What is Network as a Service Market Size?

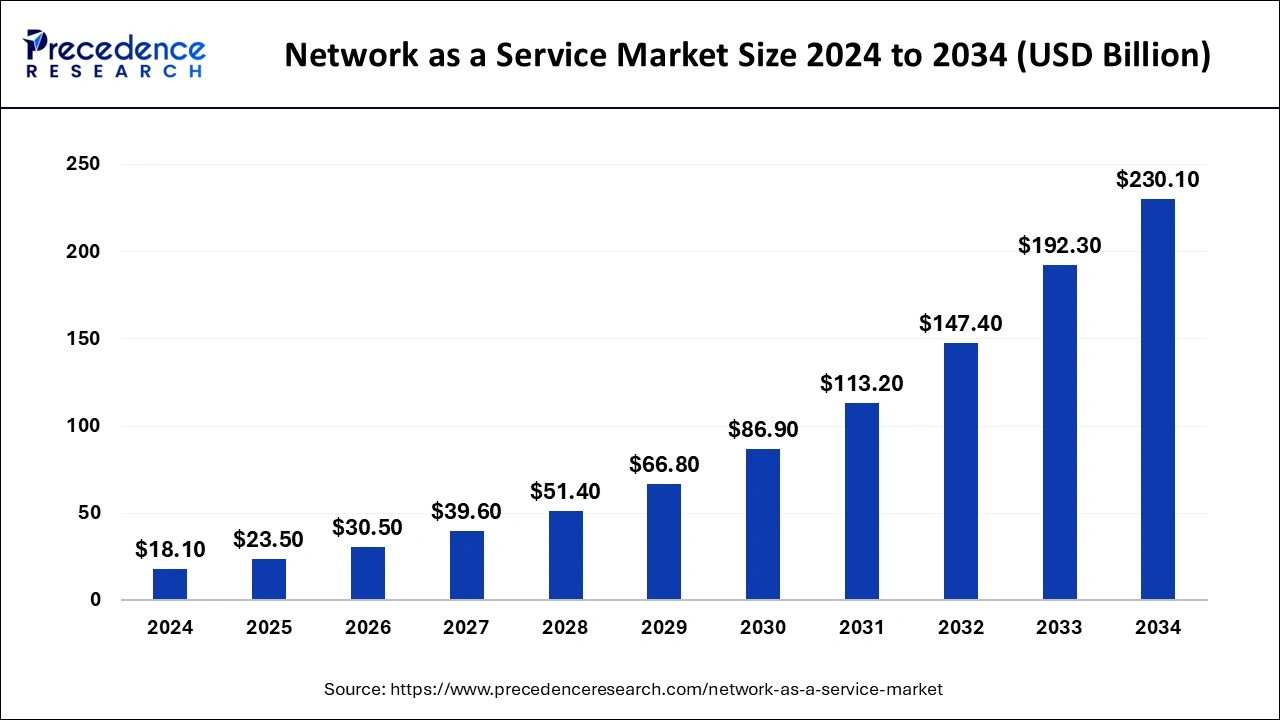

The global network as a service market size is estimated at USD 23.50 billion in 2025 and is predicted to increase from USD 30.50 billion in 2026 to approximately USD 230.10 billion by 2034, expanding at a CAGR of 28.95% from 2025 to 2034.

Market Highlights

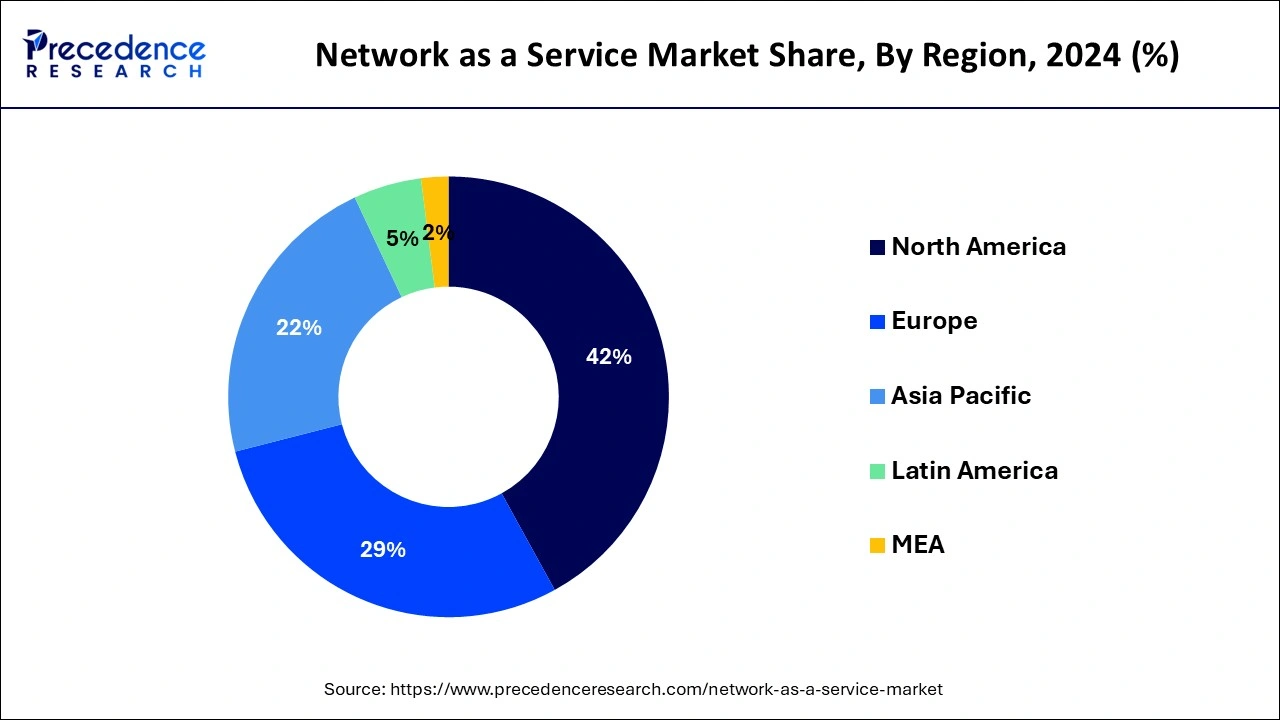

- North America dominated the network as a service market with the largest market share of 42% in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By type, the WAN as a service segment held the biggest market share of 53% in 2024.

- By type, the LAN as a service segment is anticipated to grow at a remarkable CAGR of 18.7% between 2025 and 2034.

- By enterprise type, the large enterprise segment generated over 56% of the market share in 2024.

- By enterprise type, the small and medium-sized enterprise segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the corporate customers segment generated over 59% of the market share in 2024.

- By end-user, the individual customers segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Network as a service (NaaS) is a cloud-based networking solution that provides businesses with on-demand access to network resources without the need for owning or maintaining physical network infrastructure. It operates on a subscription model, allowing organizations to scale their network capabilities as needed. NaaS offers flexibility, allowing users to manage and customize their networks easily through a centralized platform.

The network as a service market offers simplified solutions for network management by outsourcing tasks like maintenance and upgrades to service providers. This model enhances efficiency and agility, enabling companies to focus on their core operations while ensuring a secure and reliable network environment. NaaS is particularly beneficial for businesses seeking cost-effective, scalable, and easily manageable networking solutions without the burden of extensive in-house infrastructure.

Network as a Service Market Data and Statistics

- A recent survey by the Project Management Institute revealed that inefficient project management processes lead to approximately 12% wastage of organizational resources.

- Senior executives in the U.S. demonstrated a significant shift towards remote work, with over 90% expressing plans for remote work in a 2021 survey conducted by Talent Works.

- According to a workforce happiness index survey in May 2020, individuals working from home reported a satisfaction score of 75 out of 100, surpassing the score of 71 for those working from traditional office settings.

- In 2022, a report from Zippia, Inc. indicated that 94% of U.S. enterprises adopted cloud services, with 67% of their infrastructure being cloud-based. Moreover, 92% of these enterprises implemented a multi-cloud strategy. This trend is anticipated to drive the expansion of the U.S. Network as a Service market share in the foreseeable future.

Recent Trends

- Companies are moving from buying hardware to renting network services, as subscription-based models reduce upfront costs and give more flexibility.

- Cloud-managed networking is becoming the new standard, with businesses preferring networks that can be monitored and controlled directly from the cloud.

- Hybrid and remote work are boosting the need for secure, reliable remote access, making NaaS a preferred option for easy and protected connectivity.

- AI and automation are transforming network management, helping businesses predict issues, optimize performance, and reduce human errors.

- SD-WAN has become one of the most in-demand NaaS offerings, thanks to its ability to improve speed, reduce costs, and securely connect multiple office locations.

- Security is increasingly bundled into NaaS packages, with features like threat detection, firewalls, and encryption included by default.

- The rise of IoT devices is pushing companies to adopt NaaS, as it provides scalable and centralized networking for thousands of connected devices.

- Telecom operators are using NaaS in combination with 5G, offering businesses faster, smarter, and more customizable networking options such as private 5G networks.

Network as a Service MarketGrowth Factors

- As businesses undergo digital transformation, there's a growing need for flexible and scalable network solutions. Network as a Service (NaaS) supports the evolving requirements of digital initiatives, such as cloud migration and IoT integration, fostering network as a service market's growth.

- The rise of remote work, accelerated by global events, has increased the demand for NaaS. Companies are seeking reliable and secure network solutions to support a dispersed workforce, driving the adoption of NaaS for remote connectivity and collaboration.

- The widespread adoption of cloud services is a significant driver for NaaS. Organizations are increasingly leveraging cloud infrastructure, and with 94% of enterprises in the U.S. implementing cloud services, NaaS is vital for efficient and secure cloud connectivity.

- Security is a top priority for businesses, and NaaS providers are incorporating advanced security features. The growing emphasis on cybersecurity and compliance requirements is propelling the adoption of NaaS as a secure and compliant networking solution.

- Businesses are drawn to the scalability and cost-efficiency offered by NaaS. The ability to scale network resources based on demand without significant upfront investments appeals to organizations, resulting in increased adoption for optimized resource utilization.

- The integration of advanced technologies, particularly Software-Defined Networking (SDN), enhances the capabilities of NaaS. SDN allows for programmable and agile network management, addressing the need for flexibility and efficiency in modern IT infrastructures.

Market Outlook

- Industry Growth Overview: As businesses move from purchasing hardware to renting adaptable cloud-managed network services, the NaaS market is expanding. It enables companies to grow rapidly without making significant upfront investments. NaaS is becoming more popular due to its lower operating costs, quicker deployment, and easier management.

- Sustainability Trends: NaaS supports sustainability by reducing the need for physical hardware, lowering e-waste, and improving energy efficiency through shared cloud infrastructure. Providers are also optimizing networks to consume less power. Centralized cloud control helps companies cut unnecessary energy use across distributed locations.

- Major Investors: Major investors include telecom companies, cloud providers, and networking giants like Cisco, HPE, Verizon, and AT&T, who are expanding NaaS portfolios globally. Tech-focused venture funds are also supporting startups offering AI-driven network services. These investors target platforms that deliver secure, scalable, and automation-ready networking.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.50 Billion |

| Market Size in 2026 | USD 30.50 Billion |

| Market Size by 2034 | USD 230.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 28.95% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Enterprise Type, and By End-user, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in cloud adoption

- As of 2022, approximately 65% of enterprises have migrated a significant portion of their workloads to the cloud, driving the need for agile and cloud-integrated networking solutions.

The surge in cloud adoption is propelling the growth of the network as a service market as businesses increasingly migrate their operations to cloud environments. As more organizations embrace cloud services for their data storage, applications, and computing needs, the necessity for reliable and agile network solutions becomes paramount. It offers a seamless integration with cloud infrastructures, providing businesses with the flexibility and scalability required to support their operations in the cloud.

Moreover, with 94% of enterprises in the U.S. implementing cloud services, there is a growing need for efficient and secure connectivity between on-premises networks and diverse cloud platforms. NaaS simplifies this complex network management, enabling businesses to optimize their connectivity, enhance performance, and ensure a seamless transition to the cloud. The rising demand for NaaS in the context of increasing cloud adoption underscores its pivotal role in modernizing network architectures to meet the evolving demands of a cloud-centric business landscape.

Restraint

Dependency on internet connectivity

The dependency on internet connectivity poses a notable restraint for the growth of network as a service market. As network as a service relies heavily on the internet for seamless network operations, any disruptions or outages in internet connectivity can directly impact the performance and reliability of the network. This vulnerability makes organizations cautious about fully embracing NaaS, particularly in regions where internet infrastructure is inconsistent or unreliable.

Furthermore, concerns about the stability of internet connections raise questions about the dependability of NaaS for mission-critical applications. Businesses, especially those with stringent requirements for uninterrupted operations, may hesitate to fully commit to NaaS solutions due to the potential risks associated with relying on external networks. Addressing these challenges and ensuring robust backup measures could be crucial for NaaS providers to mitigate the impact of internet connectivity dependency and boost confidence in the market.

Opportunity

AI and automation integration

The integration of artificial intelligence (AI) and automation is creating significant opportunities for the network as a service market to expand. By incorporating AI-driven optimizations and automated processes, NaaS providers can enhance the efficiency and intelligence of network management. AI algorithms analyze data in real-time, enabling predictive maintenance, proactive issue resolution, and dynamic network adjustments. This not only streamlines operations but also improves the overall performance and responsiveness of NaaS solutions.

Moreover, automation plays a pivotal role in simplifying complex network tasks, reducing manual intervention, and ensuring faster response times. NaaS providers leveraging AI and automation can offer more adaptive, self-learning networks that align with the dynamic demands of modern businesses.

Segment Insights

Type Insights

The WAN as a service segment held the highest market share of 53% in 2024. WAN as a service (WaaS) is a segment within the network as a service market that specifically focuses on delivering Wide Area Network (WAN) capabilities as a scalable and subscription-based service. This solution allows businesses to access and manage their wide-area network infrastructure without the need for extensive physical hardware. Recent trends indicate a growing demand for WaaS due to its ability to provide secure and efficient connectivity across geographically dispersed locations, aligning with the increasing prevalence of remote work and the need for seamless interconnectivity.

The LAN as a service segment is anticipated to witness rapid growth at a significant CAGR of 18.7% during the projected period. LAN as a service (LANaaS) is a segment within the network as a service market that provides businesses with a cloud-based Local Area Network solution. It enables organizations to access and manage their local networks through a subscription model, eliminating the need for extensive on-premises infrastructure. A key trend in LANaaS is the growing adoption of virtual LANs, enhancing network flexibility and scalability. This allows businesses to optimize their local network resources efficiently, accommodating the evolving connectivity needs of modern workplaces in a cost-effective manner.

Enterprise Type Insights

The large enterprise segment has held a 56% market share in 2024. Large enterprises, within the context of the network as a service market, refer to sizable organizations with extensive networking needs. These enterprises typically operate on a broad scale, requiring robust and scalable network solutions. A trend in this segment involves the increasing adoption of NaaS to address complex networking requirements, providing these enterprises with flexible, cost-effective, and secure solutions. Large enterprises leverage NaaS to optimize network management, enhance connectivity, and adapt to evolving technological landscapes, aligning with their need for advanced, tailored networking services.

The small and medium-sized enterprise segment is anticipated to witness rapid growth over the projected period. Small and Medium-sized Enterprises (SMEs) in the network as a service market, refer to businesses with relatively smaller scales of operation. These enterprises typically have more streamlined networking needs but seek cost-effective and scalable solutions. A notable trend in the SME segment is the increasing adoption of NaaS to enhance network flexibility and efficiency. As SMEs strive for digital transformation, NaaS offers a viable option to optimize network resources without the need for extensive in-house infrastructure, aligning with the resource constraints often faced by smaller enterprises.

End-user Insights

The corporate customers segment held a 59% revenue share in 2024. NaaS solutions often come with centralized management capabilities, allowing corporate consumers to efficiently oversee and control their entire network infrastructure from a unified platform. This centralized approach simplifies network management and enhances operational efficiency.

The individual customers segment is anticipated to witness rapid growth over the projected period. Individual customers in the network as a service market refer to end-users seeking personalized networking solutions for their home or small-scale needs. A notable trend in this segment involves the increasing demand for affordable, user-friendly NaaS offerings that cater to individual residences and small businesses. With the rise of remote work and digital activities, there's a growing emphasis on NaaS solutions that provide seamless connectivity, security, and ease of use for individual customers, reflecting a shift towards decentralized and accessible networking solutions.

Regional Insights

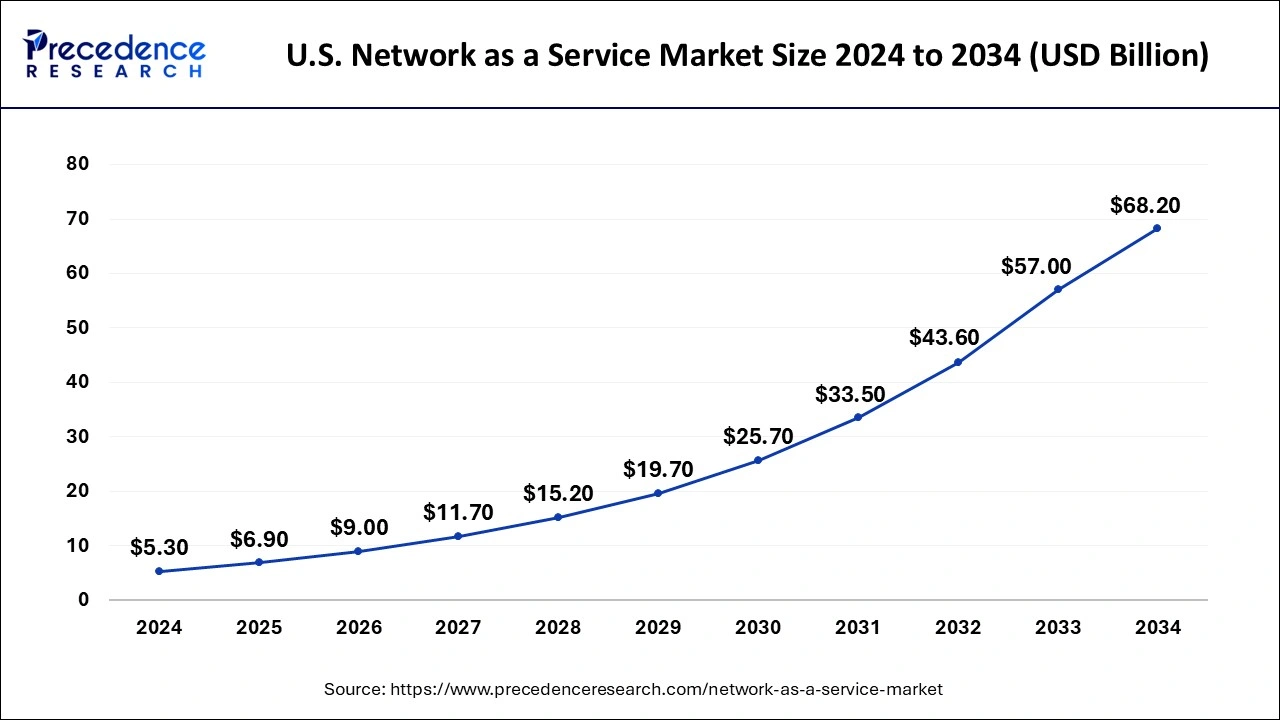

U.S.Network as a Service Market Size and Growth 2025 to 2034

The U.S. network as a service market size is valued at USD 6.90 billion in 2025 and is expected to reach around USD 68.20 billion by 2034, growing at a CAGR of 29.11% from 2025 to 2034.

North America held the largest market share of 42% in 2024 due to its advanced technological infrastructure, widespread adoption of cloud services, and the presence of key industry players. The region's proactive approach toward digital transformation, coupled with a high demand for scalable and flexible networking solutions, has fueled the network as a service market's growth. Additionally, the increasing trend of remote work and the robust IT ecosystem contribute to North America's dominant position in the NaaS market, as businesses prioritize efficient and secure network management solutions.

Asia-Pacific is poised for rapid growth in the network as a service market, due to escalating digital transformation, increasing cloud adoption, and a surge in remote work. Countries in the region are investing heavily in advanced networking technologies to support evolving business needs. Additionally, the rising demand for scalable and cost-effective network solutions is driving NaaS adoption. With a burgeoning economy, a tech-savvy population, and a focus on modernizing infrastructure, the Asia-Pacific NaaS market is well-positioned for substantial expansion.

Meanwhile, the Europe region is experiencing notable growth in the network as a service market due to several factors. The increasing adoption of cloud services, rising demand for scalable and flexible network solutions, and a focus on digital transformation are driving the expansion. Moreover, the region's emphasis on remote work and the need for efficient and secure connectivity are boosting the demand for NaaS. The evolving business landscape, coupled with the desire for cost-effective and adaptable networking solutions, contributes to the significant growth of NaaS in the European market.

|

Category |

Focus |

Trends/Innovations |

Market Impact |

|

Platform & Services |

Cloud networking solutions |

SD-WAN, edge computing, AI-driven management |

Flexible, scalable, efficient networks |

|

Security & Complaince |

Data protection, regulations |

Zero-trust, encryption, GDPR/CCPA |

Secure data, builds trust, and legal compliance |

|

Distribution & Integration |

Enterprise adoption |

Multi-cloud, API connectivity, hybrid networks |

Easier deployment, improved compatibility |

|

Customer Support & SLAs |

Service reliability |

24/7 monitoring, predictive maintenance |

Reduces downtime, boosts satisfaction |

|

Data Analytics |

Network performance |

AI analytics, traffic monitoring |

Optimizes performance, resource allocation |

|

Cost & Subscription |

Pricing models |

Flexible subscriptions, tiered plans |

Lowers CAPEX, increases adoption |

|

Technology Innovation |

Advanced networking |

5G, IoT, software-defined networks |

Supports emerging applications, market growth |

Network as a Service Market Companies

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- VMware, Inc.

- Aryaka Networks, Inc.

- Megaport Limited

- AT&T Inc.

- IBM Corporation

- Oracle Corporation

- Ciena Corporation

- Comcast Business

- Alcatel-Lucent Enterprise

- Masergy Communications, Inc.

- Verizon Communications Inc.

- GTT Communications, Inc.

- Silver Peak Systems, Inc.

Recent Developments

- In May 2023, Cloudflare Inc. joined forces with IT services giant Kyndryl to unveil a novel managed WAN as a Service offering. This strategic partnership integrated networking services with Cloudflare's Magic WAN DDoS mitigation and connectivity platform, aiming to elevate performance and security for users making the transition to modern IT technologies.

- In April 2023, Hewlett Packard Enterprise (HPE) introduced an upgraded version of its cloud management platform, HPE Aruba Networking Central, during its Atmosphere event. This release featured AI for IT operations (AIOps) and enhanced network capabilities. Utilizing the GreenLake platform, HPE provided Artificial Intelligence (AI)-powered data analytics and performance optimizations for network administrators.

- Megaport and colocation provider Element Critical collaborated in May 2023 to launch a Network as a Service (NaaS) platform. Through this partnership, customers gained access to Megaport's software-defined networks and cloud interconnection services, enabling them to connect their allocated assets directly to multiple cloud providers and branch offices via a single network port. This initiative aimed to offer enhanced control and cost management capabilities.

- In July 2022, Amazon Web Services, Inc. announced the general availability of AWS Cloud WAN, a managed WAN service facilitating the connection of site-to-site, inter-region workloads, and site-to-cloud in AWS. The platform was seamlessly integrated with leading SD-WAN vendors such as Aruba, Checkpoint, Prosimo, Aviatrix, Cisco, and VMware.

- In April 2022, Aryaka received software-defined core (SD-core) technology and software-defined wide area network (SD-WAN) service from SoftBank Corp, a prominent Japanese conglomerate. This collaboration was driven by SoftBank Corp's need to provide its customers with high-speed and stable data communications, requiring a network that was both adaptable and highly secure.

Segments Covered in the Report

By Type

- WAN as a Service

- LAN as a Service

By Enterprise Type

- Small and Medium-sized Enterprise

- Large Enterprise

By End-user

- Corporate Customers

- Individual Customers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting