Natural Menthol Crystals Market Size and Forecast 2025 to 2034

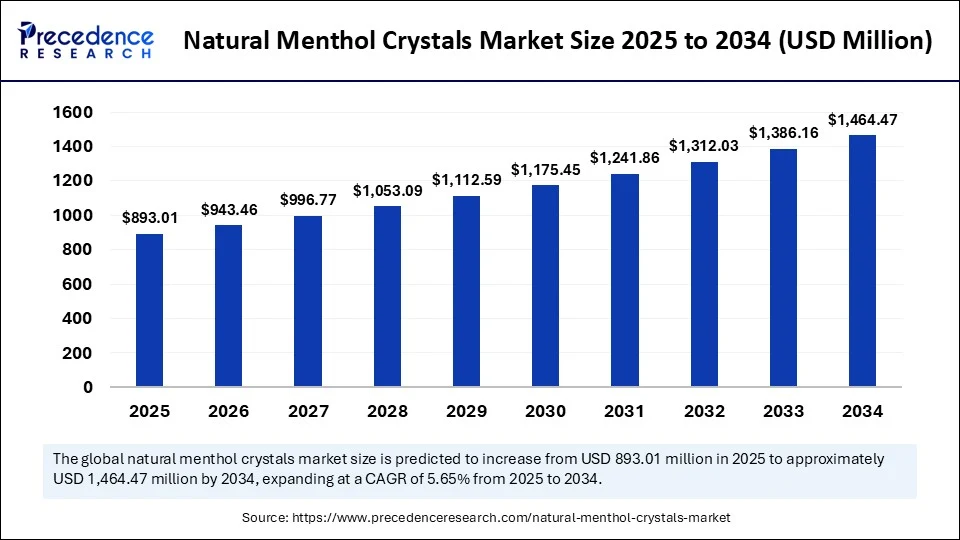

The global natural menthol crystals market size accounted for USD 845.25 million in 2024 and is predicted to increase from USD 893.01 million in 2025 to approximately USD 1,464.47 million by 2034, expanding at a CAGR of 5.65% from 2025 to 2034. The market has been witnessing robust growth due to rising demand for organic ingredients and natural health remedies worldwide.

Natural Menthol Crystals MarketKey Takeaways

- The global natural menthol crystals market was valued at USD 845.25 million in 2024.

- It is projected to reach USD 1464.47 million by 2034.

- The market is expected to grow at a CAGR of 5.65% from 2025 to 2034.

- Asia Pacific dominated the natural menthol crystals market in 2024.

- North America is expected to witness the fastest growth between 2025 and 2034.

- By source, the peppermint segment led the market in 2024.

- By purity, the 99% segment held the biggest market share in 2024.

- By application, the food & beverages segment captured the highest market share 2024.

- By distribution channel, the online stores segment generated the major market share in 2024.

How is AI reshaping the natural menthol crystal market?

Artificial Intelligence (AI) is reshaping the natural menthol crystals market by advancing demand forecasting, streamlining supply chain management, and optimizing extraction processes. AI-driven tools are now enabling manufacturers to analyze crop yields, predict peppermint oil availability, and regulate menthol extraction efficiency based on real-time climatic and geographic data. Additionally, AI-powered consumer behavior analytics are helping companies identify new application trends, especially in the personal care and wellness sectors, thereby creating precision-targeted product strategies. The use of robotics and AI-based monitoring in production facilities also enhances quality control, reducing contamination and maintaining crystal purity standards consistently across batches.

Market Overview

Natural menthol crystals are valued for their cooling properties. They are used extensively in pharmaceuticals, personal care, and food industries. The natural menthol crystals market is witnessing notable growth, driven by a diverse range of applications across therapeutic, cosmetic, and oral hygiene sectors. This surge is largely due to a rising consumer preference for natural and organic alternatives, positioning natural menthol crystals as a key ingredient in a variety of products, including vapor rubs, mouth fresheners, cooling gels, and herbal teas.

The extensive cultivation of peppermint happens in countries such as India and China, where favorable agricultural conditions contribute to high production rates. In addition, advancements in extraction techniques, which are increasingly supported by artificial intelligence and environmentally friendly methods, are enhancing the sustainability of menthol production. These innovations not only cater to the growing consumer demand for high-quality menthol but also align with the broader trend toward eco-conscious manufacturing practices. The forecast for the menthol crystals market indicates steady growth, bolstered by a wellness movement and a global inclination towards clean-label ingredients, which emphasize transparency and simplicity in product formulations.

Key Market Trends

- Shift Toward Natural and Organic Products: Consumers are increasingly favoring natural and chemical-free ingredients in their personal care, pharmaceutical, and food products. Menthol crystals, derived from peppermint or corn mint oil, meet the increased demand for clean-label and plant-based solutions. This trend is particularly witnessed in Europe and North America, where regulatory pressures and health-conscious lifestyles are driving demand.

- Ayurveda and Herbal Medicine on the Rise: The resurgence of traditional medicine systems like Ayurveda, Unani, and Traditional Chinese Medicine (TCM) is fueling menthol usage in balms, inhalers, and oils. Herbal formulations using menthol for its cooling, anti-inflammatory, and analgesic properties are gaining popularity, especially in India and Southeast Asia.

- Surge in Demand for Cooling Sensory Effects: Menthol's unique ability to stimulate cold receptors without lowering temperature has made it a favorite in oral care (toothpastes, mouthwashes), shaving gels, and even confectioneries. Brands are leveraging this sensory effect to create distinctive experiences, which helps in product differentiation.

- Technology Integration and AI-Driven Optimization: Manufacturers are increasingly adopting AI and IoT technologies to monitor crop health, optimize yield from peppermint oil, and control crystallization processes for consistent quality. Predictive analytics are helping in demand planning, while machine learning enhances product development based on consumer preferences.

- Expanding Application Across Diverse Industries: While pharmaceuticals and personal care dominate, menthol crystals are seeing expanding applications in flavoring agents, aromatherapy, tobacco substitutes, and even in the pet care and textile industries for cooling properties. This cross-industry appeal is boosting global market penetration.

- Climate Impact on Peppermint Cultivation: Volatility in weather patterns is affecting peppermint and cornmint crop yields, making supply chains unstable. As a result, companies are investing in climate-resilient farming and contract-based farming models to ensure consistent menthol oil sourcing.

- Emergence of Synthetic Alternatives: While natural menthol remains dominant, synthetic menthol derived from petroleum-based compounds is entering the market as a cost-effective alternative. However, regulatory and consumer preference for natural sources is keeping synthetic growth in check for now.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,464.47 Million |

| Market Size in 2025 | USD 893.01 Million |

| Market Size in 2024 | USD 845.25 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Application, Purity, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Plant-Based Wellness Products

The surging global preference for natural, plant-derived ingredients is a primary driver fueling the growth of the natural menthol crystals market. Consumers are increasingly cautious about the synthetic components in personal care, healthcare, and food products, shifting towards eco-friendly, herbal alternatives. Natural menthol crystals, known for their cooling, anti-inflammatory, and antimicrobial properties, are gaining popularity in topical analgesics, vapor rubs, toothpaste, and even beverages. In parallel, pharmaceutical companies are expanding menthol's use in decongestants and cold-relief products, especially as respiratory health awareness spikes post-pandemic. This health-and-wellness-driven movement is significantly boosting market traction.

Restraint

Supply Chain Instability

One of the significant factors affecting the growth of the natural menthol crystals market is the volatility in the supply of raw materials, primarily peppermint and corn mint oil. Fluctuating climatic conditions, dependency on seasonal crops, and fragmented agricultural practices can disrupt the production chain, leading to inconsistent pricing and quality. Moreover, the rising availability of synthetic menthol at a lower cost is posing a threat to natural menthol manufacturers, especially in price-sensitive markets. Regulatory challenges concerning the use of menthol in tobacco products and increasing scrutiny on essential oil sourcing practices further add to market pressure.

Opportunity

Untapped Global Markets and Product Innovation

Emerging markets in Latin America, Africa, and Southeast Asia present vast untapped potential for menthol crystal applications across pharmaceuticals, personal care, and functional foods. With increasing disposable income, urbanization, and growing awareness of natural remedies in these regions, menthol-based products are poised to gain a wider consumer base. Additionally, product innovations such as menthol-infused textiles, wellness teas, organic cosmetics, and vegan aromatherapy oils are unlocking niche yet high-growth segments. Strategic partnerships between local growers and global manufacturers can further expand market reach while ensuring sustainable sourcing and traceability.

Source Insights

Why Did the Peppermint Segment Dominate the Natural Menthol Crystal Market in 2024?

The peppermint segment dominated the market with the largest share in 2024. This is mainly due to its high menthol content, making it a preferred choice for natural extraction processes. Known for its distinctive aroma, purity, and therapeutic properties, peppermint-derived menthol is widely used across the pharmaceutical, food, and personal care industries, and parts of some countries cultivate high-grade peppermint specifically for essential oil and menthol extraction.

It is preferred for premium-grade products due to its consistent oil yield, superior quality, and pleasant cooling effect. Moreover, Peppermint's deep-rooted historical association with traditional medicine and its GRAS status further solidify its dominance in both regulated and wellness-driven markets. The segment also benefits from well-developed agricultural practices, supply chain infrastructure, and R&D-backed cultivation techniques, making it a reliable and scalable source for commercial menthol crystal production.

On the other hand, the cornmint segment is expected to grow at a significant CAGR in the coming years. This is mainly due to its extremely high menthol content and cost-effectiveness. Unlike peppermint, corn mint is more resilient to climatic variations, has a shorter cultivation cycle, and offers higher oil yield per hectare, making it highly economical for large-scale farming. Its rapid growth in rural economies, combined with low input costs, makes it ideal for producing menthol at a competitive price. With growing demand in emerging markets and the surge in menthol-based applications, especially in personal care and OTC pharmaceuticals, corn mint is increasingly being used for bulk production. Technological advancements in fractional distillation and purity refinement help to improve the quality of menthol crystals, supporting segmental growth.

Application Insights

What Made Food & Beverages the Dominant Segment in the Market?

The food & beverages segment dominated the natural menthol crystal market in 2024 due to the increased adoption of mint as a flavor. Food and beverage manufacturers are major consumers of menthol crystals, owing to their natural cooling flavor, refreshing aroma, and GRAS Generally Recognized As Safe status by regulatory bodies. Menthol is widely used in chewing gums, mints, lozenges, candies, desserts, and even beverages like herbal teas and flavored water. With a rising demand for sugar-free, natural flavorings, menthol provides an ideal solution due to its minimal caloric content and plant-based origin.

Global health trends and consumer preference for natural, clean-label products have reinforced menthol's role as a functional ingredient. Additionally, manufacturers are now integrating menthol into innovative culinary experiences, like artisanal ice creams and exotic mocktails, further fueling the demand. The F&B sector's massive scale and growing flavor make this segment the most dominant.

Meanwhile, the personal care segment is expected to expand at a significant rate during the forecast period as consumers are increasingly seeking cooling, soothing, and refreshing effects in products like facial cleansers, shaving gels, lip balms, shampoos, foot scrubs, and after-sun lotions. Menthol offers anti-itching, anti-irritant, and vasoconstrictive properties that make it perfect for sensitive skin formulations and dermatological products. Menthol is being used as both an active and aromatic agent. It helps elevate the sensory experience of personal care routines, especially in spa and aromatherapy products. With increasing interest in gender-neutral and multifunctional grooming essentials, menthol crystals are being added across diverse product lines, making this the fastest-growing segment.

Purity Insights

How Does the 99% Segment Dominate the Market in 2024?

The 99% segment dominated the natural menthol crystals market in 2024. This is mainly due to the versatility, affordability, and broad-spectrum applicability of menthol crystals with 99% purity. This grade strikes the right balance between performance and cost, making it highly popular in mass-market applications such as toothpaste, mouth fresheners, ointments, vapor rubs, and flavoring agents. Manufacturers prefer 99% purity due to its stable melting point, strong menthol aroma, and effectiveness at low dosages. It caters to both pharma and FMCG industries without the premium cost associated with ultra-pure menthol. The consistency and regulatory acceptability of this grade cement its dominance in global trade and manufacturing.

On the other hand, the 99.5% purity segment is expected to grow at a rapid pace during the projection period due to the rising usage in high-end pharmaceutical, cosmetic, and aromatherapy applications where exceptional purity and safety are paramount. Menthol crystals with 99.5% purity are often used in critical formulations such as nasal sprays, advanced topical treatments, and certified organic beauty products. The rise in demand for premium and clinical-grade ingredients is pushing this segment's growth. With increasing regulations about product transparency and purity standards, manufacturers are moving toward 99.5% menthol to comply with stringent quality benchmarks.

Distribution Channel Insights

How Does the Online Stores Segment Dominate the Natural Menthol Crystals Market?

The online stores segment dominated the market in 2024 due to ease of accessibility, global reach, and availability of product variety. From industrial bulk orders to DIY kits for aromatherapy or herbal cosmetics, e-commerce platforms offer both B2B and B2C buyers unmatched convenience. Online retail supports niche markets and small businesses that rely on menthol for artisanal or specialized production. Additionally, digital transparency, reviews, and certifications help buyers ensure product quality. The pandemic accelerated the digital shift, with buyers opting for safer, contactless procurement. Online platforms also allow direct-from-manufacturer models, which offer competitive pricing and traceability.

On the other hand, the supermarkets/hypermarkets segment is expected to expand at a significant rate in the upcoming period. This is mainly due to the availability of products from multiple brands at these stores. The visibility and accessibility of these large retail formats have driven impulse and planned purchases alike, especially for over-the-counter (OTC) products and natural personal care items. As consumers increasingly seek wellness on the go, supermarkets provide an ideal platform to explore and pick up menthol-infused products.

Regional Analysis

What Factors Contribute to Asia Pacific's Dominance in the Natural Menthol Crystals Market?

Asia Pacific dominated the market by capturing the largest share in 2024 and is expected to continue its upward trajectory in the global menthol crystals market, both in terms of production and consumption. Countries like India and China are the largest cultivators of peppermint and corn mint, the primary sources of natural menthol. India alone contributes to over 75% of the world's menthol crystal exports, owing to favorable agro-climatic conditions and a well-established extraction industry in states like Uttar Pradesh and Punjab. The region's dominance is further supported by a strong demand for menthol crystals from the pharmaceutical and personal care sectors, alongside traditional medicine systems such as Ayurveda and Traditional Chinese Medicine (TCM). The increased consumer awareness of herbal products and supportive government policies for organic farming and essential oil exports make Asia-Pacific the epicenter of menthol-based innovation and supply.

What are the Major Trends in the North American Natural Menthol Crystal Market?

North America is emerging as the fastest-growing region in the market, driven by the rising demand for natural ingredients in health and wellness products. The strong consumer shift toward clean-label cosmetics, herbal supplements, organic confectionery, and aromatherapy has fueled demand for menthol-infused solutions. In addition, the thriving vaping and alternative tobacco segment has created a new avenue for menthol applications, albeit under regulatory observation. Advanced R&D infrastructure and the adoption of AI-driven predictive analytics in sourcing and distribution are further accelerating growth. Major FMCG and pharmaceutical companies are also investing in sustainable and traceable menthol supply chains, supporting regional market growth.

What Opportunities Exist in the Natural Menthol Crystals Market Within Europe?

Europe is expected to grow at a notable rate in the upcoming period due to its environmentally conscious and health-aware consumers. Countries like Germany, France, and the UK are showing growing interest in vegan cosmetics, herbal cough remedies, and mentholated skincare products. The region's strict regulatory environment ensures that only the highest quality and ethically sourced menthol crystals enter the market, prompting suppliers to adhere to organic and sustainable sourcing standards. Additionally, menthol is being increasingly used in pharma-grade applications and functional foods due to its perceived therapeutic benefits. While the growth rate is modest compared to Asia and North America, Europe is setting the standard for responsible and premium consumption of menthol-based products.

Natural Menthol Crystals Market Companies

- BASF SE

- Symrise AG

- Arora Aromatics Pvt. Ltd.

- Fengle Perfume Co., Ltd.

- Takasago International Corporation

- Agson Global Pvt. Ltd.

- Silverline Chemicals Ltd.

- Nectar Lifesciences Ltd.

- Bhagat Aromatics Ltd.

- KM Chemicals

- AOS Products Pvt. Ltd.

- Mentha & Allied Products Ltd.

- Vinayak Ingredients (India) Pvt. Ltd.

- Nippon Terpene Chemicals, Inc.

- Shree Bankey Behari Lal Aromatics

- Kraton Corporation

- Arora Aromatics

- Swati Menthol & Allied Chemicals Ltd.

- Neeru Enterprises

- Hindustan Mint & Agro Products Pvt. Ltd.

Recent Development

- In December 2024, Colgate introduced a sensory experience in oral care with the launch of a new MaxFresh range that seamlessly blends its refreshing power with fun, flavor, and aesthetics. For the first time, the MaxFresh range debuts its iconic cooling crystals in heart shapes, offering a unique visual experience paired with fruity flavors.

(Source: https://www.aninews.in) - In June 2025, acting on an intelligence tip, the Drugs Control Administration (DCA) in Karimnagar conducted a raid on PLN Pharma Distributors last Sunday and confiscated stocks of MediSkin Medicated Soap by Dr. Ethix. This soap contains a banned combination of permethrin, cetrimide, and menthol.

(source: https://health.economictimes.indiatimes.com)

Segments Covered in the Report

By Source

- Peppermint

- Cornmint

- Others

By Application

- Pharmaceuticals

- Food & Beverages

- Personal Care

- Others

By Purity

- 99%

- 99.5%

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting