What is the Medical, Legal, and Regulatory (MLR) Review Software Market Size?

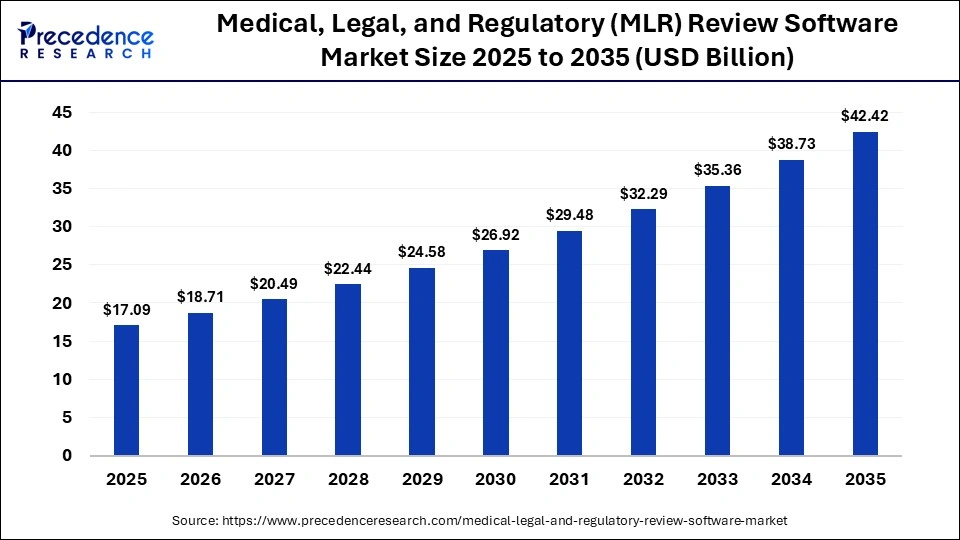

The global medical, legal, and regulatory (MLR) review software market size accounted for USD 17.09 billion in 2025 and is predicted to increase from USD 18.71 billion in 2026 to approximately USD 42.42 billion by 2035, expanding at a CAGR of 9.52% from 2026 to 2035. Regulatory compliance, FDA guidelines, and healthcare IT software hold great importance in MedTech marketing due to their truthfulness, accuracy, and the growing need to create a clear MLR review process.

Market Highlights

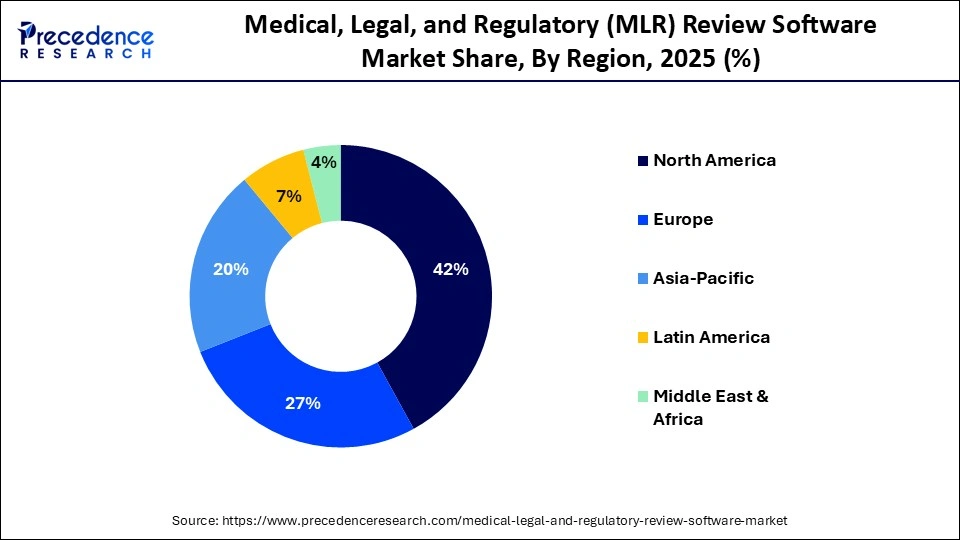

- North America dominated the market in 2025, with a revenue share of approximately 42%.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

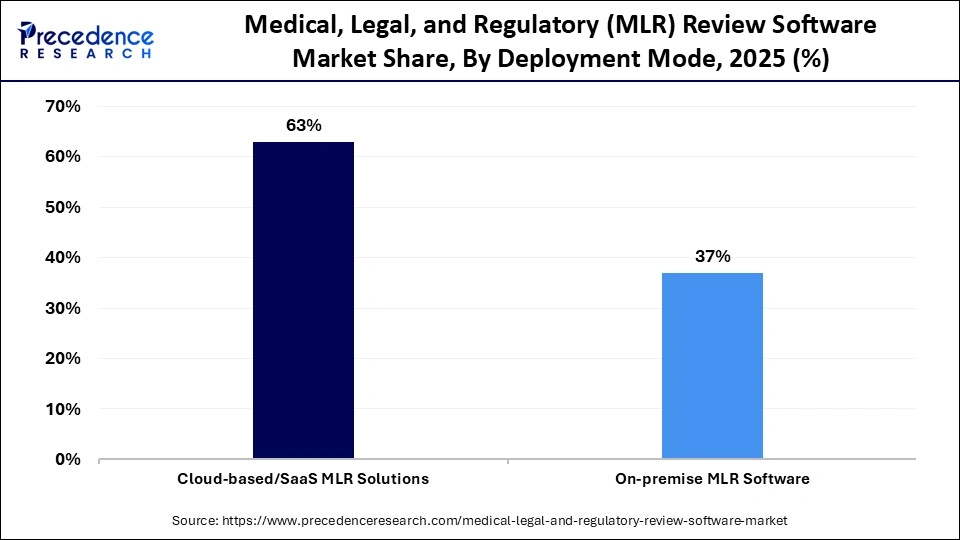

- By deployment mode, the cloud-based/SaaS MLR solutions segment dominated the market in 2025, with a revenue share of approximately 63%. The segment

- is expected to grow at the fastest CAGR in the market during the forecast period.

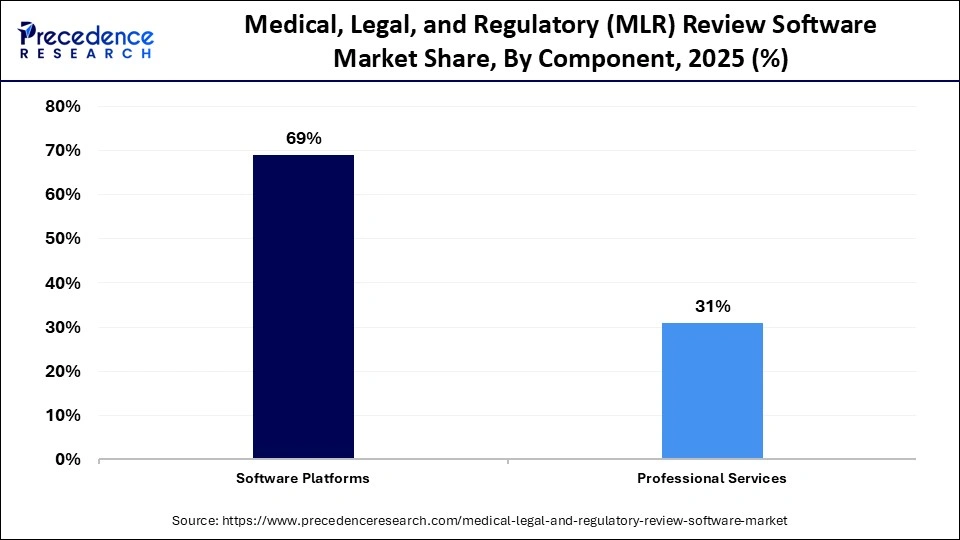

- By component, the software platforms segment dominated the market in 2025, with a revenue share of approximately 69%.

- By component, the professional services segment is expected to grow at the fastest rate in the medical, legal, and regulatory (MLR) review software market in 2025.

- By end-user, the pharmaceutical companies segment dominated the market in 2025, with a revenue share of approximately 42%.

- By end-user, the biotechnology companies segment is expected to grow at the fastest CAGR in the market during the forecast period.

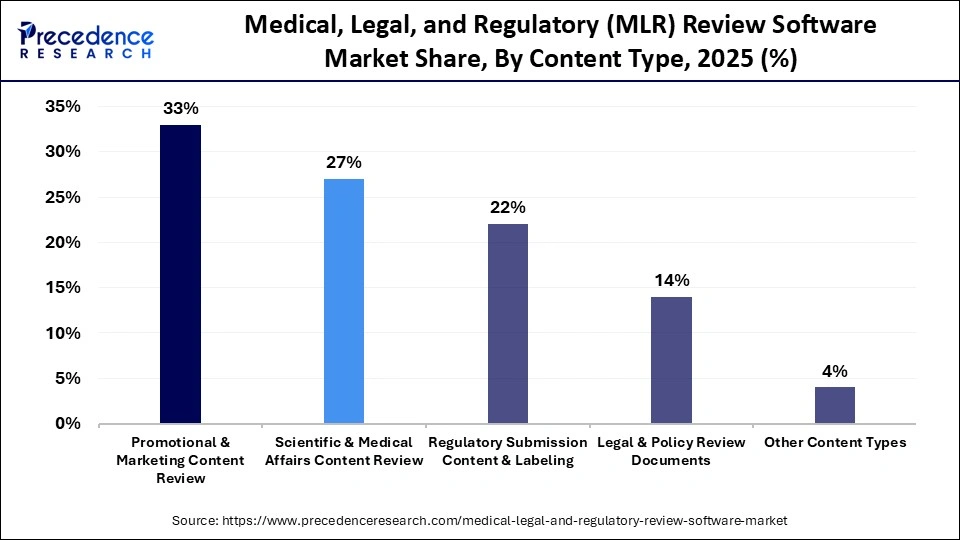

- By content type, the promotional & marketing content review segment dominated the market in 2025, with a revenue share of approximately 33%.

- By content type, the regulatory submission content & labeling segment is expected to grow at the fastest CAGR in the market during the forecast period.

Medical, Legal, and Regulatory (MLR) Review Software: Driving Healthcare Innovation

The global medical, legal, and regulatory (MLR) review software market includes enterprise platforms and cloud-based solutions designed to automate, streamline, and govern the creation, review, compliance, and approval of promotional, scientific, and regulatory content within life sciences and healthcare organizations. MLR review software supports workflow automation, version control, audit trails, content governance, cross-team collaboration, regulatory submission tracking, and analytics. Growth is driven by increasingly stringent regulatory environments, global commercialization activities, rising volumes of promotional and scientific content, and demand for auditability and compliance risk reduction.

However, regulatory compliance in medtech and medical device marketing is of great importance for ensuring honesty and accuracy in all promotional activities. The U.S. Food and Drug Administration (FDA) plays an integral role in the promotion and advertising of medical devices in the U.S. It reviews the intended use, claims about device safety and efficacy, and any potential risks related to the devices.

What are the benefits of AI in the Market?

Artificial intelligence is revolutionizing pharma's MLR review by automating content review and approval, enhancing collaboration across teams, and reducing review time and human error. The emerging AI-powered MLR tools will be cloud-based that will ensure compliance and seamless integration with digital asset management (DAM) systems. The integration of AI has reduced approval timelines and content creation timelines. IT helps to maintain a good brand reputation, adhere to legal regulations, and promote content globally. It also ensures the authenticity and accuracy of all your content and expands the medical, legal, and regulatory (MLR) review software market.

What are the Market Trends?

- Autonomous Connected Operations: There is a rapid shift towards various industrial devices such as smart meters, connected fleets, and connected machinery. The original equipment manufacturers (OEMs) have adopted remote monitoring into equipment such as compressed-air systems. The connectivity standards have opened doors for scalable industrial IoT that will expand the medical, legal, and regulatory (MLR) review software market.

- Compliance with Omnichannel Strategy: The various industries, like utilities, financial services, and telecom, focus on the omnichannel demands of modern customers. The organizations are integrating many laws and regulations around data privacy, accessibility, and security.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.09 Billion |

| Market Size in 2026 | USD 18.71 Billion |

| Market Size by 2035 | USD 42.42 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Mode, Component, End-User, Content Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Mode Insights

Which Deployment Mode Dominated the Market in 2025?

The cloud-based/SaaS MLR solutions segment dominated the medical, legal, and regulatory (MLR) review software market in 2025 with a revenue share of approximately 63%. The segment is expected to grow at the fastest CAGR in the market during the forecast period, owing to the increased adoption of cloud MLR solutions by firms, which automate the entire system and drive operational efficiency. Modern SaaS platforms are essential to ensure regulatory compliance and enable security as code. Cloud models offer scalability for small and medium enterprises, including biotechnology and medical device firms, through affordable subscription models.

Component Insights

What made Software Platforms the Dominant Segment in the Market in 2025?

The software platforms segment dominated the market in 2025 with a revenue share of approximately 69%, owing to the transition from simple workflow tools to intelligent compliance hubs. Cloud-based SaaS platforms provide a unified content ecosystem that will set the industry standard. There is a rapid shift towards AI-powered pre-screening, automated claims linking, intelligent automation, and modular content strategies.

The professional services segment is estimated to grow at the fastest rate in the medical, legal, and regulatory (MLR) review software market during the predicted timeframe due to the core roles of strategic compliance consulting, optimization of omnichannel workflow, and data-driven process improvement. The professional services teams play an integral role in medical review, legal counselling, and regulatory strategy. The various services focus on improving workflows for enabling pharmaceutical firms to maintain HCP portals, brand consistency, and websites across social media.

End-User Insights

How did the Pharmaceutical Companies Segment Dominate the Market in 2025?

The pharmaceutical companies segment dominated the market in 2025 with a revenue share of approximately 42%, owing to the growing need of pharmaceutical companies to accelerate product launches while exploring strict global regulations. The industries are focusing on replacing manual email-based approvals with cloud-based platforms that are centralized and automate reminders. The companies take efforts to ensure risk mitigation, audit readiness, regulatory inspections, and reduce documentation errors.

The biotechnology companies segment is anticipated to grow at a notable rate in the medical, legal, and regulatory (MLR) review software market during the upcoming period due to the critical importance of MLR review software for scientific communications, promotional materials, and clinical documentation. Predictive risk analytics is driven by advanced tools that are integrated with machine learning that help companies to predict potential compliance risks. The companies are increasingly adopting software to manage pre-approved content modules.

Content Type Insights

Why did the Promotional & Marketing Content Review Segment dominate the Market in 2025?

The promotional & marketing content review segment dominated the market in 2025 with a revenue share of approximately 33%, owing to the major role of MLR software in centralized collaboration, automated workflow routing, and audit readiness. With the rising expansion of digital and omnichannel marketing, these platforms have become essential to maintain regulatory adherence of life sciences content and scientific accuracy. A centralized collaboration is driven by software that provides a unified platform to unite legal, medical, and regulatory teams.

The regulatory submission content & labeling segment is predicted to grow at a rapid rate in the medical, legal, and regulatory (MLR) review software market during the studied period due to the increased shift towards omnichannel digital marketing and increasing regulatory complexity. The software platforms help to mitigate risks through intelligent automation. The software also supports the electronic submission of regulatory documents with real-time tracking and automated validation checks.

Regional Insights

How Big is the North America Medical, Legal, and Regulatory (MLR) Review Software Market Size?

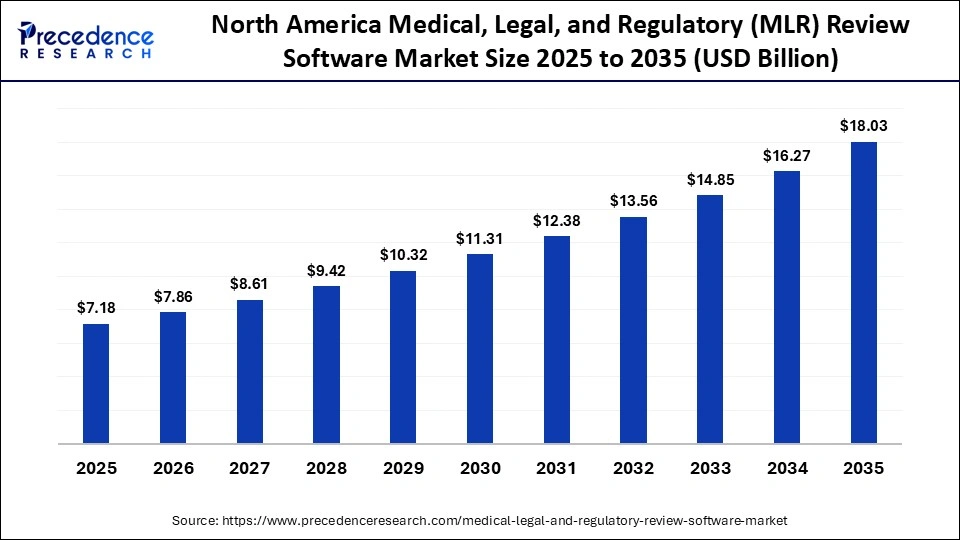

The North America medical, legal, and regulatory (MLR) review software market size is estimated at USD 7.18 billion in 2025 and is projected to reach approximately USD 18.03 billion by 2035, with a 9.64% CAGR from 2026 to 2035.

How does North America dominate the Market in 2025?

North America dominated the market in 2025 with a revenue share of approximately 42%, owing to centralized compliance management to ensure audit readiness and the rise of digital marketing across websites, healthcare portals, and social media. The U.S. Food and Drug Administration (FDA) has implemented the integrated review documentation process for new drug applications. The heavy investments in the Digital Research Alliance of Canada support data management tools and research software that are used in regulatory clinical review processes and are driving the medical, legal, and regulatory (MLR) review software market.

What is the Size of the U.S. Medical, Legal, and Regulatory (MLR) Review Software Market?

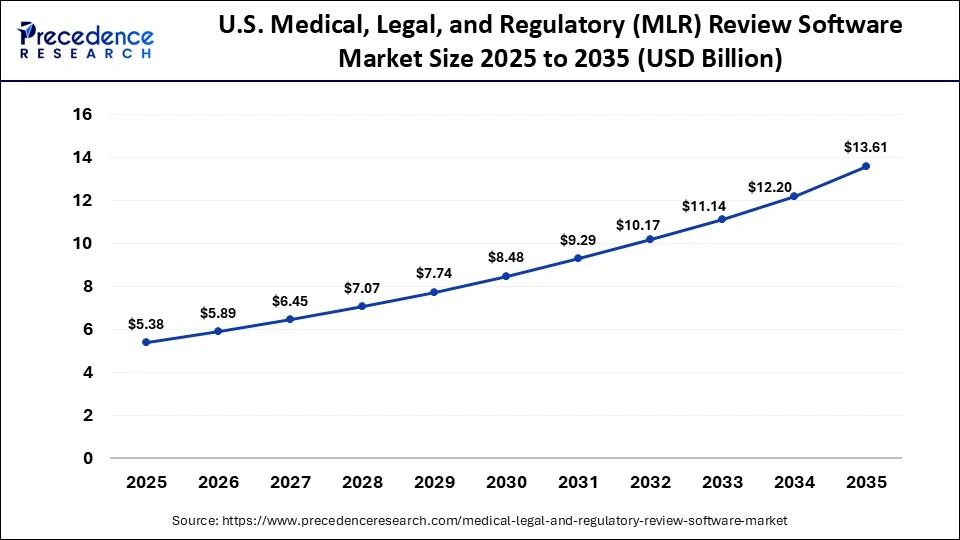

The U.S. medical, legal, and regulatory (MLR) review software market size is calculated at USD 5.38 billion in 2025 and is expected to reach nearly USD 13.61 billion in 2035, accelerating at a strong CAGR of 9.73% between 2026 and 2035.

U.S. Market Analysis

The U.S. industry is driven by a technological transformation in the life sciences sector and a shift towards omnichannel marketing, including HCP portals, social media, and websites. In January 2026, the U.S. FDA launched a regulatory accelerator to accelerate innovation across the medical device software industry. In November 2024, Revisto raised $4 million in seed funding to transform pharmaceutical marketing compliance through the integration of AI.

What is the Potential of the Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to increased adoption of MLR platforms by local pharmaceutical and biotechnology startups in countries like India and China, and the increased shift towards cloud-based MLR solutions. The APACMed is advancing software as a medical device regulations in the Asia Pacific. Asia Pacific remains the major region for innovative pharmaceutical products and medical devices, and is expanding the medical, legal, and regulatory (MLR) review software market.

India Market Trends

India is experiencing the integration of digital tools to reduce human errors and shift towards cloud-based platforms. In October 2025, the Central Drugs Standard Control Organization (CDSCO) launched new draft guidelines for the grant of a license to produce or import for sale and distribution of devices in the country. The Ministry of Health and Family Welfare launched major policy reforms for the medical device licensing framework in India in the year 2025.

Who are the Major Players in the Global Medical, Legal, and Regulatory (MLR) Review Software Market?

The major players in the medical, legal, and regulatory (MLR) review software market include Veeva Systems Inc., IQVIA Holdings Inc., Vodori, Adobe Inc., EVERSANA, Acheron Software Consultancy, Aprimo, MasterControl Solutions Inc., and Red Marker.

Recent Developments

- In January 2026, Vodori made a strategic partnership with BridgeView to transform content review and help life sciences companies to modernize and streamline their promotional and medical content review process.(Source: https://www.goerie.com)

- In April 2025, EVERSANA introduced an AI-powered solution named EVERSANA ORCHESTRATE MLR to transform the medical, legal, and regulatory process. This platform will transform 90% of common tasks in the complex review process through a single platform. It will offer an easy way to implement and comply with all regulatory requirements.(Source: https://www.eversana.com)

Segments Covered in the Report

By Deployment Mode

- Cloud-based/SaaS MLR Solutions

- On-premise MLR Software

By Component

- Software Platforms

- Content review & workflow engines

- Compliance dashboards & analytics

- Collaboration modules

- Professional Services

- Implementation & customization

- Training & support

By End-User

- Pharmaceutical Companies

- Medical Device Manufacturers

- Biotechnology Companies

- Healthcare Providers & Systems

- Contract Research Organizations (CROs)/Agencies

By Content Type

- Promotional & Marketing Content Review

- Scientific & Medical Affairs Content Review

- Regulatory Submission Content & Labeling

- Legal & Policy Review Documents

- Other Content Types

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting