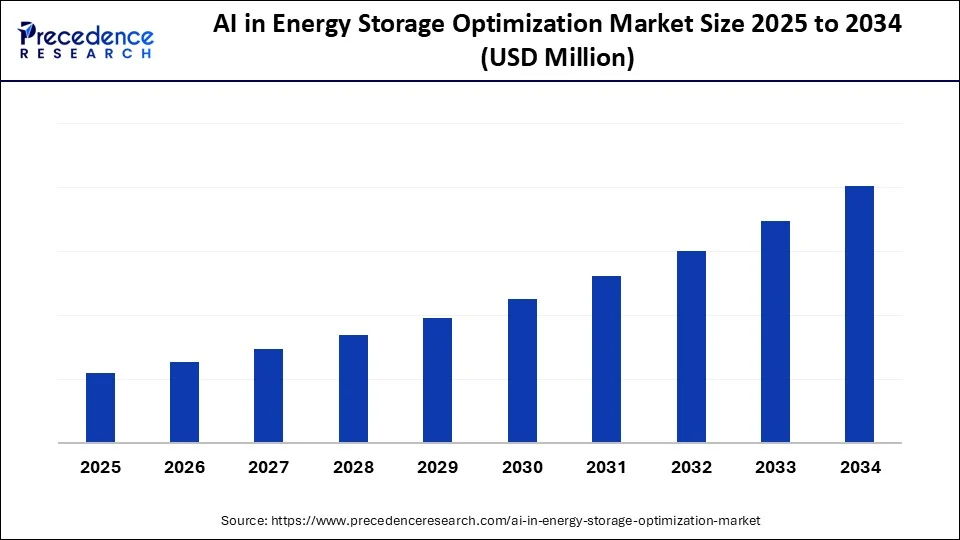

AI in Energy Storage Optimization Market Size and Forecast 2025 to 2034

The global AI in energy storage optimization market drives innovation in power management, enhancing battery performance, forecasting, and real-time energy control. The market is driven by renewable integration, smart grids, cost efficiency, predictive analytics, and enhanced energy management.

AI in Energy Storage Optimization MarketKey Takeaways

- Asia Pacific dominated the global AI in energy storage optimization market with the largest share of 40% in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By storage technology, the lithium-ion segment captured the biggest market share of 46% in 2024.

- By storage technology, the sodium-ion segment is anticipated to show considerable growth over the forecast period.

- By deployment topology, the front-of-the-meter (utility-scale) segment contributed the highest market share of 62% in 2024.

- By deployment topology, the EV charging hubs & depots segment is anticipated to show considerable growth over the forecast period.

- By control/integration layer, the site EMS/SCADA-level control segment held the maximum market share of 41% in 2024.

- By control/integration layer, the market/trading optimization layer segment is anticipated to show considerable growth over the forecast period.

- By computing architecture, the hybrid edge–cloud segment contributed the highest market share of 57% in 2024.

- By computing architecture, the edge-only control segment is anticipated to show considerable growth over the forecast period.

- By power/energy class, the 10–100 MW segment generated the major market share of 29% in 2024.

- By power/energy class, the >100 MW segment is anticipated to show considerable growth over the forecast period.

- By end-user, the manufacturing & process industries segment held the biggest market share of 26% revenue share in 2024.

- By end-user, the data centers segment is anticipated to show considerable growth over the forecast period.

Market Overview

The Artificial Intelligenceenergy storage optimization is changing the manner in which energy storage systems are controlled, implemented, and utilized within the power sector. Battery Management Systems (BMS), Energy Management Systems (EMS), and Supervisory Control and Data Acquisition (SCADA) platforms are also being incorporated with software- and firmware-based solutions which utilize machine learning, optimization methods, and advanced analytics. It is AI-based solutions that optimize the sizing, dispatch, trading, and maintenance of both front-of-the-meter and behind-the-meter storage assets.

AI-based predictive analytics increase the flexibility of the grid by predicting demand trends, renewable generation, and market prices, and as a result, optimize energy trading and dispatch. Also, the increased use of smart grids and microgrids has contributed to the demand for AI solutions that enhance the resilience and reliability of energy. Also, the increase in government funding for clean energy transition, combined with high emissions reduction goals, has seen utilities and energy providers invest in AI-controlled storage optimization technology. The market is also expanding with the development of new applications like charging infrastructure for electric vehicles and distributed energy resources.

