What is the Microgrid as a Service (MaaS) Market Size?

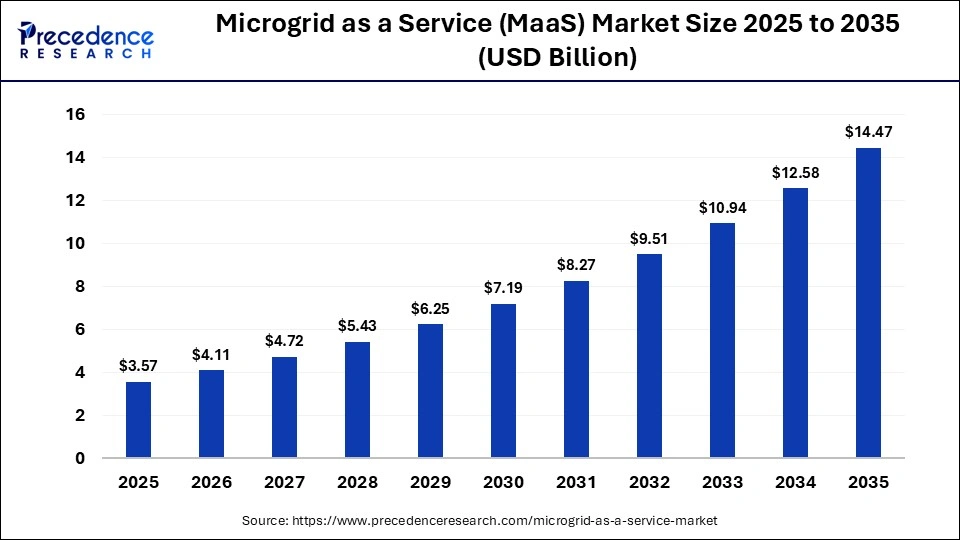

The global microgrid as a service (MaaS) market size was calculated at USD 3.57 billion in 2025 and is predicted to increase from USD 4.11 billion in 2026 to approximately USD 14.47 billion by 2035, expanding at a CAGR of 15.02% from 2026 to 2035. The microgrid as a service (MaaS) market is significantly driven by the growing adoption of advanced monitoring solutions from the grid operators, along with numerous government initiatives aimed at enhancing rural electrification. Moreover, technological advancements in the power generation sector, as well as the rapid investment by the mining sector for deploying advanced grid management solutions, are accelerating the industry in a positive direction.

Market Scope

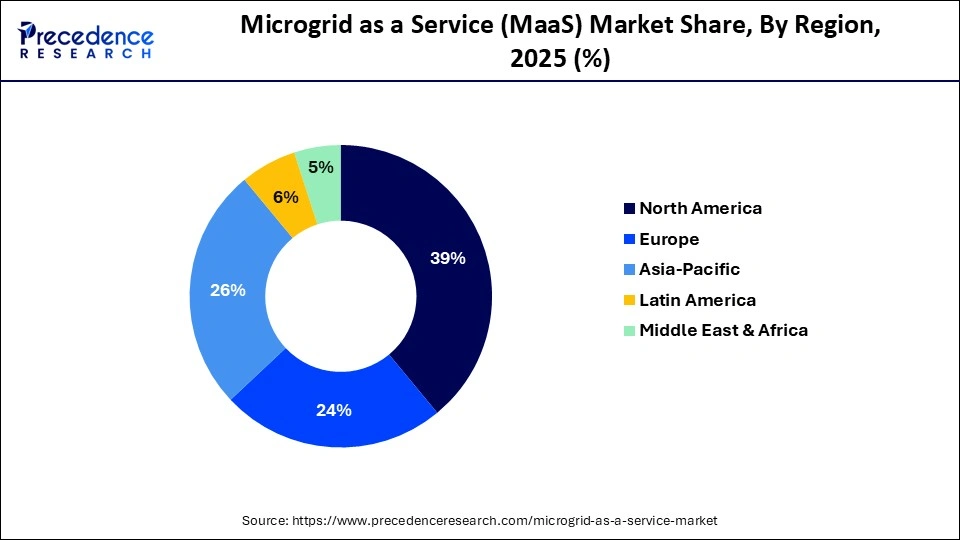

- North America led the microgrid as a service (MaaS) market with a share of around 39% in 2025.

- Asia Pacific is expected to rise with the highest CAGR during the forecast period.

- By service type, the operation & maintenance (O&M) services segment held the largest share of the market with 28% in 2025.

- By service type, the software & energy management services segment is expected to grow with the fastest CAGR between 2026 and 2035.

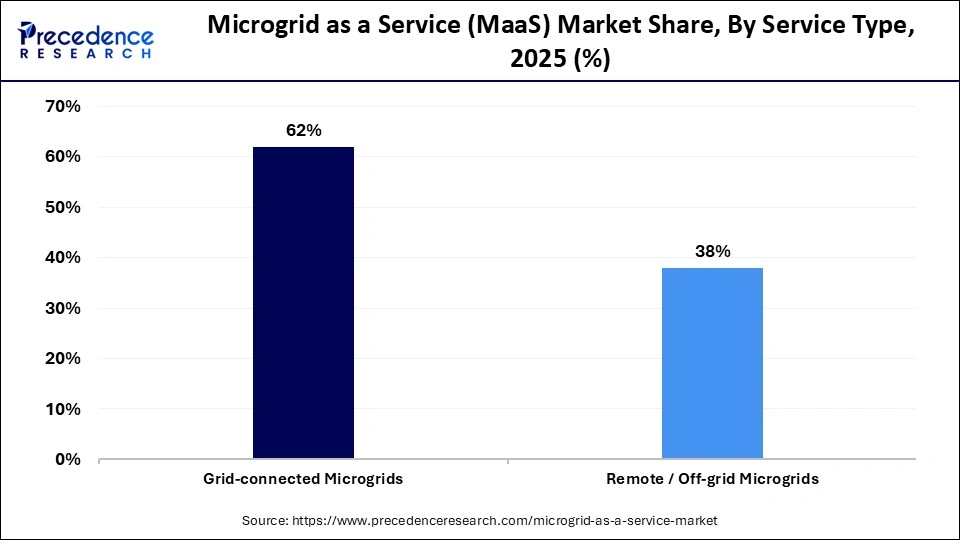

- By microgrid type, the grid-connected microgrids segment dominated the market with a share of 62% in 2025.

- By microgrid type, the remote/off-grid microgrids segment is expected to rise with the highest CAGR during the forecast period.

- By power source mix, the hybrid (Solar/Wind + Storage + Conventional backup) segment held the largest share of the microgrid as a service (MaaS) industry with 41%.

- By power source mix, the renewable-based microgrids segment is expected to expand with the fastest growth rate during the forecast period.

- By technology/asset type, the energy storage systems (ESS) integration segment held the largest share of 31% in the market.

- By technology/asset type, the microgrid controllers & software platforms segment is expected to grow with the highest CAGR during the forecast period.

- By pricing/contract model, the energy-as-a-service (EaaS)/pay-per-kwh segment led the industry with a share of 36%.

- By pricing/contract model, the performance-based contracts segment is expected to expand with the highest CAGR during the forecast period.

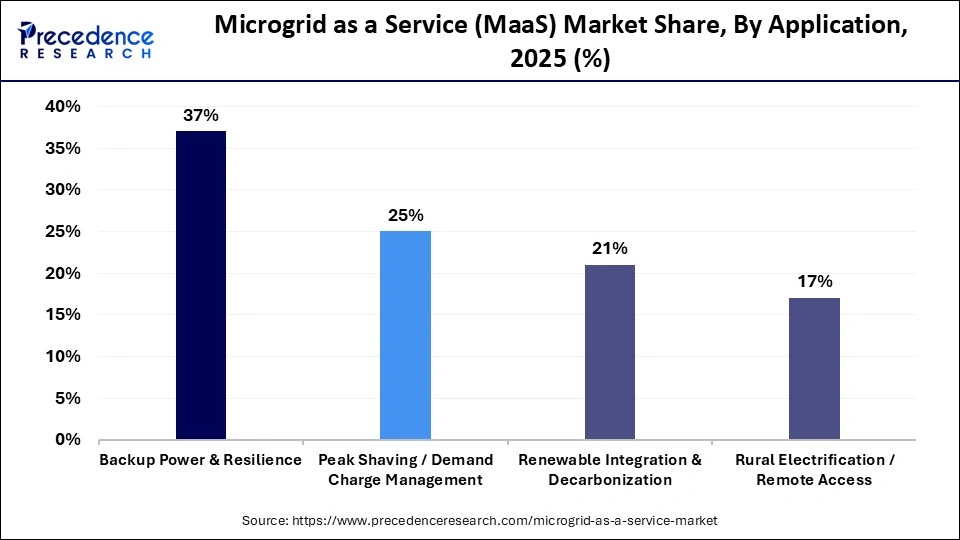

- By application, the backup power & resilience segment led the market with a share of 37%.

- By application, the renewable integration & decarbonization segment is expected to rise with the fastest CAGR during the forecast period.

- By end user, the industrial segment dominated the market with a share of around 29%.

- By end user, the commercial segment is expected to rise with the highest CAGR during the forecast period.

What Is the Landscape of the Microgrid as a Service (MaaS) Market?

The microgrid as a service (MaaS) market is a prominent sector of the energy and power industry. This industry deals in providing microgrid services to the end-users globally. MaaS enables customers to access low-carbon distributed energy systems without a high upfront cost by covering numerous services, including engineering & design, optimization software, financing, distributed energy resource (DER) integration, energy storage operation, remote monitoring, and lifecycle maintenance. The surging cases of grid instability and increasing cost of electricity in developed nations are expected to drive the growth of the microgrid as a service (MaaS) industry.

What Is the Role of AI in the Microgrid as a Service (MaaS) Sector?

AI has revolutionized the landscape of the energy and power distribution sector. The grid operators have started deploying AI to enhance grid stability and increase operational efficiency. Moreover, several AI developers are investing rapidly in designing advanced platforms for improving grid management capabilities and automating operations by enabling advanced forecasting, along with ensuring a stable power supply. Thus, AI has played a vital role in shaping the microgrid as a service (MaaS) market in a positive direction.

- In October 2025, Anode launched an AI-based mobile microgrid. These microgrids are designed for utilities, data center owners, and EV/AV fleet operators.

Microgrid as a Service (MaaS) Market Trends

- Collaborations: Numerous power management companies are collaborating with grid operators to deploy AI-enabled tools in grid platforms. For instance, in September 2025, Xendee collaborated with Eaton. This collaboration is aimed at optimizing microgrid performance using AI-enabled tools for superior energy savings, security, and sustainability.

- Government Investments: The governments of several countries are investing rapidly in integrating advanced solutions for enhancing grid management. For instance, in July 2025, the government of India invested around US$ 70 million. This investment is aimed at boosting the grid infrastructure across this nation.

- Product Launches: Several market players are launching new grid solutions for the end-user industries. For instance, in November 2025, Siemens launched Gridscale X Flexibility Manager. Gridscale X Flexibility Manager is an advanced platform designed to maximize the use of existing grid capacity and accelerate grid connections for distributed energy resources.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.57Billion |

| Market Size in 2026 | USD 4.11 Billion |

| Market Size by 2035 | USD 14.47Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Application, Microgrid Type, Power Source Mix, Technology / Asset Type, Pricing/Contract Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

Why Did the Operation & Maintenance (O&M) Services Dominate the Microgrid as a Service (MaaS) Market?

The operation & maintenance (O&M) services segment dominated the microgrid as a service (MaaS) industry with a share of 28% in 2025. The growing demand for operations and maintenance services from the grid operators has boosted the market expansion. Additionally, the rapid investment by the market players for delivering grid maintenance services to the end-users is expected to accelerate the growth of the microgrid as a service (MaaS) sector.

The software & energy management services segment is expected to expand with the fastest CAGR between 2026 and 2035. The rising adoption of high-quality energy management solutions from the grid operators has driven the market growth. Moreover, the growing focus of the software companies on designing advanced grid management software is expected to drive the growth of the microgrid as a service (MaaS) market.

Microgrid Type Insights

What Made the Grid-Connected Microgrids Segment Lead the Microgrid as a Service (MaaS) Industry?

The grid-connected microgrids segment leads the microgrid as a service (MaaS) industry with a share of 62% in 2025. The grid-connected microgrids for enhancing reliability and renewable energy integration have boosted the market growth. Additionally, several advantages of grid-connected microgrids, such as improved power quality, support in remote areas, and reduced emissions, are expected to drive the growth of the microgrid as a service (MaaS) market.

The remote/off-grid microgrids segment is expected to grow with the highest CAGR during the forecast period. The rising demand for remote microgrids from the grid operators to deliver energy access in remote areas has driven the market expansion. Also, numerous benefits of remote/off-grid microgrids, including enhanced resilience, improved energy security, and reduced carbon footprints, are expected to propel the growth of the microgrid as a service (MaaS) sector.

Power Source Mix Insights

Why Did the Hybrid (Solar/Wind + Storage + Conventional Backup) Dominate the Microgrid as a Service (MaaS) Industry?

The hybrid (Solar/Wind + Storage + Conventional backup) segment dominated the microgrid as a service (MaaS) market with a share of 41%. The rising adoption of hybrid power sources by the manufacturing sector has boosted the market growth. Additionally, several benefits of hybrid power sources, such as lower operating costs, enhanced reliability, and reduced environmental impact, are expected to propel the growth of the microgrid as a service (MaaS) sector.

The renewable-based microgrids segment is expected to rise at the fastest rate during the forecast period. The growing adoption of solar energy by the power generation sector for delivering electricity in remote areas has boosted the market expansion. Also, numerous government initiatives aimed at deploying renewable energy sources in the industrial sector is expected to drive the growth of the microgrid as a service (MaaS) market.

Technology/Asset Type Insights

What Made the Energy Storage Systems (ESS) Integration Segment Lead the Microgrid as a Service (MaaS) Industry?

The energy storage systems (ESS) integration segment leads the microgrid as a service (MaaS) market with a share of around 31%. The growing demand for energy storage systems (ESS) from the power generation sector to act as a backup source has boosted the market growth. Also, partnerships among energy storage companies and microgrid operators to design energy storage systems (ESS) is expected to propel the growth of the microgrid as a service (MaaS) market.

The microgrid controllers & software platforms segment is expected to expand with the highest CAGR during the forecast period. The increasing usage of microgrid controllers to balance the supply and demand of electricity has boosted the industrial growth. Moreover, the surging investment by software companies to develop advanced software platforms for enhancing grid management capabilities is expected to drive the growth of the microgrid as a service (MaaS) sector.

Pricing/Contract Model Insights

Why Did the Energy-as-a-Service (EaaS) / Pay-per-kWh Dominate the Microgrid-as-a-Service (MaaS) Industry?

The energy-as-a-service (EaaS) / pay-per-kWh segment dominated the microgrid-as-a-service (MaaS) industry with a share of 36%. The growing adoption of energy-as-a-service (EaaS) by business organizations to gather modern energy services from renewable sources has boosted the market growth. Also, several benefits of energy-as-a-service (EaaS), including predictable costs, enhanced efficiency, and reduced risk are expected to propel the growth of the microgrid as a service (MaaS) market.

The performance-based contracts segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of performance-based grid contracts by the healthcare companies for managing their grid operations has boosted the market expansion. Additionally, numerous advantages of performance-based contracts, such as cost-efficiency, improved performance, enhanced transparency, and increased accountability, are expected to drive the growth of the microgrid as a service (MaaS) sector.

Application Insights

What Made the Backup Power & Resilience Segment Lead the Microgrid as a Service (MaaS) Market?

The backup power & resilience segment leads the microgrid as a service (MaaS) market with a share of 37%. The surging adoption of predictive maintenance services by the grid operators to detect the faults in backup power solutions has boosted the industrial expansion. Moreover, the growing focus of AI companies on developing advanced software to monitor the performance of backup power sources is expected to accelerate the growth of the microgrid as a service (MaaS) industry.

The renewable integration & decarbonization segment is expected to grow with the fastest CAGR during the forecast period. The growing application of performance monitoring solutions in the microgrids for lowering the carbon emission has driven the market growth. Also, numerous government initiatives aimed at generating electricity from clean energy sources is expected to foster the growth of the microgrid as a service (MaaS) market.

End-User Insights

Why Did the Industrial Segment Dominate the Microgrid as a Service (MaaS) Sector?

The industrial segment dominated the microgrid as a service (MaaS) sector with a share of around 29%. The growing adoption of IoT-enabled microcontrollers from the manufacturing sector has boosted the market expansion. Also, partnerships among grid operators and software developers for deploying advanced grid management software in the industrial sector is expected to drive the growth of the microgrid as a service (MaaS) market.

The commercial segment is expected to grow with the highest CAGR during the forecast period. The rising demand for subscription-based services from the data centers to manage the grid operations has boosted the market expansion. Additionally, the rapid investment by the retail companies for deploying advanced grid management solutions is expected to boost the growth of the microgrid as a service (MaaS) market.

Regional Insights

How Big is the North America Microgrid as a Service (MaaS) Market Size?

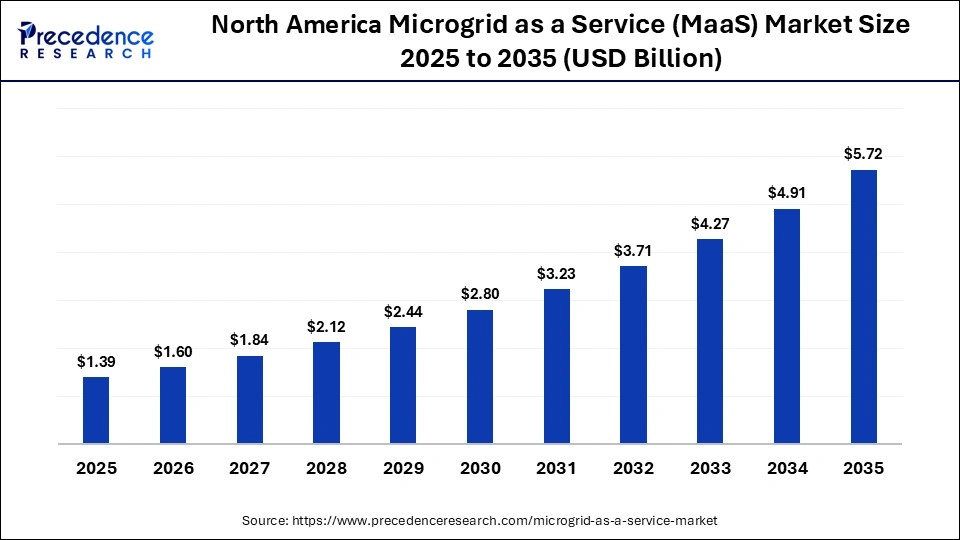

The North America microgrid as a service (MaaS) market size is estimated at USD 1.39 billion in 2025 and is projected to reach approximately USD 5.72 billion by 2035, with a 15.2% CAGR from 2026 to 2035.

Why Did North America Dominate the Microgrid as a Service (MaaS) Market in 2025?

North America dominated the microgrid as a service (MaaS) market with a share of around 39% in 2025. The growing deployment of preventive maintenance solutions by the power generation companies in the U.S., Canada, and Mexico has boosted the market growth. Additionally, the increasing emphasis of the government on developing renewable-based microgrids, along with the surging investment in the defense sector, is positively contributing to the industry. Moreover, the presence of various market players, including General Electric, Honeywell, and PowerSecure, is expected to propel the growth of the microgrid as a service (MaaS) industry in this region.

- In June 2025, PowerSecure collaborated with Edged. This collaboration is aimed at supplying advanced power distribution solutions to data centers of Edge across the United States.

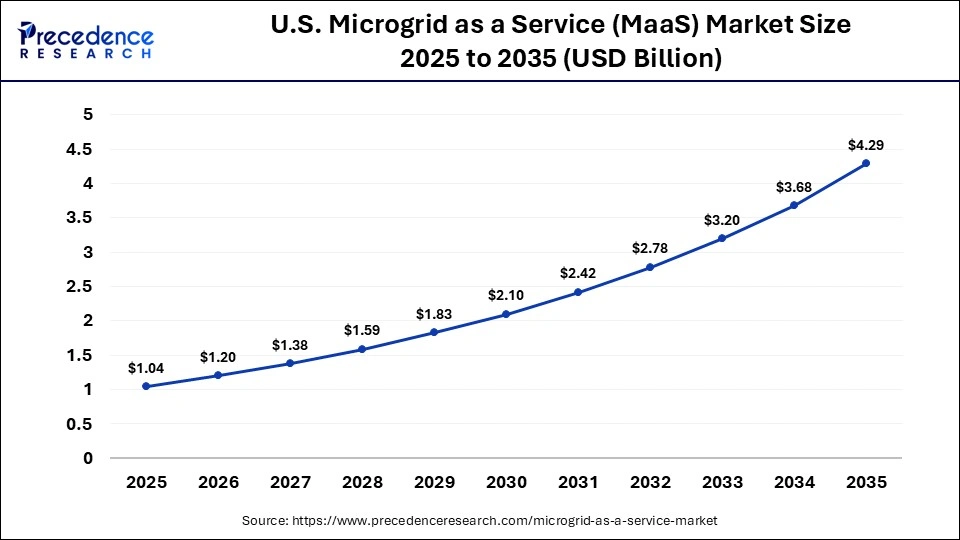

What is the Size of the U.S. Microgrid as a Service (MaaS) Market?

The U.S. microgrid as a service (MaaS) market size is calculated at USD 1.04 billion in 2025 and is expected to reach nearly USD 4.29 billion in 2035, accelerating at a strong CAGR of 15.22% between 2026 and 2035.

U.S. Microgrid as a Service (MaaS) Market Analysis

The increasing focus of the automotive brands to deploy advanced grid management solutions in their production centers to enhance grid efficiency has boosted the market expansion. Also, partnerships among AI companies and grid operators to deliver grid management services to the end-users is playing a prominent role in shaping the industrial landscape.

Why Is Asia Pacific Growing With the Highest CAGR in the Microgrid as a Service (MaaS) Market?

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rapid adoption of performance monitoring tools from the healthcare sector across numerous nations, such as India, China, Japan, and South Korea, has boosted the market expansion. Also, the rapid investment by the government for strengthening the grid infrastructure, as well as technological advancements in the manufacturing sector, is positively contributing to the industry. Moreover, the presence of various market players, such as Hitachi, Huawei, Canopy Power, and Azure Power, is expected to propel the growth of the microgrid as a service (MaaS) sector in this region.

- In December 2025, Huawei launched a solar-powered smart microgrid solution in the APAC region. This solution is designed for enhancing the use of clean energy to generate electricity.

Japan Microgrid as a Service (MaaS) Market Trends

The increasing adoption of software & energy management services by the robotics companies, as well as the technological advancements in the mining sector, has boosted the market growth. Additionally, the rapid investment by the energy providers to deploy microgrid controllers in the data centers is positively contributing to the industry. Government agencies such as Japan's Ministry of Economy, Trade, and Industry are supporting MaaS deployments through grid resilience programs linked to disaster preparedness and energy security.

Japanese utilities and independent power producers are integrating MaaS platforms with distributed solar, battery storage, and demand-response systems to stabilize power supply in industrial parks and remote regions. The growth of hyperscale and edge data centers in Tokyo and Osaka is further increasing demand for controller-driven microgrids that enable real-time load balancing and outage mitigation.

Who are the Major Players in the Global Microgrid as a Service (MaaS) Market?

The major players in the microgrid as a service (MaaS) market include Eaton, ABB, GE, Younicos, Green Energy Corp, NRG Energy, Ameresco, Schneider Electric, ENGIE, EnSync Energy, Spirae, PowerSecure

Recent Developments

- In November 2025, Schneider Electric launched the One Digital Grid Platform. One Digital Grid Platform is designed to help grid operators modernize, increase the resilience of electricity grids, and reduce energy costs.

- In September 2025, British International Investment (BII) partnered with Odyssey Energy Solutions. This partnership is aimed at accelerating mini-grid deployment in Nigeria.

- In March 2025, Itron, Inc. launched the IntelliFLEX solution. The IntelliFLEX solution is an advanced platform designed to strengthen grid reliability and optimize distributed energy resource integration.

Segments Covered in the Report

By Service Type

-

- Operation & Maintenance (O&M) Services

- Performance monitoring

- Preventive maintenance

- Software & Energy Management Services

- Microgrid controllers

- AI/ML optimization

- Engineering, Procurement & Construction (EPC) / Deployment Services

- Financing / Leasing / Subscription-based Services

- Consulting & Feasibility Assessment Services

By Application

- Backup Power & Resilience

- Peak Shaving / Demand Charge Management

- Renewable Integration & Decarbonization

- Rural Electrification / Remote Access

By Microgrid Type

- Grid-connected Microgrids

- Remote/Off-grid Microgrids

By Power Source Mix

- Hybrid (Solar/Wind + Storage + Conventional backup)

- Renewable-based Microgrids

- Solar PV dominant

- Wind-integrated

- Conventional-based Microgrids

- Diesel/gas gensets + controls

By Technology / Asset Type

- Energy Storage Systems (ESS) Integration

- Microgrid Controllers & Software Platforms

- Distributed Generation Assets

- Solar PV

- Gas gensets / CHP

- Power Electronics & Switchgear

By Pricing/Contract Model

- Energy-as-a-Service (EaaS) / Pay-per-kWh

- Subscription / Fixed Monthly Service Fee

- Performance-based Contracts (shared savings)

- Build–Own–Operate–Maintain (BOOM) Contracts

By End-User

- Commercial

- Campuses, Data Centres, Retail

- Industrial

- Manufacturing, Mining, Oil & Gas

- Utilities & Energy Providers

- Government & Defence

- Healthcare & Institutiona

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content