What is the Non-Invasive Prenatal Testing Market Size?

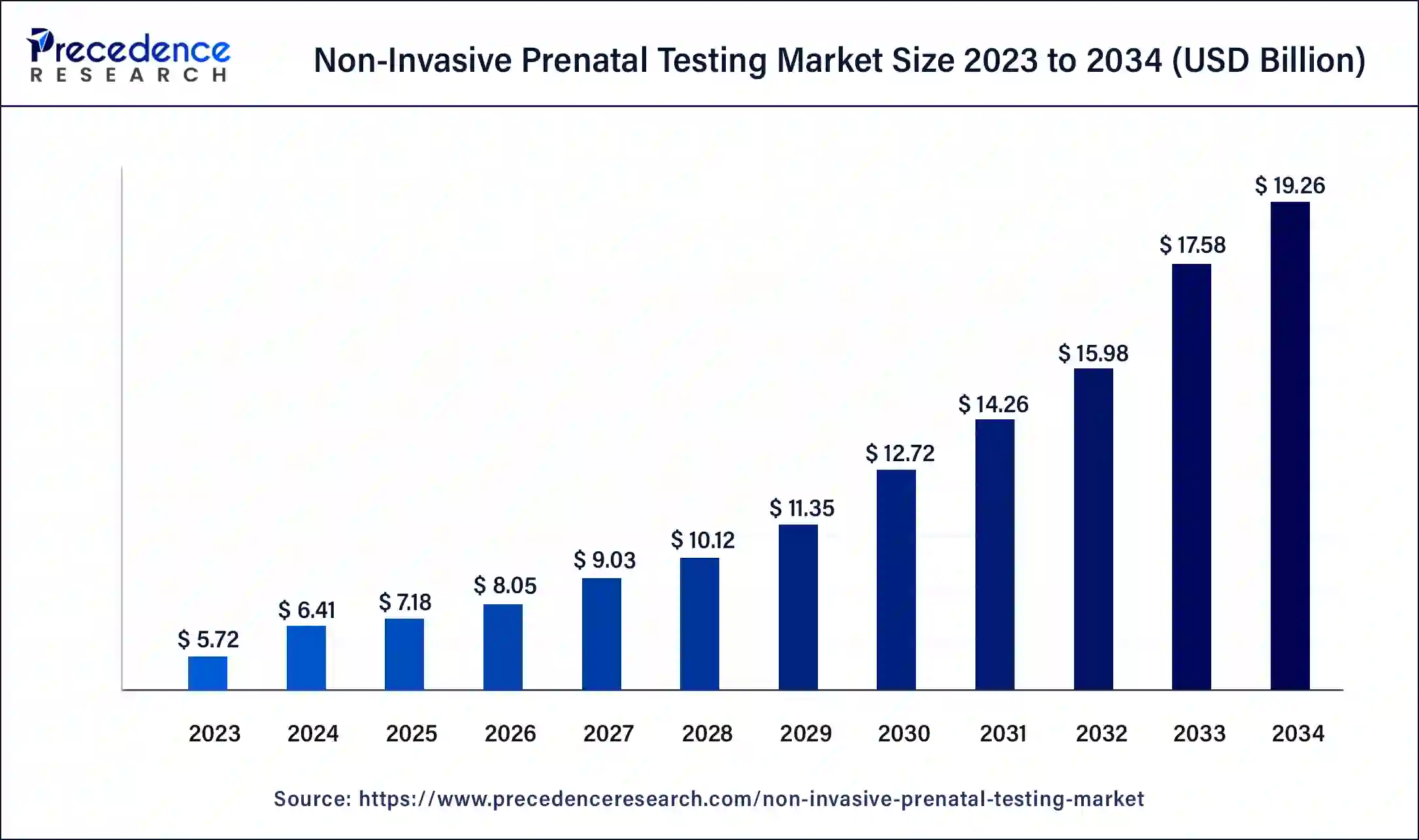

The global non-invasive prenatal testing market size is calculated at USD 7.18 billion in 2025 and is predicted to increase from USD 8.05 billion in 2026 to approximately USD 19.26 billion by 2034, expanding at a CAGR of 11.6% from 2025 to 2034.

Key Takeaways

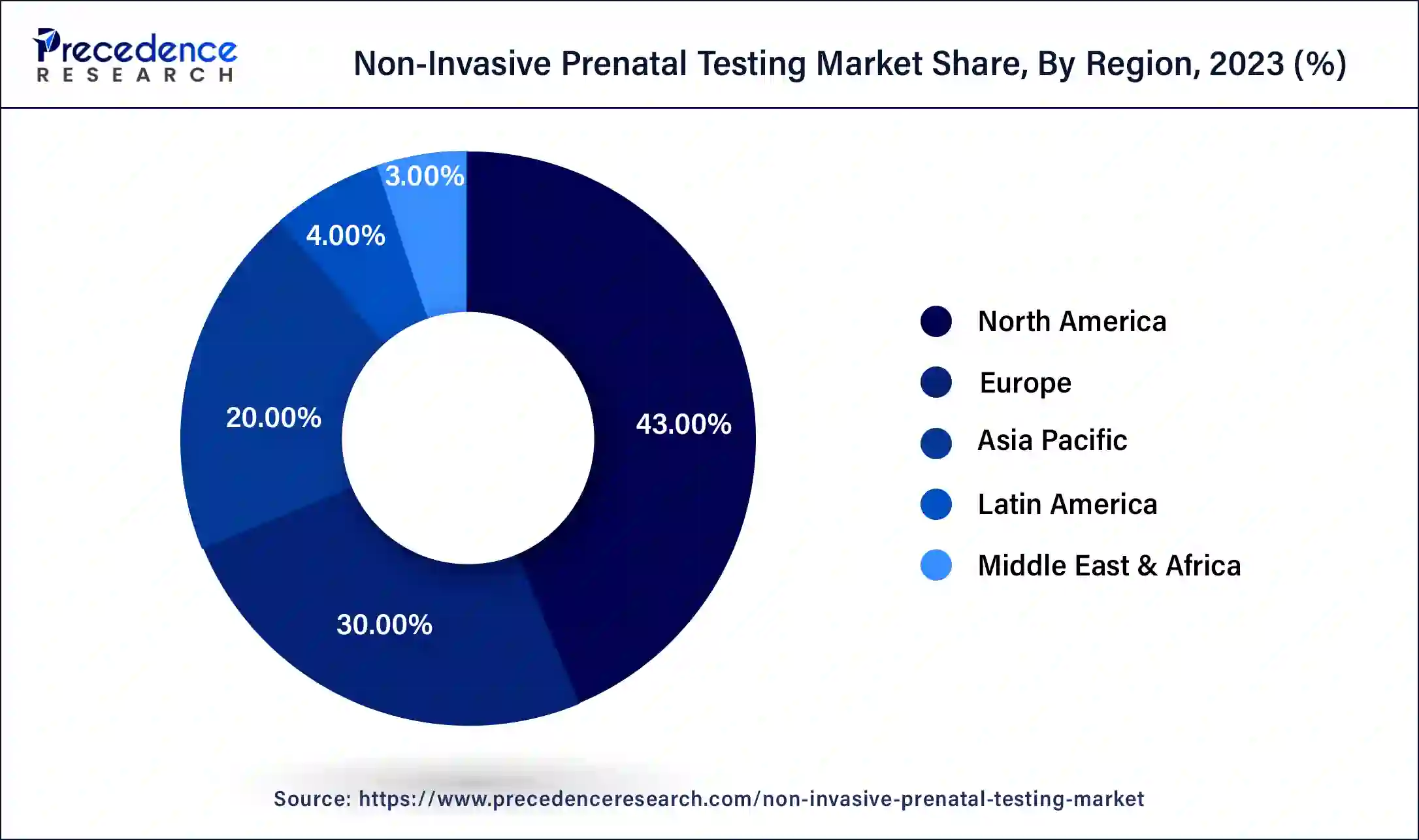

- North America accounted more than 43% of revenue share in 2023.

- Asia-Pacific is estimated to observe the fastest expansion between 2024 and 2034.

- By Component, the kits and reagents segment has held the highest market share of 45% in 2023.

- By Component, the instruments segment is expected to expand at a notable CAGR of 12.7% during the projected period.

- By Application, the down syndrome segment contributed more than 32% of revenue share in 2023.

- By Application, the turner syndrome segment is anticipated to grow at the fastest CAGR over the projected period.

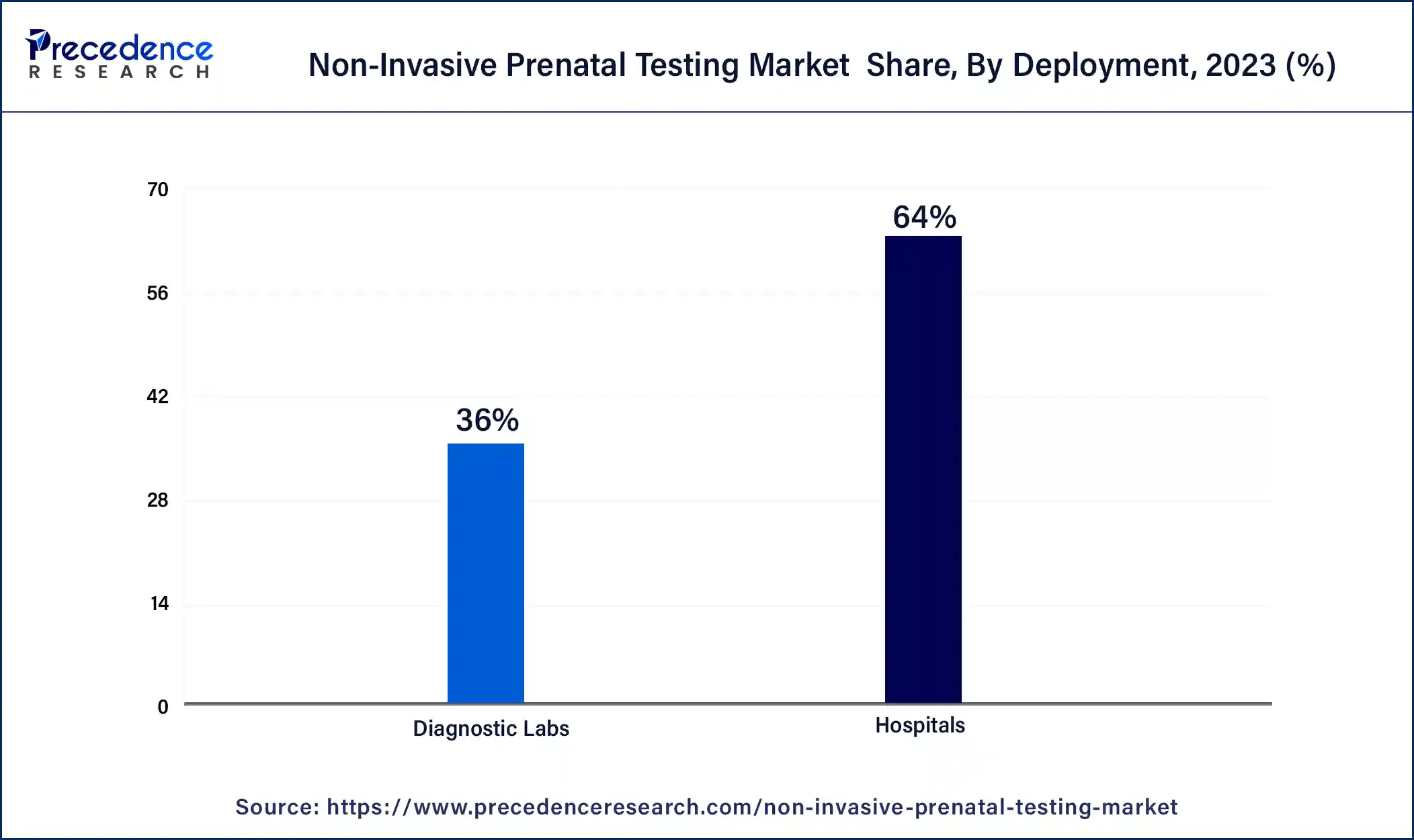

- By End User, the diagnostic laboratories segment held the biggest revenue share of 63% in 2023.

- By End User, the hospitals segment is anticipated to expand at a remarkable CAGR of 13.9% over the predicted period.

What is Non-invasive Prenatal Testing Market?

The Non-Invasive Prenatal Testing (NIPT) market is a burgeoning sector within the healthcare landscape, specializing in cutting-edge genetic assessments for expectant mothers. NIPT stands out by enabling the identification of fetal chromosomal anomalies through a straightforward blood test, eliminating the need for intrusive procedures such as amniocentesis. Recent years have witnessed remarkable growth in this industry, propelled by rising awareness, technological innovations, and an escalating emphasis on early and precise prenatal diagnostics. NIPT has emerged as the preferred choice for prospective parents, offering reduced risks and enhanced precision in detecting conditions like Down syndrome, solidifying its pivotal role in contemporary prenatal care.

How is AI Contributing to the Non-invasive Prenatal Testing Market?

AI is the reason why the whole NIPT process is more accurate. It gets the genomic data from large datasets and analyzes them to spot chromosomal differences more quickly and more accurately. Besides, it gives higher diagnostic interpretation, lowers false positives, helps in risk patterns prediction, and supports the automation of sequencing workflows as well as real-time data analysis for making clinical decisions. AI not only speeds up the testing process but also enhances the role of genetic counseling by providing predictive insights and patient-specific recommendations.

Non-Invasive Prenatal Testing Market Growth Factors

The realm of non-invasive prenatal testing (NIPT) is undergoing a remarkable surge within the healthcare domain, reshaping prenatal genetic screening practices. NIPT represents a groundbreaking paradigm shift in prenatal care, facilitating the detection of fetal chromosomal anomalies through straightforward maternal blood analysis, rendering invasive procedures like amniocentesis obsolete. This groundbreaking technology is garnering widespread acclaim and adoption for its non-intrusive attributes, precision, and diminished risks associated with both maternal and fetal health.

A principal impetus propelling the NIPT market is the burgeoning awareness and demand for early and precise prenatal diagnosis. Prospective parents increasingly favor NIPT over conventional methods due to its heightened accuracy in identifying conditions like Down syndrome and various chromosomal irregularities. The evolution of technology assumes a pivotal role in making NIPT more accessible and cost-effective. Furthermore, a surge in research and development endeavors aimed at broadening NIPT's scope to encompass a broader spectrum of genetic disorders fuels market expansion.

Notwithstanding its manifold advantages, the NIPT sector grapples with certain challenges. An overarching concern pertains to the expense associated with these tests, which may deter some individuals and healthcare systems. Ensuring affordability and widespread accessibility remains an ongoing challenge. Additionally, while NIPT boasts remarkable accuracy, it does not substitute for diagnostic methods and may occasionally yield false positives, necessitating follow-up invasive procedures. Ethical and regulatory dilemmas loom large, particularly regarding the potential misappropriation of genetic data and concerns surrounding privacy.

The NIPT arena unfolds promising prospects for healthcare entities, diagnostic enterprises, and research entities. Expanding the repertoire of detectable genetic anomalies and enhancing test accuracy can unlock new markets and avenues for revenue generation. Collaborations with pharmaceutical entities for drug development and precision medicine initiatives present growth avenues. Furthermore, venturing into burgeoning markets with escalating healthcare awareness and global expansion prospects holds substantial business potential for enterprises entrenched in the NIPT realm.

To summarize, the non-invasive prenatal testing market is flourishing owing to its non-intrusive, exceptionally precise attributes, coupled with heightened awareness among expectant parents. While challenges like affordability and ethical quandaries persist, the sector continually evolves through technological strides, offering multifarious business opportunities for stakeholders involved in prenatal care and genetic diagnostics.

Market Outlook

- Industry Growth Overview: The rise in maternal age, along with technological development and mothers' choice of non-invasive procedures like NIPT, has led to a rapid increase in the non-invasive prenatal testing market.

- Sustainability Trends: The main points are test accuracy improvement, test range (including microdeletions and single-gene disorders) expansion, and improvement through technology and reimbursement accessibility/affordability.

- Global Expansion: The market is attracting global attention, with North America at the forefront and Asia Pacific emerging as the fastest-growing region, primarily due to increased medical spending and awareness.

- Major Investors: The major players/investors, such as Illumina, Natera, Roche, BGI Genomics, LabCorp, and Quest Diagnostics, are mainly engaged in R&D and forming strategic partnerships.

- Startup Ecosystem: The new and small companies are trying to get attention by offering novel tests, getting investments, and producing point-of-care products to compete with the already established ones in the intensely competitive market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.26 Billion |

| Market Size in 2026 | USD 8.05 Billion |

| Market Size in 2025 | USD 7.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.6% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Increasing incidence of genetic disorders

The escalating occurrence of genetic disorders plays a pivotal role in propelling the growth of the non-invasive prenatal testing (NIPT) market. As the frequency of genetic anomalies and chromosomal irregularities in newborns surges, there is an increasing demand for robust and precise prenatal screening methodologies. NIPT's capacity to detect these conditions during the early stages of pregnancy positions it as an indispensable instrument for prospective parents and healthcare providers. With more couples opting to have children later in life, the susceptibility to genetic disorders becomes more pronounced. Advanced maternal age stands out as a recognized risk factor for chromosomal abnormalities, accentuating the significance of early and dependable prenatal testing.

NIPT offers a non-invasive and exceptionally accurate avenue for the identification of these disorders, instilling confidence in expectant parents and enabling them to make informed decisions regarding pregnancy. Furthermore, as awareness about the efficacy of NIPT continues to spread, a growing number of pregnant women and healthcare practitioners are choosing these tests, thereby contributing to the expansion of the market. The amalgamation of the increasing incidence of genetic disorders and NIPT's effectiveness as a diagnostic tool sets the stage for sustained market growth in the foreseeable future.

Restraints

Ethical concerns

Ethical concerns are imposing a significant restraint on the growth of the non-invasive prenatal testing (NIPT) market. As NIPT offers increasingly detailed genetic information about a fetus, it raises ethical questions regarding the potential misuse and consequences of this information. One key concern involves genetic discrimination, where individuals or their offspring could face discrimination in employment, insurance, or other aspects of life based on the genetic data revealed through NIPT. This creates apprehension among prospective parents and may deter them from opting for such testing.

Moreover, the ethical dimension extends to issues of informed consent, ensuring that individuals fully understand the implications of NIPT results, as well as the responsible handling and confidentiality of sensitive genetic information. As a result, addressing these ethical concerns through robust regulation and education is crucial to fostering trust and promoting wider adoption of NIPT, which holds immense potential for improving prenatal care.

Opportunities

Collaboration with pharmaceutical companies

Collaboration with pharmaceutical companies represents a substantial opportunity within the non-invasive prenatal testing (NIPT) market. By partnering with pharmaceutical firms, NIPT providers can contribute to drug development and precision medicine initiatives in meaningful ways. NIPT can play a pivotal role in identifying ideal candidates for clinical trials, helping pharmaceutical companies streamline patient recruitment, and ensuring that experimental treatments are tailored to patients' genetic profiles. This synergy not only accelerates drug discovery and development but also opens up new revenue streams for NIPT providers.

Moreover, collaborative efforts with pharmaceutical companies can lead to the integration of NIPT into broader healthcare ecosystems, facilitating seamless patient care pathways from prenatal screening to tailored therapeutic interventions. This comprehensive approach strengthens the market's value proposition, fosters innovation, and underscores the importance of NIPT in advancing precision medicine and improving patient outcomes, ultimately driving growth and expanding the market's reach.

Impact of COVID-19:

The COVID-19 pandemic had a mixed impact on the non-invasive prenatal testing (NIPT) market. Initially, disruptions in healthcare systems and reduced elective procedures led to a temporary decline in NIPT adoption. However, the pandemic also highlighted the importance of prenatal testing and genetics in healthcare, driving awareness and demand for NIPT in later stages. As healthcare services adapted to the pandemic with telemedicine and home-based options, NIPT providers also explored remote testing solutions. Overall, while there were short-term challenges, the long-term outlook for the NIPT market remains positive, with a growing emphasis on early and non-invasive prenatal diagnosis.

Component Insights

According to the component, the kits and reagents sector has held a 45% revenue share in 2023. The "kits and reagents" segment holds a major share in the non-invasive prenatal testing (NIPT) market because it represents the essential components required for performing NIPT procedures. These kits and reagents include specialized materials for extracting and analyzing fetal DNA from maternal blood samples. As NIPT gains prominence in prenatal care, the demand for these consumables rises significantly. Moreover, they are vital for laboratory-based NIPT services and are essential for accurate and reliable test results. Consequently, the kits and reagents segment remains a substantial contributor to the market due to its indispensable role in NIPT procedures.

The instruments sector is anticipated to expand at a significant CAGR of 12.7% during the projected period.The instruments segment holds a major share in the market due to its critical role in the non-invasive prenatal testing (NIPT) process. These instruments encompass cutting-edge technologies like next-generation sequencing (NGS) machines, which are the basis of NIPT procedures. As NIPT gains widespread adoption, the demand for high-precision and efficient instruments has surged. Moreover, ongoing advancements in NIPT technologies require constant updates and investments in instruments, solidifying their prominence. Ultimately, the instruments segment plays a pivotal role in delivering accurate and reliable prenatal genetic testing, making it a substantial contributor to the NIPT market's share.

Application Insights

The Down syndrome segment had the highest market share of 32% on the basis of the Application in 2023. The dominance of the down syndrome segment in the non-invasive prenatal testing (NIPT) market is attributable to several distinctive factors. Down syndrome, being one of the most prevalent chromosomal anomalies, commands significant attention among expectant parents. NIPT's remarkable precision in detecting down syndrome has propelled its adoption as the preferred screening choice. Moreover, healthcare professionals often advocate NIPT specifically for down syndrome, further elevating its prominence. Extensive awareness, combined with the emotional and clinical significance attached to Down syndrome, has firmly established it as a primary focal point for NIPT, resulting in its substantial market presence.

The turner syndrome is anticipated to expand at the fastest rate over the projected period. The Turner syndrome segment holds a significant growth in the non-invasive prenatal testing (NIPT) market due to several factors. Turner syndrome is a well-recognized genetic condition that affects females, and early detection is crucial for timely medical intervention. NIPT's accuracy in detecting sex chromosome abnormalities like Turner syndrome has made it a preferred choice for expectant parents and healthcare providers. Additionally, there is a growing awareness of Turner syndrome, driving demand for prenatal testing. As a result, the segment has become a major contributor to the NIPT market's growth, capitalizing on its diagnostic capabilities and medical significance.

End User Insights

The diagnostic laboratories segment held the largest revenue share of 63% in 2023. The diagnostic laboratories segment holds a major share in the non-invasive prenatal testing (NIPT) market due to its critical role in ensuring accurate and reliable test results. Diagnostic laboratories are equipped with advanced technology and skilled personnel, ensuring the precision and quality of NIPT services. Additionally, these laboratories often have established partnerships with healthcare providers and access to a broad patient base. This segment's credibility, infrastructure, and accessibility make it a preferred choice for offering NIPT services, contributing significantly to its dominant market position.

The hospitals sector is anticipated to grow at a significantly faster rate, registering a CAGR of 13.9% over the predicted period. Hospitals hold a significant growth in the non-invasive prenatal testing (NIPT) market due to their pivotal role in prenatal care. Hospitals are trusted healthcare institutions where expectant mothers often receive comprehensive prenatal services, including genetic testing. Patients prefer hospital-based NIPT services for the assurance of high-quality care, easy access to medical professionals, and integration with other healthcare services. Additionally, hospitals typically have the infrastructure to offer a wide range of diagnostic tests, making NIPT conveniently accessible to a large patient population. This established reputation and accessibility contribute to hospitals dominating the NIPT market growth.

Regional Insights

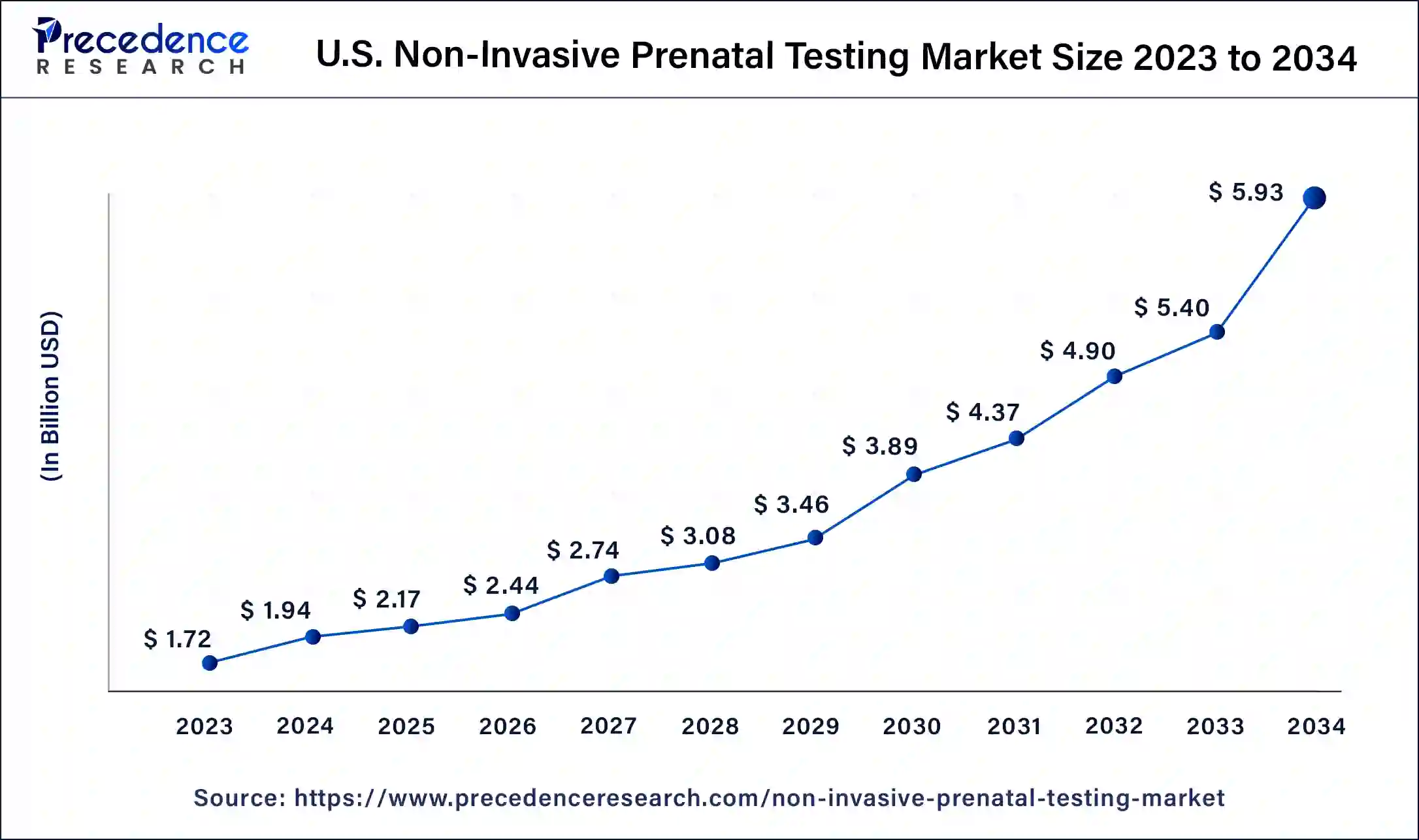

U.S. Non-Invasive Prenatal Testing Market Size and Growth 2025 to 2034

The U.S. non-invasive prenatal testing market size reached USD 2.17 billion in 2025 and is predicted to be worth around USD 5.93 billion by 2034 with a noteworthy CAGR of 11.8% from 2025 to 2034.

North America has held the largest revenue share 43% in 2023. North America commands a substantial share of the non-invasive prenatal testing (NIPT) market due to several key factors. The region boasts advanced healthcare infrastructure, high healthcare expenditure, and a robust emphasis on prenatal care. Additionally, a well-developed regulatory framework and insurance coverage for NIPT contribute to its widespread adoption. Moreover, the presence of leading NIPT technology providers, research institutions, and a well-informed population that values early and accurate prenatal testing all bolster North America's dominance in the NIPT market. These factors collectively make North America a major hub for NIPT services and innovation, driving its market share.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the non-invasive prenatal testing (NIPT) market due to several factors. The region has a large and growing population, with increasing awareness and healthcare infrastructure development. Rising maternal age, genetic disorders, and a cultural emphasis on prenatal health drive demand. Moreover, expanding economies facilitate greater affordability and accessibility to advanced medical technologies like NIPT. Government initiatives and collaborations with international NIPT providers further boost adoption. As a result, Asia-Pacific's substantial market share reflects both its population size and the increasing recognition of NIPT's value in prenatal care.

How is North America Leading in the Non-invasive Prenatal Testing Market?

North America is the leading region in the NIPT market internationally, mainly because of its well-developed healthcare systems, government policies that support NIPT, and more public awareness around prenatal diagnostics. The constant increase of insurance policies that cover the test and the provision of the highest quality testing platforms are still the main reasons for adoption by both medical staff and the public who look for safer prenatal practices.

United States Non-invasive Prenatal Testing Market Trends:

The U.S. is the most important national market represented by considerable R&D funding, test innovation, and partnerships between biotechnology and healthcare providers. The U.S. ecosystem acknowledges the use of advanced tests and focuses on patient education and accessibility.

What are the Driving Factors of the Non-invasive Prenatal Testing Market in Europe?

The second-largest region, Europe, has a high acceptance of early genetic screening and is characterized by vast clinical research. The integration of NIPT into public healthcare systems is continuously growing, and the presence of many diagnostic innovators is propelling the steady market penetration and clinical adoption across the region.

Germany Non-nvasive Prenatal Testing Market Trends:

Germany is still a key player in the European NIPT market due to its well-developed medical infrastructure and wide healthcare access. Catchy testing regulations and the increased uptake of cutting-edge genomic tools have together created an environment for the country to be the world's leading area for prenatal screening innovations and precision diagnostics.

How is Asia-Pacific Performing in the Non-invasive Prenatal Testing Market?

Asia-Pacific is the region with the fastest growth rate as a result of better healthcare systems and greater awareness of fetal health. The combination of government support and increasing preference for non-invasive early diagnosis is acting as a catalyst for the demand for innovative testing solutions across various markets.

The vast market potential of China arises from the investment in healthcare, the government-supported genetic research, and the better testing facilities. The growing population of the country and the advanced prenatal care are leading to the use of NIPT more and more in both urban and rural healthcare centers.

Value Chain Analysis

- R&D: Generates new diagnostic technologies and sequencing methods.

Key Players: Illumina, Natera, BGI Genomics, F. Hoffmann-La Roche - Clinical Trials & Regulatory Approvals: Ensures the tests' safety, performance, and compliance through validation.

Key Players: IQVIA, Parexel, ICON plc, and PPD - Formulation & Final Dosage Preparation: Generates test kits along with reagents for labs.

Key Players: Illumina, Thermo Fisher Scientific, Qiagen, and PerkinElmer - Packaging & Serialization: Test kits are being labeled and tracked for genuineness and safety.

Key Players: Illumina, Natera, Eurofins - Distribution to Hospitals, Pharmacies: The medical institutions receive test kits that have been confirmed as genuine quickly.

Key Players: LabCorp, Quest Diagnostics, Sonic Healthcare

Non-Invasive Prenatal Testing Market Companies

- Genesis Genetics (CooperSurgical, Inc.)

- Natera, Inc.

- Centogene N.V.

- Illumina, Inc. (Verinata Health, Inc.)

- Eurofins LifeCodexx GmbH

- MedGenome Labs Ltd.

- F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics)

- Myriad Women's Health, Inc. (Counsyl, Inc.)

- Progenity, Inc.

- Qiagen

- Laboratory Corp. of America Holdings

- Quest Diagnostics, Inc.

Recent Developments

- In 2022, saw Natera Inc. take a significant step by submitting a pre-submission request to the Food and Drug Administration (FDA) as part of the Q-Sub process. Their submission, made in June 2022, pertained to the panorama non-invasive prenatal test (NIPT) and its application in detecting fetal chromosomal aneuploidies and 22q11.2 deletion syndrome.

- In 2022, Genetic Technologies Limited expanded its reach by acquiring EasyDNA, reinforcing its presence in the European market. This strategic move enabled the company to offer Carrier Testing and Non-Invasive Prenatal Tests (NIPT) through its online platforms.

- In 2021, Next-Generation Genomic Co., Ltd. and Illumina, Inc. jointly introduced the VeriSeq NIPT Solution v2 in Thailand. This comprehensive solution facilitates highly accurate, scalable, and rapid genome-wide noninvasive prenatal testing.

- In 2019, BGI and Eluthia launched the NIFTY test, operating under the PreviaTest brand in Germany, enhancing the accessibility of non-invasive prenatal testing in the region.

- In 2019, Illumina expanded its NIPT portfolio with the introduction of VeriSeq NIPT Solution v2, solidifying its position in the market.

- In 2018, Illumina initiated the acquisition of Pacific Biosciences, reinforcing its sequencing solutions platform with cutting-edge long-read sequencing capabilities.

- In August 2025, Natera launched Fetal Focus, a noninvasive prenatal test for inherited conditions, enhancing cell-free DNA testing and precision medicine.

https://finance.yahoo.com - In February 2025, Yourgene Health launched IONA Care+, a non-invasive prenatal screening service in the UK, utilizing IONA Nx NIPT Workflow to provide safe, fast, and accurate results, reducing the need for invasive tests and parental stress.

https://www.news-medical.net

Segments Covered in the Report

By Component

- Instruments

- Kits and Reagents

- Services

By Application

- Down Syndrome (trisomy 21)

- Edwards Syndrome (trisomy 18)

- Patau Syndrome (trisomy 13)

- Turner Syndrome

- Other Applications

By End User

- Hospitals

- Diagnostic Labs

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting