What is the Model Optimization Platform Market Size?

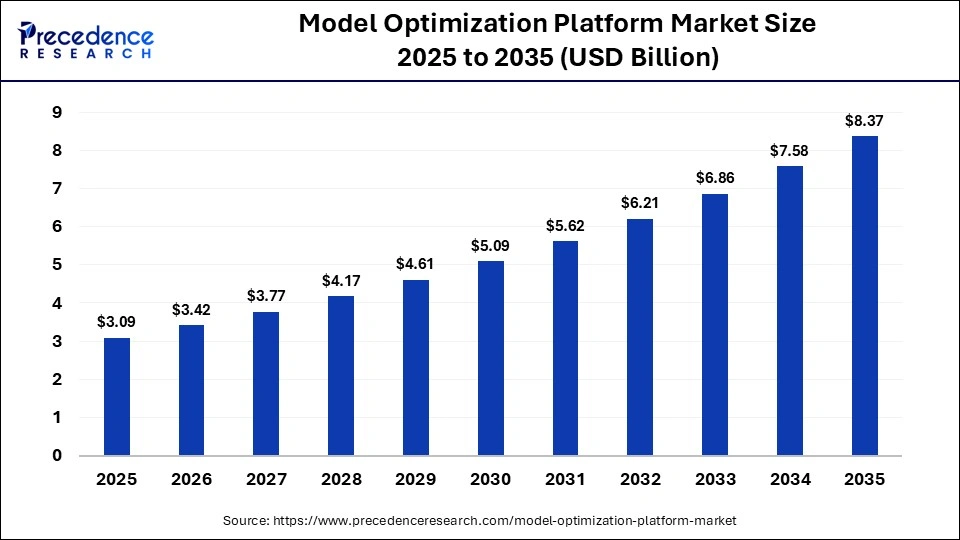

The global model optimization platform market size was calculated at USD 3.09 billion in 2025 and is predicted to increase from USD 3.42 billion in 2026 to approximately USD 8.37 billion by 2035, expanding at a CAGR of 10.47% from 2026 to 2035. The model optimization platform market is observed to grow at a rapid pace due to higher demand for generative AI and ML models across different countries. The market also observes growth due to higher demand for technologically advanced software in various domains, which helps enhance automation, scalability, efficient results, and cost-efficiency. Cloud-based technology for efficient and time-saving results also helps to fuel the growth of the market.

Market Highlights

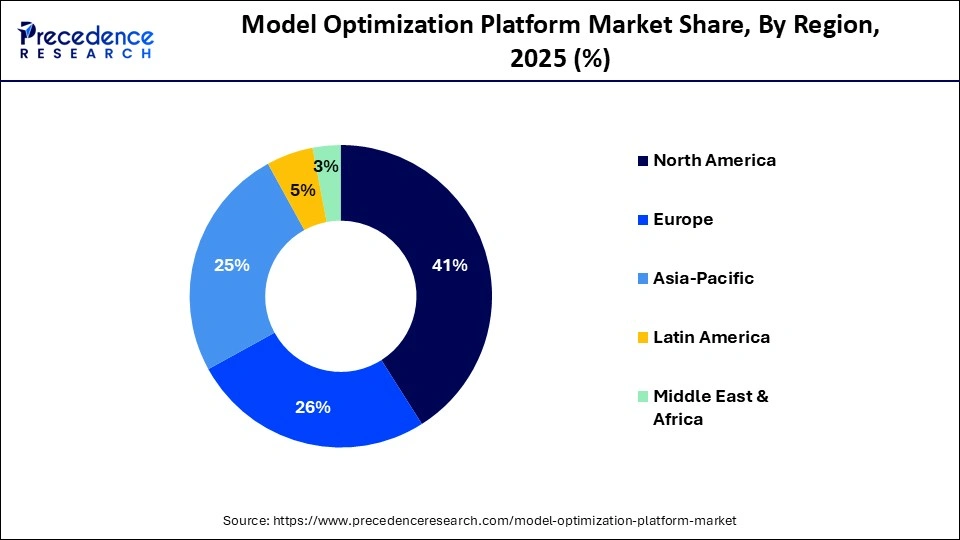

- North America led the market by accounting for a share of 41% in 2025.

- Asia Pacific is expected to grow in the foreseen period with the highest CAGR.

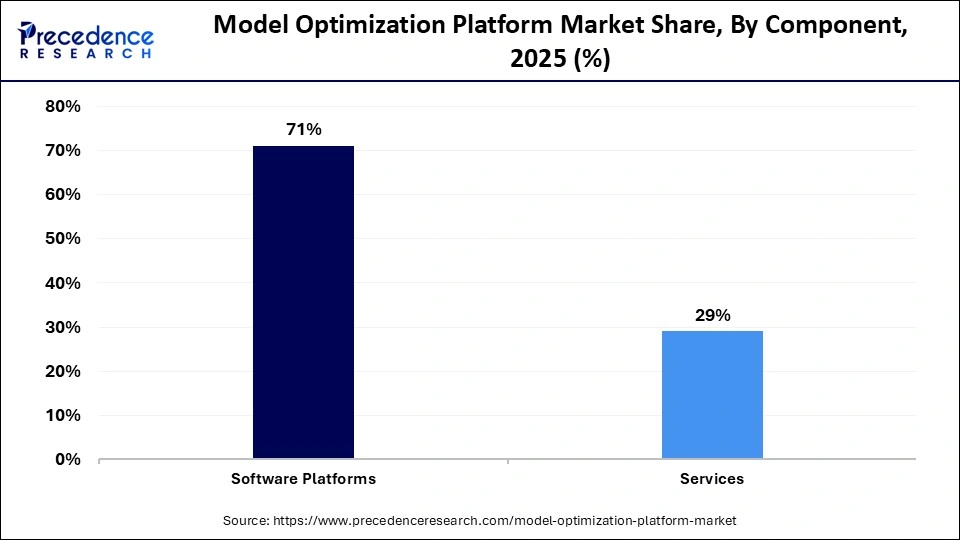

- By component, the software platform segment led the model optimization platform market in 2025 by accounting for a share of 71%.

- By component, the services segment is observed to be the fastest-growing region.

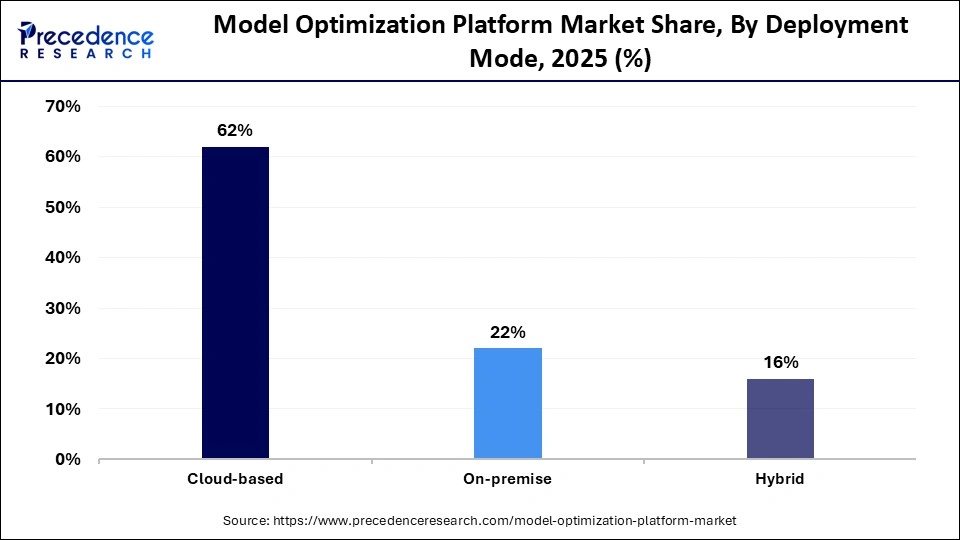

- By deployment mode, the cloud-based segment led the market by accounting for a share of 62% in 2025.

- By deployment mode, the hybrid deployment segment is observed to grow in the foreseen period.

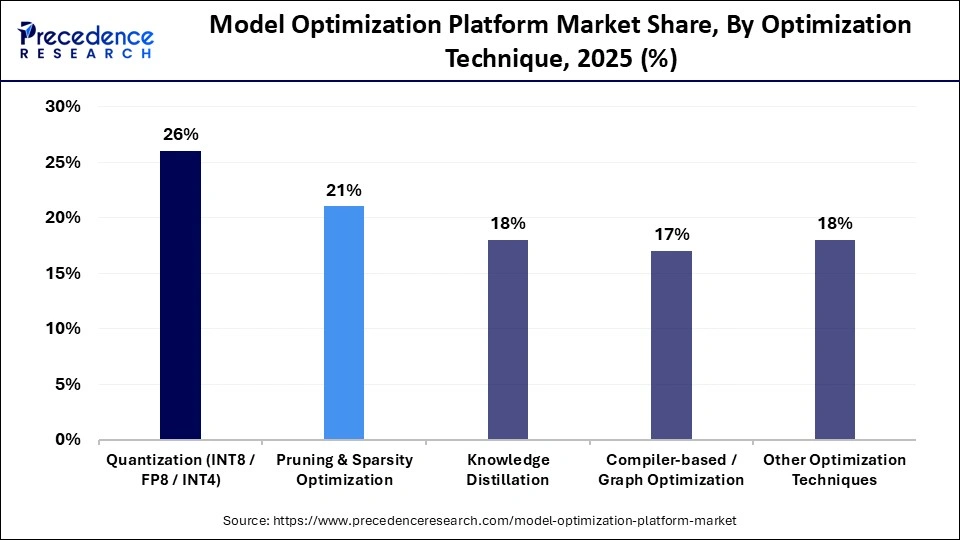

- By optimization technique, the quantization segment, holding a share of 26%, led the model optimization platform market in 2025.

- By optimization technique, the compiler-based/graph optimization segment is observed to grow in the foreseen period.

- By end-user industry, the IT and telecom segment led the market in 2025 by accounting for a share of 19%.

- By end-user industry, the automotive and mobility segment is observed to be the fastest growing in the foreseen period.

What Is the Model Optimization Platform?

The market signifies various tools and software helpful to compress, refine, and enhance AI and ML, working to fuel the growth of the industry. With the changing technology, the AI models are becoming complex due to generative AI. Hence, the market aims to lower the operational costs, lower latency, and decrease energy consumption, which is helpful for models to be cost-efficient, further fueling the growth of the market.

The market also aims to elevate the speed of AI and ML models to reduce their production time and leverage AI insights as per the consumer demands, which is helpful for fueling the growth of the market. The market also signifies the monitoring of technologically advanced models for production, automation, and meeting the growing consumer demands. The procedure also helps to lower human intervention, leading to cost savings, further fueling the growth of the market.

These platforms are increasingly deployed in data centers, edge devices, and embedded systems where compute efficiency and power optimization are enforced by operators and regulators.

Public-sector initiatives supporting AI infrastructure, including national AI missions and government-backed cloud programs, are accelerating adoption of model optimization tools for scalable deployment. Industry use cases are expanding across autonomous systems, healthcare diagnostics, and industrial automation, where optimized models enable faster inference, regulatory compliance, and predictable operating costs.

Technological Shifts Observed in the Model Optimization Platform Market

Higher adoption of AI and ML in various domains for streamlining the manufacturing and management procedures is one of the major technological factors fueling the growth of the market. A major shift from manual, bespoke model management to technological and automated advanced platforms in the whole development-to-manufacturing cycle is one of the major factors helpful for the growth of the market. The procedure also helps in monitoring and retraining certain aspects for better efficiency.

Major shifts of organizations towards cloud-based platforms for enhanced scalability and reduced operational costs are another major factor fueling the growth of the model optimization platform industry. The major shift observed helps to enhance flexibility and, along with addressing any form of issue at any time, is helpful for the market's growth. Hybrid deployment models are emerging as a trend to allow companies to work with cloud-based AI tools.

- For instance, in December 2025, Microsoft announced it would broaden its Azure AI application development for consistent management, resiliency, and governance across public cloud, on-premises, edge, and disconnected environments.

Model Optimization Platform Market Trends

- Expanding AI and IoT: technologically advanced changes in the software for an enhanced version of AI and IoT for resource-constrained devices are one of the major factors for the growth of the market.For instance, in June 2025, the US Food and Drug Administration launched Elsa, a generative AI tool to help their employees, scientific reviewers, and investigators work efficiently, as the tool helps to leverage AI capabilities to serve the American people better.

- Economic Operations: economic drivers smoothening the AI workflows with reduced operational costs are another major factor fueling the growth of the market.For instance,in January 2026, NVIDIA launched its next generation of AI with the launch of the NVIDIA Rubin platform, comprising six new chips in one AI supercomputer. The technology is made at the lowest cost to accelerate mainstream AI adoption by the company.

- Higher Demand for Autonomous Agents: higher demand for autonomous agents to plan and execute multi-step tasks is another major factor fueling the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.09 Billion |

| Market Size in 2026 | USD 3.42 Billion |

| Market Size by 2035 | USD 8.37Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type , Component, Crop Type , Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Which Component Segment Led the Model Optimization Platform Market in 2025?

The software platforms segment led the market, accounting for 71% in 2025. The segment is observed to grow due to growing demand for advanced AI and ML models in various domains for advanced production and manufacturing procedures. The updated software also helps to enhance scalability and efficiency and helps to monitor performance through platforms like AWS SageMaker, Azure ML, Google Vertex AI, and MLflow. The segment also pays attention to the efficiency of the software, which is helpful for domains such as BFSI for enhanced security, enhanced operational efficiency, and reduced costs.

The services segment is observed to be the fastest-growing segment in the foreseen period. The segment is observing major growth due to the growing demand for expertise to simplify the complex AI models along with their deployment, management, and proper optimization. The implementation and integration services help to integrate new model optimization platforms with existing IT infrastructure without any additional costs.

Deployment Mode Insights

Which Deployment Segment Led the Model Optimization Platform Market in 2025?

The cloud-based segment led the market, accounting for a share of 62% in 2025. The segment also observes growth as it is a cost-effective and scalable method to train, deploy, and manage AI/ML models. The segment also contributes to the growth of the market with the help of public cloud and pay-as-you-go models. Higher usage of AI and ML in various domains also helps to fuel the growth of the market. Factors such as dynamic resource allocation, e-commerce growth, and seamless integration, leading to higher demand for the cloud-based segment, are another major factor fueling the growth of the market.

The hybrid deployment segment is observed to be the fastest-growing segment in the foreseen period due to higher demand for cloud scalability and on-premises security. The segment allows organizations to maintain the security of confidential data on-premises, along with leveraging the cloud-based models for training, testing, and validation. Increased adoption of hybrid deployment by enterprises also helps to fuel the growth of the model optimization platform market in the foreseeable period. Data security, government assistance, and cost management also encourage organizations to adopt hybrid deployment.

Optimization Technique Insights

How Did Quantization Lead the Market in 2025?

The quantization segment led the model optimization platform industry with a 26% share in 2025. The segment observes growth due to higher demand for AI deployment with onboard model quantization tools. The market also observes growth due to higher demand for low-latency, energy-efficient AI in IoT, edge computing, and ADAS. Post-Training Quantization (PTQ) and Quantization-Aware Training (QAT), which are helpful for speed and better accuracy, are also some of the major growth drivers of the market.

The compiler-based/graph optimization segment is observed to grow in the foreseen period due to the easy understanding provided by graph models for interconnected data. The segment also helps in easy understanding of complicated data, improving efficiency, and further fueling the growth of the model optimization platform market in the foreseeable period. Such models are ideal for fraud detection, risk analysis, mapping dependencies, and understanding network infrastructure. The graph-based methods also help in finding mutual connections and recommending the right ones, further propelling the growth of the market in the foreseeable period.

End-User Industry Insights

How Did the IT and Telecom Segment Lead the Market in 2025?

The IT and telecom segment dominated the model optimization platform industry with a 19% share in 2025 due to its higher demand to manage complex 5G networks, reduce operational costs, and enhance customer experience with the help of AI/ML. The hike in 5G deployment, IoT, and edge computing requires AI-driven and real-time analytics to maintain efficiency and avoid downtime, further fueling the growth of the market. Scalability and cost-efficiency are also some of the major factors driving the growth of the market.

The automotive and mobility segment is observed to be the fastest-growing segment in the foreseen period. The segment observes growth due to growing demand for software-defined vehicles, electric vehicles, and advanced driver assistance systems (ADAS). Technological features such as AI, ML, and simulation to enhance efficiency, productivity, design, and performance are another major factor fueling the growth of the market. Such factors also help to lower the production cost, further propelling the growth of the market. The segment also helps to simplify the complex, virtualized, and upgradable software architecture of modern vehicles, further aiding the growth of the market in the foreseen period.

Regional Insights

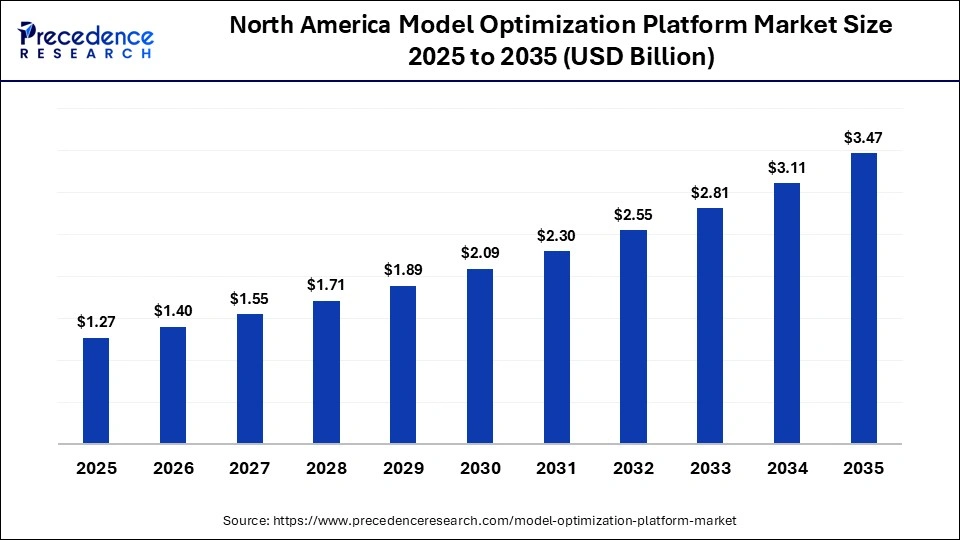

How Big is the North America Model Optimization Platform Market Size?

The North America model optimization platform market size is estimated at USD 1.27 billion in 2025 and is projected to reach approximately USD 3.47 billion by 2035, with a 10.57% CAGR from 2026 to 2035.

Why Did North America Dominate the Model Optimization Platform Market in 2025?

North America dominated the market by accounting for a share of 41% in 2025. The region dominated the market majorly due to factors such as early adoption of AI, robust cloud infrastructure, and higher demand for compliant ML models in domains such as BFSI and healthcare. Growing demand for accurate AI models, the rise of generative AI, and the necessity for managing model drift and compliance are other major factors fueling the growth of the market. Higher demand for scalable and flexible options, such as cloud-based deployment in the region, is another major factor helpful for the growth of the market.

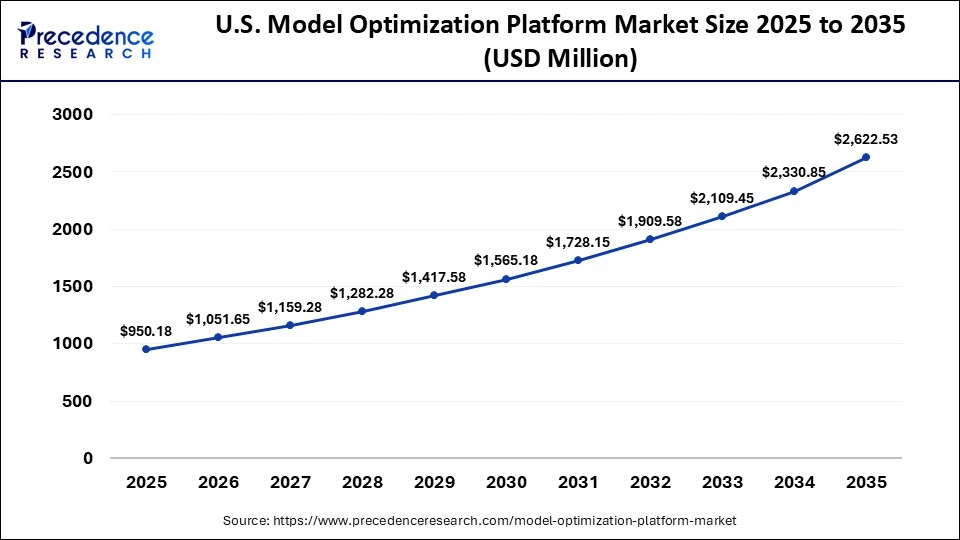

What is the Size of the U.S. Model Optimization Platform Market?

The U.S. model optimization platform market size is calculated at USD 950.18 million in 2025 and is expected to reach nearly USD 2,622.53 million in 2035, accelerating at a strong CAGR of 10.69% between 2026 and 2035.

US Model Optimization Platform Market Trends

The US has made a major contribution to the growth of the market due to supportive factors of the region, such as advanced tech infrastructure, major cloud providers (AWS, Google, and Microsoft), adoption in versatile domains, and demand for efficiency with large models. Technology, BFSI, healthcare, and manufacturing are some of the key domains adopting a model optimization platform in the region.

- For instance, in August 2025, CLIKA, an AI model optimization platform, announced that it attracted seed investment from global strategic investors from the US.

Which Factors Compel the Asia Pacific to Be the Fastest-Growing Region in the Foreseen Period?

Asia Pacific is observed to be the fastest-growing region of the model optimization platform market in the foreseeable period. The market growth is observed mainly due to factors such as widespread digital transformation, massive data generation, higher adoption of AI/ML in various domains, and other similar reasons. Public investment in domains such as AI research, infrastructure, and data frameworks also propels the growth of the market.

China Model Optimization Platform Industry Trends

China has a major contribution in the growth of the market in the foreseen period due to factors such as massive digital transformation, rising AI adoption, and high demand in various domains such as BFSI, healthcare, and manufacturing sectors. China also tops the list of innovation, vast production, and AI infrastructure investment, further fueling the growth of the market.

- For instance, in August 2025, DeepSeek, a Chinese artificial intelligence startup, released its flagship V3 model. The model has a feature that can optimize it for Chinese-made chips, with faster processing speeds, claimed by the company.

Who are the Major Players in the Global Model Optimization Platform Market?

The major players in the model optimization platform market include Google (Vertex AI & TensorFlow), Amazon (AWS SageMaker), Microsoft (Azure Machine Learning), IBM (watsonx.ai), NVIDIA (NeMo & AI Foundry), Snorkel AI, Multiverse Computing, Mistral AI, Fireworks AI, Entrans

Recent Developments in the Model Optimization Platform Market

- In October 2025, Mastercard introduced its service aimed at improving approval rates for merchants. The Payment Optimization Platform (POP) uses the data to make ideal decisions about transactions, as claimed by the company.(Source: https://www.pymnts.com)

- In June 2025, Expanso launched its platform to help enterprises save 40-80% on data infrastructure without any compromise in performance or security.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Component

- Software Platforms

- Model compression toolchains

- Optimization runtimes/inference engines

- Profiling & benchmarking suites

- Services

- Implementation & integration

- Managed optimization services

- Training & support

By Deployment Mode

- Cloud-based

- On-premise

- Hybrid Deployment

By Optimization Technique

- Quantization (INT8/FP8/INT4)

- Pruning & Sparsity Optimization

- Knowledge Distillation

- Compiler-based / Graph Optimization

- Other Optimization Techniques

By End-User Industry

- IT & Telecom

- BFSI

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Automotive & Mobility

- Media & Entertainment

- Government & Defense

- Other Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content