What is the Network Analytics Market Size?

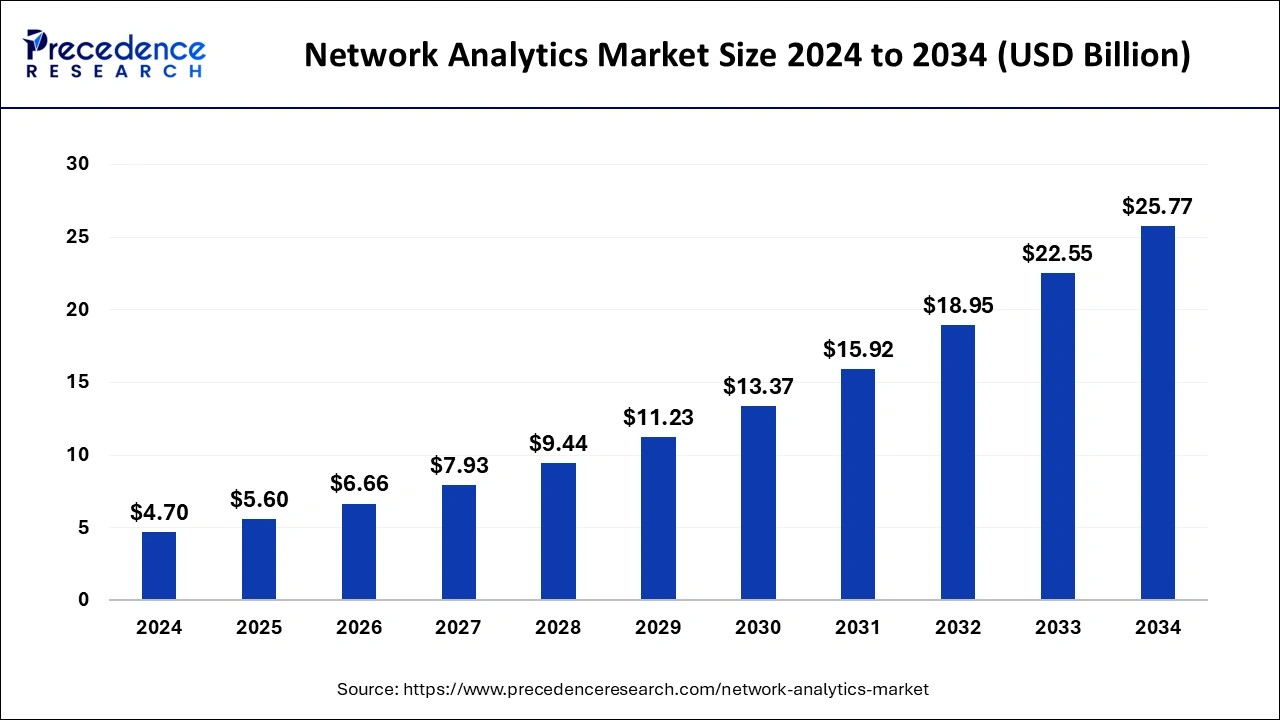

The global network analytics market size is valued at USD 5.60 billion in 2025 and is predicted to increase from USD 6.66 billion in 2026 to approximately USD 25.77 billion by 2034, expanding at a CAGR of 18.55% from 2025 to 2034.

Network Analytics MarketKey Takeaways

- The global network analytics market was valued at USD 4.70 billion in 2024.

- It is projected to reach USD 25.77 billion by 2034.

- The network analytics market is expected to grow at a CAGR of 18.55% from 2025 to 2034.

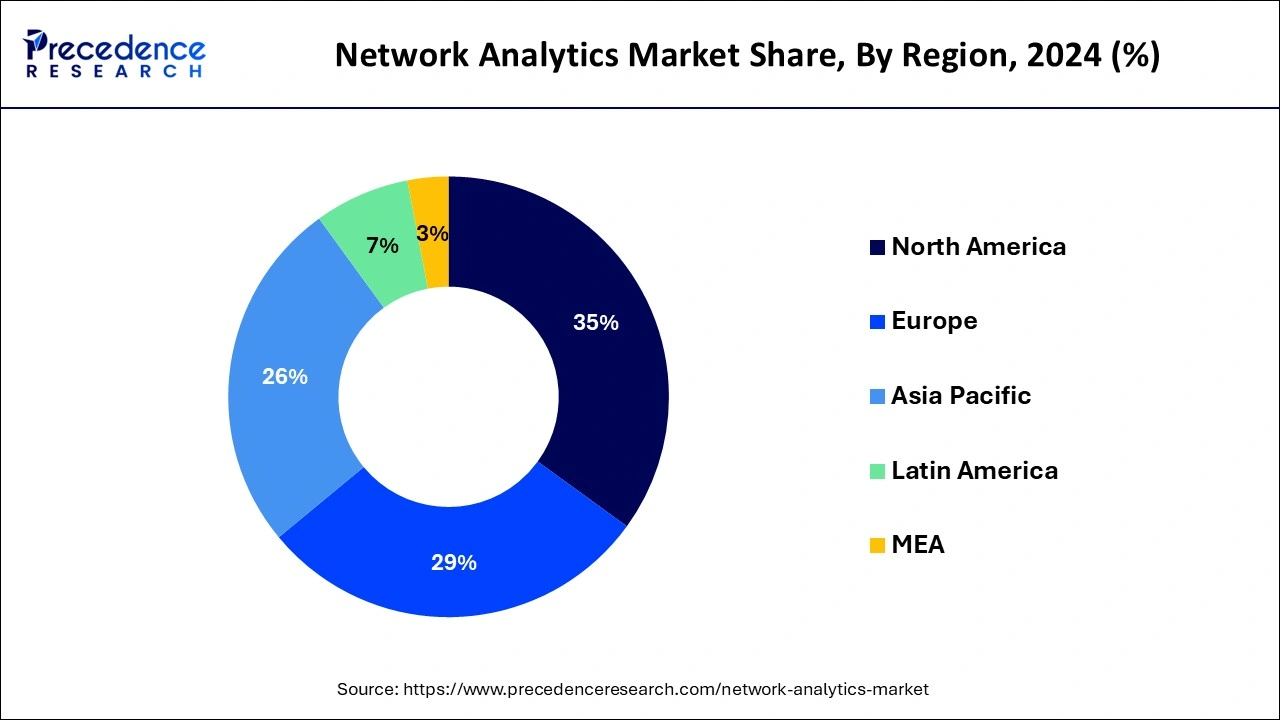

- North America has contributed over 35% of market share in 2024.

- Asia-Pacific is estimated to expand at a remarkable CAGR of 22% between 2025 and 2034.

- By component, the network intelligence solutions segment has held the biggest market share of 65% in 2024.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 20.22% between 2025 and 2034.

- By enterprise size, the large enterprise segment has captured over 61% of market share in 2024.

- By enterprise size, the small and medium enterprises (SMEs) segment is projected to grow at the notable CAGR of 21.25% over the projected period.

- By end-user, the telecom providers segment has recorded more than 36% of market share in 2024.

- By end-user, the cloud service providers segment is growing at the remarkable CAGR of 19.43% over the projected period.

- By application, the network performance management segment has accounted over 31% of market share in 2024.

- By application, the quality management segment is expected to expand at the fastest CAGR of 21.03% over the projected period.

What are Network Analytics?

Network analytics refers to the process of gathering and analyzing data from computer networks to gain insights into their performance, security, and overall health. By monitoring network traffic, devices, and interactions, network analytics helps identify patterns, anomalies, and potential issues. This information can be used to optimize network performance, detect, and mitigate security threats, and improve overall efficiency. Using specialized software and algorithms, network analytics tools can visualize network data, generate reports, and provide real-time alerts to network administrators. These insights enable organizations to make informed decisions about network design, capacity planning, and resource allocation. Ultimately, network analytics plays a crucial role in ensuring that networks operate smoothly, securely, and cost-effectively, helping businesses and organizations to meet their connectivity needs while maximizing productivity and minimizing downtime.

Network Analytics Market Data and Statistics

- In December 2022, Nokia extended its collaboration with BT in a five-year agreement, supplying its AVA Analytics software for fixed networks. This partnership aims to bolster BT's network monitoring capabilities utilizing machine learning (ML) and artificial intelligence (AI).

- Cisco Systems reported that global mobile data traffic was approximately 19.01 exabytes per month in 2018. By 2022, this figure was projected to soar to around 77.5 exabytes per month, indicating a staggering compound annual growth rate of 46% over the period.

- In October 2022, Oracle launched the Oracle Network Analytics Suite, a new set of cloud-native analytics solutions. These solutions integrate various network function data with ML and AI to empower operators in making more informed, automated decisions concerning the stability and performance of their entire 5G network core.

- In June 2022, Zain Kuwait, a digital service provider, invested in technology from Accedian and Cisco, alongside other performance analytics and end-user experience solution providers. This investment aims to automate Zain Kuwait's network, enhancing network visibility and service assurance.

- IDC predicts that by 2023, 60% of enterprises will have implemented AI-enabled network analytics to manage their network complexities effectively.

- As per a survey by Enterprise Management Associates, 80% of enterprises consider real-time network analytics crucial for their business operations.

What are the Growth Factors in the Network Analytics Market?

- The continuous proliferation of data-intensive applications, streaming services, and IoT devices is generating massive volumes of network data. This surge in data traffic fuels the demand for network analytics solutions to effectively manage, optimize, and secure networks. Cisco forecasts that global IP traffic will nearly triple from 2021 to 2026, reaching 3.3 zettabytes per year, underscoring the need for robust network analytics tools to handle this growth.

- Networks are becoming increasingly complex with the adoption of technologies such as cloud computing, SDN, and edge computing. This complexity introduces challenges in network management, monitoring, and troubleshooting. Network analytics solutions equipped with AI and machine learning capabilities help organizations gain deeper insights into their intricate network infrastructures, facilitating proactive management and rapid problem resolution.

- With the escalating frequency and sophistication of cyber threats, organizations are prioritizing network security. Network analytics plays a pivotal role in threat detection, anomaly detection, and incident response. According to the Ponemon Institute, the average cost of a data breach is $4.24 million, emphasizing the importance of investing in advanced network analytics solutions to fortify cyber defenses and safeguard sensitive data.

- Businesses increasingly require real-time visibility into network performance, user experience, and application behavior to ensure optimal operation and customer satisfaction. Network analytics solutions provide actionable insights into network activity, enabling organizations to identify and address issues promptly.

- The rollout of 5G networks promises unprecedented speed, capacity, and connectivity, driving the adoption of network analytics solutions tailored for 5G environments. These solutions enable operators to monitor and optimize 5G network performance, manage network slices, and deliver innovative services.

- Organizations across various industries are subject to stringent compliance requirements and regulatory mandates concerning data privacy, network security, and operational transparency. Network analytics solutions aid in compliance efforts by providing detailed audit trails, monitoring access controls, and detecting policy violations. The implementation of regulations such as GDPR and CCPA underscores the importance of robust network analytics solutions in ensuring regulatory compliance and mitigating legal risks.

Network Analytics Market Outlook:

- Industry Growth Overview: From 2025 to 2030, the network analytics market is expected to experience robust growth as organizations ramp up investments in real-time monitoring, cloud optimization, and AI-aided security solutions. The positive momentum comes as demand accelerated after businesses transitioned to automation, zero-trust networks, and scalable traffic intelligence, particularly across North America and the Asia Pacific.

- Global Expansion: Large players in the services sector expanded into Southeast Asia, Eastern Europe, and LATAM to be close to hyperscale and telecom operators. The enterprise community was also creating analytics hubs in these regions for faster deployment, with APAC as an ideal environment, particularly due to regulatory incentives, higher cloud penetration, and increasing enterprise digitization.

- Key Players: Both private equity and technology investors began to enter the market as they were drawn in by the very strong recurring revenue models, while AI-driven analytics were a hot commodity. Several companies invested in platform companies focused on network optimization, security analytics, and cloud intelligence.

- Startup Ecosystem: The startup ecosystem experienced rapid growth in segments such as AI-led anomaly detection, intent-based networking, and edge analytics. New entrants like Forward Networks (USA) and NetAI (UK) garnered substantial interest from venture capitalists by providing scalable, automated alternatives to traditional network monitoring platforms.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.55% |

| Market Size in 2025 | USD 5.60 Billion |

| Market Size in 2026 | USD 6.66 Billion |

| Market Size by 2034 | USD 25.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Enterprise Size, By End-user, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Escalating volume of data traffic

The escalating volume of data traffic is a significant driver for the network analytics market. As more devices connect to networks and people consume increasingly data-intensive content like videos and games, the strain on networks grows. This surge in data traffic creates challenges for network operators in managing, optimizing, and securing their infrastructure. Network analytics solutions play a crucial role in addressing these challenges by providing insights into network performance, identifying bottlenecks, and predicting capacity requirements.

Moreover, as data traffic continues to increase, businesses and organizations are under pressure to ensure a seamless user experience and maintain operational efficiency. Network Analytics tools help them achieve this by offering real-time visibility into network activity, enabling proactive monitoring, and facilitating rapid problem resolution. Therefore, the escalating volume of data traffic not only highlights the importance of Network Analytics in managing network congestion and optimizing resource allocation but also drives the market demand for advanced solutions that can handle the growing complexity of modern networks.

Restraint

Integration challenges with existing infrastructure

Integration challenges with existing infrastructure can hinder the market demand for network analytics solutions. Many organizations have complex and heterogeneous IT environments, comprising a mix of legacy systems, proprietary technologies, and cloud-based platforms. Integrating new network analytics tools with such diverse infrastructures often proves challenging due to compatibility issues, interoperability constraints, and data silos. These integration hurdles can slow down the deployment process, increase implementation costs, and impede the seamless operation of network analytics solutions within the existing ecosystem.

Moreover, the complexity of integration processes can deter organizations from adopting network analytics solutions altogether. The need for specialized expertise and resources to navigate integration challenges adds to the perceived barriers, especially for small and medium-sized businesses with limited IT budgets and technical capabilities. As a result, integration challenges with existing infrastructure act as significant restraints on the market demand for network analytics solutions, limiting their adoption and hindering organizations from harnessing the full potential of analytics-driven insights for network management and optimization.

Opportunity

Rising demand for real-time analytics

The rising demand for real-time analytics presents significant opportunities in the network analytics market. As businesses strive to stay competitive in today's fast-paced digital landscape, the need for instant insights into network performance, security threats, and user behavior becomes paramount. Real-time analytics solutions enable organizations to monitor their networks continuously, detect anomalies or issues as they occur, and respond promptly to prevent disruptions. This capability not only enhances operational efficiency but also minimizes downtime, improves user experience, and strengthens overall network security.

Moreover, real-time analytics empower organizations to make data-driven decisions in the moment, enabling agile and proactive network management strategies. By leveraging real-time insights, businesses can optimize network resources, allocate bandwidth dynamically, and prioritize critical applications or services in response to changing demands. As a result, the rising demand for real-time analytics drives innovation in the network analytics market, leading to the development of advanced solutions that offer instantaneous visibility, actionable intelligence, and predictive capabilities to meet the evolving needs of modern enterprises.

Component Insights

The network intelligence solutions segment held the highest market share of 65% in 2024. The network intelligence solutions segment in the network analytics market refers to software and tools that provide deep insights into network performance, security, and user behaviour. These solutions utilize advanced analytics techniques, such as machine learning and AI, to analyse vast amounts of network data in real time, enabling organizations to make informed decisions and optimize their network operations effectively. Trends in this segment include the integration of AI-driven automation, enabling predictive maintenance and proactive network management. Additionally, there is a growing focus on enhancing security intelligence capabilities to detect and mitigate cyber threats in real time, reflecting the increasing importance of network security in today's digital landscape.

The services segment is anticipated to witness rapid growth at a significant CAGR of 20.22% during the projected period. In the network analytics market, the services segment typically encompasses a range of offerings provided by vendors or third-party providers to support the implementation, integration, customization, and ongoing maintenance of network analytics solutions. These services may include consulting, deployment, training, support, and managed services. One prominent trend in the services segment of the network analytics market is the increasing demand for managed services, where organizations outsource the management and operation of their network analytics infrastructure to specialized service providers. This allows businesses to leverage the expertise and resources of external partners to optimize their network performance, enhance security, and ensure regulatory compliance while focusing on their core operations.

Enterprise Size Insights

The large enterprise segment held a 61% market share in 2024. Large enterprises, typically characterized by extensive operations and significant resources, form a crucial segment in the network analytics market. They often have complex and distributed network infrastructures, driving demand for advanced analytics solutions to optimize performance, enhance security, and support digital transformation initiatives. Trends indicate increasing adoption of cloud-based analytics platforms and AI-driven insights among large enterprises to streamline network management and bolster competitive edge.

The small and medium enterprises (SMEs) segment is anticipated to witness rapid growth over the projected period. Small and medium enterprises (SMEs) typically refer to businesses with fewer than 500 employees. In the network analytics market, SMEs are increasingly adopting scalable and cost-effective solutions to monitor and optimize their networks. Trends show a growing demand for cloud-based network analytics tools tailored to SMEs' specific needs and budgets.

End-user Insights

The telecom providers segment has held a 36% market share in 2024. Telecom providers, also known as telecommunications service providers, are companies that offer communication services such as voice, data, and internet connectivity to consumers and businesses. In the network analytics market, telecom providers are increasingly adopting analytics solutions to enhance network performance, optimize resources, and improve customer experiences.

The cloud service providers segment is anticipated to witness rapid growth over the projected period. Cloud service providers are companies that offer various cloud-based services, including infrastructure, platforms, and software, to businesses and individuals over the internet. In the network analytics market, the cloud service providers segment refers to those organizations that provide network analytics solutions as part of their cloud offerings. A prominent trend in this segment is the integration of advanced analytics capabilities into cloud platforms, enabling users to gain insights into their network performance, security, and efficiency seamlessly. Additionally, cloud service providers are focusing on enhancing scalability, flexibility, and real-time analytics capabilities to meet the evolving demands of their customers for robust network management solutions.

Application Insights

The network performance management segment has held a 31% market share in 2024. Network performance management in the network analytics market refers to the practice of monitoring, analyzing, and optimizing the performance of computer networks. This segment focuses on assessing network speed, reliability, and efficiency to ensure optimal operation and user experience. Key trends in network performance management include the increasing adoption of real-time monitoring tools, the integration of AI and machine learning for predictive analytics, and the emphasis on cloud-based solutions for scalability and flexibility in managing network performance.

The quality management segment is anticipated to witness rapid growth over the projected period. In the network analytics market, quality management focuses on assessing and optimizing the performance and reliability of network services. This segment involves monitoring parameters such as latency, packet loss, and jitter to ensure that network resources meet predefined quality standards. Trends in quality management include the integration of advanced analytics techniques, such as machine learning and AI, to proactively identify and address potential issues before they impact user experience. Additionally, there is a growing emphasis on real-time analytics to provide immediate insights into network quality and facilitate prompt remediation actions.

Regional Insights

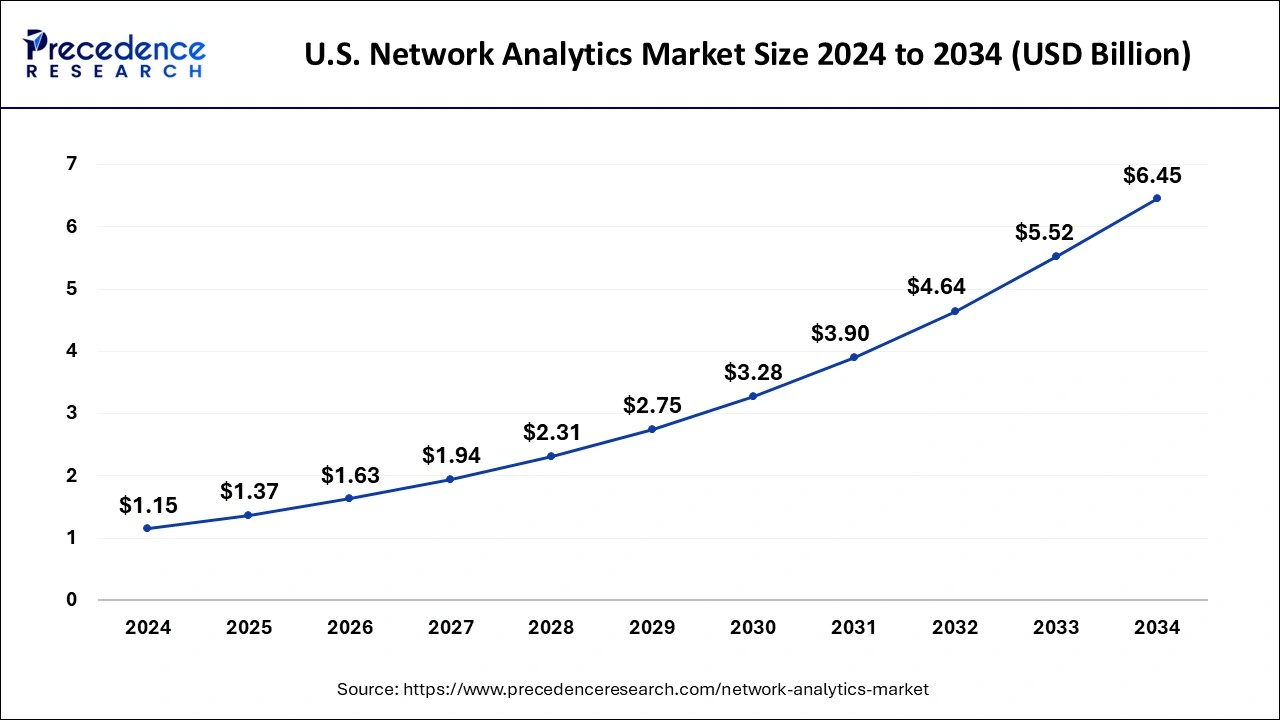

U.S.Network Analytics Market Size and Growth 2025 to 2034

The U.S. network analytics market size is estimated at USD 1.37 billion in 2025 and is projected to surpass around USD 6.45 billion by 2034 at a CAGR of 18.82% from 2025 to 2034.

North America held a share of 35% in the network analytics market due to several factors.The region boasts advanced telecommunications infrastructure, high internet penetration rates, and a strong presence of key market players. Moreover, North American businesses prioritize digital transformation initiatives and invest significantly in cutting-edge technologies, including Network Analytics solutions, to enhance operational efficiency and maintain a competitive edge. Additionally, favorable government regulations and initiatives supporting the adoption of advanced networking technologies contribute to the region's dominance in the network analytics market.

The U.S. is the leader in the North American network analytics market, growth driven by increased demand for cloud-based communications and increased adoption of digital technologies, and rising risk of cybersecurity threats. Rising network complexity is driving the need for advanced network analytics tools for monitoring and analyzing. Additionally, the government is focusing on advancing the cybersecurity sector, especially in, face of quantum computing threats, fueling areas of network analytics technologies in the country.

Google's Threat Analysis Group is blocking coordinated influence operations domain. Additionally, YouTube channels and social media account termination, which are suspected of spreading disinformation or propaganda, are expected to reduce the risk of cyber threats, and the U.S. network analytics market is expected to witness major expansion in the upcoming period.

Asia-Pacific is experiencing rapid growth in the network analytics market due to several factors. Firstly, the region's expanding digital infrastructure and increasing adoption of advanced technologies such as 5G, IoT, and cloud computing are generating vast amounts of network data, driving the demand for analytics solutions. Additionally, rising cybersecurity concerns and a growing emphasis on enhancing network performance and user experience are prompting organizations across various industries to invest in network analytics tools. Moreover, favorable government initiatives and the presence of key market players are further fueling market growth in the Asia-Pacific region.

In April 2025, high-temp exploitation campaigns against critical infrastructure networks by targeting SAP NetWeaver Visual Composer were launched by the China-nexus nation-state APTs, actors exploited the CVE-2025-31324 vulnerability in SAP NetWeaver Visual Composer. China is focusing on enhancing cross-border data flow compliance and market-based allocation of data.?(Source:https://blog.eclecticiq.com)

Meanwhile, Europe is experiencing notable growth in the network analytics market due to several factors. Firstly, the region's rapid adoption of advanced technologies like 5G, IoT, and cloud computing is driving the demand for network analytics solutions to manage and optimize these complex infrastructures. Additionally, stringent data privacy regulations, such as GDPR, are prompting organizations to invest in network analytics tools for enhanced security and compliance. Furthermore, the increasing digitalization across industries, coupled with a focus on improving operational efficiency and customer experience, is fueling the uptake of network analytics solutions in Europe.

What Made Germany Lead the European Network Analytics Market?

Germany has positioned itself at the forefront of Europe with the strength of its industrial base, advanced telecommunications networks, and a commitment to investing in cybersecurity for companies. Employers relied on network analytics for automation, secure communications, and improving IT operations. Germany's focus on Industry 4.0, independent laboratories for internet and cloud services, or cybersecurity, has increased demand for reliable networks and network observability. Additionally, Germany has a basis for edge-based analytics, threat detection, and network monitoring, and it is integrated into automated management for manufacturing, automotive, or enterprise IT applications.

Why did Latin America grow at a Considerable Rate in the Network Analytics Market?

Latin America has registered considerable growth as telecom companies improved networks, enhanced the quality of service, and expanded 4G and 5G service. Enterprises embraced analytics to help mitigate outages, cybersecurity threats, and increase digital traffic. The region represented opportunities with the rise of affordable analytics tools, managed monitoring services, and security solutions. The continued adoption of digital offerings within banking, e-commerce, education, and government continued to fuel demand in the region.

Brazil Network Analytics Market Trends

Brazil led the region based on market size, strong growth of digital footprint, and expanding cloud service space. Companies utilize network analytics to cope with the influx of digital traffic and improve reliability. Government digitalization programs support adoption. In Brazil, opportunities existed with security analytics, telecom automation, and real-time monitoring of analytics for enterprises and service providers.

Why did the Middle East and Africa Demonstrate Stable Growth in the Network Analytics Market?

The Middle East and Africa demonstrated stable growth, owing to investment in digital infrastructure, smart city initiatives, and telecom upgrades. Both governments and enterprises leveraged a variety of analytics tools to oversee network performance and improve services. The growth of cloud services, coupled with increasing cybersecurity requirements, aided the growth of this market. The region offered opportunities for 5G analytics, managed monitoring services, and secure automation of network applications for the public and private sectors.

The UAE Network Analytics Market Trends

The UAE led the region due to its strong digital evolution strategies, sophisticated telecommunications architecture, and advanced 5G public adoption. Companies and governmental agencies relied on various analytics to increase performance, operate secure network services, and oversee smart city projects. The UAE offered opportunities in AI-enabled analytics capabilities, cloud-based network monitoring, and automated service assurance.

Network Analytics Market Companies

- Cisco Systems

- Nokia Corporation

- Oracle Corporation

- IBM Corporation

- Accenture

- Google LLC

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- SAS Institute Inc.

- Juniper Networks, Inc.

- Splunk Inc.

- Extreme Networks, Inc.

- Nokia Solutions and Networks

- Broadcom Inc.

- Ericsson AB

Recent Developments

- In February 2025, Rohde & Schwarz's ipoque and the Helmut-Schmidt University of the Federal Armed Forces Hamburg (HSU/UniBw H), and relies upon the university's 5G campus network collaborated to explore anomaly detection in 5G Campus Networks and mitigate the threats of unauthorized drones, via “analyzing patterns within vast 5G network data streams.”(Source: https://www.rcrwireless.com)

- In February 2025, HEAVY.AI, the pioneer in GPU-accelerated analytics, partnered with Ookla, a global leader in network intelligence and connectivity insights to support telecommunications providers, enterprises, and government agencies with robust data visualization and analytics capabilities, improving network performance optimization and decision-making at a historic scale. (Source: https://www.businesswire.com)

- In January 2025, MultiPlan Corporation, a major provider of technology and data solutions that improve affordability, quality, and transparency in healthcare, collaborated with J2 Health, a cloud-based software solution that optimizes provider network performance. The collaboration will empower MultiPlan's network optimization strategy, providing tailored solutions and resource efficiency. (Source: https://www.businesswire.com)

- In March 2023, IBM and Nokia forged a partnership aimed at assisting the burgeoning sector. Their collaboration seeks to empower enterprises with secure, tailored connectivity services facilitated by a highly resilient 5G cloud network.

- In November 2023, Vodafone Group Plc joined forces with Accenture to commercialize Vodafone's shared operations. This strategic alliance aims to expedite growth, elevate customer service, and generate substantial efficiencies for Vodafone's operating companies and partner markets. Additionally, it aims to create fresh career opportunities for Vodafone's workforce.

- On April 2023, Accenture entered into a partnership with Google Cloud to bolster businesses' defenses against persistent cyber threats and safeguard critical assets more effectively.

- In June 2023, Cisco introduced the Networking Cloud Platform, designed to streamline the management of networking equipment via a unified interface. This platform rollout coincides with enhancements to various Cisco products, including the ThousandEyes infrastructure monitoring service and the Catalyst portfolio.

- In November 2023, Accenture unveiled a network of generative AI studios in North America. These studios serve as hubs where companies can explore opportunities to optimize and transform their businesses responsibly through the adoption of generative AI applications.

Segments Covered in the Report

By Component

- Network Intelligence Solutions

- Services

- Professional Services

- Managed Service

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-user

- Cloud Service Providers

- Managed Service Providers

- Telecom Providers

- Others

By Application

- Customer Analysis

- Risk Management

- Fault Detection

- Network Performance Management

- Quality Management

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting