Modular Self-Contained Aisle and Racking Systems Market Size and Forecast 2025 to 2034

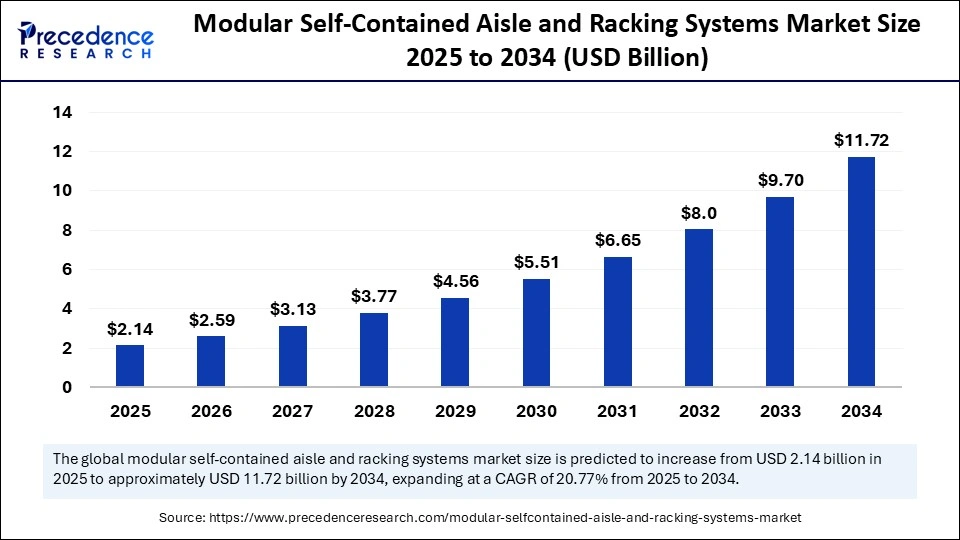

The global modular self-contained aisle and racking systems market size accounted for USD 1.78 billion in 2024 and is predicted to increase from USD 2.14 billion in 2025 to approximately USD11.72 billion by 2034, expanding at a CAGR of 20.77% from 2025 to 2034. The modular self-contained aisle and racking market is expanding rapidly, driven by growing data center demand, the need for energy-efficient infrastructure, and flexible, scalable storage and cooling solutions.

Modular Self-Contained Aisle and Racking Systems Market Key Takeaways

- In terms of revenue, the global modular self-contained aisle and racking systems market was valued at USD 1.78 billion in 2024.

- It is projected to reach USD 11.72 billion by 2034.

- The market is expected to grow at a CAGR of 20.77% from 2025 to 2034.

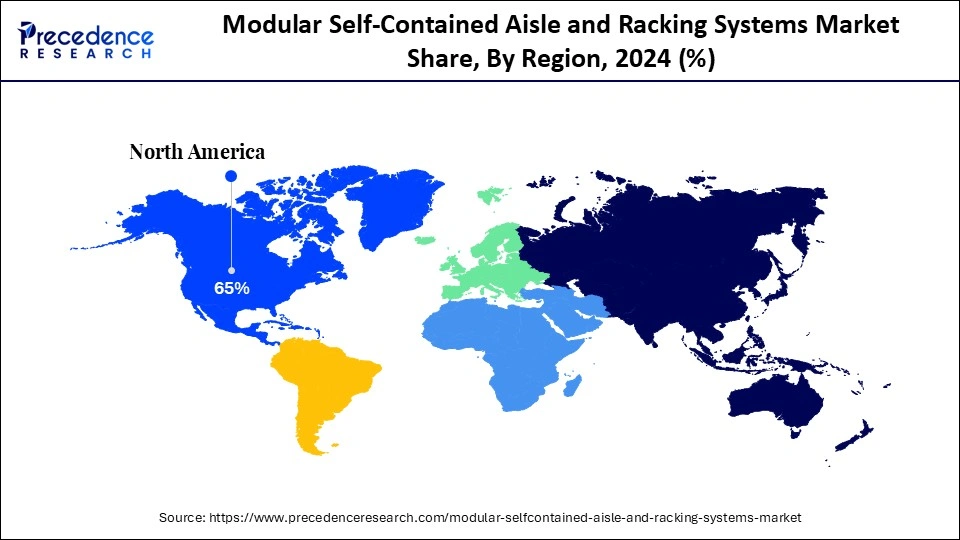

- North America dominated the modular self-contained aisle and racking systems market with the largest market share of 65% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR from 2025 and 2034.

- By system type, the modular warehouse racking segment held the biggest market share of 40% in 2024.

- By system type, the hot aisle containment systems segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By material, the steel segment captured the highest market share of 55% in 2024.

- By material, the composite materials segment is expected to expand at a notable CAGR over the projected period.

- By load capacity, the medium-duty systems segment contributed the maximum market share of 45% in 2024.

- By load capacity, the heavy-duty systems segment is expected to expand at a notable CAGR over the projected period.

- By application, the warehousing & logistics segment held the largest market share of 50% in 2024.

- By application, the data centers segment is expected to expand at a notable CAGR over the projected period.

- By end user, the e-commerce & retail segment accounted for the significant market share of 35% of market share in 2024.

- By end user, the data center operators segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the direct OEM sales segment generated the major market share of 60% in 2024.

- By distribution channel, the online sales platforms segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The Modular Self-Contained Aisle and Racking Systems Market refers to advanced, pre-engineered storage and aisle containment solutions widely used in data centers, warehouses, logistics hubs, retail distribution, and industrial facilities. These systems integrate modular racks, shelving units, and aisle containment enclosures to optimize space utilization, improve airflow (in data centers), enhance energy efficiency, and ensure better inventory management.

In warehouses, they provide flexible, scalable, and durable storage capacity, while in data centers, they help maintain controlled cooling and airflow within hot/cold aisles. Market growth is driven by the rise in e-commerce warehousing, automation, energy-efficient data centers, and Industry 4.0 logistics infrastructure.

AI-Enabled Innovations in Modular Self-Contained Aisle and Racking Systems

The rise of Artificial Intelligence (AI) as part of modular self-contained aisle and racking modules will change the face of warehouse operations by 2025. Companies are already building in the use of AI to drive new efficiencies, safety features, and adaptability into storage solutions.AI algorithms, for example, are being used to optimize stock placement by studying pick frequencies and relationships of items, resulting in reduced travel times and increased flow in aisle systems and operations. AI-based systems are enabling real-time stock counts, as well, putting an end to excessive manual stock counts and double-checking stock accuracy.

AI in modular racking systems is also starting to allow storage systems to better utilize space and provide optimal scalability to meet the volatility of demand and operational challenges. As AI continues to develop, its role in the revolution of modular aisle and racking systems will be increasingly important to the future of intelligent warehousing.

Modular Self-Contained Aisle and Racking Systems Market Growth Factors

- Data Center Growth: The rapid construction of hyperscale and colocation data centers is driving the uptake of modular aisle containment and racking systems, which enable efficient airflow management as well as scalability and optimization of existing infrastructure.

- Energy Efficiency Focus: The increase in energy prices, supply chain constraints, and sustainability efforts are forcing operators to invest in aisle containment systems, which lower cooling requirements, reduce power usage effectiveness (PUE), and support their green data center efforts.

- Flexible Infrastructure: Companies want scalable and modular solutions that can keep pace with fluctuating workloads and future technology integration, which makes a self-contained aisle and racking system ideal for flexibility and space optimization without significant effort to redesign.

- Increased IT Equipment Density: Increased rack power densities from AI, cloud, and HPC workloads are increasing the demand for advanced racking and containment solutions that improve thermal management, reduce hotspots, and support continuous and reliable IT operations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.72 Billion |

| Market Size in 2025 | USD 2.14 Billion |

| Market Size in 2024 | USD 1.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.77% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Material, Load Capacity, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is e-commerce growth driving modular self-contained aisle & racking systems?

A core driver in the modular self-contained aisle and racking systems market is the acceleration of the e-commerce and logistics sector globally. Today, companies are managing worldwide inventories and are required to find flexible storage solutions in an effort to allow for maximum space utilization and increase speed in order to fulfill orders. For example, in August 2025, Amazon announced 12 fulfillment centers and six sort centers in India. This indicates a rising trend within e-commerce aimed at creating advanced organizational mechanisms with the use of racking and modular aisle systems. (Source: https://www.itln.in)

E-commerce companies and logistics organizations have invested in self-contained solutions that reduce downtime and adapt to new layouts. Also, since food services and other consumer goods must be stored at a relevant temperature, the increased need for cold chain logistics adds to the growth rate of modular aisle and racking systems. This trend easily distinguishes modular aisle and racking systems' levels of storage as underpinning infrastructure for modern supply chains.

Restraint

Do high setup costs limit the growth of modular self-contained aisle & racking systems?

The key impediment to broader adoption is the high upfront cost of installation and customization. Unlike traditional shelving, module self-contained aisle and racking systems usually involve precision engineering, specialized materials, and skilled labor during setup. This is making investment especially daunting for small and mid-sized warehouses.

Because of installation costs and ongoing service costs, many companies, especially those in emerging markets, end up postponing or limiting their adoption of modular self-contained aisle and racking systems, despite the known efficiencies and space saving; for instance, pallet racking saves far more space than traditional shelving.

Opportunity

How is sustainability developing new pathways for modular self-contained aisle & racking systems?

Sustainability is becoming a very important opportunity factor for the market for modular self-contained aisle and racking systems. Warehouses and data centers are under pressure to act to reduce carbon footprints, reduce energy consumption, and achieve credible green building certification. In January 2025, Airsys, a leading provider of innovative cooling solutions, launched UniCool Edge, the Horizontal Airflow Cooling System designed specifically for Edge Data Centres and modular server environments. (Source: https://digitalinfranetwork.com)

Sustainable modular aisle and racking system designs are permitting facility operators to increase life cycles, better re-purpose assets, and decrease overall operating costs. With the increase in major multinational companies forced to adopt green logistics and infrastructure operational strategies, more and more are seeking modular racking solutions in alignment with ESG objectives.

System Type Insight

Why Does Modular Warehouse Racking Have the Largest Share of the Modular Self-Contained Aisle and Racking Systems Market?

The modular racking system segment dominates the modular self-contained aisle and racking systems market in 2024, as they are used by the majority of warehousing and logistics facilities. Their versatility, space conservation, and ability to carry medium-duty load requirements make them a highly desirable option for retail, e-commerce, and third-party logistics firms.

Conversely, the hot aisle containment systems segment comprises the fastest-growing segment of the market, primarily due to continued rapid data center growth spurred by the demand for energy-efficient cooling and increased server density. The operators of these facilities have started to utilize containment solutions to preserve efficient airflow and achieve ongoing operational cost-saving benefits.

Material Insights

Which Material Dominated the Modular Self-Contained Aisle and Racking Systems Market in 2024?

The steel segment captured approximately 55% market share because of its attributes of durability, weight capacity, and overall low cost. Steel has proven to be highly efficient and stable, and is widely used as a practical material of choice for industries and commercial environments with great daily workloads to support inventory management.

On the other hand, the composite materials segment will grow the fastest, as industries continue to require lighter options, flexibility, and corrosion-resistant properties in their support structures. These materials offer simple installation, adaptability to new configurations, and extended lifecycle performance, and because of this, they are becoming more desirable for data centers and specialized logistics use as facilities become more technologically enhanced.

Load Capacity Insights

Why do Medium-Duty Systems Dominate the Modular Self-Contained Aisle and Racking Systems Market?

The medium-duty systems segment is the largest market in terms of capacity for modular self-contained aisle and racking systems. They are a strong, cost-effective option and are common in warehouses, retail locations, and e-commerce fulfillment centers, environments where the goods may not be excessively heavy, but the requirements require a quick retrieval and flexible storage layouts.

The heavy-duty systems segment is expected to be the fastest-growing segment due to the need for bulk goods, oversized items, and high-density storage. Most of this growth will be derived from industries that demand consumer products, automotive, and data storage with bulk storage needs, with a stronger demand for high-capacity and scalable space. Many of the use cases are particularly difficult and require strong infrastructure.

Application Insights

How Warehousing and Logistics Dominate the Modular Self-Contained Aisle and Racking Systems Market?

The rehousing & logistics segment leads all application sectors for modular self-contained aisle and racking systems. E-commerce, global trade transactions, and the need for increased storage solutions at the warehouse level have bolstered this sector in the modular self-contained aisle and racking systems market. Modular self-contained aisle and racking systems can provide better inventory management, greater space utilization, and increased supply chain performance and efficiency. This application sector will continue as a necessity in distribution hubs and retail storage facilities where significant product volumes are processed regularly.

The data centers segment shows the greatest growth as an application area. The trend toward greater digitalization and cloud adoption is driving demand for more advanced racking and aisle containment solutions from vendors. As companies spend large amounts of money on modernizing IT infrastructure, data centers are increasingly relying on modular systems to provide maximized scale, energy efficiency, and zero downtime.

End User Insights

Which End-User Dominates the Modular Self-Contained Aisle and Racking Systems Market in 2024?

The e-commerce & retail segment is leading the modular self-contained aisle and racking system market, with the rise of online shopping and omnichannel retailing. E-commerce and retail depend on efficient, flexible, and scalable storage solutions that help manage inventory and fast-moving product lines, often requiring diverse inventories. With modular racking systems, warehouses can tailor their layouts to optimize storage capacity, improve order fulfilment time, and enhance supply chain responsiveness.

The data center operators segment is the fastest-growing end user within the modular self-contained aisle and racking market, inspired by the growth of digital infrastructure and cloud-based consumption. Data center operators are adopting modular containment and racking systems to facilitate high-density servers, enhance cooling efficiency, and realize uptime dependability. Increased spending in hyperscale and colocation facilities is also accelerating the take-up of these products within the data center industry.

Distribution Channel Insights

Why is a Direct OEM sale Platform the Most Common Distribution Channel in the Modular Self-Contained Aisle and Racking Systems Market?

The direct OEM sales segment dominated the modular self-contained aisle and racking systems market in the distribution channel segment because companies want the direct relationship with manufacturers of typically custom solutions, quality assurance, and consistency across large project implementations. There is always strong after-sales support, custom system design, and long-term performance expectations with the direct OEM channel of sales. The direct OEM is highly sought after in warehousing, logistics, and retail customers with complex infrastructure needs.

The online sales platforms segment is expected to expand at a notable CAGR due to ease of shipping, faster product availability, and pricing transparency. Businesses will increasingly rely on digital platforms to be able to source modular coverage, make easier comparisons upon purchasing, and have scalable procurement processes. This report recognizes the trend, particularly from SMEs and data center operators, who prefer the efficient, quick, and easy procuring of modular racking and containment systems without getting into long negotiation cycles.

U.S. Modular Self-Contained Aisle and Racking Systems Market Size and Growth 2025 to 2034

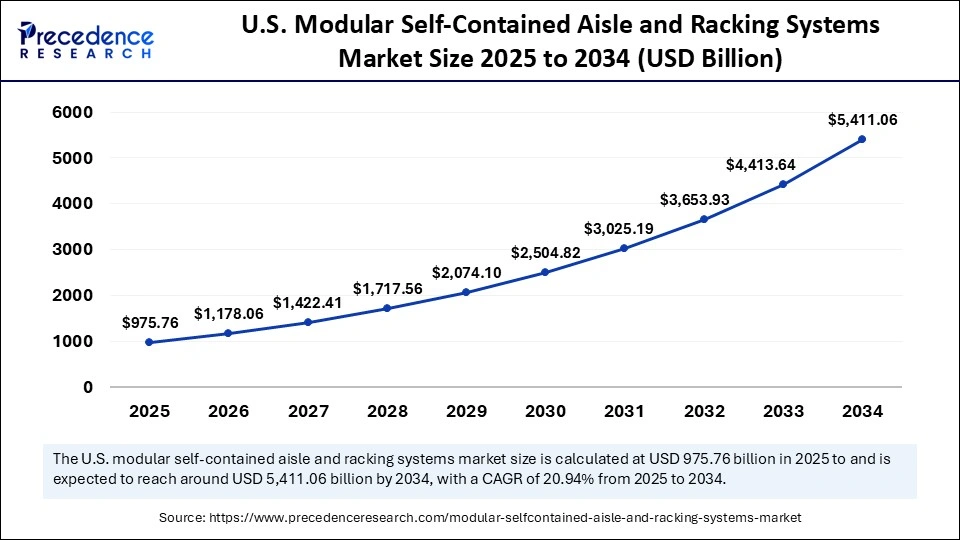

The U.S. modular self-contained aisle and racking systems market size was evaluated at USD 808.25 million in 2024 and is projected to be worth around USD 5,411.06 million by 2034, growing at a CAGR of 20.94% from 2025 to 2034.

Why is North America Dominating the Modular Self-Contained Aisle and Racking Systems Market?

North America is dominating the modular self-contained aisle and racking systems market due to its advanced infrastructure, technological advancements, and well-established logistics industry. The focus in the region on automation and efficient warehouse solutions has encouraged the use of modular racking systems to improve space utilization and operational efficiency. Industries including e-commerce, retail, and manufacturing are allocating more budget for storage solutions that can scale and are able to keep pace with demand.

The United States is at the forefront of the modular self-contained aisle and racking systems market, with a major share attributed to the size of its e-commerce market and advanced manufacturing capabilities. Increased demand for efficient warehousing solutions leads to a boom in modular racking and storage systems, namely at distribution centers and fulfillment centers. Companies in these sectors are seeking to save and improve storage space and inventory visibility, thus developing further demand for modular racking solutions.

Why is Asia Pacific the Growing Modular Self-Contained Aisle and Racking Systems Market?

The rapid growth that is happening in Asia Pacific can largely be attributed to a combination of industrialization, urbanization, and growth in e-commerce. The strong investments in smart warehousing and automation are driving forward the adoption of modular racking systems at an accelerated pace. Initiatives taken by governments to support logistics infrastructure and the modernisation of supply chains are also contributing to the growth of the market across the region.

China comparatively is leading the fastest-growing market in the Asia Pacific region as its large manufacturing and retail industries have a heightened demand for effective storage solutions, and a greater focus on automated logistics, modern warehouses, and infrastructure will see China become a critical region for the growth of modular racking systems in the Asia Pacific market.

Modular Self-Contained Aisle and Racking Systems Market Companies

- Vertiv Group Corp.

- Schneider Electric SE

- Eaton Corporation plc

- Stulz GmbH

- Panduit Corp.

- Rittal GmbH & Co. KG

- Daikin Applied (Data Center Containment)

- Dexion (Constructor Group AS)

- Mecalux, S.A.

- SSI Schäfer Group

- Dematic (KION Group)

- Interroll Holding AG

- Kardex Holding AG

- Montel Inc.

- Ridg-U-Rak, Inc.

- AR Racking

- Nedcon B.V.

- Steel King Industries, Inc.

- Hannibal Industries, Inc.

- Knapp AG

Latest statements and investments by major players

- June 2025 – Schneider Electric introduced scalable, data-validated white space solutions evolving its EcoStruxure™ Data Center Solutions portfolio, designed for modern data centers, enhancing efficiency and sustainability in edge and hyperscale environments.(Source: https://www.webwire.com)

- In August 2024, Tobin Scientific launches a 40,000 sq. ft. cGMP-compliant facility in Wilmington, featuring dual -20°C chambers and high-density racking to meet increasing demand for temperature-controlled storage.(Source: https://www.ssi-schaefer.com)

Segments Covered in the Report

By System Type

- Hot Aisle Containment Systems (Data Centers)

- Cold Aisle Containment Systems (Data Centers)

- Modular Warehouse Racking Systems

- Pallet Racking Systems

- Cantilever & Mobile Racking Systems

- Automated & Smart Racking Systems

- Hybrid/Custom Aisle Containment & Storage Solutions

By Material

- Steel

- Aluminium

- Composite Materials

- High-Performance Plastics

- Hybrid/Custom Materials

By Load Capacity

- Light-Duty Systems

- Medium-Duty Systems

- Heavy-Duty Systems

By Application

- Data Centers (Cooling Efficiency & Containment)

- Warehousing & Logistics (Inventory Storage)

- Retail Distribution Centers

- Manufacturing & Industrial Facilities

- Cold Storage & Food Distribution

- Pharmaceuticals & Healthcare Storage

By End User

- E-commerce & Retail Companies

- 3PL (Third-Party Logistics) Providers

- Data Center Operators & Cloud Providers

- Manufacturing Enterprises

- Healthcare & Pharma Companies

- Government & Defense Facilities

By Distribution Channel

- Direct OEM Sales

- Distributors & Integrators

- Online Sales Platforms

- EPC Contractors & Facility Management Providers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting