What is Marine Data Center Market Size?

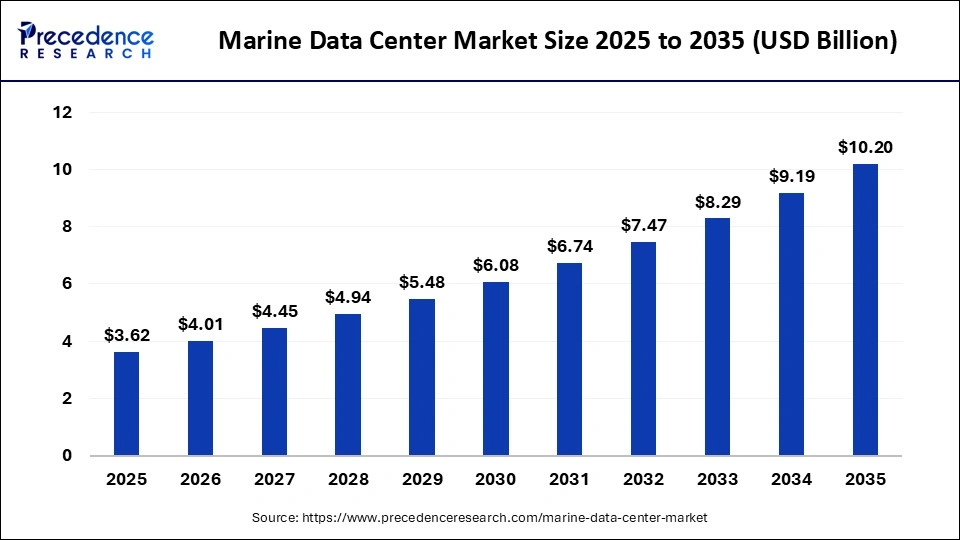

The global marine data center market size is calculated at USD 3.62 billion in 2025 and is predicted to increase from USD 4.01 billion in 2026 to approximately USD 10.20 billion by 2035, expanding at a CAGR of 10.91% from 2026 to 2035. The market for marine data centers is driven by rising data demand, energy-efficient offshore infrastructure, and the need for low-latency, sustainable hyperscale storage solutions.

Market Highlights

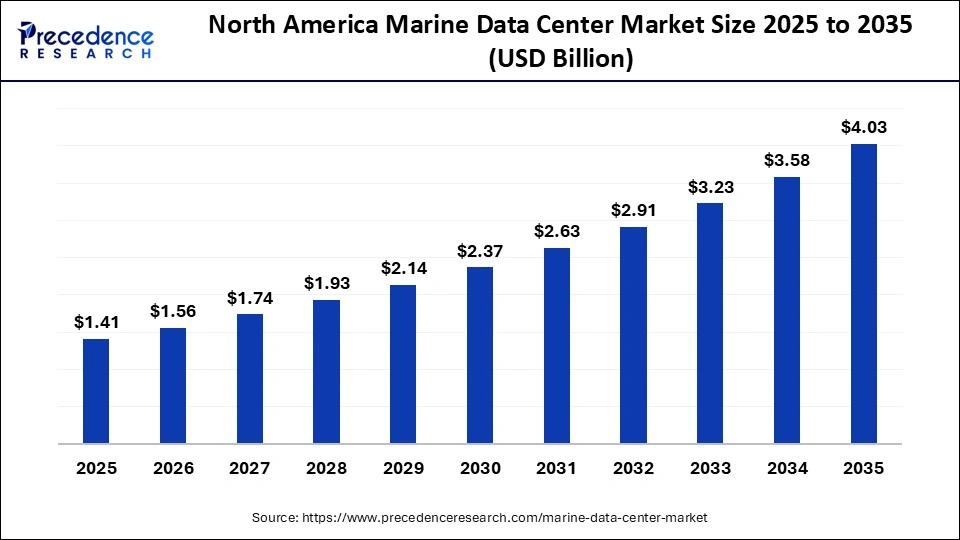

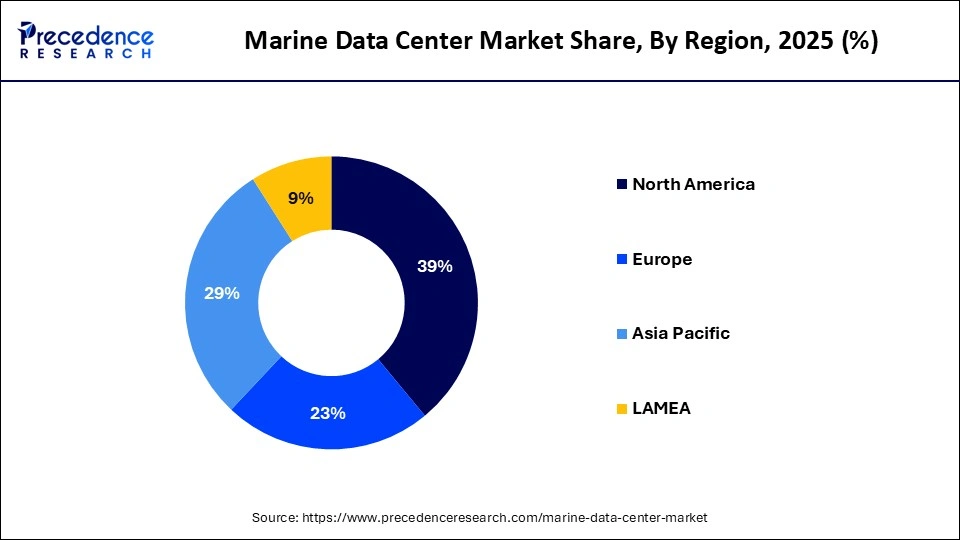

- North America dominated the market, holding the largest market share of 39% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By type, the offshore data centers segment held the major market share in 2025.

- By type, the marine power infrastructure segment is poised to grow at a remarkable CAGR between 2026 and 2035.

- By application, the telecom segment contributed the biggest market share in 2025.

- By application, the energy segment is growing at a remarkable CAGR between 2026 and 2035.

Revolutionizing Ocean-Based Computing: How Marine Data Centers Are Redefining Digital Infrastructure

The marine data center market is a revolutionary front-end in digital infrastructure, which is pushed by the shift to sustainable, energy-efficient, and high-performance computing environments all over the world. By moving the data centers to offshore or underwater locations, operators can use the naturally low temperatures in the ocean to cool down their devices, which would cut the energy consumption and carbon emissions significantly. The major cloud providers and telecommunication operators are testing modular and submersible units that can provide a better level of reliability, reduced operational expenses, and better physical security. These systems also make the processing of the data nearer to the population centers on the coasts and therefore make the latency low, as well as enhance the efficiency of the network.

The marine data center market is also growing because of the swift development of marine engineering, integration of marine renewable power, and underwater connectivity. Submerged data center modules are being used to supplement offshore wind, tidal, and wave energy sources to make them self-sustaining to create low-emission systems, which will meet the requirements of global ESG and decarbonization. The attributes of 5G and high-capacity subsea fiber networks are growth in viability as they offer a smooth high high bandwidth connection to land infrastructure. The fact that the computation of edges, AI processes, and cloud workloads is required nearer to population entities who live along a thickly populated coastline will also generate an additional boost in adoption.

Key AI Integration in the Marine Data Center Market

Artificial intelligence is making the development of marine data centers take center stage so that its future can be smarter, autonomous, and a highly efficient offshore computing environment. Predictive maintenance systems based on AI processes sensor data of subsea structures, cooling loops, and power units, and identify faults at an early stage and minimize operational downtime. Machine learning algorithms maximize energy consumption by regulating cooling needs according to the real-time ocean thermal variations, which reduces power consumption by a considerable margin. The environment is monitored with the help of high-tech analytics, i.e., it analyzes subsurface acoustic, temperature, as well as marine-life activity information to ensure compliance with ecology. In addition, the AI-based digital twins have the capability of modeling structural behavior, weather impact, and hardware strain in state planning and risk determination.

Marine Data Center Market Outlook

The marine data center market is growing due to the necessity to provide offshore, power-efficient, and climate-resistant data storage infrastructure. Underwater deployments are more efficient in cooling and consuming less land, which appeals to industries that need high-performance and sustainable data processing.

Areas that have high infrastructure along the coastlines, including North America, Northern Europe, and East Asia, are fast-tracking the marine data center pilots and full-scale deployments. Data centers based on the ocean are becoming an important part of the digital infrastructure planning of governments and enterprises.

Microsoft, Huawei, Nautilus Data Technologies, and Subsea Cloud are some of the major investors in marine data center R&D and implementation. These players are interested in reducing the cost of energy, enhancing sustainability, and ensuring the reliability of the data processing in the offshore settings.

The Subsea Cloud, Highland Data Center, and EcoDataCenter Marine are the startups that are innovating in the cost-effective, fast-to-launch subsea data center technologies. They emphasize the modular architecture, reduce the time of deployment and sustainability in their green solutions to attract the enterprise and government

Market scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.62 Billion |

| Market Size in 2026 | USD 4.01 Billion |

| Market Size by 2035 | USD 10.20 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.91% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Marine Data Center Market Segment Insights

Type Insights

Offshore Data Centers: The offshore data centers segment has led in the marine data center market due to its very effective cooling ecosystem that facilitates performance optimization and carbon emission reduction. These floating or immersible platforms are designed to deploy at a high rate of scale so that data-intensive industries can be able to scale without high footprint requirements. The resilience to disasters is enhanced by offshore units that isolate critical infrastructure against the effects of disasters on the ground. Capacity to support modular, containerized environments is also aligned with the increased trend of enterprises towards distributed computing, AI computing, and high-density server environments.

Marine Power Infrastructure: The segment of marine power infrastructure will also grow significantly because operators are investing in the high-efficiency and renewable-integrated systems of power to support next-generation marine data centers. The modernization of power subsystems is increasing with the increasing adoption of offshore wind, tidal, and wave energy solutions. The developments in underwater power cabling,energy storage systems, and microgrid systems can create steady and scalable electricity services to underwater and offshore locations. The need to have low-emission power infrastructure, which is fault-tolerant, will also keep increasing because of sustainability requirements.

Underwater Data Centers: Underwater data centres are gaining popularity due to their extreme energy efficiency, less than 10 kW cooling requirement and their ability to maintain constant levels of temperature during the year. Complete submerging in deep water also allows servers to operate under optimum temperatures, and thus reduces the complexity and cost of cooling systems. The rising population of pilots, especially those of the big technology companies, is enhancing its commercial adoption rate and shaping its future.

Marine Connectivity Solutions: The marine connectivity solutions line of business is expanding as a result of the necessity to ensure high quality of communications networks, which are low-latency and have to be deployed underwater and offshore in data centers. The development of fiber-optic cables underwater, marine 5G/6G systems, and satellite-supported backup systems is allowing smooth information exchange between marine plants and land-based systems. The resilience of the submarine cable system is expanding due to the rising demand forcloud services, content delivery, and real-time analytics across the coastal areas. The necessity to have high-bandwidth, fault-tolerant solutions to connectivity is vital, and thus, this segment is a key driver of marine data center market expansion.

Distribution Channel Insights

Telecom: In 2024, telecom delivered the highest revenue in the market for marine data center due to the increasing global digitalization, which increased the need to use powerful and low-latency, and highly reliable communication infrastructures. Telecom networks play a critical role in offshore data centers, marine connectivity solutions, and underwater digital platforms, where they are important to maintain a steady stream of data transfer over long distances, remote monitoring, and energy-risk intelligence. With the spread of cloud computing, IoT sensors, and AI-based analytics into marine and offshore fields, telecom became the major provider of operational visibility and mitigation of energy risks- the most dominant revenue unit in the segment.

Energy: There is a huge increase anticipated in the the marine data center market owing to the fast development of the offshore renewable resources, dependence on the marine power infrastructure, and the electrification of maritime operations. The offshore wind turbines, tidal, floating solar and hybrid marine grid require the sophisticated energy-risk management service to reach the goal of reliability, grid stability and weather-proof operation. The decarbonization drive makes operators adopt digital monitoring, predictive analytics, and failure-prevention technology, which will increase the rate of service adoption.

Research and Development: The research and development department is increasingly becoming strategic in a world where organizations continue working to demonstrate high rates of prototyping, testing, and implementation of the next-generation marine digital infrastructure. The advanced telecom and energy-risk management services are now in demand by the R&D centers to prove the new designs of underwater data centers, to optimize marine power systems, and to increase the resilience of the underwater communication networks. With business going green in cooling, autonomous offshore modules, and artificial intelligence-based optimization of energy needs, research and development become a pivotal point of distribution that drives the process of innovation and implementation of sophisticated energy-risk models.

Shipping: Shipping division is becoming a powerful distribution channel since the new ships are embracing digital systems, the internet of things, and hybrid energy remedies that demand proper risk-management services. Maritime processes are growing reliant on telecoms to provide navigation information, cargo, engine control, and safety communications, promoting the need for energy-risk intelligence. The shift to greener shipping, with LNG, battery-hybrid propulsion, and renewable-assisted propulsion, creates new power stability and stability in operational risks, which cause further growth in service adoption.

Marine Data Center Market Regional Insights

The North America marine data center market size is estimated at USD 1.41 billion in 2025 and is projected to reach approximately USD 4.03 billion by 2035, with a 11.07% CAGR from 2026 to 2035

Why Did North America Lead the Global Marine Data Center Market in 2024?

North America led the global marine data center market with the highest share in 2024, led by developed digital infrastructure, early adoption of next-generation cooling technologies, and a high presence of hyperscale cloud providers. The area was a leader in implementing offshore and near-shore submerged data center prototypes, which was due to the long-term investments of the technology giants in the quest to have energy-efficient and high-density compute environments. Favorable regulation systems, powerful marine engineering, and the availability of stable coastal grids also hastened deployments. The cooperation between governmental organizations, research centers, and firms was also encouraging testbed projects on the East and the West Coasts.

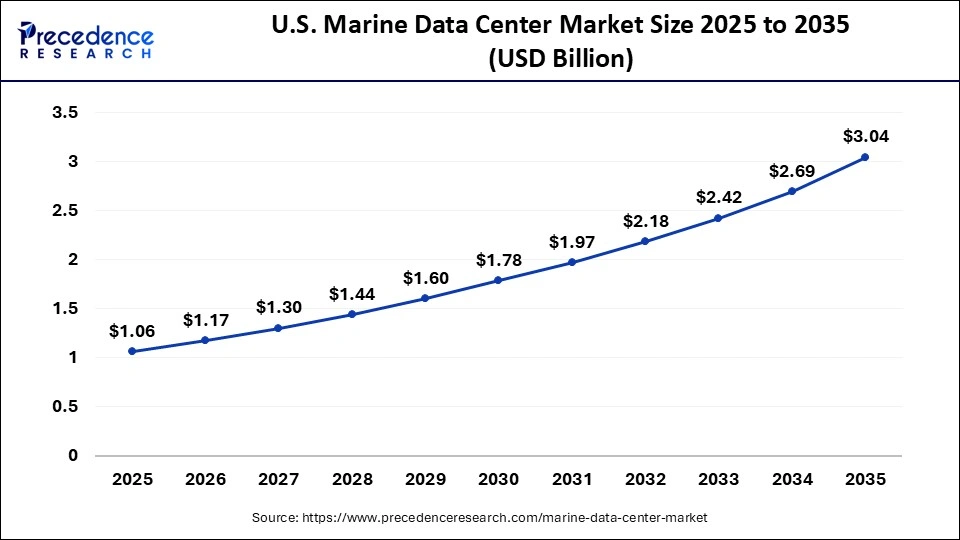

The U.S. marine data center market size is calculated at USD 1.06 billion in 2025 and is expected to reach nearly USD 3.04 billion in 2035, accelerating at a strong CAGR of 11.11% between 2026 and 2035

U.S Marine Data Center Market Analysis

In 2024, the United States will have significant funding for submerged server modules by major U.S. cloud and AI infrastructure companies, aiming to decrease the cost of cooling, increase the density of compute, and save on energy. The American coastline, covering Atlantic, Pacific, and Gulf areas, provides a perfect environment, grid connectivity, and deep-water engineering capabilities towards the prevalence of commercial deployments. The marine data center market perspective was further boosted by federal and state efforts that facilitated the adoption of clean energy sources such as offshore wind energy and marine renewables. The U.S. is also at the forefront in R&Ds and universities, naval research laboratories, and technology companies are coming up with new pressure-resistant enclosures, modular pods, and underwater surveillance systems.

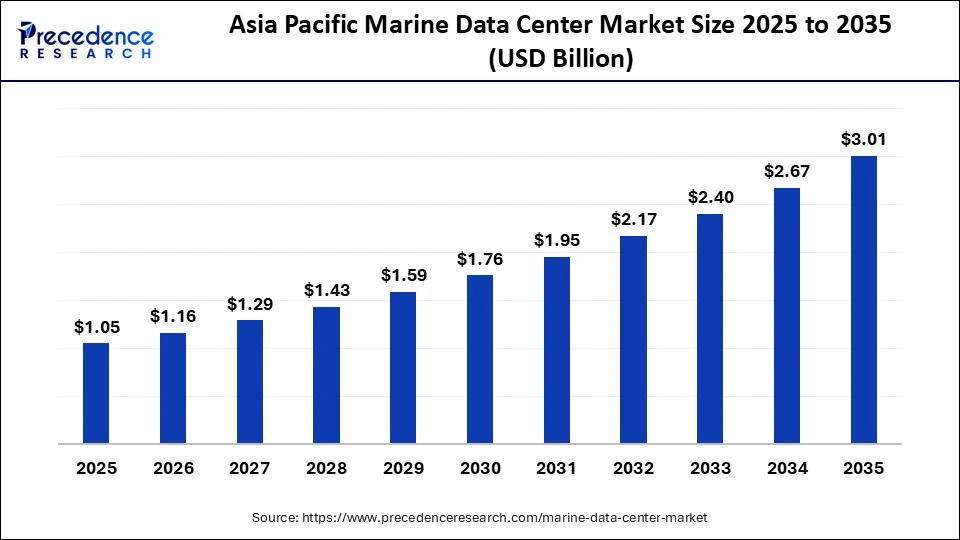

The Asia Pacific marine data center market size is expected to be worth USD 3.01 billion by 2035, increasing from USD 1.05 billion by 2025, growing at a CAGR of 11.11% from 2026 to 2035

Why Is Asia Pacific Undergoing the Fastest Growth in the Marine Data Center Market?

Asia Pacific has been estimated to achieve the highest CAGR throughout the forecast period due to the rapid digital transformation process, huge cloud growth, and the increasing load of AI and high-performance computing. The geographical location of the region, its rich sources of renewable energy, and a favorable climate that renders the standard practices of data cooling expensive make major influences on implementing the use of submerged, energy-efficient models of marine data centers. China, Japan, Singapore, and South Korea, among others, have been spending a lot of their money on green data infrastructure, fast-tracking underwater modules to cut carbon footprints and provide low-latency edge services. Efforts on the digital economy promoted by the governments, maritime innovation funds, and cooperation between telecom, cloud, and subsea engineering companies are increasing the adoption.

China Marine Data Center Market Trends

It is emerging as one of the most vibrant adopters in the marine data center environment with massive investment in China, government incentives and growing demand in the energy-efficient digital infrastructure. The major cloud vendors and state operators of the country are working on feasibility studies and pilot projects on the submerged data pods to reduce the operating energy usage and strengthen the national computing architecture. The rate of commercialization is growing due to new technologies in the field of underwater robotics, intelligent cooling, AI-powered surveillance, and materials that are resistant to pressure. Also, the Chinese decision to be carbon-neutral by 2060 is compelling operators to consider ocean-cooled infrastructure as a viable option to land-based hyperscale campuses that are limited in power consumption and space.

The European marine data centre market is undergoing a significant and sustainable growth due to the great commitment to the carbon neutrality of the territory, high-tech marine engineering needs and the increasing necessity to decarbonize digital infrastructure. Land space, data-centre approval standards, and energy charges have been significant constraints in Europe, so offshore implementation and cooling at sea is an attractive options. It also enjoys the advantages of developed offshore wind ecosystems in countries like the UK, Germany, Denmark, and the Netherlands, which will be able to easily integrate the renewable energy with underwater or near-shore data center modules. The partnership of technology companies, energy innovators, and marine research centres is leading to innovation of enclosures that are pressure-resistant, cooling automation using AI, and deployment systems that are eco-friendly.

UK Marine Data Center Market Trends

Offshore wind capacity is on the rise, the UK has become a leading nation in the development of expertise in subsea engineering, and the country has national targets of net-zero, making it look like an emerging European center of marine data centers. Large hyperscale and telecom carriers are considering underwater and near-shore data center projects to cut energy usage in cooling, enhance compute density, and remove congestion in on-land infrastructure, especially in and around London and other overcrowded technology centers. The marine research ecosystem in the UK is fully developed, with the presence of naval institutes, ocean-technology companies, which have facilitated developments in corrosion-resistant construction, automated surveillance, and marine-friendly deployment lines.

Marine Data Center Market Companies

A global leader in colocation and interconnection services, operating International Business Exchange (IBX) data centers across major markets. Equinix enables low-latency cloud connectivity, hybrid IT deployment, and multi-cloud ecosystems.

One of the largest global data center providers specializing in colocation, hyperscale campuses, and interconnection services. The company supports cloud, enterprise, and content providers with scalable, carrier-neutral environments.

Operates a global network of data centers under the Nexcenter brand, offering hybrid cloud, managed hosting, and network services. NTT focuses on high-reliability infrastructure and enterprise digital transformation.

Provides hybrid cloud data center solutions, enterprise hosting, and managed services through IBM Cloud and SoftLayer infrastructure. IBM integrates AI, automation, and security features into its global data center operations.

Operates hyperscale Azure data centers supporting cloud compute, storage, AI, and enterprise digital workloads. The company provides hybrid architectures through Azure Arc, high-availability infrastructure, and global backbone networks.

Runs large-scale cloud data centers powering Google Cloud Platform with advanced cooling, custom hardware, and AI-driven optimization. Google emphasizes energy-efficient, carbon-free operations across its infrastructure.

Specializes in application delivery controllers, DDoS protection, and secure traffic management for data centers. Its appliances support high-performance networking and multi-cloud optimization.

Provides data center power, cooling, monitoring, and modular infrastructure solutions through EcoStruxure. The company enables efficient facility management, sustainability optimization, and mission-critical uptime.

Supplies power systems, thermal management, racks, and data center infrastructure management (DCIM) tools. Vertiv supports hyperscale, enterprise, and edge deployments with high-reliability engineering.

Provides subsea cable systems, network services, and managed hosting to support cloud connectivity across Asia, Europe, and the Middle East. The company focuses on telecom-grade global backbone solutions.

A European colocation provider (now part of Digital Realty) offering high-density data centers with strong interconnection ecosystems. Interxion supports enterprise, cloud, and content delivery customers across major EU hubs.

Operates carrier-neutral data centers in Asia, Europe, and North America, providing colocation, connectivity, and disaster recovery services. Telehouse facilities are known for high uptime and robust network ecosystems.

Recent Developments

- In October 2025, Chinese underwater data center company HiCloud published a pilot project that is a direct connection of subsea servers with an offshore wind farm, showing a demonstration of a model of data infrastructure completely renewed and ocean-cooled. The company further announced that it was planning to expand these deployments to 500MW, and this will be one of the largest underwater data center projects in the world in the future.

- In June 2025,HiCloud, with the support of local governments, launched the first earth-based wind-powered underwater data center on the planet on the territory of Shanghai, Lin-gang district. Natural seawater cooling will be used to integrate offshore wind energy in the project to create a completely renewable and thermally stable subsea data environment.

- In February 2025 by HiCloud to the one that it had deployed off Hainan and it also deployed 400 high-performance servers to enhance processing power. This expansion stresses the increasing utilization of submerged groups of information to assist energy-saving high-density computing.

Marine Data Center Market Segment Covered in the Report

By Type

- Offshore Data Centers

- Underwater Data Centers

- Marine Power Infrastructure

- Cooling Systems

- Marine Connectivity Solutions

By Application

- IT

- Telecom

- Shipping

- Energy

- Research and Development

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting