What is Vibration Monitoring Market Size?

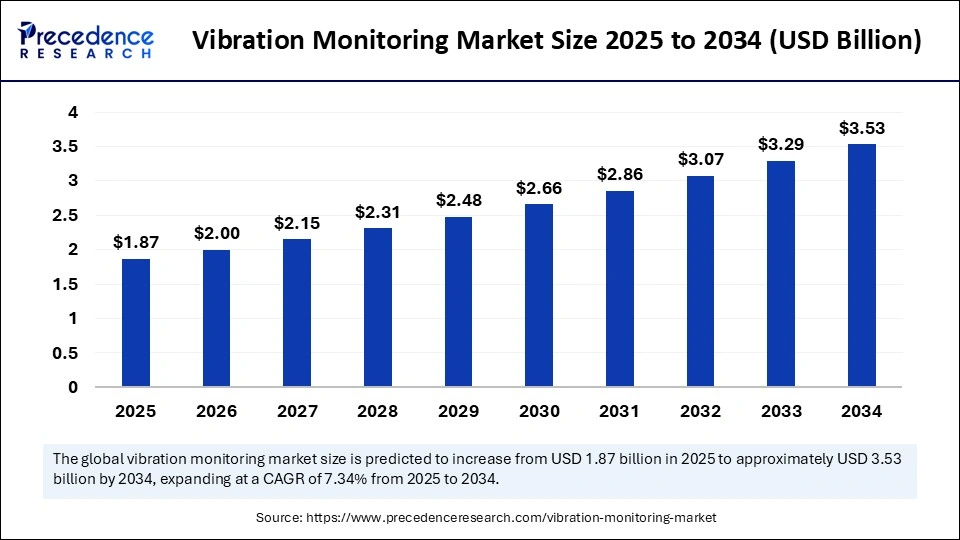

The global vibration monitoring market size accounted for USD 1.87 billion in 2025 and is predicted to increase from USD 2.00 billion in 2026 to approximately USD 3.75 billion by 2035, expanding at a CAGR of 7.21% from 2026 to 2035. The growth of the market is driven by increasing demand for predictive maintenance solutions to ensure equipment reliability across industries.

Market Highlights

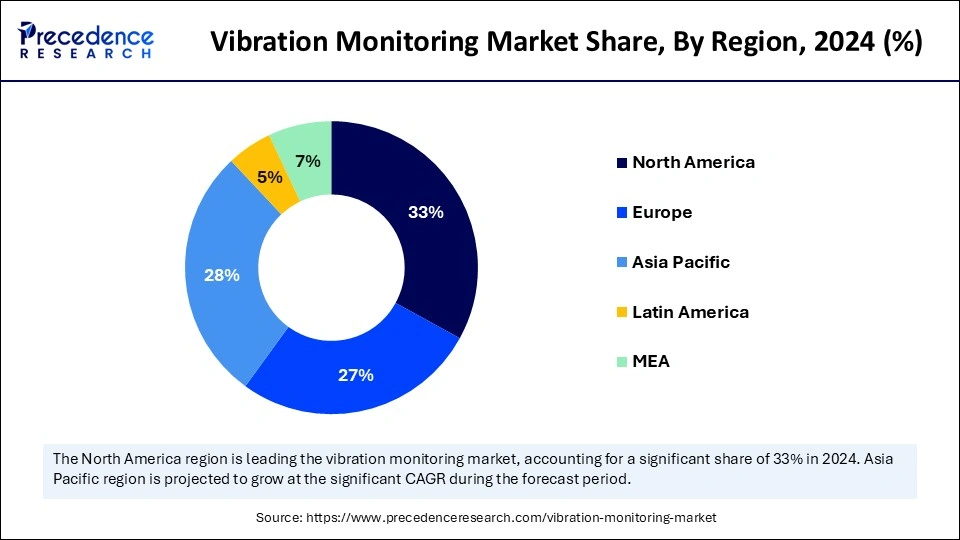

- North America dominated the vibration monitoring market with the largest share in 2025.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By component, the hardware segment held the largest share of the market in 2025.

- By component, the software segment is projected to grow at the fastest rate in the upcoming period.

- By process, the portable vibration monitoring segment dominated the market with the largest share in 2025.

- By process, the online vibration monitoring segment is expected to grow at the fastest rate in the coming years.

- By industry, the oil & gas segment led the market in 2025.

- By industry, the automotive segment is expected to grow at the fastest rate between 2026 and 2035.

How is AI transforming traditional vibration monitoring methods?

Moving from a reactive to a predictive approach, artificial intelligence is revolutionizing conventional vibration monitoring techniques. AI finds even the smallest changes that might point to a future issue by analyzing patterns in real time as opposed to merely gathering and displaying vibration data. It eliminates the need for human interpretation by automatically recognizing flaws, categorizing them, and suggesting solutions. In addition to increasing speed and accuracy, AI-powered vibration monitoring solutions help industries reduce maintenance costs, prolong machine life, and avoid unplanned equipment failures.

Market Overview

The vibration monitoring market is experiencing rapid growth, driven by the growing focus on asset reliability, predictive maintenance, and operational efficiency in important sectors like manufacturing, energy, and oil & gas. The use of sophisticated vibration monitoring systems, particularly those that are connected with Internet of things, is growing as businesses look to reduce downtime and prevent expensive equipment failures. Furthermore, strict safety regulations and the evolution of Industry 4.0 support market expansion. The development of wireless technology and real-time analytics further contributes to the growth of the market.

How do new technologies support vibration monitoring market growth?

Vibration monitoring systems are getting smarter, faster, and more dependable, thanks to new technologies. Wireless sensors make it possible to gather data without complicated wiring, which simplifies and lowers the cost of installation. Real-time monitoring and remote access are made possible by IoT integration. Artificial intelligence and advanced data analytics are also being used to anticipate equipment failures before they occur, assisting industries in reducing repair costs and downtime. Traditional monitoring is being transformed into intelligent networked systems by these advancements.

Vibration Monitoring MarketGrowth Factors

- The rising adoption of predictive maintenance solutions to reduce unplanned downtime and maintenance costs boosts the growth of the market.

- Increased focus on improving asset reliability and operational efficiency in manufacturing is projected to boost the market's growth.

- The growing use of wireless and cloud-based monitoring systems, which enable real-time data analysis, influencing the market.

- The adoption of Industry 4.0 and smart factory initiatives are driving the demand for advanced monitoring solutions, including vibration monitoring tools.

- Stringent government regulations and safety standards mandating continuous equipment monitoring support the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.87 Billion |

| Market Size in 2026 | USD 2.00 Billion |

| Market Size by 2035 | USD 3.75 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.21% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Process, Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Emergence of wireless and battery-free sensors

Batteries and wired power sources are no longer necessary, thanks to new sensor technologies. The emergence of wireless sensors has improved the efficiency and capability of vibration monitoring systems by capturing energy from vibrations. Sensor deployment is now simpler and more affordable thanks to this innovation, particularly in hazardous or remote areas where wiring is difficult. Several companies are launching wireless sensors to gain a competitive edge. For instance, in March 2025, EnOcean GmbH launched a self-powered wireless vibration sensor for industrial monitoring. This sensor eliminates the need for external power.(Source: https://www.enocean.com)

Need to enhance cybersecurity in vibration monitoring systems

With increased connectivity, protecting vibration monitoring data from cyber threats has become critical. Vendors are embedding advanced cybersecurity measures such as encryption, secure firmware updates, and blockchain verification to safeguard sensitive industrial data. Robust cybersecurity builds trust among users, encouraging the adoption of vibration monitoring systems. Organizations can maintain the functionality of their equipment and minimize potential harm by securing vibration monitoring data.

Focus on Sustainable and Green Monitoring Solutions

The rising trend toward sustainability is encouraging the use of eco-friendly materials and low-power devices in vibration monitoring systems. Several companies are developing energy-efficient sensors and vibration monitoring systems that reduce environmental impact without compromising performance. Recently, Schneider Electric launched a line of energy-efficient vibration sensors made from recyclable materials.

Restraint

Integration complexity, durability issues, and high costs

Integrating modern vibration monitoring solutions with existing legacy systems is often complex and costly, which restrains the growth of the vibration monitoring market. Compatibility issues and lack of standardization hinder seamless deployment and data exchange. Sensors used in extreme industrial conditions such as high temperatures, corrosive atmospheres, or heavy vibrations can suffer from reduced lifespan or inaccurate readings. Ensuring sensor reliability remains a challenge. Moreover, implementing vibration monitoring systems requires substantial investments in hardware and software, limiting the growth of the market.

Opportunities

Demand from the aerospace industry

The rising demand for vibration monitoring systems from the aerospace industry creates immense opportunities in the vibration monitoring market. Landing gear, gearboxes, engines, and other aircraft parts are extremely sensitive to vibration. These equipment require vibration monitoring solutions to ensure their optimal working conditions. Vibration monitoring is critical to prevent costly failures and reduce the risks of accidents. By monitoring equipment performance, it optimizes maintenance schedules and reduces downtime.

Need for remote monitoring in offshore and hazardous zones

The need for remote monitoring is rising, especially in hazardous zones like oil rigs, mines, and power plants where human access is limited. IoT-enabled and wireless solutions enable for monitoring of equipment from remote locations. Remote monitoring also reduces operational and maintenance costs by reducing on-site inspections. Recently, Baker Hughes launched a remote vibration monitoring solution tailored for offshore oil platforms.

Segment Insights

Component Insights

The hardware segment dominated the vibration monitoring market with the largest share in 2025. This is mainly due to the vital function of hardware like sensors in collecting vibration data in real-time. These devices serve as the foundation of vibration monitoring systems, particularly in sectors where dependability is crucial, such as manufacturing, energy, and transportation. The increased need for high-performance sensors in challenging conditions and advancements in sensor technology further bolstered segmental growth.

The software segment is projected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to the rising need for quick analysis of large datasets. Vibration monitoring software has the ability to analyze large datasets and generate actionable insights. This further helps with decision-making. Vibration monitoring software helps with predictive maintenance and assists businesses in transforming unstructured data into useful insights.

Process Insights

The portable vibration monitoring segment dominated the vibration monitoring market with the largest share in 2025. This is mainly due to its affordability, versatility, and widespread use in routine maintenance tasks. Technicians favor portable vibration monitoring devices and handheld analyzers as they allow for fast diagnostics of numerous machines without requiring permanent installation. For regular maintenance and troubleshooting, industries like manufacturing, power, and oil & gas rely heavily on portable vibration monitoring tools.

- In January 2025, Fluke Corporation launched the Fluke 810 Plus, a next-gen handheld vibration tester with built-in diagnostics features. This tool helps identify mechanical problems in machinery.

The online vibration monitoring segment is expected to grow at the fastest rate in the coming years. The growth of the segment is attributed to the growing need for continuous and real-time monitoring of asset health. The increasing need for predictive maintenance further contributes to segmental growth. Online vibration monitoring systems minimize unscheduled downtime by giving real-time information on equipment performance, which is particularly crucial for mission-critical assets in the mining, oil & gas, and energy sectors.

- In March 2025, Emerson introduced a cloud-connected online vibration monitoring solution for continuous equipment diagnostics.

Industry Insights

The oil & gas segment dominated the vibration monitoring market in 2025 because of its heavy reliance on machinery that operates in hazardous and extreme conditions. To avoid expensive malfunctions in pumps, compressors, and drilling equipment, constant vibration monitoring is essential. The adoption rate of vibration monitoring solutions in onshore and offshore facilities has increased due to the increased need to improve operational efficiency, safety, and compliance.

The automotive segment is expected to grow at the fastest rate during the projection period, driven by factors such as the transition to electric vehicles, increased automation in production lines, and the need for quality control. Automakers increasingly used vibration monitoring solutions to monitor robotic arms and enhance predictive maintenance capabilities to minimize downtime and guarantee the efficient operation of assembly lines. The rising focus on improving production efficiency further drives the demand for vibration monitoring solutions in the automotive industry.

Regional Insights

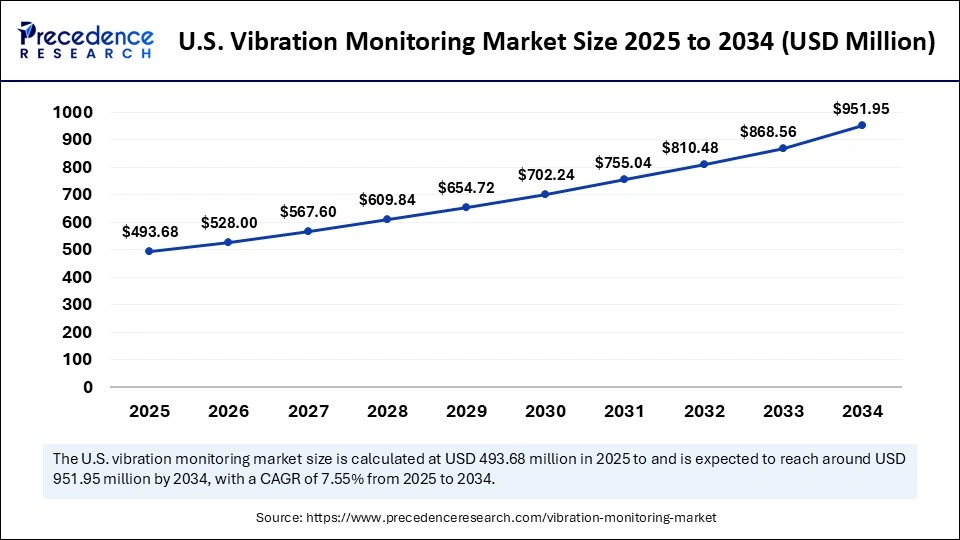

U.S. Vibration Monitoring Market Size and Growth 2026 to 2035

The U.S. vibration monitoring market size is exhibited at USD 493.68 million in 2025 and is projected to be worth around USD 1018.46 million by 2035, growing at a CAGR of 7.51% from 2026 to 2035

North America registered dominance in the vibration monitoring market by holding the largest share in 2025. This is mainly due to its robust industrial base, boosting the demand for condition-monitoring solutions. There is a strong emphasis on industrial automation, facilitating the adoption of sophisticated vibration monitoring solutions. The region is home to some of the renowned market players, sustaining the long-term growth of the market in the region. Condition monitoring systems have become an integral part of operations in the manufacturing,aerospace, and oil & gas industries in the region, bolstering the regional market growth.

Asia Pacific is expected to witness the fastest growth in the upcoming years. The rapid expansion of the manufacturing sector is a major factor driving the growth of the market in the region. With the rapid industrialization, the adoption of industrial machinery is rising. This significantly creates the need for vibration monitoring to ensure optimal conditions of industrial machinery. The growing emphasis on minimizing downtown and enhancing operational efficiency and government initiatives to promote digital transformation are likely to support the growth of the market in the region.

Europe is considered to be a significantly growing area. The growth of the vibration monitoring market in Europe can be attributed to stringent regulations regarding workforce safety, environmental standards, and a focus on improving industrial efficiency. There is a strong emphasis on predictive maintenance in aerospace, automotive, and energy industries to minimize downtime, boosting the demand for vibration monitoring solutions. Moreover, there is a rising trend toward smart manufacturing, contributing to the growth of the market.

Vibration Monitoring Market Companies

- Honeywell International Inc

- Emerson Electric Co.

- SKF

- Schaeffler AG

- Analog Device Inc.

- ALS

- Teledyne FLIR LLC

- Parker Hannifin Corp

- Rockwell Automation

- Baker Hughes Company

Recent Developments

- In April 2024, The Timken Company launched a new wireless sensor and condition monitoring solution to help users detect failure or major change before it happens through temperature and vibration monitoring. (Source: https://www.bearing-news.com)

- In November 2023, Worldsensing announced the launch of its new wireless sensor, the Vibration Meter. This sensor measures vibrations in long-term, continuous vibration monitoring projects. The new product uses a tri-axial MEMS accelerometer with longer battery life, wider communications range and more competitive points than existing vibration-related technologies on the market, while complying with key regulatory standards. (Source: https://www.worldsensing.com)

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Process

- Online Vibration Monitoring

- Portable Vibration Monitoring

By Industry

- Oil & Gas

- Power Generation

- Mining & Metals

- Chemicals

- Automotive

- Aerospace

- Food & Beverages

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting