What is the Marine Pharmaceutical Market Size?

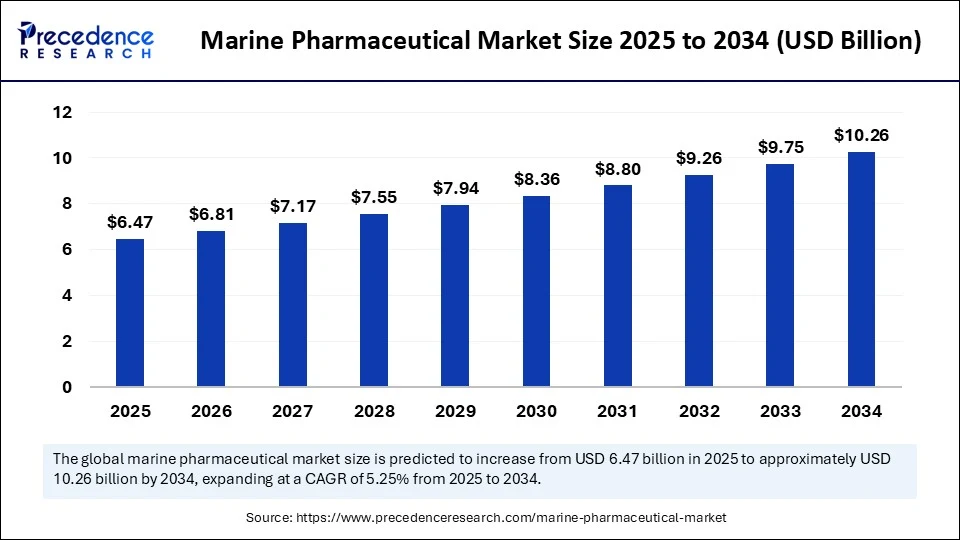

The global marine pharmaceutical market size is valued at USD 6.47 billion in 2025 and is predicted to increase from USD 6.81 billion in 2026 to approximately USD 10.26 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034. This market is growing due to the increasing demand for novel bioactive compounds, especially derived from marine organisms, for use in drug discovery and therapeutic applications.

Marine Pharmaceutical MarketKey Takeaways

- North America dominated the marine pharmaceutical market with the largest share of 37% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By source organism, the marine invertebrates segment held the biggest market share of 38% in 2024.

- By source organism, the marine microorganism segment is observed to grow at the fastest CAGR during the forecast period.

- By compound type, the polyketides segment held the highest market share of 30% in 2024.

- By compound type, the peptides segment is expected to grow at the fastest CAGR in the upcoming period.

- By therapeutic area, the oncology segment generated the major market share of 42% in 2024.

- By therapeutic area, the neurology segment is likely to grow at the fastest CAGR in the coming years.

- By product type, the approved drugs segment captured the biggest market share of 47% in 2024.

- By product type, the pipeline drugs segment is expected to grow at the fastest CAGR during the forecast period.

- By development stage, the clinical trials segment held the largest market share of 41% in 2024.

- By development stage, the preclinical segment is expected to grow at the fastest CAGR in the market.

- By end-user, the pharmaceutical companies segment held the largest market share of 45% in 2024.

- By end user, the marine biotech startups segment is expected to grow at the fastest CAGR in the market.

Market Overview

The marine pharmaceutical market refers to the global industry involved in the discovery, development, and commercialization of pharmaceutical products derived from marine organisms, including sponges, algae, tunicates, molluscs, bacteria, fungi, and deep-sea organisms. These marine-derived bioactives possess unique chemical structures and exhibit a wide range of therapeutic properties, including anticancer, antiviral, antibacterial, anti-inflammatory, analgesic, and neuroprotective effects. Marine pharmaceuticals are increasingly being explored due to their structural novelty, ecological diversity, and effectiveness against drug-resistant pathogens and complex diseases such as cancer and Alzheimer's. The market encompasses drug discovery platforms, active pharmaceutical ingredients (APIs), preclinical and clinical candidates, and marketed products derived from marine natural sources.

How is Artificial Intelligence Revolutionizing Drug Discovery and Development in the Marine Pharmaceutical Market?

Artificial Intelligence (AI) is transforming the marine pharmaceutical market by accelerating the identification of bioactive compounds from marine organisms and predicting their therapeutic potential with greater accuracy. Finding new marine drugs used to be a laborious process that involved extensive laboratory testing and random screening. However, AI simplifies this by using sophisticated algorithms that forecast pharmacological activity, simulate molecular interactions, and analyze large datasets. Researchers can now identify promising marine-derived molecules more quickly and affordably by utilizing machine learning and deep learning, thereby creating new treatment options for conditions such as inflammation, infections, and cancer.

Marine Pharmaceutical Market Outlook

- Industry Growth Overview: The market is poised for explosive growth between 2025 and 2034, driven by the need for novel drugs to combat cancer, antimicrobial resistance, and chronic diseases. Rising demand for oncology treatments, anti-inflammatory agents, and marine-derived nutraceuticals further drives the growth of the market.

- Global Expansion:Leading players are expanding their reach globally to address the worldwide disease burden. There is strong potential for market expansion across emerging regions, driven by expanding R&D infrastructure, rising healthcare expenditure, and a focus on marine biotechnology.

- Major Investors:Venture capital and strategic investors are actively funding the sector, attracted by high technical barriers and significant clinical impact potential. Key players include Roche, Pfizer, Novartis, Aker BioMarine, and Lonza Group.

- Startup Ecosystem:The startup ecosystem is maturing rapidly, with innovation focused on advanced isolation techniques, next-generation sequencing, and AI-powered drug-discovery platforms. Emerging firms are leveraging strategic partnerships with academic institutions and larger pharmaceutical firms to accelerate development.

Marine Pharmaceutical Market Growth Factors

- Untapped Marine Biodiversity: Oceans host millions of unexplored species that produce unique bioactive compounds, offering vast potential for new drug discoveries.

- Rising Demand for Natural Therapies: The need for novel treatments, especially for cancer and antibiotic resistance, is pushing interest in marine-derived, natural alternatives.

- Advancements in Drug Discovery Technologies: Tools such as AI, metagenomics, and high-throughput screening are accelerating the identification and development of marine compounds.

- Increased Investments and Partnerships: Growing funding from governments and pharmaceutical companies, along with academic-industry collaborations, is boosting marine drug research and development.

- Expanding Therapeutic Scope: Marine compounds show promise in oncology, neurology, and infectious diseases, making them versatile drug candidates.

- Supportive Regulatory Incentives: Fast-track approvals and orphan drug benefits are encouraging the development of marine-based drugs, especially for rare conditions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.26 Billion |

| Market Size in 2026 | USD 6.81 Billion |

| Market Size in 2025 | USD 6.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source Organism, Compound Type, Therapeutic Area, Product Type, Development Stage, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding Marine Biodiversity Exploration

In addition to covering up about 71% of the Earth's surface, the ocean is home to a wealth of unusual biological species that have not yet been thoroughly studied. Bioactive compounds with unique chemical structures and strong biological activity are the result of marine organisms' evolution to survive harsh environments. The search for novel antibiotics, antivirals, and anticancer medications is one area where this biodiversity is increasingly viewed as a goldmine for pharmaceutical innovation. Diverse marine species are becoming increasingly accessible, and discoveries are occurring more rapidly thanks to government funding and partnerships with biotech companies.

Rising Demand for Novel Drug Candidates

The rising demand for novel drug candidates drives the growth of the marine pharmaceutical market. Pharmaceutical firms are increasingly looking to the marine environment for novel treatments because of the emergence of drug resistant bacteria and the emergence of drug-resistant bacteria and the plateauing of conventional small-molecule drug development. Chemicals derived from marine environments often have different modes of action than those found on land, presenting new possibilities for testing illnesses with unmet clinical needs. In fields such as immunology, infectious disease, and oncology, where traditional therapies are failing, this tendency is particularly pronounced.

Restraint

High Cost and Complexity of Marine Drug Discovery

The high cost associated with the discovery and development of marine-derived drugs hampers the growth of the marine pharmaceutical market. Deep-sea sampling, compound extraction, and exploration all require large financial outlays for marine drug discovery. Marine species are challenging to culture in laboratories, and complex synthetic replication is frequently required for large-scale production. These procedures increase development costs. Moreover, a steady supply of compounds is difficult due to the scarcity of many marine species. Pharmaceutical companies often struggle to justify large R&D expenditures in the absence of guarantees for commercial scalability.

Regulatory and Approval Challenges

Drugs derived from marine sources must undergo additional toxicity, safety, and efficacy testing due to their unique chemical structures, which adds time to the development process. Specific regulations for compounds of marine origin are frequently absent from regulatory bodies. This raises the risk of development and slows down clinical advancements. Moreover, regulatory disparities among nations make international approvals more difficult and discourage multinational pharmaceutical companies from entering this specialized market.

Opportunities

Untapped Marine Biodiversity

There are still millions of marine species that science is unaware of, and the oceans remain largely unexplored. These organisms may contain bioactive substances with unique structures and medicinal qualities. There are numerous opportunities to discover new drug leads through expanding deep-sea exploration and advanced sampling technologies, particularly for diseases that currently lack effective treatments.

Rising Demand for Natural and Novel Therapies

Naturally derived treatments are in high demand as consumers and health systems look for alternatives to synthetic drugs. Marine compounds offer a range of mechanisms of action and distinctive molecular characteristics. In fields where innovative solutions are needed, such as immunology, neurology, and oncology, this trend creates opportunities for marine-based treatments.

Segmental Insights

Source Organism Insights

Why did the marine invertebrates segment dominate the marine pharmaceutical market in 2024?

The marine invertebrates segment dominated the market with the largest share in 2024. Marine invertebrates such as sponges, tunicates, and mollusks have long been the primary source of marine-derived bioactive compounds. These organisms produce strong antiviral, anti-inflammatory, and anticancer metabolites. Their ability to adapt to harsh marine conditions has resulted in a chemical diversity that is unparalleled by organisms on land. Yondelis is an approved medication derived from tunicates, demonstrating the commercial success segment and solidifying its leadership in marine drug development.

The marine microorganisms segment is expected to grow at the highest CAGR during the projection period. Marine microorganisms, particularly bacteria and fungi, have been a focus of marine drug discovery due to their ease of cultivation and vast metabolic potential. Through fermentation, these microbes generate unique cytotoxic and antimicrobial compounds that are scalable and appealing to the commercial sector. Metagenomics and synthetic biology developments have also made it possible to access microbial species that were previously unculturable, thereby accelerating the growth of this segment and expanding its drug pipeline.

Compound Type Insights

How does the polyketides segment dominate the marine pharmaceutical market in 2024?

The polyketides segment dominated the market in 2024. The dominance of polyketides stems from their broad therapeutic applications and potent biological activity. These complex molecules are commonly derived from marine bacteria and sponges and are used in the treatment of cancer, infections, and inflammation. Their ability to interfere with multiple biological targets and their successful incorporation into commercial drugs underscore their market leadership. Their chemical diversity and proven pharmacological efficacy position polyketides as the most valuable marine-derived compound type to date.

The peptides segment is likely to grow at the fastest rate over the forecast period. This is mainly due to the high specificity, low toxicity, and effectiveness of peptides in targeting complex disease pathways. Marine-derived peptides have shown promise in areas such as neurology and metabolic disorders, and recent advancements in peptide synthesis and stabilization have improved their stability. These characteristics, combined with a strong R&D focus and increasing clinical interest, are accelerating their adoption in marine-based therapeutics.

Therapeutic Area Insights

What made oncology the dominant segment in the marine pharmaceutical market in 2024?

The oncology segment dominated the market because compounds derived from marine sources are very effective at destroying tumor cells. Because marine molecules exhibit high cytotoxic activity, they are excellent options for treating cancer. Clinical use and regulatory approval have been attained by medications derived from marine sources such as trabectedin and lurbinectedin. Given that cancer is one of the most important worldwide health issues, the marine oncology pipeline continues to be the most developed and well-funded.

The neurology segment is expected to grow at the fastest CAGR in the upcoming period, as marine compounds demonstrate neuroprotective, anti-inflammatory, and regenerative effects, offering a promising approach for treating diseases such as Alzheimer's, Parkinson's, and epilepsy. The growing burden of neurodegenerative conditions and the lack of effective therapies have made this an area of strategic focus. Research into marine peptides and lipids that cross the blood–brain barrier is gaining traction, creating a robust future pipeline in this domain.

Product Type Insights

Why did the approved drugs segment dominate the marine pharmaceutical market in 2024?

The approved drugs segment maintained its dominance in the market, holding the largest share in 2024. The dominance of approved drugs stems from their proven effectiveness and adherence to all the required testing. These drugs serve as effective examples of treatments derived from marine sources. Products that have received regulatory approval and are utilized in actual clinical settings include Yondelis (trabectedin), Zepzelca (lurbinectedin), and Priel (ziconotide). They give stakeholders confidence and influence investment and regulatory trends by demonstrating the effectiveness of the marine approach to drug discovery in terms of market presence and revenue generation.

The pipeline drugs segment is expected to grow at the fastest rate, as pharmaceutical and biotech firms race to develop new marine-based therapeutics. Several compounds are in preclinical and clinical stages targeting cancer, infections, and neurological diseases. Technological innovations, AI-based screening, and high-throughput marine bioprospecting have significantly reduced discovery timelines, leading to a rich and growing development pipeline.

Development Stage Insights

How does the clinical trials segment dominate the marine pharmaceutical market in 2024?

The clinical trials segment dominated the market with a major revenue share in 2024 due to the fact that numerous compounds originating from marine sources have advanced from discovery to sophisticated human testing. These comprise phase I–III trials for neurotherapeutics, anti-infectives, and anticancer drugs. Clinical trials are now the most active stage of development in the industry, thanks to continued investment and regulatory support prompted by the success of earlier marine drugs in clinical evaluations.

The preclinical segment is expected to expand at a rapid pace in the coming years due to the rising discovery of thousands of new marine bioactive molecules. Early-stage evaluation of toxicity, bioavailability, and therapeutic potential is being fast-tracked by modern screening technologies. Institutions and startups are investing heavily in preclinical marine programs, setting the foundation for future clinical and commercial success.

End User Insights

Why did the pharmaceutical companies segment dominate the marine pharmaceutical market in 2024?

The pharmaceutical companies segment dominated the market in 2024. The dominance of this segment stems from well-established and big pharmaceutical companies that are equipped with the resources, capital, and regulatory knowledge necessary to commercialize compounds derived from marine sources. These companies can scale production, carry out comprehensive clinical trials, and handle approval procedures. Large pharmaceutical companies are still at the forefront of licensing acquisitions and commercialization due to their growing strategic focus on marine bioactivity. Moreover, the rising participation of these companies in R&D and clinical trials to fast-track approvals facilitates the long-term growth of the market.

The marine biotech startups segment is expected to grow at the highest CAGR over the projection period due to their innovative approach and niche specialization. These startups often collaborate with academic institutions and leverage AI, genomics, and sustainable marine sampling to discover new drug candidates. Their agility and focus on early-stage R&D position them as key disruptors in the evolving marine pharmaceutical landscape.

Regional Insights

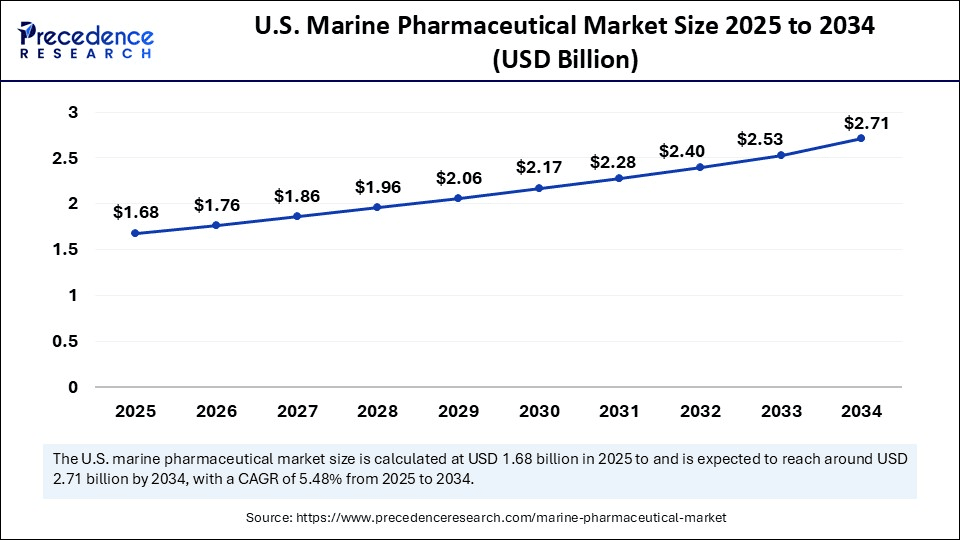

U.S. Marine Pharmaceutical Market Size and Growth 2025 to 2034

The U.S. marine pharmaceutical market size is exhibited at USD 1.68 billion in 2025 and is projected to be worth around USD 2.71 billion by 2034, growing at a CAGR of 5.48% from 2025 to 2034.

What made North America the dominant region in the marine pharmaceutical market?

North America dominated the marine pharmaceutical market by holding the largest share in 2024. This is because of its sophisticated R&D infrastructure, thriving pharmaceutical ecosystem, and significant investment in marine biotechnology. The region benefits from its well-established clinical trial networks, regulatory know-how, and strategic funding, which speed up the development and release of medications derived from marine sources. The region is home to a large number of market players and academic institutions, reinforcing its hegemony in the field of marine pharmaceuticals.

U.S. Marine Pharmaceutical Market Trends

The U.S. leads the market in North America, as it acts as the central hub for innovation and research & development (R&D). Its leading position is supported by a strong ecosystem of research institutions, major pharmaceutical companies, and substantial funding from agencies such as the National Institutes of Health (NIH) and the National Cancer Institute (NCI). The U.S. regulatory system, guided by the FDA, offers clear pathways for the development and commercialization of high-value, marine-derived drugs for diseases like cancer.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate in the coming years, owing to its vast marine biodiversity, rising healthcare needs, and increasing focus on biotechnology. Government initiatives, expanding research capabilities, and robust academic-industry partnerships are driving the acceleration of marine pharmaceutical development. The rising government investment in marine exploration and innovation continues to support market growth.

India Marine Pharmaceutical Market Trends

India is an emerging player in the marine pharmaceutical industry, leveraging its long coastline and strong expertise in drug manufacturing. Strategic government efforts, such as the Drugs from Sea program led by the Ministry of Earth Sciences and CSIR, which aims to explore the country's rich marine biodiversity for new therapeutic compounds, also support the market. There is a strong emphasis on early-stage research, identifying promising lead molecules, and leveraging its expertise in generic drug production to develop affordable marine-based treatments, which propel the market.

What Potentiates the Growth of the Latin America Marine Pharmaceutical Market?

The marine pharmaceutical market in Latin America is a growing sector with significant untapped potential, thanks to the region's extensive coastlines and rich marine biodiversity. Although still a smaller part of the global market, its growth is fueled by increased research efforts by academia and biotech firms in countries like Brazil and Argentina, focusing on bioprospecting for new compounds, particularly for cancer and infectious diseases. The market remains primarily research-focused and relies on imported raw materials and technology. Challenges include a fragmented regulatory environment and the need for additional investment in specialized infrastructure to advance from research to commercial manufacturing.

Brazil Marine Pharmaceutical Market Trends

Brazil is the largest and fastest-growing marine pharmaceutical market in Latin America, driven by significant investment in its biotech sector and a strong emphasis on researching marine-derived compounds for high-value applications like cancer immunotherapy and neurology. The country benefits from an extensive coastline and a rich marine ecosystem, offering abundant sources for bioprospecting. Government agencies such as ANVISA are working to improve regulatory pathways for marine-derived drugs, and collaborations between local companies and global pharmaceutical firms are accelerating R&D efforts aimed at both domestic use and potential export.

What Opportunities Exist in the Middle East and Africa for the Marine Pharmaceutical Market?

The Middle East and Africa (MEA) region offers significant market opportunities, driven by rising healthcare spending, rising chronic disease rates, and a push toward advanced biotech solutions. Increasing investments in healthcare infrastructure and growing interest in marine-derived natural products also contribute to market growth. There is a strong focus on enhancing research capabilities and on forming strategic international partnerships to address challenges such as a shortage of specialized personnel and a fragmented regulatory landscape, supporting market growth.

Saudi Arabia Marine Pharmaceutical Market Trends

Saudi Arabia is leading the MEA market with substantial government funding and incentives focused on localizing pharmaceutical production and establishing a biotech hub. The country aims to shift toward a knowledge-based economy and reduce reliance on imports. Although traditional pharmaceuticals currently dominate, the infrastructure being developed for broader biotech research is expected to support future exploration and development of marine-derived compounds for conditions such as hereditary and chronic diseases.

How is the Opportunistic Rise of Europe in the Marine Pharmaceutical Market?

Europe is expected to experience significant growth in the coming years, driven by extensive R&D, a strong academic and industrial research infrastructure, and a focus on sustainability and innovation. Strict regulations from the European Medicines Agency (EMA) ensure high safety standards, encouraging the industry to develop effective, residue-free products. The market is driven by demand for new compounds from various marine organisms targeting oncology and inflammatory disorders, with several approved marine-derived drugs already available for pain management and some cancers.

Germany Marine Pharmaceutical Market Trends

Germany is a leader in the global marine pharmaceutical market, hosting major international companies like Bayer AG and BASF SE, and serving as an important hub for research and development. The country benefits from strong government support and a highly skilled workforce, with research focused on marine-derived compounds as biomarkers, in drug discovery, and as delivery vehicles. Germany's focus on precision and reliability in its research infrastructure supports thorough development and commercialization of new therapies, from laboratory research to advanced clinical trials.

Value Chain Analysis

Research and Development & Bioprospecting

This stage involves identifying and isolating bioactive compounds from marine organisms, including algae, sponges, and microorganisms.

- Key Players:BASF, Marinomed, PharmaMar, Seaweed Energy Solutions.

Clinical Trials and Regulatory Approval

This stage involves conducting human trials in phases (I–III) to validate the safety and efficacy of marine-derived drugs.

- Key Players: PharmaMar, Novartis, Pfizer, Johnson & Johnson.

Manufacturing & Formulation

This stage involves scaling up production of marine-derived pharmaceuticals and formulating them into usable drug forms.

- Key Players: Lonza, Catalent, Thermo Fisher Scientific, Patheon.

Distribution and Supply Chain Management

This stage ensures commercialization and promotion of marine pharmaceuticals to hospitals, pharmacies, and research institutions.

- Key Players: Pfizer, Novartis, Johnson & Johnson, Bayer

Top companies in the Marine Pharmaceutical Market

- PharmaMar S.A.: Leading developer of marine-derived anti-cancer drugs, including YONDELIS and ZEPZELCA.

Aker BioMarine: Key supplier of krill-based omega-3 fatty acids (Superba Krill) for supplements and potential pharmaceuticals. - Marinomed Biotech AG: Develops antiviral therapies using red algae compounds, such as the Carragelose platform for respiratory infections.

- Bristol Myers Squibb: Large pharmaceutical company with a broad pipeline that includes research and development efforts inspired by marine natural products.

- Biomar Microbial Technologies: Specializes in discovering anti-infective and anti-cancer lead compounds from marine microorganisms.

Other Key Players

- Nereus Pharmaceuticals

- Innate Pharma

- Esperance Pharmaceuticals

- Abyss Ingredients

- SeaPharm Inc.

- Sirenas Marine Discovery

- GlycoMar Ltd.

- Marine Biotech Co., Ltd. (China)

- Chugai Pharmaceutical Co., Ltd.

- Okinawa Institute of Science and Technology (OIST)

- OceanX Biotech

- Neurochem Inc.

- Sinclair Pharmaceuticals

- Biotika (Slovakia)

- Tethys Research LLC

Recent Development

- On 28 April 2025, PharmaMar presented eleven scientific publications at the AACR Annual Meeting on marine-derived compounds, including lurbinectedin, ecubectedin, PM54, PM534, and trabectedin, showcasing promising preclinical and clinical data. (Source: https://pharmamar.com)

Segments Covered in the Report

By Source Organism

- Marine Microorganisms

- Marine Bacteria

- Marine Fungi

- Cyanobacteria

- Marine Invertebrates

- Sponges

- Tunicates

- Mollusks

- Corals

- Echinoderms

- Marine Algae

- Red Algae

- Brown Algae

- Green Algae

- Marine Vertebrates

- Fish

- Sharks

- Others (Sea Cucumbers, Deep-sea extremophiles)

By Compound Type

- Polyketides

- Peptides

- Alkaloids

- Terpenoids

- Macrolides

- Fatty Acids

- Others (Saponins, Phenolics, Glycosides)

By Therapeutic Area

- Oncology

- Solid Tumors

- Hematologic Malignancies

- Infectious Diseases

- Antibacterial

- Antiviral

- Antifungal

- Neurology

- Alzheimer's

- Epilepsy

- Cardiovascular Diseases

- Inflammatory & Autoimmune Diseases

- Pain Management

- Others (Dermatological, Endocrine)

By Product Type

- Approved Drugs

- Cytarabine (from sponge)

- Trabectedin (from tunicate)

- Ziconotide (from cone snail)

- Brentuximab Vedotin (ADC with marine-derived cytotoxin)

- Marine-Derived Nutraceuticals

- Marine Peptide APIs (Bulk Supply)

By Development Stage

- Discovery

- Preclinical

- Clinical Trials

- Phase I

- Phase II

- Phase III

- Commercialized

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Marine Biotech Startups

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content