What Factors Are Fueling the Rapid Expansion of the AI in Energy Storage Optimization Market?

- Incorporation of Renewable Energy: The increasingly high interest in solar and wind energy has generated intermittency and variability problems. These are solved using AI to predict the trends of the renewable generation and dispatch the storage to maximize it. This will ensure that the grid will be more stable, incorporate renewable energy, and maximize the use of clean energy.

- Smart Grids, Microgrids: There is a growing demand to optimize AI-enabled storage with the growth in smart grid and microgrid applications. AI assists real-time balancing of the energy, anticipating demand, and automated management of the decentralized networks.

- Electric automobile development: The rising popularity of EVs is pushing to incorporate AI into the processes of charging and discharging. The coordination of EV fleets and storage resources serves to enhance the efficiency of energy distribution of the AI, generate sources of revenue, and enhance the overall robustness of the charging infrastructure.

- Government Policies & Decarbonization Goals: Government assistance programs and climate targets are fostering the shift to the utilization of AI-driven optimization of energy storage. The renewable energy policy, grid modernization, and a carbon-neutral policy provoke the trend in the use of AI because the utilities and energy providers are interested in this trend and are investing in AI solutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Storage Technology, Deployment Topology, Control/Integration Layer, Computing Architecture, Power/Energy Class, End-User (BTM), and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Renewable Energy Integration

One of the main forces of the AI in energy storage optimization market is the growing pace of the adoption of renewable energy sources, especially solar and wind. Renewables, unlike traditional generation, are intermittent in nature, from which there is a huge variation in power supply, which may lead to grid instability. AI enhances grid reliability and makes use of renewable energy more efficient by enabling more accurate predictions and optimization of the balance between supply and demand. Besides, there is a need to keep the management smarter because the world governments are doing their best to achieve clean energy needs and carbon neutrality. AI-driven solutions provide intelligence to include larger volumes of renewables without compromising on stability, which benefits their status as a cornerstone technology in the evolving energy ecosystem.

Restraint

High Implementation Costs

A barrier to AI applications in the energy storage optimization market is the high implementation costs, even though it has monumental potential. The development of high-quality AI algorithms, their application to energy management systems, and their infrastructure are expensive to install. Also, organizations require qualified staff members who are learned in artificial intelligence, data analytics, and power systems to run and maintain such solutions. It is usually possible in large utilities and multinationals, but in small and mid-enterprises, the initial investment may be prohibitive. This is an economic barrier that slows penetration of the markets, particularly in developing economies, where the budget constraint is more prominent.

Opportunity

Smart Energy Optimization

The development of smart energy optimization systems can become one of the most promising opportunities in the AI in energy storage optimization market. The AI-based energy management systems represent a revolutionary solution because the process of changing charge and discharge cycles in real-time can be adapted to the current data, including weather forecasts, electricity demand, grid conditions, and market prices. These types of smart optimization do more than just enhance stability within the grid; they have economic benefits to utilities, businesses, and even consumers. With the rise of the cost and sustainability, as well as grid flexibility, the primary drivers of the market growth are smart energy optimization.

Storage Technology Insights

Why Did the Lithium-Ion Segment Dominate the AI in Energy Storage Optimization Market with a 46% Share in 2024?

The lithium-ion (LFP) segment led the market in 2024. Lithium iron phosphate batteries are popular in grid-scale storage and electric vehicle applications with the advantages of high safety, thermal stability, long cycle life, and cost benefits compared to other lithium chemistries. AI technologies are changing the management of LFP-based battery energy storage systems. Through advanced analytics and machine learning, AI-driven battery management systems (BMS) continuously monitor real-time operational data such as temperature, voltage, and charge-discharge cycles. In addition, AI is also use to enhance the lifecycle management through predicting failures and through the maximization of battery life and final efficiency, and profitability.

The sodium-ion segment is expected to grow at a significant CAGR over the forecast period, attributed to the fact that the world is seeking affordable and scalable solutions to lithium-ion technology. The natural abundance of sodium and affordable price make SIBs one of the most appealing large-scale grid storage types, especially in areas that have limited lithium supply chains. The key role of AI in the maximization of the SIB performance is during the entire life cycle, with the first place being in material discovery because machine learning improves the discovery of high-performance electrode and electrolyte materials. AI can help monitor in real-time and predictive maintenance, and integrate with intermittent renewable energy sources like wind and solar to make the systems more adaptable and efficient.

Deployment Topology Insights

What Factors Enabled the Front-of-the-Meter (Utility-Scale) Segment to Capture a 62% Revenue Share in 2024?

The front-of-the-meter (utility-scale) segment held aroun 62% market share in 2024. Lithium iron phosphate batteries are popular in grid-scale storage and electric vehicle applications with the advantages of high safety, thermal stability, long cycle life, and cost benefits compared to other lithium chemistries. The management of LFP-based battery energy storage systems (BESS) is changing with the use of AI technologies. Through advanced analytics and machine learning, AI-driven battery management systems (BMS) continuously monitor real-time operational data such as temperature, voltage, and charge-discharge cycles. In addition, AI is also used to enhance the lifecycle management through predicting failures and through the maximization of battery life and final efficiency, and profitability.

The EV charging hubs & depots segment is expected to grow substantially in the AI in energy storage optimization market, due to the fast electric vehicle adoption and the escalating demand for smart charging stations. Energy storage optimization with the help of AI also helps these hubs to complement electricity demand and supply using predictive analytics and dynamic algorithms. Through the help of renewable energy and battery energy storage systems (BESS), AI decreases the burden on peak power and lowers the price of electricity, and enhances the sustainability of the charge processes. AI may be employed to provide real-time load balancing among multiple users in case of public hubs, and in fleet depots, to effectively schedule and the optimization of the vehicles' availability.

Control/Integration Layer Insights

How Did the Site EMS/SCADA-Level Control Segment Lead the AI in Energy Storage Optimization Market in 2024?

The site EMS/SCADA-level control segment led the market in 2024. The AI is integrated to provide predictive and adaptive intelligence to the conventional Energy Management System (EMS) and Supervisory Control and Data Acquisition (SCADA) infrastructure. This enables active control and optimization of energy storage facilities, and sensitivity to generation, demand, and grid conditions. Controlling using AI ensures better load balancing, stops overloading of the system, and also optimizes the time of dispatching energy in the most cost-effective way. Moreover, AI-driven predictive maintenance increases the operational reliability and minimizes downtime, as well as increases the lifespan of batteries and other components. EMS/SCADA-level AI integration is emerging as a foundation of utility and commercial energy storage initiatives by enhancing the economic returns also the technical stability.

The market/trading optimization layer segment is expected to grow at a significant CAGR over the forecast period. Using predictive analytics and machine learning, AI algorithms predict electricity prices, renewable generation, and demand patterns to use their best trading and dispatch strategies. This enables the operators to seize revenue opportunities of energy arbitrage, frequency regulation, and grid services. Moreover, AI enables involvement in the demand response programs and virtual power plants (VPPs), which maximizes flexibility and economic returns. With the increasing dynamism of markets and penetration by renewables, the intelligence of multi-layered optimization will be very important.

Computing Architecture Insights

Why Did the Hybrid Edge–Cloud Segment Hold a 57% Share in the AI in Energy Storage Optimization Market in 2024?

The hybrid edge-cloud segment dominated the market and occupied a 57% share in 2024. The high-level analytics of cloud computing and the real-time responsiveness of edge computing. The edge AI-based control systems take real-time battery, renewable, and grid signal data and make charge-discharge cycle decisions and load balancing. The cloud also supports scale predictive analytics, scenario modeling, and long-term optimization plans, which require additional computing resources. It is a hybrid solution that balances between strategy and operational efficiency, and is effective in the management of smart grids that integrate variable renewable energy.

The edge-only control segment is expected to grow at a significant CAGR over the forecast period, as a result of the increasing use of microgrids and decentralized energy systems. Such a localized control is especially important in applications with very rapid response needs, like frequency regulation or peak load balancing of a grid with renewable energy sources in abundance. In addition to this, edge-only systems provide greater levels of data privacy and security as sensitive operational information is not required to be transferred to external cloud servers. They are also attractive to smaller operators, community energy projects, and new markets where powerful cloud infrastructure might not be a reality because they are scalable and cost-effective.

Power/Energy Class Insights

What Made the 10–100 MW Segment Lead the AI in Energy Storage Optimization Market in 2024?

The 10–100 MW segment held around 29% market share in 2024. Such power is also required for grid-scale energy storage projects, which could serve as balancing resources in renewable integration, peak shaving, or frequency regulation. The solutions in this group are AI-based and are based on machine learning and predictive analytics to anticipate energy demand, optimise charging and discharging cycles, and extend the battery life by detecting faults when they are still faults, before failure. These systems assist utilities and operators to maximize effectiveness without necessarily expending more than what is expended in higher-capacity systems. The use of AI in the 10-100 MW industry has continued to grow, as it represents the best compromise between cost and the size capable of impacting renewable-intensive grids.

The 100 MW segment is expected to grow substantially in the AI in energy storage optimization market, due to increased utility-scale needs necessary to stabilize more complex energy grids. AI and ML play a key role in optimizing such large-scale systems, running massive datasets to determine which charges and discharging schedules are most profitable and effective. These AI-controlled controls would change the storage system into a passive reserve asset into an active market participant that dynamically recognizes real-time energy prices, renewable output, and grid conditions. Also, AI improves system reliability through failure prediction, dispatch optimization, and coordination of distributed resources to aid long-duration grid stability. Further, as the levels of renewable integration grow, the >100 MW AI-optimized storage systems are set to become a key to decarbonization and energy security on a large scale.

End-User Insights

Why Did the Manufacturing & Process Industries Segment Dominate the Market?

The manufacturing & process industries segment led the market while holding around 26% share in 2024. These are very power-intensive industries, and the processes of production require stable and stable power. In this case of energy storage, AI can optimize energy storage by processing real-time data of industrial equipment, production cycles, and grid indicators to determine the energy requirement more accurately. The AI-based storage solutions will generate benefits by minimizing the cost of energy, decreasing downtimes, and improving the efficiency of operations. However, the complexity of industrial energy systems and sector-specific challenges, such as variable production cycles, necessitate highly customized AI models.

The data centers segment is expected to grow at a significant CAGR over the forecast period. The data centers are electricity guzzlers, and they mostly have difficulties with reliability, efficiency, and carbon minimization. AI-based energy storage can be used that utilizes predictive analytics and real-time monitoring capabilities to reduce power consumption, handle high-density loads, and lower operational expenses. AI also ensures a steady and low-latency power supply, which plays a crucial role in avoiding downtime in operations that involve a lot of time. As hyperscale and edge data centers continue to proliferate across the globe, the AI-based storage solutions will be at the core of sustainability.

Region Insights

Why is Asia Pacific Leading the AI in Energy Storage Optimization Market?

The Asia Pacific led the global market in 2024, making it the global leader in AI-based energy storage optimization. The increasing urbanization and industrialization accelerated by the fast change in the region towards the adoption of renewable energy have contributed to the increased demand for efficient and intelligent methods of storage. Applied to residential, business, and industry, AI is helping to achieve a balance between the evolving energy demands, grid stabilization, and cost reduction. The region also has favourable policies to promote clean energy and a declining price of solar, wind, and energy storage systems to boost growth in the region.

The large investments made in renewable energy and grid-scale storage projects are making China the most influential player in the Asia Pacific. Being the largest energy consumer in the world, China is confronted with a special challenge of grid stability, renewable intermittency, and soaring electricity demand. Also, the fact that China is a leader in the production of lithium-ion and sodium-ion batteries becomes even more decisive to the scaling of AI-enhanced solutions.

Why is North America Undergoing the Fastest Growth in the AI in Energy Storage Optimization Market?

North America is projected to experience the most rapid CAGR in the forecast period because of the transition towards the integration of renewable energy and grid modernization. It is proactively implementing AI-enabled optimization of grid-level storage to improve grid variability between wind and solar energy to form reliability and resilience. The favorable government policies, renewable energy mandates, and investments in smart grid infrastructure further accelerate adoption. It is presumed that North America will first invent AI in the optimization of storage to lead to efficient and sustainable energy systems, with the intensity of investments in energy technology startups and the novel R&D being significant.

The U.S. has been one of the first to develop AI-powered energy storage optimization in North America due to the proactive policy of clean energy transition and a well-developed technological ecosystem. It also has a high ranking in the sphere of cloud computing, AI research, and advanced analytics, which also contribute to increasing the scaling of such solutions in the country. With the movement to large utilities, data centers, and EV charging networks to transition to AI-informed storage solutions, the U.S. is leading the way to establish best practices on the global stage about smart, resilient, and low-carbon energy environments.

What Are the Key Trends Driving the European AI in Energy Storage Optimization Market?

The European AI in energy storage optimization market is expected to account for a substantial market share in 2024, as a result of the decarbonization and renewable integration targets. The transition to the consumption of wind, solar, and distributed energy resources in Europe is creating a strong demand for AI-based optimization of residential storage systems, as well as utility-scale storage systems. Further demand stimulation is the introduction of smart cities and EVs, along with energy trading solutions with high functionality. On the strengthening of a low-carbon, resilient energy future, Europe is a frontrunner in creating AI-enhanced storage technologies with robust policy and technological support.

Germany is central to the process of developing European AI in the energy storage optimization market. The intense dependence of the country on solar and wind generation has ensured that optimization of the storage is important in ensuring that the grid remains stable. AI-based systems are also finding application in residential and commercial storage to optimise the utilisation of renewable resources and minimise the use of fossil-based backup. Strong government subsidies, feed-in tariffs, and innovation funding further accelerate deployment. Also, the dominance of Germany in the auto and EV industry increases the demand for AI-based storage integration with charging infrastructure.

AI in Energy Storage Optimization Market Companies

- Tesla,

- Fluence,

- Wärtsilä,

- GE Vernova,

- Siemens,

- Schneider Electric,

- ABB,

- Honeywell,

- Panasonic Energy,

- LG Energy Solution,

- BYD,

- CATL,

- Sungrow,

- Huawei Digital Power,

- Hitachi Energy,

- Nidec ASI,

- Doosan GridTech,

- Powin,

- Saft (TotalEnergies),

- SolarEdge (incl. Kokam)

Recent Developments

- In August 2025, Gridmatic launched the AI Load Optimizer that enables large energy consumers to exploit advanced forecasting and automation in their tactical energy use. This enhances productivity, reduces expenses, and encourages smarter load management through AI in business and industry. (Source: https://www.businesswire.com)

- In May 2025, Solis announced two technology innovations: the largest wall-mounted hybrid inverter in the world and Solis AI, an artificial intelligence that optimizes solar energy. Intended to be used both at homes and businesses, these innovations will automate energy flows, optimize the use of solar, and create new benchmarks in the integration of solar-plus-storage technology. (Source: https://solarquarter.com)

- In March 2025, Zendure launched the first AI-powered balcony power plant solution, SolarFlow 800 Pro, and SolarFlow 2400 AC, a lightweight AC-coupled rooftop system. Both products act off AI to make the best of energy flows, enhance the use of renewable sources, and provide considerable cost efficiencies, which intensifies the Zendure role in the market of intelligent energy storage.(Source:https://www.prnewswire.com)

Market Segmentation

By Storage Technology

- Lithium-ion (NMC)

- Lithium-ion (LFP)

- Sodium-ion

- Vanadium Redox Flow

- Zinc-Bromine Flow

- Sodium–Sulfur (NaS)

- Lead–Carbon / Advanced Lead–Acid

- Flywheel

- Supercapacitor

- Compressed/Liquid Air (CAES/LAES)

- Thermal (Molten Salt/Phase-Change)

- Hybrid Battery–Supercapacitor

By Deployment Topology

- Front-of-the-Meter (Utility-Scale)

- Behind-the-Meter — Residential

- Behind-the-Meter — Commercial & Industrial

- Microgrids (Isolated/Campus/Community)

- EV Charging Hubs & Depots

By Control/Integration Layer

- BMS-Level Embedded Intelligence

- Site EMS/SCADA-Level Control

- Market/Trading Optimization Layer

- Fleet/VPP Aggregation Layer

By Computing Architecture

- Edge-Only Control

- Cloud-Only Optimization

- Hybrid Edge–Cloud

By Power/Energy Class

- <100 kW

- 100 kW–1 MW

- 1–10 MW

- 10–100 MW

- 100 MW

By End-User (BTM)

- Data Centers

- Manufacturing & Process Industries

- Commercial Buildings & Campuses

- Healthcare

- Retail & Warehousing/Logistics

- Telecom & Towers

- Mining & Oil & Gas

By Region

- North America

- Europe

- Asia–Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting