motor Market Companies

- Schneider Electric SE

- The Curtiss-Wright Corporation

- Prodrive Technologies

- Toshiba Corporation

- General Electric Co.

- CG Power and Industrial Solutions Ltd.

- Aisin

- ABB, Ltd.

- Alstom S.A.

- Siemens AG

- Delphi Automotive LLP

- Voith GmbH

- Mitsubishi Electric Corporation

- Bombardier Inc.

- American Traction Systems

- VEM Group

- Caterpillar Inc.

- TTM Rail - Transtech Melbourne Pty Ltd.

- Kawasaki Heavy Industries Ltd.

- Traktionssysteme Austria GmbH

- Hyundai Rotem Company

- Hitachi, Ltd.

- Ansaldo Signalling

- Magna International

Recent Developments

- In October 2019, a reputable company, Tata Motor, accepted a contract for the delivery of 300 Urban 9/9 electric buses that travel along Ahmedabad's BRTS circuit. This company is the only one in India to receive such a sizable order. Additionally, it helps the government's push for e-mobility.

- A renowned firm, CZECH Railways, received a contract in July 2019 to deliver 300 traction motors to the Skoda Subsidiary Pars Nova. Additionally, the renowned rolling stock maker Stadler granted the leading business ABB a traction equipment deals worth more than $140 million. The ABB began offering the most cutting-edge technology for locomotives and trains in the US and throughout Europe.

Segments Covered in the Report

By Vehicle Type

- Plug-in Hybrid Electric Vehicles

- Mild Hybrid Vehicles

- Full Hybrid Vehicles

By Type

- AC

- DC

By Power Rating

- Below 200 KW

- 200 KW To 400 KW

- Above 400 K W

By Application

- Railways

- Electric Vehicles

- Elevators

- Conveyors

- Industrial Machinery

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting