What is Medical Isotope Production Market Size?

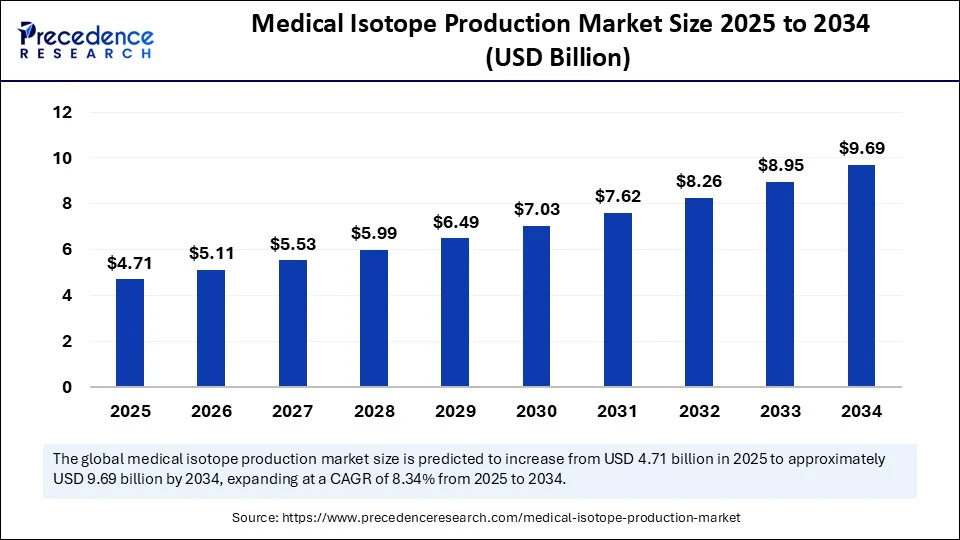

The global medical isotope production market size accounted for USD 4.71 billion in 2025 and is predicted to increase from USD 5.11 billion in 2026 to approximately USD 9.69 billion by 2034, expanding at a CAGR of 8.34% from 2025 to 2034. The medical isotope production market is gaining momentum due to increasing demand for nuclear medicine in cancer and cardiac diagnostics, supportive government initiatives, and improvements in cyclotron and reactor-based production methods that are growing the market globally.

Market Highlights

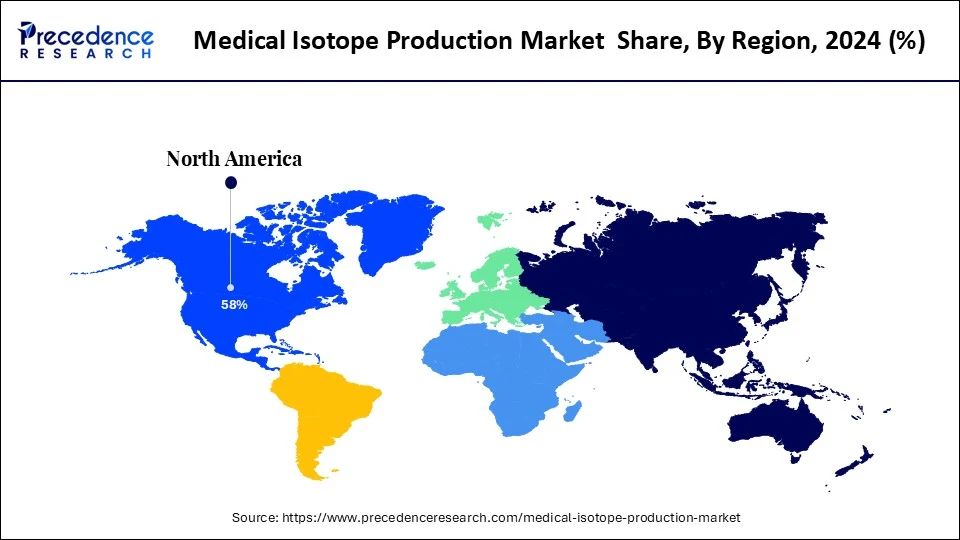

- North America dominated the medical isotope production market with the largest market share 58% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

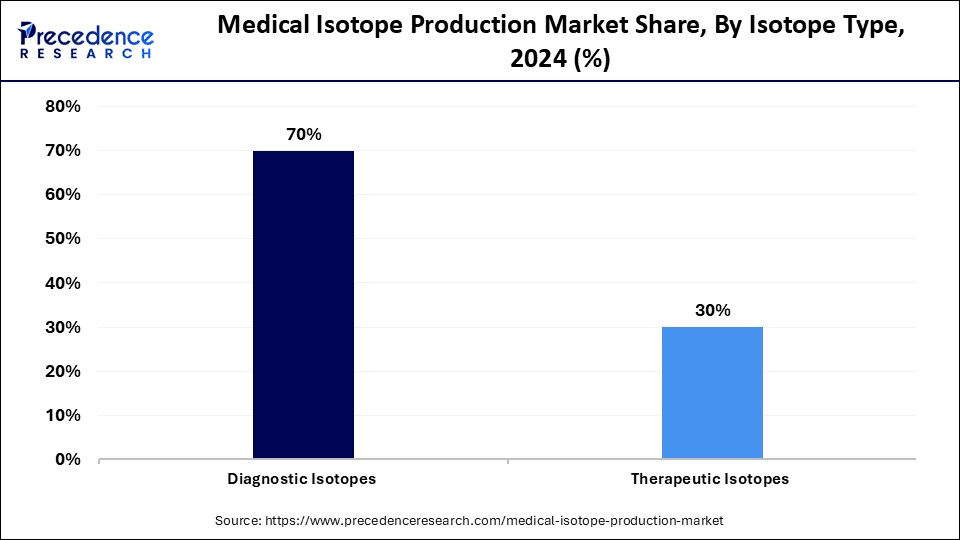

- By isotope type, the diagnostic segment held the biggest market share of 70% in 2024.

- By isotope type, the therapeutic segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

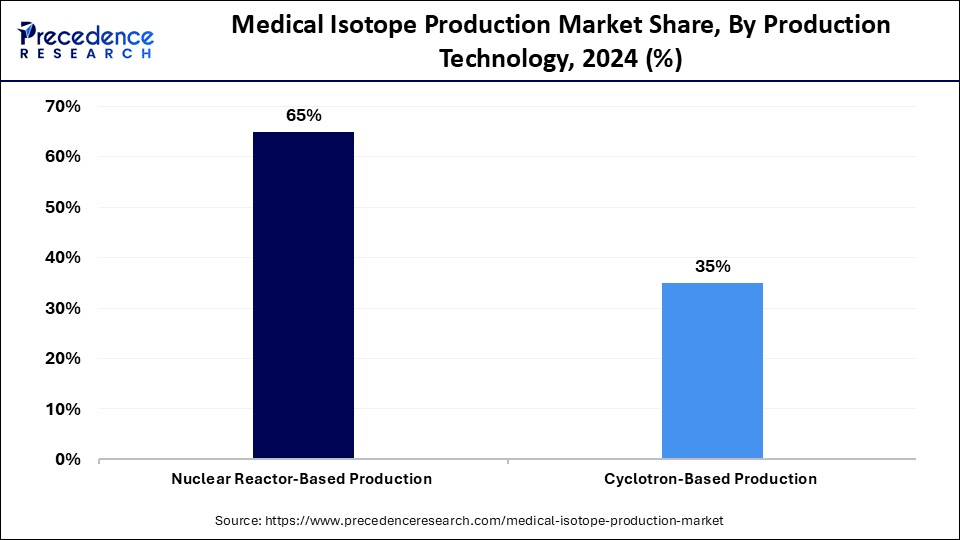

- By production technology, the nuclear reactor-based production segment captured the highest market share of 65% in 2024.

- By production technology, the cyclotron-based production segment is expected to expand at a notable CAGR over the projected period.

- By application, the diagnostic segment generated the major market share of 45% in 2024.

- By application, the therapeutic segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospital and clinics segment accounted for largest market share of 55% in 2024.

- By end user, the pharma and biotech companies segment is expected to expand at a notable CAGR over the projected period.

What are the Emerging Applications of Medical Isotope Production?

The medical isotope production market refers to the industry involved in the generation, processing, and supply of radioactive isotopes used primarily for diagnostic imaging, therapeutic applications, and research in the medical field. These isotopes, also known as radioisotopes, are typically produced in nuclear reactors or cyclotrons and are integral to nuclear medicine procedures such as PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography).

Medical isotopes like Technetium-99m, Iodine-131, Fluorine-18, and Lutetium-177 are utilized for cancer diagnosis, cardiology, neurology, thyroid treatments, and more. Market dynamics are influenced by isotope availability, production technologies, regulatory frameworks, and expansion in nuclear medicine applications.

AI in Medical Isotope Production: Trajectories of Nuclear Medicine

Artificial Intelligence (AI) continues to redefine how medical isotopes, which are indispensable in both diagnostics and therapeutic cancer modeling, are produced and shipped around the world. In June 2025, three major industry partnerships were formed to increase the supply of isotopes to the nuclear medicine community because they were already leveraging the capabilities of AI to improve the dependence and timing of medical isotope production.

- In July, Oak Ridge National Laboratory and Vanderbilt University initiated a joint symposium on the AI-driven development of actinium-225 to target cancer therapies. Additionally, UK Company Astral Systems received £4.5 M to spin out desk-sized fusion reactors, optimized using AI to provide on-location and on-demand isotopes.

Likewise, in the research space, neural-network models are being employed to model isotopes production cross-sections to improve forecasts of isotopes yields and consistency. Overall, these advances in both the industry and research laboratories are showcasing the game-changing benefits AI will confer on the medical isotopes supply chain by increasing safely produced and scalable solutions for nuclear medicine.

Medical Isotope Production Market Growth Factors

- Increasing Cancer Incidence:The rising global burden of cancer has enhanced the demand for isotopes such as Technetium-99 m, which are used in diagnostic imaging and therapy, and will contribute overall, to the medical isotope production market growth.

- Wider Application of Nuclear Medicine:Nuclear medicine in cardiology, neurology, and oncology is more apparent with exacting diagnostics and targeting therapies, which are now leading to an increase in the demand for many medical isotopes from healthcare delivery.

- Increased Older Adult Population: Global demographic transitions are leading to many older adults living longer than previous cohorts, which will have a greater predisposition to chronic diseases, and utilize nuclear diagnostic technology, increasing demand for medical isotopes in hospitals and diagnostic/training centers.

- Growth in Government and International Financial Support: The growth in funds being directed into isotope and research initiatives from governments, as well as organizations such as the IAEA, is leading to the investment and maintenance of an isotope supply chain and the growth of the medical isotope production market.

Medical Isotope Production Market Outlook:

- Global Expansion: A specific progression is mainly propelled by a rise in investments in production capacity, like in Ontario, Canada, to meet demand for isotopes, such as cobalt-60, in cancer therapy and equipment sterilization.

- Major Investor: In September 2025, the Ontario government invested 18 million Canadian dollars ($13 million U.S.) to boost the production of medical isotopes at the McMaster Nuclear Reactor on McMaster University's campus in Hamilton.

- Startup Ecosystem: Agilera Pharma, a Norway-based startup that provides end-to-end services for establishing and producing diverse radiopharmaceuticals, like Actinium-225 (Ac-225) and Lead-212 (Pb-212).

Marketb Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.71 Billion |

| Market Size in 2026 | USD 5.11 Billion |

| Market Size by 2034 | USD 9.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.34% |

| Dominating Region | North America |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Isotope Type, Production Technology, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the Rise in Cancer Incidence behind the Surge in Medical Isotope Demand?

One significant market driver for medical isotope production is the increasing global burden of cancer. The World Health Organization (WHO) states that almost 10 million people died from cancer in 2022, making cancer one of the leading causes of death worldwide. Medical isotopes like Technetium-99m are critical for identifying cancer early through nuclear imaging.

The International Atomic Energy Agency (IAEA) states that over 50 million nuclear medicine procedures are performed annually worldwide. Most of which involve cancer diagnostics.

In anticipation of growing demand for medical isotopes, government-backed investments are expanding medical isotope production the National Research Universal Reactor in Canada and the National Isotope Development Center (NIDC) of the U.S. Department of Energy (DOE) are scaling up non-reactor-based production for isotopes in hopes of weaning the world off aging reactors and foreign supplies.

Restraint

Is Stringent Regulatory Oversight Delaying Medical Isotope Production?

The complex and stringent regulatory landscape will represent a major obstacle to the timely expansion of medical isotope production. Isotope producers must navigate rigorous safety, transport, and environmental regulations from regulatory agencies, including the U.S. Nuclear Regulatory Commission (NRC), Health Canada, and the International Atomic Energy Agency (IAEA). For example, the NRC's licensing process for new isotope production facilities and the transport of radioactive materials will, in some cases, take the better part of several years.

- In 2023, additional detailed updates were also issued by the NRC for molybdenum-99 producers to provide further enhanced safety assessments, which delayed the timelines for new U.S.-based producers.

- Furthermore, reports from the IAEA have continuously indicated that regulatory delays continue to be one of the main challenges for countries trying to adopt non-reactor-based technologies, which continues to have an effect.

Opportunity

Can the Global Expansion of Theranostics Create New Opportunities for Medical Isotope Production?

The increased global interest in Theranostics diagnostics and therapy represents a significant opportunity for the medical isotope production marketplace. Theranostic procedures are vastly growing in acceptance across countries like India, Australia, and Brazil, simply because theranostics provide differential targeting and uniqueness.

- In March 2025, India's Department of Atomic Energy announced the expansion of its isotope production for theranostic purposes with a focus on Lutetium-177 and Gallium-68.

Accordingly, the U.S. FDA has approved and granted Priority Review to a sizeable number of radiopharmaceuticals for theranostic uses, indicating a strong regulatory framework. These decisions create interest in the need for new isotopes and supply chains. Given the healthcare systems prioritizing precision medicine, the global expansion of theranostics can serve as an expansive growth engine for isotope producers, especially in developing healthcare markets and nuclear medicine clusters.

Segment Insights

Isotope Type Insights

How Does Diagnostic Isotope Segment Hold Such a Significant Share of the Medical Isotope Production Market?

The diagnostic isotope segment holds the largest share of the medical isotope production market, owing to the large volume of diagnostic isotopes typically used in non-invasive imaging when diseases are identified. These isotopes are mainly used in SPECT or PET imaging in cardiology, oncology, and neurology. The most prominent among the isotopes is Technetium-99m (Tc-99m), which accounts for almost 70% of the market demand for diagnostic isotopes.

The Tc-99m is the dominant sub-segment owing to its proven clinical utility, existing infrastructure, and widespread use. The emerging diagnostic isotope growth is Gallium-68 (Ga-68), which is advancing quickly due to increasing use of PET imaging, largely from use for neuroendocrine tumors and prostate cancer. Ga-68 is excellent for peptide-based tracers and clinical uptake has increased because of generate production style, clinical availability and use.

Therapeutic isotope is the fastest growing segment, as important to the treatment of cancers and chronic conditions with targeted radiotherapy. The segment is helped by the increasing cancer incidence and the demand for less invasive therapies. Therapeutic isotopes are not exclusively for oncology; they are also used in bone pain palliation and other therapies, making them a major contributor to the overall medical isotopes landscape.

Iodine-131 (I-131) has the largest share of this segment due to its universally accepted clinical use and effectiveness in treating thyroid disorders. Lutetium-177 (Lu-177) is the fastest growing isotope, gaining traction at a rapid rate for its use in targeted radionuclide therapies for patients with neuroendocrine tumors and metastatic prostate cancer. The precision, low toxicity, and rapidly expanding use of Lu-177 as a cornerstone of many radioligand therapies has raised the profile of Lu-177, and the demand for the isotope is at its highest since it potential is being discussed in the context of personalized treatment for cancer patients.

Production Technology Insights

Why Is Nuclear Reactor-Based Production Dominant in 2024?

Nuclear reactor-based production has the largest slice of the medical isotope production market, accounting for around 65% of the segment. This method of producing isotopes is the main source of numerous isotopes used in clinical procedures on a large scale, such as Molybdenum-99 (which decays into Technetium-99m), Iodine-131, and others. Reactor-based production can produce isotopes with high throughput and consistent outputs, which makes it necessary to supply hospitals and imaging centers worldwide.

Cyclotron-based production is the fast-growing technology in the medical isotope market, focused on demand for short-lived PET isotopes, particularly Fluorine-18 and Gallium-68. Cyclotrons facilitate the onsite or regional production, thereby reducing losses due to decay during transport, and allow for on-demand use for imaging procedures on the same day. Cyclotrons, therefore, allow decentralizing imaging procedures to use advanced imaging for diagnostic purposes in oncology and neurology.

Application Insights

How Does Diagnostic Application Segment Dominant The Market In 2024?

The most dominant segment of the market continues to be diagnostic applications, driven by the role of PET and SPECT imaging in timely disease detection. Due to the strong global need for accurate diagnosis of cancer, the oncology subsegment remains the largest, facilitated by the widespread use of Technetium-99m and Fluorine-18.

Oncology leads and is widely used in the detection and monitoring of tumours; however, the neurology subsegment is growing faster, driven by increased incidence of Alzheimer's and Parkinson's diseases, driving demand for Gallium-68 and Fluorine-18 isotopes in brain imaging.

Therapeutic applications are driven by the need for targeted radiotherapy. Thyroid disorders lead to the overall use in therapeutics typically treated with Iodine-131, for hyperthyroidism and thyroid cancer. Established practices in health care settings and global access to Iodine-131 ensure it remains the leading isotope in the therapeutic segment.

Thyroid disorders represent the leading therapeutic applications, mainly treated with Iodine-131, due to its proven clinical efficacy along with pre-existing internationally accepted protocols. While hyperthyroidism and thyroid cancer maintain steady and anticipated development levels of demand, cancer therapy is continuously evolving with the proliferation of the use of isotopes, such as Lutetium-177, in targeted therapies for prostate and neuroendocrine tumors, providing high specificity and low side effects.

End User Insights

How is the Hospitals & Clinics the Dominated the Medical Isotope Production Market in 2024?

Hospitals and clinics lead the way in the end-user segment with approximately 55% market share. These end users are the major center for diagnostic imaging and radiotherapy procedures, where a nuclear medicine department would be available. Hospitals are good end users of radiopharmaceuticals, and they have nuclear medicine departments, and have highly advanced imaging systems such as SPECT and PET, and personnel that are capable of administering and storing radiopharmaceuticals.

Pharmaceutical and biotechnology companies comprise the fastest-growing end-user segment because they are playing an increasingly important role in the development of novel radiopharmaceuticals and patient-focused therapies. Pharmaceutical companies and biotech-focused companies are investing in research that is integrating isotopes such as Lu-177 and Ga-68 for targeted cancer therapies and diagnostics. The increasing number of clinical trials, developments in radiotheranostics, and collaborations with contract manufacturing organizations (CMOs) and academic institutions will continue to fuel the growth of this segment.

Regional Insights

U.S. Medical Isotope Production Market Size and Growth 2025 to 2034

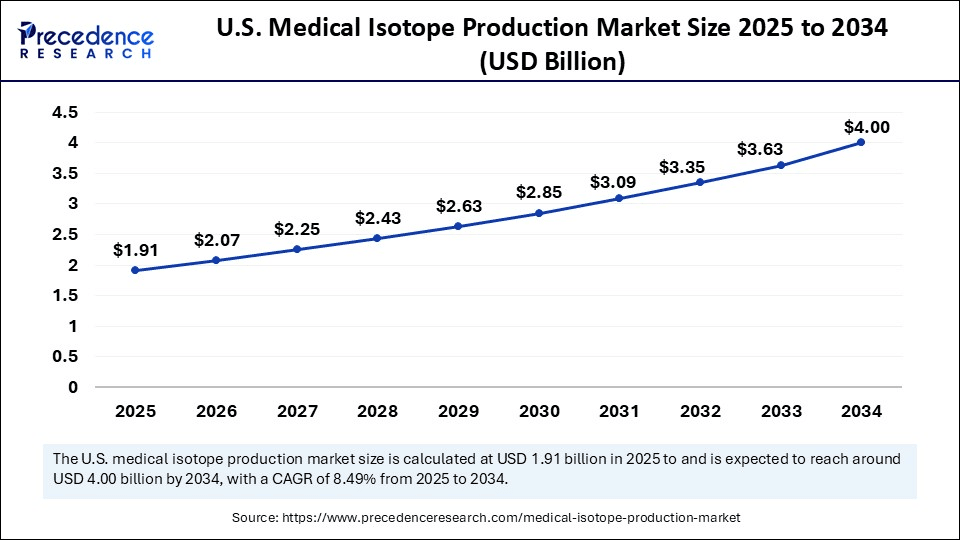

The U.S. medical isotope production market size is exhibited at USD 1.91 billion in 2025 and is projected to be worth around USD 4.00 billion by 2034, growing at a CAGR of 8.49% from 2025 to 2034.

How is North America Leading the Medical Isotope Production Market?

North America took a commanding share of the medical isotope production market in 2024 because of its strong nuclear medicine infrastructure, robust government support, and increasing domestic production capabilities. The U.S. Department of Energy (DOE) has been instrumental, funding isotope production projects via its Isotope Program. In 2024, SHINE Technologies of Wisconsin made great strides toward commercial production of molybdenum-99 (Mo-99) and lutetium-177 (Lu-177) through fusion-based production, making the U.S. less reliant on foreign isotope suppliers.

Persistent Regulatory Changes: U.S. Market Analysis

The United States is still the leading producer of medical isotopes in North America. With over 20 million nuclear medicine procedures per year, there is a significant and ongoing need for isotopes (e.g., Mo-99, I-131, and Tc-99m) in the United States.NorthStar Medical Radioisotopes and SHINE Technologies continue to pioneer production with innovative methods that are non-reactor-based, utilize fewer resources, and create less waste while increasing operational safety.

The U.S. also has regulatory momentum that streamlines the licensing and transportation protocols necessary to maintain a viable domestic supply chain of isotopes that can accommodate growing clinical demands.

How Europe is strengthening its Position in the Global Medical Isotope Supply Chain?

Europe is poised to become a region of major growth in the production of medical isotopes as infrastructure investments are encouraged and initiatives aimed at securing a local supply are harnessed. Most notably, in July 2024, the European Commission is expected to approve Dutch state funding of €2 billion towards building the PALLAS reactor in Petten, Netherlands. This next-generation facility is being constructed to lock in long-term production of priority isotopes, such as molybdenum-99 (Mo-99), which is relied on for countless imaging procedures throughout the year. Europe has been experiencing chronic isotope shortages as a result of maintenance closures at existing reactors, such as the temporary closure of the High Flux Reactor in Petten in October 2023, illustrating the urgent need to establish a more stable supply of isotopes.

As part of the European effort to grow capacity, the Netherlands has put its plans into action and is building new capacity. The Netherlands is the home of the High Flux Reactor (HFR) in Petten, which is currently one of a small number of reactors worldwide capable of producing Mo99. In addition to the HFR, the Netherlands is building a new PALLAS reactor, which is scheduled to be operational by 2030. This €2 billion investment is expected to help enhance locally sourced production of medical isotopes, which will allow Europe to be less dependent on older international facilities.

Asia has become the Global Hub for the Medical Isotope Production Market

The Asia Pacific region is the fastest-growing market in medical isotopes production due to expanding nuclear medicine potential and increasing healthcare demands. Countries such as China and India are heavily investing in isotope development and associated infrastructure to support increasing medical needs, particularly related to cancer diagnosis and therapy. The India Bhabha Atomic Research Centre (BARC) operates 24 medical cyclotrons to produce isotopes such as Molybdenum-99 (Mo-99), Iodine-131, and Samarium-153. China, on the other hand, has launched a Three-Year Action to expand on isotope production. These investments and programs are setting strong foundations for an independent isotope supply.

Extensive Government Support: China Market Analysis

China is well on its way to being Asia Pacific's largest player in medical isotope production. China is scaling both cyclotron and reactor production under its national energy roadmap with strong industry and government support. They are focusing on building domestic production capacity and reducing reliance on imports, as they move to meet the increasing need for cancer and chronic disease support. The government's actions are in line with further modernizing its health system and improving access to nuclear medicine.

Exploration of Targeted Therapy and the Nuclear Center is Supporting Latin America

A lucrative growth of the Latin American medical isotope production market is pushed by the ongoing efforts into the progress of targeted cancer therapy isotopes. Such as Rosatom, a Russian state atomic energy corporation, signed a 5-year contract in 2023 with Brazil's Institute for Energy and Nuclear Research (IPEN) to offer lutetium-177 and actinium-225. On the other hand, developing a new facility in Bolivia for a nuclear medicine center in El Alto, which will facilitate a cyclotron to produce radiopharmaceuticals locally.

Promoting Multipurpose Reactor (RMB) Project: Brazil Market Analysis

Brazilian firms are leveraging domestic production of necessary radioisotopes, especially molybdenum-99 (Mo-99), iodine-131 (I-131), and iridium-192 (Ir-192), to end the country's reliance on imports. However, the National Nuclear Energy Commission (CNEN) and Argentina's Invap signed an MoU in September to initiate construction in 2026.

Spurring Local Production is Assisting MEA

The prospective progression of the medical isotope production market in MEA will be influenced by the revolutionary developments in local production, such as the United Arab Emirates is leading in stable isotope labeled compounds, with a well-established research and development presence in its pharmaceutical and biotechnology sectors.

Impactful International Cooperation: African Market Analysis

The emergence of the significant expansion in Africa will be secured by several firms, such as the IAEA, which continues to support African countries in optimizing their nuclear medicine services through training, equipment provision, and advice on quality assurance systems for safe use of radiopharmaceuticals.

Medical Isotope Production Market: Value Chain Analysis

- R&D : The market is emphasising target determination, isotope production method development, preclinical testing, clinical trials, and regulatory approval.

Key Players: Novartis AG, Bayer AG, GE HealthCare Technologies Inc., etc. - Formulation and Final Dosage Preparation: It prominently includes a multi-step process, like radionuclide production, that revolutionises raw radioactive material into a safe, sterile, and targeted radiopharmaceutical suitable for human use.

Key Players: Curium, Cardinal Health, Eckert & Ziegler, etc. - Patient Support & Services: This specifically leverages its integrated, comprehensive care, facilitated by hospitals and cancer centers, government health schemes, non-profit organizations (NGOs), and manufacturer-sponsored programs.

Key Players: Lantheus Holdings, Telix Pharmaceuticals, Bayer, etc.

Key Players in Medical Isotope Production Market and Their Offerings

- Curium Pharma: Partners with NRG PALLAS for multi-year Mo-99 production to secure Tc-99m supply.

- BWX Technologies, Inc.: Via its subsidiary BWXT Medical, uses a proprietary neutron-capture process to produce Mo-99 from natural molybdenum, reducing waste and proliferation risk. Also collaborating to supply high-purity Ac-225 for cancer therapies.

- Nordion (Canada) / Sotera Health: Leading global supplier of high-specific-activity Cobalt-60 for medical sterilization and radiotherapy.

- Cardinal Health: Through its Center for Theranostics Advancement, produces cGMP-grade Actinium-225 weekly at commercial scale (in collaboration with TerraPower Isotopes). s

- NTP Radioisotopes (South Africa): Operates SAFARI-1 reactor to supply up to a third of the world's Mo-99; also produces I-131 and non-carrier-added Lu-177.

- SHINE Technologies: Developing a fusion-based Mo-99 production process (via their “Chrysalis” facility) to deliver non-HEU, proliferation-resistant supply; also making non-carrier-added Lu-177.

Latest statements and investments by major players

- In January?2025, Darlington Unit 1 in Ontario officially began medical isotope production, becoming the world's first large-scale nuclear power reactor to produce molybdenum-99, a critical isotope used in diagnostic imaging globally.(Source: https://www.neimagazine.com)

- In January?17?2025, Nusano launched its commercial isotope operations in West Valley City, Utah. The new facility will enhance U.S. domestic supply of rare medical isotopes, aiming to address ongoing shortages in nuclear medicine.(Source: https://www.auntminnie.com)

- In October?2024, Romania's Nuclearelectrica announced plans to produce Lutetium-177 for cancer therapy using the Cernavod? nuclear plant, marking a strategic expansion into targeted radionuclide treatment for global cancer care needs.(Source: https://www.romania-insider.com)

- In January 2025, Ontario government welcomed a CAD 22 million investment for expanding medical isotope production capabilities, supporting infrastructure at Bruce Power and promoting global leadership in isotope supply for cancer diagnostics and therapy.(Source: https://news.ontario.ca)

Segments Covered in the Report

By Isotope Type

- Diagnostic Isotopes

- Technetium-99m (Tc-99m)

- Fluorine-18 (F-18)

- Gallium-68 (Ga-68)

- Iodine-123 (I-123)

- Thallium-201

- Others (e.g., Xenon-133)

- Therapeutic Isotopes

- Iodine-131 (I-131)

- Lutetium-177 (Lu-177)

- Yttrium-90 (Y-90)

- Samarium-153 (Sm-153)

- Radium-223 (Ra-223)

- Others (e.g., Actinium-225, Rhenium-186)

- Largest (Tier 1): Iodine-131

By Production Technology

- Nuclear Reactor-Based Production

- Fission-based

- Neutron activation

- Cyclotron-Based Production

- Proton acceleration

- Deuteron-based reactions

By Application

- Diagnostic

- Oncology

- Cardiology

- Neurology

- Orthopedics

- Others

- Therapeutic

- Thyroid Disorders

- Cancer Therapy

- Bone Pain Palliation

- Others

- Research Application

- Radiopharmaceutical R&D

- Clinical Trials

- Pre-clinical Imaging

By End-User

- Hospitals & Clinics

- Diagnostic Imaging Centers

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting