Noise, Vibration, And Harshness Testing Market Size and Forecast 2025 to 2034

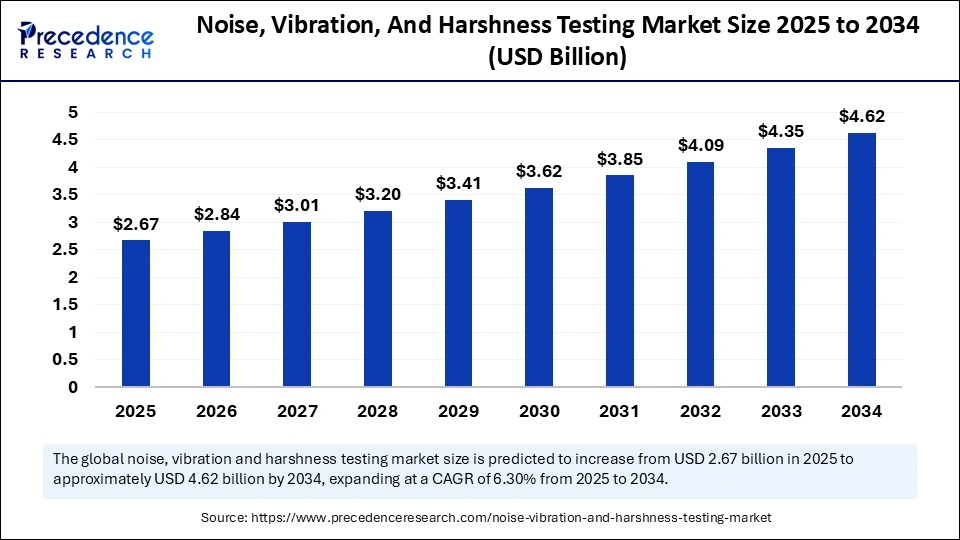

The global noise, vibration, and harshness testing market size accounted for USD 2.51 billion in 2024 and is predicted to increase from USD 2.67 billion in 2025 to approximately USD 4.62 billion by 2034, expanding at a CAGR of 6.30% from 2025 to 2034.The market is growing rapidly due to increasing demand for quieter and more comfortable vehicles and the transition to electric and hybrid technologies.

Noise, Vibration, And Harshness Testing Market Key Takeaways

- In terms of revenue, the noise, vibration, and harshness testing market is valued at $2.67 billion in 2025.

- It is projected to reach $4.62 billion by 2034.

- The market is expected to grow at a CAGR of 6.30% from 2025 to 2034.

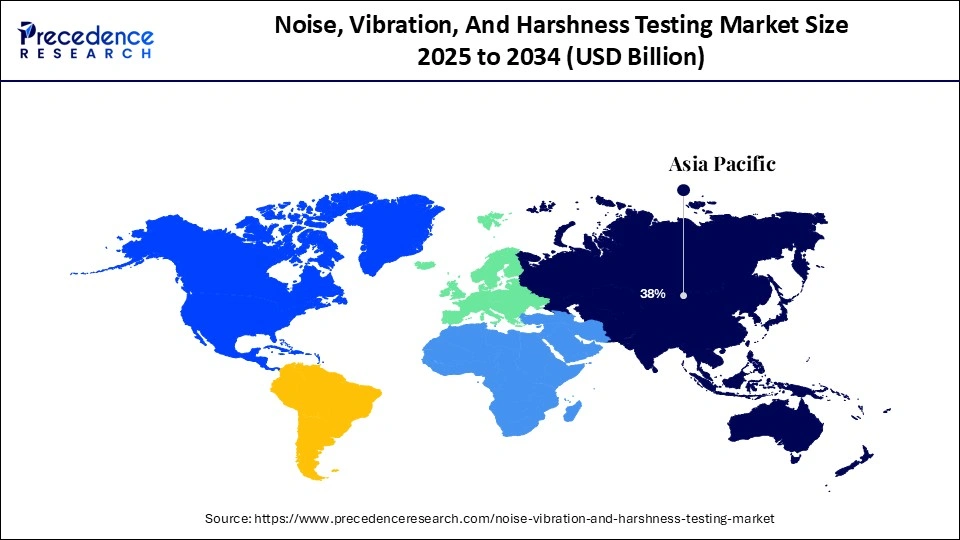

- Asia Pacific held the major market share of 38% in 2024.

- China is growing at a solid CAGR of 7.5% from 2025 to 2034.

- North America is projected to grow at a CAGR of 6% during the forecast period from 2025 to 2034.

- By component, the hardware segment contributed the biggest market share of 60% in 2024.

- By component, the software segment is expected to grow at a CAGR of 7.1% during the predicted timeframe.

- By application, the sound intensity and quality analysis segment held a significant share of 53% in 2024.

- By application, the powertrain performance testing segment is expanding at a notable CAGR of 7.32% from 2025 to 2034.

- By end-use, the automotive segment captured the largest market share of 44% in 2024.

- By end-use, the consumer electronics segment expanding at a solid CAGR of 6.6% in the upcoming years.

How does Artificial Intelligence Impact the Noise, Vibration, And Harshness Testing Market?

Artificial Intelligence (AI) is transforming the market for noise, vibration, and harshness testing by offering faster, more accurate data analysis, predictive maintenance, and optimized design processes. AI can be used to monitor noise and vibration data from sensors embedded in machinery and vehicles, and is capable of real-time diagnostics and predictive maintenance. Overall, AI-powered noise cancellation in communication solutions and AI-based noise, vibration, and harshness control technologies automate issue detection and resolution, expanding the scope of applications.

- In February 2025, Communication solutions like Cisco and Avaya offered AI-powered noise-cancellation as part of their contact center solutions by focusing on AI and NLP technologies in noise cancellation.

Asia Pacific Noise, Vibration, And Harshness Testing Market Size and Growth 2025 to 2034

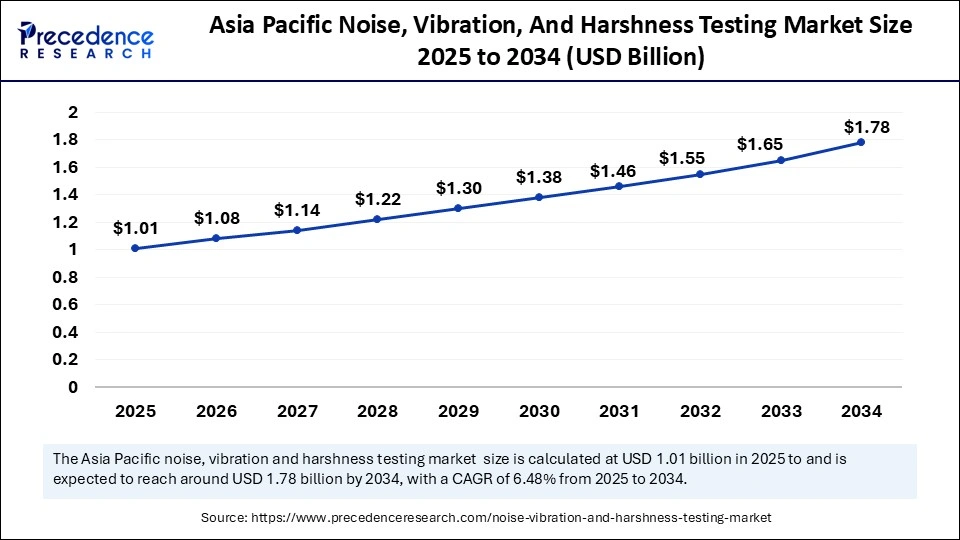

Asia Pacific noise, vibration, and harshness testing market size was exhibited at USD 0.95 billion in 2024 and is projected to be worth around USD 1.78 billion by 2034, growing at a CAGR of 6.48% from 2025 to 2034.

Asia's Stronghold on the Market

Asia Pacific region dominated the noise, vibration, and harshness testing market with the largest market share of 38% in 2024. The rapid expansion of the automotive industry, particularly in China, Japan, India, and South Korea, created the need for noise, vibration, and harshness testing solutions. Governments around the region have imposed stringent regulations to reduce noise pollution and ensure vehicle safety. This encourages manufacturers to invest in noise, vibration, and harshness testing to meet these standards. The aerospace and defense sectors in the region heavily utilize these solutions to improve comfort and reduce operational noise. Furthermore, increasing consumer demand for quality consumer electronics contributes to the necessity for noise, vibration, and harshness testing solutions.

The Massive Automotive Industry of China to Support the Market

China plays a pivotal role in the noise, vibration, and harshness testing market in Asia Pacific and is expected to expand at a solid CAGR of 7.5%. This is due to its massive automotive industry and the ongoing infrastructure projects and developments, which drive the demand for noise, vibration, and harshness testing solutions. Additionally, China is also developing noise and vibration control solutions to make a footprint in the broad market.

The Emergence of India in the Development of Local Testing Facilities

India is considered a conspicuous force in the market, resulting from its expanding automotive industry with increasing manufacturing and export activities. An endeavor by India to promote electric mobility for battery manufacturing is boosting the demand for these solutions, specifically designed for electric vehicles. Additionally, the government of India imposed regulations to reduce noise emissions from vehicles, pushing manufacturers to invest in noise, vibration, and harshness testing solutions to ensure compliance and avoid penalties. This results in the development of local testing facilities and the adoption of advanced testing technologies.

Government Backing in North America Drives the Market

North America is expected to grow at a CAGR of 6% in the market during the forecast period, stemming from its stringent government regulations, the presence of major aerospace and automotive manufacturers, and an emphasis on improving vehicle comfort and ride quality. Additionally, North America is home to numerous aerospace and automotive companies such as Boeing, Lockheed Martin, and various automobile manufacturers. These industries are focusing on reducing noise pollution, boosting the demand for noise, vibration, and harshness testing.

The U.S. Noise, Vibration, and Harshness Testing Market Trends

The U.S. plays a significant role in the noise, vibration, and harshness testing market because of its robust automotive industry and the demand to comply with stringent regulations. The large automotive production and the presence of prominent noise, vibration, and harshness testing companies in the country make it a key player in this market. Furthermore, the growing emphasis on electric vehicles and the increasing demand for comfortable and quiet vehicles further fuel the market in the U.S. Government initiatives to reduce noise emission further drive the market growth.

The Environmental Protection Agency (EPA) in the U.S. had established noise limits for vehicles, primarily through the Noise Control Act of 1972, which regulates noise pollution, including from motor vehicles and construction equipment. This regulation led to increased noise, vibration, and harshness testing within the automotive industry to ensure compliance and lower noise pollution.

Europe: A Notable Region in the Noise, Vibration, and Harshness Testing Market

Europe is expected to grow at a notable rate in the foreseeable future. This is due to its well-established automotive sector in Western Europe, especially Germany, which holds a robust automotive industry with leading manufacturers and suppliers. Furthermore, environmental regulations and government initiatives promoting the use of noise and vibration control and monitoring solutions to reduce noise pollution contribute to regional market growth.

Market Overview

The noise, vibration, and harshness testing market deals with the solutions to measure, modify, and optimize the noise, vibration, and harshness characteristics of a product, primarily vehicles and related components, to ensure comfort, safety, and performance characteristics of vehicles and other products. This test focuses on both interior and exterior noise and vibration, including airborne and structure-borne noises. The market is witnessing significant growth due to increased vehicle production, rising demand for electric vehicles, rigorous environmental regulations, and advancements in testing technologies. The noise, vibration, and harshness testing provides proper solutions for ensuring product quality, enhancing customer satisfaction, and meeting regulatory standards.

Noise, Vibration, And Harshness Testing Market Growth Factors

- Automotive Industry Growth: The growing automotive industry and the increasing vehicle production drive the need for noise, vibration, and harshness testing to ensure performance.

- Shift Towards Electric Vehicles: The transition to electric and hybrid vehicles necessitates specialized noise, vibration, and harshness testing to optimize performance and reduce noise in these new powertrains. As consumers increasingly expect quieter and smoother driving experiences, this spurs the necessity for noise, vibration, and harshness testing solutions.

- Rising Demand for Eco-Friendly Solutions: The increasing awareness of noise pollution and its impact on human health and well-being is propelling the demand for noise, vibration, and harshness testing to reduce noise emissions. The rising emphasis on sustainable and eco-friendly solutions is also influencing the noise, vibration, and harshness testing market.

- Regulatory Compliance: Stringent regulations regarding noise emissions and safety standards from government bodies like the Environmental Protection Agency are spurring the demand for noise, vibration, and harshness testing in different industries.

- Technological Advancements: Innovative technologies, such as AI and machine learning, enhance the capabilities, accuracy, and efficiency of noise, vibration, and harshness testing solutions. The adoption of advanced technologies in vehicles like autonomous driving and connected car features also requires noise, vibration, and harshness testing to address compatibility and performance challenges.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.62 Billion |

| Market Size in 2025 | USD 2.67 Billion |

| Market Size in 2024 | USD 2.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.30% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | China |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-Use,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Drivers

Increasing Demand for Quieter and Comfortable Vehicles

The primary driving factor for the noise, vibration, and harshness testing market is the increasing demand for quieter and comfortable vehicles. Consumers are rapidly shifting toward vehicles with enhanced comfort and luxury, including reduced noise and vibration. Governments and regulatory bodies around the world have imposed stricter regulations to reduce noise pollution. This leads to a greater emphasis on noise, vibration, and harshness testing to optimize vehicle design and ensure compliance with standards.

Restraint

Higher Initial Investment

The primary restraining factor in the noise, vibration, and harshness testing market is the higher initial investment required for setting up and maintaining testing facilities, together with the demand for specialized infrastructure and skilled personnel. This financial hurdle leads to a significant barrier and can discourage smaller companies and startups from entering the market. Therefore, several companies in the market are focusing on developing more accessible and affordable testing solutions, like cloud-based platforms and smaller and more portable equipment, to address the higher initial investment constraint.

Opportunity

Rising Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) creates immense opportunities in the noise, vibration, and harshness testing market. EVs are quieter than combustion engine vehicles with unique noise, vibration, and harshness characteristics, including noise and vibration from the electric motor, road, and tires, which require specialized testing. The global electric vehicle industry is expanding rapidly, creating the need for noise, vibration, and harshness testing services and solutions. Governments have imposed regulations on the automotive industry to reduce noise emissions, supporting the growth of the market.

Component Insights

The hardware segment held a dominant market share of 60% in 2024 due to its essential role in capturing and analyzing noise, vibration, and harshness data. This region's dominance is further attributed to the widespread use of sensors and transducers that directly measure noise and vibration levels, while data acquisition systems, analyzers, and meters offer the infrastructure for processing and analyzing this data. The requirement for these hardware components is prevalent across various industries such as automotive, consumer electronics, industrial machinery, and aerospace.

The software segment is expected to grow at the fastest CAGR of 7.1% during the assessment years, owing to its capabilities of enhanced analysis, optimization, and simulation. Software solutions not only enable detailed analysis of sound quality and modal analysis but also provide acoustic simulation and dynamic design optimization for improving noise, vibration, and harshness performance. Software helps in data processing and analysis, making it crucial in testing solutions.

Application Insights

The sound intensity and quality analysis segment accounted for the highest market share of 53% in 2024. This is because of rising consumer demand for quieter and higher-quality products across various industries to improve the overall sound quality and reduce noise levels. Rigorous regulations regarding noise reduction and the demand for improved acoustic performance, particularly in the automotive and consumer electronics sectors, further bolstered the segmental growth. Addressing noise and vibration issues ultimately enhances the overall quality and perceived value of products, particularly in luxury vehicles and high-end electronics.

In October 2024, SimScale enables engineers to compute and visualize Engineered Reverberation Performance (ERP) as part of the noise, vibration, and harshness simulation process by offering actionable insights into noise emissions across various components. This features two key methods for the evaluation: ERP as a Graph Over Frequency Range and ERP Density Field Visualization. Both methods give a holistic view of their design performance in terms of noise radiation.

The powertrain performance testing is projected to grow at a solid CAGR of 7.32% during the forecast period. The growth of the segment is attributed to the rising demand for advanced powertrain systems due to a shift toward electric vehicles and hybrid powertrains, which have unique noise and vibration characteristics that require specialized testing methods. The stringent regulatory requirements include vehicle emissions and safety standards to ensure compliance. This rising necessity to scrutinize and enhance the noise, vibration, and harshness characteristics of these systems for improved performance, efficiency, and reliability further contributes to segmental growth.

End-Use Insights

The automotive segment accounted for the major market share of 44% in 2024. This is because customers are increasingly expecting a smooth and quiet ride, making noise, vibration, and harshness testing essential for optimizing vehicle performance and passenger experience. Also, integration of electric powertrains, advanced driver assistance systems, and other features introduces new sources of noise and vibration, necessitating advanced noise, vibration, and harshness testing solutions. Therefore, these solutions are considered pivotal for optimizing vehicle comfort, ensuring compliance with regulations, and maintaining high-quality standards.

The consumer electronics segment is projected to grow at a CAGR of 6.6% in the upcoming years, owing to the growing demand for quieter and more efficient electronic devices. Noise, vibration, and harshness testing are pivotal for product development and quality assurance, especially for products, including smartphones, laptops, and home appliances. Furthermore, recent advancements in noise, vibration, and harshness testing technologies allow more accurate analysis, simulation, and optimization of designs.

Noise, Vibration, And Harshness Testing Market Companies

- Hottinger Brüel & Kjær (Spectris)

- HEAD Acoustics GmbH

- Dewesoft d.o.o.

- Siemens

- Data Physics Corporation

- NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.)

- Axiometrix Solutions

- IMV Corporation

- Prosig Ltd.

- Norsonic

- Signal.X Technologies, LLC

- Bertrandt

- Schaeffler AG

Recent Developments

- In September 2024, Advantech unveiled an audio extraction solution, PCIE-1802 cards, which feature 24-bit analog input channels and synchronized sampling at up to 216 kS/s, catering to the needs of microphone arrays, specifically designed for vehicle noise, vibration, and harshness testing. This solution strives to improve the accuracy of sound data capture to achieve deeper insights into vehicle acoustics and their design optimization for automotive manufacturers.

- In May 2022, the German testing company imc Test and Measurement launched a new software solution, WAVE 2022, for noise and vibration analysis. The new software offers a comprehensive range of analysis functions for sound pressure and sound power measurement and the analysis of vibrations.

Segments Covered in the Report

By Component

- Hardware

- Sensors and Transducers

- Data Acquisition Systems

- Analyzers

- Excitation Devices

- Others

- Software

- Services

By Application

- Buzz, Squeak and Rattle Noise Testing

- Sound Intensity and Quality Analysis

- Powertrain Performance Testing

- Pass-by Noise Testing

- Others

By End-Use

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Construction

- Energy & Utility

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting